At the end of 2022, the Central Bank issued a Russian license to Alfa-Forex LLC. From that moment on, the company became an official participant in the securities market to carry out the activities of a forex dealer in the Russian Federation.

The licensing procedure at the Central Bank has been a mandatory requirement since 2016 according to the Forex Law.

history of the company

When searching for information about this broker, there is sometimes a little confusion with dates. If we talk about the time of creation of the Alfa Group group of companies, it was 1989, only then their activities were in no way connected with trading. But the company Alfa Forex Limited , which we will talk about today, was founded in 2003 . So, in terms of age Alfa-Forex is slightly inferior to the old-timers of the market, but still, 13 years of work can be considered a long time and count on the absence of pitfalls.

In 2005 , the London office of Alfa Capital Markets was opened, and the company can be considered to have entered the international level . At the moment, when studying the documentation, it is clear that the registration is offshore (British Virgin Islands), while regulation is carried out by Cysec. Let me remind you once again - you shouldn’t be afraid of offshore companies, almost all brokers do this.

For those who are worried about the safety of their deposits and the quick resolution of possible problems, I would advise you to pay attention to the fact that the broker is associated with Alfa Bank . You can verify this yourself; just go to the bank’s website and find the company name in the list of affiliates. The screenshot shows the mention of the broker in the latest list dated September 30, 2016 .

I would like to note separately that the regulator may not resolve your conflict with the company (I hope it won’t come to that). But possible reputational losses may force the bank to meet you halfway. Remember that formally you will need to contact the regulator; Alfa Bank is not obliged to pay you anything. There is no document that would oblige him to do this .

A connection with a bank might make you think that the broker provides banking forex services, but this is not the case. If you are interested in this type of activity, then pay attention to VTB24 - this is banking forex in its purest form. However, the connection with the bank makes you take Alfa-Forex more seriously than simple companies registered offshore. So there is still a certain advantage from this.

Register an account with Alpha Forex

Alfa Forex has several truly unique offers for traders. Some of them really help in trading.

Features of trading with Alfa-Forex

At Alfa Forex, a trader will not find a variety of account types (nano, micro, standard, Stp, etc.) and many options for depositing funds. The company provides a couple of account options with different conditions and rather meager methods for making a deposit (the fastest and commission-free are associated with Alfa-Bank). Judging by the reviews, Alfa-Forex clients don’t particularly like this.

Trading conditions

The trading conditions for an account opened on the MT5 platform differ from the trading conditions for an account opened on MT4 (minimum order, step, leverage size and method of execution of a trading order). In addition, the amount of leverage within one trading platform may differ for different instruments. Therefore, I recommend carefully studying the margin requirements, and if something is not clear, contact support; fortunately, their employees are almost always on site and work quite professionally.

Applications for depositing and withdrawing funds in the WebMoney PS are processed the fastest, and the cheapest way is to replenish and withdraw funds through Alfa-Click or by bank transfer to Alfa-Bank. It is worth considering that Alfa-Forex is sensitive to payment details; after entering funds from a WebMoney wallet, you cannot withdraw them through other payment systems.

Traders using the ZuluTrade trade copying service will be pleased with the quality of communication. Slippage on signals is close to zero. If you are planning to engage in automated trading and were thinking about opening an account with the native broker for ZuluTrade (AAAFX), then it is better to stick with Alfa-Forex. Slippage is identical in both cases, and the comfort from using Alfa-Forex is undoubtedly higher.

I also recommend reading:

RAMM trades copying service from AMarkets

What is the RAMM service and how to copy trades in it

Alfa-Forex allows you to trade through the ActTrader terminal. However, traders should take into account the fact that it is not yet technically possible to use it in PAMM accounts and that the account currency in ActTrader can only be USD.

Alfa-Forex bonds

Bonds from Alfa-Forex (link) are a new and quite interesting instrument, but it is worth calculating in advance all the risks associated with leverage and the changing economic situation in the Russian Federation and abroad. The following video reveals the details of working with Alpha bonds.

