Trading systems are built on the basis of various levels. Fibonacci levels have been used in trading for a long time - as soon as traders saw that price fluctuations for certain assets often repeat the Fibonacci numerical sequence and quite clearly. The tool is so effective that it is part of the standard settings of MetaTrader4/5, a trading platform that is by far the most popular and in demand.

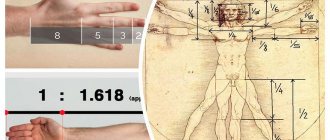

Leonardo Fibonacci lived in ancient Italy, it was he who found a simple numerical sequence that is found everywhere and is considered universal for a huge number of natural phenomena.

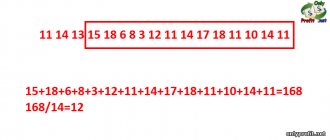

The sequence looks like this: 0, then 1, then 1 (0+1), then 2 (1+1), after 3 (1+2), then 5 (2+3), 8 (3+5), etc. d. Thus, it turns out that the Fibonacci sequence is the sum of the two preceding numbers.

These numbers allow us to determine an interesting proportion: if the first is divided by the second, we get 0.618 (regardless of which numbers in the sequence we take). And if you divide the numbers by one, it comes out to 0.382. These fractions are called the golden ratio; in nature it occurs very often - a striking example is a spiral (like seeds in a sunflower).

Corrective Fibonacci levels in trading look like this: 0.236, 0.382, 0.500, 0.618, 0.764.

Extension levels: 0, 0.382, 0.618, 1.000, 1.382, 1.618. All these numbers are calculated from a sequence, but there is no point in counting them manually for traders. The main thing is to understand how they work and what they are used for, what information they provide and how to successfully use them in trading.

Trading using Fibonacci levels is carried out using special indicators that automatically draw lines on the chart or instrument in the trading terminal. Retracement levels are used in a variety of ways: as support/resistance, for opening trades, placing stops. Traders use expansion levels to set take profits.

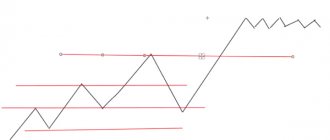

On a Fibonacci chart, it can be used on the basis of swings - candles that have at least two upper highs or upper lows on the left and right. It is also worth remembering that Forex Fibonacci levels are a trend tool and are not used during moments of consolidation. When the trend moves up, the price gravitates toward pullbacks from resistance levels built on Fibonacci fractions; for a downward trend and support, everything works similarly.

To build levels, the trader will need swings, as well as a grid on a live chart. First they look for the lower swings, after them the upper ones and the net is stretched between them.

How to use Fibonacci levels in Forex

Fibonacci retracement levels are included in almost all charting programs. In some, fan lines, arcs and time periods can be found as standard tools, but Fibonacci lines are considered the most universal and understandable option.

What you need to know about Fibonacci lines for trading:

- On a 0-100 scale, the values are calculated as 23.6, 38.2, 50.0, 61.8, 76.4%. These ratios are the main indicator that can predict likely future price movements (price often bounces off levels). The indicator displays levels on the price chart and makes it possible to predict future movements.

- If you want to trade manually on a price chart or in a program, select the function of showing correction levels: starting from the bottom point of the trend, you need to drag the cursor to the top point. 5 horizontal lines will appear showing the values 0, 38.2, 50, 61.8, 100% (another line of 23.6% can be added).

- The lines can be used as support/resistance levels depending on whether Fibonacci trading is above or below the lines.

- The longer the time period, the more clearly the levels work.

- The main task of a trader is to find a fading trend, correctly stretch the Fibonacci lines, wait for confirmation and open an order.

Number series are used in different ways in trading.

On an uptrend

When Fibonacci levels are used, the Forex market should be trending. If there is no trend, you need to wait for it. This tool allows you to determine the exact cost and the correct direction of entry. Works on all time periods, suitable for most assets: currency pairs, such as EUR USD, GBP USD, USD JPY, Gold, Futures contracts, CFDs, indices, etc.

First you need to go to the trading terminal, select an asset and time frame, find an uptrend on the chart, determine its beginning by the minimum of the start candle, find the maximum of the candle of this trend. They are usually identified not by shadows, but by tails. Next, you need to click on the Fibonacci icon with the cursor, move it to the chart, and stretch it between the minimum/maximum. Pull from bottom to top, left to right.

