- one of these areas is an analogue of a bank deposit, but in cryptocurrency and with higher interest rates.

From this article you will learn:

- What is staking and how does it work?

- Types of staking

- Staking on binance

- Staking through specialized platforms

- Staking via hot crypto wallets

- Staking on hardware wallets

- Real staking profitability

- Choosing Coins for Staking

- Advantages and weaknesses of cryptocurrency staking

- Conclusion

What is staking and how does it work?

Staking is sometimes called “wallet mining.” Staking can also be compared to a bank deposit, the principle is similar - in the bank the money in the account is “blocked”, and in staking the cryptocurrency is “blocked”.

In general terms, it is convenient to consider the operating principle of this scheme using the example of masternodes, which provide validation of transactions in a number of altcoins:

- When using the PoW (Proof of Work) algorithm, energy-intensive mining is used to confirm transactions . After the transition to PoS, individual nodes (masternodes) began to validate transactions.

- In order to become a masternode, the user must lock a certain number of coins in the wallet.

- For its work, each node receives a certain income in crypto , usually 5-15% per annum. There are various schemes for organizing this process; we will consider a detailed classification below. Another scheme is also possible, in which there are no masternodes, and any node can be elected to the role of validator; the more coins it owns, the higher the chance of being elected.

I also recommend reading:

What is Ethereum cryptocurrency? Review of the coin, reasons for its popularity

Ether has long been assigned the title of the second crypt after Bitcoin. At one time, Ethereum was called almost the killer of Bitcoin, [...]

Any staking option involves freezing cryptocurrency for a certain period. This period can be either fixed or indefinite - there are different options.

Coin staking became popular in the second half of the 1990s, but was invented much earlier. In 2012, Scott Nadal and Sunny King presented to the general public a description of Peercoin, the first project based on the Proof of Stake consensus algorithm.

In 2014, their idea was developed by Daniel Larimer and presented the DPoS (delegated proof of stake) algorithm. But the foundations were laid in 2012, cryptocurrency staking was technically possible, but it was not particularly popular.

Ethereum 2.0 update will double the staking market

PoS also attracts those projects that initially worked on other algorithms. The most striking example is Ethereum, whose developers are preparing to transfer the project from PoW to PoS in the first quarter of this year. This should solve the problem of scaling, high commissions and attract new validating investors to staking.

With the transition of Ethereum to PoS, the share of staking in the market will increase sharply. According to preliminary calculations by Collin Myers, head of product strategy at the ConsenSys startup, after the launch of Ethereum 2.0 on PoS, validators will be able to receive from 4.6% to 10.3% per annum. It is noteworthy that due to sharding (the reduction in the number of shards shortly after launch from 1024 to 64 and the resulting reduction in the number of validators and rewards), profitability will decrease over time.

To confirm blocks, the Ethereum network validator will need a deposit of at least 32 ETH ($4154 at today's rate). With such an entry threshold, we should expect an increase in staking offers from exchanges. Thus, the launch of an ETH staking service has already been announced by the largest Swiss crypto exchange Bitcoin Suisse. There will be no minimum deposit, the site commission will be 15%.

According to Binance Research analysts, the transition of Ethereum to PoS will double the value of assets and the share of staking in the market and make ETH the most popular currency in the PoS algorithm. According to them, in October 2022, the total capitalization of PoS projects was $11.2 billion (and according to the latest data from StakingRewards, $10.44 billion), of which $6.4 billion was used for staking. The launch of Ethereum 2.0 will increase capitalization to $24.8 billion.

Our experts are more cautious in assessing the prospects for the transition of Ethereum to PoS and its impact on the market. Maria Stankevich believes that the transition of Ethereum to PoS is unlikely to radically change the staking market, but will most likely have a positive impact on its price.

“It’s worth noting here that the American regulator warned that the transition to PoS could make Ethereum a security. This could create problems for the project in the US. In this case, the proposal of the Commodity Futures Trading Commission (CFTC) to launch futures on Ethereum will become irrelevant. So far, no licensed American exchange has announced its readiness to launch such a product. However, this is an important event, since Ethereum is one of the leading blockchain networks; not only individual projects that created their tokens in it, but also such popular areas as decentralized finance and decentralized applications depend on its development ,” noted Maria Stankevich.

Victor Argonov believes that:

“Now this transition is in question. The coin retains its status as a leader in home mining, which cannot be said, for example, about Bitcoin (BTC). Her team is carefully studying the feasibility of moving to PoS and will look at the experience of other coins.”

