The following day trading strategies are for both beginners and professionals, but remember that day trading is full of risk and most of those who try to day trade end up losing money.

One reason for this is that financial markets are dynamic and extremely efficient. Markets are dominated by machines, which means they are very difficult to beat.

Just trust me: “day trading is extremely risky and can result in significant financial losses in a very short period of time.”

Okay, okay, you know about the risks, you've heard them millions of times, but you still want to learn how to day trade.

Well let's get started...

#1. 30 minute range.

This is a day trading strategy that I read about quite a few years ago in a book that I believe was written by Perry Kaufman.

The idea is to watch the market for the first 30 minutes using a 5 minute chart.

You then draw a resistance line on the chart at the highest level the market reached during the first 30 minutes. And draw a support line at the lowest level. This is your range.

Then you wait until the market breaks one of these lines and you enter a trade in that direction.

For example, at 8am GMT yesterday the FTSE 100 opened at 6,507.2. The lowest price in the first 30 minutes was 6503.3, and the highest was 6525.5.

At 9:25 am, the FTSE broke through 6526.3, breaking the upper range and indicating a buy signal. The stop loss can then be placed below the lower range.

Profits can be made using another indicator such as Pivot Levels or RSI. Or you can place your take profit based on the risk:reward ratio. You can also use a trailing stop.

As you can see, the strategy worked out great:

Stanley Druckenmiller

Stanley Druckenmiller grew up in a middle-class family in the suburbs of Philadelphia. He began his career in financial markets in 1977 as an apprentice at a bank in Pittsburgh. He achieved quick success, thanks to which, after four years in the financial markets, he opened his own company - Duquesne Capital Management. For several years he was associated with George Soros, managing his funds.

Stanley Druckenmiller had a huge career as a manager at Quantum Fund from 1988 to 2000. His fame came in 1994 with the publication of the best-selling book The New Market Wizards, which included his story. He ended his career in 2010, two years after the start of the last financial crisis.

# 2. Pivot strategy No. 1

I already mentioned, pivot points are one of my favorite day trading strategies because I know professional day traders still look at them. You can read more about Pivot Levels in this article.

The first simple method of using pivot points is to buy when the market hits a pivot level and sell when the market hits a resistance point.

Make it a rule to only buy at the pivot level if the market is in an uptrend. And sell only at a reversal from the level if the market is in a downward trend.

If the market completely breaks the third support, it is usually not worth buying. Since the price will most likely bounce off the level because traders are taking profits, it is only sometimes that you will be able to take a few pips out of the market.

As you can see in the following example, the FTSE 100 (which is in a multi-month uptrend) has moved nicely from yesterday to the day before. The second resistance was a great place to sell:

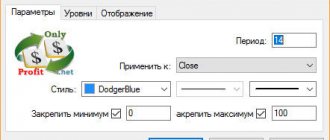

Puria strategy – two indicators and stable profit in the end

Forex strategy "Puria" is based on signals from the MA and MACD indicators. The first one is already familiar to us, and the second one represents a family of oscillators (leading indicators).

MACD was created by Gerald Appel and is one of the best. The indicator uses two exponential MAs, determining their difference.

The intersection of the zero level indicator curve signals a change in the price trend.

In MA we use three moving averages with periods:

- 5 – yellow.

- 75 – red.

- 85 - red.

We configure MACD as follows:

- SMA – 1.

- Fast – 15.

- Slow – 26.

We sell when the yellow moving average breaks through two red moving averages from above, and when the first bar in the MACD closes below the zero level.

We buy when the yellow moving average breaks through the red ones from bottom to top, and one bar in the MACD closes above zero.

Stop loss is set at 14 points. We exit the transaction using Take profit.

# 3. Pivot strategy No. 2

Pivots can be used in a variety of ways and work great as profit targets. And when placing a stop, you must make sure that it is away from the key pivot level.

Another role of the pivot is that it is a trend indicator. So, if the market is above the pivot then it is an uptrend and if the market is below the pivot then it is bearish.

Buying the market as the price goes up from the level and selling when it goes down is another method that traders use.

