We have already figured out how to open an account on the Binance exchange and how to fund it. It's time to start trading instructions.

Video instruction:

Binance has two trading interfaces: basic mode and advanced.

The main trading mode is made in a white background, you can access it through the “Trade - Main” tab or through the “Balance” menu and next to the desired cryptocurrency, select “Transaction” and the required trading pair.

Method 1: get into the main trading mode through the top menu

Method 2: get into the main trading mode through “Balance” and “Transaction”

Let's look at the main elements of the main trading mode and how to work with them

Binance exchange interface with designated areas

Interface navigation:

- Information panel

- Depth of orders for buying and selling

- Price chart

- Submission of applications

- Selecting currency pairs

- Trading history

- Your order and transaction history

1) Information panel

The main elements of the selected trading pair are displayed here:

- Trading pair name;

- Last trade price;

- Change over 24 hours in absolute and percentage values;

- Maximum price for 24 hours;

- Minimum price for 24 hours;

- Trading volume per day.

2) Depth of orders for buying and selling

A table of orders for buying and selling, or in traders' slang, a glass. In the green area there are orders to buy Bitcoin, and in the red area there are orders to sell. For example, let's look at the order book of the BTC/USDT pair:

Depth of Market: orders to buy and sell BTC for USDT

- The order table shows at what price in USDT they are willing to buy and sell bitcoins;

- The best buy price is highlighted with a green rectangle. For 9041.02 USDT they are ready to buy 1.965153 BTC, which in dollars equals $17,766.98. At the bottom of the glass there are orders to buy at lower prices.

- The best selling price is highlighted with a red rectangle. For 9042.73 USDT they are willing to sell 0.121943 BTC, which in dollars equals $1,102.69. At the top of the order book are orders to sell at higher prices.

- The difference between the best price to buy and sell is called SPREAD. In our example, the spread is 9042.73-9041.02 = $1.71.

- In the very middle of the order book we see the price of the last transaction.

3) Price chart

To the right of the order book and at the top is a price chart. By default, the chart is displayed in a 15-minute interval and looks like Japanese candlesticks. The chart shows moving averages, trading volumes and other technical indicators. The intervals and type of graph can be changed.

Trading chart with volumes and indicators

TradingView mode has many settings, experiment with them yourself and leave the parameters you need. TradingView mode is configured by clicking on the gear:

TradingView Mode on Binance

The “Depth Chart” mode shows buy and sell orders at various price levels. Essentially, this is a graphical representation of our order book:

We look at the density of buy and sell orders

4) Placing orders for purchase and sale

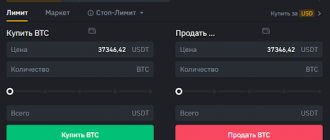

Your buy and sell orders area looks like this:

Area of your requests

By default, the area for placing limit orders is displayed, that is, orders that have a specific price and a specific volume for purchase or sale without any other conditions.

In the screenshot above, a limit purchase order is placed with the following parameters: purchase 1 BTC at a price of $9050, a total of $9050 will be spent. If the last price on the market is, for example, 9070 and there are orders to buy at a price above $9050, then our order will go into the order book and wait its turn. If the last price on the market is, for example, $9040 and there are orders to sell at a price below $9050 in a volume of more than one BTC, then our order will be executed instantly. In this case, the execution price will be even better (lower) $9050, since we will collect all orders from the order book, which are located in limits up to $9050.

Also in the screenshot above there is a sell order with the following parameters: sale of 0.5 BTC at a price of $9055, in total $4527.4 will be received for the transaction. The logic of order execution is similar to the logic of a purchase order.

The “market” order type requires you to fill out only the required volume to buy or sell, the order will be executed at the BEST price available on the market. It is not recommended to use this mode for large trading volumes and for low-liquidity assets; you may receive very poor order execution prices.

The “stop limit” order type is created for conditional orders, that is, the order will be activated if certain conditions are met. Stop is the order activation price. Limit – the price at which the order will be submitted. Quantity – the volume of the order. For example, you have 2 BTC and the current market price is $9500. If the price drops below $9,000, then you want to get rid of half the position. In this case, the parameters of your “stop limit” order will be as follows: stop = $9000, limit = $8800 (it is better to indicate the price below the stop so that the order is accurately executed), volume – 1 BTC (half of the position).

Stop limit order fields

5) Selection of currency pairs

To the right of the chart is the area for selecting currency pairs.

