Olymp Trade is a broker that is very popular among traders from different countries. It offers them good trading conditions, a convenient platform, but most importantly, clients can receive training. The site contains materials that will help you understand trading and start trading binary options successfully. In addition, everyone can use strategies that will help increase their chance of making a profit. You should familiarize yourself with them, take a few for yourself and try them out.

What strategies will help you make a profit on Olymp Trade?

On the Olymp Trade website you can find descriptions of popular strategies. The “Training” section contains 8 simple but effective tactics. They are as follows:

- "Binary Gambit";

- “Sliding along the averages”;

- "MACD Professional";

- "Japanese standard";

- "Japanese Pearl";

- "Reflection";

- "The Law of Relative Strength";

- "Trio".

All these tactics have their own characteristics, secrets and nuances. You need to familiarize yourself with them in order to subsequently choose the optimal one by testing it on a demo account. If it gives results, apply it in real trading and get income.

The main mistake of novice traders

The first and main mistake of beginners is trading at random; to put it simply, people, relying on Russian chance and luck, begin to place bets at random. Naturally, such trading leads to the loss of the entire deposit, after which angry reviews appear that all this is a scam and there is no money you'll earn money. In part, I agree with this, because when you play roulette, you definitely won’t end up winning. Therefore, I will tell you what Olymp Trade strategies are, with which you will definitely not be left in the red. In fact, there is nothing difficult in studying them, and the concept of trading, after spending very little time, you will get up to speed and will be able to use them in the near future. THE MAIN MAIN thing is not to be led by instincts and passion, do not just press up or down, trade with a clear head and stick to the plan, otherwise you can join the army of those who also traded at random. So, if the picture below doesn’t tell you anything, then training is simply necessary for you.

Binary Gambit

This is a win-win strategy on Olymp Trade, which is perfect for beginners. However, experienced traders are delighted with it, since it provides the opportunity to regularly receive income. It is based on thorough market analysis. To make forecasting easier, the broker posted an economic calendar on the platform. Using this tool, it is easy to select important events for making a forecast.

To use the Binary Gambit tactic, you will need to find the economic calendar, open it and configure it. In the parameters, it is recommended to set a filter for important news (3 pictures with a bull) and select currencies for trading. It is better to enter the market just 15 seconds before the event occurs.

It is recommended to buy 2 options (“higher” and “lower”) with a duration of 10 minutes. After 2 minutes, when the two-minute candles close, the losing contract will need to be closed early. Thanks to this, it will be possible to compensate for losses on the option and return up to 50% of the amount bet on it. The second trade is closed with a profit that will cover the loss from the first contract.

Many people like the Binary Gambit tactic because it allows you to earn income in any case. Of course, it will not be very high, but nevertheless, losses will be avoided.

Why is it better to start on a demo and when to switch to real?

The minimum deposit on the site is only 350 rubles or 10 dollars. A small amount that is not so bad to lose initially. But why do this?

Almost every newbie fails the first time. It takes time to learn. Even the simplest strategies cannot be learned without practice. And it may take months to build your own trading model, which takes into account the characteristics of assets, the method of market analysis and other aspects. In addition, the trader simply needs to get used to the new trading platform.

Why then risk even a little money at first, when there is an opportunity to practice on a demo account, which opens immediately after registering an account.

With a virtual account, you can get acquainted with the trading platform, develop your own strategies or test ready-made ones. It is also necessary for practice. Although some experts, in particular Gleb Zadoya, argue that the demo should only be used to get acquainted with the platform, and trading should be done on a real account.

Previously, we talked about the features of a demo account for options. So then we talked about some of the disadvantages that arise when working with the simulator for a long time. There may be a fear of real trading or relaxation, which has no place in financial markets. Therefore, there is no need to wait for the moment when virtual trading will make you a professional. This won't happen anyway. You'll only make it worse.

You need to top up your account after you can answer “Yes” to all the questions below.

- Have you become fully familiar with the platform and will be able to almost automatically switch between assets, TF and expiration period?

- Do you already have a strategy that gives at least a small profit?

- Are you ready to lose the amount you will be trading with?

Ready? Then we continue to find out how to trade on OlympTrade.

We slide along the averages

This strategy for Olymp Trade is ideal for beginners. It is considered one of the simplest and most effective, so it will help you navigate the market and reduce costs. Trading with it is not difficult. First you need to add two simple moving averages to the chart. In this case, the period of the first should be equal to 60, and the second – 4.

The fast line will follow the patterns drawn by the candles on the chart. The slow one will give signals exclusively to global trends, since it is not sensitive. A signal to purchase an option “above” will be a breakout of the slow SMA from below, and a “below” option will be a breakout of the line from above.

