In 2012, developer Evan Duffield, who had been interested in studying Bitcoin for several years, proposed 10 ways to increase the anonymity of Bitcoin transactions, but the cryptocurrency team abandoned his ideas so as not to violate the principle of immutability of the protocol code. After this, Duffield began developing his own cryptocurrency - this is how the history of the DASH cryptocurrency began. Compared to Bitcoin, transactions are confirmed an order of magnitude faster, there are no problems with scaling, and Dash integrates seamlessly into the Bitcoin ecosystem (the code for both cryptocurrencies is similar).

In the past, this cryptocurrency was known as DarkCoin and XCoin. Although the launch took place in 2014, the name DASH appeared only in 2015.

The popularity of the coin is evidenced by statistics from the official website (as of the fourth quarter of 2022):

- daily turnover – more than $1.4 billion;

- the network processes more than 9,300 transactions per day;

- More than 42,000 users are active per day.

Capitalization is also not bad - as of April 2019, it exceeds $1 billion. In the coinmarketcap.com rating, the DASH cryptocurrency ranks 13th.

Technical characteristics and operating principle

The peculiarity of DASH is that in addition to standard mining, a second level is also implemented for the extraction of tokens, consisting of several thousand nodes. The second layer is necessary to increase confidentiality, it also provides instant transactions and distributed network management. Part of the funds mined at the second level goes to the reserve, and the DASH cryptocurrency is self-financing. Forming a reserve is one of the ways to attract funds for project development.

What are masternodes

Masternode is a server running on a P2P network. It is thanks to masternodes that Dash provides high transaction confirmation speeds, anonymity and decentralized management. Also, the 2-level structure ensures network security and the operation of the budget system.

Any node that owns at least 1,000 Dash cryptocurrency tokens can become a masternode. In addition to the reward from the network, its owner receives voting rights. Each masternode = 1 vote, voting is held to resolve vital issues. In terms of profit, master node owners receive 45% of the block reward.

At the time of writing this review, there are 4,800 nodes in the world. A quarter of the total is in the United States.

System security is achieved through a high entry threshold, since not every node can become a masternode. Below is a table from the White Paper, in which developers estimate the probability of success of attackers when attempting to attack a network.

For example from the table above:

- If attackers managed to take control of 1,000 masternodes out of 2,300, the chance of success would be 0.6755%.

- At the current token price of $115, an attempt to “buy” the required number of nodes is doomed to failure. In this example, more than $115 million would be needed and this would give a probability of success of 0.6755%. At the same time, coins in the case of mass purchases rapidly increased in price, so that the amount could exceed a billion dollars. At such costs, the meaning of the attack is lost.

As for the profit from owning a master node, at the current rate you can earn a little less than $7,500 in a year. Not bad, but at the peak of the hype around cryptocurrencies, the annual income exceeded $15 thousand. The annual income is affected by the annual planned decrease in profit by 7% and the rate of the DASH cryptocurrency .

When a new masternode starts, a message is sent to the network containing information about the balance (1,000 DASH cryptocurrency tokens), IP, a set of keys and a number of other data. Once added to the network, every 15 minutes the master node sends messages confirming that it is operational.

However, 1,000 DASH is not blocked or frozen. The owner of the node can withdraw funds at any time, but at the same time ceases to be a masternode, which means he loses 45% of the block reward.

PrivateSend

This technology is a modified version of the CoinJoin technique. Any user of the DASH cryptocurrency can enable the mixing function in their wallet, after which the source of the funds will not be determined.

To better understand the principle of PrivateSend, let’s figure out what processes occur:

- First, the transaction is divided into denominations. The accepted denominations here are 0.001, 0.01, 0.1, 1.0 and 10 DASH. There is a complete analogy with fiat currency - it accepts denominations, for example, 10, 50, 100, 1000 rubles, the same principle works here.

- Next, the wallet sends a request to the masternodes, informing them that you are interested in mixing a certain amount. Neither IP nor any data identifying you is transmitted to the node.

- Then you need 2 users to appear, mix the same amount. After this, the master node instructs the wallets of 3 users so that they pay the specified denomination to another address, but to themselves. As a result, the cryptocurrency does not leave your wallet, but an outside observer will see an incomprehensible chain of transactions.

- This sequence is repeated with each denomination, the mixing cycle is called a round, their number can range from 1 to 16. The number of mixing cycles is set by the user in the crypto wallet settings.

