How to accurately separate 2 successful ones from 998 fraudulent ones out of 1000 trading systems

Currently on the Internet you can find... tens of thousands

supposedly “successful” trading trading systems, thanks to which (if you believe the advertising) you can consistently earn “1000% per annum”, “800 points per month”, “40 points of profit with 15 stop points”... up to the original advertising

“summer (New Year ) discounts!

Buy our advisor with a 50% discount for only $795... and go on vacation. He will trade, and you will spend money.” As Academy moderators joke, the number of “successful” trading systems in Russia alone has exceeded the number of successful traders throughout the world since the birth of the exchange

To understand the complexity of the task, imagine - in front of you there are about 1 thousand advertised products

, externally similar to each other and having the same name -

forex trading systems

. You need to learn how to accurately find 1-2 unique trading systems, separating them from 998 fakes

Drawing

Find out of 1000 trading systems of trading only 2 unique and successful trading systems of the forex currency market

Are you confident that you can handle finding a successful trading system?

To be sure, you need to be a pro in this specialty.

, which

- has clear criteria for distinguishing unique from fake

- knows the techniques for making counterfeits in this profession

- experience that gives rise to intuition (seeing internal contradictions where, even for specialists, all formal criteria and signs are at first glance observed when counterfeiting).

The difference between amateurism and professionalism

Through this algorithm you will be able to detect fraud and deception, both in Forex and in life.

The formula for amateurism.

Everything unknown seems majestic (Cornelius Tacitus), and therefore is perceived on faith, without the desire to understand its essence. As a result, scammers always offer amateurs what amateurs want to believe and want to receive (from a Rembrandt painting to a “successful” forex trading system)

MF professionalism formula.

Professionalism is the ability to see the algorithm of the great, learning to apply it in everyday work.

We will demonstrate the application of MF formulas using the example of trading systems of modern forex trading

Forms of fraud when advertising “successful trading systems”

Any professional trading system differs from an amateur one in form

and

content

, the FORM of professionalism is felt by most people intuitively thanks to their acquired life experience

. For example,

- when you go for a consultation with a dentist, lawyer, accountant, technologist, engineer... you intuitively feel their professionalism (and never have your teeth treated by a lawyer).

- even in football - if your experience as a football “fan” is counted in decades... watch a match at least once with detailed comments from a professional football coach, and you will understand that you are... an amateur (no offense, hint - take a textbook for coaches and you will understand what kind of amateurs they are majority of fans and sports commentators of matches)

Difference between Forex and other activities

(dentistry, football, etc.) is that

a novice trader (amateur) confuses the concepts of receiving a service and becoming a pro himself

- going to a football match, we want to receive a service

- to watch football... and not to master the profession of a football coach - When we go to the dentist for an appointment, we also go for a service - to cure our teeth, and not to become a doctor. A dentist can tell you all he wants about your teeth... you can buy a full set of dental equipment... but you won’t become a dentist even if you sacrifice all your teeth to learn the “secrets” of this profession

- just like consulting a lawyer... will not make you a lawyer, visiting a service station while servicing your car will not make you a professional car mechanic

- In trading, everything is turned upside down... A novice trader believes... that in Forex such a substitution of concepts is possible... to become one of the top 3% of pros by simply something

.

Demand

(the desire of beginners to become millionaires on the Forex currency market)

logically gives rise to fraudulent offers

.

On the Internet, a whole fraudulent

industry has developed, selling supposedly “successful” Forex trading systems, because...

amateurism is a perfect environment for fraud and deception to flourish in Forex

Determining Entry Points

Once the general requirements for assets have been formed, we can move on to describing what charts we will work on and what to look for on them. And here again everything depends on our trading style. For intraday trading, this will be your own set of charts, for example, daily, hourly and 15-minute. For the medium term - your own, for example, weekly, daily and hourly.

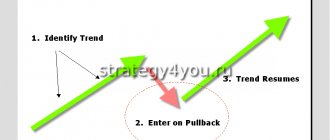

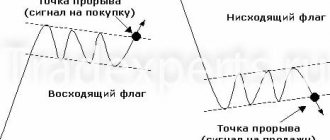

- The trading strategy imposes requirements on what we will look for on the charts when analyzing assets. And here you need to go from what you are trading. Levels, trend, specific chart pattern?