6 uptrend lines appear on the chart - usually 0, 23.6, 38.2, 50, 61.8, 100, they are called Fibonacci lines. In most cases, the correction reaches level 38, rebounds from it and again follows the trend. In rare cases, a rebound occurs from level 23 and jumps to lower ones. For example, the GBPUSD pair often flies to 50 and rarely reaches 61 levels.

Orders are placed simply. For example, on the chart the trend begins its downward correction. During an uptrend, you can only enter into Buy transactions; you should not sell during a correction. The price value is determined at level 38 - let it be 1.3513, you need to move up 5-7 points, you get 1.3519. Here you need to open Buy Limit. Then the price of level 23 is determined (let it be 1.3621), the indentation is the same downwards and TP is set at 1.3615. The deal is ready.

As an example, we offer a Forex Strategy based on RSI and Fibonacci extension 1.618:

On a downward trend

If the trend is downward, the lines are drawn from left to right, but from top to bottom, and the reverse sequence is formed.

The principle of operation is exactly the same, only in reverse. It is also worth remembering that after opening an order, the price may jump in the wrong direction as expected. In this case, you can wait out the drawdown (if the deposit allows it) or set Stop-loss (if the trader has the opportunity to incur a loss and close the deal with a minus). Many traders set Take-Profit from level 50 to compensate for the drawdown loss.

conclusions

These trading techniques were tested in practice long before they received a mathematical interpretation and special tools. Due to their popularity, all Fibo indicators are now used as additional signals: millions of traders see approximately the same picture and make the same decisions . Large players actively take advantage of this by placing pending orders in the area of strong Fibo lines and luring many small transactions into these traps. Also, most popular trading methods suggest placing Stop Loss directly at Fibo levels - there they are usually “removed” during speculation. Therefore, we approach the use of Fibonacci indicators wisely.

The method and all Fib indicators are very subjective, like most ideas in technical analysis. We invite the reader to decide for themselves what is more profitable for you: building lines manually or using special Fibonacci indicators.

Automated methods do not have any particular advantages, if only because the trader evaluates the situation comprehensively, and the Fibonacci indicator only from a mathematical point of view. If you are sure (with sufficient experience) that you perform Fibo calculations correctly and you do not need to frequently adjust the lines, for example, for medium-term trading, then we recommend performing the construction manually - it is more reliable.

Fibonacci indicators cannot be used separately from other tools; they can be used as part of a comprehensive trading system.

When Fibo Retracement Levels Don't Work

Fibonacci levels are approximate guidelines and provide information regarding the likely movement, but are not absolute signals. It happens that support/resistance levels are broken through - the same thing happens with Fibonacci levels. The rules exist and work, but there are many exceptions, so it is advisable to check the signals with other instruments and insure yourself to the maximum when opening any position.

That is why all Fibo strategies involve the use of additional signals, an example is the Simple Breakout strategy:

Levels require careful development, constant refinement and filtering. It happens that the levels are broken through, that instead of a 50% rebound happens at 61.8, sometimes the price even goes past the levels and considers the significant ones to be weak, and the weak ones to be important. In view of all these features, it is important to be able to combine different instruments into strategies and constantly gain experience in trading with the selected funds.

Advantages and disadvantages

Let's list the advantages and disadvantages of trading using Fibonacci levels in a table:

| pros | Minuses |

| Simplicity. In Quick and other trading systems, Fibonacci levels are built into the toolbar | Sometimes it is difficult to determine the beginning of a trend direction |

| Suitable for the securities market, incl. derivatives, Forex, cryptocurrencies | The algorithm does not work very well on flats |

| A good way to determine entry and exit points, set stop orders, determine support and resistance levels | Low probability of forecasting on daily and hourly timeframes |

| The tool allows you to “get your teeth into” (master a skill) in a short period of time | |

| Fibonacci levels work on any time frame |

How to add the Fibo indicator to a price chart

To add a Fibonacci grid to a chart in the MetaTrader4/5 trading terminal, just select the following path in the main menu: “Insert/Fibonacci/Lines”. To insert the indicator into the right place, hover the mouse cursor over it, hold down the left button, hold and drag until the extreme points are correctly identified.

