What is the WMZ wallet intended for?

When registering in the WebMoney system, each client receives his own unique identifier - WMID.

However, it cannot be indicated as a requisite for receiving funds. In order to be able to carry out financial transactions, the client must create a so-called WM wallet within the framework of his participant ID. But unlike wallets and purses that we carry in our bags and pockets, you cannot simultaneously store rubles, dollars, euros and other currencies in one WM wallet. For each you need to generate a separate wallet.

Like WMID, its number will consist of 12 digits, but before this digital combination there will also be an alphabetic prefix: Z, R, U, E and others. They indicate what funds the wallet is intended for. And transferring money from one participant in the system to another is possible only between wallets of the same type.

Buying several orders from the list

For participants who need to exchange a large amount of funds, it is often convenient to buy several of the most profitable orders at once (among which there are small and even very small ones, but this makes them no less profitable at the rate of the order), but it is not entirely convenient to select each application, pay for each one through merchant.webmoney and spend a lot of time on it.

This problem can be easily solved as follows. You don’t have to select and pay for other people’s orders one by one, but create and pay once for one new order of your own with the exchange direction you are interested in. And only then, by entering this application from the list of your new applications, simply buy up all the most profitable applications from the exchange list opposite to your application. At the same time, you will need to spend one click to buy each of the applications and there is no need to pay for each application separately through the merchant, since you have already paid the entire exchange amount by submitting your new application.

Let us explain the above with an example. Let's say you have 2000 WMZ and you need to exchange them for WMR, and in the WMR -> WMZ list there are 10 profitable applications that suit you.

- changing the rate of your new application - this is useful when during the exchange process there are no more profitable applications and you need to leave your application with a rate that suits you in case someone makes an exchange on it;

- combining several new orders into one - this is useful if you have one or more amounts to exchange, and you already have a new order. If you need to automatically track the availability of various volumes on the exchange, then you can use the corresponding XML interface described in the operating rules.

Read: How to cash out electronic money

Video Electronic currency WMZ - what kind of currency is it

Being the main one, this type of money is widely used in the field of online commerce. It is possible to purchase WMZ quickly and with minimal commissions. This can be done using exchangers or within the system, through Keeper. This method is the safest. When choosing another method of exchange, be careful not to be tempted by too favorable conditions.

The advantages of using both WMZ and Webmoney in general:

- high level of confidentiality;

- multi-level protection of all funds and operations;

- ease of use;

- high speed of operations;

- clear and easy interface.

What is WMZ? Essentially, these are dollars in electronic format. If necessary, they can be purchased or converted. The emphasis is placed on this currency, since it is the most popular and frequently used.

From this video you will learn the basic principles of operation of this payment service and registration, including operations with wmz.

One of such systems is WebMoney, and it is this service, namely the WMZ electronic wallet, that will be discussed in this article. Today, with the help of Webmoney, you can take out loans and make financial exchange transactions with low interest rates.

Webmoney is one of the most popular systems in RuNet, providing its clients with the highest level of information confidentiality and funds protection. Thanks to the WMZ wallet, making purchases or paying your bills is often much more profitable than the traditional way. The wallet is replenished simply: either from another VSW wallet, or from a bank card, electronic or postal transfer.

WMZ is considered an electronic analogue of the American dollar. Since many online payments are made in US currency, it is recommended to have a dollar wallet. If necessary, dollars can be exchanged at any time for another currency you need. VSW wallet is very important for paying for purchases in foreign online stores, where prices are indicated in conventional units.

There are seven different types of currencies in the currently popular Webmoney Transfer system:

- WMZ – wallet with funds equivalent to US dollars;

- WMR – a wallet with funds equivalent to Russian rubles;

- WME – wallet with funds equivalent to euros;

- WMU – a wallet with funds equivalent to Ukrainian hryvnia;

- WMB – wallet with funds equivalent to Belarusian rubles;

- WMG is a wallet with funds equivalent to gold.

After registering in the WebMoney system, you receive a 12-digit number called WM ID, to which the VSW wallet is attached. Using the WMKeeper Classic program, you can create exactly the wallet you need. There are seven options to choose from.

Each wallet has its own unique number. In the case of a dollar wallet, the numbers are preceded by a capital Latin Z, which is a prefix and denotes those funds for which the wallet, in fact, is intended. For example, Z490568827686 is a wallet for WMZ currency.

Control of exchange transactions

A list of all new participant applications is presented on the List of your new applications page. Here, each participant can monitor the progress of the current exchange at any time, find out what part of the current orders have been redeemed, and also view the history of all their exchange transactions. By default, the list shows only current orders that are currently being exchanged, but if necessary, you can select three more display options:

- show all requests;

- only unpaid;

- only repaid.

