It's no secret that the success of investing on the stock exchange largely depends on the brokerage company you work with. A good broker helps you avoid wasting extra time and money, competently compiling your investor portfolio and adjusting it depending on the market situation. Moreover, a broker must meet subjective criteria to at least be pleasant to work with. After all, you have one goal - to earn money .

The broker's task is to increase the investor's financial well-being

The outcome of your investment will depend on which brokerage company you choose. Therefore, the first step on the path to success is to study and compare different brokers and choose the best one.

Before delving into the topic, let's understand the definition - what does a broker mean?

A broker is an intermediary for concluding financial transactions. The broker helps private and corporate clients profitably invest money in one or another valuable asset, which will increase in price in the future and, thereby, bring profit to the investor. For his work, the broker receives a commission , which constitutes his earnings.

A stock broker is an intermediary for concluding transactions in the stock market.

When thinking about an intermediary, the question immediately arises: which broker is better - Russian or foreign? Many people mistakenly think that the main thing when choosing a broker is the tariff. In fact, there are many more important points that are worth paying attention to.

To make your life easier and save you from wandering around the websites of foreign and Russian brokers, we at investonomic.ru have compiled a rating of the best companies in 2022, as well as a list of criteria on how to independently find a proven and reliable broker. Comparing the most popular foreign and domestic brokers will help you choose the best partner for investing in the international and Russian stock market. ✅

The best Russian brokers

The first question from almost anyone who is just entering the investment market is: when there are so many brokers, which one should you choose?

Let's start the ranking of the very best with the best domestic brokers. This list is also not small: on the Moscow Exchange website alone, dozens of brokerage companies offer intermediary services in the stock market.

And only a comparison of the working conditions of different sites will help you choose the best offer.

Below you will find a table of the Top 10 brokers in Russia . In compiling this top, we focused on factual information about the broker (number of active clients, volume of client transactions), as well as user ratings and reviews.

| Broker | Website | Year of foundation | Trade turnover for the month, billion rubles * | Number of active clients** |

