Hi, friend! It seems that the latest hype around cryptocurrencies is beginning to subside. We probably won’t see the highs that we saw in April-May for another 4 years. Does this mean that we can forget about making money on cryptocurrencies for this period? Not at all! Today I want to tell you about such an interesting financial instrument as Binance futures.

Before we begin, I want to remind you that any investment involves the risk of losing money. And in the case of Binance futures, these risks are very high, since we are talking about margin trading. On these futures you can lose all the money you invest in them. But the flip side of high risk is high return. You can really make a lot of money on cryptocurrency futures. But this requires experience with this insidious tool, the ability to work with risks and good capital. Experience can only be gained by trading this instrument; I will give a couple of recommendations regarding working with risks in the article, but good capital can be amassed over time by investing.

Registration

To register for the futures trading section, you first need an account on the Binance exchange.

Follow the link – binance.com/ru/futures. Fill in the fields. In the “Futures Referral ID” , enter the promotional code alphainvestor. This will give you a 10% discount on commissions (and when trading with leverage, commissions can be quite significant).

If you agree with the Binance terms and conditions, leave a checkmark and click “Create an account” , then confirm your email address.

***

Congratulations, you now have an account on Binance with the futures section activated. Identity verification is not required to work with futures. I recommend immediately enabling two-factor authentication in your account settings.

Types of futures

What are USD-M and COIN-M futures

USD-M futures are futures in which the base currency is the stablecoins USDT, BUSD (cryptocurrency equivalents of the dollar), or the BNB exchange token. With these USDT, BUSD or BNB, you buy or sell futures for the cryptocurrencies available on the platform.

COIN-M futures are futures in which the base currency is various cryptocurrencies.

I recommend focusing on USD-M futures as they are easier to understand.

What are perpetual and deliverable futures?

Deliverable contracts (quarterly futures) are futures with a specific expiration date (that is, maturity). On this date, the futures seller is obliged to transfer cryptocurrency to the buyer, and the buyer is obliged to transfer money to the seller.

Perpetual contracts are futures without an expiration date; positions on them can be held as long as you like.

I recommend focusing on perpetual futures, as there are more nuances in working with deliverable futures.

***

Thus, we will consider working with USD-M perpetual futures.

What is a cryptocurrency futures?

The concept of futures has long been known in the world economy. This tool has become widespread in exchange activities. The development of cryptocurrencies has led to the spread of futures contracts in this area.

The greatest advantage of cryptocurrency derivatives is the ability to make investments without owning real assets. In this case, the investor takes on the risks of cryptocurrency changes. This property of digital assets gives traders the ability to purchase them as cheaply as possible and put them up for sale as soon as they rise in price, and vice versa.

Refill

Before you start working with futures, you need, of course, to top up your futures wallet.

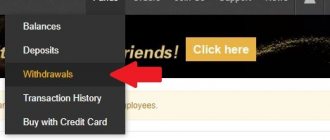

The futures wallet can be replenished by transfer from the main (spot) wallet of the exchange. And the main wallet can be replenished directly using the appropriate functionality of the exchange (for example, from a card), or through exchangers, which can be selected using Bestchange. I enter/withdraw cryptocurrencies through exchangers.

In order to transfer money from a spot account to a futures account, we open a futures wallet. Fill in the fields and click “Confirm”.

The transfer occurs instantly and no commission is charged. In the same way, you can transfer funds back to your spot wallet.

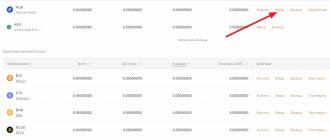

Where can I find a complete list of futures?

Naturally, every trader begins his work by selecting financial assets that could later be included in his investment portfolio. The article “Investment Portfolio of Securities” describes in detail what it is, as well as what rules must be followed during the formation of this portfolio. However, where exactly can you find a list of futures contracts available for trading? The full list is posted on the official website of the exchange.

Let's consider the procedure for searching for an asset using the example of the Chicago Mercantile Exchange .

- In order to later find the required contract in the trading platform, you first need to determine the ticker of the trading instrument. Let's say we need to find gold .