To configure the indicator, right-click on any place on the chart and select “List of objects/Fibo/Properties”. After placing levels, sometimes you need to remove them. To do this, right-click on any place on the chart and select “List of objects/Fibo/Delete”. The grid will disappear.

To install Fibonacci in the QUIK trading platform, you need to find a special toolbar or install it in the context menu on the panel using the “Chart” item.

Next, just left-click on the desired toolbar icon, stretch the grid, and then in the settings window that appears, create an appearance and select parameters.

TradingView what is it

TradingView in simple words, an online platform for technical analysis.

TradingView's main product is interactive price charts for various assets and tools for convenient technical analysis.

A secondary product, various statistical information and the ability for traders to communicate with each other by publishing their own trading ideas.

Is it possible for a modern trader to do without TradingView?

My opinion is definitely no. There is simply no better product for charting and technical analysis.

By starting to use TradingView, you move to a new level of technical analytics and understanding of the market situation.

Creating a TradingView Account

How to create an account on the TradingView platform? Everything is very simple, follow the link and see the window.

TradingView Welcome Window

Click on the cross, in the upper right corner we find the login button, follow it and click the TradingView registration button below, register in a way convenient for you.

Methods for registering on TradingView

To get started, a simple free account will do; it is already enough to get acquainted with TradingView and improve the level of your skill and quality of working with charts.

I think that we need to return to the types of TradingView subscriptions later in order to fully understand whether this or that subscription is needed. Now I suggest moving on to the interface.

TradingView Interface Overview

The TradingView interface is not as complicated as it seems at first glance.

TradingView Home Page Interface

After registering, the first thing you will see is the main page of the TradingView website. You can see analyzes of the market situation by other traders, market overview charts and other tabs. The main tool will be the widget on the right side of the screen, which is marked with a red frame.

Click on the first button called “List of quotes and information”, a new tab will open, to add the desired instrument, click on the plus sign and add it to the list, for example, the BTCUSDT pair on Binance.

Adding an instrument to the TradingView quote list

After the instrument is added, right-click on the instrument to create a new chart.

Create a new TradingView chart

After this, the working panel of the TradingView platform will open. This is where all the analytics tools are located, and where most of the time is spent on site.

TradingView's main technical analysis area

The main area of the TradingView platform is divided into seven groups. Each has its own function and we will work with everyone. For convenience, I have identified these groups by color, let's list them:

- The first and largest area, red, is the area of the interactive chart; it displays the asset price chart, performs technical analysis and all calculations.

- The second area, purple, is the technical analyst panel, all the standard technical analysis tools, trend lines, Fibonacci grids and others are located here, we will discuss in more detail below.

- The third area, green, is the chart settings panel located in the first area.

- The fourth area, yellow, is the data area of the blue panel, more specifically the “List of Quotes and Information” button.

- The fifth area, orange, is the instrument data window.

- The sixth area is blue, the navigation panel for sections of the TradingView site.

- The seventh area is the TradingView user interface area.

Next we will look at all these areas in detail.

TradingView interactive chart area

TradingView interactive chart area

In principle, the main area of the graph is intuitive, but let's look at it in detail.

- The number one marks the area of the TradingView chart; a chart is automatically drawn on it, according to the specified parameters.

- The number two marks the area of the price scale; if you click on it with the left mouse button and hold it down, moving the mouse you can expand and narrow the chart. Right-clicking on the timeline brings up the scale settings menu.

- Number three, date scale, click on the scale and hold the left mouse button, moving the mouse you can expand and contract the graph.

- The number four marks the area for quickly changing the graph display mode; you can select the graph display mode: 1d, 5d, 1 month, 3 months, 6 months, year, 5 years.

- The number five marks the area of statistical information on the instrument. The name of the instrument, on which exchange it is traded, price statistics: opening, closing, maximum and minimum, percentage change per day.

- If you right-click on the area under number one, you can call up the area settings menu. The settings menu is marked with the number six.

- In the lower right corner, number seven, is the area for selecting the display of the price scale and setting the time zone on the chart.

In general, the TradingView interactive chart interface is very informative and you can understand that you can customize each parameter for yourself.