Since all bonds are associated with the largest enterprises in Russia, they will undoubtedly feel the ambiguity of the current economic situation. In general, on the one hand, it is quite interesting and attractive, but on the other hand, a stop out (60% or an 8% change in the asset price when using leverage) eliminates most trading vehicles. A forward contract for USDRUB (which is also quite new for Forex) in this case is both more interesting and easier for a trader and can be traded with a leverage of 1:25 as a standard instrument of the foreign exchange market.

Online currency exchange

Nowadays, currency exchange has ceased to be a problem, and there is no point in standing in line at the coveted exchange window. The only problem is that the exchange rate is often unprofitable. If you change $100, the lost amount will not be that big, but what if the amount is $10,000? What if $100,000...?

Alfa-Forex offers a really useful service - online . Its meaning is that the conversion occurs at the most favorable rate at the moment. When exchanging large amounts, you save a lot.

The exchange is carried out according to the following scheme:

- First you need to open 2 accounts with the broker , in different currencies . If you need, for example, to exchange euros for rubles, then accounts must be opened in euros and Russian currency;

- fill out conversion form ;

- after this, the current market rate is requested ;

- the last step is the actual exchange. Click “ Confirm ” and the exchange takes place.

The commission is only 22 kopecks , there is a mobile application for working from a tablet or phone. The company also offers absolutely free deposits and withdrawals, so such an exchange has enough advantages.

Conclusions for a licensed AF dealer

Without a doubt, the “white” forex dealer Alfa-Forex is truly worthy of your attention! Even if you do not delve into the study of its real advantages, trust is aroused by the mere mention that its founder is Alfa-Bank, whose impeccable reputation is well known to many. The entire banking group, including AB and the subsidiary AF, is extremely concerned about the reputation of the entire holding as a whole - it is in accordance with this that personnel are selected for each department, structure or branch. Of course, a bank with such a rich long-term history could not “give birth” to a forex dealer engaged in fraud and taking money from honest citizens - this is completely out of the question! Obtaining a domestic license, necessary for conducting honest activities, only complemented the overall picture of Alfa-Forex as a guarantor of stability and reliability in conducting forex transactions. That is why, by choosing Alfa-Forex as a forex dealer , you can be absolutely sure that your savings are in good hands, and any transactions are crystal honest and transparent .

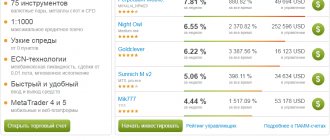

PAMM accounts Alfa-Forex

Formally, this broker’s PAMM investment capabilities are the same as those of other companies. But there are a couple of features that are not in favor of Alpha . I'll briefly go over the main ones:

- It is impossible to find a rating of PAMM accounts on the company’s website . This seems incredible, but there is a mention of PAMMs in the investment section and that’s it, it’s impossible to see the rating. In order to still get into it, you will have to register and gain access through your personal account, this is the only way that works. Registration of a personal account is also not the fastest; in 4 stages you need to provide a lot of information. Only after this can you get into the rating;

- There are practically no filters , so choosing the best PAMM accounts is difficult if you don’t know its name.

The company's attitude towards PAMMs

Sometimes I get the impression that PAMM's behavior is very incomprehensible. Even if the people responsible for this did not understand how to organize work with PAMM accounts, then at least they could look at the example of competitors. Hence the conclusion - Alfa-Forex simply does not consider PAMM accounts as something serious, at least these are the thoughts that come to mind.

The lack of filters is generally a topic for a separate discussion. Accounts can be sorted by age, amount of funds raised and a couple of other parameters. Where are the filters for maximum drawdown, the number of transactions completed per unit of time, and currency pairs? There is none of this .

Investments in rubles

Another interesting feature is that in terms of volume, ruble accounts prevail over dollar and euro accounts . As a possible explanation for this phenomenon, I would say that it is convenient to attract investments in rubles, and it is convenient to replenish accounts in this currency (do not forget about the connection between Alfa Bank and the broker).

