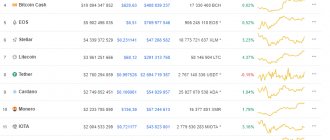

- Market Capitalization: $2,197,571,633,801.31

- 24H Volume: $142,851,133,921.78

- BTC Dominance: 37.69%

| # | Name | Price | Changes 24h | Ryn. Capitalization | Volume 24h | In circulation | Price chart (7D) |

You can buy, sell, exchange any cryptocurrency on cryptocurrency exchanges, exchangers or p2p platforms.

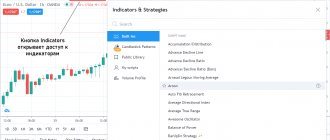

Schedule

The table above shows online cryptocurrency rates (1900+) in real time. The following parameters are available for analysis: actual value, price change over 24 hours, market capitalization, daily trading volume, the number of crypto coins in circulation and a visual graph of exchange rates for the last 7 days. We recommend bookmarking the page to always know the current quotes and important information about coins.

The cryptocurrency rate changes in real time, instantly. The default price is in US dollars. The base fiat currency can be changed to another one, for example, to the Russian ruble RUB or euro EUR. In the columns, the list can be sorted by the desired parameter and a search for cryptocurrencies by name is implemented. There are 50 crypto coins on the page; to view others you need to select “Next”. When you click on the name, an online cryptocurrency chart for the entire time, a chart for the last year, information on trading volume, opportunities to buy/sell an asset, and a calculator will appear on the screen.

The reason for the change in the cryptocurrency rate is fluctuations in the ratio of supply and demand in accordance with all the laws of economics. There is a direct relationship between the value of an asset and its demand in the market. Of course, with digital currencies, the rate is influenced by many indirect factors.

The editors of Profinvestment.com will look at how the rates of popular cryptocurrencies have changed over the course of their existence.

How to buy Rucoin

Having learned how promising the rucoin cryptocurrency is, its mining is arousing quite serious interest from users who want to try working with it. So, before you buy or mine Russian cryptocurrency, you will have to make sure that you have a special program that opens a wallet intended for Rucoin. The same program is suitable when you need to organize control over newly received cryptocurrency capital.

Thanks to the wallet, it will be possible not only to receive and save rukoin, but also to carry out all the necessary payment transactions without the use of foreign funds. Today there are several ways to get rukoin:

- The first method is very simple and to some extent even arrogant, but as the practice of other cryptocurrencies shows, it can work. To replenish your wallet with a new Russian cryptocurrency, you only need to take from the wallet its unique number used for replenishment (do not confuse it with the access key). What to do with it next? It’s all very simple: select a page where users can see it, post a link to information about the coin along with the number, or try to describe what this coin is, conveying the data to the maximum number of people interested in it. And be sure to ask that several rukoin coins be sent to the specified account as gratitude. Of course, it is naive to hope that this will work or bring in a lot of money, but perhaps someone will actually respond. Although the chances that you will be able to earn Rukoin cryptocurrency in this way are negligible.

- The second quite successful method is mining Russian cryptocurrency. Since digital money is subject to mining in most cases, mining as a way to earn coins is also suitable for Russian cryptocurrency. Anyone can mine it, but in order to carry out this process, you will need to use special programs. In addition, you will need a pool, but this is not a problem either, since there are a considerable amount of resources on the Internet that allow you to mine a new crypto coin. The main thing is not to forget to indicate in the settings that your goal is to produce Russian digital currency, and you can wait until a certain amount of work is done by the computer and the coins end up in the miner’s wallet. In addition, you don’t need any specialized equipment or strategy to quickly figure out how to mine rucoin. Mining this coin is relatively simple.

- The third available option is to buy Russian cryptocurrency on the exchange. Of course, in this case you will have to fork out a significant amount, but you will receive coins quickly and profitably. Today, to exchange rucoins, you can use a considerable number of different exchanges, exchangers or currency markets. The exchange can be carried out using crypto coins or fiat money. Thanks to this, you can significantly increase your capital, taking advantage of the opportunity to conduct speculative transactions. Many exchanges allow you to make purchases directly through them, pay for various goods and more.

To read: Bitcoin White (BTW) cryptocurrency in 2022

As you can see, there are many options for how to get rukoin. Some of them are, of course, quite original, but exchange trading and mining look standard, and have been used with other cryptocurrencies for a long time. Most likely, this will also work just as well for Russian cryptocurrency. So there is only one problem left - to determine for yourself whether you are ready to work with a new, relatively unfamiliar currency, even if it positions itself as relatively stable.

Bitcoin cryptocurrency rate

The first recorded Bitcoin rate was: 1 dollar for 1,309.03 BTC (in 2009). Since then, the value of the coin has increased many times, reaching its maximum in December 2022 (almost $20,000).