Each option should have its own trading system and visual representation of what you will be looking for on the charts. In other words, your system should have a clear example of what should be on the chart, indicating entry levels and stop setting. For example, if you are trading a false breakout, the pattern might look like this.

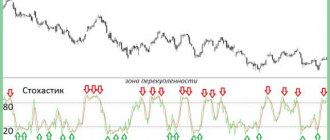

If, in addition to price movement on the chart, you use indicators, then you should also write down their settings, values and position, as well as on which chart you will look at them. Typically, a daily time frame is used for this, since indicators give many false signals on charts of lower periods. Having described the requirements for indicators, you support them with an example of a chart. The more visual the system is, the easier it is for you to work with it.

Tools of forex deception and fraud in advertising of “successful trading systems” for trading

To convince beginners to buy a “miracle trading system”, they are usually used

- pseudo statements

(account histories) - you can “draw” any account. - investment password

for a trading account (collusion between a “successful” trader and a DC) - go to the trading terminal of a supposedly “successful” trader, open his account and see how the account has been increased hundreds of times over the course of a year. This is what the technical support of the DC “drawn” for the hidden sale of a “unique trading system” - pseudo “successful technical indicators”

- programmers select periods from the trading history, adjust an indicator for them, with the help of which the account increases hundreds or thousands of times (as soon as the trend / flat changes, this indicator will lose your account with the same speed) - purchasing sites

opened 3-7 years ago, where forecasts are entered retroactively, looking at the history of quotes - a book of reviews

on behalf of supposedly traders who previously purchased this trading system - playing on human emotions and instincts

instead of logic and CONSCIOUS choice by the trader of a trading system - a tool

entire

future profession)

there is a psychological attack

- 1000% per annum in the conditions of the global economic crisis... buy our Forex advisor

now

... discounts now... the number of indicators is limited (??? ), call now (does any university in the world, from Moscow State University to Harvard, advertise itself like this? Although the “number of places” there is indeed limited)

An example of understanding forex deception and fraud based on the form of advertising material

- read the ad again

Quote

Buy our advisor with a 50% discount right now for only $795... and go on vacation. He will trade, and you will spend money."

- think about the dentist and teeth, professionals and services for amateurs... and instead of buying a “miracle trading system”, smile when you see a form

of fraud on the Internet - if you have not seen a form of fraud and believe that this trading system can make you a professional trader and will “earn money on Forex” for the rest of your days in amounts greater than Soros (without having a single advantage of the TS over Soros) - it’s too early for you to open a real account on Forex

The 2nd difference between successful trading systems is more complex - professional trading-specific algorithms

Mandatory components of a trading strategy

Each strategy should include certain points that together will ensure trading stability:

- Rationale. This is the main idea on which the trading strategy is built. It is the foundation on which all other components are based;

- Currency pairs for trading;

- Timeframe and trading time (trading session);

- Entry rules (signals to open a position);

- Exit rules. How stop loss and take profit are set;

- Trading lot volume and risk limitation.

If all these parameters are taken into account, you can begin testing the strategy on a history or demo account.

Professional criteria from the classics of trading for testing trading systems

Trading classics gave only one

A professional criterion for detecting fraudulent trading systems

is not to buy a “black box” trading system

- a trading system in which you do not know the tools embedded in the indicators and generating trading signals for opening and closing transactions.

The criterion is correct.

- The MF algorithm is explained above WHY you should not buy a forex trading system - a “black box” for a conscious understanding of the conclusions of the classics - in a black box it is impossible to analyze the trading system through technical analysis)

- an example of checking if the forex trading system of a supposedly successful trader

is an optimization of Bill Williams' Alligator (EMA 5 replaced by 7) - check how the UNsolved problems of technical analysis of Bill Williams himself are solved - see the article in the traders' magazine When and why Bill Williams' Alligator... will definitely deceive the trader - if the author of this trading system has no idea about these problems of technical analysis in the trading system of Bill Williams - how are you going to make money through this grief of the Forex trading system?

Conclusion: if it is not clear on the basis of which instruments the signals of a supposedly successful trading system are generated, then you have fraud and deception (according to the classics “black box”), no matter how many fake account histories Dealing Centers draw on MetaTrader (MT4) or other forex trading terminals

Why did the Forex classics limit themselves to only one professional criterion for checking trading systems?

