Trading is much more popular now than it was five years ago. Many have heard about Bitcoin, which is many times more expensive than gold, about exchanges, quotes, and the foreign exchange market. About huge earnings and risks. Popular culture had a great influence on the formation of the “image” of trading.

Many “smart” articles have been written about trading, overloaded with complex concepts. We want you not to get confused in the labyrinths of terminology, but still imagine what trading is, what prospects it opens up, what its advantages and disadvantages are. And the main thing is whether you really need it.

What do traders actually do?

They do two things: they try to predict the future and they take money from each other.

Predict the future

To make money, a trader must make a forecast. For example, how the price of the dollar will change, how the share price of Gazprom or Sberbank will change. And based on your forecast, make a deal - open either up or down.

Traders try to predict the future in two ways - technical and fundamental analysis.

Technical analysis is when I look at a chart and make a prediction. There are a lot of different methods in this analytical direction. For example, here is an analysis based on support and resistance levels:

The price seems to rely on invisible lines and pushes away from them.

Here is an analysis based on Fibonacci levels.

And so on.

Fundamental analysis is when a trader studies the overall health of the economy. And makes a forecast. For example, the news comes out that Donald Trump is losing the election - the trader immediately thinks whether the ruble will fall in price against the dollar or rise in price. The news came out about the closure of borders due to Covid - the trader also thinks whether airline shares will fall in price or not.

Then, based on their forecasts, traders open trades. If the forecast is correct, they make money; if it is wrong, they lose money.

They take money from each other

Where do market traders get money from? From other traders. For me to make money on a change in exchange rate, someone else must lose money on it. That is, I will make the correct prediction, and you, for example, will make the wrong one. You will lose money on your forecast, and I will receive it.

Let's summarize

Traders in the market do two things - try to predict the future and take money from each other.

Top 3 platforms for trading on American stock exchanges

If we consider the rating of the most reliable foreign platforms that are suitable for both professionals and beginners, then we should highlight 3 popular versions. The trading platforms presented below are the most convenient in terms of price/quality ratio.

Rox

Beginners are advised to use ROX, since it is much more economical than familiar copies, but has an initial set of functionality, which can then be expanded with additional programs and graphic platforms of any level.

First of all, the bet is on trading in moderate volumes at the start stage, while there is no stable profit. Thanks to simple controls, it’s easy to understand the settings, and you don’t need a powerful computer.

Takion

The next good platform that traders often use is Takion. The list of its main characteristics includes high data transfer speed and ample opportunities for trading with various strategies.

It is useful for online transactions on the NYSE, since the software of this resource allows users to make transactions in large volumes. Among the advantages, it is worth highlighting built-in charts and full Level 2, access to dark pools and ECN, it is possible to profitably exchange “baskets”.

Fusion ex-graybox

And Fusion is considered a reliable trading platform even for an intermediate level trader. It also provides a full Level 2, a flexible list of functionality and a convenient filter system. The list of main advantages includes the largest short list and low requirements for Internet connection speed.

The portal always guarantees support for groups of traders, firms and other individual clients when entering US stock exchanges, which makes it a truly interesting option.

Why you can’t make money from trading

There are two reasons.

You can't predict the future

Nobody knows the future. No one at all. Unexpected news can instantly collapse the markets, and no one will be prepared for it. So traders traded the Turkish lira, traded and traded, everything was fine. Then suddenly the news comes out - the Turks tried to overthrow Erdogan. And the lira exchange rate collapsed.

Or here is an example with the Swiss franc. On Sunday, the Swiss government decided to stop keeping the franc at the same level as the dollar. None of the traders expected this at all. On Monday morning the picture at the market was like this:

How could this be predicted by technical or fundamental analytics? Not at all.

Secondly, the price is influenced by a huge number of factors. For example, Trump lost the election to Biden - how will the ruble react? Let's say the ruble falls. What if at this moment all EU countries accept the Russian coronavirus vaccine? What if oil suddenly starts to rise, and the ruble strengthens along with it? What if America is overwhelmed by a wave of unrest and the dollar, on the contrary, weakens against the ruble?