Of course, there have been downfalls, such as the cryptocurrency crisis at the end of 2018. But gradually everything returned to growth, because cryptocurrencies are becoming more and more popular financial instruments every day.

Cryptocurrency Law

At the end of 2017, the Ministry of Finance presented the latest bill on digital assets, which can be found on the official website of the department. The document defines cryptocurrency, tokens and mining for the first time. At the same time, cryptocurrency is not recognized as a legal means of payment in the Russian Federation. It will be possible to buy and sell it only on registered exchanges, and only legal entities will be able to issue cryptocurrency or tokens.

As for individuals, they will be forced to contact such operators and open accounts with them. The maximum amount for which digital assets can be purchased will be limited to 50,000 rubles. Also, the bill recognizes mining as a business activity, and accordingly, it will be necessary to pay income tax.

They plan to adopt a law on cryptocurrencies in the first half of this year. True, he has a long way to go before that. The draft will be submitted to the State Duma, where it will have three readings and changes will probably be made to it. After this, it will be reviewed by members of the Federation Council and signed by the President - only after that the law will come into force.

Having examined the crypto market in our country, we can confidently say that there are more and more adherents of digital assets in our country. Every day more and more people are involved in the digital economy. This means that the state will not be able to ignore this and will have to develop mechanisms for interaction between the world of cryptocurrencies and government agencies.

Some countries have already opened their market for cryptocurrencies, others, on the contrary, prohibit their movement, although not entirely successfully. It is not yet entirely clear which path Russia will take. On the other hand, our country is famous for its programmers, and the population continues to technically evolve. If this trend continues, it is safe to assume that cryptocurrencies will begin to play an increasingly significant role in the lives of ordinary Russians.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.

Ethereum cryptocurrency rate

The starting price in September 2014 was $2.85 per coin. The strongest growth was seen starting in February 2022. By June, the Ethereum rate reached its first historical maximum – $389, and by January 2022 – up to $1,400.

Since the rates of all cryptocurrencies significantly depend on BTC, Ethereum also fell significantly. But this does not mean that it has no prospects - many consider it an even better solution than Bitcoin.

Ripple cryptocurrency rate

The peak of popularity of the cryptocurrency, as expected, came at the beginning of 2018, when the cost of one coin reached $3.31. Now the dynamics of the Ripple exchange rate shows a bullish trend, but price spikes are periodically noticed.

There are two opinions about the currency - despite the fact that it is a truly effective banking instrument, users are distrustful that a significant part of the funds is held by the project developers. Nevertheless, the demand for cryptocurrency will not fall in the near future.

Russian cryptocurrencies list

In our country there has always been no shortage of good programmers. This means that the worldwide trend of crypto fever could not but affect Russia. So, there is nothing surprising in the fact that domestic cryptocurrencies, which have their own characteristics, began to appear on the territory of our country. Gradually their popularity is becoming greater and their appearance on the largest and still young, such as the Kukoin exchange, platforms for trading cryptocurrencies, is no longer news. Perhaps soon any person on the street will know what a cryptocurrency is; the list of the most popular ones is already widely known. In the meantime, I propose to take a closer look at the most popular domestic cryptocurrency projects.

RuCoin

The Russian cryptocurrency RuCoin is a fairly young domestic altcoin, which has already received due attention from those wishing to make money on cryptocurrency. Rukoin works on the principle of a peer-to-peer system, which is similar to the same Bitcoin, although the Stellar cryptocurrency works on the same principle.

The main characteristics of the currency are:

- The total issue will be 500 million units;

- Payments are published in a common blockchain, which will ensure high security;

- Open source;

- The transaction confirmation speed is less than 1 second with a throughput of more than 100 thousand transactions per second;

- Low commission for transactions within the system no more than 0.01%.

Considering the youth of the cryptocurrency, it is still difficult to judge its prospects, but it is definitely worth taking a closer look at it.

Waves

To call Waves one of many Russian cryptocurrencies would not be entirely correct. Entrepreneur Alexander Ivanov created a blockchain platform that prioritizes user tokens, that is, smart contracts. In particular, within the system you can raise funds for your projects through crowdfunding in bitcoins, conventional currencies (dollars or euros), and also, of course, in Waves. Many experts predict rapid development and growth in value for the platform and its internal currency.

SibCoin

Another Russian coin, SibCoin, is a Russian fork of the Dash cryptocurrency, designed to improve the security level of the parent platform. The Siberian Chervonets was released, and this is what the leader of the development team Ivan Rublev called the coin, back in 2015 and since then it can be found on the most popular crypto exchanges in the world, where users go to buy Ethereum, Bitcoin and other cryptocurrencies.

