History of the creation and development of the foreign exchange market

- Invest and receive up to an additional 5000 USD,

claim bonus - Register and get 30 USD for trading,

free 30 USD

Now everyone knows that the dollar is the main world currency, but the trend towards a reduction in its use and the course towards de-dollarization of economies can be seen very clearly, especially in light of the statements of the current President Trump. Perhaps in the coming years, new currency changes and shocks await us, but for now let’s just look at how the history of the foreign exchange market developed, what major events influenced the bringing of the trading system to its modern form.

So, in the period before the victory over Nazi Germany, the foreign exchange market was a complete mess . An excellent example that fully illustrated what was happening at that time was the exchange rate of the German mark, which the cunning Minister of Economics represented for different trading partners in different meanings. That is, when trading, for example, with one company, the German government calculated based on one exchange rate, while trading with another, on a completely different exchange rate. This approach at this stage in the history of the Forex market was practiced in many places, so currency quotes at the moment could not be a reliable source of information for planning, because everything could change literally in a second. At the same time, change not because of market situations and within the framework of normal habitual pricing, but because of someone’s whim .

, the British pound was used in the calculations of various international trade transactions . This is a very old currency that has enjoyed well-deserved respect and trust. In addition, not so long ago it was a very powerful country, influencing almost everything that happens in the world, especially in political and economic terms. Therefore, we can say that the pound also played a significant role in the history of the creation of Forex, as it was an important means of payment before the transition to a new dollar standard pegged to gold, the main reference point in the financial environment.

By the way, it is still very popular to this day as a tool for preserving capital - just look at what happens to the prices of the yellow metal when the global economic performance worsens and during periods of crisis, when all investors try to move into reliable assets. Also notable is the example of 2011, when the United States almost experienced a technical default - prices reached their historical maximum at above $1,900 per troy ounce.

What is the Forex market (foreign exchange market)?

The Forex market is a global platform where currencies are traded, and the history of its creation is quite interesting. Was founded in 1976. It was during this period that the countries of the world abandoned the gold standard, heading for the Jamaican system. Its main feature is that the exchange rate is set not by an individual state, but by the market itself.

Forex is necessary to maintain a stable situation in the global economy, as well as for different countries to exchange capital.

Often when talking about Forex, they mean the exchange. In fact, it is an over-the-counter platform. Speaking about Forex and what its history of creation is, it is worth noting that the word “Forex” itself in the English language environment means not only exchange, but also a set of currency transactions.

Why Forex trading is in demand

Why does forex trading continue to gain popularity in 2020? It's easy to explain. More and more people are showing interest in trading. Especially young people. For most of them, the main motivation is the prospect of fast and big earnings. Forex, in theory, can provide this. Here you can earn as much in a week as you would in 10 years on stocks.

But this is in theory. Let's face it: 90% of people will not become brilliant scientists, actors, doctors, and so on. Not everyone can become a talented trader either. There is a height in Forex that can be achieved with perseverance and hard work. This is what you need to focus on.

There are other reasons, for example:

- Easy access to Forex. Traders from all over the world can access trading platforms as long as they have access to the internet and an extra couple of hundred bucks.

- Open markets. Trading is not limited to one exchange. Around the clock, 5 days a week.

- Forex versatility. There are many automation tools. By choosing less aggressive styles, a trader can turn trading into a money-making hobby or side hustle.

But if you don’t understand how the market works, if you don’t understand the risks associated with it, they don’t work. Just take note.

Advantages and disadvantages

Pros of Forex:

- Leverage. Margin trading allows the investor to multiply the starting capital by 10, 20, 30 (as much as the broker allows) times and trade in large lots. This increases profits, but for beginners this is rather a minus, because in case of losses, it is not the money added by the broker that is written off, but your own money.

- Mobility. You no longer need to focus on charts and monitors. The capabilities of modern gadgets allow you to trade from any place where there is Internet access.

- No taxes. When you buy shares, you take ownership of them and pay tax. In Forex there is only a broker spread.

- Liquidity. Money is an asset with 100% liquidity. This is not a depreciated share, which you not only won’t sell at par, but in general you’ll be very lucky if anyone covets it. Currency is never left behind.

In addition, one must still recognize that the foreign exchange market is so large, with so many people trading, that it is incredibly difficult to manipulate Forex prices. Even if someone trades very large volumes, in general everything is compensated.

Founders of the Forex market

It is impossible to single out one person who separately owns the authorship of the financial concept. A huge role belongs to Richard Nixon, who ended the era of the “gold standard”. Once the Jamaican system was operational, its shortcomings became apparent. French President Giscard d'Estaing and German Chancellor Helmut Schmidt proposed correcting them. In their opinion, summits must be held to regulate the market. For the Forex market, changes affected its role - it became possible to adjust the rate for currency exchange. During this period and beyond, as Warren Buffett's story argues, the market became more open to people and made it possible for some to become richer.