How to make sense of all this mess? Each analyst will understand it differently. And some of the traders will “guess” and make money, others will “not guess” and lose money.

No one will just give away their money

If you decide to become a trader, you decide to take money from other traders in the market.

Opening an account for trading means saying: “I’m the only smart one, and you’re all stupid. Now your money will be mine."

Do you think this might be true? How can you be smarter than millions of people, analysts, stock speculators with higher economic education who trade on the stock exchange? No.

They are much smarter than you. And they are not going to give you their money just like that.

If you saw a trend in the market and decided to trade with the trend, do you think that other traders are blind and do not see it? If you read the news about border closures, do you think other speculators don't know about it? Actually, there are thousands of people who learned about this border closure long before the journalists and long before you.

Understand two simple things

- You can't predict the future.

- You are not the smartest.

The Rise of Money (2008)

Another documentary series based on the book of the same name by Neil Fergusson about the history of the formation of the global financial system.

The six episodes track the evolution of the global financial system, showing the connections between all the key events in financial history and clearly identifying how they are interconnected. The series describes the history of the origins of money and bank cards, the historical role of bonds, and the first days on the Paris and Amsterdam stock exchanges.

Complex concepts from the world of money and economics, patterns of development, prosperity and decline of financial structures are presented in simple language and with clear examples. This is a kind of encyclopedia that captivates the viewer from the first frames. The documentary series is for informational purposes and will be useful both to specialists and to all those interested in the history of the development of market relations.

Is it possible to make short-term earnings from trading?

Yes, it's possible. You can still make a correct prediction and “guess”. And make a profit. But trading will never become a systematic source of income for you.

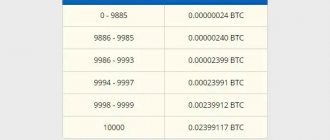

I periodically receive promotional emails from the Alpari broker. They say: “So-and-so’s PAMM account earned 800% in a week.” Here's a typical example. That is, a trader in the foreign exchange market received 800% profit in one week.

But find a PAMM account that would systematically generate such returns for, say, 15 years. There is none of them. Today there is a profit, tomorrow there is a loss, after tomorrow it goes to zero, then again a loss, again a profit. Sometimes you're lucky, sometimes you're unlucky.

About Livermore

When people ask me about making short-term money from trading, I always use Jesse Livermore as an example. This man speculated in the financial market back in the first half of the twentieth century. He is considered the greatest stock speculator in history.

He made huge fortunes on the stock exchange three times. Why three times? Because every time he completely lost them and had to earn them again. Once again he lost his money in 1940. And he shot himself.

Wall Street Warriors (2006-2019)

Documentary series about traders with Alexander Gerchik in the title role. In it, he tells how from an ordinary emigrant from Russia he became one of the Wall Street warriors. The filmmakers allow us to look into the everyday life of people who create entire fortunes during the day, and see in what ways results are achieved.

The heroes of the film are employees of large financial companies. Three seasons of the American film keep you in suspense; they will show the details of the life of trading sharks, the dramatic moments of stock trading from sudden huge profits to the instant loss of gigantic fortunes. The film shows the hidden behind the scenes, where intrigue, greed and traps lie in wait. Any deal entails tough confrontations and overcoming many pitfalls.

It is not easy for a decent trader to survive in such an environment; trading requires incredible awareness and validity of any step, commitment to principles, thoughtful goals and motivation.

Why do brokers offer trading training?

Because this is the best way to lure you into the stock game. You come to the broker’s website, register and start learning. You study all the intricacies of technical analytics and even, perhaps, fundamental analysis.

When the training ends, you begin to think: “I’m definitely the smartest now. I know everything. I know how to set up candlestick models, patterns, Wolfe and Elliott waves, and trend indicators with oscillators.”

And you start trading.

And gradually you lose all your money. What about a broker? And he is happy. Stock market brokers receive a commission from every trader's action. The trader opened a deal - the broker earned money, the trader closed it - the broker also earned money. Even if the trader lost money on this trade, the broker still makes money.

