Options are the most flexible of the existing exchange instruments; in this parameter they are head and shoulders above futures. This type of contract allows you to build the most flexible trading strategies, reducing risk to a minimum. Options for beginners seem like a complex and confusing instrument, but this is a false impression. Spend 15-20 minutes reading this material and you will already know the theory in general terms. All that remains is to consolidate the knowledge in practice.

Important note: below we will talk about classic options , not binary ones. BO - instruments actively promoted by offshore brokers, do not belong to exchange-traded instruments and are not traded on classic stock exchanges.

What is an option

This term refers to a time-limited contract that gives the right to buy or sell any asset. This definition implies 2 key features of options:

- they give the right to buy or sell an asset, rather than an obligation . For example, the holder of a Call option to buy Apple shares may not exercise it if the price of the underlying asset (apple company securities) changes in a direction unfavorable for him.

- these contracts are limited in time , they have an expiration date - this is the time for which the conclusion of the transaction is postponed.

When it comes to the types of underlying assets, there are options contracts for all types of instruments. These can be precious metals, currencies, commodity market instruments, cryptocurrency, art objects. There are contracts for weather futures (traded including on the Chicago Mercantile Exchange), traders even make money on the correct weather forecast.

Options are traded on the same exchanges where traders trade futures contracts. If you are just starting to work in this direction, the article on what futures are will be useful; be sure to read it.

The video below provides a detailed analysis of the nature of options. I recommend checking it out.

Greetings, fellow traders! Below is an informational article about stock options. By Larry D. Spears. Lots of letters of text (almost 4.5 sheets). At the end is my comment.

Dedicated to the victims of the “dreaded” options myth: Larry D. Spears

Stock options are a valuable tool for any investor who wants to maximize their returns while improving risk management. But despite the obvious benefits, very few investors try to use (or even understand) options strategies. If you are not part of this small group, then you have most likely fallen victim to an options myth that goes something like this:

“This is not for you. Only truly sophisticated and experienced investors should engage in options trading. When it comes to options, it comes down to huge risks - all or nothing, hit or miss. You could lose your entire investment capital unless you choose a really good stock that will never completely collapse. Only in this case can you recoup if a wrong decision was made, because you still have some investment capital.”

This mantra is instilled in clients by hundreds, thousands of financial professionals around the world. These “advisers” either themselves do not understand anything about options trading, or view it as a very risky type of investment. Some well-known brokerages (for example, Edward Jones) do not allow their clients to trade options.

But in fact, this tool is quite suitable for any trader or investor, and you should start trading them, whether you are an active trader, an average investor who is looking for an opportunity to insure (hedge) his investment portfolio against possible market downturns, or just a retiree who is looking for an opportunity earn a small increase in pension and dividends from shares.

Let's look at the basics of options trading to understand what options are, how the options market works, and why trading these derivatives should be part of your trading or investing activities. First, a little history...

////////////////// Learn about futures trading. //////////////////

The Formation of the Options Industry Despite the fact that the idea itself dates back several centuries, the options market in its modern form has existed for only 40 years. Initially, options were represented by separate contracts that were negotiated and concluded directly between two parties - the buyer and the seller. Prices and contract terms were set on an individual basis. The underlying assets included stocks, real estate, grains, metals, and even... tulip bulbs. Everything changed on April 26, 1973, when the Chicago Board Options Exchange first introduced a list of stock options available for trading. Each traded option had certain parameters - a standard contract expiration date, a standard strike price, etc. More importantly, it was a ready-made options market where the interests of both parties (buyer and seller) were protected by a third party (the exchange).

Any Chicago Board Options Exchange trader can accept your order to buy/sell an option and place it on the exchange. And when a counter order appears on the market, a deal will be concluded. Both parties do not need to personally participate in concluding the transaction. Moreover, brokerage commissions have become more moderate than they were in the past, when brokers had to negotiate every clause in the options contract. Since then, the market began to develop rapidly. In 1973, 2 million contracts were concluded, while in 1980 there were already about 100 million.

According to the Options Industry Council, nearly 300 million trades are made in the options market every day. In 2010, more than 3.6 billion were concluded. Today options are traded on 40 exchange platforms around the world. More than 10 electronic trading platforms also provide this opportunity, 8 of them are located in the USA.

Of course, these numbers don't tell you anything. So let's get back to basics.

////////////////// You may be interested in reading the article “Gold Trading”. //////////////////

What is an option?

An option is a type of derivative contract that gives the holder (potential buyer or seller) the right, but not the obligation, to buy or sell an asset (commodity, security) at a pre-agreed price at a contractually specified point in the future or over a certain period of time. (Note that so-called “American” options can be exercised at any time before the expiration date, while “European” options can only be exercised on the contract expiration date.)

