The Kraken cryptocurrency exchange is one of the oldest exchanges in the industry among the current leaders. The company was officially opened on July 28, 2011 in San Francisco, public beta testing of the trading platform began in May 2013, and in September the exchange was already open to a wide range of traders.

Kraken is considered one of the most reliable exchanges among cryptocurrency traders for several reasons:

- The exchange has passed the Proof-of-reserves cryptographic audit: the number of cryptocurrencies on user balances coincides with the number of cryptocurrencies in Kraken wallets;

- The exchange tries to work within the legal framework and complies with AML/KYC procedures in Europe and America;

- Kraken cooperates with the German bank Fidor, which makes this exchange very convenient and accessible to Europeans;

- The Kraken team consists of recognized industry experts and regularly conducts technical audits of cryptocurrencies, hardware wallets and other exchanges;

- The exchange became especially popular after the collapse of MtGox; many traders switched to Kraken, as it has stood the test of time.

Official Kraken website

Review navigation:

- How to register on Kraken

- Several levels of account verification

- How to protect your exchange account and the cryptocurrencies on it

- How to top up your account

- How to withdraw funds

- Trading modes

- Types of trading orders

- Commissions on Kraken

- Margin trading

- Futures

- Staking: earning cryptocurrency without risk

- OTC trading

- Mobile app

- Reviews on the exchange

- Official information about the exchange

How to register on the Kraken exchange

Currently, the exchange interface is partially translated into Russian, but there are also pages entirely in English. Let's look at the registration process step by step:

1. Go to the official website of the exchange.

2. In the upper right corner, click on the “Create Account” button:

Register on Kraken

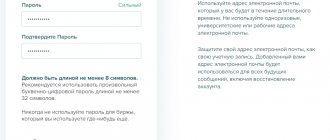

3. Fill out the registration form and agree to the terms of the exchange. Be sure to come up with a unique password that has not been used anywhere before. This is very important, the password is the key to your digital savings. Use lowercase and uppercase letters, symbols and numbers in your password so that it cannot be guessed by simple brute force.

Fill out the registration form

4. After filling out the form, we confirm your Email, your account is open, but for trading operations you must go through the procedure of verifying your identity.

Technical support service

So, another important nuance is the Kraken support. Employees work 24 hours a day, 7 days a week. Of course, any request will not go unnoticed and will receive a response.

So, you can use email or online chat. In addition, the company's website has a Help Center. In general, everything looks quite simple and clear!

How to get verified on Kraken

The Kraken exchange will not allow you to trade until you pass at least one of the verification levels. Verification is a procedure for checking a trader’s identity, during which he provides his personal data and documents confirming them.

Verification levels on Kraken:

Basic level - cryptocurrency input and output is available (withdrawal limit up to $5,000 per day, equivalent in cryptocurrency). Spot and margin trading becomes available. To pass the basic level you must provide: full name, residential address and telephone number.

Medium level - the limit on cryptocurrency withdrawal increases to $100,000 per day, the equivalent in cryptocurrency. Working with fiat currencies becomes available: deposits and withdrawals of up to $100,000 per day and up to $500,000 per month. There is also the opportunity to trade futures. To pass the intermediate level, you must pass the basic level and additionally provide: a certificate of your occupation, an identity card, confirm your residential address, provide a photo with a document and the inscription “For Kraken + current date.”

About the level - the limit on cryptocurrency withdrawal increases to $10,000,000 per day, the equivalent in cryptocurrency. Fiat currency limits are also increasing: deposits and withdrawals up to $10,000,000 per day and up to $100,000,000 per month. Increased leverage for margin trading, an OTC platform become available, and API limits are expanded. To pass the Pro level, you must pass the intermediate level and additionally provide: documents for AML verification, financial statements.

Information on verification levels in tabular form

If you have any questions during the identity verification procedure, you can contact the exchange support.

Enable two-factor authentication to protect your account

Two-factor authentication allows you to add an “additional key” to your account in addition to your password. If the password is compromised, the attacker will not be able to get into the account, since it will also be protected by two-factor authentication.

To enable two-factor authentication, go to “Account - Security” and activate the slider next to two-factor login authorization:

Activating two-factor authentication

In the next step, select the “Authenticator App” option.

Download the Google Authenticator application on your mobile device if you do not already have it installed:

Link for AppStore.

Link for Google Play.

Kraken will generate a QR code and its symbolic meaning. Save them in a safe place (encrypted RAR file or flash card). You can save the QR code as a page or take a screenshot of it.