In the foreign exchange market it’s about the same story, only there are spreads, not commissions.

The broker doesn't care whether you make money or not. He wants you to trade, and trade as much as possible. Therefore, he will train you, he will offer you bonuses, he will lure you with new trading terminals, webinars, books, analytics and all sorts of other things.

Brokers need your money. And nothing more.

Myths about stock trading

A few myths about investing and trading that haunt the minds of novice traders:

- Being a trader is easy and pleasant. This myth is probably the most popular. In fact, being a trader is a very hard job. Stock speculators experience enormous psychological stress, process a lot of financial information, and constantly learn new trading methods. Few beginners can withstand such a load and become a professional.

- Trading strategies depend on the initial capital. Many novice traders, having a small initial capital, do not take it seriously and trade with increased risk. You can't do that. Regardless of your amount of money, you must clearly work on your strategy. As capital grows, you begin to diversify risks and divide portfolios into speculative, medium-term and long-term ones.

- The stock exchange is a scam. This point of view is erroneous, since exchange trading is regulated at the federal level. There are no stricter laws than stock trading laws. Their compliance is monitored by the Central Bank and various supervisory and regulatory authorities. In case of non-compliance with the law, the exchange, broker or individual employees are deprived of licenses and certificates, without which it is impossible to continue exchange activities.

Why do some traders teach others?

Because they make money from it. They receive a stable income and do not risk anything. For example, if a hundred people bought a trading course for ten thousand rubles, that’s a million in your pocket.

And if all these hundred people lose their money in trading, you can tell them: “Well, it happens. We had to follow the rules of capital management, we had to not deviate from our strategy, we had to analyze the market more correctly.” You can find any number of ways to tell a person: “It’s not my course that’s bad, it’s you who are stupid.”

Why did Larry Williams start teaching? He won the trading competition, receiving 2,000 percent profit. And then he gradually moved away from trading and began teaching training courses. Why?

Because this is stability, this is calm. There are no sleepless nights, stress or risks.

Why did his daughter earn ten times less than her father? Why didn’t all of America go to study with him if he was such a great stock speculator?

Because not all people have gone crazy yet.

8.Traders (1996-2000)

The Canadian series follows investment bank employees as they fight for their financial future. The footage contains a lot of professional slang and terms, showing the psychological component of trading and the characters’ characters.

The storyline debunks many financial misconceptions and myths. The world of big money, intrigue and fraud is shown in great detail. The main characters of the drama have different positions: from maintaining the independence of the bank to expanding at any cost. Huge dividends and short-lived success, personal experiences and problems with the law, ups and downs - you will see all this in 5 seasons of the film, which received the award for best drama series in 1998.

What would happen if you could make money from trading?

This is what would happen.

There would be one trading strategy

The only one that helps pump huge amounts of money out of the market. For example, if Fibonacci levels could do this, then there would only be a strategy for Fibonacci levels.

And no Gann fan, no support levels, no indicators or patterns.

The exchange would disappear

Someone alone would have taken absolutely all the money from the exchange. All speculators would be wrong in their forecasts and go bankrupt, while only one would get rich.

There would be no exchange, because no one would buy or sell anything on it. Everyone would know that there is “some kind of dark force” that immediately takes away all the money.

No one would teach trading

Because this one person who would learn to pump money from the stock exchange would not tell anyone about how he does it. He would be pumping billions out of the markets, and not selling trading courses for a couple of thousand rubles.

On the stock exchange, all traders are competitors to each other. Why raise your own competitors? Train them? Why do this if they will only interfere with making money? Nobody in their right mind would do this.

Traders would become the richest people in the world

Have you wondered why the richest people now are Bezos, Arnault, Gates, Zukurberg? Why is Bezos with his Amazon, Gates with Microsoft, Zuckerberg with Facebook on this list? Why are there no traders there?

Isn't this a paradox?

Which of the following came true?

Nothing. There are thousands of market trading strategies. And traders continue to come up with new ones. The exchange is as it was. And trading volumes on the stock exchange are only growing. Trading is taught everywhere - there are tons of courses on the Internet and even official offline courses from brokers licensed by the Central Bank.

