Cryptocurrency exchange script So you have grown up, my dear crypto children! I remember how you were just taking your first steps down the slippery slope of the crypto business, and now you are already looking for a cryptocurrency exchange script, which means you are thinking about creating your own trading platform.

Everything is correct, if you trade crypto, it is better to use your own resource. As they say, whoever chops wood himself will warm himself with it twice.

But like any caring mother, I, Olga Krylova, am very worried about the difficulties that you will encounter on your way, so take my parting words along the way. I will tell you what you need to take care of first when starting an exchange, where to get software for it, what to look for when choosing it, and give some tips. Good luck to you!

Cryptocurrency rate: BTC. ETH. LTC. XMR. DASH - Real Time

Why is it profitable to trade Bitcoins on the exchange?

One cannot but agree that the popularity of Bitcoin is experiencing a real boom. Trading cryptocurrency on the stock exchange is now more than relevant. Can any currency boast such a rapid rise in value against the dollar? In addition, the forecasts for the future are quite serious.

If at the moment 1 Bitcoin is equal to more than $7,000, then just a month ago it cost at least two hundred dollars less. It is quite possible that analysts’ predictions will come true and it will cross the $100,000 mark.

It makes sense for owners of small savings in Bitcoin to think about the excellent opportunity to significantly increase them.

The Bitcoin cryptocurrency exchange is exactly what is needed at the moment. With a successful combination of circumstances, speculation on the difference in quotes can significantly increase the amount of everyone’s crypto savings and make them significant.

Cryptocurrency rate: BTC. ETH. LTC. XMR. DASH - Real Time

Experienced traders who have an understanding of Forex have every chance to significantly improve their financial condition. As they say, God himself ordered them to engage in cryptocurrency trading. And beginners should listen to advice: is it worth missing out on a unique chance when you can get real profits with minimal risks.

It cannot be underestimated that the owner of Bitcoins has in his hands a unique currency, the advantages of which only the ignorant do not know. And if now there is an opportunity to increase your fortune, then it would be a sin not to take advantage of it.

The growing demand for Bitcoin trading and payments has led many to open their own exchanges. The latter represent an excellent opportunity to earn a good income by charging a commission for conducting transactions (the exchange retains a small percentage of each transaction and each payment as a reward).

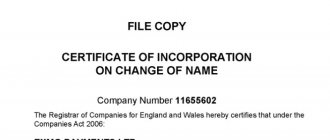

Standard requirements for the owner of an exchange service for licensing

Crypto-exchange activities as financial ones are usually strictly controlled by law, so licensing includes a number of procedures:

- registration of a company office in a jurisdiction (crypto exchanges often try to optimize their costs by dividing the business into several structures and sharing risks);

- opening accounts;

- searching and hiring employees who are proficient in AML;

- technical equipment (including specialized software);

- preparation of a package of necessary documents.

The list of requirements is identical for all countries. Differences may lie in the depth of verification of the provided documents and information by government agencies. The higher the global status of a country, the longer, more thorough and expensive the licensing procedure will be for the owner of a crypto-exchange service.

For example, in Estonia, a license can be obtained for approximately 7,000 euros, and the company guarantees that there will be no refusal to obtain a license, and you can launch a crypto exchange business in just a few months.

In Japan, the future owner needs to be prepared to contribute authorized capital (10 million Japanese yen, or approximately 90 thousand US dollars), include at least one director who is a resident of Japan, and also regularly undergo audits of current activities for compliance with Japanese law.

Basic knowledge for working on the cryptocurrency exchange

So, what does it take to set up your own Bitcoin exchange? To plunge into the world of cryptocurrency and understand all its aspects, you need to thoroughly study the principles of mining, trading and find a reliable exchange.

A search on the Internet can be a guide, but it must be very thorough, and the choice must be informed and justified. You need to pay special attention to the image and business authority of the trading platform, find out how long it has been running, and what the results are.

A reputable online cryptocurrency exchange will be sure to preserve its history and respect its own authority, providing potential consumers with a wide range of information about its activities.

Positive reviews are also important, but when re-reading them, you need to take a closer look at how reliable they are, because it is possible that there may be custom comments. Forums can help here, where people communicate and clarify many issues, and expose “scammers” and “fraudsters.” Definitely, you need to choose only more well-known exchanges, with a positive image and a long presence on the market.

Types of cryptocurrency exchanges

Trading platforms. These are websites that connect buyers and sellers and charge a fee for each transaction.

Direct trade. These platforms provide tools for direct exchange between people. Direct trading exchanges do not have a fixed market price; instead, each seller sets their own exchange rate.