Basics of the trader's profession

I highlight three pillars of becoming a successful Forex trader:

- Understanding the stock market. Despite the structural differences, Forex and the stock market operate according to the same laws. Many indicators were originally developed specifically for the stock market, where they work most effectively. Understanding the operation of stock exchanges will provide all the knowledge and skills necessary to move to such a risky market as Forex.

- Understanding market psychology. Forex is not about numbers and lines on a chart. This is the interaction of real people - the struggle of a bull market against a bear market. The bull is a symbol of hope and positive change. The bear is a symbol of fear and curtailment of activity.

- Understanding market correlations. Since currencies form the basis of trade, economic relationships and financial services, Forex is influenced by a number of factors. There are a number of closely interrelated market correlations between currency prices and other related markets. These correlations depend on which specific currency we choose to trade. For example, the value of the Canadian dollar is heavily influenced by that country's commodity prices because a large percentage of its GDP comes from natural resources and mining.

How did the concept of the financial market develop?

An important decision was made in Florence in 1291, where letters of exchange were created. During this period, developed countries had their own currencies, but it was almost impossible to compare them with each other. The rates were set by private bankers (the well-known Medici family). Until the end of the 19th century there was no common currency. The British pound took on a partial role, since many banks operated in England.

But at the same time, the most reserve and stable currency was gold. Each bank was obliged to convert its reserves into it. From 1879 to 1914, gold was tied to the dollar, and the situation was stable, but the war changed everything. Then a global increase in inflation and a return to the “Gold Standard”. After the global financial crisis of 1929, this concept was abandoned:

- Germany, Japan and Great Britain 1931;

- USA 1933;

- France 1936

As part of Forex courses for investors, more details about which are at www.gq-blog.com, trainers talk about how each stage affected the global economy.

Bretton Woods agreements

The Forex market began to take shape almost after the Second World War, and moved online later. In 1944, 44 countries nominated more than 7 thousand of their representatives to the anti-German conference in the American town of Bretton Woods. As part of the event, the following decisions were made:

- fixing exchange rates;

- reserve currency - dollar;

- the creation of organizations that would monitor global financial and economic relations: the beginning of the development of the WTO, the International Monetary Fund and the World Bank.

International monetary system

Today we work under the Jamaican currency system, which is more liberalized in comparison with its predecessors. In addition, today's system has the following features:

- dollarization - a country’s refusal to use its own currency and another one appears instead;

- a country decides to peg the exchange rate of its currency to another;

- variable rate, which means the price is formed depending on supply and demand.

As part of a meeting at the Plaza Hotel in 1985, the ability of central banks to set the exchange rate was secured.

The emergence of financial markets in Europe

The formation of something similar in the foreign exchange market began in the 16th century, and trading was held only in Amsterdam. Later they moved to large cities. Rates varied depending on the balance of countries, and during this period traders began to actively enter the market. In 1572, a forex client (similar to today's role) could no longer directly exchange a charter. Restrictions brought new participants to the market - intermediary brokers.

Smithsonian Agreement

Since the dollar was “pegged” to gold, the increase in the money supply caused difficulties for Americans. Already by the beginning of the 70s, the US Treasury did not own enough money to cover what was in reserve with banks in other countries. Richard Nixon takes a major role and declares that the dollar is no longer equal to gold. This happened on August 15, 1971 and officially became known as the Smithsonian Treaty. 2 years have passed and the international monetary system has changed, choosing a floating exchange rate.

In 1976, Jamaica decided that the exchange rate was set by the market, not the government. The Bretton Woods system has completely disappeared.

What platforms are used for trading?

The trading platform and its tools are our main weapon in our personal war for profit on Forex. Choose any one you like and go ahead.

The choice of platform depends on the broker. More often, brokers provide free and popular software such as MetaTrader 4 or MetaTrader 5. Solutions such as ActivTrader and cTrader are also popular.

There are brokers that use their own proprietary programs that are not available anywhere else. But almost all brokers without exception support trading via a web terminal. So, in general, all you need for Forex is a browser and fast internet.

Features of the formation of Forex in Russia

The world history of Forex is also connected with Russia, where it came in the early 90s, and knowing how it works, many were able to make a profit and make their activity the main source of passive income. Dealing banks in St. Petersburg were the first to get involved, followed by the rest. If previously earning income on such a market seemed unrealistic, then thanks to the Wall Street Bot advisor, this situation has changed for the better. Speaking about the features of the development of the site in the Russian Federation, I will highlight the following:

- mass opening of brokerage companies;

- many of the companies showed themselves to be dishonest partners and closed without paying investors their funds.