But for traders, investing in rubles is not the most profitable option. It is enough to compare the amount of inflation (in the USA it is always less than in Russia) to understand that the ruble will constantly depreciate faster than the American currency. And if we take into account the behavior of the ruble during the crisis, then it loses a significant share of its attractiveness as an investment currency. Of course, we can say that the company compensates for this with higher interest rates on ruble deposits, but this does not help much.

Fall in the number of PAMMs in 2016

I noticed one more nuance when studying the number of PAMMs - the graph shows a sharp change in their number in mid-2016 . This reduction in quantity is due to the fact that the company changed the method of counting them.

If previously all accounts were taken into account indiscriminately, now only those accounts on which managers have been active during the last 3 weeks . This led to such a decline in the total number of PAMMs; some of the inactive accounts were no longer taken into account. But in general, the dynamics are positive - both the number of accounts and the number of funds raised are growing.

In general, working with PAMM accounts is organized very inconveniently . The worst thing I've ever seen.

GENERAL CONDITIONS OF COOPERATION

Initially, a Cypriot forex broker, officially registered in 2016, operated under this brand. However, after 2 years, a reorganization was carried out, as a result of which the company’s place of registration changed. The company received official permission to carry out brokerage activities in Russia.

The Alfa-Forex trademark belongs to the financial holding company ABH Holdings SA. According to the latest amendments to the law on the interbank foreign exchange market, brokerage activities have the right to be carried out exclusively by subsidiaries of banking institutions. The dealer in question fully complies with this requirement, therefore, in 2022, it received a perpetual license from the Central Bank of the Russian Federation.

The company in question is also included in the Forex Dealers Association. The broker operates absolutely legally in Russia. All investor rights are reserved. In the event of bankruptcy of the organization, they will be compensated for financial losses from the compensation fund.

Contracts for Difference CFDs

Let me remind you of the meaning of trading contracts for difference: one party to the transaction undertakes to transfer the difference between the value of the asset to the other party at the end of the contract. For example, you bought shares of a company, and at the end of the contract they increased in price. In this case, you will make a profit.

Alfa-Forex offers its clients to trade CFDs not only on shares of Western companies, but also on domestic , as well as on commodity market products and stock indices. So the trader has a choice, and a pretty good one.

Among the features of trading contracts for difference at Alfa-Forex I can highlight:

- big choice . Over 100 tools available;

- fixed leverage 1:20;

- low entry threshold , you can trade with only $100 in your account;

- if the transaction size exceeds 0.01 lot, then the swap will not be charged to you. As for the commission, the minimum value is 0.07 points;

- if you invested in US stocks, you receive quarterly dividends ;

- trading is carried out through the usual MT4 and MT5 , as well as their mobile versions.

It is also worth paying attention to the fact that the amount of leverage/Stop Out level depends on the size of your deposit.

For example, for the US SPX 500 Index for different deposit sizes these values will be:

- up to $50,000 – 1:20/20% (leverage and Stop Out level, respectively);

- from $50,000 to $200,000 – 1:10/20%;

- from $200,000 to $2 million – 1:5/27%;

- over $2 million – 1:3/40%.

Required skill level for the job

This broker does not offer cent accounts and limits leverage. Thus, Alpha Forex does not allow beginners to trade with a limited deposit. They can deposit a small amount, but given the level of leverage available, trading with such a trading account is very risky.

On the other hand, high speed and reliability make this broker a good choice for experienced traders. It is worth noting that the company does not offer training courses, hoping that knowledgeable clients come to work here.

If you have any questions, you can contact support. At Alfa Forex, she is attentive to clients, kindly and professionally solving problems with which they were approached.

Conclusion

The Alfa Forex company provides traders with the opportunity to work on world and Russian exchanges on favorable terms. It is mainly focused on providing services not to beginners, but to experienced traders. The diverse capabilities available to customers are combined with high reliability and quality of work.

Related posts:

- Review of Forex brokers 2022 - list of reliable and proven ones

- Exchange lots - what is it, full description

- What qualities do you need to have to be successful...

- How to trade stock indices on Forex

- PAMM - how it works and how to choose the right one

- How to choose a broker for investment for a beginner - top 5...