Currency pair selection area

The screenshot above displays trading pairs relative to BTC, that is, those cryptocurrencies that can be purchased or sold for Bitcoin. Clicking on the line of the desired currency pair will update the order book, chart and orders for the corresponding currency pair.

6) Trading history

In the lower right corner is the trading history:

Trading history for the selected cryptocurrency

- First column: transaction price;

- Second column: transaction volume;

- Third column: transaction time.

You can also switch the mode at the top and view your trading history.

7) Your history of orders and transactions

At the bottom are your current orders, that is, orders that have not yet been executed + trading history for 24 hours.

Open orders and trading history

Let's look at each column in the table above:

- Date: time and date of submitting the application;

- Pair: trading pair, in the screenshot above we are selling BNB tokens for BTC;

- Type: field missing;

- Side: selling or buying, we sell;

- Price: bid price, we sell at 0.0025 BTC for 1 BNB;

- Quantity: amount of asset to sell, sell 4.31 BNB;

- Completed: what percentage of the application has been completed. For example, if they buy 1.15 BNB from us, but the rest do not buy, then this parameter will become equal to 1.15/4.31 = 26.68%.

- Total: how much funds will be received upon execution of the application. We will receive 0.010775 BTC (4.31*0.0025).

- Activation conditions: the field is filled in when placing a stop order;

- Cancel: button to cancel the application.

Preparing to trade

Before trading on binance, a visitor needs to take several steps, namely create an account on the exchange, log in and go through verification.

Registration

The process of creating a personal account is extremely simple and straightforward. To do this, the user needs to click on the corresponding yellow “Register with Binance” button on the main page of the site. Then they proceed to filling out the form, which will require an email address and a password consisting of at least 8 characters. After checking the box next to the terms and conditions agreement, click “Create an account.”

Register using referral ID: AHJUCEJW and receive a discount of up to 40% on Binance commissions for all transactions.

Registration

Verification

After creating your personal account, you must go through authorization and identification. First, the system will require you to complete a captcha confirming that this is not a robot - drag the slider from left to right. Then an email with a registration confirmation code will be sent to the specified email address. It must be entered in the verification tab that opens.

Next, you will need to set up your personal account. At this stage, there is a choice of a method for depositing funds and the possibility of enhancing data security by creating an additional level of verification. Two-factor authentication can be done using your phone and through Google.

Identity verification is used to identify the participant by the system. This procedure is not mandatory, however, accounts that fail this verification have a daily withdrawal limit of no more than 2 Bitcoin, as opposed to 100 BTC for those who have verified their identity.

Verification consists of two stages. During the first, you need to provide personal data, and in the second, you must confirm them by uploading photographs of your passport or other identification document.

How to log into your personal account

To log into your personal account, you need to click on the “Login” button and enter the email and password that you specified during registration. If two-factor authentication is installed, you need to confirm your action using the method you chose - via phone or Google.

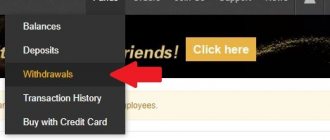

Refill

The transition to replenishing your account is located on the main page of the site. To credit funds to your balance, you need to select “Fiat and spot” in the drop-down list of commands in the “Wallet” tab. A table with a list of all possible coins can be found in your personal account, and the available search will help you choose a specific one.

Having found the required token, you need to click on “Enter”. After this, the user will receive a public address where they can send coins. It is important to note that only those tokens that have been selected can be sent to this generated address. If an attempt is made to replenish it with any other coins, the trader risks losing his funds.

If you need to top up with regular currency, choose “Fiat”. There are different ways for this operation - using electronic wallets or replenishing your account through terminals - but the most popular is using a bank card. Fiat top-up is available exclusively to those who have passed the identification process.

The procedure for transferring funds is extremely simple:

- Specify the currency type and transfer option.

- Enter the amount taking into account the commission (if any).

- Fill out the payment form and click “Pay”.

Registration

Before you can start trading binary options, you need to become a Binance client. To do this you will need to register an account. It's quick and simple:

- Click the “Registration” button in the corner of the main page of the site.

- In the form that opens, enter your personal email address or cell phone number.

- Create a strong password.

- Agree to the site rules.

- Confirm your decision.

Next, you will need to confirm your email address or mobile phone number. You just need to indicate the code from the letter or follow the link in the letter. After all these steps, the user becomes a client of the Binance broker.