By left-clicking on the line of the selected application, you can go to the detailed information page, which provides a list of all exchange transactions carried out on this application, as well as a number of functions for its management. The participant is given the opportunity to:

- change the application rate;

- convert this request into a counter request for the most advantageous offer for a reverse exchange;

- combine this application with another application of yours;

- delete the request.

Read: How to recover deleted SMS and when is it possible

Features of use

As mentioned above, this format of funds opens by default when registering with Webmoney. Withdrawing funds entails certain expenses, that is, a commission. This currency has a number of advantages; it can be paid on most services at a favorable rate. This applies to those stores or services where goods are sold for rubles, but it is possible to pay in dollars electronically.

The nuances of using, exchanging and withdrawing funds in dollar equivalent:

- commission is about three percent of the transfer amount;

- waiting period from one to five days.

Alternative payment systems

Let's compare WebMoney with other electronic payment systems.

| Commissions for withdrawal to cards, other e-wallets | Fees for transfers within the system | Transfer time to other electronic wallets, cards | |

| Webmoney | Up to 8% of the amount | 0,8% | Up to 3-5 working days |

| Skrill | 5.5 euros | 1.45% of the amount | Up to 5 working days |

| QIWI | 2% of the amount +50 rubles | 0% | Up to 5 working days |

| Neteller | 5.5 euros | 1.45% of the amount | Up to 10 working days |

| Paysafecard | No commission, you cannot withdraw money to cards or electronic wallets | it is forbidden |

How to top up a VSW wallet in WebMoney at the best rate and minus the minimum commissions?

So, of course, it is possible to buy WMZ using all the methods available on the Internet. But everyone strives to do this with maximum benefit for themselves. This can be done through special services of the WebMoney system, for example, Webmoney Keeper. This method is almost one hundred percent reliable, but it is not the most profitable option.

The reliability of this method is almost 100%, however, it is not always the most profitable option. There are no less reliable methods that will allow you to carry out the operation with even greater real benefits for you.

Now there are many Internet services that offer to transfer any currency to a Webmoney wallet, as well as exchange one currency for another. If you find offers that are too unbelievably profitable, be wary and don’t fall for the trick. It is worth choosing services with a good past and positive reputation. Such a company must have existed for a long time and adhere to the average course. Only then can you not worry about your money.

Product Types

Webmoney Keeper

- a well-thought-out, developed system that offers different products for clients: individuals and businesses.

EPS offers a kind of prepaid card - WebMoney.

To purchase it, you do not need to register in the payment system; you can buy it through terminals.

Webmoney account

WebMoney account is a client’s account in the system. Here you can set a profile picture, undergo verification (identity confirmation), and provide additional information.

By logging into your account, you can order electronic cards or open an electronic wallet.

Electronic cards

Electronic (virtual) card Webmoney is a convenient service for paying for purchases online. Customers will pay only 1% for replenishing the card, and refunds will be free.

The product is compatible with Apple Pay and Google Pay.

Withdrawing Webmoney to a card from a wallet of the same EPS is not subject to commission.

If you need to quickly cash out money at a terminal, this product is most convenient.

Electronic wallets

When asked how to use Webmoney, most clients have wallets in mind.

E-Wallet is a personal account of a registered EPS participant.

Only the owner has the right to use it.

Login, payment for goods and services, transfers are confirmed by entering a code.

Electronic wallets can be created with different currencies, and then transfer funds from one currency to another through the Webmoney exchanger.

Creating a wallet

After registering on the WebMoney service, the user will be assigned a unique identification number - WMID. This is an analogue of a person’s passport for logging into the system and making payment or other transactions.

The service offers users to create an unlimited number of wallets of the selected type. When deciding to open another storage facility, you should remember that the created account cannot be deleted. To avoid confusion, in the future it is recommended to connect only the necessary wallets.

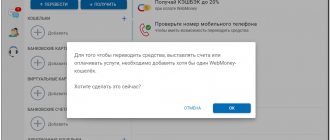

To increase the limits on monetary transactions, it is necessary to obtain a formal certificate. This involves confirming your own identity by sending a scan of your passport to the Attestation Center.

After increasing the certificate level, you can fully use the WMZ wallet.

Conversion using the WebMoney service

Keeper Stansard wallet number

SDP Exchanger service for withdrawal of funds

Creating a wallet using Keeper Classic

FAQ

I have 100 WMZ. I urgently need WMR. What is the best and fastest way to do this?

If efficiency is more important than profit, then you need to do the following.

- Check that your Z-wallet has an amount of no less than 100.8 wmz

- Open the list of current WM exchanges.

- Select the exchange direction “I want WMR, I’ll give WMZ”.