- The mixing process can take more than one hour. So if you plan to use this feature, use it early.

- Please note that if, when completing a transaction, you do not indicate that you need to use anonymous funds (mixed), then the wallet will send both regular DASH and those that went through mixing to the specified address.

To use this feature you will have to pay a fee:

- A commission equal to the commission of a regular transaction is paid when the amount is divided into denominations.

- Mixing – a commission of 0.001 DASH will be charged for interrupting the operation. According to statistics, on average, the same commission is paid for every 10th mixing.

- At the stage of spending mixed funds, the usual commission and the amount missing for rounding to the minimum denomination are written off.

In general, the function is useful. The convenient thing is that you are not forced to use it and pay increased fees. If you need anonymity, activate the appropriate option in your wallet settings; if not, use DASH as a regular crypto.

InstantSend

Under this name lies a service for making instant payments; this distinguishes DASH from most other cryptocurrencies. If the crypto does not use InstantSend, then there are two options:

- Wait until you have the required number of network confirmations. During periods of high network load, the waiting period can reach 10-15 minutes or even more. At the peak of the popularity of cryptocurrencies such as Bitcoin, people waited for hours for confirmation of their transfers.

- Work with zero confirmation. This scheme is only permissible in cases where the network is not the only guarantee of payment. This speeds up the transaction, but it cannot be a way out of the situation, since it only works in special cases.

InstantSend in the DASH cryptocurrency is made possible by the presence of a second layer with several thousand masternodes. When using this function:

- A quorum of 10 random master nodes is selected.

- Quorum analyzes transaction inputs. In order for it to be recognized as valid, a majority of nodes must decide that the inputs have more than 6 confirmations. In this case, transaction inputs are blocked by nodes until the crypto transfer is confirmed.

- The transaction is confirmed in the next 6 blocks, after which the inputs are unlocked and can be used for other transactions. If the number of entries exceeds 4, an increased fee will be charged.

For such transactions, the InstantSend option must be checked in the wallet and the receiving party’s wallet must also know that this type of transfer is used. Otherwise, the transaction will proceed as usual.

InstantSend transfers are almost 100% protected from the threat of double spending. To write off funds twice, you need to rewrite at least 24 nearest blocks. Given the scale of the network, this is extremely problematic. If attackers try to do something similar, it will immediately become clear that a 51% attack is being carried out.

In the table we compare DASH with Bitcoin and Ethereum:

| Cryptocurrency | Bitcoin | Ethereum | DASH |

| Launch | 03.01.2009 | 30.07.2015 | 18.01.2014 |

| Author | Satoshi Nakamoto | Vitalik Buterin | Evan Duffield |

| Hash algorithm | SHA-256 | Ethash | X11 |

| Block mining time, min. | 10 | 0.216 | 2.62 |

| Maximum token emission | 21 million | — | Instantly |

| Transaction speed, min. | A couple of minutes | Less than a minute | Instantly |

| Confidentiality | Under a pseudonym | PrivateSend provides a high level of anonymity | Under a pseudonym |

| Innovation | The first successful cryptocurrency | Implementation of Masternodes, PrivateSend, InstantSend | A successful smart contract platform |

A little history

Dash was originally created as XCoin (XCO) on January 18, 2014. On February 28, 2014, the name was changed to "Darkcoin". March 25, 2015 Darkcoin was introduced as "Dash"

I discovered Bitcoin in mid-2010 and it has captivated my mind ever since. A couple of years later, in 2012, I started to really think about how to add anonymity to Bitcoin. I found about 10 ways to do this, but after the release, they didn’t want to include my code in Bitcoin. The developers wanted the core protocol to remain basically the same, and that goes for everything else that builds on it. This was the birth of the Darkcoin concept. I implemented the X11 algorithm over a weekend and found that it worked surprisingly well and solved the problem of fair reward distribution, which could be a good basis for a cryptocurrency startup. I actually built a similar growth curve into X11, where miners have to fight to create even a small advantage, just like they did in the early days of Bitcoin. I think this is essential to creating a living ecosystem. — Evan Duffield, March 2014

Dash creator Evan Duffield wanted the speed of transactions to allow his cryptocurrency to be used in retail.

He wanted to solve the problem of long waiting times for bitcoin transactions to be confirmed, which prevents merchants from effectively using it for trading, or are forced to rely on third-party services that allow transactions to be carried out without confirmations.