Auxiliary panel for setting up the TradingView interactive chart

If you look at the top, there is a toolbar above the main area of the chart, let's look at it in detail.

TradingView Interactive Chart Toolbar

Under the number one , the quick menu for the chart and account is marked.

TradingView chart quick menu

In the quick menu, you can turn on or off autosaves, change the color of the chart for working at night, open access to the chart, change the name of the chart, copy it, and export data. The menu also provides access to account data.

The number two marks the search area for symbols, that is, tools.

TradingView Symbol Search Area

By entering the symbol of an instrument, for example BTC, you can find trading pairs and the exchanges on which they are traded.

Using the button under the number three , you can change the time frame of the chart, that is, the time during which one candle is formed.

Changing the time frame of the TradingView chart

If you select 5 minutes, then one candle is formed in 5 minutes, if you select 1 hour, then one candle is formed in an hour, and so on.

The button below the number four allows you to select the type of graph display. Namely, the choice of a candlestick model.

Selecting a candlestick chart display model

A candlestick chart pattern is a representation of a price chart. For example, bars can be represented in a chart in the form of bars, or they can be represented in the form of crosses and zeros.

By clicking on the button marked with the number five and a plus sign in a circle, you can compare several tools.

TradingView comparison tool

For example, let’s superimpose the broadcast graph, that is, we’ll make a comparison. After adding, we see an orange line, this is the price of ETH.

Number six, button to add indicators. Indicators are an integral tool for a technical analyst.

Adding TradingView Indicators

What are TradingView indicators? These are ready-made analytical tools. The TradingView platform offers several dozen free built-in generally accepted indicators; in addition, there are also paid and free custom indicators.

Number seven , the reporting button, shows various information about the selected company.

TradingView reporting button

The templates button, marked with the number nine , displays ready-made indicator templates.

Ready-made TradingView indicator templates

For example, adding oscillator templates we get indicators, stochastic, rsi, cci.

A button with an alarm symbol, marked with the number ten , means the alert tab.

TradingView Alert

The TradingView platform offers the configuration of various alerts, such as price crossovers, or alerts when an indicator or strategy is triggered. Alerts can be received via push notification in the app, via email, or even via a webhook.

The buttons under the number 10 are responsible for market simulation; daily time frame simulation is available in the basic subscription. Simulation is the reproduction of the market from a given point, that is, you can work out your strategy on history.

The number 11 marks tools for separating chart windows, as well as screenshots and other settings. Also, not all functions work with the basic subscription.

Splitting TradingView Windows

Right navigation bar

The navigation bar on the right is usually used to display a list of quotes.

List of TradingView quotes

Also on this panel there is an alerts tab, an information tab on tools, and other not particularly necessary information such as chats for communication.

Technical Analysis Toolbar

Much more interesting is the technical analysis toolbar.

TradingView Technical Analysis Tools

This panel contains various tools that can be plotted on a chart. For example: trend lines, Gann tools, geometric shapes and other tools.

User Toolbar

The user toolbar is located at the bottom. Not all users use it. The first tab is a stock screener.

TradingView Stock Screener

The TradingView stock screener is a search for stocks and cryptocurrencies using various parameters.

Notes tab, here the trader can write notes to himself.

Notes

Pine editor tab, Pine is the programming language in which the indicators on the TradingView website work. Necessary for writing custom indicators and strategies

Pine Editor

The strategy tester tab is a tab that displays a graph of the profitability of your strategy, including history. The strategy is also written in the Pine language.

TradingView Trading Strategy

Types of TradingView subscriptions

So, we got acquainted with the main tools, now let's move on to subscriptions.

Types of TradingView subscriptions

There are four types of TradingView subscriptions. The first basic one is given by default. The second PRO will be sufficient for the average trader. The third PRO+ gives a little more opportunities for the trader. And the latest Premium further expands the number of possible chart alerts and so on, with the possibility of unlimited alerts.

Conclusion

TradingView is a web platform for technical analysis. Serves as a good tool for profitable trading. Wide opportunities primarily open up in the creation and use of proprietary indicators and strategies. There is also a variety of technical analysis tools. Intuitive and user-friendly interface. There are auxiliary notification functions.

Fibonacci trading – 2 examples

The levels become most important due to the fact that they can be considered support/resistance zones, areas of accumulation of market orders, breakout lines or corrective pullbacks.

