Hello, dear readers of the KtoNaNovenkogo.ru blog. Today I want to continue the conversation about electronic money, popular in RuNet and in the world. The turn has come to a relatively new virtual payment system under a very simple name - Unified Wallet, which was launched by Wallet One (abbreviated as W1).

Among the obvious advantages of this service, we can immediately highlight the ease of registration, the ability to work with your account anonymously, and a fairly low or no commission for moving funds within a payment system.

It should also be noted that there are a huge number of services that can be paid for through this system and a large number of ways to deposit and withdraw money from the account. Well, recently it became possible to connect a Unified Cashier to accept payments on your website (without commission). This payment system reminds me most of all of RURU.

But a barrel of honey can be ruined by a fly in the ointment. All these advantages and benefits may come to naught if your account is blocked or problems arise with the transfer or withdrawal of funds.

Unfortunately, there are negative reviews on the Internet about working with the Unified Wallet. True, you will find a lot of negativity about other payment systems (for example, Likpay or RBC Money, and even the bourgeois Moneybookers and Paer).

Of course, if possible, it is better to work with major market players ala WebMoney (through Keeper Classic with protection through E-num authorization) or the world leader PayPal, but they are also not ideal and not comprehensive.

What is WalletOne (W1 wallet) and what is it for?

Wallet One (Valet Van, Wallet One, W1, official website https://www.walletone.com) is a multi-currency electronic wallet that anyone can use to store personal funds and carry out various financial transactions on the Internet (money transfers, payments goods and services, etc.).

One of the main advantages of the Unified Wallet is low commissions for many types of transactions (for most transactions the commission is 0%), as well as the absence of mandatory account verification (you can use the wallet anonymously, but within the established limits for this type of account).

In Wallet One you can work with the following currencies: US dollar, euro, Ukrainian hryvnia, Russian ruble, Kazakh tenge, South African rand, Tajik somoni, Belarusian ruble, Georgian lari, Polish zloty.

Payment systems

Today, the Single Wallet electronic money system actively cooperates with a huge number of other popular payment systems in the Russian Federation, such as WebMoney, Yandex.Money, RBC-Money, Qiwi and many others. As a rule, within the Unified Wallet payment system, money transfers are carried out interactively. On average, the speed of a money transfer is only a few seconds. When transferring funds from other payment systems, the user will have to pay a commission, the amount of which varies up to 2.5%. If you plan to repay a loan using the Unified Wallet, the transfer fee will be 2%.

Advice from Sravni.ru: When sending a payment for a loan, do not forget about the transfer fee, include it in the amount so that the bank receives the required amount.

Step-by-step registration in Wallet One

As with many modern payment systems, registering a W1 wallet is quite simple and takes only a few minutes:

- Go to the official website of the wallet walletone.com;

- In the upper right corner, click on the “Registration” button;

- On the page that opens, indicate your mobile phone number.

- Enter the PIN code received in the SMS message and complete the registration.

- The system will automatically redirect you to your wallet’s personal account (or you will need to re-enter your PIN code that came in the SMS message.

- After logging into your Wallet One account, the system will immediately automatically determine the country and region of your residence and offer to confirm this data.

- You can immediately go to the settings (in the menu on the right at the very bottom, select “Settings” and in the “Profile” section link your email address (for additional account protection and to receive reports on transactions by Email). Also in the settings in the “Security" section You can immediately change your wallet password.

Note: after registration, you can immediately start using the wallet, but you should take into account the limits on operations (we’ll look at them later in the review), since after registration the wallet receives the status “Entry Level” (Anonymous).

The very first Bitcoin wallet

Satoshi Nakamoto, the mysterious and still undisclosed creator of Bitcoin, understood that in addition to the blockchain, it was necessary to develop an application for making transactions and storing currency. Therefore, with his hands, a protocol called Bitcoin-Qt was created, which turned into the very first Bitcoin wallet.

It was a full-fledged desktop client. To use it, you had to download the entire blockchain onto your computer. However, at that time, crypto enthusiasts had no other options. But the blockchain also weighed less, which means that using such a wallet was easier.

Bitcoin-Qt was later renamed Bitcoin Core. This wallet is still used by many today. But as stated above, it is of little interest to the average user.