Weaknesses of cryptocurrency

There are no ideal crypto projects, and DASH is no exception. Among the main disadvantages we highlight:

- Possibility of de-anonymization. We said above that PrivateSend, one of the versions of the CoinJoin technology implementation, provides for the merging of transactions. In theory, you can track recipients simply by tracking these merges. So there is no 100% anonymity in DASH. New addresses are constantly being added to the mixer, it is difficult to track recipients, but it is possible.

- Another de-anonymization opportunity comes from yet another implementation of CoinJoin, which involves a party that knows the sender. Let's take an example from the diagram shown below. Alice uses CoinJoin technology on a wallet with a balance of 1.2 BTC, 0.2 BTC remains on the wallet, and 1 BTC is involved in CoinJoin. Of this amount, 0.7 BTC is spent truly anonymously, and 0.3 BTC goes to a known party, for example, a crypto exchange or exchanger. And using the balance that went to a known party, you can track the sender of the crypt, and CoinJoin does not help in this situation.

- The third method of de-anonymization also involves tracking the real owner of the crypt through communication with a known source. The diagram below is taken from the DASH Cryptocurrency White Paper. Alice buys 1.2 BTC on Coinbase. Then she uses 1 BTC in CoinJoin, leaving a balance of 0.2 BTC. Anonymously, she sends 0.7 BTC, and 0.3 BTC is returned to the wallet, that is, a total of 0.5 BTC remains on it. You can find out who Alice really is simply by tracing the origin of those same 0.2 BTC.

Note that all methods of de-anonymizing the DASH cryptocurrency are complex and if you do not break the law, then it is unlikely that anyone will deliberately hunt for you. The anonymity of this cryptocurrency is still higher than that of Bitcoin, Ethereum and other top cryptocurrencies.

Undeniable advantages

Some of the benefits of Dash include the following:

- Dash can be used for commercial transactions and can be spent anywhere. Thanks to fast transactions, this coin can be used for general trading. In addition, traders are interested in selling for a currency that is growing day by day;

- enabled a feature known as PrivateSend, which can mix coins through master nodes to make transactions completely anonymous and untraceable. Unlike Bitcoin, which has become a false symbol of anonymity, Dash is able to hide transaction data;

- payment confirmation is much faster than other cryptocurrencies;

- The security of the transaction is verified by miners who collectively host thousands of servers around the world. Unlike centralized banks, the Dash system is much more stable. By destroying one server, you will not violate the integrity of the blockchain;

- This is a cryptocurrency focused more on shopping than mining. However, mining it is also quite profitable. But the payment capabilities of this crypt clearly prevail.

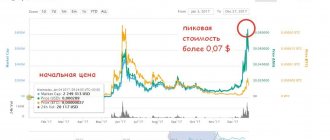

DASH course

Current Dash exchange rate to dollar, ruble and bitcoin:

The peak of popularity of the cryptocurrency falls on December 2022. Then the cost of the token reached $1,499. This was followed by a 20-fold collapse in value and some recovery in the spring of 2019. The same is with capitalization; at its peak, this figure fell slightly short of $9 billion.

The reason for high volatility is not in problems with the cryptocurrency itself or the futility of the project, but in the general situation with cryptocurrencies in the world. Note that volumes have been at a high level recently, so interest in DASH has not gone away.

Team

Dash Creator Evan Duffield

Core Team Dash consists of 50 specialists who work to improve the protocol and ensure the stable operation of the cryptocurrency. Some team members are located in Phoenix, Arizona, but most work from around the world.

Creator: Evan Duffield

— still participates in the life of the project. Evan became interested in programming as a teenager and later worked as a programmer for IT companies before he became interested in distributed ledger technologies. In 2013, he decided to completely switch to programming in the field of blockchain and cryptocurrencies.

Evan met Bitcoin completely by accident. While preparing for the Series 65 exam (an investment consulting exam in the United States), the programmer first encountered the word “bitcoin”, but did not pay attention to it. Bitcoin captured his consciousness in 2010 when Evan read about it for the second time.

While communicating on the Bitcointalk forum, the future creator of Dash realized that the main problem with Bitcoin is the lack of interchangeability of coins. He started looking for ways to fix this and found several options, one of which he proposed introducing into the Bitcoin protocol. However, the community refused, which became the prerequisite for the creation of a new cryptocurrency, which today we know as Dash.