- Stock Broker - who is it and how to choose one

- How to choose a broker for the stock exchange - what...

Eurobonds of Russian companies

The main advantage of investments of this kind is the possibility of receiving dividends at the level of 26% per year . This offer only works if you invest currency in shares of Russian companies . Trading stocks may seem daunting for beginners, but in reality you can earn good income without much risk or effort.

This method of investment can be considered as a replacement for the usual bank deposit , judge for yourself:

- you get more than the bank can offer;

- at any time you have the opportunity to withdraw your funds . Moreover, the conclusion can be made either complete or partial;

- your income will consist of 2 parts : guaranteed income from the coupon + profit due to the increase in the value of the shares themselves.

To better understand the algorithm of such investments, I will explain:

- By purchasing shares of a company, you give that same company the opportunity to manage your funds. You could say you are lending to her;

- any debtor pays his creditor , this rule also works here. That is, the company pays you a commission (the same coupon income), due to this, a constant part of the income is formed.

Now a couple of features of investing in stocks:

- low entry threshold - you can start investing as early as $1000;

- shares of more than 20 largest companies in the Russian Federation , including Gazprom, Lukoil, Alfa-Bank;

- You can trade through your personal account ; no additional software needs to be installed. So you can invest from literally any PC with access to the Internet.

Trading platforms

The broker offers, first of all, those platforms to which traders and investors around the world are already accustomed, namely MetaTrader 4 and 5, ZuluTrade, as well as ActTrader - the company’s own development. Most of these platforms are compatible not only with PCs, but also with mobile devices from Apple and Android. On the broker's website you can easily download software for your specific device.

Leave your feedback about Alfa Forex! Perhaps we missed something in the review, or you have something to say about the services - be sure to share your opinion: thereby, you will benefit other traders.

We also recommend reading Teletrade reviews

Zulutrade from Alfa-Forex

Each broker gives its clients the opportunity to copy the signals of other, more experienced traders. Alfa-Forex offers this opportunity through a separate online platform – Zulu Trade .

In Zulu Trade, you can familiarize yourself with the rating of the best signal providers, choose the one you like, and then copy its entries into the market.

Among the features I would like to note:

- inability to use the service for PAMMs , only for a personal account;

- there is no possibility to trade CFDs ;

- the spread is a little higher , but that's normal. The fact is that the company includes a small fee for using the transaction copying service;

- no requotes;

- If you wish, you can trade on the created account yourself. That is, transactions created by the manager can be closed independently and entered into the market independently.

If you are planning to trade using this service, let me remind you that the company does not guarantee profitable work on the selected account . Even if he showed excellent results in the past, there is no guarantee that the work will be carried out as effectively in the future.

As for the recommendations, they are standard:

- choose a signal provider only from among those who work on real accounts;

- large account age = high reliability of the strategy used;

- the number of funds raised shows the level of trust;

- also study the deposit growth curve . Ideally, it should not have sharp drawdowns, because this is an indirect confirmation that the manager uses martingale in trading.

Alfa-Forex offers good trading conditions, surpassing its competitors in a number of indicators. Let's take a closer look at the tools for a trader.

Application of Zulu Trade

The work of a trader is associated with high risk. Those who want to reduce it can start copying the trades of professional traders. The Zulu Trade platform can help them with this. Users have the opportunity to select the most suitable candidate and receive signals from him to open and close positions. There are several restrictions here:

- This service cannot be used by traders working on PAMM accounts.

- Zulu Trade is not available when working with CFD contracts.

When working with this platform, the spread will be slightly larger - the broker in this form receives a fee for providing such services.

Trading conditions

In principle, Alfa-Forex’s trading conditions are not much different from what its competitors offer:

- trading can be carried out on more than 160 currency pairs . Of course, this cannot be considered a key advantage. Still, most traders limit themselves to majors and a couple of the most popular crosses, so a few dozen pairs would be enough;

- an account not only in dollars, but also in rubles and euros ;

- As for execution , I suspect that a lot depends on the specific account. That is, there is a kind of hybrid - combining “kitchen” + market execution for large orders;

- the company actively promotes trading in ruble pairs - here the spread is simply ridiculous (at the level of 1-2 kopecks) and exclusive liquidity throughout the working week.