Types of staking

The classification can be based on several criteria. If you take into account the method of organization, you can:

- Engage in staking yourself, becoming, for example, a masternode . Crypto developers set the minimum allowable amount of crypto, after blocking which a network node receives the status of a masternode. The amounts are significant, so this route is not suitable for small crypto investors. For example, in Dash, only the holder of at least 1000 coins can become a masternode; taking into account the altcoin exchange rate at the time of writing this review, this will require more than $200,000. Another scheme of work is also possible, when validators are selected randomly, but having more crypto increases the likelihood of being chosen.

- Use a staking pool . A pool is an association of a group of crypto investors; they pool their coins and thereby increase the likelihood of being selected for validation. Income is divided in proportion to the contribution of each pool participant.

- Stake through crypto exchanges, such as Binance . From an organizational point of view, this is the simplest option; there are also no problems with security.

- Staking through profile platforms . Almost the same as in the case of exchanges, but the functionality of the platforms is limited solely to blocking coins; they are not intended for active trading of cryptocurrencies.

Depending on the storage method, crypts are distinguished:

- Hot stacking . The connection between the participants is maintained, the crypt is stored in regular wallets.

- Cold staking . It is used by large holders; the peculiarity of this type is the storage of altcoins on a hardware wallet. This gives the highest possible level of protection.

Staking also differs depending on the conditions under which the crypt is blocked. Highlight:

- DeFi staking. A promising direction, within this type, user-locked tokens are used to provide financial services to other people through smart contracts. It is more convenient to do this through crypto exchanges, since exchanges independently monitor reliable DeFi projects, cutting off offers with excessive risk.

- Fixed staking

. It is called so because the coin blocking period is known in advance. For example, on Binance the blocking period starts at 30 days, and there are also plans with 60 and 90 days blocking. By analogy with a regular bank deposit, the user does not have the right to withdraw crypto early. Or rather, he can do this, but he will lose all his accumulated income. - Flexible or perpetual staking . It is distinguished by the absence of a strict limitation on the period of blocking of coins. Interest is accrued until the user decides to withdraw the crypto.

At this stage, staking cryptocurrency may seem complicated and incomprehensible, but even current knowledge is enough to make money. You don’t need to understand the structure of smart contracts or study DeFi projects on your own - crypto exchanges or special staking platforms will do this for you.

Stellar (XLM)

Stellar is a network that allows people to transfer assets around the world efficiently, quickly and conveniently. It allows cross-border transfers to be made faster and easier than bank transfer systems.

The Stellar network was founded in 2014 and has its own digital currency, Lumen (XLM).

You can store Lumen XLM on various wallets and exchanges, such as Ledger crypto wallet, Coinbase exchange and Binance exchange. You can participate in staking pools on exchanges and wallets and receive a reward of 1% per annum. So, by investing 1,000 units of XLM, you can receive an annual income of 10 XLM.

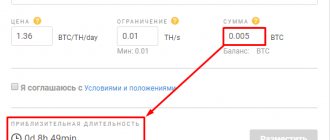

Staking through specialized platforms

Staking coins is also possible through separate platforms. Unlike exchanges, they are created exclusively for staking.

Examples of such platforms:

- Everstake. Profitability, depending on the specific cryptocurrency, ranges from 5% to 20%. It is possible to stake Tezos, Polkadot, Cosmoc, ICON, Near, Cardano.

- P2P.org. Compared to Everstake, it supports more altcoins. At the time of writing the review, 20 cryptocurrencies were supported on the platform and 8 more were being prepared for addition. More than $6 billion worth of assets have already been blocked on the platform, this proves the popularity of p2p.org.

- Dokia Capital. Something between Everstake and p2p.org - 6 altcoins are supported, 6 more are planned to be introduced in the near future, further expansion of the coin pool is possible.

The principle of operation is approximately the same as in the case of cryptocurrency exchanges. After registering on the site, you need to add your wallet where the crypto is stored, and then stake a certain amount of crypto. The reward is credited automatically.

QTUM

QTUM is an open-source decentralized cryptocurrency network, a hybrid of Ethereum and Bitcoin.

You can earn a 6.00% APY by listing your QTUM assets on Binance, MyCointainer and Coinbase. Atomic wallet and Guarda crypto wallets also support the QTUM rate with an annual reward of 6% without commission.

Staking via hot crypto wallets

Many cryptocurrency wallets support staking functionality. This is convenient - you do not need to register separately on the corresponding exchange or platform. Examples of such wallets:

- Guarda. More than 10 altcoins are offered, there are popular coins, such as Ethereum, and little-known ones. In most cases, the profitability does not reach 10% per annum, but there are exceptions; according to Ontology, at the time of preparation of the review, they offered more than 35% per annum.

- Trust Wallet. A multi-currency wallet that supports many altcoins and several dozen blockchains, it is also suitable for storing non-fungible tokens. It has a staking function, however, it supports a relatively small number of coins; at the time of preparation of the review, only 11 altcoins were supported.