What distinguishes a speculator from an investor

Speculation refers to trading with repeated purchase and sale of assets while holding a position from several seconds to several weeks - an attempt to make money on price fluctuations over short periods of time. Trading speculation is possible both on a rise in value (long position) and a fall (short position).

An investor buys an asset on the stock market in order to profit from growth and receive dividends.

The terms of investment strategies range from a year to decades.

Classification of speculators

- Scalping. Work within the spread of the order book, quickly buy/sell, up to hundreds of transactions per trading session.

- Intraday. Intraday trading, open positions are not carried over to the next trading day. On average from 1 to 5 transactions per session.

- Swing. A strategy for following short-term stock market trends. Trend is your friend. Work from 1 day.

Investor classification

- Short-term investment - up to 1 year.

- Medium term - from one year to 3 years.

- Long-term - over 3 years.

Warning about Forex and binary options

Binary options are bets on price movements. The name contains an algorithm - all or nothing, winning or completely losing the money you bet. BO in the Russian market is not a strategy, but a roulette that has nothing to do with the stock market. A breeding ground for trade fraud. In some countries they are prohibited, in others they are under the control of regulatory authorities.

Forex is an international interbank currency exchange market. Holes in the legislation of our country allow the existence of companies speculating on this topic.

When signing an agreement with a Forex dealer, you must understand that you bear great risks as a non-professional market participant; you will not apply any strategies here.

# 4. Opening gap

When a Gap occurs at the open, it shows that a large number of traders have moved to one side of the trade, and this imbalance often predicts that the market will continue in that direction.

However, in stocks, scalpers often buy into the market and try to see a closed gap.

There were shares, when it opens below the low of the previous day, when retested, as can be seen from the chart, it gives a good profit.

#5. Create your own levels

Of course, traders look at pivot points and this helps them work.

But pivot points are just simple formulas based on the previous day's price range. After all, it's easy to create your own levels.

A trader I know did just that. He modified the reference levels slightly and used a simple formula to create his own levels, which turned out to have an amazing ability to predict market turns.

Pivot (P) = (top + bottom + close) / 3 R1 = P + (P - bottom) S1 = P - (top - P) R2 = P + (top - bottom) S2 = P - (top - bottom) R3 = top + 2 × (P - bottom) S3 = bottom - 2 × (top - P)

# 6. Chaikin indicator

Many technical indicators seem to do the same thing, just under a different guise. But the Chaikin Volatility Indicator, developed by Mark Chaikin, seems a little different.

The Chaikin Volatility Indicator attempts to match increased volume with price movements, but why is it different?

Take a look at the hourly chart below. While most indicators seem to move in random patterns, Chaikin shows a clear pattern because it takes volume into account.

As you can see, Chaikin crosses the zero line at approximately the same time every day. (Usually around 12 - 2 pm when US markets begin to act).

This helps with timing. So the idea is to buy/sell the market only when it crosses the zero line.

Therefore, if the last candle was green, buy the market when the zero line is crossed, and if the last candle was red, sell when the zero line is crossed. (But don't trade if the RSI is either oversold or overbought). This will put you in a situation where the markets will start to overheat and hold you back when trading stops.

It would be wise to exit the trade when Chaikin is close to his peak, so look for Chaikin when he hits 80-120, or wait for the indicator to turn down.

#7 Combination Indicators (Cowabunga Style)

One of the most popular day trading strategies is indicator aggregation as it helps confirm the trend and direction you want to trade.

One good example of this is the Cowabunga Forex system, which has been discussed on the Baby Pips forum for several years.

The creator of the Cowabunga system looks at two diagrams; a four-hour chart to confirm the long-term trend and a 15-minute chart to enter the trade. Long trades are only taken if the four-hour chart is in an uptrend and the 15-minute chart shows the following:

- The 5 EMA should cross upward the 10 EMA (indicated on my chart by a black candle)

- RSI must be greater than 50

- Stochastic should be directed upward and not be in the overbought zone

- The MACD histogram should go from negative to positive or be negative and begin to increase in value. (We want to catch trends early, so the MACD histogram should be negative).

Also, when using Cowabunga, you should try to avoid markets during press releases.

About us: Admirals

Admirals is a global, award-winning, regulated Forex and CFD broker offering trading in over 8,000 financial instruments on the most popular trading platforms in the world: MetaTrader 4 and MetaTrader 5. Start trading today!

