For more than 5 years I have been using the epayments system , which consists of a wallet and a payment card. In this article I will tell you how convenient it is to use the card, how to top up your wallet, whether epayments works with cryptocurrency and how. The main purpose of the article is to talk in detail about the system and leave your feedback.

February 2022 seems to have signed the epayments verdict. All users of the system not only had their wallets frozen, but also their cards and all funds. The fact is that the British regulator FCA had questions regarding epayments, and it was decided to suspend the office’s activities until all legal entities were resolved. problems. You cannot withdraw money from your accounts. You can't withdraw from the card either.

It is not clear how long the proceedings will take. Some people talk about several days or weeks, but, in my opinion, this is too optimistic. Most likely you will have to wait several months. But there is also good news. epayments has an FCA license, which means that all your money is safe. Even if the FCA decides to close epayments, the money will be returned to users. The only question is when this will happen and what additional papers will need to be provided to confirm that the money in the accounts is honestly earned and all taxes have been paid.

- Epayments: what is it and what is it used for?

- My reasons for using an epayments payment card

- My experience ordering an epayments card

- How much does it cost to service an epayments card?

- Where can I withdraw money from an epayments card without commission in Russia?

- How to withdraw webmoney to epayments?

- How to top up Epayments with crypto (bitcoins, litecoins, ether)?

Epayments: what is it and what is it used for?

→ What are epayments? Is it really another payment system?

Yes, epayments is another payment system.

→ But why? After all, there is webmoney, paypal, Ya.Money, QIWI wallet, etc.?

Yes, yes, but there are pitfalls everywhere. First of all, I like Epayments for its tariffs. All internal transfers, unlike WebMoney, are commission-free. For cash withdrawals from an ATM, epayments charges less than payoneer.

The system is simple, convenient and pleasant to use. I am also pleased with the responsive support service. The support service resolves all my questions quite quickly.

The ePayments system itself consists of two parts: a wallet and a payment card.

An iPayment wallet is an analogue of a WebMoney wallet. There are only three currencies: rub (Russian rubles), usd (US dollars) and eur (euro).

A payment card is a physical credit (Mastercard) plastic card that is ordered separately. Cards are also issued for two currencies - for usd and for eur.

→ Who will benefit from the epayments card?

Remote workers, money makers, those who work with crypto. For those who do not want to show their Internet income to the country's banks (Epayements is a British company). Or for those who do not have access to visa/mastercard cards for some reason.

The last point may seem crazy, but don’t rush to conclusions. For example, in Thailand it is almost impossible to open a bank account and get a Visa/Mastercard: many local banks issue cards of the Asian UnionPay system (Bangkok Bank is a prime example). Another example: in Montenegro, to open a visa or mastercard, you first need to deposit 1000 euros into your account. Yes, maestro cards are easily issued here, but it is impossible to withdraw WebMoney to them.

→ Where can I use the epayments system?

The system works with aviasales, admitad, properller ads, vkontakte and other companies.

conclusions

Even if we leave aside the fact that ePayments is an excellent insurance against unpredictable laws, the system already has a lot of advantages:

- Guarantee of the safety of your funds, monitored by the FCA.

- Personal bank card.

- Transfers around the world without commission.

- It is enough to confirm your identity once (unlike the WebMoney certificate system).

The only downside is, perhaps, the cost of annual maintenance, but this can only become a barrier for beginners; the system is not designed for them. Overall, ePayments gives you peace of mind that you will definitely receive the money you earn online! Register, order a card and sleep peacefully.

My reasons for using an epayments payment card

In addition to those very vague reasons stated at the beginning of the post, there are several more reasons why I use epayments:

- withdrawal of money from the wallet to the epayments card - no commission and instant (in Webmoney, a commission of 0.8% of the amount is charged for transfers within the system)

- easy to withdraw webmoney (instant transfer), the percentage is one of the lowest (0.8% webmoney + 1% exchanger)

- can be replenished with cryptocurrency and withdrawn to crypto (bitcoins, lightcons, ethereum, bitcoin cash) with a small commission

- for withdrawals from ATMs in the card currency there is a fixed commission of $2.6

- payment at POS terminals (in stores) - no commission

- You can pay with the card on the Internet (online stores, airbnb, air tickets)

- the card works without any problems in all countries of the world

- withdrawal of travelpayouts commissions with an increased rate of 60% and no commission (they charge $30 for withdrawal via bank transfer)

- withdrawal of commissions admitad

- the card is easily linked to paypal - only for payment from the card, you cannot credit from paypal

- easy transfer to YaD - no limit of 15 thousand as in WebMoney

- transfer to Visa Qiwi Wallet

An alternative to the epayments card can be a webmoney card, but there is a problem with registration at the place of residence and a completely different commission.