Trading classics:

- or they don’t see other criteria for checking trading systems

- or they are afraid that these criteria can be applied to their trading systems... seeing and evaluating them in a completely different light (which we will do in the following chapters of the book).

Which of the 2 assumptions is true - let each forex trader draw his own conclusion.

Below we give the MF criteria for checking trading trading systems

What is a trading strategy?

A trading strategy is a set of rules that allow you to systematize trading, give the trader a clear idea of when to enter a trade, when it is time to exit it, and when it is better to refrain from trading altogether. The system also provides at what time and on what timeframe to trade, what currency pairs to use and what lot to enter into transactions. TS helps to turn off emotions and protect against their negative impact on trading.

Masterforex-V professional criteria for checking trading trading systems

1. Find the uniqueness of the trading system through technical analysis - WHAT and HOW the author discovered or improved from the classics of trading to generate NEW trading signals

This is a way to

consciously understand the algorithm of a specific Forex trading system and then use its strengths

. To do this, find

- what new

discovery was made by the author of the trading system in relation to the classic trading strategies of forex trading (in other words, what specific “advantage” and

what

does a trader get with the help of this trading system) - what exactly is this discovery?

- optimizes and corrects errors and unresolved problems in a particular Forex classic and provides a more accurate and accurate measurement

Standard form of fraud

— one of the trading systems of the classics of trading (DeMark, Bill Williams, Larry Williams, Sperandeo, Dinapoli, Prechter, Raschke, etc.) is taken and presented by the author as... his own discovery. The result is logical - 99% of traders lose their deposits using these trading systems. The same amount (or more) will be lost using “optimized” trading systems, in which the primary algorithm of classic trading errors has not been corrected

For example, a teacher of forex training courses at DC Broko published a “scientific” (??) article in a magazine (!!) about his (??)

a trading system that is copied word for word... from a book by another author, officially published 5 years ago.

When this unfortunate forex teacher under Brokaw was caught in plagiarism, instead of apologizing, without blinking an eye, he stated... that he and his son... are co-authors (???) of Grebenshchikov's book Forex

, so we are 2 (or 3? ) the same text was born in their heads, down to the commas, with a difference of 5 years.

This MF algorithm for checking trading trading systems answers questions

- why find and correct the mistakes of Elliott, Bill Williams, Alexander Elder, Thomas Demark, Eric Nyman, Prechter, Neely, Dinapoli, etc. - because their trading systems of the classics of Internet trading lose 97% of traders in the world

- Why do 100% of traders lose after forex training courses at Dealing Centers? Because they repeat only some provisions of the classics of trading with repetition... of all the mistakes of the classics of trading

- the problem of traders, after learning Forex, similar teachers will have in the future - in the book of the same Grebenshchikov there are a lot of UNSOLVED problems - see the special course of the department of the Higher School of the Academy Grebenshchikov's trading system and the correction of its errors through the TS MF

When a trader reaches this level of analysis of classical trading trading systems, he will easily discover

that

- the author of the trading system is trying to hide

- what to replace

Understanding that the unresolved problems of Elliott, Bill Williams, Elder, Neely and others will not disappear anywhere - the trader will encounter them in real trading and working on Forex.

Therefore, for free assistance to traders for the first time in the world in the traders' magazine Exchange Leader

Masterforex-V Academy began publishing trading systems as... as expected in any science

- classical trading system (Elliott, Larry Williams, Bill Williams, Gartley, Murphy, Demark, Bollinger, etc.)

- problems and unresolved problems of trading classics

- solving these problems in the trading system Masterforex-V and the departments of the Academy

Checking the operation of the trading system on ANY TF, starting from a tick chart or m1/2 to n4, n8, d1, w1

In the Forex currency market, the same algorithm for the movement of all forex currency pairs on all timeframes - from the tick chart and m1 to d1, w1, MN

- Otherwise, the computer program of the Forex Game Organizer cannot work. The computer is not capable of improvising

- understand the tick chart algorithm and M1 - you will understand every movement on all TFs of the Forex “market” (including n4, n8, d1, w1, w2, MN)

- therefore, all trading systems “working only on senior Forex TFs”... are not working on the modern managed “Forex market” (including fraudulent ones)

- thanks to this MF criterion, even without being a pro, in 5-10 minutes you can distinguish a successful trading system from a fraudulent one

- if the author of a pseudo-successful trading trading system tells you that his “trading system” only works on large timeframes, then you have a loser or a scammer (or both), who, instead of testing his trading system on M1, will offer... read reviews from traders, statements (of course, the same DC), will give an investment password to a demo account (drawn by the technical support of the DC kitchen) - other attributes of fraud and deception of pseudo trading systems (see above)

Drawings of calculation of current trades of various TFs online through the Masterforex-V trading system

(made by new traders after several months of learning forex - calculations of the movement of forex currency pairs accurate to the point of each step online - see.