- Left-click on the first application in the list.

- In the “Submitting a counter request for WM exchange” window, in the “How much WMZ do you have” field, enter the value “100”, in the “R Wallet to which you will receive WMR” field, enter the number of your R-wallet.

- Click the “Pay Application” button and then make a direct payment through the Merchant.

- Go to the keeper window and press the F5 button.

How can I exchange 100 WMZ for WMR at the best rate?

- Check that your Z-wallet has an amount of no less than 100.8 wmz

- Open the Current WM exchange list window and select the exchange direction “I want WMZ, I will give WMR”.

- Determine in which line of the list you would like to see your application and calculate the amount of WMR that you can receive using the reverse exchange rate.

- Open the window for submitting a new request for WM exchange.

- Select the exchange direction “WMZ -> WMR”.

- In the “How much WMZ do you have” field, enter the value “100”.

- In the “How much WMR do you need” field, enter the calculated exchange amount, and in the “WMR wallet to which you will receive WMR” field, enter the number of your R-wallet.

- Click the “Pay Application” button and then make a direct payment through the Merchant.

- Monitor the position of your application in the exchange list, adjusting the rate if necessary.

Read: MTS you can find out where my phone was sent for warranty repair Status of equipment repair Complaint about MTS repair under warranty. Returning a phone purchased from MTS under warranty

I need to exchange a large amount of WMZ for WMR. Time is running out, and all applications on the list offer no more than 20-50 WMZ for exchange. What to do?

current exchange

- Submit and pay for your new application in the direction of WMZ -> WMR at an inflated rate.

- Open a new order and under the table with the most profitable order from the list of opposite exchanges, click the link “Buy this order (turning your new one into a counter to this one)”.

- Repeat the previous operation several times until your application is fully paid off.

When I change the rate of my new application, an error is given that the rate has been changed by more than 20% and everything remains the same, but I am sure that I entered the correct rate. What to do?

Most likely, you made a mistake in choosing the type of course - Direct or Reverse.

Yesterday I submitted a new request at the best rate for buyers, but no one has paid for it yet. What's the matter?

Check the position of your application in the exchange list; most likely, other participants have “pushed” it from the first positions. Change the exchange rate.

I created and paid for a new request, but it is not in the current exchange list...?

Make sure that the status of your application is “Paid, exchange in progress.” Compare the rate of your application with the rate of the most recent application in the exchange list, only the first 50 applications are displayed on this page.

Website: https://wm.exchanger.ru

Where can I withdraw funds from my WMZ Webmoney wallet?

You can easily and simply withdraw money from your WebMoney dollar wallet using the information provided below. There are several main ways:

- To a bank card. In this case, a small commission of one to three percent is charged (depending on the bank). Transfers are possible both to a bank account and directly to a card linked to WebMoney. The transfer is completed within two days.

- Via Western Union. Using this method of withdrawing funds, you will pay a commission of 3.5% of the total amount. This way you can withdraw cash. How fast? No longer than 48 hours.

- Direct bank transfer with cash withdrawal. Commission from 0.5 percent. Usually carried out within 24 hours.

- Through exchange offices and WebMoney dealers. If you decide to withdraw your funds from your VSW wallet using the services of exchangers or dealer companies, be extremely careful, as fraud is possible. However, this method is currently quite common, since the client receives cash immediately at the time of application and pays a small commission - about one percent.

- By transferring to another electronic system. In this case, the transfer is carried out instantly without any commissions or deductions.

- Through a bank branch or partner's office. Using this method of withdrawing money, the client is required to pay a commission in the amount of 3 percent of the withdrawn amount.

Where can you use payments?

Webmoney is an international payment system, so the list of areas where you can use a Webmoney wallet is quite wide.

Payments in online stores

Many online stores offer payment for purchases via WM.

Service fees are sometimes not charged, meaning clients will only pay a 0.8% fee for the transfer

.

International transactions

Transferring money from one Webmoney wallet to another is cheaper than ordering international transfers

or use other payment systems.

Online casino and gambling

Most online casinos accept WM payments, and money is credited instantly.

Many clients do not know that when paying at an online casino via Webmoney, you can get benefits when converting currencies if you have several wallets.

It is also worth paying attention to the fact that some online gambling establishments offer a bonus for replenishing your account via Webmoney.

Withdrawing money from an ATM

Cashing out money through an ATM using WM cards occurs without commission.

If you use Visa or Mastercard after you have previously deposited money from your wallet, withdrawing cash will also be free.

I/O tariffs

For operations to deposit/withdraw funds to/from the system, a fee is charged in accordance with the current tariffs of agents (see table).