We also used to use a WebMoney virtual card to pay for purchases on the Internet. But there, firstly, the limit is 15,000 rubles (despite the fall of the ruble, the limit was never raised), and secondly, transferring funds to the card costs 0.8% of the amount. Thirdly, debits from a virtual card are not clear how. The last time the account was updated it took a day, and in the end I had to do another operation (transferring a ruble) to understand how much money was written off. There is also a fourth thing - for such a small service they also charge an annual fee. Fifthly, the virtual card was closed (summer 2016).

It’s worth saying a word about the payoneer card. After comparing rates, epayments was a clear winner.

Starting April 1, epayments will temporarily not be able to accept bank transfers in USD. The restrictions will also apply to sending transfers in USD. All other operations, including bank transfers in EUR, operate as normal.

ePayments wallet, user reviews

The Payments payment system was founded in 2011 and is intended primarily for Internet businessmen and freelancers, that is, people who make money online and want to remain outside the access of tax authorities. The company is officially registered in London and, according to the information on the official website, has a large staff of over 200 people.

can offer its users - the payment system does not transmit any data about clients to the tax office, but at the same time it works completely legally and has proven its reliability over seven years of operation.

First of all, the payment system is interesting because it allows you to have not only a wallet, but also an ePayments card, which allows you to withdraw funds from an ATM of any bank in popular currencies. Along with this, the project organizers are very loyal to their clients and allow them to work even without verification, albeit with somewhat limited functionality.

In general, Payments is an excellent service that will be very convenient and useful when traveling, when withdrawing large sums offline, and will become an indispensable assistant in business and for individuals making money online.

Reviews of ePayments indicate that the payment system became a real salvation for many when everyone’s favorite Advanced Cash began working with cards on a limited basis. The convenience of the payment system itself and its card, low commissions and fast withdrawal of funds are also noted. Negative reviews that any problems arose while working with Payments are not so common.

My experience ordering an epayments card

To order a plastic card, you need to register an account in the system >>

Next, you need to verify your account in order to use the card's capabilities to the maximum. To verify, you need to upload a scan of your passport, confirm your phone number and email. Sounds like getting a certificate in webmoney, doesn't it?

Verification takes up to several days.

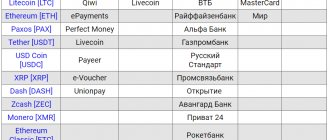

After verification, you can order a card. To order a card, you need to top up your epayments wallet. This can be done in several ways: through a bank transfer in any bank, from a visa/mastercard card, from a Yandex wallet or cryptocurrency (btc, bcc, ltc, eth):

We pay by card and wait:

I ordered my first epayments card back in 2014. I chose mail for delivery (free delivery option worldwide). The card took exactly 2 weeks, and the gloomy reputation of the Russian Post did not affect the speed of delivery. I recently updated the card, ordered it to Thailand - the card arrived within a week.

After the card has arrived, it needs to be activated. The letter you receive the card contains instructions and an activation code. The activation procedure is not complicated and goes quickly.

Actually, after this procedure all the goodies are available: replenishment by bank transfer, limits on replenishments via WebMoney have been removed, there are no limits on the amount of withdrawals per month and for the entire period of the card’s life, etc.

Register with epayments

How to use the wallet

Registration

First you need to register in the service, to do this you need to provide an email address or phone number. Then, in your account, complete the registration process:

Registration in ePayments

Naturally, all data must be correct, the payment password must be remembered or written down, so that in the future there will be no problems using the wallet. And you can postpone ordering a card until the moment you realize that you need it.

After registration, you will receive your ePayments wallet number, it is displayed in the upper left part of your personal account, in the form XXX-XXXXXX, where X is a number.

Actually, it is this number that you need to provide to your employer, customer, or indicate it in your affiliate program account so that money can be transferred to you. To transfer money to another ePayments user, it is also enough to know only the wallet number (a phone number or email will also do).

How much does it cost to service an epayments card?

Servicing a USD card (not a wallet, but a card) costs $2.9 per month. But if you pay more than $300 for purchases with your card in a month, then the service for the next month will be free.

For an EUR card the numbers are slightly different. The service costs 2.40€. For free service you need to pay €300 per month by card.

This option is very convenient for me. I often buy airline tickets/book hotels with a card, and kill 2 birds with one stone: I get free service and use payments without commissions.

Registration process

Registration in the ePayments system is a little complicated. The first stage of registration is entering personal data in Latin. Be sure to enter the correct phone number - a verification code will be sent to it.