Brokers. These are sites that anyone can visit to buy currencies at a price set by a broker. Cryptocurrency brokers are similar to foreign exchange dealers.

Cryptocurrency funds. They are a professionally managed pool where you can buy and hold cryptocurrency assets. One example is GBTC.

How to launch your own exchange?

Find out what things you need to consider before launching your own Bitcoin/cryptocurrency exchange, how to structure the internal software architecture and, most importantly, where you can get the exchange software.

Decide where you want to do business. Whether you want to operate globally or limit yourself to a specific region or country, it is usually necessary to obtain the necessary licensing and approval for the company to open an exchange according to the operational scope.

Laws vary from location to location, therefore, consult a legal expert regarding licensing and compliance with local laws and regulations.

Find out about the relevant regulations in this area. Almost all governments require organizations that engage in financial business to adhere to Know Your Customer (KYC) norms.

This is the process by which a business verifies the identity of its customers against government-issued ID cards or passports. The main goal is to combat money laundering.

Make sure you adhere to your country's KYC regulations and integrate a suitable customer verification process into the exchange. Otherwise, there is a risk of prosecution.

Enter into a partnership with a bank or payment processor. You need to work with a bank or processor to process fiat payments. Choosing a reliable bank with many online services is a good option.

This is more relevant in developing and underdeveloped countries where most banks do not have the ability to process an immediate online banking transaction. Transactions may take up to two days.

Partnering with a bank that has fast clearing and settlement of funds will provide convenience to the client. Additions and withdrawals can be automated through a payment gateway or done through manual transfer.

Establish transaction history and liquidity on the exchange. Any exchange needs liquidity to operate successfully. Clients are hesitant to place orders or even invest unless they see a large order book and active trading activity.

New cryptocurrency exchanges naturally face liquidity issues. There are three established ways to increase liquidity:

- You can simulate trading activity within an exchange by buying and selling between two artificial accounts.

- You can implement an API that links your exchange to another existing exchange.

- You can join a whole network of cryptocurrency exchanges, such as Trust-Deposit, which pool the liquidity of all the exchanges in their network. The larger the network, the higher the liquidity.

Implementation of best security practices. Any exchange requires a top-notch security system to ensure that the funds of the operator and its traders remain safe.

This should also apply to customer personal data, which includes personal data and bank account information. According to a report by Reuters, a third of all Bitcoin exchanges operating between 2009 and 2015 were hacked. Key Point: Safety must be a top priority.

Customer support. Finally, customer support is another important component of a successful exchange or exchange. Staff are required to verify KYC data, respond to complaints, process deposits and cash withdrawals, etc. A fast technical support mechanism ensures that customers do not run away at the first problem.

What should you think about first?

You need to decide which market your exchange is targeting. Will it work on a global scale, or will it be limited to a specific region or country? In addition, the company will need appropriate permits and licenses to ensure that the service complies with the requirements and regulations of the countries in which it will operate.

Laws vary in each state, so expert advice may be required. He will advise you on how best to comply with licensing and operating requirements.

Foreign exchange companies must adhere to KYC norms. KYC (Know Your Customer) regulations oblige the company to verify the identities of its customers, collect passport data and other information.

The main goal is to combat money laundering. Make sure you comply with the relevant requirements in your home country. Otherwise, one day the police may show up at your office door.

To make payments in classic currencies, you will need an agreement with a bank or payment system. A reliable bank with a developed online platform is a good choice. This problem is most acute in developing countries, where most banks cannot initiate transactions online. Some transfers take up to two days.

A bank with fast and efficient payments will be convenient for the company’s clients. Depositing and withdrawing funds can be done by creating a payment gateway or even using regular money transfers.

To operate successfully, any exchange needs liquidity. Clients are hesitant to place orders or fund accounts on sites without explicit trading activity. New exchanges naturally face a lack of liquidity.

There are three common ways to increase apparent liquidity:

- Simulate trading activity on the stock exchange by conducting transactions between fictitious players;

- Implement an API interface that connects your trading platform with another exchange;

- Join a network of cryptocurrency exchanges, for example, Trust-Deposit. It links the liquidity of all exchanges on the network. The larger the network, the higher the liquidity.

Security must be ensured. The exchange must guarantee reliable protection of traders’ and operator’s money, as well as clients’ personal information. Data leaks from cryptocurrency exchanges are a serious problem. So, at the infamous Mt. The Gox hack went undetected for years.