As for leverage and Stop Out level, these parameters depend on the size of the deposit.

There is the following dependency:

- for a deposit of up to $50,000, the leverage and Stop Out level are 1:200 and 20% , respectively;

- from $50,000 to $200,000 – 1:100/20%;

- from $200,000 to $2,000,000 – 1:50/27%;

- for a deposit over 2,000,000 – 1:50/40%.

The above numbers are valid only for the EUR/USD currency pair; for other instruments these figures may differ depending on the size of the deposit. But in general, the trend continues: the larger the deposit, the lower the maximum leverage and the higher the StopOut level.

Alfa Forex review and specialist reviews about it

Trading conditions for Alfa Forex clients

Familiarity with the broker's trading conditions confirms their compliance with all regulatory requirements:

- The maximum leverage is 1:40;

- There are no consulting services;

- There is no possibility of passive income;

- The amount of capital at the start depends directly on the trading strategy that the speculator chooses.

For fans of long-term transactions, we can recommend the EUR/RUR and USD/RUR pairs. In the contract specifications, the commission for transferring a trading position to the next day immediately attracts attention. With a correct analysis of the current market situation, open sell orders can give a good profit depending on the volume of the transaction.

Also, speculators should remember the triple swap amount that the broker takes on the night from Wednesday to Thursday for all pairs except EUR/RUR, USD/RUR, USD/CAD. For them, the commission is charged from Thursday to Friday, which is what many traders emphasize in their reviews.

As for the types of trading accounts, the project developers provide two types:

Account for hedging orders. Here, each open position is taken into account separately. You can open several transactions for one instrument in any direction; Unhedged account. An account that provides for mutual exchange when opening multidirectional positions. For one instrument, all positions are combined.

There are no minimum start-up capital requirements. To calculate the required level of funds, the trader needs to go to the “Trading conditions” section (the “margin requirements” tab).

This is where the minimum capital required to maintain an open position is indicated. Tariffs are quite reasonable.

Registering an account with Alpha Direct

To register with the Alfa-Forex broker, you must fill out the form provided by the developers.

This is an option for those who have not yet been a client of Alfa-Bank JSC. After filling out this form, the bank manager contacts the potential client. Subsequently, he will request passport data, TIN and SNILS. To register, you also need to have Russian citizenship.

The account opening process lasts from several hours and can take up to two business days.

After you transfer the documents to your personal account (a personal visit to the office is an option), your passport is checked, a trading account is opened in MT and a special section is created in Alfa-Bank for a nominal account. To replenish your account, you will receive all information and step-by-step connection to the working terminal by email. email specified during registration.

When registering for a project, it would be a good idea to read the user agreement. Its analogue is the Framework Agreement.

Externally it looks like this and is certified by a seal. The document excludes conflicts of interest and is focused on the main requests of the target audience.

BEST FOREX BROKERS ACCORDING TO INTERFAX DATA

Top ECN broker, operating for over 20 years!

Now I additionally receive income from their cashback promotion ==>>> CASHBASK FROM ALPARI | review / reviews 2010. Certified by CROFR! | MAXIMUM BONUS | review / reviews Verified foreign broker |

START WITH 10USD | review / reviews Included in the TOP 3 leading ratings of Forex brokers. Great for Russia | MAXIMUM $1500 BONUS | review/feedback AS WELL AS THE BEST BINARY OPTIONS BROKERS IN 2022:

This options broker has the best reputation on the web!

| START WITH 10$ | review / reviews New fixed options. These are the only ones! | START WITH 1$ | review/feedback

Account types

As soon as I began to study the available account types, I immediately noticed the lack of recently popular ECN accounts . Not that this is a critical drawback, it’s just strange - there are competitors, and for quite a long time, but Alfa-Forex is not active in this area. Otherwise, everything is standard: several types of regular ones and a demo account.