The rest of the first Bitcoin wallets worked on the same principle. This continued until 2014, when a solution called Trezor appeared on the market. It was the first hardware wallet for storing bitcoins. Developers regularly publish each new version of the source code of the program on which the device operates. This allows each user to independently verify that this wallet is safe.

Based on the Trezor code, other hardware wallets were subsequently developed. For example, now one of the most popular solutions is Ledger Nano S. This is a more advanced hardware wallet that, although it stores cryptocurrencies autonomously, allows you to connect to it from a computer or smartphone, if necessary, through special applications.

The main advantages of the Unified Wallet for users

- Reliable payment system and wallet, working stably since 2007.

- There are official representative offices of Wallet One in many countries, such as Russia, Ukraine, the Republic of Belarus, Georgia, Kazakhstan, Moldova, Tajikistan, Poland, Azerbaijan, China, Great Britain, India, USA, South Africa.

- The site is simple and easy to use and is available in many languages.

- Most transactions in the W1 wallet have low commissions or are carried out without commissions at all.

- Without account verification, fairly high limits on transactions are available, and after verification, the limits increase significantly and it becomes possible to make transfers to accounts and cards in foreign currencies.

- On the official website you can download and install official Wallet One applications for iOS and Android on your mobile phone.

- A wide selection of ways to replenish your account and withdraw funds from your wallet (bank transfers, payment systems, exchangers, etc.).

- W1 Wallet Unified has an internal currency exchanger (you can quickly and safely exchange currencies directly in your electronic wallet).

- The WalletOne wallet is supported by tens of thousands of sites and online stores where you can quickly and conveniently pay for goods and services.

- In the personal account of the Unified Wallet there is a convenient analytics section in which you can monitor your wallet operations, track receipts and withdrawals of money.

What to look for when choosing a wallet?

Before registering with EPS, the user needs to become familiar with its capabilities and advantages. When choosing an electronic wallet, you should pay attention to the following parameters.

- Prevalence – it is recommended to choose a wallet that is supported by many online resources.

- Functionality - the more tools for work are provided, the more opportunities the user receives. Preference should be given to wallets in which you can open an account in several currencies, perform various financial transactions, and pay for services.

- Easy registration - this will allow you to quickly access your profile, top it up and start conducting financial transactions.

- Scope of use - for use on foreign and domestic sites, it is worth registering wallets on different web resources.

Reference!

There is no charge for creating and servicing EPS wallets.

Limits and restrictions in the WalletOne electronic wallet

Depending on the user’s country of residence, the Unified Wallet may have different limits and restrictions on transactions, depending on whether the account has been verified or not (documents confirming identity are provided or not).

After verification, Wallet One has an “Entry Level” and the following limits (let’s consider in dollars):

- Incoming transactions no more than $500 per transaction;

- Replenishment of the wallet no more than $1,000 per day ($3,000 per month);

- The withdrawal limits are exactly the same as the wallet replenishment limits indicated above.

It is also worth noting that without verification, users cannot withdraw money in foreign currencies.

Note: after passing identity verification in the WalletOne wallet (ValetVan), the limits increase on average by 3 times or more.

How does the Bitcoin blockchain work?

Before understanding the principles of operation of Bitcoin wallets, you need to understand how the technology itself works on which the cryptocurrency operates. It's called blockchain. Here are its main features:

- The functioning of the network is ensured by a huge number of computers located in different parts of the planet. Blockchain technology connects them with each other.

- The network itself (blockchain) consists of many blocks. Moreover, they are connected sequentially. That is, you cannot remove a block from the network, because this will disrupt the structure of the entire chain following it.

- Each block records all transactions completed or partially completed during its formation. A new block appears once every 10 minutes. Once completed, it takes its place in the general blockchain and will never be changed again. And new transactions will be recorded in the next block.

Thus, blockchain is a sequential chain of blocks. Moreover, each block is connected to the previous one, as well as transactions within the block itself.

How to use Wallet One (W1)

The Unified Wallet website is available in many languages, so it will be quite easy for a new user to understand its operation, especially since it is made with high quality, focusing on convenience and ease of use for ordinary users.

After registering and logging into the personal account of the Wallet One wallet, you can immediately familiarize yourself with its internal menu, and also set additional account security settings and confirmation of transactions in the link settings in order to protect your account as much as possible.