- Opening CME Group exchange website

- After this, you should open the section “Trading»-«Products" Among the subsections that appear, select “ Metals»

- In the column "Precious"You will see a contract for gold, it is designated as follows"GC Gold»

- We open detailed information on gold futures. In particular, you need to find a link to the specification of this contract

You will need this link more than once during trading. The fact is that such a table contains universal information on the contract, including the instrument ticker, in this case it is GC .

If you don't understand any section of the table, use Google's machine translation:

If you are not comfortable viewing information through the exchange, use the website rjobrien.com . On it you can look:

- contact specification;

- list of symbols;

- futures calendar and other useful information.

Terminal interface

Now let's open the main interface of the Binance futures trading web terminal and see what's what.

The interface can be divided into 5 parts.

- Selecting a cryptocurrency pair with chart display

- Exchange glass

- Control Panel

- Positions

- Margin ratio

I usually only need three elements - graphics, a control panel and a window for working with positions. True, when I opened the page, the latter was not displayed, and at first I could not understand what was going on. It turned out that you just need to reduce the page display scale. Not very conveniently implemented.

What is cross and isolated margin

In the control panel, you can select one of two types of margin that will be used when opening a transaction.

In cross margin , all funds in the futures wallet will be used as collateral.

In isolated margin , only the amount you use in the transaction will be used as collateral.

Which margin mode to choose will depend on your trading strategy.

For example, I allocated a small amount (about $250) with which I wanted to buy Ethereum with x4 leverage. I was ready to risk the entire amount, so I simply transferred $250 from the spot wallet to the futures wallet and bought futures in cross-margin mode.

If you plan to hold several open futures positions, then, of course, it is better to use isolated margin to control the risks in each specific transaction.

Scalping

I really like the principle of this approach, since it is simply aerobatics.

Look, I'll show you a graph of the Bitcoin price for the last 60 minutes.

It would seem that there are fluctuations, but they are not that big. And yet, we see peaks and troughs ranging from $57,200 to $57,600. The idea of scalping is to make very small profits on a large number of trades.

That is, you deliberately limit yourself to receiving tens of percent, but make several transactions per hour to earn one or two percent.

Of course, scalping is a very interesting, active and emotional type of trading. Essentially, this is trading over very short periods of time.

You are unlikely to lose your assets here, as is possible with long-term investing or trading, but an incorrect implementation of this strategy can lead to the loss of several percent of your initial deposit every day.

Leverage

The most important thing you need to learn when trading futures is how to properly manage risks. By increasing leverage, we increase risks and potential returns.

The leverage size is also set in the control panel.

I would not recommend using leverage greater than x5. Since even with x5 you risk losing your deposit if the price moves 20% in the opposite direction from your forecast (in fact, due to some features that I will talk about later, even a little less than 20%). And in the cryptocurrency market such movements are a frequent occurrence.

And with a leverage of x125, you completely lose your deposit, in theory, with a movement of only 0.8%. In practice, the position will be closed already with a movement of approximately 0.4% - because, while providing margin lending services, the exchange sometimes suffers losses on large volumes when forced to close client positions, which it pays off from a special fund, to which it takes contributions from clients. Therefore, positions are closed a little earlier than they should be. And the larger the leverage, the more noticeable this difference is. To avoid paying into the insurance fund, it is recommended to close the position before it reaches the liquidation price.

In general, risk management recommendations are as follows: 1. Do not invest more than 5-10% of your portfolio in Binance futures trading. It is advisable to have more conservative assets in the portfolio - stocks, bonds, ETFs, precious metals, real estate, etc.

2. Do not use leverage higher than x5 when trading. And keep in mind that short positions (sell positions) are more insidious than long positions (buy positions). Because if you take a long without leverage (x1), then the position cannot be liquidated. You trade with your own. But shorts without a shoulder are impossible. After all, even a short with x1 leverage is already a loan in the amount of your deposit. And the position will be liquidated when the price of the underlying asset rises a little less (due to the contribution to the insurance fund that I talked about) than twice.

Open a Binance Futures Account

If you want to start trading cryptocurrencies, one of the best things you can do is open an account on Binance. If you already have a Binance account, this will make things easier considering that you will just need to follow a few simple steps.

