STEX (Russian STEX, short for Stocks Exchange, this is the old name of the site) is a licensed trading platform focused on buying and selling cryptocurrency. The platform provides good trading volumes, speed and liquidity, thanks to the use of several high-frequency trading algorithms. According to information on the official website, the platform was launched by the Estonian private company Etna Development OÜ, therefore, it is subject to the laws of Estonia and the European Union. Fiat deposit and withdrawal methods are supported (USD, RUB, EUR, JPY).

Update : The STEX exchange, at the request of the regulator, introduces mandatory verification for all clients. Check out the list of crypto exchanges without verification.

Official website: stex.com

STEX user funds are stored in both hot and cold wallets for security. The exchange is currently used by more than 300,000 users, who note the time-tested stability of the site, low trading commissions (from 0.05%), as well as the availability of a full set of necessary licenses and a friendly interface.

The list of digital assets on STEX is huge - more than 400 trading pairs with Bitcoin, Ethereum, Litecoin, Tether, etc.

Please note: STEX.com has no relation to another site with a similar name STEX Exchange (domain stex.exchange, but now redirects to trade.50x.com). These are two different cryptocurrency exchanges.

STEX cryptocurrency exchange review

| Name | STEX (STEX) |

| Former name | Stock Exchange |

| Official site | stex.com |

| Year of foundation | 2017 |

| Location | Tallinn, Estonia |

| Registration number | 14477355 |

| License number | FRK000120;FVR000142 |

| Parent company | Etna Development OÜ |

| Russian language support | yes (you cannot switch on the main page, it turns on automatically after registration). The total number of available languages is 11 |

| Trading volume as of May 31, 2022 | $20 514 616 |

| Number of clients | 300 000+ |

| Rating | 83rd place in the ranking of crypto exchanges according to Coinmarketcap and 28th according to Coingecko (real volumes) |

| Overestimation of trading volumes | No |

| Working with fiat | yes, for verified accounts |

| Fiat accounts | USD, EUR, RUB, JPY |

| Payment systems | Advcash, Payeer, Epay, Perfect Money, Sepa |

| Minimum amount | 10 USD, 10 EUR, 10 JPY, 100 RUB |

| Commissions (fiat) | from 2% to 5% |

| Cryptocurrency deposit fee | 0% |

| Commission for withdrawal of cryptocurrency | depends on the chosen coin |

| Verification | not mandatory, needed for expanded use of the STEX exchange and increased security |

| Safety | two-factor authentication (2FA), SMS authorization, session history, IP whitelist (you can log into your account only from the specified IP) |

| Trading commission | 0,05%-0,2% |

| Minimum purchase/sale amount | 0.00000001 |

| Number of cryptocurrencies | 287 |

| Number of currency pairs | 406 |

| Internal token | STEX |

| Liquid cryptocurrency pairs | LTC/BTC; ETH/BTC; LTC/USDT |

| Margin trading | No |

| Professional graphics | Yes |

| Warrants | limit (regular); stop limit |

| Mobile app | available for Android and iOS |

| Trading terminal (WEB) | advanced and simplified mode |

| API | There is |

| [email protected] |

Advantages and disadvantages of a crypto exchange

pros

- A convenient and well-designed trading platform with a clear interface.

- Availability of a license.

- Russian version of the site.

- Mobile app.

- High liquidity, large selection of trading pairs.

- Favorable conditions, low commission fees.

- Good level of security.

- Effective technical support.

- Fiat money support.

- A large number of cryptocurrencies for trading.

- Several verification methods.

- Charts from TradingView.

- Platform for conducting IEO.

- Free listing of cryptocurrencies and tokens.

- No negative reviews on the STEX exchange (at the time of writing the review).

Minuses

- Working with fiat currencies is available after account confirmation.

- No margin trading.