Make sure you save the QR code or its symbolic value. You will need it if you lose your device or change it. After this, scan the QR code using the application on your mobile device. Click on the plus sign and select “scan barcode”. We point the phone camera at the barcode generated by Kraken. The application should display the phrase: “secret key saved.”

Enter the 6 digits generated on your phone in the “Enter 6-digit code from Google Authenticator” field and click on the “Submit” button. That's it, two-factor authentication is enabled. Kraken may additionally ask you to confirm this action by entering a password or via email.

Be sure to keep backups

Two-factor login authentication is now enabled. You can add additional degrees of protection to other operations: transfers, trading, global settings using a master key. To do this, activate the sliders opposite the desired setting and generate keys by analogy with the operation discussed above.

You can add a “second key” for other operations

Your Kraken account is now more secure.

Safety

Kraken is one of the most secure online cryptocurrency exchanges in the world. The exchange offers users two-factor authentication (2FA), PGP encryption, and a global settings lock that prevents any account changes during a certain period of time.

Kraken has not been hacked in its entire existence, but there have been cases where unwary users' accounts have been hacked due to the lack of 2FA security.

Security settings are made through the “Security” .

Global Settings Lock (GSL) is enabled in the “Settings” – “Account” .

How to top up your account on Kraken

To replenish your account, go to the balances page and for the desired fiat currency or cryptocurrency, click on the “deposit” button. If your verification level allows you to replenish the selected asset, then the system will generate a cryptocurrency address or details for replenishing your account.

Bitcoin account replenishment example

You do not have to top up your fiat account, especially since in some cases payment may be difficult on the part of the bank. Perhaps it would be more rational to first buy cryptocurrency and then top up the cryptocurrency account. To buy cryptocurrency, use our review of ways to buy cryptocurrency.

Mobile app

The Kraken platform has its own mobile application - Kraken IOS APP. This is very convenient, considering that there is no mobile version of the site.

The application allows you to:

- automatically enter into transactions with cryptocurrency;

- receive information about price changes in real time;

- view balance and open orders;

- Convert currencies of different trading pairs.

A significant disadvantage of the application is that it is intended only for Apple users. There is no such application for Android device owners yet.

How to withdraw funds from Kraken

To withdraw funds from the Kraken exchange, we also go to the balances page. We find the asset we want to withdraw and click on the “Withdraw” button. On the next page, enter the details or address for withdrawal and confirm them by email. The next step is to select confirmed details for withdrawal, fill in the withdrawal amount and confirm it. Please note that there is a withdrawal fee. It is individual for each asset.

Making a withdrawal from the exchange

Registration

To register on the Kraken exchange website, you need to click on the corresponding button at the top of the screen.

So, a standard questionnaire will appear in front of you, indicating:

- E-mail address;

- Username (login);

- strong password;

- current location.

First, you must agree with the rules of the exchange. Secondly, you need to click on the “Create account” button.

After this, you will receive an activation code, which you will need to enter in a special field. This will confirm your account. Then complete the captcha. And that is all! You have successfully registered on the Kraken platform!

Trading modes on Kraken

Cryptocurrency trading can be found at the “Trade” link. The exchange has four trading modes:

Simple - order registration mode, where the purchase price is indicated and only two types of orders are available (limit and market). The simple trading mode is suitable for beginners; it does not have any trading functions and does not even have a chart with a glass.

Simple order execution mode

Medium – mode for placing an order, where you can specify additional order settings other than price and type. In the middle mode, you can select the leverage, set the activation date and conditions for canceling the order, select the currencies to pay the commission and activate the conditional limit order option.

Placing an order in medium mode

Complex – a mode for placing an order, in which additional fields are added relative to the average order, namely: a more complex setting of the limit price, several types of conditions for closing an order (here you can set take profit and stop losses).

Complex order execution mode

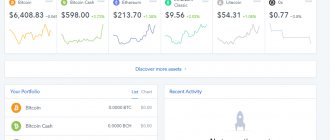

Kraken Pro is a trading mode for traders, where in addition to placing orders there is a price chart (by default in the form of Japanese candlesticks) and technical indicators, an order book with a visual representation of the depth, a table of recent transactions and an information panel.

This is what the Kraken Pro trading mode looks like

Additional functions

Additional Features on the Kraken Exchange

Kraken is a full-service exchange that offers many features that, collectively, no other exchange offers.

Darkpool

The service allows traders to secretly place large buy and sell orders without alerting other market participants.

☝️

Dark pools provide a space for traders to trade anonymously.

Margin trading

The Kraken trading platform offers margin trading with X5 leverage, a professional trading interface, an advanced API and high borrowing limits with low fees.