This material does not contain, and should not be construed as containing, investment advice, recommendations or an offer or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future trading as circumstances may change over time. Before making any investment decisions, you should seek the advice of independent financial experts to ensure you understand the risks.

#8. News trading

If robots are so common in today's markets, one way to defeat this would certainly be to respond to news releases.

However, computers are already becoming so smart that they read news feeds and instantly react to events.

However, a good way to trade news is to make sure you know exactly how the market views the situation before the news release occurs and what the traders themselves are expecting.

For example, if markets expect the Federal Reserve to raise interest rates, that effect will already be reflected in the markets, and they won't move too much when it actually happens.

The big move will come when the Fed surprises the market.

The next time the Fed meets to discuss interest rates (or whenever a big event looms), decide what outcome the market expects and analyze whether the event will make sense for the unexpected outcome.

Placing a trade shortly before an event and then closing it once the market has priced in the new situation is a good strategy for day traders.

The important point is not to jump on board with an old press release, but to know the importance of the announcement and how much of a surprise it will be to the markets.

If it is a big surprise, there will be a large and prolonged movement, and may even last for several days. These events provide more opportunities for profit.

Another method of news trading is to simply keep your ear to the ground when the market is open.

There are many companies that offer live news streaming, although it is expensive.

You will have no luck with liquid and heavily traded markets because bank traders and hedge funds get information faster. But maybe you could create a small watchlist of traded stocks and keep an eye on any big news.

What made Steven Cohen one of the most famous day traders?

Steven Cohen was born in 1957 in Great Neck, New York. In November 2011, he was ranked 35th on Forbes' list of America's 400 richest people. Currently, his net worth is estimated at $8.3 billion! Why is he one of the most famous traders today?

He is known for his uncanny ability to make money in any market condition. BusinessWeek magazine called Cohen "the most powerful trader on Wall Street." He is the founder of SAC Capital Partners.

He studied economics at the University of Pennsylvania, played poker, and became interested in the stock market. In 1978, Cohen took a job at Gruntal, where he earned $8,000 for the company on his first day. As a top day trader, Cohen earned the organization approximately $100,000 a day. By 1984, he managed a $75 million portfolio and a team of six traders. There were transactions in his account that helped Gruntal cover losses incurred due to the transactions of other traders.

In 1992, after leaving Gruntal, Cohen opened the hedge fund SAC Capital Partners, investing $20 million of his own money into it (today the company manages more than $12 billion). At the time, the hedge fund industry was still relatively small, and the bull market of the 1990s was just heating up.

SAC Capital Partners currently employs more than 600 people. However, Cohen still makes many of his own deals. He starts his workday at 8 a.m. and monitors market charts on his monitors, suggesting ideas to employees. About 15% of the company's profit comes from the operations it performs!

#9. Absorption Candles

There is a lot of debate about the effectiveness of using candlesticks in trading, but one thing is for sure, there are very few traders who use anything other than candlestick charts when trading.

Probably my favorite candlestick pattern is the bearish or bullish engulfing pattern.

A Bullish Engulfing pattern occurs when a bearish red candle is immediately followed by a large green candle that completely engulfs the previous day's candle.

The Bearish Engulfing picture is simply the opposite. A good example of this occurred the other day for the EUR/GBP pair

#10. Doji candlestick

They occur when the price moves up, down, but ends up where it started. Therefore, the candle has a barely noticeable body, and two long wicks coming out from the top and bottom.

Doji indicate uncertainty, so they can signal a reversal, and often occur during major news events.

The best way to day trade Doji depends on the long term trend. If the market falls and then enters a big Doji, you should take this signal as a bullish sign and look to buy. If the market develops and there is a doji, you should sell.

Doji is one type of trading that should probably always be combined with some other strategy.

Breakout strategy - an organic combination of technical and fundamental analysis

Special mention should be made of Forex breakout strategies. They are based on the phenomenon of a breakdown of an important price level. This usually happens with the participation of large market players.

If the price adheres to the corridor for a long time, then at some point it will leave it. The Forex breakout strategy is based not only on technical analysis, but also on a deep understanding of the psychology of market tycoons aimed at super-profits.