The underlying assets for options include over 2,600 stocks (1 lot = 100 shares), ETFs, broad market indices, currencies, interest rate instruments, commodities, financial futures, metals, etc.

However, regardless of the type of underlying asset, there are only two main types of options:

• Call option - gives the holder the right, but not the obligation, to BUY a specific underlying asset at a specified price within a limited period of time. For example, the January 30 WFC call option gives the buyer the right to buy 100 shares of Wells Fargo & Co. stock. (NYSE:WFC), which is the underlying asset of this option, at a price of $30 per share (this is the strike price) at any convenient time until the expiration date (in this case, January 21, 2011). As you understand, "30" refers to the price, not the date. I'll explain a little later why the option expires on January 21st.

• Put option - gives the holder the right, but not the obligation, to SELL a specified underlying asset at a specified price within a limited period of time. For example, the February 15 DELL put option gives the buyer the right to buy 100 shares of Dell Inc. stock. (NasdaqGS:DELL) at a price of $15 per share at any time until the expiration date (in this case, February 19, 2011).

Both put options and call options have three common characteristics: • Underlying asset - An option that is a derivative naturally has some asset on which it exists. In the first case, these are shares of Wells Fargo.

• Strike price (or strike price) is the price at which the owner of an option can buy or sell securities under that option. In the second example, the strike price is $15. The minimum step for changing the strike price may differ depending on the underlying asset: for relatively cheap shares the minimum step is $1, for “average” shares it is $2.5, and for expensive shares it is $5.

• The expiration date is the specific date after which an option can no longer be exercised, meaning it ceases to exist. In the US, options typically stop trading on the third Friday of a given month. They officially expire the next day. Typically options trading is based on 4 cycles (options expire every 3 months). For example, first cycle options expire on the third Friday of January, April, July and October. However, stock options that are particularly popular expire every month. There are even some options that expire every week.

////////////////// Also read the article “Fractal Indicator”. //////////////////

Determining Option Value The final key to learning the basics of options trading is understanding how the value or “premium” is determined and the factors that cause that value to change as you get closer to the expiration date.

The “premium” of an option (also called “option premium”) consists of two parts - the actual value and the time (term) value. All options have a time value. But only so-called “in-the-money” options have actual value. The term “in the money” reflects the difference between the option's strike price and the current market value of the underlying asset. Thus, a call option has actual value only when the current value of the shares that are the underlying asset is higher than the exercise price of this option. By analogy, a put option has actual value only when the current value of the underlying asset is below the strike price of the option.

For example, if Wells Fargo stock is priced at $30.75 and the January 30 call has a premium of $2.45, then the option's intrinsic value would be 75 cents. ($30.75 price of the underlying asset - $30.00 strike price = $0.75). The rest of the premium—$1.70 ($2.45 – $0.75 = $1.70)—is the time value of the option. On the other hand, if Wells Fargo stock had a current value of $29.05 and the value of the January 30 call option was $1.35, then the entire premium on that option would be term or time value.

First of all, the buyer of the January call option with a strike price of 30 (the underlying asset is Wells Fargo stock) needs the value of the underlying asset to rise to at least $32.45 (strike price + the premium he paid for the option) by the time the option expires, to cover losses on the transaction. If the price of the underlying asset rises to any level above $32.45, the option buyer will profit. If the Wells Fargo stock price is between $30.00 and $32.45 at the time the option expires, the buyer will suffer a partial loss, losing only a certain portion of the $245 ($2.45 premium (cost) x 100 shares) he paid for the option. If the option expires and the asset price is below $30.00, the buyer will lose the entire amount invested in the transaction (in this case, $245). However, it is worth noting that $245 is the maximum possible loss on this trade, regardless of how much the asset price falls below $30 per share.

Now let's look at a put option example: Let's say DELL stock is priced at $13.75 per share at the time of purchase, and the February put option is worth $2.90 (that is, its premium is $2.90), which means it is an in-the-money option. In this case, the actual value of the option would be $1.25 ($15.00 strike price - $13.75 value of the underlying asset = $1.25). The rest of the option premium—$1.65 ($2.90 – $1.25 = $1.65)—will be time value.

However, if DELL's stock price is only $15.30 per share, that means the aforementioned put option is out of the money. His premium is $1.55, and it consists entirely of time value. If a trader buys an in-the-money put option (Option 1), he would need Dell stock to fall to $12.10 to cover expenses (that is, to break even: $15.00 - $2.90 = $12.10). A partial loss will be observed if the current value of the underlying asset at the time of option expiration is between $15.00 and $12.10. A complete loss of the money invested in the trade will occur at any price of the underlying asset above $15.00, while any price below $12.10 will bring a profit.