Important! After registration, you need to correctly fill in your personal profile information. You cannot enter non-existent data, as the broker will require confirmation.

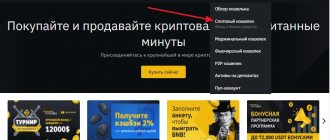

Available modes for trading on Binance

Cryptocurrency trading on Binance can be carried out in several modes, namely conversion, classic for beginners, advanced for those with experience, margin and P2P for professionals. The required section can be selected in the drop-down menu of the “Trade” tab.

Conversion is the easiest way to trade

Another name is basic mode. With its help, trading on Binance will be easy even for a beginner. Its essence lies in the simple purchase of the selected cryptocurrency.

Classic – suitable for beginners

This mode involves placing transactions for the purchase and sale of currencies, creating orders and the ability to use many different analytical tools that allow you to determine and predict the future exchange rate of a currency.

The interface features a course graph in the center, course history on the left, and currently available offers on the right.

Advanced – full access on one screen

Similar to the classic type, but differs in the presence of tools that allow for more detailed monitoring of market conditions, which is attractive for experienced players.

Margin trading on binance

To learn and try how to trade in the “margin” mode on Binance, the participant must pass personal identification and enable two-factor authentication mode. This type allows the use of borrowed funds.

P2P

The peer-to-peer (P2P) principle implies the conclusion of agreements without the participation of third parties directly between the parties (buyer and seller). In addition, the OTC section can be used to deposit fiat money, withdraw it, and convert it into cryptocurrency.

How to earn income from staking cryptocurrencies on the Binance exchange?

Every registered user can receive passive income on Binance. The only condition is the presence of this cryptocurrency on a personal deposit. The launch of staking does not mean that coins become unavailable for other operations.

You can sell or withdraw all or part of your assets at any time. But, in this case, staking payments will completely stop or decrease in direct proportion to the number of altcoins withdrawn. The basis for recalculation is the fact that the order was issued. That is, coins frozen on a limit or stop-limit order no longer participate in staking.

As for the timing, the client can choose between fixed, perpetual and defi staking. Let's talk in more detail about each type.

Fixed staking

Locked Staking has an exact final completion date that the client sets when the assets are frozen. That is, the fixed staking agreement expires 7, 30, 60 or 90 days after launch. The minimum unlocking period is usually 24 hours, with the exception of the BAND cryptocurrency, which has an Unlock Period of 7 days.

| Coin | Minimum deposit | Income (% per annum) | Freezing period (days) | Minimum unlock period (days) |

| EOS | 10 | 6.79 | 60;90 | 1 |

| BAND | 20 | 12,5 | 7;30;60 | 7 |

| DASH | 1 | 7,12 | 7;30;60;90 | 1 |

| GXS | 100 | 4,53 | 7;30;60;90 | 1 |

| ONE | 1000 | 16 | 30;60 | 1 |

The minimum unlocking period is the period after which interest begins to accrue on the staked deposit. If the client stops staking earlier, he will not receive any income.

Perpetual staking

Flexible Staking does not have a fixed end date, meaning interest accrues until the client places a sell order or withdraws the cryptocurrency from the exchange. Money starts flowing in a day after staking is launched and is paid out every 30 days.

This method is convenient because your coins simply lie on the spot wallet, and within 30 days you receive rewards for storing the coins.

The amount of income and the minimum amount of funds depends on the coin. Binance staking 25 altcoins is supported. See the full list here.

Defi staking

DeFi (decentralized finance) is a way of providing financial services to users through smart contracts. Existing DeFi projects aim to provide higher annual returns for certain currencies. To connect defi staking to Binance, you do not need to buy tokens from one of the decentralized lending projects. Suitable assets:

- BNB;

- USDT;

- BUSD;

- DAI.

The exchange itself will invest them in a profitable project. There is a relatively high threshold for users of DeFi products. Binance DeFi staking acts on behalf of users to participate in certain DeFi products, receives and distributes realized profits, and helps users participate in decentralized lending with one click.

Open defi staking in the “ Finance ” section and click “ Stake now ”. Binance selects only the best DeFi projects in the industry and monitors system performance in real time to reduce the risks associated with such projects. Binance clients get rid of exorbitant commissions. With a minimum level of risk, users can earn the highest possible profit in the best possible way.

Read more about staking on Binance in our special material.