For such a profit to appear, the majority of trading participants must generate it from their losses.

#11. Pairs trading

Pairs trading is quite simple, but again, it is difficult to succeed when the markets are so efficient.

First of all, you need to look for two stocks in the same category that are moving in different directions, and for this you can use different market scanners. For example, on Finviz or on the Thinkorswim trading platform.

The idea is to sell the weaker stock and buy the strongest one (in the same category). You should hold the trade for no more than one day and exit when you have made a good profit.

Ray Dalio

Raymond Dalio is an American investor and billionaire, hedge fund chairman and philanthropist. Dalio is the founder of the investment firm Bridgewater Associates, one of the largest hedge funds in the world. In January 2022, he was among the 100 richest people in the world (according to Bloomberg).

“I believe that the biggest problem of humanity is emotional sensitivity in situations where we find out whether we are right or wrong, and determine our strengths and weaknesses.”

This quote is very profound for several reasons. First of all, sensitivity is highly undesirable in trading. If you worry too much about every losing trade, you will start making a series of serious mistakes. Secondly, whether you are right should be 100% irrelevant to you. According to Mark Douglas, you can be wrong more often than you are right and still make money. Ultimately, you must identify your strengths and weaknesses before you can succeed in trading. Our personality influences our trading, and this influence can be both negative and positive.

#12. Trend lines

The problem with technical indicators is that they inherently lag. Behind them are traders from all over the world who receive the same signals.

This is why many successful day traders ignore indicators and only look at naked price patterns.

Trendlines are the cornerstone of technical analysis and trend trading. Anyone can draw trend lines on a chart using a modern mapping package.

Upward trend lines must be connected by at least two higher levels, and downward trend lines must be connected by at least two lower highs. But the trick to trendline trading is strict risk management and careful position sizing.

In this example, a break of the downtrend line is a good buy signal. The new uptrend line gives the trader room for a stop. The stop can then be moved as the trend progresses.

It is equally important to trade the correct position size. If you are unable to estimate the odds of your trade, use the Kelly calculator ++https://www.albionresearch.com/kelly/+ and you can find the correct position size to use in your trade.

#13. Triangle patterns

Triangle patterns are formed from converging trend lines so can be traded in a similar way and I have covered them in detail here.

Triangle patterns such as wedges are useful for finding markets that are about to enter new trends. They are useful because you can immediately start trading a new trend without having to wait for technical indicator crossovers.

Larry Williams

Larry Williams was born on October 6, 1942 in Miles. He graduated from Billings High School in 1960 and from Oregon State University in 1964. He began trading in financial markets in 1962. In 1966, Larry Williams became a professional stock trader. He is also a writer - the author of many books related to technical analysis:

- Secrets of trading in the futures market

- Long-term secrets of short-term trading

the World Futures Championship in 1987 achieving a return rate of 11,376%. In turn, during training sessions where he conducted live trading sessions, he earned $1.2 million (1999-2006).

#14. Correlation

Another thing to pay attention to when day trading is the different correlations between assets.

You can apply a technical technique and create correlation matrices. This way, you can buy an asset when the correlation moves away from the average. Or you can keep it simple and just use common sense.

The idea is to find which markets move together and which move inversely.

For example, crude oil and the US dollar typically move in opposite directions (because oil is priced in dollars, after all). This means that when the dollar falls, oil becomes more expensive and increases in price.

But these correlations don't always last, and when they break, it presents a golden opportunity to trigger a hedged trade.

For example, if your analysis says oil supplies are rising, but you also think the dollar will rise (perhaps because the US economy is growing and the Fed wants to raise rates), you could buy both the dollar and oil at the same time.

They usually cancel each other out, but in certain scenarios they can provide low-risk trades.

Kerry trade

Carry trade is used by many large companies around the world to generate significant interest income. Essentially, you buy a currency with a higher interest rate and sell a currency with a lower interest rate.

So, for example, if the Australian dollar has a 4% interest rate and the Japanese yen has a 1% interest rate, then buying the AUD/JPY pair will give a net 3% interest rate and this is considered a positive carry trade.

On the other hand, if you sold the AUD/JPY pair, you would pay a 3 percent interest rate. This is considered a negative trade. Traders should be aware of the impact of carryover trades when they buy and sell currencies because negative costs can sometimes eat up potential profits above expected returns.