At the second stage, you will need to enter and be sure to remember your payment password. All transactions are carried out using it. The next tab on the registration panel is ordering a card. But, unfortunately, you won’t be able to order a card right away. First you will need to wait for registration confirmation by mail - this happens manually, only on weekdays.

After this, you need to verify your account with scans of documents, I managed to go through all the steps in a few minutes, all that was left was to confirm the address - this is perhaps the most time-consuming step of all.

Only after this you will have access to all the functionality of the ePayments system.

Where can I withdraw money from an epayments card without commission in Russia?

It won’t be possible without any commission at all, but it can be reduced. Alfa Bank ATMs dispense dollars, i.e. You won’t have to pay for the conversion from dollars to rubles. Only a one-time payment for withdrawal from an ATM. Typically, such ATMs are located in Alfa Bank branches.

Another option is to come to the VTB branch with your passport.

How to withdraw currency from an epayments card

There is another option for withdrawing currency, but with a minimum commission. Open a foreign currency account in a bank. The account currency is the one you are going to withdraw. In the Epayments admin panel, select “Transfer” -> “To bank account”. Enter your bank details and confirm the transfer. Then you go to a bank branch and withdraw currency from your account. Transfer commission - 0.8% of the amount (min 85$, max 135$). It is advantageous to transfer large amounts so that the commission percentage is greater than the maximum commission amount.

This method works in Ukraine, Russia, and other countries. The advantages of this method are the minimum commission compared to withdrawals through private exchangers.

Pros and cons of Payments payment system

pros

Definitely, the EPS called ePayments has more advantages than disadvantages, this explains its growing popularity among users. The main advantages of the payment system include:

- Works with rubles, dollars, euros and cryptocurrency.

- The site has a Russian-language version , which makes working with it easier for residents of the CIS.

- Issues Mastercard cards personally, without intermediaries .

- You can deposit and withdraw in various ways - through a card, using bank details, transferring cryptocurrency and through the wallets of other users.

- There is an application for iOS and Android.

- Low commissions when working with an ePayments card, zero commission for transfers in the system.

- You can pay with a payment card in offline stores (when paying, there is an automatic conversion into the currency of your country).

- Business solutions have been developed, in particular, mass payments.

- Users' payment data is under serious protection; the payment system regularly undergoes PCI DSS Level 1 certification.

Minuses

Among the disadvantages of ePayments, I would include a large number of restrictions for unverified users. On the one hand, such participants have the right to use the system, but strict limits for this category of users make cooperation with the payment system simply impractical. Therefore, when registering with ePayments, in any case, prepare for verification if you plan to work seriously with it.

Along with this, I would like to note that there are not so many ways to replenish and withdraw money, in particular, EPS does not work with the favorite payment cards of Internet investors, and it is not found in HYIP projects, so it will not be possible to use it as the only payment service.

There are also two inconvenient points :

- Since the payment system is designed to work with crypto, take care of replenishing your balance in advance, because you can wait several hours for Bitcoin confirmation. Otherwise, the following situation may arise: you planned to withdraw money from an ATM at 19:00, sent bitcoins at 18:30, but they don’t get confirmation at all.

Only at 23:00 they finally arrived and the trip to the ATM is postponed until tomorrow. But if you have money on your bank card or Yandex money, this point will not affect you, since you can also top up ePayments from them.

Only at 23:00 they finally arrived and the trip to the ATM is postponed until tomorrow. But if you have money on your bank card or Yandex money, this point will not affect you, since you can also top up ePayments from them. - If you have money in the same Advcash, Perfect Money or any other system, you need to exchange it first for cryptocurrency, then send this cryptocurrency to your ePayments wallet, and the service will convert the money back into dollars. There is a loss on commissions.

How to withdraw webmoney to epayments?

I am often asked “how to link epayments to WebMoney.” To withdraw WebMoney to an epayments card, you need to do the following. Go to the web version of Webmoney and link the epayments card to your wallet there.

After that, in your ePayments personal account, select “Top up” -> “From your WebMoney wallet”:

Next, enter the amount and click “To Webmoney”:

After this, you will be transferred to standard WebMoney forms, where you need to specify your login/password and confirmation code. If everything is correct, the funds are credited instantly.

Summarize

An account in the Payments system and a card from this payment system will allow you to make fast and profitable transactions - both online and offline. A number of advantages and minor disadvantages make it popular among users, and therefore this EPS will become indispensable if you earn income on the Internet and are interested in cashing it out.

I hope my review and reviews of ePayments have revealed for you all the features of this payment system, which will help you make an objective choice. Good luck!