Tips for beginners

The main advice for novice exchange players who want to trade cryptocurrency on Binance is the competent distribution of available resources when concluding agreements. The formation of a crypto-portfolio will help with this - a set of several crypto-currencies and coins that are collected by the trader independently to make a profit from their purchase and sale. The most efficient and effective portfolio consists of:

- 10% – assets with high risk and growth potential;

- 20% – assets with medium risk, for example, altcoins;

- 30% – reserve stock in case of drawdown;

- 40% – low-risk assets.

However, competently compiling a crypto portfolio is not enough to trade profitably on Binance. To make the right and profitable decision on a transaction, it is extremely important to use fundamental and technical analysis. The first is created to assess the actual value of an asset by analyzing and monitoring macroeconomic indicators, for example, the state of industries that are associated with it. The essence of the second is to assess the value of an asset and the movement of the exchange rate in the past to determine the price in the future.

Of course, for short-term trading there is no need to evaluate economic macro parameters. In this case, only a technical analysis of the asset will be sufficient. For long-term trading, it is better to use a combination of these methods.

Block 1. Information on the pair

In the first upper window there is information on the currency pair that we are currently trading.

First comes the name of the pair.

Further information is provided on the latest current price for this pair, then the price change over the last 24 hours is shown.

The following is the maximum and minimum price for the last 24 hours. And the trading volume per day.

Using the following buttons you can change the color theme of the exchange from light to dark. And the last button allows you to share the course schedule on social networks.

Market selection

The first step is to start trading directly. Spot, futures markets and P2P platform are available to all platform participants. For OTC mode, the trader must meet certain requirements, in particular, have a verified account of the second level or higher, and the order amount must exceed 20 BTC. Within the framework of it, it is possible to conclude large over-the-counter agreements with the participation of a third party.

Spot trading on Binance is suitable for those who prefer instant transactions. To switch to this mode, select the “Spot Markets” tab. If you want to use futures contracts, you need to refer to the “Futures Markets” tab.

It is worth noting that you can only trade futures on Binance from a special futures account in a separate terminal.

Types of Spot Contracts

Spot transactions are classified based on the timing of transactions:

- TOD . An abbreviation for the English word "today", i.e. today. This type implies delivery on the same day on which the contract was concluded. This trading mode is also called T+0.

- TOM . Accordingly, it comes from the English “tomorrow” - tomorrow. With this type, calculation and delivery are carried out the next day. This trading mode is called T+1.

- SPT . Abbreviation of English "spot", place. In this case, calculation and delivery are carried out 2 days after the transaction is concluded.

It is worth considering that in all of the listed types, only working days are taken.

For example, if you enter into a TOD spot contract on Friday, settlement will be made on the same day. If this is a TOM type transaction, then delivery will be made only on Monday, and in the case of SPT - on Tuesday.

Selecting a trading pair

Placing an order begins with choosing a cryptocurrency ratio. Their list is located on the right side of the page with a price change chart.

Trading pairs are divided into categories: ALTS (ETH, TRX and XMP), BNB, BTC, FIAT (list of national currencies), Margin and Zones. They are arranged alphabetically, so finding the one you need is easy. After clicking on the selected currency ratio, you go to the analysis of exchange rate dynamics.

According to trading volume, the top 5 pairs include:

- BTC/USDT

- ETH/USDT

- DOGE/USDT

- SHIB/USDT

- BUSD/USDT

Let's look at how to trade on Binance using the ETH/USDT trading pair as an example.

(Ethereum) ETH is one of the most popular cryptocurrencies, with a trading turnover of more than $1.4 billion.

After clicking on a trading pair, a chart of its rate changes opens. By default, the display is in Basic mode, but you can switch to Depth Charts and Trading view, which opens up the ability to draw on the chart, as well as work with Fibonacci levels, moving averages, RSI and other indicators.

Depth diagrams show all available and implemented purchase and sale options for the selected currency ratio in different price categories.

To make it easier to analyze and work with graphs, their size can be increased by clicking on the expansion icon located in the upper right part next to “Depth Charts”. This tool allows you to display the graph in full screen.

What Binance offers: spot, margin trading, futures

Of course, before moving on to one or another trading method, you need to register on the service and undergo verification in order to gain access to all the products and functionality of the crypto exchange. Additionally, secure your account by enabling 2F authentication.