And the richest people in the world are not traders.

Pros of the profession

A trader specializes in trading on securities exchanges, trading stocks, bonds, futures, earning his capital on the difference in the cost of exchange products. The main advantages of this profession include:

- The absence of any border or ceiling on income growth. There are no limits here and everything depends only on the individual trader.

- In this profession, you can build a career from scratch in the shortest possible time.

- Some of the work is related to creativity. As a trader, you are unlikely to ever be bored. You will have to constantly analyze your own results and study the market.

If not trading, then what?

Investments. Invest, don't speculate. I have two articles on this topic, read to understand the difference:

- What is investment?

- What is speculation?

Investing means investing money in such a way as to receive passive income. It's like buying a cow to milk it and sell the milk. That is, you buy a cow not to sell it to someone at a higher price, but to receive a stable, regular income in the form of milk.

Investing means investing in a business. Business is something that can “increase itself.” For example, you opened a shopping center and began renting out premises. Then they saved up the rent, opened another center, then another and another.

And it doesn’t matter to you how prices for shopping centers change, you don’t try to guess price fluctuations, you simply create more and more assets, get more and more passive income from them and get richer.

About Buffett

When investor Warren Buffett was asked by a journalist: “How to buy stocks correctly,” Buffett answered him: “Buy stocks that you will never sell in your life.”

Never selling in your life means, in principle, depriving yourself of the opportunity to speculate. No “overbuying”, only regular passive income.

Here is the key to wealth.

The Men Who Built America (2012)

We present a historical film - a fascinating story about the first generation of major American entrepreneurs - business stars: Fords, Rockefellers, Carnegies. An amazing story of outstanding people, similar to today's Jobs, Buffetts and Gates.

These were the leaders who shaped the standards of the American Dream. And they laid the foundation for US dominance in all spheres of life. People are visionaries with an inventive mind, innovators unparalleled in history before them.

You will learn that not everything went smoothly for the greats either; ups were followed by downs and vice versa. You will learn about many facts for the first time. And you will see how in 50 years a small group of people changed the course of history, set the United States of America on the path to greatness.

Why investing is safer than trading

Because the world's population is growing. It is constantly growing, the standard of living is gradually increasing, the volume of needs is increasing. To satisfy these needs, material values are needed. Material values are created by business, and business cannot survive without investment.

Look at a chart of the Dow Jones Industrial Average since 1900.

It is constantly growing upward. Sometimes faster, sometimes slower, sometimes with ups and downs, but it still grows upward. This index shows the general state of US industry; as you can see, this industry is constantly developing and gaining momentum.

But, let me note right away, investing is safer and more reliable only if you are willing to keep money in your investments for the long term, ideally for at least 10 years. During this time, even in the event of a crisis, the market will have time to “retreat” and recover.

Billions (2016)

The series is recognized as one of the best dramas about trading. Each episode is a confrontation between two strong personalities: ambitious Wall Street financial genius Bobby Axelrod and principled federal prosecutor Chuck Rhodes. Watching Billions is like watching a masterful poker game between business and the law.

Bobby has achieved amazing success in trading and often takes big risks, where a small careless step leads beyond the bounds of the law. And even though his intentions are pure to a certain extent, the game is very dangerous. The stakes in it are quite high - with 10-digit figures. Therefore, you have to dodge and be cunning in order to keep your own intentions and motives secret.

Prosecutor Rhodes, with a reputation as a principled fighter against corruption, has not lost a single one of his 80 cases in court. And information about the suspicious operations of companies associated with Axelrod is of great interest to him.

The rivals are strong and experienced “players”, so each episode ends with unexpected twists. All the characters in the series have a unique charm and complex character, which is revealed gradually, revealing the true motives of the characters.

You will watch 5 seasons in one breath, because this is a film not only about money, but also about the life values of the American elite.

What else to read and watch

Read my articles about the main investment instruments - stocks and bonds. I explain there how they work, how to compare their risks.

Also read the article about an individual investment account. I tell you there how to get a deduction of 13% on this account, even if you don’t invest at all or invest very small amounts from it.