In the second case (when the put option is out of the money), the buyer will only cover the costs if the price falls to $13.45, but if the price falls below, the buyer will make a profit. However, a total loss will occur if the asset price reaches any level above the strike price (in this case $15.00) at option expiration.

The actual value of any option is an absolute value. It is always the difference between the at-the-money option strike price and the current value of the underlying asset.

Unlike intrinsic value, time value is constantly changing. It is influenced by many factors, from the volatility of the underlying asset and the overall market to how deep the option is in the money or out of the money. The amount of time remaining until the contract expires also has a strong influence on the time value of the option.

As an option approaches expiration, it loses value. It is this “erosion” of an option's time value that motivates many stock options sellers. They hope that the options they sell will expire out-of-the-money, thereby allowing them to keep all or part of the option premium that the buyers paid them if the option expires slightly in-the-money.

Options buyers (who do not use a combination of buying and selling) are, of course, hoping for the opposite result, expecting that the price movement in the market for the underlying asset will cover their costs and allow them to make money. The main factor that motivates them is a predetermined (limited) maximum loss for each individual transaction, as well as an impressive amount of potential profit. For example, a buyer of call options on Wells Fargo stock managed a position worth $2,905 for several months and risked losing a maximum of $135. However, the potential profit was theoretically unlimited. Phenomenal, isn't it?

For example, if Wells Fargo stock rose to $36.00 per share, the option buyer would earn $465. The profitability of the trade (the ratio between profit and risk) would be 344.4% ($465/$135 = 344.4%). But if the stock market price had remained below $30.00 at the time the option expired, the buyer would have only lost $135. In a similar situation, the stock trader would have risked $2,905 and would have made $695 if the price reached $36.00 per share. The profitability of the trade (the ratio between profit and risk) would be only 23.9% ($695/$2,905 = 23.9%). And he could lose all of $2,905 if the company went bankrupt and its shares became worthless.

The benefits for option buyers are obvious, but unfortunately, time erosion works against them. However, there are a large number of trading strategies that combine buying and selling options in order to optimize the ratio between potential profit and risk.

////////////////// You may be interested in an article about margin trading. //////////////////

My comment. The most important question is: do Forex traders need all this options stuff? Or in other words, what is better: options or classic Forex? The question is not as simple as it seems. The fact is that options contain one important thing - this is the expiration time. That is, when trading options, we must take into account price and time. In Forex, everything is much simpler. We can, for example, trade from price levels - we will enter the market, set take profit and stop loss without regard to the time factor. In options, the time factor is one of the basic components that cannot be ignored.

That is, options are inherently more complex. The second important point is prevalence. Classic Forex is available at every step, but with options everything is much more complicated. Very few brokers provide options trading with normal commissions. The third point is trading costs (commission). In options it is much higher than in Forex.

////////////////// It will be useful for you to read the article “Forex prices”. //////////////////

Based on all of the above, my conclusion is that stock options are perhaps an interesting thing, but regular Forex is simpler, easier and more accessible.

Types of options

The classification depends on the selected criterion.

Type:

- European . They are inconvenient because they allow the owner of the right to buy/sell to use it only during the expiration date . This reduces room for maneuver. For example, before the expiration date, the price of the BA changes in a favorable direction, but the trader cannot execute the contract ahead of schedule. He waits until the expiration date, during which time the chart may go in the unprofitable direction. By the expiration date, it may go out of the money.

- American ones are more flexible compared to European ones due to the fact that they can be executed on any day before expiration. The trader can exercise his right to sell or buy the underlying asset before expiration. This increases the chances of success; there is no reference to a specific date, control over the transaction is maintained throughout its entire life.

Let’s assume that at the end of May a Call option is purchased (the underlying asset is Aeroflot stock futures). The strike price of 8,000 rubles was selected, which means that in order to make money, the price must be above 8,000 rubles when the contract is executed.

The execution date is set for June 17, 2022. This example is shown for the Moscow Exchange, where American options are traded, so the trader can exercise it until 06/17/20.