Top up your balance with any cryptocurrency or fiat supported by Binance - a direct transfer from your personal wallet to your platform account when it comes to digital assets. Or deposit funds through Visa/MasterCard cards, popular payment systems, if the deposit is made in traditional currency. After authorizing the account, the trader will see (top line of the monitor) Binance offers.

In particular, the “Trade” section, in which, among others, the following proposals are presented:

- conversion – here you can make over-the-counter transactions and exchange cryptocurrencies with a wide selection of cross-pairs, without commissions or slippages;

- classic trading – speculation on the spot market;

- advanced trading : the name itself suggests - a product for experienced players (all Binance tools are collected in one window);

- margin trading – concluding transactions with leverage;

- P2P exchange service – here you can carry out transactions directly with other market participants on your own terms.

Also in the top line of the personal account menu, next to the “Trading” section, there is the “Derivatives” section, which includes, among other offers, trading of deferred contracts - futures. Let’s take a closer look at the most popular methods of trading crypto assets.

Classic: Cryptocurrency Trading on the Spot Market

Highly recommended for all neophytes in the field of digital finance and investment, as it does not require in-depth knowledge. Go from your account to the “Classic” tab through the “Trading” section. Then we proceed as follows:

- In the center of the monitor is the window of the basic version of the trading terminal. If you wish, you can switch to TradingView, which is more familiar to most traders.

- In the upper right side of the screen, select the market in which we plan to profitably speculate - BUSD, USDT, BNB, BTC, ALTS (altcoins ETH, TRX, XRP, DODG), fiat (15 currencies, including the ruble).

- In the same zone, but lower, we decide on a trading pair - for example, BTC/USDT.

- Next up for analysis – we study an online chart that displays the volatility of the selected cryptocurrency pair for at least a few days. The required time frame can be set in the terminal functions. We also examine the history of transactions (on the right under the selection of currency pairs) and the market depth - to the left of the trading terminal. The collected information will help you enter the auction most profitably.

- Let's move on to selecting and placing an order. Binance on spot offers 3 order options - market, limit, stop limit. The first contract allows you to make an instant transaction at the current market price. Disadvantage: possible slippage. Therefore, it is advisable to focus on the second option – the limit. This type of order allows you to set your own price for buying/selling a crypto asset - when the trend breaks through the set level, the contract will be triggered and funds will be credited to the trader’s account. The stop limit is identical to the previous type, but with one important addition - a regulating price level can be added to the contract, which protects against large losses in the event of a deep rate correction, which is not uncommon for the cryptocurrency market.

Finally, click buy or sell BTC if we are trading using the combination chosen as an example - BTC/USDT. After execution, we repeat the procedure - the high volatility of digital assets allows us to make quite a lot of transactions within one day session, increasing the trader’s profit.

Margin trading or trading with leverage

Making bets using leverage (borrowed funds), as well as trading futures, which will be discussed below, is the domain of professional players with deep knowledge and experience in the margin trading segment.

There is no place for beginners here - an unjustified risk. Before you begin trading with leverage, you must undergo identity verification if the procedure was postponed at the time of account registration. The further algorithm of actions is reflected in the following steps:

- We go to Binance Margin by clicking on the “Margin” tab in the personal account menu, where we select an account - cross or isolated, and then activate the profile. The first one offers trading on all available pairs with 3X leverage - the entire account bears the risks. The second option provides 5X leverage, but for one specific currency pair, which bears all the risks.

- We transfer funds from the spot wallet to the Binance margin account.

- We indicate the digital asset that we plan to borrow. The maximum is regulated by the volume of collateral - the trader’s funds on the margin account, and the individual limit of a particular cryptocurrency.

- Go to the “Tenders” tab. The process is no different from trading on the spot market.

- At the end of the auction we pay off the debt.

Technically not difficult. However, this type of speculation is associated with high risks that must be taken into account. For example, a crypto exchange updates the loan interest rate every 60 minutes, since funds are lent solely to increase the value of assets.

Therefore, you need to constantly monitor the account status in the “Margin” tab. Moreover, in a situation where the market movement is directed in the opposite direction from the speculator’s forecast, the exchange has the right to liquidate an open position so as not to incur losses. At the same time, debt obligations are not removed from the trader, who will have to repay the entire amount of borrowed funds.

Futures: Short and Long positions

How it works: a trader opens a Short (short) position if he predicts a fall in the quotes of the selected crypto asset in the foreseeable future. Or Long (long) position when the rate is expected to rise.