- Theory and practice of the Masterforex-V trading system

- How Masterforex-V Academy students work in forex(e) statements, facts and comments ( from different

Dealing Centers, banks and foreign Forex brokers)

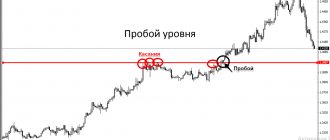

clear criteria for the transition of a Forex currency pair from a trend to a flat (flat) and back

A standard form of Forex deception/scam -

if the trading system cannot provide clear criteria for the transition of a trend to a flat and back

- trading classics... did not solve the problem of transition from flat

to trend and back - the transition of a flat to a trend and back is always carefully disguised by the Forex game organizer.

- currency pairs are in flat 70% of the time

- ask a simple question to the author of a pseudo-successful trading system - does his trading system work in a flat or in a trend? By what criteria does his trading system switch from trend to flat and back... and everything will become clear to you

The criteria for the transition of an online trend to flat and back

to the first in the world are given in the new technical analysis of Masterforex-V

A hint for traders switching to a flat (correction) of a senior TF - drawing of a wave of a senior time frame MF

Think about why both waves are called “waves of the senior TF MF”, due to which a new countdown begins (including the transition of the trend impulse into a flat and back. Without this wave... the trend continues at the same wave level of the MF)

understanding each movement of a Forex currency pair in a trend and in a flat

- determine the wave level of flat and trend (m1... m10... n1... n4... n8, etc.)

- counting waves and sub-waves

2nd flat tip

from the Masterforex-V trading system: the beginning of a flat - cancellation of impulse waves

Examples from the practice of students of the MF Academy online

Look carefully at fig. and find which waves COULD have become a trend impulse wave, but breaking through the MF pivots... at WHAT points canceled the trend impulse and turned the movement of currency pairs into a flat

After this, the author of any miracle system

- how will its indicator or automatic advisor find such waves of a senior TF at which there may be a new count of impulse waves... or a flat if the rollback by m1/2

exceeds the permissible “norm” of correction - How did he manage to introduce criteria into the advisor’s settings that none of the classics of trading could find in relation to flat?

After similar questions from sane sellers of automated forex advisors

will stop offering you to buy his miracle automatic forex trading system for 795 or 1950 dollars, realizing that you are not the amateur who does not see the deception and who will buy it.

Why would a fraudulent seller of trading systems (and a whole series of Dealing Centers) waste time on the pros, if there are so many more amateur Forex traders on the Internet.

application of a trading system to trading for ANY Forex currency pair

- if a forex trading system is only capable of trading on a specific currency pair and is not applicable to others... you have a scammer in front of you

- for example, calculate the number of EURUSD pullback points on a pronounced trend

to automatically open trades - as soon as the trend changes... miracle automatic forex advisor... everyone loses

online forex trading strategies

- if a trading system can only explain history... you have a scammer

results of work of DIFFERENT traders through the trading system... in DIFFERENT Dealing Centers and Forex brokers

- then the collusion between the trader and the broker is minimized

- see dozens of winners of trading competitions

different Dealing Centers and Forex brokers

— Academy students Standard form of forex deception/fraud

- an investment password is given to a “real” account opened in the kitchens of a DC or Western brokers (the Dealing Center can, on weekends, enter/correct any account history for its “successful” trader, who organizes an investment fund, collects money in this DC, then “loses” it "). The managers of the Dealing Center/broker will sympathize with investors and will even tell you the passport details of this fraudster... by which you will not find him anyway.