Dash Community Development

Ryan Raylor is the current CEO of Dash Core Group. Dash Core Group is an organization that supports the network through various initiatives. At the start of his career at Dash in 2016, Ryan served as CFO. She became CEO after the position was vacated by founder Evan Duffield in April 2022.

Ryan previously worked as a financial analyst. His main area of expertise was the payments industry and investments. This, not least of all, allowed Dash to become a leader in electronic currencies.

The Dash team is one of the largest in the crypto world, and it continues to grow. The cryptocurrency has centers in several countries, each of which has its own local team.

How to buy

Crypto is suitable both as an investment object and as a tool for speculative operations. In addition to mining, there are other methods of obtaining coins.

Exchanges

This cryptocurrency is quite popular; the stage of listing on major exchanges has long been completed. Now DASH is traded not only on large crypto exchanges, but also on all more or less large platforms. The greatest liquidity is observed on Bithumb, LBank.

As for purchasing on the exchange, you can buy tokens for both fiat and other cryptocurrencies. It only depends on whether the crypto exchange where you are planning a purchase supports fiat currency or only electronic money.

To buy crypto:

- The transaction volume is set.

- Select the type of order (limit or market).

- The direction of trade is selected - buying a cryptocurrency or selling it.

For large volumes, it is better to choose exchanges with the maximum DASH turnover. You will have to wait less for the required counter volume to appear and your request will be satisfied.

Get the most favorable rate on the crypto exchange.

Exchangers

Exchange services are convenient because they do not require complex verification, and they work with both crypto and fiat. Today, dozens of Internet exchangers operate in the DASH-fiat direction.

To find the optimal rate for purchasing cryptocurrency, we recommend using aggregator sites that collect data from all exchangers registered on them. As an example, let's look at BestChange.

The direction of exchange is set on the left side of this site. For example, you need to buy DASH tokens for rubles from a Qiwi wallet. The search returns a ton of results.

The most favorable rate is RUB 7,906.97. for 1 token. On the exchange at the same time, the crypt is valued at 7,677.40 rubles. for 1 coin. The difference is 2.99%, for small amounts the commission is acceptable.

The exchange itself takes a few minutes:

- The buyer transfers fiat to the details of the exchanger.

- The exchange service, after receiving fiat currency, sends the crypt to the buyer’s wallet.

- Since DASH does not have to wait long for transaction confirmation, the coins end up in your wallet very quickly.

Among the disadvantages of this option, we note the unfavorable course in a number of areas.

Verified exchanges

If you want to exchange or purchase Dash, it is best to use trusted cryptocurrency exchanges. The most popular services today are Polonics and the Kraken exchange. Fortunately, all these exchanges have been using Dash for a long time.

The second no less popular way is to use currency exchangers. There are quite a few good exchangers, but it is best to monitor the most favorable rate using the Bestchange service. This service very conveniently sorts all exchangers, freeing you from the need to scroll through many sites. Although not all of them work with Dash yet, finding a good rate where the exchange operation is possible will not be difficult.

What can you spend it on?

Crypto can be used as a secure way to transfer money anywhere in the world where there is Internet access. In addition, more and more online stores and other services support DASH as payment for their goods and services. Cryptocurrency is used to pay for hotel reservations, pay for dinners at restaurants, and purchase electronics and clothing in online stores.

Discoverdash.com has a list of shops, restaurants and other establishments where you can pay with this crypto. In total, there are 4,800 such places, and support for Dash is beginning to appear in Russia and other countries in the post-Soviet space.

If you have DASH coins and there are no stores in your city that support them as a means of payment for purchases, try finding the product you need in online stores. The price is even more favorable than in Fiat.

Summarize

As the cryptocurrency develops, new projects arise, which are even spawned by other projects in the so-called “fork”. One such fork is Dash, a 2015 fork of Bitcoin that has many similarities but clear improvements in critical areas that define money. Bitcoin has historically dominated the cryptocurrency market despite technical limitations, while projects like Dash have smaller network effects and therefore market capitalization despite superior practical utility.

No matter which crypto project you choose, a huge number of crypto projects and tokens are demonstrating a rapidly growing and maturing space that is already making waves in the investment world. As cryptocurrencies like Dash continue to become more popular, investors can look to capitalize on the growth and adoption of this new industry.

Igor Titov

Economist, financial analyst, trader, investor. Personal interests – finance, trading, cryptocurrencies and investing.