Technological launch map

The gradual development and launch of the STeX trading platform includes the following stages:

- August 2022 - creation of the concept of a trading system, software, fundraising;

- September 2022 - the exchange structure, internal protocols, interface core were created, 15 million tokens were sold, 15,000 Ethereum were collected;

- October 2022 - internal modules and systems are fully developed and improved in accordance with the technical recommendations of hired specialists and first users;

- November 2022 - testing, launch of a gateway for exchanging currencies from a cold to a cold wallet, protocols are fully ready, high-speed interface;

- December 2022 - alpha testing of the trading terminal with a load for two months;

- February 2022 - complete interface assembly, beta testing of the system;

- March 27, 2022 - opening of the STeX exchange, improvement of the system, gradual addition of crypto coins;

- June 2022 - introduction of additional trading and investment functions.

Registration on the official website

To create an account, click Sign Up on the main page of stex.com.

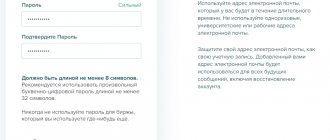

Read the terms of use of the site and confirm your agreement with them. Enter your email and create a complex password. Enter the referral code if you came by invitation from an existing user. Confirm by ticking that you are 21 years of age or older. You can also subscribe to the project newsletter if you wish.

Solve the captcha and click “Submit”. After this, you will receive an email by email, following the link from which you need to confirm your account. You will be taken directly to the trading platform, where you can start buying or selling cryptocurrency.

Financial side of the project

According to the white book , financier Oleg Mityaev calculated everything down to the last penny:

- 25% — Liquidity.

- 15% — Research, development and infrastructure.

- 10% - Legalization.

- 20% — Project marketing.

- 15% — ICO marketing.

- 10% — A2A liquidity pool

- 5% - reserve fund.

It’s funny to compare the costs of advertising and project development - 15% .

Personal Area

To get to your STEX Personal Account, click on your account name in the upper right corner and select the “Profile” menu item. In the left column is a list of LC sections:

- Balance. Shows your account status for each specific coin. From here you can withdraw and replenish funds.

- Referral program. By clicking the “Referral Program” button, we receive our own referral link and code, which can be distributed everywhere. The exchange pays 25% of the commission for trading operations performed by referrals.

- History of deposits, history of withdrawals. Latest deposits and withdrawals.

- Open applications. Your current open orders on the trading platform.

- Application history. Previously created and already closed orders.

- Account settings. You can change the password, enable SMS authorization, allow login or API3 from certain IP addresses. In addition, two-factor authentication via Google or Microsoft authenticators is enabled here.

- Data verification. The process of verifying an account on the STEX exchange allows you to reduce trading commissions, interact with fiat currencies when replenishing your balance, and also restore 2FA in case of its loss. There are three ways to verify your account: through the STEX support service (in this case, the trading commission will be 0.1%), through the PrivatBank bank (also 0.1%) or through the Cryptonomica service (the same 0.05% that is promised on the main page ).

- Reports. History and analysis of trading operations.

Safety

STEX exchange takes the security of user accounts very seriously. Each client is asked to set up two-factor authentication (2FA), SMS authorization, and IP waylist immediately after registration. 2FA is an additional level of security. Every time you want to log in, trade on an exchange, or withdraw funds, a code will be generated in the Google Authenticator app.

There is no information that the STEX cryptocurrency exchange has ever been hacked. The greatest difficulty for hackers is that their cloud cluster is physically located in several countries around the world. All systems are encrypted and cannot be accessed without special permission from employees. The security of assets stored in user accounts is ensured by the use of cold wallets without access to the Internet.

Development team

Here is a partial list of the founders and developers of the platform. All have many years of experience in structures related to blockchain technologies.

- The founder and CEO of the cryptocurrency exchange is a famous person – Nick Price.

- The leader and co-founder of the project is Maxim Vladykin.

- The project designer is Alexandra Mukovozova.

- Marketing Manager - Josh Clow.

- Head of Legal and Financial Department – Ivan Mityaev.

Thirty-six-year-old Nick is the founder of the famous KeyCAPTCHA, which protects 20,000 sites from spam. Fluent in several programming languages.