☝️

Read the full article: Cryptocurrency margin trading: concept, nuances, recommendations

Futures trading

Traders typically use futures to hedge risk.

Kraken futures trading provides a feature that is not as easily found on other leading crypto exchanges. The exchange competes directly with BitMex, the undisputed leader in margin and futures trading, but given Kraken's good reputation, many traders are leaning towards this platform.

OTC trading

Over-the-counter trading provides anonymity that centralized exchanges often cannot achieve. Kraken is constantly evolving to create a seamless OTC trading experience.

☝️

Kraken's purchase of the Circle OTC platform in December 2022 provided exchange clients with the opportunity to trade with higher liquidity and tighter spreads, with improved automation and tools to streamline the trading process from quote to settlement

Types of trading orders

A limit order allows you to set the maximum/minimum price at which you buy/sell. When buying: If this price is lower than the last market price, your limit order is added to the order book. When selling: If this price is higher than the last market price, your limit order is added to the order book. Limit orders are used to control the purchase or sale price of an asset.

Note: The limit order price must be within 10% of the last market price.

A market order is executed at current prices in the order book and takes liquidity from it. You should use this type of order with caution, as you can get an asset at a price worse than the last one, although the Kraken exchange regulates slippage within 1%.

A stop-limit order allows you to limit losses from an open position or gain a position if the price has changed in accordance with specified conditions. The trader must fill out two prices for a stop order: a stop price and a limit price. The stop price is the market price of the last trade that triggered the limit order. The limit price is the price at which the order will be placed. For example, you bought Bitcoin at $9,500 and want to place an order at a certain price if it drops below $9,000. Then you need to set a stop order with an activation price of $9000 and an execution price of, for example, $8950. If the price of Bitcoin reaches $9,000, then you will have a trade to sell Bitcoin at $8,950. This type of order protects you from strong slippage, but if there are strong movements in the market, your order may not be fully executed.

A market stop order is an order with a condition and immediate execution. The order is activated when a certain price is reached and is instantly executed based on the current liquidity from the order book. For example, you bought Bitcoin at 9500 and want to sell it instantly if the price drops below 9000. Then you need to set a stop order with an activation price of 9000. If the price of Bitcoin reaches this level, then all your Bitcoins will be automatically sold.

Take profit by market - a take profit order with a market price, which allows you to close a transaction at the market price when the desired profit level is reached. For example, you bought Bitcoin at $9,000 and want to sell it on the market when the price reaches $9,500. In this case, you select this order type and all your Bitcoins will be sold on the market when the price reaches $9500. Most likely, the execution price of your trades will be slightly less than $9,500 in the end, since you will take liquidity from the order book.

Limit Take Profit is a fixed price take profit order that allows you to close a trade at a fixed price when the desired profit level is reached. For example, you bought Bitcoin at $9,000 and want to sell it when the price reaches $9,500. You don't want to simply place a limit order, since in this case it will be immediately visible in the order book and will serve as some kind of resistance. In this case, you can set that when the price reaches $9500, let a sell order be placed at a price of $9499, for example. The take profit limit may not be executed if the market turns sharply against the initial movement.

Commissions on Kraken

The page with current commissions can be found here.

Commissions are different for makers and takers.

The taker is the one who takes liquidity from the order book, that is, his order is executed at the market price.

The maker is the one who creates liquidity and his order enters the order book.

The level of commissions depends on the 30-day trading turnover. The commission percentage ranges from 0.02% to 0.26%. When trading on margin, not only a commission is charged for opening, but also for providing borrowed funds (interest is calculated every 4 hours).

Trading commission table

Commissions for withdrawing cryptocurrency are displayed when submitting a withdrawal request.

Working conditions

Of course, you shouldn’t be surprised that the exchange is designed to work with the US and Western European markets. Despite this, customers from Japan and Canada also remain on the radar. That is why the ranking of fiat currencies on Kraken includes: dollar, euro, British pound, Japanese yen and Canadian dollar.

Trading pairs

As for trading pairs, they are thought out to the smallest detail. Here you can find both top cryptocurrencies and new promising coins.

So, for trading on the stock exchange you can use the following aspects:

- 276 trading pairs;

- 30 digital currencies;

- 5 fiat currencies.

We cannot ignore the fact that Kraken developers are actively working on the platform. Of course, they plan to expand user capabilities to cosmic heights. Other popular destinations will be added in the near future.

Fortunately, the listing will soon be replenished with new pairs. But the resource itself will acquire effective tools and functions.

Commissions

Of course, like any other exchange, Kraken involves charging fees for any activity on the platform. Luckily, you can check out all the details below.