As a result, 1% of the total number of bitcoins in circulation was stolen. According to Reuters, between 2009 and 2015, a third of all existing cryptocurrency exchanges were hacked. In other words, safety should be a top priority.

Finally, customer support is another important component of a successful company. Personnel are needed to collect personal data, answer customer questions, process deposits, withdraw funds in classic currencies, etc. Operational support ensures that customers can trade and bring profit to the company from the moment of registration.

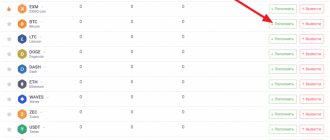

To successfully launch and operate a cryptocurrency exchange, you need the following tools:

- Graphs showing the volatility of Bitcoin, as well as other alternative and fiduciary currencies. They can be used to create different trading pairs when making transactions.

- Passive and aggressive orders – a table with players’ orders.

- To conduct a qualitative analysis, you need a detailed history of completed trade transactions. This is useful for determining the demand of trading participants, as well as for more accurate forecasts, which is the basis of exchange trading.

Advantages and disadvantages of exchangers

Disadvantages of working with exchangers:

- Great exchange rate. It happens that the rate on the exchanger is higher than the exchange rate.

- Schedule. It is not possible to use manual or semi-automatic services at any time, 24/7; they do not work, for example, at night. There is no such problem on crypto exchanges.

- Limitation on money reserves. On the websites of online exchangers, small reserves are displayed, both in crypto and fiat. The reserves of an exchange office can be up to $10 thousand, while the reserves of cryptocurrency exchanges amount to millions and billions of US dollars.

- Limited listing of crypto coins. For example, no more than ten types of cryptocurrencies can be presented, and only the most popular ones.

- Low level of protection. The level of security of exchangers compared to crypto exchanges is not high enough. Crypto exchanges have developed sophisticated functionality to protect users’ personal data.

Advantages of exchangers:

- Ease of operation. Some services allow you to conduct exchange transactions without providing personal information. Exchangers have a simplified user interface compared to crypto exchanges.

- Relatively fast exchange. Typically, TOP exchangers have an automatic customer service mode. Therefore, all operations take no more than 2-3 minutes.

- There is support for popular payment systems that cooperate with many banks.

- Discounts and bonuses on exchange. For frequent transfers, the exchanger may give bonuses in the form of a reduction in the commission percentage, as well as provide other interesting bonuses.

Marketplace Software

A script is an automatic program to achieve a certain goal, so as not to do it manually, using an interface.

Professional assistance in organizing an exchange is valued among experienced players. To create your own trading platform, you should download the cryptocurrency exchange script. It should accept different currency pairs, operate a point of sale from different countries and provide greater income opportunities.

The site must ensure the protection of operations, for this:

- SLL site security is installed;

- Limits on withdrawal of funds are automatically set;

- the intelligent system against fraudsters is being tested;

- a two-stage installation system for the site owner is fixed;

- The experience of European jurisdiction is taken into account.

For successful trading, you should read the presentation, make sure of the positive qualities of the program’s sellers, then download the cryptocurrency faucet script to connect various systems and payment methods.

Exchange operations are technically supported throughout the entire life cycle of the project, and the exchange platform is constantly updated.

There are three main ways to get software to run a crypto exchange, which we will discuss below.

Self-development

You can write special software yourself by assembling a team of developers from friends and freelancers. Make sure that they understand the general principles of the exchange, the specifics of cryptocurrencies, blockchain, and are able to implement the above-mentioned components.

The choice of programming language also depends on what currencies the exchange plans to work with. Additionally, you should ensure that the software is compatible with various payment processing platforms or banks to secure exchange transactions.

The most important thing is to evaluate the cost of money and time associated with developing, maintaining and updating software within the company. Due to the complexity of exchange software, development and debugging may take 1-2 years (the determining factor is the experience of the developers).

Depending on the salaries of employees and the complexity of the project (support for various languages, currencies; creation of a mobile application, etc.), development costs can amount to up to 400 thousand euros.

Keep in mind that this is just an estimate and the final amount depends on many factors.

Ready-made cryptocurrency exchange scripts/open source applications

There are quite a few open source stock exchange scripts on GitHub and other sites. Obviously, their main advantage is that they are free. However, risks must also be taken into account:

- To tailor the program to specific needs, you will need a person with the appropriate knowledge. Getting to know the work and modifying the script will require additional time and money;

- There is no guarantee that an open source program is safe or reliable. It may contain errors and vulnerabilities, and in the worst case, malicious code that will slowly and quietly steal bitcoins;

- There is relatively little support for open source systems. The development team will have to figure out how to fix bugs or improve system performance on their own. If the author of the program completely abandons the project, then there will be no support or help from anywhere.