Let's move on to the Aeroflot stock chart. The purchase was made when the price of the securities was slightly less than 80 rubles per share. At the moment their cost rose to 97.74 rubles. for 1 share, the maximum was reached on June 9, 2022. Since the work is carried out on the MICEX, the holder of the Call contract can execute it ahead of schedule, for example, at a price of 95.00.

the European was traded , the trader would have to wait for expiration. According to the regulations, it takes place on June 17, 2020. during evening clearing (18:45-19:05 Moscow time, usually the time is limited to 18:45-19:00 Moscow time, but on days when contracts expire, the time range increases by 5 minutes). At this point, the Call option becomes less profitable - Aeroflot stock quotes dropped to around 85 rubles. for 1 paper.

Executing the contract still makes a profit , but compared to closing early at a higher rate, the trader loses more than half of the potential profit. That is why the American is more popular .

As for fixing the result of a transaction, it can be done either by opening a counter position or directly by early execution of the current contract. The second option is used in the absence of a counterparty to conclude a counter transaction.

According to the method of organizing trade:

- Marginable (futures type). At the time of conclusion of the transaction, the premium is not transferred to the seller of the contract, but, as in the case of futures, the collateral is recorded in the accounts of the seller and the buyer. Another difference from the second type is the presence of variation margin , it is transferred at the end of each trading session.

- Non-margined – when purchasing a contract, the premium is transferred to the seller, and the GO for the option is recorded on his account. There is no variation margin; instead, when the price changes, the GO on the seller’s (subscriber’s) account changes. There are other differences in how these types of contracts work.

Deliverable options

This is the name of those contracts under which the underlying asset is delivered . At the same time, the trader is not forced to hold the contract until expiration (if it is an American type); positions can be closed with a reverse transaction - this is how the trading result is recorded. You can contact your broker for early execution.

As a rule, the underlying asset is a futures contract . Expiration of options (deliverable) occurs 2 days before the expiration of the corresponding futures during evening clearing on the MICEX.

Deliverable options and futures are widely used in real business to hedge risks. This type of contract allows, for example, to hedge against unfavorable changes in the price of raw materials, equipment, currency and other categories of underlying assets.

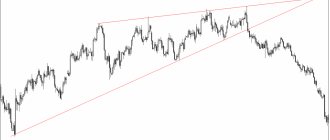

Continuous barriers

The most real exotic options are barrier options.

In such options there is a barrier, but unlike European barriers, which apply only to expiration, here we mean a barrier that is valid throughout the life of the option. Such barriers are called either continuous or American. If they talk about a barrier without specifying anything, they usually mean just such barriers. A continuous barrier can also be placed in the OTM range of the underlying asset rate relative to the option strike, which does not make sense for a European barrier. And in general, here the number of possible options increases. You can define a barrier option with two barriers (upper and lower). You can make one barrier of the knockout type, and another of the knockin type... There are many options, some more popular, some rare. Such exotic goods are traded, of course, on the OTC market.

What is important about this type of exotic is that its final payment depends not only on the price of the asset at expiration, but also on the entire path that the random process of the underlying asset’s rate has taken from the moment the contract was concluded to the expiration.

How options trading differs from futures

If we describe what options and futures are in simple words, the key difference is flexibility :

- When dealing with options, the buyer acquires the right to buy and sell the underlying asset in the future.

- When dealing with futures, the parties agree on a deal that is delayed in time. The buyer has no choice regarding the execution of the transaction at expiration.

Both types of instruments can be seen as a dispute between 2 parties about what the price will be after a certain time. When purchasing a deliverable futures contract, for example, on Gazprom shares, the buyer actually purchases the securities of this company, but with a time delay. At expiration, he will receive shares at a price agreed in advance.

Example with Gazprom futures

The figure below shows September futures for Gazprom shares. Let's assume that the purchase of 1 contract is completed on July 17, 2022. at a price of RUB 18,596. (1 futures implies the purchase of 100 securities). If you do not close the contract with a counter position and do not extend it, then in September there are 2 options:

- The price of the underlying asset will increase , for example, to 250 rubles. per security, then the buyer will still be able to buy shares at 185.96 rubles.

- The price will drop , for example, to 150 rubles. for 1 security, the trader still buys them for 185.96 rubles. for one. In fact, he loses 35.96 rubles. on every share. But usually futures are used for speculative transactions and rarely held until expiration. For them, the result is either fixed by counter positions, or the contract is transferred to the next month.

When working with options in the same situation, the trader could exercise the contract if was favorable for him. If the stock price is falling, there is no point in doing it. It is more profitable to lose the premium paid when purchasing the contract and not exercise the right to purchase Gazprom securities. This is the key difference between futures and options.

If we are talking about the margined type, the difference is no longer so obvious. the guarantee collateral is blocked on the account . During clearing, variation margin is paid, positions are constantly revalued. During expiration, the corresponding futures instead of the option.