You may be wondering why such a low interest rate would be attractive? It is important to remember that with this trading technique you can earn multiples of the difference in interest rates. For example, based on the 3% we mentioned earlier, a position with 1:10 leverage could potentially earn 30% per annum.

Now, although a carry trade sounds like a no-loss trade, the reality is that you should still be aware of potential market fluctuations while you hold your position. Depending on whether the market moves in the direction of a positive carry trade, you can make a profit or loss that exceeds the interest rate differential.

Essentially, the best carry trades are those that not only have an attractive interest rate differential, but also a positive market bias in the direction you choose.

# 15. Pump and dump on the stock exchange (Pump and dumps or P&D)

Penny stocks (trading as low as $1) have caused people to lose a lot of money over the years and should generally be avoided.

Penny stock promoters pay to promote worthless companies, which are usually little more than "projectiles" for shadier operations.

Marketing campaigns push ultra-cheap stocks down to a couple of cents and allow promoters to get their money back and more. They then sell their shares, leaving those who bought them with large losses.

But is it possible to take advantage of fraud by going the other way?

Tim Sykes is a stock trader who watches for scams in Penny Stocks, then he tries to sell them once they are pumped up by the promoters.

The moves from some of these dumps can be very sharp and fast, making them ideal for day traders.

So what pump and dump should you look for? Marijuana, solar energy, bitcoin, biotechnology, mining, foreign companies.

Andy Krieger

Andy Krieger is a trader who worked for the investment bank Salomon Brothers and one of the largest US banks of the 20th century, Bankers Trust.

He joined Bankers Trust in 1986 and quickly gained a reputation as an excellent trader. Thanks to Edney, his employer raised his managed capital limit by $700 million from the standard $50 million.

His most successful deal occurred on October 19, 1987, the so-called Black Monday. In October 1987, the Dow Jones index fell 22.6%, so investors began to invest in other, more stable assets. Andy realized that since everyone invests in everything, there are 1-2 national currencies that are overvalued. Therefore, he focused on the New Zealand dollar, which he considered an excellent currency for short selling in case of panic in global financial markets. During this crisis, Andrew Krieger used a 1:400 leverage on his allocated capital and thereby opened a short position on the NZU/USD pair worth more than the then money supply in New Zealand (the country's Central Bank was not ready for this, so the exchange rate decreased by 5%). According to preliminary estimates, between 30 and 40 million US dollars were actually invested.

This deal made Andy $300 million for Bankers Trust. To stop the financial attack, the head of the Central Bank of New Zealand called and threatened the heads of the American bank.

In 1988, Andy Krieger resigned from Bankers Trust and got a job at the D. Soros Foundation. Later, he told reporters that he quit because of a feeling of resentment - she earned 300 million dollars for the bank, but received only 3 million in gratitude.

#16. Go with the flow - read the feed

Jesse Livermore is one of the most famous stock traders of all time, and he is known for relying on his tape reading skills and pure price action.

Jesse traded so much in the market that he developed an intuition. Because of this, he never needed anything more than bare price sequence to open trades.

Trading this way requires you to go with the flow. You tune into the market and become “one” with it without trying to predict.

It may take years of practice, but it still works...

For example, a Japanese CIS day trader can monitor hundreds of different markets and sense when a stock is about to move. He "monitors chats and has his eyes glued to the bid-ask screens." He typically looks at the 300 most heavily traded stocks.

And his only rule is: “buy shares that are being bought and sell shares that are being sold.”

Joe Ross

Joe Ross is a world-renowned trader and investor with over 50 years of experience in the markets. He was educated at UCLA and George Washington University in Norfolk, Virginia. He started his. work in financial markets very early, at the age of 14. Thanks to its strategy, in which low operational risk is key, constantly adapted to current market conditions, it has survived more than one global financial crisis.

Joe Ross is the author of several original investment strategies, and for many years (since the 1980s) he has been teaching young students how to navigate the financial markets and minimize investment risk. In addition, Joe Ross is the author of 12 books on investing. The most famous of them:

- "Trading Guide"

- Law of graphs

- "Hook Trade"

#17. Moving averages and long-term trend

Another thing Jesse Livermore teaches is that nothing is more important than the long-term trend. In other words, are you in a bull market or a bear market?