USD

| Way | Term | Agent commission |

| Transfer from a commercial bank | 1-2 banking days | Commission of the bank |

| Through an exchange office | By agreement | Exchange office commission |

EUR

| Way | Term | Agent commission |

| Prepaid WME card | Instantly | By agreement |

| Exchange on the wm.exchanger exchange | Instantly | By agreement |

| Exchange for electronic currencies of other systems | By agreement | Exchange office commission |

| By bank transfer (over 10,000 WME) | 1-3 banking days | Commission of the bank |

| By bank transfer (for individuals, less than 10,000 WME) | 1-3 banking days | Commission of the bank |

| NETTO Processing terminals in Moldova | Instantly | 0 (at agent rate) |

| By bank transfer online | Instantly | 2% |

| Cash at bank branches | Instantly | 2% |

| Through TelCell Terminals in Armenia | Instantly | 3% |

| In cash through the CONTACT money transfer system | 10-15 minutes | 2% (minimum 3 euros) |

RUR

| Way | Term | Agent commission |

| Cash at terminals, cash desks, payment acceptance points | ||

| Cash in banks | ||

| By postal transfer | 2-5 banking days | 0.5% + postal commission 1.7% (not less than 35 rubles + VAT 18%. |

| Through money transfer systems | see website | |

| Bank transaction | 1-3 banking days | 0-2% see website |

| From a bank card | Instantly | see website |

| Via Internet banking | Instantly | cm. website |

| From a mobile phone account | Instantly | Beeline – 8.6% + 10 rub. MTS – 11.6% Megafon – 8.11% Tele2 – 13.12% |

WMG

| Way | Term | Agent commission |

| Exchange on one of the sections of the wm.exchanger exchange or through WM-Keeper (example) | Instantly | By agreement |

| Exchange for cash at exchange offices | By agreement | By agreement |

| Exchange for electronic currencies of other systems | By agreement | By agreement |

| By bank transfer based on permanent agreements with Metdeal | 1-3 banking days | The current price is indicated on the website |

| By bank transfer based on invoices (for individuals) | 1-3 banking days | The current price is indicated on the website (applications up to 200 WMG + 8USD) |

UAH

| Way | Term | Agent commission |

| Through terminals and ATMs | instantly | see website |

| Box office | Instantly | see website |

| Internet banking | Instantly | see website |

| Transfer from an account or through the cash desk of any bank | 1-3 banking days | Commission of the bank |

| Payment cards Visa/MasterCard | Instantly | 1,5% |

| NSMEP payment cards | Instantly | 1% |

| WMU card or voucher | Instantly | agent commission |

| POS terminals "Watermelon" | instantly | trading commission points |

| Via SMS | instantly | according to the chosen tariff |

Kazakh tenge

| Way | Term | Agent commission |

| Bank transfer | 1-2 banking days | according to bank tariffs |

| From an account in the EKZT system | Instantly | 0% |

| Visa/Master card through the EKZT system | 5 minutes | 0% |

| Cash terminals via EKZT (Qiwi/Kassa24) | 30 minutes | 0-4% |

| ATMs of JSC Bank CenterCredit through the EKZT system | 30 minutes | 0% |

| In the branches of Eximbank Kazakhstan JSC through the EKZT system | 30 minutes | 0.5%, minimum 200 tenge |

Belarusian rubles: through JSC Technobank

| Way | Term | Agent commission |

| At the cash desks of JSC Technobank | 15 – 60 minutes | 3% |

| At ATMs, information kiosks, self-service terminals, cash desks | 15 – 60 minutes | 3% |

| At the cash desks of Belarusian banks, the ERIP system (section “Electronic money”) | 30 – 90 minutes | 3% |

| Through RUE "Belpochta" | Next banking day until 11:00 | 3% |

| Via scratch cards | Instantly | 3% |

| By notification or by bank transfer at the cash desks of any Belarusian bank | 3-5 banking days | 3% |

| Online replenishment with Visa / MasterCard | Instantly | 3% |

* Tariff amount is rounded to 10.

- Tweet

- Share

- +1

- VKontakte

You can exchange WMR for Webmoney:

- Ethereum (ETH) on Webmoney WMR

- Tether Omni (USDT) on Webmoney WMR

- Russian Standard RUB on Webmoney WMR

- Ethereum Classic (ETC) on Webmoney WMR

- Visa/Master USD to Webmoney WMR

- Vanguard RUB on Webmoney WMR

- Visa/Master AMD on Webmoney WMR

- Sberbank RUB to Webmoney WMR

- Kaspi Bank Kosh on Webmoney WMR

- Perfect Money USD on Webmoney WMR

- Webmoney WME to Webmoney WMR

- EXMO USD to Webmoney WMR