It is also immediately important to understand what the Unified Wallet number is and where you can find it in your personal account, since it is by the wallet number that you can replenish your account in WalletOne and receive funds from other users of this payment system.

Wallet One Unified Wallet Number is a unique digital account number for each client of a given payment system, which is automatically generated when creating each new wallet in the system.

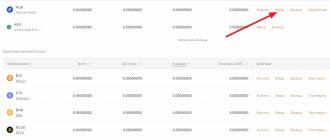

The WalletOne wallet number is displayed in your personal account in the upper right corner (under the phone number) and consists of 12 digits.

Having figured out what the W1 wallet number is, we will next consider how to properly use this wallet and perform various operations (replenishment of an account, transfers, withdrawal of money from the wallet).

How to top up your wallet

Depending on your country of residence, you can top up your personal Wallet One wallet (Valet Van) in various ways:

- In the Russian Federation: through payment terminals, from a mobile phone account (Beeline, MTS, Megafon, TELE2), in Euroset or Svyaznoy stores, through online banking (Alfa Click, Russian Standard, PSB-Retail), through a QIWI wallet or electronic exchange offices .

- In Ukraine: through electronic exchangers.

- In Kazakhstan: through online banking, bank transfers or cards, Kassa24 payment terminals, or through electronic exchangers.

Note: you can choose the most profitable electronic exchanger for replenishing the Unified Wallet through monitoring electronic exchangers (for example, through BestChange monitoring).

How to transfer funds to other users

- In your Wallet Unified account, select “Transfers” in the menu on the right.

- On the page that opens, select “Transfer money to a friend.”

- In the pop-up window, fill in all the fields (Email or mobile phone number of the recipient, transfer amount and payment purpose if desired) and click the “Continue” button.

- We confirm the transfer.

Note: transfers to other users can also be sent with a protection code (in the transfer window below you must select “Transfer with protection”). In this case, after making the transfer, you need to send the protection code to the payee in the most convenient way for yourself, and until he enters it, he will not be able to receive the transfer.

How to withdraw money from your wallet

To withdraw money from your WalletOne W1 wallet, you need to go to the “Transfers” section in your wallet’s personal account and select the most suitable withdrawal option:

- To a bank card (Visa, MasterCard, MIR).

- To a bank account.

- Receive in cash (this method is not available in many countries).

- To a card of any bank or to the account of any other payment system through exchangers.

Note: most often, many users use electronic exchange offices to withdraw funds from their Wallet One wallet at a favorable rate and in various directions.

Virtual cards

To perform financial transactions on the Internet, you can issue a virtual card. Funds are withdrawn from electronic wallets to it, then used as a regular bank card. They use it to pay in stores, pay for purchases on the Internet, and withdraw money from ATMs.

Reference!

Virtual cards allow you to cash out electronic currency.

Virtual cards are issued by the following EPS and banks.

- "Yandex money". A ruble card, which requires a mandatory user identification procedure to expand its functionality. Issued on the basis of the MasterCard payment system. There is a system of bonuses for purchases from partners.

- QIWI Visa card. The debit card is linked to a mobile phone number and provides cashback of up to 20% when purchasing from partners. It cannot be used in offline stores.

- Sberbank digital card. This is a full-fledged payment card that can be linked to a phone number and used to pay in offline stores. Supports NFC technology through the installed application.

- Debit card from Rosbank. It can be linked to a bank account and is suitable for payment in offline stores. Cashback is 1% on all purchases, and up to 10% in certain categories.

- From AB Rossiya Bank. The only virtual card that can be issued on the territory of the Republic of Crimea. Produced on the basis of the Mir payment system, it is not suitable for use in foreign online stores.

You can apply for virtual cards online or by visiting a bank branch in person.

Reviews about WalletOne (WalletOne com)

Over the long period of its operation, Wallet One has gathered around itself a very large audience of regular users, and you can find a wide variety of reviews about it on the Internet (both positive and negative). Some people like this e-wallet because it’s easy to set up and use, even for beginners; others don’t like it because it’s not very reliable and for many other personal reasons. In any case, this wallet deserves attention and can be used for certain purposes along with wallets from other payment systems, since it has a lot of advantages, has been working steadily for more than 10 years and is officially presented in many countries. We leave our feedback about Wallet One in the comments to this review and share it on social networks if it was useful to you.