Brief description of company account types:

- MT4/MT5 trading account – as the name suggests, they are intended for trading through the MT4/MT5 terminal (both can be downloaded from the company’s website). The main accounts through which traders trade have all major currency pairs;

- affiliate account – needed only to make a profit if you managed to attract a new client;

- ZuluTrade accounts – you should create them only if you are going to use the transaction copying service. If not, then it would be more logical to stick to standard MT4/MT5 accounts;

- SwapFreeMT4MT5 – swap-free accounts for trading in MT4 and MT5, respectively. That is, there will be no charge for transferring a position to the next day;

- BondsMT5 – involves investing in bonds of Russian companies;

- MT5 CFD account – allows you to trade contracts for difference via MT5;

- In order to practice without losing anything, you can open a demo account on Forex and work with virtual money.

About the proposed conditions

Although a small deposit is allowed, clients are not offered the option of using cent accounts. Therefore, depositing small amounts is risky and can quickly lead to losses.

Alfa Forex has a reputation as a broker that provides high speed transaction execution. There have been rare cases where communication was lost for a short time.

The spreads used are relatively small. The minimum spread is used for the EUR/USD pair. It is equal to 1.7 points. For GBP/USD the spread reaches 2.2 points. For AUD/USD it can reach even higher values of 2.8.

- What are trading accounts?

Here you can not only make transactions yourself, but also resort to using PAMM accounts. However, the company has a poorly organized process for analyzing the effectiveness of such traders. A client planning to invest in them receives insufficient information to make an informed choice. Information about traders on the site includes data on the volume of funds, working hours and similar. At the same time, it is impossible to obtain information about the number of completed transactions, maximum drawdowns and other parameters of trading efficiency.

The broker makes it possible to invest in Russian bonds. This is a profitable opportunity to earn money - you can usually count on payments of at least 20% per annum. Such investments are a good alternative to deposits.

Analytics from Alfa-Forex

After reading this section, it becomes not entirely clear why it was created on the site at all. Most likely, because it’s supposed to be that way, there’s a problem with filling.

Let me briefly go through the main points of the analysis:

- review of the day – the section is updated once a day;

- dealer reviews – briefly describes the main news and the market reaction to them. Updates occur once a day;

- brief and uninformative comments on key events in the analyst’s opinion. There are no screenshots indicating the support/resistance levels noted in the text, the comments are uninformative ;

- online quotes – current exchange rates are displayed online;

- technical analysis - resembles the same comments on the market, just more levels are indicated. Again, there are no screenshots, so it is almost impossible to use the technical analysis in the form in which it is presented on the site. The section is updated at best once a day;

- advanced technical analysis finally invites us to look at the author’s analytics in screenshots of charts. I don’t presume to judge the reliability of the analysis, but the fact that the information in this section may not be updated for a whole week is surprising;

- economic articles - chapter long abandoned.

The last update was at the beginning of July 2016, that is, almost six months have passed, and not a single new material has been added.

To summarize, we can say that the company is not at all interested in providing analytics to its clients , and the section was created simply because it is customary, and all other brokers have it. Again, this cannot be considered a critical drawback; I don’t know a single consistently earning trader who works using broker analytics. This information is also unlikely to be useful to large clients.

Estimation of Alfa-forex trading costs.

To assess trading conditions, I opened and closed 10 orders with a minimum lot (0.01) for the EUR/USD pair. Traded for 2 days: 04/03/15 and 04/06/15. The most memorable day was the 3rd: the first Friday of the month, the release of non-farm payrolls (or Unemployment Rate) in the USA. I couldn’t help but take advantage of this opportunity to check the execution of orders at high volatility. About half an hour before the news came out, I placed 2 differently directed pending orders (buy-stop and sell-stop). Stop loss and take profit were set at a distance of 10 points on the 4th sign. A minute before the news, the market had already begun to tremble, and the spread began to widen considerably. From 0.7 to 12 points on a 4-digit. For the pound (GBP/USD) and Audi (AUD/USD) the spread reached 16 points, for the geisha (USDJPY) as well as for the euro, but the Canadian fell specifically - 31.6 points on the 4-digit. Unfortunately, I didn’t have time to screenshot it. But what remains is the double removal of the above orders: 2 stop losses with a difference, attention, 4 seconds! Moreover, not a single transaction lasted more than 1 second. Well, okay, this is what it is, non-pharma anyway. But the most unpleasant thing is that instead of 20 points of loss (-2 $ with 0.01 lot), the total loss from these transactions was -74.1 points (-7.41 $ with 0.01 lot). How can this be, you ask? I will answer - slippage. I didn't even understand what happened at first. Only after analyzing the history and transactions on the chart, everything fell into place.