Before using the “Sliding along the average” tactic, you will need to configure the terminal. The chart should be set up in the form of Japanese candlesticks, the time frame should be 1 minute, and the trade duration should be set to 25–30 minutes.

Where should you start?

Any conscious person understands that successful and effective work requires the presence of certain knowledge and practice. In order to start doing something, you need to thoroughly study its field and gain important knowledge. All this knowledge needs to be put into practice and worked to perfection. Today it is possible to obtain any reliable information on the Internet.

Study according to a specific general education program or engage in self-education through all possible resources. But you need to understand that at any stage of training there may be a need for outside help or advice. The presented company offers not only training materials and programs, but also consultations with leading experts in various fields. This is why it is so easy for even the most ordinary beginner to get used to it and start earning money on this platform.

MACD Professional

This tactic requires the use of 3 oscillators at once - MACD, Trend Line and Parabolic SAR. By combining them, you can conduct a qualitative analysis of the current trend, notice its reversal, recognize the movement, and the value of the asset. Thanks to the indicators, you can get 3 types of signals:

- Preliminary (inform about the best moments to buy contracts, notify about the appearance of the main signal).

- Reinforcing (confirms the appearance of the main signal).

- Basic (help determine the moment of opening the contract).

To use the “MACD Professional” strategy, you will need to set the MACD settings to 12, 26 and 9. Then, 3 preliminary signals are recorded on the chart - the general direction of the trend (“above” or “below”), an increase in the MACD histogram (above or below zero line) and the discrepancy between the histogram and the asset chart.

Analysts recommend paying attention to the Reinforcing Signal, which indicates the emergence of a trend. It is the 1st or 2nd Parabolic SAR point. They appear above or below the chart. However, you can purchase a contract when all 3 signals are visible on the chart. The MACD Professional tactic can be used exclusively for uptrends and downtrends.

Features of trading conditions

If you open a chart for any underlying asset, you will immediately see that the market value changes its direction over time. Even with a pronounced upward or downward trend, the price rises/falls. These fluctuations should be used in trading to increase the balance of the trading account.

Beginning traders should definitely include an economic calendar . Professionals definitely use it in binary trading. Beginners may at first underestimate the importance of fundamental analysis. The economic calendar guides traders - when important financial market news is released, a stable trend may appear on the chart, which is convenient to use for making money on binary options.

Japanese standard

This trading strategy for Olymp Trade is suitable for those who are taking their first steps in trading. It does not require the use of indicators for technical analysis. Its principle of operation is to recognize different combinations on the chart in the “candlestick” display mode. It is important to monitor their colors, then you will be able to understand the direction of the asset’s value.

To play for a rise, you will need to wait until the green candle overlaps the red one. After which you need to open a contract with an expiration period of 5 minutes. To play short, you should catch the moment when a red candle forms and overlaps the green one. Then an option is opened with an expiration time of 5 minutes.

Most traders believe that the Japanese Standard tactic brings huge profits. Having learned to work with candles, you can close up to 5 contracts per hour with a profit. Other strategies cannot boast of this result, so it is worth adopting the “Japanese Standard” and using it more often in trading.

Profitable Olymp Trade strategies for beginners

According to statistics, if you correctly decipher the signals, you can get a profit on options of up to 80%. We saw this in the statistics - with an investment of 100 rubles, we received 180 rubles.

To avoid losing to beginners, it is necessary to use Doji candles only during strong movements. And it is desirable that these movements take place during the European and American sessions.

If there are no movements and no jumps are expected, then it is better to hold off on trading. You only know one strategy so far. Therefore, in other situations you will only lose money. It is better to wait for a favorable situation.

Be sure to read our review about Olymp Trade.

Japanese pearl

The tactic is based on an indicator called the “Ichimoku Cloud”. With its help, you can determine the strength and direction of the trend and close contracts with profit on long time frames.

To start trading using the Japanese Pearl, you will need to open an additional window for analysis, and then set the time frame to 1 hour. Then you need to put the indicator on the chart with the usual settings and wait for the signal.

A Call trade is opened when the Tenkan Sen and Kijun Sen lines cross upward. Its expiration period should be 3 hours. The Put contract is bought when the Tenkan line breaks the Kijun moving average from top to bottom.

To get greater profits, it is recommended to give preference to assets with high income. Trading time also affects profits; it is better to make transactions from 10:00 to 20:00 Moscow time.

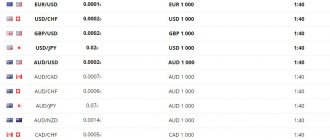

Assets on the OlympTrade platform

The underlying assets are what traders trade. Many brokers try to bribe clients with hundreds of different assets. Although we all know that the more choice the better, most traders use currency pairs and commodities in their trading because these are the most convenient assets for trading.