Check out the course “Personal Finance and Investments” from Netology. It is led by professional investor and financial consultant Sergey Spirin. It was he who finally convinced me that making money from trading is a waste of time.

During the course, you will first understand what passive investments are and how they work, and then you will understand the main types of financial instruments, find out how to create investment portfolios from scratch, make changes to them, etc.

If you are not ready to purchase paid materials yet, here is a recording of a free webinar from Ak Bars Bank. It's about investing in ETFs. The bank has other webinars on investments, you will find them on the Ak Bars YouTube channel.

Check out three free e-books from the educational project City of Investors. I read them with pleasure, and Vasily Blinov, who created this site, took a course on investing through IPO in the City of Investors. The materials are very good, everything is explained in clear language.

- How to become financially independent in 1 year. The book will tell you how to properly manage your income in order to achieve absolute financial independence. This is not at all as difficult as it might seem at first glance.

- 5 ways to effectively invest 1000+ rubles. The author gives examples of real investments and analyzes them in detail. Although, the word “capital” is hardly appropriate here, because people invested very tiny amounts - from a thousand rubles. From the book you will learn that it is enough to use even small amounts for investment. The main thing is to start.

- 6 steps to financial security. What steps should every person take to secure their financial future, achieve stability in terms of money and feel confident.

The project also has very cool webinars, check them out:

- How and where to invest in 2022. Evgeny Khodchenkov, who has been investing for 13 years, will teach you how to choose financial assets correctly and spend only 3-4 hours on it every month. Explains how to create a portfolio with a return of 20% per year. This is not 700% per week from a PAMM account, but it is reliable and stable. The webinar is free.

- Passive income on a slot machine 2022. This is a webinar workshop on how to make your first investment and not trust money to scammers. How to choose the right tools to manage risks and receive additional profits through deductions. The workshop lasts ten days. This material is already paid, but relatively cheap - 1,290 rubles.

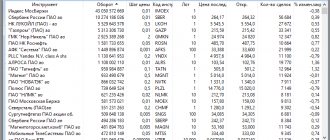

Review of the best trading platforms

Among all trading terminals there are leaders:

- investments in the domestic segment (Alfa-Direct and QUIK);

- trading on international (Zerich Trader Workstation);

- Forex platforms (Metatrader 5, Libertex and IFX Trader);

- futures segment of organized trading (CQG Trader).

Therefore, novice traders should take note of the TOP 13 most reliable platforms where they can make transactions.

Alpha direct

The program facilitates the placement of orders for the purchase or sale of shares, bonds, futures, shares and other financial instruments on the resources of exchange platforms of the Russian Federation.

There is also support for margin lending operations for quick sales and unsecured purchases, as well as repo transactions and brokerage accounts. Additionally, they offer a software application for smartphones and a trial period in demo mode.

Quik

The Russian Quik terminal is one of the most popular programs among domestic versions. It allows you to independently design the interface: configure the number of screens on the page, select analytical charts and launch the required tools. And the software is compatible with almost all analytical databases for technical analysis (like AmiBroker).

The site allows you to exchange text messages and use a whole set of utilities during trading to analyze the state of your investment portfolio. At the same time, functions are included for automating financial transactions, where you can set your own conditions for withdrawing orders.

Zerich trader workstation

A powerful multifunctional platform gives access not only to the futures market, but also to the international analogue of stocks, currencies and options.

The portal allows you to quickly conduct transactions with any assets. The menu has a user-friendly interface, and there is a separate news feed integrated into the platform itself. It can be installed on a smartphone or tablet based on iOS or Android. Although in terms of its effectiveness, the program is not much different from the functionality of the same QUIK. But here the specificity of the markets to which there is continuous access is focused on the American segment: NASDAQ, NYSE, AMEX.

Metatrader 4

The list of popular trading platforms among singles also includes MetaTrader 4, as an earlier version. Considering the versatility of the site, the vast majority of brokers of the 2 most popular trading markets interact with this platform - the Forex currency market and the binary options market.