However, if you don't have a Binance account, you can follow our complete guide on how to open a Binance account.

If you want to open a Binance futures trading account, you will need to log into the exchange with your username and password. Once you are on the main screen, you will need to select the Trade

" and click "

Futures

".

Once you click on the “Futures” button, a new page will open, you will see an option that will allow you to log into the futures trading services offered by Binance. It is worth noting that users from certain regions may encounter some restrictions.

In the lower right corner there is a section “ Open a futures account”

"

You can click " Open Now

" to start using this service offered by the Binance exchange.

Once you click "Open Now", you will have the option to fund your Binance Futures account, which may take a few seconds. You can use funds from another wallet or simply transfer digital currencies that were in your regular Binance account.

Futures calculator

For convenience, the developers have implemented a position calculation calculator, which is located in the control panel. A very convenient thing. Before opening a position, you can look in advance and select the optimal contract conditions (leverage size, liquidation price, etc.).

As you can see, the liquidation price when buying an asset with leverage x1 is zero. Try entering the same numbers into the calculator, but instead of buying, enter sales. You will see confirmation of the insidiousness of the short position that I talked about.

Classification of contracts

Futures are divided into two categories: delivery and settlement . Naturally, trading technology changes depending on the type of contract. Therefore, before starting trading operations, it is necessary to carefully study the characteristic features of both types.

Delivery

The essence of deliverable futures contract is clearly expressed in the very name of the derivative. It involves completing a transaction with the actual delivery of goods. Thus, at the end of the contract's maturity, the buyer must receive the asset at a predetermined price. Compliance with the conditions is monitored by the exchange ; if the rules of the transaction are violated, a fine is imposed on the participant.

Settlement

A settled futures is the radical opposite, because according to the terms of this contract, the actual delivery of the asset is not provided . Payments between participants are made exclusively in cash.

From all that has been said above, we can conclude that delivery futures are used mainly by agricultural and industrial enterprises that are really interested in purchasing raw materials or finished goods at the best price. In turn, settlement contracts are used by investors to make speculative transactions.

Fees, Interest and Financing Rate

If I understand correctly, when trading Binance futures, you will deal with two types of commissions:

- Trading commissions

- Financing rate (funding, funding)

I also tried to find information about the fee for using leverage, but, as far as I understand, the funding system replaces it. We'll talk about funding later, but first we'll look at trading commissions.

Trading commissions

Trading commissions for futures are similar to the trading commissions for the Binance spot section, but slightly lower. However, due to the use of leverage, the commission amounts are higher. It turns out that in percentage terms the commission is slightly less, but if compared in absolute values, it is more. And the higher the leverage, the more significant the commissions will be.

The standard rate is 0.02% of the volume for the maker (who created the order) and 0.04% for the taker (who accepted the order). But it can be reduced if you trade large volumes and/or hold and use the exchange token – BNB (Binance Coin) to pay commissions.

Financing rate

For perpetual futures, Binance has implemented a funding system that helps keep the futures price close to the price of the underlying asset. After all, when we are dealing with deliverable futures, the obligation to deliver the underlying asset keeps the price close to the price of the underlying asset. With perpetual futures, there is no delivery obligation, which means the futures price, in fact, is in no way tied to the price of the underlying asset. And it is precisely in order to keep the futures price close to the price of the underlying asset that a funding system has been introduced.

Without delving too deeply into the operating principles of the system, I will explain what it is. And it lies in the fact that in a bull market (that is, growing), bulls (that is, buyers) pay bears (that is, sellers) a percentage of the volume of open positions, and in a bear market, bears pay bulls.

The fee depends on the funding rate, which varies depending on the phase of the market (that is, the balance of supply and demand). You are charged every 8 hours.

That is, if you open a buy position and the market grows, then your “paper” (that is, unrecorded) profit will grow, but your deposit will be charged a small percentage of the transaction volume, equal to the funding rate. If the market falls, the “paper” loss will grow, and your deposit will be credited with a small percentage of the transaction volume, equal to the funding rate. If you opened a sell position, the opposite is true.