Third party software

Such software, as a rule, has already been thoroughly tested and verified to work. At the same time, it allows you to customize and change some functions according to individual preferences (for example, design, branding, languages, currencies, graphics, etc.).

This software relieves the buyer of difficulties with technical aspects, development and maintenance. Since the main components (trading core, wallets, interface and administration panel) have already been developed and tested, you just have to customize the software as you wish.

This option significantly saves time (it often takes only a couple of months to launch a project) and money (purchasing a license for ready-made software is much cheaper than developing it yourself).

Efficiency and CPM script for the VKontakte advertising exchange

Efficiency means the interest of subscribers in the public (the higher, the better), CPM is the price for (the lower, the better)

How this will help: select a VK community in which advertising is more likely to be profitable.

Of course, there are other tools for analyzing public pages, but this script will also be useful, first of all, as an addition, in order, for example, to finally decide for yourself in which public to advertise.

Look at the picture and pay attention to the colors of the efficiency and CPM indicators:

Green - excellent indicators; Blue - good indicators; Red - poor indicators.

How to work with this script:

1. Install the browser add-on - ViolentMonkey for Opera, Yandex and Google Chrome

2. After installing the add-on, copy the contents of the dlya_birzhi_vk.txt file from the archive into the desired window in the add-on.

Click “Create”, copy the code from the text file there, click “Save and Close”.

3. Go to the VK exchange and simply refresh the page. If you are filtering communities by parameters, refresh the page after you have selected the parameters. Otherwise, KPI and CRM will not be shown.

download Efficiency and CPM script for the VK advertising exchange:

download VKontakte script

After reading it, it’s better to buy from the developer!!!

To comment, register or log in!

Gram Post 1.0 auto posting script on Instagram

Gram Post auto posting script on Instagram - multi Instagram accounts; easy to install and use; Schedule report; Multi-language support; Video posting support; View records; user subscriptions; Spintax support; group categories; PayPal integration

nonameno.com

What to look for when choosing software?

Some solutions and scripts seem useful and very cool, but this is deceiving. Just sales packaging. Finding out how it actually works is only possible by installing it on your own server, through trial and error.

Customization can be a living hell, the functionality is not flexible, and the platform is not scalable at all. In this case, only disappointment awaits you in the future.

Architecture

Perhaps the basis of all web applications is their architecture. The architecture is developed for several types of projects with varying loads. In cryptocurrency exchanges these are small, medium and large (enterprise) projects. However, this also applies to the development of marketplace platforms.

A characteristic feature of a small project is the all-in-one architecture. One of the most popular in 2000. It may cost less, however, the throughput and load are also not so great, but minimal. There is no need to talk or think about trading volumes or transactions exceeding several thousand.

Currently, the largest number are mid-level projects. To create and launch a cryptocurrency exchange, you should use a modular system with isolated components. If you have several high-quality system administrators on your team, then you can launch an effective platform with decent daily volumes.

Large or enterprise cryptocurrency exchanges will not work with the above architecture. But what then to do in this case? A distributed, isolated modular system with balancing and an ultra-powerful server (a la m5.24xlarge) will help you.

The components of cryptocurrency exchange software have been described in our previous articles. These are the graphical user interface, wallets, trading engine, administrative system and database.

Proper synchronized work is the key to success at the start. Each of these components for an average project should be hosted on a standalone server. Levels of protection vary from component to component. Technical requirements for the server also vary.

KYC and AML modules

Recently, news has often surfaced - one country or another has banned exchanges. Facebook has banned advertising of cryptocurrencies. Binance moved its operations from Japan to Malta, which is the largest exchange in the world.

The requirements for exchanges and the complexity of opening them are increasing in India. And Belarus and Estonia have completely legalized these businesses. However, this does not in any case negate the need to comply with the requirements of your countries.

Exchanges and payment systems require that they know their clients. What is included in the minimum kit for KYC? For most countries, it is enough to provide user data, their identification using ID cards, international passports, and driver's licenses.

The next level of identification involves having information about the user’s place of residence. Bank statement, utility bill, or mobile operator bill. KYC is important not only for trading platforms, but also when launching an ICO.

AML or Anti-Money Laundering. In short, to protect yourself, you are required to provide reports on financial transactions passing through your exchange to higher authorities and the state. It is important to remember that all this is only necessary for exchanges that work with fiat money, such as the dollar, euro and other regulated states.