Trading

Steblecoin

Darkpool

Margin trading

Margin trading

Margin trading allows a trader to open positions with funds exceeding his account balance. Leverage up to 5x is available on Kraken, meaning a trader can open positions of $5,000 if he has $1,000 in his account.

A margin position can be opened in medium, complex or Pro trading modes; you must select the “leverage” option and set its value.

Please remember that Kraken will charge you a fee of 0.01%-0.02% every 4 hours for your open margin position. The rate depends on the asset being borrowed:

Commission table for margin positions

Margin trading is available after passing the basic level of verification.

Reviews

According to reviews from Russian-speaking users on otzyvmarketing.ru/kraken, the Kraken cryptocurrency exchange received a rating of 4.38. Among its advantages, traders from Russia highlighted:

- variety of currencies and tokens;

- possibility of margin trading;

- high level of security and availability of 2FA;

- mobile trading;

- good trading conditions;

- division of the commission between the parties to the transaction.

Among the shortcomings, the platform is oriented “to the west”, which affects the inability to work on the exchange with rubles and use familiar payment systems.

Overseas citizens on trustpilot.com/review/kraken.com say Kraken has an "amazing product and excellent customer service." Many note the user-friendly interface, honest and transparent platform policy, responsive technical support. support.

Among the disadvantages, users note a large number of checks and high commissions.

Earning cryptocurrency on Kraken using staking

Some coins can be increased in quantity simply by staking them. Kraken on the backend delegates coins to nodes and shares part of the rewards received. For the user, this procedure is as simplified as possible, since he just needs to keep the coins on the exchange.

Staking option for February 2020, access only for Tezos, plus plans to connect Cosmos and Dash.

Staking is located in the “Staking” menu. To stake, purchase the required coins and receive rewards every two weeks. The annual return on Tezos is 6%. It should be borne in mind that this profitability is in the coins themselves. The dollar return will depend on the price of the asset itself.

Coin staking option available on Kraken

OTC trading

OTC is over-the-counter trading designed for large traders who lack liquidity in the order book or who do not want to wait a long time for a large order to be executed.

To access OTC, you must have the highest level of verification. OTC trades start at $100,000. The following currencies are currently available for OTC trades:

Fiat currencies

- US dollar (USD);

- Euro (EUR);

- Canadian dollar (CAD);

- Japanese yen (JPY);

- British pound (GBP).

Cryptocurrencies

- Bitcoin (XBT);

- Ethereum (ETH);

- Tether (USDT);

- Monero (XMR);

- Ethereum Classic (ETC) .

The list of assets available for OTC is periodically adjusted. Be sure to update the list of assets available for OTC trading before a major transaction.

OTC trading algorithm step by step:

- We go through the “About level” verification;

- We send a request for an OTC transaction by email: [email protected]

- The agent helps to carry out a major transaction for the exchange of assets: we list the assets for exchange, we receive the desired asset.

Official instructions for OTC exchange can be found here.

What does the company/project do?

Kraken is considered the largest crypto exchange by Euro volume, according to a June 2022 study. It was founded in 2011 by Jesse Powell. The official launch of the platform took place in 2013.

The Kraken exchange is owned by Payward Inc. The exchange is not controlled by any supervisory authority, but this is a standard situation for the world of cryptocurrencies (at least for 2022).

Kraken managed to gain the trust of users. No successful hacker attacks on the exchange were recorded. Additionally, Kraken was chosen as a platform through which users who were victims of the Mt.Gox scam could claim their lost funds. Mt.Gox was a huge Japanese Bitcoin exchange that filed for bankruptcy in 2014 after a series of questionable incidents. The company was placed under special administration, with Kraken acting as a trusted partner to process payments to creditors.

Kraken stores most of its assets in cold wallets, of course, except for those directly used to support trading. It is worth noting that users leave not only positive reviews about the exchange.

Kraken is a self-regulating exchange, that is, it develops its own security policy and operating rules. However, it complies with the rules and regulations in many supported jurisdictions. It is registered as a Money Services Business (MSB) with FinCEN in the US and FINTRAC in Canada. Kraken Futures is regulated in the United Kingdom by the Financial Conduct Authority.

By 2014, the platform occupied a leading position in the euro/bitcoin trading pair. In 2015, the exchange added the ability to buy Ethereum and became the second largest BTC/ETH exchange in the world. The exchange serves 4 million clients in two hundred countries.

Supported currencies:

Bitcoin, Ethereum, Bitcoin Cash, Litecoin, DASH and others. Fiat currencies are also supported: CAD, EUR, GBP, JPY and USD.