Basic principles taken into account in trading:

- The level of 23.6% is the first target of price movement after the trend reversal. Here they expect the price to continue moving along the trend or a corrective rebound (its probability is 50%).

- There was no correction, which means that the price will break through the 23.6% level towards 38.2%.

- The price did not break through 38.2%, it does not go further - this means that there will be a correction to 23.6% and its probability is higher in the absence of a rebound from 23.6%.

- 50% is the half-point of the price range, overcoming it and moving the price to 61.8% indicates that the trend is entering the maturity phase.

- When the 61.8% resistance zone is overcome, the trend enters its final phase.

- When the price reaches 100%, wait for the trend to reverse.

Two examples of trading on the AUD/USD daily chart. First uptrend.

Fibonacci levels are set on the chart - the logic is that the Australian currency will correct downwards from its highest level in recent times and will find support on one of the lines. Many traders will place buy orders at these levels.

Then the price found support at 23.6% and continued to fight off it for the next couple of weeks. Then the currency pair tested the support level at 38.2%, but did not consolidate below. Then the Australian continued to move up and broke through the price swing high level. It can be seen that opening a buy position at 38.2% would give a good profit.

Further work is carried out with a downward trend on the four-hour chart of AUD/USD.

Trading in a downtrend is reduced to the fact that you need to wait for an upward correction from the minimum and catch a rebound from one of the Fibo resistance levels, since many traders will sell from them. And then - the opportunity to successfully complete a transaction.

History of the method

Probably, many have heard about the so-called “golden ratio” proportion, which is used in many fields: mathematics, physics, biology and even art. This ratio is equal to the number 1.618 and is denoted as Φ.

Thus, in a regular five-pointed star, the value of Φ is equal to the ratio of the lengths of the segments:

- red to blue;

- blue to green;

- green to yellow.

The proportion of the golden ratio is also observed in the structure of the human body and face. When assessing external attractiveness, we pay attention to the ratio of the sizes of the head and body, the correctness of facial features, etc. And the more beautiful a person seems to us, the more the proportions of his face and body are close to the Φ value.

The number Φ is expressed by the formula:

In the 12th century, the Italian mathematician Leonardo Pisano, better known as Fibonacci (son of Bonacci), discovered a certain pattern of numbers, which was later described in the Book of Abacus. His father was a sailor and traveled often. Leonardo was interested in mathematics and, while traveling with his father, learned about the number sequence that was used for poetry in ancient India. The mathematician delved into the study of this pattern and introduced it to European science, as a result of which the sequence was called the Fibonacci numbers.

This sequence is a number series:

1-1-2-3-5-8-13-21-34-55-89-144-233-377…..etc. to infinity.

Sequence Features:

- Each value is equal to the sum of the previous two. For example, 5+8=13; 34+55=89.

- The ratio of the previous term to the next one is a result close to the value of 0.618: 34/55=0.618; 5/8=0.625. And the inverse ratio gives a result close to the number Φ: 55/34=1.618; 144/89=1.618.

- The ratio of the values of the sequence member to the next one after 1 is close to 0.382: 3/8=0.375; 34/89=0.382.

- Dividing by the value through 2 gives a result close to 0.236: 89/377 = 0.236; 55/233=0.236.

Final Thoughts

Fibonacci numbers are found throughout nature, and many traders believe they have significance when charting financial markets.

However, as with all technical indicators, the relationship between price action, chart patterns and indicators is not based on any scientific principles or physical laws. Thus, the usefulness of a Fibonacci retracement tool may be related to the number of market participants paying attention to it. So even though Fibonacci retracement levels don't necessarily correlate with anything tangible, they can work as a tool to try to predict areas of interest.

We give our subscribers the opportunity to try themselves in business!

FreshForex has a $2019 No Deposit Bonus

: All new clients who open an account using a special link receive 2022 USD for trading. In this case, you do not need to confirm your account.

Using the FreshForex no deposit bonus is a chance to:

• start trading

without investing your own money;

evaluate the company’s trading conditions in combat conditions

— execution speed, terminal operation, spreads, etc.;

• test your trading strategy on a real account

, but at the broker's expense.

———————————————————————————————-