- Exodus . A popular wallet that supports more than 100 coins, some of which can be staked directly from the Exodus client.

There are other wallets with the ability to block crypto for earnings. The only difference is the set of supported altcoins. As an example of how to organize this process, let’s look at the process of blocking ADA tokens through Exodus.

For this:

- In the list of tokens you need to find Cardano or another altcoin for which staking is available. To do this, go to the wallet section, scroll to the end of the list and click on the “Add more” button. A list of all supported altcoins will open; if staking is available for a specific coin, the annual yield will be displayed in the APY column. To add an asset to your wallet, you need to check the box on the left side of the list.

- We return to the wallet and select the desired altcoin. There is an “Earn Rewards” button in the upper left corner, click on it.

- If the wallet has the required amount of crypto, in the case of Cardano 5 coins, then all that remains is to confirm their blocking. To stake, all you have to do is click on “Staking ADA”, keep in mind that all coins available on the wallet will be blocked; it is impossible to independently specify the amount for staking.

- The reward is collected manually . All you need to do is log into your wallet periodically and click on “Claim ADA rewards”. As for how staking works in this example, the logic is the same as in the previous examples, only the tool with which tokens are blocked changes.

There is nothing complicated; other cryptocurrencies are staked using the same logic. Wallets also have calculators for approximate calculation of profit when blocked for different periods.

Staking is a new market trend and future industry standard

Experts note that in 2022, staking may become a new market standard. As analysts expect, exchanges are likely to be the main validators in most PoS projects. They have a huge user base and customer trust, and are also the easiest to launch staking support. Exchanges offer liquidity and developed infrastructure. For the average investor, making money on PoS coins is easier with them than on their own, storing them in wallets.

Most likely, the market will face a competitive struggle to attract users. In July, Kucoin launched so-called “soft staking”, allowing trading of frozen coins. This will give traders the opportunity to earn from the movement of their assets. In the fight for leadership, Binance waived the commission from users for staking. The company has a huge market share - in order to compete with it, exchanges will most likely have to significantly reduce their commissions or abandon them altogether. As a result of the competition between platforms for investors, users will become increasingly attached to exchanges as the centers of their cryptocurrency financial life.

The transition of projects to staking will inevitably have a positive impact on their value. And Tezos is a prime example of this. In November, the coin increased in price by 53% after Coinbase launched staking on it and by 120% from November to December after staking was added to it on other major exchanges. Tezos currently ranks 9th in terms of capitalization. This is even more impressive considering the fact that most digital assets have been falling in value recently.

Staking on hardware wallets

The main advantage of this method is maximum security and maintaining control over the crypt during the entire blocking period. There are several hardware wallets through which you can stake crypto, this can be done through:

- Ledger.

- Trust Wallet.

- Trezor.

- CoolWallet S.

I also recommend reading:

PrimeXBT is a cryptocurrency exchange + binary options. Review and reviews

PrimeXBT exchange claims to be the best universal trading platform. There is no emphasis here only on cryptocurrencies or stock market instruments, […]

This option is primarily suitable for owners of large capital in cryptocurrency. As is the case with regular staking, coins must be stored in a stack at one address; when they are moved, the reward is lost.

Let's sum it up

There are many cryptocurrency staking platforms available in the market. Unfortunately, even among the leaders, not all projects offer convenient and favorable conditions.

An analysis of the top 5 staking platforms showed that one of the most profitable options for work is presented in the ROY Club. The project is inferior to competitors in the number of available cryptocurrencies. At the same time, ROY Club compares favorably with its analogues in the high level of profitability of offers, security and the presence of simple instructions, thanks to which anyone can start making money on staking.

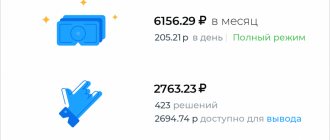

Real staking profitability

Returns are always stated as an annual percentage. That is, if the description indicates, for example, 10% per annum, then if blocked for 1-3 months, the crypt holder will receive a much smaller profit.

For example, when Cardano is locked, the annualized return is 4.91%. That is, if 10,000 ADA is blocked, then after the blocking period ends, the cryptocurrency holder’s wallet will have 10,491 ADA. The reward is paid not in fiat, but in the same cryptocurrency.

If the crypt was staked not for a year, but, for example, for 2 months, then the income would be 6 times less. During the blocking period, earnings would be 4.91%/6 = 0.81333% or 81.833333 ADA.

Income in fiat can be anything, since risks associated with the volatility of the cryptocurrency itself remain. At the time of calculations, 1 ADA cost $1.98, depending on the change in the exchange rate by the time the blocking ended, the results could be as follows:

- The rate has remained virtually unchanged. The profit in fiat currency will be 491 x $1.98 = $972.18.