Team experience

The entire STeX Exchange team has many years of experience in technical issues and creating startups. Nick Price developed applications for Mac, Windows, Linux

, iPhone and Android mobile applications.

Has deep knowledge and experience in creating horizontal scaling and intra-exchange cryptocurrency arbitrage (millions of users per day and billions of records). Maxim Vladykin has experience as director of business development at KeyCAPTCHA, manager of technical support management, and development of the Scrum system.

Ivan Mityaev is the developer of the high-speed trading algorithm HFT. Josh Clow is an experienced business planner and marketer. Alexandra Mukovozova has been involved in spatial design for several years.

STeX advisors: Sergey Popov, professor at a Brazilian university. Works in the field of Stochastic Processes, Nxt crypto currency and PoS. He is one of the founders of the WINGS and IOTA projects.

Gigi Janelidze is the chief designer of Yandex. Assists in the creation of STeX tools and interface. Mark Zhong is an expert in Unix systems (administrator), MBA, IT PM, expert on crypto exchanges and currencies.

For personal safety reasons, part of the team remains incognito

. The same applies to information about the headquarters and locations of servers and cryptocurrency cold storage wallets.

Registration on the STeX cryptocurrency exchange is no different from other projects, so we will not dwell on it.

Deposit and withdrawal

To top up your STEX balance, go to the “Balance” section of your personal account and click the “Deposit” button next to the currency of interest. After this, you need to click on “Deposit Address”.

The address will be displayed. You need to send a strictly selected cryptocurrency to it; sending any other will result in loss of funds. The minimum deposit amount is indicated here, it is different for each coin: for Ethereum - 0.01 ETH; Bitcoin - any amount; Tether – 4.99 USDT, etc.

The STEX exchange supports fiat currencies . You can make a deposit to an account in USD (US dollar), RUB (Russian ruble), EUR (euro), JPY (Japanese yen). Minimum amounts - 10 USD, EUR, JPY; 100 rubles. Each account has individual replenishment methods:

- USD: EPAY, Perfect Money, Payeer, Advcash.

- RUB: Perfect Money, Payeer.

- EUR: EPAY, Perfect Money, Payeer, Advcash, Skrill, Rapid, SEPA bank transfer.

- JPY: EPAY.

To withdraw money from the exchange, you must click “Withdraw” in the same section, indicate the desired receiving address and amount (or check the “withdraw all” box). The minimum amount depends on the cryptocurrency: Bitcoin - 0.002 BTC; Ethereum - 0.004 ETH; Tether – 1 USDT, etc. You can also withdraw funds from the STEX exchange through fiat.

To confirm the withdrawal of the deposit, a two-factor authentication code or email is used. The term for crediting cryptocurrency depends on the blockchain network and the required number of confirmations. On average, the process takes up to 1 hour.

Platform functionality

STEX supports over 400 virtual coins and tokens. Transactions are concluded in six main markets:

- VTS;

- ETH;

- LTC;

- NXT;

- USDT;

- xEUR.

Stex exchange also works with fiat currencies: USD, EUR and RUB. The exchange pays dividends to holders of NXT digital shares. User deposits are kept in cold storage, and online wallets are used only when performing financial transactions. Additional security is provided by 2FA. Automated trading is available through the popular SAT bot.

How to trade on the STEX exchange

To go to the trading terminal, click “Trade” at the top of the STEX cryptocurrency exchange website.

In the lower right corner of the trading terminal, markets (BTC, ETH, LTC, USDT, xEUR, FIAT) are displayed, divided into tabs. You can sort currencies by quotes or alphabetically, and also use the “search” field to quickly find the coin you need. Having selected the appropriate pair, you go to the page where you can buy or sell this cryptocurrency.

To sell or buy selected coins, you need to select the order mode (regular or stop limit), indicate their value and quantity.