| BKS | https://broker.ru/ | 1995 | 1 010,0 | 45 598 |

| VTB | https://broker.vtb.ru/ | 2008 | 439,0 | 161 196 |

| Tinkoff | https://www.tinkoff.ru/invest/ | 2018 | 206,0 | 601 923 |

| FINAM | https://www.finam.ru/ | 1994 | 171,0 | 33 358 |

| Opening Broker | https://open-broker.ru/ | 1995 | 158,0 | 33 547 |

| Alfa-Direct | https://www.alfadirect.ru/ | 1998 | 121,0 | 26 127 |

*Turnover on the stock market **According to smart-lab.ru

Leading dollar-ruble market operators

| 2 230 009 418 027 | |||||

| 2 | MKB Investments LLC | 1 607 881 036 946 | |||

| 3 | JSC "ALFA-BANK" | 1 599 656 624 172 | |||

| 4 | JSC Tinkoff Bank | 1 305 917 404 876 | |||

| 5 | VTB | 811 780 505 219 | |||

| 6 | PJSC Sberbank | 806 263 738 484 | |||

| 7 | FC Otkritie Bank Group | 510 978 652 169 | |||

| 8 | IC "Renaissance Capital" | 492 162 067 278 | |||

| 9 | PJSC JSCB "Metallinvestbank" | 414 626 355 348 | |||

| 10 | PJSC Gazprom | 357 496 813 403 | |||

| 11 | Bank GPB (JSC) | 315 751 260 916 | |||

| 12 | JSC Raiffeisenbank | 304 444 764 636 | |||

| 13 | JSC CB "Citibank" | 182 979 255 790 | |||

| 14 | JSC BANK "SNGB" | 165 904 532 523 | |||

| 15 | JSC "IC "IT Invest" | 156 265 643 385 | |||

| 16 | LLC "HSBC Bank (RR)" | 147 706 730 420 | |||

| 17 | PJSC ROSBANK | 126 399 370 618 | |||

| 18 | JSC UniCredit Bank | 120 151 548 477 | |||

| 19 | PJSC "Bank" Saint-Petersburg" | 102 180 644 590 | |||

| 20 | PJSC "Sovcombank" | 84 570 544 880 | |||

| 21 | FINAM | 83 716 362 393 | |||

| 22 | ING BANK (EURASIA) JSC | 79 129 247 143 | |||

| 23 | UNIVER Capital LLC | 52 539 155 703 | |||

| 24 | PJSC Bank ZENIT | 51 632 529 723 | |||

| 25 | LLC FC INTRAST | 49 175 180 050 | |||

| 26 | JSC Rosselkhozbank | 44 531 760 288 | |||

| 27 | JSC "Bank Credit Suisse (Moscow)" | 42 449 544 193 | |||

| 28 | PJSC Promsvyazbank | 41 351 110 783 | |||

| 29 | LLC "IC VELES Capital" | 40 274 607 862 | |||

| 30 | JSC "REALIST BANK" | 38 011 130 688 | |||

| 31 | VEB.RF | 37 617 627 561 | |||

| 32 | Goldman Sachs Bank LLC | 35 590 812 958 | |||

| 33 | "BNP PARIBAS BANK" JSC | 33 018 851 620 | |||

| 34 | AK BARS Bank Group | 31 486 331 092 | |||

| 35 | PJSC "CREDIT BANK OF MOSCOW" | 30 630 229 638 | |||

| 36 | ATON LLC | 28 512 610 545 | |||

| 37 | ICBC Bank (JSC) | 27 922 094 503 | |||

| 38 | BBR Bank (JSC) | 18 972 109 880 | |||

| 39 | RNKO "Payment Center" (LLC) | 17 683 734 620 | |||

| 40 | LLC CB "Stolichny Credit" | 17 159 664 400 | |||

| 41 | JSCB "BANK OF CHINA" (JSC) | 15 258 504 701 | |||

| 42 | ALOR+ LLC | 12 231 207 488 | |||

| 43 | JSC "Uglemetbank" | 11 243 055 495 | |||

| 44 | PJSC SKB Primorye "Primsotsbank" | 11 114 565 253 | |||

| 45 | JSC ROSEXIMBANK | 10 780 808 548 | |||

| 46 | JSC Banca Intesa | 10 470 110 550 | |||

| 47 | PJSC "BANK URALSIB" | 10 457 772 907 | |||

| 48 | JSC Far Eastern Bank | 10 244 071 394 | |||

| 49 | JSCB "Lanta-Bank" (JSC) | 10 098 445 798 | |||

| 50 | PJSC JSCB "Primorye" | 10 060 629 953 | |||

| USDRUB (SWAP) | |||||

| 1 | PJSC Sberbank | 4 888 434 618 613 | |||

| 2 | Bank GPB (JSC) | 4 298 413 524 020 | |||

| 3 | VTB | 4 038 385 652 289 | |||

| 4 | PJSC "Sovcombank" | 1 835 805 896 140 | |||

| 5 | JSC "ALFA-BANK" | 1 773 401 998 371 | |||

| 6 | FG BKS | 1 687 356 920 851 | |||

| 7 | PJSC ROSBANK | 1 492 042 190 700 | |||

| 8 | JSC CB "Citibank" | 1 475 053 856 050 | |||

| 9 | Deutsche Bank LLC | 771 716 189 400 | |||

| 10 | JSC Raiffeisenbank | 768 506 611 140 | |||

| 11 | Tavrichesky Bank (JSC) | 710 615 720 100 | |||

| 12 | JSC UniCredit Bank | 674 313 816 410 | |||

| 13 | ING BANK (EURASIA) JSC | 660 126 795 700 | |||

| 14 | PJSC "Bank" Saint-Petersburg" | 653 533 989 770 | |||

| 15 | FC Otkritie Bank Group | 537 227 090 240 | |||

| 16 | Goldman Sachs Bank LLC | 458 705 688 180 | |||

| 17 | PJSC "SKB-bank" | 436 733 309 690 | |||

| 18 | JSC "COMMERZBANK (EURASIA)" | 380 298 230 580 | |||

| 19 | PJSC Promsvyazbank | 373 784 497 795 | |||

| 20 | PJSC "CREDIT BANK OF MOSCOW" | 317 306 045 150 | |||

| 21 | JSC Banca Intesa | 314 507 502 180 | |||

| 22 | FINAM | 257 260 623 311 | |||

| 23 | JSC "Bank Credit Suisse (Moscow)" | 232 944 468 280 | |||