If your exchange offers cryptocurrency-to-cryptocurrency trading pairs, then it is not necessary to implement these modules. However, once you decide to launch fiat money, be prepared.

Liquidity

Liquidity is the most important element when developing a cryptocurrency exchange. Without sufficient liquidity, your exchange will not be listed on Coinmarketcap, users will be unhappy, and as a result, customer outflow. Disinformation has always existed, but there are only 2 options for generating liquidity.

Local market makers. Generation of orders based on algorithms, current exchange rates, and general market conditions. Market makers work on behalf of platform owners and their wallets. As of 2022, every major exchange has local market makers.

External liquidity. If the first option does not suit you, there is a much more interesting one - obtaining external liquidity, for example with Kraken. What happens in this case? Exchanges synchronize with each other, as soon as an application appears on Kraken, it is immediately with you and vice versa.

It’s hard to say which of these two options to choose. There are pros and cons to each of them. It is possible to achieve unity and harmony in liquidity only by combining both options in the platform.

Currencies and Cryptocurrencies

What currencies should be supported on the exchange? What about fiat money? In fact, everything is quite simple here. After doing a little analysis of the target countries, you can easily tell what kind of fiat money they use.

For example, for most European countries there must be at least 2 currencies: the euro and the national currency of the country (Swiss franc for example).

Regarding cryptocurrencies, you can always check Coinmarketcap to see which coins are gaining popularity and which are losing value. Capitalization is another important point. It's definitely worth using Bitcoin and Ethereum. Add Litecoin to them and here is the minimum acceptable set.

Of course, if you are thinking about how to create a token on Ethereum, it would be great to integrate it as well. To some extent it also depends on the target country. For example, Monero has been popular in Turkey for a long time. Your list of currencies can be a huge advantage for you, and using it as well as ICO marketing.

Trade and exchange

There are three types of exchanges with several subtypes. First of all, these are exchangers, trading systems with a glass, and of course margin trading with leverage. Each type has its own characteristics. The first makes money from the course, the second from transactions, and the third from excitement. When choosing a cryptocurrency exchange script, pay attention to what properties it has.

User functionality

In addition to the standard profile with several data fields, there are also opportunities to receive live notifications, 2-factor authentication, deposit and withdrawal of money including fiat and cryptocurrencies. Trading history, logs and security. Integral functionality for users.

Functionality of the administrative part

As the owner of an exchange, you must have a full range of functionality. If the KYC module is enabled, then first of all user management. Whether you do it yourself or using your managers makes no difference.

However, delineating user roles for greater security simply has to be there. Hot and cold wallets must be connected.

Trading pair management is also important, but not as important as reports and transaction lists. Smart filters based on user preferences and market conditions. Communication with users is best implemented through the administrative part. An alternative is Zendesk.

Where to select the script?

The market is crammed with different options, each with its own characteristics and disadvantages.

Free, open-source scripts. Perhaps the most delicious solution. Free scripts that can be downloaded and installed every moment to launch the exchange. Is it worth downloading them? Definitely yes. At the very least, you will understand the architecture of the exchange and its components.

However, such scripts often have holes in them so that the developers can extract money little by little.

In this case, you hire a team of developers and experts who audit, and then restructure and refactor the code. I think it is unnecessary to say that such scripts will not withstand significant loads.

Cheap scripts. If you have a little knowledge of development, for example, on WordPress, it will not be difficult for you to download ready-made open-source scripts, make small changes to the CSS and sell it under your own name.

These are the solutions you will find on the Internet. At their core, they are practically no different from the previous point.

White-label scripts. Such scripts already have ready-made functionality that you can deploy on the server and run. Ideal for starting your Bitcoin exchange business, but often falls short for companies with slightly higher expectations.

Aftertaste

This is all a bit complicated, but at the same time it’s not very complicated, if you don’t step on the rake, which, I must say, are present. Don't forget about JWT, SSL, CORS, and a bunch of other goodies that are sure to come your way along the way. But in general, this is a working scheme for automating mechanisms that can be useful not only when creating an exchanger. I do not claim to be an expert in this matter, I am only expressing my conclusions after a rather laborious process of going through all of the above. You should not take it literally - much is very subjective and does not pretend to be an axiom. I would say most of it. But water does not flow under a lying stone, and the best solution for today is development and moving on.

I hope someone finds this information useful. I just wanted to share a little about the feelings and experience gained from the process.

Further development is positioned as a p2p platform for making exchanges. I welcome any questions or suggestions, and thank you very much for your time.