Orders before opening:

Click to enlarge.

Orders after closing:

Click to enlarge.

My sell-stop opened almost at the stated price of 1.08729 (stated SL - 1.08730) and closed with a slip of 10.2 points at 4 digits (set SL - 1.08830; closing price - 1.08932). It’s still tolerable in such a bumpy situation. But the buy-stop opened with a slip of 8.1 points in 4 digits, the opening price was 1.09401 (stated 1.09320), and the order was closed with a difference of 35.7 points. (lined SL – 1.09220; closing price – 1.08863). In total, the purchase, in addition to the stated stop loss of 10 pips, slipped an additional 43.8 points, which brought a total of -53.8 pips. In my opinion, this is already overkill, even on such a fundamental factor. But there was still one advantage, and that was the speed of execution of orders, you can’t even find fault here, a rocket.

The remaining 8 orders went smoothly, mostly at low volatility, without any comments. On Monday (04/06/15), the whole of Europe was resting after Catholic Easter, the market practically did not move. Only in the American session there was a period of average volatility, during which we managed to trade a little. The entire transaction history is presented below:

Click to enlarge.

As you can see from the screenshot, the total trading costs were -$5.13. They got by with "little blood."

The company's average market spreads for major currencies, crosses and metals:

Education

Unlike most large Forex brokers, Alfa-Forex does not provide trading training on its own. In the corresponding section of the broker there are links to the so-called broker-certified partners for training in Forex trading and several videos simply telling about the advantages of banking Forex. Even as a material for beginners, the usefulness of this is a big question, this can be considered another confirmation that the company is focused more on professionals than on beginners.

In this section there is online support , within its framework it is offered:

- morning trading plan for the day . Every morning at 9:30 a.m. you can check out how a financial expert sees the day ahead. It is difficult to judge its usefulness, and it cannot be called training. After all, the expert does not teach analysis, but literally indicates at what levels the price can stop;

- evening analogue . In principle, the same thing, but the price behavior during the day is taken into account and a possible forecast is made for the beginning of the next day.

Free webinars are also held on topics such as “Divergence”, “Market Turning Areas”, etc... But there is no clearly structured structure for teaching beginners the basics of working in the market .

Broker Finam

It is considered one of the best brokers and is the largest investment holding company in Russia. Finam Forex has been providing brokerage services since 1994. The broker has received many awards. Every year the company receives several prestigious awards and still continues to hold a leading position in the Forex market.

To register a broker, you just need to open an account. The maximum leverage is also 40:1 and there are no additional margin call conditions.

Metatrader 4 support

Broker Finam supports the MT4 platform, which is also available on mobile devices. Despite the fact that MT5 is a newer platform, MT4 is considered the most stable. Therefore, in this case, the point goes to the Fins.

Services

At this point, the Finam broker is significantly superior to its competitor. The site contains a lot of analytics in various areas, training materials and courses, and also provides personal training remotely or at company offices. The site even has a function for copying trades, but it is only available to Finam Forex clients.

Instructions for registering with a broker

Registration is standard, you will need:

Fill in the current data

About yourself, place of residence. Let me remind you, provide only relevant , factual information. Otherwise, there may be problems with verification and withdrawal of funds. When registering a personal account, you will have to provide a lot of information.

Verification

After this, you will definitely need to undergo verification , that is, confirm that the information you entered corresponds to reality. To do this, you can upload a scan of your passport or any other document confirming your identity.

Important note: you cannot use a scan of one document to verify data . So the ideal option is to use, for example, a scan of a passport and driver’s license or other document.