The main advantages of crypto are:

- High transaction security thanks to the use of Darksend technology;

- Instant execution of payments - InstantX technology;

- The commission is lower than for bank transfers, often completely free.

During its existence, the coin has become quite popular among investors. Its market capitalization has already exceeded 25 million US dollars, and the current exchange rate is more than one and a half dollars. All this suggests that the prospects for the coin are good, and therefore, it may well be considered as an object for a profitable investment.

Litecoin cryptocurrency rate

The Bitcoin hard fork, which resulted in the formation of Litecoin, took place in October 2011. But at that time there was no declared exchange rate, information only starts in 2013 - 3-10 cents per coin.

November 2013 was a breakthrough, the price level increased almost 100 times in two weeks. Another rise was at the turn of 2022 and 2022; in the summer of 2018, the rate of the Litecoin cryptocurrency fell sharply.

Binance Coin cryptocurrency rate

BNB is considered one of the most successful tokens from crypto exchanges. Binance has managed to turn its functionality token into a successful financial asset. At one point, the capitalization of the coin reached 176 million USD. The Binance Coin rate today is $23,291.

Stellar Lumen cryptocurrency rate

The fork and one of Ripple's main competitors initially had a price of just $0.06 per unit. After that, the price rose and fell more than once and was subject to correction. It is worth noting that there are few news channels around the cryptocurrency, which does not provide prerequisites for either growth or decline. As of April 26, 2022, the Stellar Lumen rate is $0.0979.

What does the cryptocurrency rate depend on?

The main reasons on which the ratio of supply and demand for a particular digital currency depends:

- The influence of large players buying or selling a large amount of cryptocurrency at once.

- Cross-influence of courses. The most striking example is that the Bitcoin rate always pulls with it the cost of most altcoins.

- Economic and political factors regarding the ban or, conversely, approval of cryptocurrencies in countries around the world.

- News background regarding the crypto market in general or a specific coin.

Due to the variety and instability of factors, the cryptocurrency market is extremely volatile. This simultaneously causes difficulties for investing/trading and makes it possible to make significant money on a jump in the exchange rate.

Cryptocurrency in Russia

The situation with cryptocurrencies and their recognition by official authorities is ambiguous. Moreover, this concerns not only Russia. In most developed countries of the world, the state is loyal to cryptocurrency and its use by the population. In the European Union, for example, cybercurrency is equal to official money, and users do not pay taxes on profits from transactions with it. But in the USA and Japan, although transactions with cybercurrencies are allowed, tax on profits from transactions with it must be paid. But in China, cybercurrencies were completely banned, which does not prevent the Chinese from being the largest holders of cryptocurrencies in the world.

Despite the fact that some of our fellow citizens do not even have an idea of what the Bitcoin cryptocurrency is, others, more inquisitive, have taken full advantage of their knowledge and made good money from it. Apparently, such “unaccounted earnings” seriously worried state regulatory authorities, who increasingly began to talk about banning cybercurrency on the territory of our country. The first attempts to ban cryptocurrencies by the Central Bank and the Prosecutor General’s Office were made in 2014. Then all these statements were limited to an advisory form, although a little later the Ministry of Finance took the initiative to legislatively establish the status of cryptocurrencies as a “monetary surrogate” and significantly limit their circulation on the territory of the Russian Federation. However, the bill was never submitted to Parliament.

The very next year, 2015, the judicial authority blocked several sites that allowed working with bitcoins. And although the ban was later lifted, it stirred up the public, and the Ministry of Finance prepared a new draft law that provided for criminal penalties for the use of cryptocurrencies. The main argument for this decision was that cryptocurrency is an ideal tool for scammers. The situation changed dramatically only in mid-2016.

Officials recognized the need to use blockchain, which simply cannot function fully without cryptocurrencies. Operators of virtual currencies were exempted from liability for such activities, and the Ministry of Finance and the Central Bank took a wait-and-see approach. However, this situation could not last forever and a new bill is currently being developed, which should put an end to the possibilities of using cryptocurrencies in Russia. I'll tell you about it a little later.

Cryptocurrency in Russia has come a long way from non-recognition and prohibition to being considered as a promising area that can benefit the state. At the moment, there is a bill that will consolidate the legal status of cryptocurrencies in our country.

Currently, you can easily buy cryptocurrency for rubles in the multicurrency online exchanger Matbi. The service is completely Russian-language and is suitable for both beginners and experienced crypto investors. We go through a simple registration, top up the balance with rubles, and then exchange rubles for cryptocurrency. Matbi supports Bitcoin, Litecoin, Dash and Zcash. Conveniently, the developers have created their own online wallet for each cryptocurrency, thereby making it easier for beginners to get acquainted with the crypto market. The service has been operating for more than 5 years, which is a significant period for the young and developing cryptocurrency market.