MF tip: before opening a real trading account as a trader or investor... search the websites of bankrupt investment funds in which Dealing Centers in Russia and foreign brokerage companies their accounts were opened... you will learn a lot of new and interesting things for yourself

auxiliary use of MTS (mechanical trading systems) and Forex advisors

- any MTS in the form of a “black box” (without explanation of the system setup algorithm) is a fraud

- any MTS that is unable to identify NARROW areas of its application and determine the transition of a trend to a flat and a change in trend... will lead you to losing your deposit

- Masterforex-V Academy has a whole faculty of Automation of the Masterforex-V trading system and other trading systems.

Development of new forex/forex indicators with a clear explanation of which algorithms are used in which NARROW areas of movement and what they provide for forex trading. Some of the new Forex indicators are publicly available on the Academy traders forum

using money management

Below is a separate chapter of the book

long-term use of the Forex trading system - the test of time

The bottom line is that the longer the trading system shows a stable result in obtaining a profit, the more serious the settings for generating trading signals from the discoveries of technical analysis of trading, incl. there are things that cannot be changed

- in the forex market - see chapter 1 of the book - The balance of strengths and weaknesses in the structure of any organization. The Masterforex-V theory is about finding advantages in the managed Forex market, because... any shortcoming is always an integral part and continuation of dignity.

A successful forex trading system should not be mastered by millions of traders, otherwise this trading system will be... “taken into account by the forex market”

Cypriot (14 October 2009 - 15:45):

Vyacheslav Vasilyevich, it is written in your book that if Bill Williams had not published his knowledge, his system would still have worked!

. Aren't you afraid for the MasterForex trading system?

In order for a successful trading system to be taken into account by the forex market, it must be mastered by millions of traders

- This is why the Academy’s closed forum was created, so that, unlike Bill Williams, it does not promote and disclose the points of unmistakable profit, a new technical analysis of the MF, etc.

- the ratio of 3% successful and 97% unsuccessful in Forex will remain in any case. Nobody is going to teach 3% of several tens of millions of traders in a closed forum (unlike Bill Williams’ books, which most (?) part of the world’s traders have read and are trying to apply to trading).

Brief conclusions from MF about Forex trading systems as the 1st step towards correcting the mistakes of Bill Williams, A. Elder, L. Williams and others.

Having understood the algorithm for creating and operating a trading trading system (from the discoveries of technical, fundamental and wave analysis of Forex), you can draw your own conclusions

- how not to make a mistake in choosing a trading trading system (see forms of deception / scam of Forex trading systems above)

- how to test a trading trading system in 5 minutes

Now we can begin to correct the errors of Elliott, Fibonacci, Bill Williams, Alexander Elder, Larry Williams, T. DeMark and others, consciously realizing that this is the only

the way to find our

advantages

of working as traders in the foreign exchange managed Forex / FOREX market

Discussion of the chapter of the book Masterforex-V on the Forex Traders Forum of the MF Academy.

Section 1. Misconceptions of the Forex market (typical mistakes of 97% of losing traders: what and how needs to be changed on the path to success in Forex) >>

Chapter 1. Trading system and new technical analysis Masterforex-V: how to create a profitable forex trading system taking into account... future market changes>>

Chapter 2. Synthesis of binary patterns of MF: the essence of the new technical analysis Masterforex-V >>

Chapter 3. ABC or the shortest course in technical analysis of trading when entering the 1st grade of the MF School>>

Chapter 4. Trading: 1st reference point MF / Masterforex-V (Elliott pattern / MF) >>

Read more

Chapter 6. Technical levels of resistance and support in the Masterforex-V trading system >>

Chapter 7. Wave levels of Masterforex-V and synthesis of LONG-TERM, MEDIUM-TERM and SHORT-TERM >>

Chapter 8. Sloping channel MF: solving the unsolved problems of the classic trend channel >>

Chapter 9. Moving averages (MA) are the main Forex indicator. Correction of shortcomings of MA in TS MF >>

Chapter 10. Which is better for a trader: SHORT-TERM or MEDIUM-TERM forex trading? >>

Chapter 11. Bill Williams' Trading System >>

Chapter 12. Points for a trader to open Forex trades without mistakes >>

Chapter 13. Why Stop-loss is undesirable and unprofitable for traders. What kind of “airbag” instead >>

Section 3. Psychology of trading - the 2nd component of a trader’s success or failure in the forex market >>

Book 2. Technical analysis of forex/forex in the Masterforex-V trading system >>

Book 3. Points of opening and closing transactions on the Forex/Forex market (basic rate) >>