Registration of a personal account

If, due to some problems, scans of documents cannot be uploaded, then they can be sent by email [email protected] , just do not forget to indicate your personal account number in the subject line of the letter . The verification process will take a maximum of 2-3 days, after which you will be able to use the functionality of your personal account to the maximum - open an account and start trading.

Previously, it was possible to scan a signed application form, but now this option is not possible . Only verification through your personal account with uploading scanned copies of your documents, and the application form is filled out online in your personal account.

Another important point is that you cannot change your data in your personal account yourself . If you registered, passed verification, but some data has changed (changed last name, registration address), then you can change the information only by contacting support in chat or by phone.

Registering a new trading account with Alfa-Forex.

There are no more obstacles to opening a real account, you can get started. In addition to a real account, the personal account has the function of opening a personal account. It is intended for banking transactions (external deposits and debits), as well as for the distribution of funds between accounts. By the way, before opening an account, it’s time to contact support and ask all the questions that accumulated during the registration process. An online consultant can be called both from the main page of the site and from your Personal Account. Moscow time is now 23:09, let's check if the managers are sleeping.

Deposit and withdrawal of funds

You can top up your personal account in the following ways:

- via Alfa-Bank by bank transfer ;

- through the Alpha Click ;

- through any third-party bank by bank transfer;

- through your personal account using a plastic card .

The option of working through WebMoney is currently not available. As for withdrawing funds, all of the above methods work.

In terms of time - transfers through bank branches can take up to 5 days ; when replenishing from a plastic card, the account is replenished instantly. The Alfa-Click system requires a wait of up to 2 days. The fastest way is an Alfa Bank debit card.

It is most profitable to deposit/withdraw money using your account with Alfa-Bank, in which case the commission is 0. When working with a card, 1% is charged for Alfa-Bank cards and 2% for cards of other banks.

Internal transfer

In addition, Alfa-Forex offers its clients the opportunity to transfer money from one account to another. This is done through your personal account in the Payments - Internal transfer :

- the details of the donor account are indicated debited from it ;

- and details of the acceptor credited to it .

Only works for accounts with the same currency .

Transfers over 600 thousand rubles

There is one more restriction on replenishing your account - you cannot make a payment in the amount of more than 600 thousand rubles or the equivalent in foreign currency without additional steps. If the need for this still arises, then you need:

- paper version of the agreement on conversion arbitration transactions. You will need the " Margin Trading " conditions;

- then on each page from 1 to 10 you will need a bank employee’s signature and stamp , he will put it when making the payment. You will also sign on these same pages.

Or you can not complicate your life and break a large payment into several small ones, less than 600,000 rubles. In this case, the replenishment can be completed as usual, without printing the agreement.

Summary

Alfa-Forex leaves the impression of a good broker, it’s just focused more on working with large clients, professionals who have been on the market for several years. They do not need analytics from the broker, nor training, they only need the ability to trade normally and have convenient conditions for replenishing/withdrawing funds from the account.

Among the advantages I would highlight:

- favorable conversion conditions;

- minimum spread on ruble pairs;

- the opportunity to invest in shares of Russian companies;

- good PAMMs.

Disadvantages:

- lack of clear training and analytics;

- a meager list of options for replenishing/withdrawing funds from the account.

In general, I can say that the broker is more suitable for experienced traders . Beginners should better pay attention to other companies with a well-thought-out training system and daily analytics.

Registration in Alfa-Forex

This concludes today's review. Leave comments and don't forget to subscribe to blog updates. All the best!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

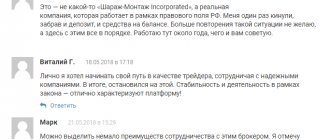

Customer Reviews

There are a small number of negative reviews, which mainly relate to delays in transferring money. In other matters, clients speak highly of the broker, noting the following advantages:

- fast execution of transactions;

- financial reliability;

- low spreads.

This broker provides all the necessary conditions for traders to successfully carry out transactions. You can learn more about customer reviews at the link https://tradersunion.com/ru/brokers/forex/view/alfa-foreks/.