Mining

We said above that DASH has a lot in common with Bitcoin. Similar features apply to the consensus mechanism - both use PoW (Proof of Work). This means that DASH can be mined using regular mining on ASICs or video cards. The X11 consensus algorithm is used, which should slightly reduce the load on the equipment.

Mining itself is a solution to a complex problem, the result of which is finding a block and joining it to the blockchain. The miner who finds the block receives a reward. Miners mine a block in an average of 2.62 minutes.

The two-level structure makes itself felt in the distribution of block rewards:

- Miners and masternode holders receive 45% each.

- Another 10% goes to reserve. This fund finances work to improve the network. DASH's annual budget is in the tens of millions of dollars.

As for the equipment, given the current complexity of mining, it makes sense to “dig” either with ASIC devices or with the help of video cards. ASICs are preferable since they are specially designed for crypto mining and have high power with minimal power consumption.

You won't be able to mine much with one video card. Therefore, miners build farms that combine several devices and “mine” in pools.

Flaws

There are a number of disadvantages:

- It has 19,000,000 coins as a fixed quantity.

- The Dash cryptocurrency still lacks a critical mass of users or sellers.

- The keyword Dash is widely used by several companies, so it is difficult to simply associate it with cryptocurrencies. This is disadvantageous, especially compared to Bitcoin. This leads to a decline in brand recognition and a decrease in its sole value as a cryptocurrency.

- There are other types of altcoins that bear striking similarities to the Dash cryptocurrency, i.e. Pivx, MUE and Crown. This is not good for a brand name at all.

When Evan Duffield launched Dash, he was able to mine a large amount of the currency in a short period of time. In the first 48 hours of Dash's launch, 1.9 million coins were received.

Duffield said this was due to a bug in the code, which was quickly fixed. Many believe that this was nothing more than pre-mining. Duffield categorically denies all allegations.

Types of storage wallets

Below we briefly list popular wallets for PCs, mobile devices and hardware types. Each has its own advantages and disadvantages.

Desktop

In this group of wallets we highlight:

- DASH core is the official solution from the crypto developers. Requires downloading the entire blockchain and has maximum functionality, including support for PrivateSend and InstantSend functions.

- Jaxx is a cross-platform solution, the ShapeShift exchanger is integrated, cryptocurrencies can be exchanged from one to another directly in the wallet. But the functions PrivateSend and InstantSend are missing. Suitable as an option for storing a small amount of crypto.

- Exodus differs from Jaxx only in the set of supported altcoins. Reliable, there are versions for smartphones.

Among other good solutions, we note Guarda, Coinomi, Electrum.

Links to download the listed wallets are on the official website: https://www.dash.org/downloads/

Mobile

Always at hand, and in terms of functionality they are not inferior to their desktop counterparts:

- DASH Android, iOS – mobile wallets from cryptocurrency developers. PrivateSend and InstantSend are supported.

- Edge – no support for crypto mixing and instant transfers.

- Coinomi – suitable for storing a cryptocurrency portfolio. More than 300 altcoins are supported.

- Abra – 30 cryptocurrencies are supported, the account can be topped up by bank transfer or card.

Among other mobile wallets, we note Jaxx, Electrum, Evercoin, Ethos, Trust, Bitnovo.

The download link for all applications is just above.

Hardware

They differ from those listed above in that they exist in the form of separate devices. Work with DASH is supported by such manufacturers as:

- Trezor;

- Ledger;

- KeepKey.

Hardware wallets differ from conventional desktop and mobile wallets in their maximum reliability. This is analogous to safes in which large amounts of fiat currency are stored.

Development plan

Most of the work has already been done; in the next couple of years, the developers plan:

- Q2 2022 – release of Dash Core version 0.14;

- III quarter 2022 – release of Dash Core version 1.0;

- 2019 – release of DashPay Wallet MVP;

- 2019 – Dash Wallet functionality update.

A full version of Dash Core should be released in the coming months. It will feature reliable protection against 51% attacks, the ability to send payments to user names, and a developer library and SDK will be available.

Road map

Conclusion

Dash is undoubtedly a speculative investment that has great potential to become the next Bitcoin. This potential depends on developers and the community focusing on users rather than short-term gains.

The above information clearly indicates that Dash has many fundamental advantages over other digital currencies that are currently available.

buy cryptocurrency on the Binance exchange, review of the exchange here... or on the KuCoin exchange, review of the exchange here...