Here is an example of an analytical review in MT4 ⇒

In addition to a demo account, the demand among clients is for wide functionality, connecting third-party indicators and adding scripts, paid and free advisors downloaded from the Internet. Most user tools (bars and candles, Fibonacci levels) are already included in the standard version of the program, making work easier.

Metatrader 5

An improved duplicate of the previous platform has its own “glasses” of value for each trading segment: spot or futures.

By default, registered clients are offered 4 types of order execution: Market, Request, Exchange, Instant. In parallel with this, the system has almost:

- 38 technical indicators;

- 21 timeframes;

- 17 display styles Custom Indicators;

- 4 zoom modes;

- and even auto trading (a special robot created using the MQL5 language).

Libertex

The equally famous exchange platform does not offer original services, but promises stable operation and quick display of the latest market data. It provides a standard opportunity to perform familiar transactions with currencies, energy resources, shares and other index instruments.

The main feature of the platform is considered to be user simplicity (clear interface) and versatility. Clients will be able to use financial leverage and make settings in their personal account even from a smartphone (and conclude transactions too).

Ifx trader

The resource in question provides the opportunity to fully work with 107 purely using currency instruments.

There are currently 34 types of CFDs on modern shares of American issuers. The minimum deposit limit is 1 dollar, and the leverage is 1 to 1000. A good advantage is the instant execution of transactions and the same fast deposit/withdrawal of funds from sites. Promotions with prizes of up to $50 thousand are periodically held for users, and there is 24-hour support.

Cqg trader

Another professional platform for trading futures on international platforms. There is everything needed to conduct high-quality technical analysis, since viewing quotes in current time is available to everyone.

The terminal itself is distinguished by its high price, versatility and reliability of order execution, as well as the ability to accept orders from outside and redirect them further to the market.

The multilingual interface gives you the chance to combine personal robots with the system and set up a connection to such international platforms as: CME, CBOT, NYMEX, ICE and EUREX.

Ninja trader

Ninja Trader is considered a good tool for an experienced trader. Among the key advantages of the resource, it can be noted that it provides the ability to connect any script and indicator to the process, of which there are many on the Internet. To fully work with the program, you need to download it from the official website and register via a valid email.

Transaq

The Transaq system is considered the leader among platforms for working in the stock markets after QUIK. It has its own module for automating exchange activities (Transaq Connector), but compared to common distributions it does not have an intuitive design or ease of use.

But this shortcoming is compensated by a wide multifunctional set of tools for monitoring the progress of trading in the stock, foreign exchange and derivatives markets, including scalping.

Overview of the Ctrader platform

Manual and automatic trading of CFD contracts and Forex market currencies can be carried out using the cTrader terminal.

This platform is available in desktop, mobile and web versions, works seamlessly with the API and interacts with developer tools and transaction copying services. Spotware has developed an ecosystem around the product where users can exchange robots, strategies and personal indicators.

The site is suitable for high-speed intraday trading, where a trader has the right to make transactions with one touch from any part of it. And the interface itself is native and not overloaded. Both brokers and retail traders often work here, since all trading that takes place through this platform has a high level of transparency in a dynamic environment.

Zulutrade review

This service is a reliable intermediary between the trader and his subscribers. ZuluTrade operates on the basis of a direct auto-connection to the broker’s server: everything happens without the intervention of a third party, and the subscriber does not have to constantly be in the broker’s terminal.

Due to the fact that the account and investments are synchronized with the trading counterpart of the binary broker, the organization does not require additional input of money or the presence of any minimum amount. But the recommendations on the site indicate that the deposit size should be at least $300. The site has a bonus service for testing the success of the selected trader through demo (for a period of 30 days).

Mirror trader

The basis for social trading was created by Tradency, where each user has the right to choose the strategies of other competitors and duplicate their signals. But the main difference from other platforms is the large number of strategies to choose from, flexible filters and transparency of work.

The platform is considered simple, but the only thing that is alarming is the minimum deposit amount - $1000. Many users complain about the difficulty of putting together a competent portfolio. Experienced traders recommend investing money for the long term.