| 24 | JSC "IC "IT Invest" | 228 449 227 547 | |||

| 25 | JSC SEB Bank | 195 574 854 850 | |||

| 26 | VEB.RF | 167 844 526 270 | |||

| 27 | MKB Investments LLC | 160 422 725 798 | |||

| 28 | JSC Rosselkhozbank | 150 252 396 594 | |||

| 29 | JSC Tinkoff Bank | 140 275 257 550 | |||

| 30 | LLC "HSBC Bank (RR)" | 135 586 442 870 | |||

| 31 | "BNP PARIBAS BANK" JSC | 113 045 196 160 | |||

| 32 | LLC "IC VELES Capital" | 108 983 823 950 | |||

| 33 | PJSC "MTS-Bank" | 95 398 858 610 | |||

| 34 | UNIVER Capital LLC | 87 965 080 515 | |||

| 35 | JSC Bank "Development-Capital" | 86 942 018 480 | |||

| 36 | JSC JSCB "Alef-Bank" | 83 652 147 410 | |||

| 37 | JSC JSCB KEB HNB Bank | 78 609 912 060 | |||

| 39 | IC "Renaissance Capital" | 76 803 443 020 | |||

| 40 | UBS Bank LLC | 74 338 913 020 | |||

| 41 | JSC ROSEXIMBANK | 73 443 183 840 | |||

| 42 | CB "ENERGOTRANSBANK" (JSC) | 73 436 694 333 | |||

| 43 | AK BARS Bank Group | 71 978 280 240 | |||

| 44 | Credit Agricole CIB JSC | 60 668 779 910 | |||

| 45 | RONIN LLC | 58 599 020 110 | |||

| 46 | BBR Bank (JSC) | 58 398 683 770 | |||

| 47 | JSC JSCB "NOVIKOMBANK" | 58 219 512 780 | |||

| 48 | "Bank "IBA-MOSCOW" LLC | 51 633 784 950 | |||

| 49 | JSC "KOSHELEV-BANK" | 51 397 192 740 | |||

| 50 | PJSC JSCB "Metallinvestbank" | 51 333 945 770 | |||

| USDRUB Pension Fund | |||||

| 1 | JSC "ALFA-BANK" | 94 634 365 000 | |||

| 2 | VTB | 66 572 578 440 | |||

| 3 | PJSC Sberbank | 58 800 405 130 | |||

| 4 | AK BARS Bank Group | 40 784 039 653 | |||

| 5 | OJSC "Joint Stock Savings Bank "Belarusbank" (JSC "ASB Belarusbank") | 32 682 728 313 | |||

| 6 | LLC "IC VELES Capital" | 25 642 684 250 | |||

| 7 | PJSC "CREDIT BANK OF MOSCOW" | 22 393 435 000 | |||

| 8 | PJSC "SKB-bank" | 20 815 887 300 | |||

| 9 | JSC "IC "IT Invest" | 14 469 871 456 | |||

| 10 | PJSC "Sovcombank" | 13 112 589 950 | |||

Dear site visitors, to send your suggestion or ask a question, use the feedback form.

We value your opinion and will definitely consider your questions and, where possible, confirm receipt of the Letter and provide a written response.

If there are justified and significant claims, the Exchange, together with the Expert Councils, will take measures to develop and implement appropriate changes.

Go to the full version of the site Go to the mobile version of the site

Copyright © Moscow Exchange, 2011 - 2022. All rights to information and analytical materials posted on this Exchange website are protected in accordance with Russian legislation. Before you start using the site, we suggest that you read the User Agreement. Reproduction, distribution and other use of information posted on the Exchange website, or part of it, is permitted only with the prior written consent of the Exchange.

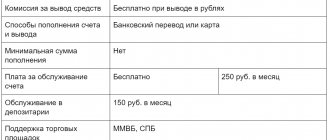

Brokers rating by commission

Brokers charge a commission for intermediary services, and it is from the commission their main income comes. Every broker is interested in the client trading more and more often, so he tries to offer favorable conditions in order to retain the client. ✅

As a rule, the commission amount for top brokers is a fraction of a percent of the transaction amount and depends on the volume and frequency of transactions.

The top ten brokers with the minimum commission are as follows:

| Broker | Website | Broker commission |

| FINAM | https://www.finam.ru/ | Depository commission: 177 rub. per month; On the derivatives market: 0.45 rubles per contract; Foreign exchange market: 0.0008% of turnover, but not less than 25 rubles. for the deal. |

| XM | https://www.xm.com/ru | From 0.01% to 0.1% Inactive accounts are charged a monthly fee of $5 or the full amount of funds in the account if it is less than $5 |

| Etoro | https://www.etoro.com/ | There are no commissions: the broker receives profit from the spread, which starts from 2 points and depends on the specific instrument; |

| EXANTE | https://exante.eu/ru/ | 0.02 USD per share - the maximum rate on the main US exchanges; from 0.02% to 0.18% - on European exchanges; from 0.1% to 0.1927% - on Asian exchanges. |