Olymp Trade has it all. Special OTC currency pairs have also been added, allowing you to trade on weekends and after sessions close. In total, the broker has about twenty assets. Of these, only three are commodities (gold, silver, oil), and the rest are currency pairs, as well as OTC pairs. The developers of Olymp Trade plan to supplement the list with various assets and shares in the near future. At the moment, stock indices and shares of large companies have already been added.

Register and open an account

Assets are located above the chart. With one click you can switch between six assets. To select others, press the down arrow button:

To conveniently switch favorite assets that are not on the main line, you should remove the irrelevant asset, and in its place the one necessary for the user will be installed. To select and display the desired pair, stock or index product, click the plus located in the right corner:

Thus, as a result of a number of changes at Olymptrade.com, asset management has become easier and much more convenient.

Reflection

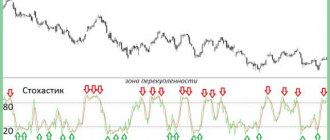

This strategy for Olymp Trade is suitable for experienced traders. Analysts advise using it when you want to trade against the current trend in anticipation of an imminent price reversal. The risk is high, so to obtain more accurate data, take into account 3 signals from the Slow Stochastic indicator, price levels and Japanese candlestick patterns. Working with them is difficult; first you will need to make a number of settings.

First of all, a time frame of 1 minute is set on the Japanese Candlestick chart. Then the Slow Stohastic oscillator is superimposed on it, and its parameter changes to 5. When the indicator appears under the chart, you will need to mark the levels of the overbought and oversold zones, creating 2 horizontal lines. Then the coordinates are set. For the top line - “80”, for the bottom - “20”.

Now you can move on to trading. You can enter the market when the value of an asset increases when the Slow Stohastic lines rise above 20 and the candles create a reversal pattern for an increase. The duration of the contract should be 4-5 minutes.

Downside options are purchased in a similar way. However, in this case, the Slow Stohastic lines should be below 80, and the candles should form a downward reversal pattern.

Law of relative strength

This tactic is quite simple and can be used successfully by beginners. It allows you to find trend reversal points using one indicator - RSI. You will need to open it, go to the settings and set the period to 5. The chart must be switched to candlestick mode and the timeframe set to 1 minute.

After this, 2 levels will be marked on the oscillator - 30 (oversold) and 70 (overbought). When the moving average crosses level 30, you should open a Call trade. When it leaves the overbought zone, you can purchase a Put contract.

Analysts recommend using the “Law of Relative Strength” strategy during the overlap of the American and trading sessions or during periods when there is a lull, that is, from 10:00–20:00 Moscow time.

RSI indicator and Bollinger waves

In this case, the previous strategy is supplemented with signals that give quotes touching the upper or lower border of Bollinger waves. The second indicator confirms the information received and reduces the number of false entries into the market and, accordingly, losses.

To use this strategy, you need to enable the RSI and overlay Bollinger waves on the chart, changing the period from the standard value to 1.

The work is carried out according to the following scheme:

- When the current exchange rate quotes are located below the lower boundary of the Bollinger waves, and the RSI line breaks through 30 and begins to move upward, it is necessary to open Call type transactions;

- When the exchange rate quotes are above the upper limit of Bollinger waves, and the RSI indicator line crosses 70 and moves downward, you need to open a Put position.

The advantage of this strategy is that it can be used not only for scalping, but also for trading with long expiration periods. You can set time periods from 1 to 15 minutes. But in the latter case, it is better to increase the chart timeframe. To avoid “losses”, invest no more than 2% of the amount of funds on deposit in each transaction.

Trio

“TriO” is a strategy for OlympTrade, which is used when you need to find the most favorable points and enter the market in order to make money on a trend reversal. This is not easy to do, so you will have to use 3 oscillators RSI, Williams %R and CCI at once. With their help, you can receive the most accurate signals to buy or sell options.

First, you will need to select 3 oscillators in the “Technical Analysis” section and add them to the chart. Then you need to configure them. For RSI, you should select 7 candles, then the overbought and oversold levels will be at 30 and 70. On the Williams %R indicator, coordinates of -20 and -80 are set and levels are added. To do this, use the “Line” tool located in the console on the left. The coordinates on the CCI oscillator are 100 and -100.

Now you can start analyzing the data. It must be remembered that to open a contract, the signals from all oscillators must match. It is recommended to open a bullish trade when their lines return from the overbought zone, and to open a bullish trade when the price returns from the oversold zone.