Binance offers its clients several types of deferred contracts – USDⓈ-M and COIN-M. Both options are perpetual and deliverable (quarterly) futures, but the first type is settled in USDT or BUSD stablecoins.

The second is in the cryptocurrency supported by the trading platform. To start trading, you must activate 2F authentication if this procedure was ignored during the registration process. Next we proceed according to the following scenario:

- As in the situation with margin trading, you need to create an additional account on Binance Futures to trade deferred contracts by going to the section through the “Derivatives” section.

- We replenish the futures account with any cryptocurrency that the service supports - it will be used as margin security.

- We choose the type of open-ended or delivery contracts.

- We decide on the size of leverage. Binance offers up to 125X leverage on these financial instruments.

- We open Short or Long positions after first studying the market dynamics. In order to open a particular position, we use traditional orders for spot trading - limit or market.

Again, from a technical point of view, everything is simple. However, the risks are no less than with margin trading. An extreme price movement in the opposite direction from the forecast (open position) is a guarantee of liquidation of the margin balance on the trader’s futures account.

Orders on Binance

First of all, to start trading on Binance and placing orders, you need to decide on its type. The following types are distinguished on the exchange:

- Market - Market . An application to conclude a purchase and sale transaction at the currently relevant price. To complete it, you must have a counter offer with the same conditions.

- Deferred – Limit . A request to close, which occurs when a certain set price is reached or exceeded. For example, if a player knows for sure that the value of an asset will increase in the near future, then he can place a Limit, which will be closed when the established conditions are reached.

- Pending stop order – Stop-Limit . It is a symbiosis of a stop order and a pending order. The essence of Stop-Limit is that only when the stop price is reached, the order becomes pending and will await execution. The advantage of this type is the ability to independently control the price at which the order will be executed.

- Fungible orders – OCO. These are 2 offers placed simultaneously that are opposite to each other, for example, a deferred limit and a deferred stop. When you close one of the pair, the second is automatically deleted. The same thing happens if you cancel one of them. This type can be found in the menu of the “Stop Limit” tab.

About the concept

Translated from English, the word “spot” means “place”. A spot contract (spot transaction) is a form of transactions for which settlement is made immediately, i.e. on the spot, within a maximum of 1-2 days from the date of conclusion.

It is a complete analogue of a cash or cash transaction.

The simplest example of such a transaction, as I noted at the beginning of the article, is the purchase of any products at the market or in a store for cash. You give the seller your money and immediately receive the goods.

One more example can be given - the purchase of currency on the Moscow Exchange at the market price. In this case, you give your rubles, and the next day or 2 days later you receive your currency.

Another concept associated with the term spot is the spot price, or spot rate. This is the price at which the spot contract is entered into. It reflects the current situation.

The terms of the contract are fixed at the time of the transaction and do not change anymore. Such conditions may include:

- price;

- type of asset;

- scope of supply;

- period (day to day, after 1 day or after 2 days).

How to place an order

Having figured out how to trade spot on Binance, you should move on to directly placing an order. This process is completed in a few simple steps:

- Select order type.

- Indicate the number of coins purchased or sold and their price.

The red button is pressed in case of sale, and the green button in case of purchase of cryptocurrency.

On the left side of the terminal, to the left of the price change graph, there are 2 tables that contain placed orders to sell coins (top) and to buy them (bottom). The line located between them reflects the current rate of the selected cryptocurrency. In this case, it is the ratio of ETH to USDT.

When purchasing coins, it is not necessary to indicate their price yourself. You can use any of the offers in the list by clicking on it, and the cost will automatically appear in the completed application. If this value is satisfactory, then click the green “Buy” button.

Advanced trading terminal

Externally, it is very different from the Basic version. A black design theme is used, the main elements are the same, but arranged differently.

There are more opportunities for analyzing markets, but as for directly concluding transactions, the types of orders remain the same. In the lower left corner there is a window for setting transaction parameters.

The speed of execution of orders for the purchase and sale of cryptocurrency is the same in both types of terminals. It depends only on how quickly a counter application appears, absorbing yours.

Strategies

The choice of trading strategy on Binance depends on the user’s preferences, his desires and the final result that he expects. There are active and passive trading. Active strategies include:

- Day trading (involves entering and exiting positions on the same day, a fairly profitable option, but associated with great stress and high risks).

- Swing trading (holding positions for several weeks or a month allows you to refrain from hasty decisions and evaluate all changes in the exchange rate).