One such striking example is Forex Light, a broker that opens the “kitchen” of trading and promises significant profits.

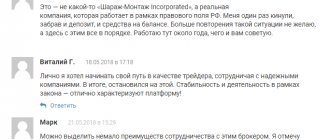

The history of Forex in Russia is connected with the desire of people to become richer by investing small amounts. By the end of the 90s, due to some companies offering "cheap cheese in a mousetrap", confidence in this financial structure became less reliable.

Is it possible to make money on Forex?

We have already found out that Forex is not roulette or a tool for speculative earnings, but a global currency exchange mechanism, in which earnings on quotes is only one of the options. And if it works for some, why not for others?

How much can you earn

Whatever the answer, it will inevitably give birth to holy wars. Therefore, here I will say a little about something else. To be honest, today most people come to Forex through advertising. They bribe you with a profit of 10%, 20%, 30% per transaction, which translates into theoretical hundreds of percent every month.

If you succeed, feel free to share your success in the comments. If you are just at the beginning of your journey in Forex, don’t fall for this nonsense. There are no guarantees in trading. Only possibilities and probabilities. No matter how good we are, no one guarantees any income at all.

So yes, if you dream of living off your $100-$500 trading balance, think again. Trading is a marathon, not a sprint. A slow process that requires patience and discipline. Trading without knowledge, experience and with a limited budget is a deliberate fiasco in Forex.

How to pay taxes on Forex

There are several options

- trade through a licensed broker;

- trade through an offshore broker, submit declarations yourself, registering as an individual entrepreneur or self-employed person;

- get some dusty, lazy job, and don’t share your money with anyone.

Yes, technically this is possible. But this is at your own peril and risk, and in general I did not advise this.

Reviews

Victor Sperandeo, founding partner of EAM Partners, LP says about Forex:

“The key to success in trading is emotional discipline. If intelligence was the key, there would be a lot more people making money trading."

Well, absolutely fair.

Legendary bear George Soros commented:

“Markets are constantly in a state of uncertainty, and money is created by discounting the obvious and betting on the unexpected.”

And renowned commodity trader Michael Marcus believes that “forex trading is a talent. Without it, alas, you cannot get into the upper echelon of successful traders. This requires innate skill. It's like being a great violinist. But being a competent trader and making money is a skill you can learn.”

Trading participants on the currency exchange

Forex is not only about speculation and making money on exchange rates, as many people think! Completely different participants in trading on the Forex currency exchange can pursue their own goals and objectives, but at the same time influence the exchange rate. Among the participants we highlight the following:

- Individuals;

- Central Banks;

- Commercial banks and financial organizations;

- Institutional investors;

- Brokers.

It is worth noting that individuals became trading participants not so long ago, and they can carry out their activities exclusively through brokerage companies. This category refers to private traders and investors. This is due, first of all, to the size of capital, since the vast majority do not have the opportunity to open 1 standard lot, which is 100 thousand units of currency. Therefore, with the help of brokerage companies that provide the missing amount in the form of leverage, today anyone can buy currency and make money on the difference in rates even with 100 dollars.

Central banks ensure the stability of the national currency and carry out the tasks assigned to them by the government. This could be the purchase of currency for reserves or, on the contrary, its sale to maintain it in a certain price corridor.

Commercial banks can both speculate on exchange rates and provide their own operational activities - exchange funds for clients or act as intermediaries in large transactions where currency exchange is required.

Institutional investors are also participants in the Forex market, as they either invest in currencies directly or buy various securities: bonds, shares, during an initial offering.

Bretton Woods Agreement

Before World War II was about to end, a union of countries needed to create a monetary system to fill the void left by the abandonment of the gold exchange standard monetary system. In July 1944, more than 700 representatives gathered in Bretton Woods, New Hampshire, to deliberate and create what would be called the Bretton Woods system of international monetary management.

The Bretton Woods Agreement gave rise to the following important nuances:

- method of setting a fixed exchange rate;

- the US dollar replaces the gold standard and becomes the reserve currency in the cash reserve;

- the creation of three international agencies to monitor economic processes: IBRD (International Bank for Reconstruction and Development), IMF (International Monetary Fund), as well as GATT (General Arrangement on Tariffs and Trade).

EXCLUSIVE: How to use a regression line in the Forex game←

Subsequently, the US dollar became the only currency whose value was backed by gold, which was the main reason for the failure of the Bretton Woods system. Despite the fact that this system collapsed, it left behind many important and useful achievements that exist and function even now. These organizations include the IBRD, the IMF and the GATT, which later became the World Trade Organization.