WalletsRates Team

A team of experienced authors works on the articles. The website WalletsRates.com publishes useful guides, instructions and reviews of electronic wallets and exchangers, money transfer systems and online acquiring sites.

Types of Bitcoin wallets

To use cryptocurrency, you need to have your own Bitcoin wallet. However, you will also have to choose its type:

- "Cold" wallet. Designed to work offline and provides reliable storage of digital coins without an Internet connection. Of course, to send or receive a transaction, you cannot do without a network connection. However, if the task is only storage, cold wallets are the best option.

- "Hot" wallet. It is convenient because it is constantly connected to the Internet, and allows you to make transactions very quickly. Hot wallets include, for example, applications for storing cryptocurrency on a smartphone and browser extensions.

Types of desktop wallets

Wallets designed for use on a PC can also be divided into two categories. Some of them are a simplified version that uses a small amount of computer resources. They are similar to a banking application - with their help you can receive and send transactions, view your balance, but at the same time you do not participate in any way in the operation of the blockchain.

But full-fledged desktop wallets work completely differently. With their help, your computer turns into a node—that’s what each device participating in the blockchain is called. These wallets require the entire Bitcoin block chain to be downloaded to your computer at all times. And it weighs a lot - already now it is more than 350 GB, and this volume is constantly growing.

Such applications are used mainly by people who consider it their duty to participate in maintaining the functionality of the Bitcoin network. But the average user has no use for such programs. Not only will they take up a lot of hard drive space, but they will also constantly use PC resources, slowing down all other processes on it.

Hardware wallets

Separately, you can highlight hardware wallets. This is the name given to special devices designed exclusively for storing cryptocurrency and not having a permanent connection to the Internet. Outwardly, they usually resemble a simple flash drive. But in fact they are a much more secure and reliable device.

Hardware wallets are considered to be the best solution for long-term storage of Bitcoin and other cryptocurrencies. After all, it does not have a permanent connection to the Internet, and it can be connected to any computer when access is needed. However, hardware wallets must be purchased from the companies that create them, while all other types of wallets can be used absolutely free.

Compliance with 54-FZ

The Unified Cash Register has tools to comply with 54-FZ. You can set up sending checks to the Federal Tax Service through the Wallet One control center.

Setting process:

- Registration in the ATOL online system.

- Connecting an online cash register.

- Conclusion of an agreement with the OFD.

- Configuring the transfer of additional parameters to the Wallet One API.

- Online linking of the cash register terminal to the “Unified Cash Desk”.

After completing the setup, checks will begin to be sent for fiscalization to the cash register terminal. Alternatives

Alternatives to the service are Robokassa and Yandex-Kassa. Both projects are also focused mainly on clients from Russia and comply with 54-FZ.

Bottom line

The system is used by customers mainly for small payments and purchases. Most new users have problems completing the initial account identification, which is annoying and can negatively affect sales - the buyer may simply refuse to make a purchase on your site. In addition, with the help of Wallet One, deception and theft of money from inexperienced users are regularly committed, which also negatively affects the reputation of the system and sites affiliated with it.

The aggregator is suitable only for projects with a low average bill and clients who are well versed in online payments and Internet security.

Rate the text:

Author of the publication

offline 3 years

MasterCode

Comments: 2Publications: 582Registration: 10-09-2018

Connection procedure

- An account is registered in the service, and online store (IM) data is entered.

- The IM activation procedure takes place (the account and site ownership status are confirmed).

- The system provides access to test operating mode.

- To switch to working mode, you must go through a moderation procedure (company documents are checked, the compliance of the IM website with system requirements, and the legitimacy of the business).

- Withdrawal of funds is possible only after the client identification procedure (signing of the contract).

Conditions for connecting to the service

Registration in the “Unified Cash Desk” payment system takes less than a minute, and the requirements for the client’s website are standard.

You must select an account type:

- Personal. Limit – 3,000,000 rubles. All you need is a passport. You can withdraw money using cards and electronic wallets.

- Business. Only for legal entities and individual entrepreneurs. Limit – 100,000,000 rubles. You will need to conclude an agreement. Withdrawal of money is carried out to a current account.

After setting up your account and filling out all the forms, you will need to wait for verification, immediately after which you can start accepting payments. You can start using the wallet right away.