Go to the official website

Denis HyipHunter Knyazev

Blog creator. Private investor. He has been making money in highly profitable investment projects and cryptocurrencies since 2014. Consults partners. Join the blog's Telegram channel and our chat.

Don't miss other articles from this section:

02.12.20204734

ePayCore wallet: reviews and review of payment without commissions.

- 02.12.2020183562

Perfect Money wallet – registration, how to top up Perfect Money, reviews

- 15.08.202096646

Yandex Money wallet - registration, how to create and use a wallet

- 06.06.202015722

Which payment system to choose for HYIPs?

- 05.06.202149514

Payeer wallet – registration, reviews, entrance to Payeer personal account

- 21.01.20211423

Exchanger Xchange Cash. Reviews and review of a 24-hour service proven over the years

When is it necessary to top up ePayments?

In the Payments system, wallet and card balances are not combined. Therefore, to withdraw cash from an ATM or make purchases using your card, you must first top it up.

It is also necessary to ensure that there are funds in the account to pay the monthly fee for servicing the “plastic”. It is 2.9 dollars. This amount can be debited from your wallet if there is not enough money on the card. You can use it for free only if your monthly expenses are at least $300.

Important! If the card is inactive for more than 6 months, it will automatically be charged $10 per month. Servicing a wallet that has not had any transactions for more than 1 year costs $3 per month. Therefore, even if you do not use Payments for a long time, you will have to top up your account with at least an amount sufficient to pay the fee for inactivity.

Restrictions and limits

Unverified users can deposit a maximum of $2,500 per year. After verification, the following limits for replenishing the wallet are available:

- Transfer from another ePayments account. The minimum amount is 1 cent.

- Bank transfer. The minimum amount is 1 dollar.

- Replenishment from a bank card. You can transfer from 10 to 1,500 dollars at a time, no more than 5,000 per day and 10,000 per week. The allowed number of operations per day is 5.

- From Yandex.Money. You can transfer from 1 to 60,000 rubles at a time, no more than 5,000 dollars per day and 15,000 per month. Number of operations – up to 5 per day.

- With WebMoney. The limit on the transfer amount is from 10 to 10,000 dollars, no more than 20,000 per day. 5 operations per day are allowed.

The ePayments card can be topped up to 5 times a day with a maximum amount of $20,000. You cannot store more money on it.

Getting to know the ePayments.com system

Let's start with what ensures the security of payments in ePayments.

The service is registered in the UK and is subject to fairly strict laws of the Kingdom, that is, its laws provide the legal basis for the payment system.

So, legal support is guaranteed by the fairly well-known company Salans, in turn, all processes with cards are regulated by FIS, which is one of the largest in its segment.

NatWest and HSBC banks , the largest in Britain.

The money of system participants is necessarily insured, as this is required by the country’s legislation and MasterCard rules. WaveCrest holding also acts as an issuer of plastic cards issued to ePayments users.

Looking at this entire armada of companies, there really is no doubt that security is at a high level. In fact, users note this, but more on that later.

Much attention is paid to security, let's start with personal data in order:

- When making payment transactions, the information does not reach third parties, and the recipient sees only the sender’s wallet number;

- Credentials are also stored out of reach, on servers that attackers cannot gain access to;

- Also on the side of users is the special PDA act, adopted in the UK in 1998 by Parliament and guaranteeing the protection of any private data that you provide.

How are financial transactions between system participants protected?

As the company points out, these are the latest protection systems that allow you to constantly monitor any attempts at fraud (fraud monitoring).

Of course, when carrying out any operations, it is necessary to enter a special confirmation password; it is issued for a certain period and can be known exclusively to the sender.

Additionally, a special Secure Socket Layer data encryption system is used.

The security of your e-wallet is ensured by various restrictions on your IP address.

To do this, you can set restrictions yourself - by a given range or country of location.

Each user can order an additional plastic system card and use it for their own convenience, while it will also be protected from possible hacking.

Firstly , a unique pin code that cannot be selected without the participation of the owner.

Secondly , if suddenly the card is stolen or you lose it, access is instantly blocked in any convenient way - by phone or through an application, personal account.

That is, with regard to the main criterion declared by the company - safety, there are no questions here.

What about convenience, do all the features satisfy the interests of modern users? After all, these are mainly representatives of business industries working on the Internet (Forex companies, participants in the digital currency market).

How to order a card?

The card can be ordered after the user completes the registration procedure. The issue cost is 35 $ or 29 € depending on the account currency. Delivery from England takes on average from 7 days to 6 weeks and is carried out in three ways:

- by mail;

- via Royal Mail service;

- express delivery.

In the first two cases, delivery is free, in the last case the fee will be 40 € or 45 $.

How to open a real account on Forex: the first steps of a trader