| Tinkoff Investments | https://www.tinkoff.ru/invest/ | Deposit, withdrawal of money, account maintenance - free; The commission for transactions only depends on the tariff: Investor - 0.3%; Trader - 0.05% or 0.025% with a daily turnover of 200,000 ₽; Premium - 0.025% and from 0.25% to 4% for transactions in over-the-counter foreign securities. |

| Interactive Brokers | https://www.interactivebrokers.co.uk/ | 0.01% to 0.15% |

| Opening Broker | https://open-broker.ru/ | Universal tariff : 0.057% - shares, bonds; 0.74 ₽ — futures and options; 0.010% - currency; 0.05% - foreign shares. Account maintenance - 0.17%/month. Tariff Investor : 0.24% - stocks, bonds, 10 ₽ - futures and options, 0.036% - currency, 0.05% - foreign shares. Account maintenance is free. |

| BCS Broker | https://broker.ru/ | Investor tariff - 0.1% (one rate on all sites without additional commissions); Trader tariff - 0.015%; Tariff Investor Pro - 0.015% - 0.3%; Tariff Trader Pro - 0.015% - 0.045%; |

| VTB Investments | https://broker.vtb.ru/ | Transactions with securities - 0.01% of the amount; Transactions with securities and currency - depend on the tariff; Transactions on the derivatives market - 1 ₽ per contract; Transactions on the over-the-counter market - from 0.15% of the amount; |

| Alfa-Direct | https://www.alfadirect.ru/ | tariff : Transactions with securities - from 0.014% for the exchange market and from 0.1% for the over-the-counter market; Transactions with currency - from 0.011%; Transactions with futures - from 0.5 exchange fee. Tariff S : Transactions with securities - 0.03% (except for futures); Transactions with currency - 0.03% (except for futures); Transactions with futures - from 0.5 exchange fee. |

Sberbank

The Sberbank mobile application is installed in almost every smartphone, so it is not surprising that 237 thousand Russians chose this particular broker.

Passive investor

For novice investors, the “Independent” tariff is most suitable (link to tariffs). There are no fees for account maintenance and depository services, and the transaction commission is 0.06% (+0.01% of the Moscow Exchange commission). Thus, an inactive investor will pay 70 ₽ per month.

Novice trader

If a trader chooses the same tariff (the conditions of the “Investment” tariff are much worse, which is compensated by investment recommendations and the availability of special offers), then his expenses will be 1,400 rubles per month (or 70 rubles per trading day).

Rating of brokers by turnover

An important parameter when choosing a broker is monthly turnover According to the Moscow Exchange, monthly trading turnover on the site is:

| Broker | Website | Trade turnover, rub |

| BCS Broker | https://broker.ru/ | 898 227 697 995 |

| VTB Investments | https://broker.vtb.ru/ | 361 950 509 601 |

| Tinkoff Investments | https://www.tinkoff.ru/invest/ | 179 064 988 857 |

| FINAM | https://www.finam.ru/ | 152 340 868 977 |

| Opening Broker | https://open-broker.ru/ | 152 043 217 710 |

| Alfa-Direct | https://www.alfadirect.ru/ | 83 137 448 438 |

VTB

VTB is actively developing, it already has 216,008 clients, and its commissions are among the lowest (link to tariffs).

Passive investor

The “My Online” tariff will suit him, under the terms of which he will only need to pay a commission for transactions of 0.05% (+0.01% for the Moscow Exchange). Our investor's expenses will be 60 rubles.

Novice trader

A trader can choose the “Investor Standard” tariff with a monthly service fee of 150 ₽ and a transaction commission of 0.0413% (+0.01% for the Moscow Exchange). Expenses for a trading day will be 51.3 ₽, and for a month - 1176 ₽ (1026 + 150). However, the service fee can be reduced to 105 rubles if you purchase a lot of VTB shares, the price of which in February 2022 is 400 rubles.

Compare returns from stocks with interest on deposits

Deposit calculator

Rating by number of clients

An important indicator of the performance of a brokerage company is the number of clients that the broker managed to attract. And the more clients a broker has and the more money they have, the greater the volume of transactions and, accordingly, the broker’s earnings.

Active clients on the exchange are those who have made at least one transaction within a month.