Example. You bought $400 worth of Bitcoin using your $100 (that is, with x4 leverage). Let's say the market is growing steadily, the funding rate is about 0.02%. Then, per day (that is, in 3 8-hour intervals) 3*400*0.02% = $0.24 will be withdrawn from your deposit. Accordingly, you will no longer have $100 as collateral, but $99.76. And the liquidation price, accordingly, will also rise a little.

Benefits of trading futures on Binance

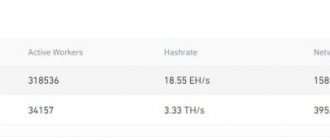

Futures operations are still at the stage of formation and development, but their turnover is growing daily. Binance Futures is an entire ecosystem that includes many services for making money.

Trading futures on Binance has many advantages:

- This is a reliable, rapidly developing exchange that allows you to make futures transactions on favorable terms;

- Assets have high liquidity, thanks to which investors can make a profit in a short period of time;

- Convenient service, simple registration and quick account opening;

- Wide range of leverage;

- Low commissions on transactions;

- The prospect of making money from falling market prices when using short orders;

- A profitable affiliate program that allows you to earn a percentage of transactions from attracted clients.

Despite all the advantages of futures trading on specialized platforms, this activity is subject to great risk. The price of cryptocurrency is quite unstable, so traders can make both large profits and huge losses. Therefore, it is important to take futures trading seriously, study trends, and also develop intuition.

Using the Binance Futures platform, you can understand the intricacies of the cryptocurrency market step by step, gradually gaining experience and developing analytical skills. Having learned to competently assess the dynamics of economic processes and make the right investment decisions, you can receive high incomes even without significant investments. The purchase and sale of cryptocurrencies is developing and will expand every year, occupying a significant share in the global economy, so studying this area is very important today.

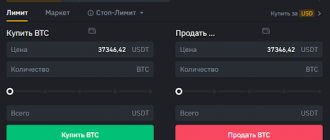

Opening an order. Order types

An order can be opened either directly from the chart (by specifying the volume in the appropriate window and clicking the “Buy” or “Sell” button), or from the control panel.

Consider the option of opening a deal from the control panel. 3 types of orders available Limit. Pending order. A deal is opened when the price reaches the value you specify, which is lower than the current one when buying and higher than the current one when selling. Typically, such orders are placed in anticipation of a quick trend change. Market. The transaction is opened immediately at the current market price (at the best offer). Stop limit. Pending order. A deal is opened when the price reaches the value you specify, which is higher than the current one when buying and lower than the current one when selling. Typically, such orders are placed in anticipation of a continuation of the trend. That is, limit orders are placed when they want to SELL ABOVE the current price, or BUY BELOW the current price.

Stop-limit orders, on the contrary, are placed when they want to BUY ABOVE the current price, or BUY ABOVE the current price.

If the logic of limit orders is quite clear, then with stop limits everything is more complicated. Who would want to buy at a price that is higher than the current one and sell at a price lower than the current one?! Somehow everything is turned upside down, right?

In fact, there are situations when such orders are needed. For example, a trader sees some uncertainty in the market, but he sees a level located above the current price, and if it is broken through, the price, in his opinion, will continue to grow actively. Then he places a stop limit order at this level or even higher. And if the price reaches it, it will be a signal for the trader to buy, which will be executed automatically by the exchange thanks to the stop limit order.

Another example. Let's say you have a certain amount of bitcoins. You plan to sell them soon, but you assume that the price may go higher, and therefore you are in no hurry to do so. However, you are also afraid of a sharp price collapse. And to limit losses in case of a collapse, you can place a stop-limit order below the current price.

***

To place an order, select the margin mode, leverage size, order type, indicate the price (if it is not a market order) and volume in the appropriate fields. You can also, if desired, set take profit (automatic fixation of profit) and/or stop loss (automatic fixation of loss) by checking the corresponding checkbox and indicating the levels at which the position should be closed with profit or loss. When all parameters are specified, click “Buy” or “Sell”.

Types of orders and how to use them

There are 5 types of orders available on the Binance Future futures trading platform:

- Limit - a buy/sell order executed at the price you set. You fill out and wait for a counter offer to appear.