- Trend trading (holding positions longer).

- Scalping (aimed at high-frequency transactions with small changes in the value of an asset).

Passive investing differentiates between strategies such as “Buy and Hold” (purchase tokens and hold them in a portfolio) and “Index Investing” (buying indices in traditional markets).

Futures vs spot market

As on classic exchanges, transactions on crypto futures are concluded with margin leverage, but not necessarily. It all depends on the site:

- you can work in the range from 1:1 to 1:100 and higher;

- The level of lending depends on the conditions of the exchange.

A feature of futures is the moment of price convergence - the closer the expiration date of the futures contract, the closer it is.

This is the basis for an elementary arbitration model. If the gap between the perpetual and futures contracts is 300–500 points, the trader buys one and sells the other. By the time the futures contract expires, it closes it and opens a similar one for a future period or simply fixes profit. The initial difference of 300–500 points is reduced to 20–30, forming an income of 250–450 points, although small, but without risks.

It is worth noting that on crypto exchanges you do not have to wait for months. Gaps widen during impulses and decrease during flat periods. Therefore, depending on the conditions, 2–3% can be withdrawn either 1–2 times a month or more often.

If we talk about the Binance Futures exchange, futures are not traded here yet. Traders can work with the Binance perpetual contract and engage in either high-risk leverage trading or place safety orders, hedging investments directly in Bitcoin.

Pros and cons of trading on Binance

Among the main advantages of Binance are:

- high liquidity,

- a huge number of available trading pairs,

- intuitive interface,

- access to trading operations on P2P and OTC principles, in margin mode and by using futures contracts in an additional terminal,

- multilingual and Russian version available,

- low level of commissions and the possibility of reducing them in various ways, ongoing promotions and bonuses,

- a lot of tools for analyzing market conditions, price levels and other macroeconomic parameters,

- the presence of an educational base that allows you to figure out how to trade on Binance from scratch,

- lack of mandatory identification confirmation.

However, even such a wonderful platform has some drawbacks.

- The identification process is quite complex

- small limit on withdrawal of funds for unverified users (2 BTC)

- low speed of terminals with high activity of traders

ID confirmation

Binance is a certified broker and therefore requires its clients to verify their accounts. To confirm your identity, you need to upload the following files:

- Scanned copies of your passport or driver's license.

- A scanned copy of a utility bill or bank statement indicating the date of issue.

- A photo with a passport in hand - the page with the photo and full name of the owner must be open on the passport.

All photographs must be of excellent quality, without unnecessary objects, sun glare, darkening, or blurring. Only high-quality copies will help you pass verification in the shortest possible time.

Recommendations on how to trade correctly

To trade correctly on Binance, you should follow some recommendations:

- Start with small deposits, with the expectation that the risk of loss should not exceed a maximum of 5% of the final spot amount.

- Try margin trading, which is quite profitable, however, is characterized by high risks. Before you start, you should watch the introductory videos.

How to reduce commissions?

When placing offers, the exchange charges a small commission. It can be reduced in several ways.

The first and easiest is to use the local cryptocurrency Binance Coin (BNB) to pay the commission percentage.

The next option is active transactions. When implementing large trading volumes, the trader receives VIP levels, the increase of which implies a reduction in commission.

The last way is to register using a referral id. This way you reduce the percentage on all operations in Binance to 20% and can go up to 40%.

Register using referral ID: AHJUCEJW and receive a discount of up to 40% on Binance commissions for all transactions.

Registration

Referral program

The Binance Futures exchange has an affiliate program in which a client can distribute a referral link and receive a percentage from the commission of invitees. The proportion of remuneration is set individually. Depending on the target audience, a Binance link can be created with a payment of 20–40% of the commission of a specific invitee, or you can add a discount for the referral. In the second case, the client, who is entitled to a 20% commission, will receive, for example, 10% from the referral commission, and the invitee will have a discount from the futures commission of 10% - miningbitcoin .

Registration binance.com

How do you use futures, for trading or hedging?

Safety of using the Binance platform

Users should not worry about the reliability of the exchange. Security is the main priority of the Binance platform. The Binance website uses SSL encryption. By using the services of an honest site, users do not have to fear fraud and theft. The company uses industry leading security protocols.

In addition, the platform is licensed and has its headquarters in Malta, which is part of the European Union. This means that Binance is following his directives.

Important warning!