According to the Moscow Exchange, the number of active clients per month on the sites was:

| Broker | Website | Active clients |

| Tinkoff Investments | https://www.tinkoff.ru/invest/ | 717 105 |

| VTB Investments | https://broker.vtb.ru/ | 183 834 |

| BCS Broker | https://broker.ru/ | 48 131 |

| Opening Broker | https://open-broker.ru/ | 34 697 |

| FINAM | https://www.finam.ru/ | 33 358 |

| Alfa-Direct | https://www.alfadirect.ru/ | 29 552 |

Criterias of choice

I will briefly discuss the criteria for selecting a brokerage company that guided me when compiling the review.

- Reliability

I associate it with the presence of a license from the Bank of Russia and with the history of the company. In order to save time, I do not look at the list of licensed intermediaries on the official website of the Central Bank, but immediately go to the website of the Moscow Exchange. There is a list of professional participants. Without a license you will not be allowed to trade.

- Moscow Exchange rating

I study at the same time as the first point. I will write more in a separate section of the article.

Complete information about current strategies that have already brought millions of passive income to investors

- Tariffs and conditions

Here you can’t do without visiting the company’s website. Unfortunately, the interface of many of them leaves much to be desired. Especially regarding the description of tariff plans. Sometimes it is necessary to call an employee to clarify details.

- Availability of tools

Not everyone gives access to the St. Petersburg Exchange. For example, Sberbank and PSB do not do this. And in Tinkoff Investments you may not find some mutual investment funds from Sberbank. Customers say that these tools are added upon request in chat.

More than 100 cool lessons, tests and exercises for brain development

Start developing

- Trading platform

Many large brokers not only provide access to the QUIK platform, well-known among traders, but also develop their own programs for computers and mobile phones. For example, Sberbank has so far limited itself to only QUIK and the Sberbank Investor mobile trading platform, which is not very convenient. And the Tinkoff Investments application is praised by many beginners for its simplicity.

- Technical support and feedback

I studied a lot of reviews about working with different brokerage companies. For some people, high-quality technical support and the presence of a chat in the application are mandatory selection conditions. But I think that this applies to active traders who play on rising or falling quotes and make several transactions a day. As a long-term investor, in 3 years of trading on the stock exchange, I only needed to contact my broker once, when I decided to transfer the IIS to another intermediary.

The first 4 points can be studied by any novice investor on their own, and the remaining two can be studied based on customer reviews. Sometimes the broker gives you the opportunity to test the trading platform on a demo account. For example, I did this at Finam.

How to choose a broker yourself

For independent trading in the stock market, finding a broker is the most important step.

But how to check a broker and find the one who offers the best conditions?

Don’t worry: below you will find instructions with the main criteria that a good broker meets. Moreover, for different investors these criteria have different priorities. Some people focus on commissions rather than on the broker’s position in the market. For some, it is critical to be able to open an account remotely and not have to go to a broker’s office, etc. ✅

License

A licensed and regulated broker provides peace of mind. The absence of a license means the absence of any guarantees.

Also, when choosing a broker, pay attention to the jurisdiction in which he operates. The presence of an authoritative regulator will, if not completely insure against risks, then at least reduce them. Large brokers work with serious regulators, such as US, UK, MiFID, and not in offshore zones.

Please note: to work in foreign markets, Russian brokers must have a legal entity abroad.

Market position

High market positions are an objective indicator of the quality and reliability of a broker. The main parameters are: the amount of share capital, trading turnover per day/month/year, active clients, open transactions in the system, etc.

Ratings and current statistics are open information. It can be viewed, for example, on the website of the Moscow Exchange.

Broker commissions

Brokers make money from commissions from transactions. Therefore, in order to attract clients, especially large ones, the broker offers tariff plans with different commission conditions.

As a rule, depositing and withdrawing funds occurs without commissions. Ideally, there should be many input and output methods.

Also, some brokers may charge higher commissions if the account is below a certain amount.

In addition to the brokerage commission, additional fees may apply. Sometimes brokers charge a separate fee for depository services, since assets purchased on the exchange are stored in the depository, which also builds money. Some brokers may have free account maintenance.

Availability

Before choosing a broker, decide on the main tool, since different brokers have different tools in their arsenal.

For many, the threshold cost is critical, and then you need to look for brokers who offer to open an account with a minimum amount. If you have 30,000 euros to invest, then there is room to roam. And with a more modest initial capital, you need to look for other options.

Selecting Tools

Some companies do not have access to American stocks, others do not have access to certain ETFs, and still others do not have access to some bonds. But there are also those who have everything (or almost everything).

A large number of markets and a wide selection of financial instruments indicate the quality of the broker. Even if you are not interested in a particular asset now, in the future, as your portfolio grows, you will be pleased with the variety of instruments.