- Market - a market order is executed immediately on the most favorable conditions at the current moment.

- A stop-limit order has two components: a limit price and a stop price. The stop price is the exchange rate of the selected crypto coin, upon reaching which the system activates the application. But the best offer is the limit price. That is, the stop gives a signal to place an order in the book, and when the market reaches the limit price, you need to buy or sell.

- A stop market involves turning a limit order into a market order when the op price is reached.

- Trailing stop - the order is activated when the rate of the selected coin on the market reaches the maximum (or minimum) value (+/- 1%).

Open Position Review

At the bottom of the screen you can see placed orders and open positions. As I said, sometimes you need to zoom out in the browser to display this window. In this window we see: 1. Contract name (cryptocurrency pair) and leverage size

2. Contract volume

3. Entry price

4. Marking price. It is close to the asset price, but slightly different. This is the price at which profit/loss is calculated. It reflects the average value taken from quotes of the underlying asset on different cryptocurrency exchanges. It is less volatile than the asset price on Binance, as it eliminates sudden price fluctuations that can happen when a large player enters the market. It is compensated by values taken from other exchanges.

5. Liquidation price. If the marking price reaches this value, the transaction will be forcibly closed and your deposit will be reset to zero.

6. Margin ratio

7. Margin

8. PNL (ROE%). The most important parameter that shows your profit or loss in absolute value and percentage. PNL – means Profit'n'Loss (profit and loss).

9. Position closing buttons. You can close according to the market, or specify limit values at which the transaction will be closed with a profit (take profit) or with a loss (stop loss). It is also convenient to track the position in a futures account.

What is earnings on Binance Futures?

Using the online service, it becomes possible to make a profit on market fluctuations and asset volatility, using derivative contracts. The essence of these instruments is to calculate projected profits and losses that will be realized not at the present time, but in the future.

Binance Futures allows you to create the following orders:

- Limit order , which has a fixed cost;

- Market order , which is placed on the most favorable conditions at the moment;

- Stop limit is a contract that is valid only if specified conditions are met and for a specific period of time.

The platform provides traders with a large number of opportunities for implementing perpetual contracts for cryptocurrencies and generating income.

Test network

I tried to briefly explain what Binance futures are and “what they are used for.” However, this topic is quite extensive, and such a superficial review will probably not be enough (especially if you are completely new to this business, have never dealt with margin trading and do not understand all the terms).

Therefore, for a deeper understanding of the tool, I recommend trying the test network, which will allow you to practice on a demo account. If it works out, then you can start trying to trade on a real account with small volumes.

The test network is available at the link – testnet.binancefuture.com/ru/futures/BTCUSDT

Overview of trading strategies

Now let's figure out what strategies there are and which one you should pay attention to.

To begin with, I want to show you a well-known chart.

Yes, this is the Bitcoin exchange rate against the US dollar. It turns out that you can earn money without any trading strategies, just by buying Bitcoin. The same applies to a large number of other cryptocurrencies. Let us therefore highlight a very powerful strategy that is particularly applicable to the digital money market, which is called “buy and hold”.

Of course, many will say that this is not trading, but investing, and quite passive one at that. But don’t forget: actions are not always important and necessary. The goal of a trader, investor, or any other part of the stock market, cryptocurrency, or other valuable assets is to make a profit. And if someone made 1 trade, recording 800% of the profit in six months, and the other made 100 trades and earned only 50%, then the first is a more successful trader than the second. It's hard to disagree with this!

My experience

I have a small but successful experience with Binance futures. I bought Ethereum in March when it was worth about $1.8 thousand. The deposit was about $252, I bought it for an amount 4 times the deposit (that is, approximately $1,000, leverage x4). In May, when Ethereum was at its historical highs, the closing position was estimated at approximately $1,500. That is, the profit was about $1,250 (500%). But I held off a little, expecting further growth. As a result, I closed it in June after the collapse with a profit of about $250 (100%).

In the future, I plan to use futures to open short positions within the part of the investment portfolio allocated for cryptocurrency speculation. If you are interested in how I will do, subscribe to blog updates and follow, I publish reports on my investments weekly.