I know traders who enter a bull market and try to sell every day, simply because it seems like the most natural thing to do. After all, the market is more expensive than yesterday, so it should be lower today.

This is the most difficult way, since the trend continues on and on.

An easier way to trade is to determine the direction you want to trade and then use short-term indicators to enter your positions.

In fact, it may be the easiest way to trade, whether you are a beginner or a professional.

If you are in a bull market, trade long positions. And if the 20th MA crosses the 50 Moving Average, open a position.

Likewise, if you are in a bear market, only trade short.

#18. Build a mechanical trading system

If you want to build a mechanical day trading system and test it using a program like Amibroker or TradeStaion, you're in for a big hit.

Building an intraday system will bring with it a very long list of obstacles, and it is an expensive and time-consuming process.

In fact, I will save you time by telling you not to try to use an automated trading system for day trading (especially Forex). You simply cannot make money from this. Not when you're playing against Goldman Sachs and the "robots."

The best bet would be to create a basic trading system that at least breaks even.

Then use your human intuition and market knowledge to join forces with the robot and come out ahead.

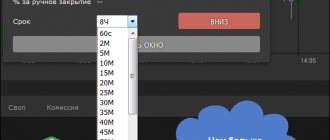

Trading strategy 5 Minute Binary Option V6.1

A long-suffering trading strategy, which I finished testing just yesterday. But on the other hand, I liked the 5 Minute Binary Option V6.1 strategy for its simplicity and the ability to completely turn off the brain - there is nothing complicated about it. Well, no, you sit and wait for the arrow to appear, after which you look at the filter indicator and, if there are conditions for entry, make a deal. A child can handle it too.

Technical characteristics of the trading strategy 5 Minute Binary Option V6.1:

- Asset: any currency pair

- Time Frame: M5

- Expiration time: end of current candle

- Profitability: 65-75%

- Number of signals: enough to keep you awake (trade multiple assets)

Suitable brokers for the 5 Minute Binary Option V6.1 strategy:

- Binomo

- IQ Option

Example of trading using the 5 Minute Binary Option V6.1 strategy:

Learn more about the 5 Minute Binary Option V6.1 strategy

#19. Use of screening and online tools

In the next article, I will discuss some free online tools that traders use while trading. They are mainly designed for medium to long term trading, but you can use them for day trading as well.

Using a stock screener such as Finviz or Google Screener, you can display stocks that you think might be good candidates to buy or sell during day trading.

Look for high volume stocks that are significantly oversold or overbought according to RSI or technical readings. Combine these readings with fundamental indicators such as PE or PEG.

Let's say you find a stock with a PE below 15, PEG below 1, RSI of 18, and high insider ownership. You could buy at the open and exit at the close.

Overall, while there is momentum in short-term day trading, fundamental value drivers can take a long time to change.

You can also look for interesting articles on Seeking Alpha Pro that may be relevant in your next session.

Or, browse StockTwits and Twitter for stocks that are experiencing high social volume.

If you see a stock market starting to trade on StockTwits, take a look at the price chart. Maybe it is near a support level or maybe it is about to break a trend line. Keep watching it and if it breaks out you will have your deal.

Neil Fuller

Nial Fuller is a profitable trader, trainer and author of widely understood trading techniques. He has over 12 years of financial experience. He is an expert in price action trading.

Since founding his blog in 2008, Nial Fuller has been the most popular Forex trader in the world, with over a quarter of a million monthly readers. You can find more about Price Action here.

#20. Just sit and wait.

Sometimes the best approach for a day trader is to do nothing. Short-term opportunities rarely arise, so traders must learn to do nothing at all until a suitable opportunity arises.

Wait on the sidelines and don't take any action until something really big happens that is so incredible that it would be a mistake to miss it.

If you stay focused and continue to do your analysis and research, these opportunities will actually become more frequent, which is what most traders realize.

But if the markets are calm and there are no trends or opportunities, just do nothing.

Even day traders don't have to trade every day.

- Tweet

- Share 0

- +1

- LinkedIn 0

- VKontakte