- The cost of ADA has almost doubled and 1 coin is valued at $4. At the same distance, the profit in fiat is already 491 x $4 = $1964, twice as much as in the previous example.

- The price of the crypt has fallen and 1 ADA token is valued at $1, the profit in fiat will be $491.

This is one of the main differences from a bank deposit. In the case of a bank, the stated interest is equal to the return in fiat currency. In the case of crypto, the stated percentage of income in crypto will most likely not coincide with the profit in fiat currency. The exception is staking of stablecoins, their rate is tied to some fiat currency, but such offers are few compared to the total number of cryptocurrencies available for staking.

Cosmos (ATOM)

Cosmos is a cross-chain blockchain project created by the Tendermint team in 2016. Cosmos' goal is to create an "Internet on Blockchain" based on the transfer of ATOM tokens and build a deeply integrated tokenomics ecosystem. Cosmos Hub is the first cross-chain hub of the Cosmos ecosystem, and ATOM is the native staking token for Cosmos Hub that can be used to prevent spam, receive dividends, and vote in the community.

Currently, the ATOM staking reward is 8.32% per annum on the Coinbase and Binance exchanges. It can also be listed with the same annual reward on MyCointainer, Atomic Wallet and Ledger Live.

Choosing Coins for Staking

The most difficult thing in staking coins is choosing a specific altcoin and deciding on the balance between risk and profitability. When choosing, we recommend:

- Don't chase high returns . An annual profit of up to 10-15% is considered the norm; the standard rule works - the higher the profit, the lower the reliability. There are projects offering 100-500% per annum, but this does not mean that you will earn this 500%. And even if you make money, there is no guarantee that the crypt will not collapse to near-zero values during the blocking.

- Choose more or less well-known projects.

- Work only with reliable crypto exchanges or verified sites.

- Understand the rules of staking . They can differ significantly, for example, in DeFi staking there is no fixed period for freezing crypto assets. If you work with a fixed staking and unlock the crypt ahead of schedule, the reward will be lost. These nuances are important and need to be studied before starting work.

I also recommend reading:

What is a Bitcoin faucet? Bitcoin faucets 2022 that pay

What is a Bitcoin faucet? This question is often of interest to those who are just starting to explore the world of cryptocurrencies. In simple terms […]

As for the choice of cryptocurrencies for earning money, new projects appear regularly. The most convenient way to track information on them is through stakingrewards. This resource allows you not only to obtain data on all altcoins on which staking is possible, but also to estimate profitability.

DASH

The third place in the top cryptocurrencies for staking in 2022 is occupied by DASH. This is a unique cryptocurrency, a fork of Bitcoin, with additional privacy and fast transaction capabilities thanks to InstantSand and PrivateSand technologies.

You can earn dividends by managing masternodes. But to run a master node, you will need 1000 units of DASH, and 1 unit costs approximately $150.

You can place DASH on Guarda, Atomic, MyCointainer and Ledger crypto wallets, with an annual reward of 5.72%, and an annual earnings of 57.2474 DASH when storing 1000 DASH units. Binance and Coinbase also support DASH staking with an annual reward rate of 5.72%.

Advantages and weaknesses of cryptocurrency staking

There are many advantages, these include:

- Guaranteed income in crypto.

- Passive nature of the work.

- Low entry threshold.

- Energy efficiency. This is not PoW, no extra energy is wasted.

- Flexibility. You can create a portfolio of altcoins with different annual returns.

- The opportunity to earn many times more compared to a bank deposit.

I also recommend reading:

Cryptocurrency Cardano (ADA) – review and prospects of the Ethereum killer

At the time of its founding, Cardano was called a possible Ethereum killer and one of the best altcoins. The future has shown that the Cardano cryptocurrency is quite […]

There are also disadvantages and should not be ignored:

- The protocol/exchange can be attacked by attackers. There is no guarantee that the money will be returned if it is stolen.

- Risks associated with crypto volatility remain. You can earn +10% in cryptocurrency, but due to a decrease in its value, you can go negative.

- In DeFi staking, there is an increased risk of encountering unreliable projects.

- The validator node holding your crypto must guarantee 100% uptime, otherwise it may be blocked.

Like any investment option, staking is not a holy grail, but it cannot be called a lottery. This is just another way to make money on cryptocurrency; it can be combined with stock trading or classic mining.

Conclusion

Cryptocurrency staking is definitely replacing mining due to its low entry threshold and ease of participation. There is no need to buy, install or maintain expensive equipment. Of course, there are downsides to PoS, such as the need to hold coins if you want to maximize profits.

If you want to invest this way, then only do so in cryptocurrencies that you actually have reason to believe in. There is no point in holding and earning coins that will become worthless in a few years.