You can set the price yourself or select it from your trading history or order book. You can also set the amount manually, or click on the amount in your wallet. The minimum quantity for buying and selling is 0.00000001 in any cryptocurrency. Note. A “regular order” is a familiar limit order. “Stop-Limit” is a limit order, but in the order we also indicate the stop price at which the order itself is activated. For example, if the BTC/USD quote price drops to $8650, then a buy order at $8600 will be activated.

To complete the order creation, click “Buy” or “Sell”. After placing an order, the system will look for an opposing party offering the same or lower price. If your price is lower than the price offered by other traders, the order is automatically moved to the open list and will remain there until a suitable counter order is created. After this, the operation will be completed automatically.

All open orders of the selected trading pair are located at the bottom of the “trade history” page or in the profile - in the “open orders” section. If desired, you can always cancel an order or create a new one.

STEX does not support margin trading or working with futures.

There is no market execution of the order, but you can click on orders in the order book and buy them back.

Depositing funds

To introduce cryptocurrency to the exchange you must:

- In your profile, select the “Balance” section

- Next to the selected currency, click “Deposit”:

- Click on “Show Deposit Address”

- Copy the generated digital wallet address:

- We paste it into the “Recipient Address” column where we want to transfer the coins from (another digital wallet, another exchange, exchanger, etc.)

- We are waiting for the funds to be transferred

Commissions

On the STEX trading platform, there is no difference between fees for makers and takers. Fixed fee:

- 0.2% of each transaction after registration

- 0.1% after verification through the STEX exchange or PrivatBank

- 0.05% after account verification through Cryptonomica.

This is below the market average of 0.25%.

The withdrawal fee depends on the chosen cryptocurrency or fiat payment system. Thus, when withdrawing Bitcoin, 0.001 BTC is charged; Tether – 0.002 BTC; Ethereum - 0.003 ETH, etc.

Economic component

STE tokens issued is 50,000,000 , the rate without bonuses will be 1 ETH = 400 STE . 9 million tokens on sale , which can be purchased at a discount of 6 to 12% compared to the final price for the last stage of the ICO. From April 1 to April 11, 6% discount is 2.35 ETH for 1,000 tokens , from March 1 to March 31, 12% discount is 2.20 ETH for 1,000 tokens . Trade is going on rather weakly, probably the project is NOT interesting . The sale of A2A tokens is planned from mid-April at the rate of 1 A2A = 0.0002 ETH. I wonder how many of the planned tokens will be sold?

Technical support

If you encounter a problem that is not described in the FAQ section, you can contact a support agent. The response usually takes several hours. To speed up the solution process, it is advisable to immediately indicate all the data about the problem that may be needed: cryptocurrency, wallet address, TxID, order number, etc.

STEX has a Twitter account, but it's mainly for project news rather than support. In any case, you can go there too. Phone support is not available.

Reviews about the support service are good. Most users say that their issue was resolved efficiently, although not very quickly.

Problems that STEX is going to solve

- Problem

Many coins suffer from one biggest problem: lack of liquidity . This has huge implications for active traders/investors. Imagine you have coin A and a good opportunity to sell it for a profit. And at the same time, you want to invest in a new promising token or coin B. The only problem is that they are traded (or have better rates) on different exchanges, and if you try to trade this idea, you have to complete the first trade and then transfer your assets from one exchange to another - waste time and commissions.

Solution:

Thanks to our unique HFT , originally designed to work on traditional exchanges, we can solve this problem by providing access to all trading opportunities from one trading platform, one trading account, instantly.

And much more. We will offer cutting-edge financial tools such as leverage, portfolio margin, futures and blockchain options - ready to use for anyone wanting to get the most out of cryptocurrency trading.2.

2. Problem

usually not possible to trade one coin and invest in another on the same exchange . Most coins have better rates on different exchanges. No exchange can manage the trading of all coins.

Solution:

A2A technology translates as any-2-any and means that with the opening of the STEX exchange, where at the initial stage it will be possible to trade any cryptocurrencies from the TOP-100 list, you will be able to exchange any cryptocurrency for any other in one action. That is, it will be possible to have 10 thousand pairs for trading operations.

a2a technology