BCS broker

BCS is one of the largest trading platforms and is one of the “big three” private brokers in Russia. This platform accounts for about 20% of trading volume on the Moscow Exchange.

The BCS broker has one of the most favorable conditions for “large clients”; the average account size is one of the highest among all brokers in the Russian Federation. One of the most unique services is the opening of a single account for the Russian Federation, the USA and the EU.

In this article we will make a detailed review of the BCS broker - tariffs, conditions for opening an account, trading features, etc. And we will make a general conclusion whether it is worth using the services of this site and who it will suit best.

- What is BCS broker

- How to open an account with BCS broker In the office

- Open a BCS broker account online

Broker BCS

BKS – works with individuals and legal entities. According to Moscow Exchange, the company ranks second in terms of the volume of client transactions per month - 3,705 billion rubles.

Official website of BCS World of Investments →

In terms of the number of registered accounts for individuals, BCS Investments is among the top 5 leading operators on the Moscow Exchange.

The BCS company was registered in 1995, and in the same year received a license from the Central Bank for brokerage services. In 2007, the broker was one of the first in the Russian Federation to offer clients online trading. Through BCS, investors and traders can enter not only Russian but also international markets through a licensed Russian company. Most other Russian brokers still do not have access to foreign markets, which sets BCS apart in this respect.

The BCS broker has won prestigious international and Russian competitions many times, and has also been awarded honorary prizes and ratings.

The broker is gradually transforming into a full-fledged ecosystem, as other financial companies, such as Sber or Tinkoff, do.

Official information about BCS

The BrokerCreditService company was founded in Novosibirsk back in 1995. Three years later, BCS (by the way, the company is sometimes mistakenly called BKS) becomes a member of the MICEX stock market and a participant in the RTS. Since 2002, the company has been the first in Russia to offer clients online trading services. In 2008, BCS traders gained access to international markets.

In 2012, the BKS Broker brand appeared. And next year, the broker takes the first three places in the ratings of the main operators of the derivatives, stock and foreign exchange markets of the MB. In the NRA rating, BCS Broker belongs to the AAA category (maximum reliability).

Most recently, BCS clients gained access to direct purchase and sale of Chinese yuan on the exchange. Traders can also buy shares of a US company within the framework of a Unified Brokerage Account.

In 2015, the company celebrated its 20th anniversary on a grand scale. Today BCS Broker has a wide branch network throughout Russia - more than 120 offices and agent points in major cities. The number of BCS clients has already exceeded 110,000!

Which markets does BSK Investments enter?

Through BCS, investors can enter and conduct transactions in several markets:

- Russian stock exchanges are Moscow and St. Petersburg.

- International – NASDAQ, NYSE, NYSE MKT, NYSE Arca, LSE IOB, Xetra.

According to customer reviews, BCS has one of the most reliable functionality compared to some other Russian brokers. All quote data is visible in real time, which allows investors and traders to conclude transactions as quickly and profitably as possible.

Where to trade

To start investing through BCS, you do not need large capital. You can enter the market with any amount. Through this broker, experienced investors can obtain qualified status and benefit from an expanded list of instruments.

You can open an account with BCS at your nearest office or remotely on the website. The company has 70 representative offices in all major cities of Russia. A complete list and addresses are available at the link. If you want to get a personal consultation from a company specialist, contact the office, write in the chat on the official website, or leave a request.

If you are not ready to immediately dive into investing, but just want to explore the broker’s capabilities, download the demo version of the brokerage account. 300,000 rubles are available on the virtual account, which can be “spent” on demo transactions: buy stocks, bonds, currencies and funds. Operations are available on three markets – derivatives, stock and foreign exchange.

Personal Area

After opening a bank account, as well as a brokerage account or IIS, you can start investing and conducting transactions. All clients are automatically connected to a personal account for banking and brokerage operations.

Log in to your personal account BCS World of Investments →

Access to your BCS-Online personal account is protected at two levels:

- A password that each user comes up with himself.

- An SMS code that is sent to the mobile phone specified in the individual’s application form during registration.

Users can access their personal account through a browser on any device with Internet access. Here clients can:

- manage a bank account in BCS;

- manage a brokerage account or individual investment account;

- change currency at the exchange rate;

- carry out operations on the derivatives and stock markets;

- view account transactions;

- order brokerage reports.

Access to your BCS-Online personal account is free for all clients who have brokerage and bank accounts.

Mobile application BCS World of Investments

A mobile application for conducting transactions on exchanges is the most popular option among users. Brokers understand this, so they pay close attention to its development. The BCS World of Investments mobile application for investors was one of the first to appear.

Over time, it has been transformed and updated. Now this is a completely different product compared to the first version. It has an intuitive multifunctional interface. Clients have been using the BCS application for 5 years, so it has many fewer problems than services that were launched not so long ago.

The BCS World of Investments application menu consists of 5 screens:

- "Briefcase". Here you can view account information, exchange rates, assets and account balance. From this screen you can go to the “Deposit” and “Withdraw” tabs.

- "Markets". Here you can see market quotes in real time. Any instruments, both Russian and foreign, can be added to “Favorites”. Or view ready-made solutions selected by the broker.

- "For you". This screen contains investment ideas, popular securities and selections that may interest you.

- "Connection". The tab is intended for communication - call back, chat with support service or contact the developer.

- "More". This screen contains reports, documents, settings and terms of service. Here you can sign Form W8-BEN to reduce your tax rate on transactions in the US market, or apply to qualify as a qualified investor. Broker BCS helps in resolving these issues.

The BCS My Investments application contains all the opportunities for beginners and more experienced investors. You can place limit orders, set alerts and analyze the dynamics of security prices, which is important for traders and active investors.

The BCS mobile application for investments has a high rating on Google Play - 4.7 points, in the App Store - 4.6. The support service takes feedback very seriously, so both positive and negative user reviews do not go unnoticed.

Trading terminals

The BCS broker has several trading terminals for traders and experienced investors. These are QIUK, MetaTrader, WebQuik, TSLab platform, Tradematic Trader, Tradematic Strategy Trader, Trust Manager and others. To understand which option you need, request an online consultation with a broker or come to the office in person.

Some terminals are software for trust management, others are designed to automate trading in the derivatives and stock markets. There are also specialized mobile applications. For example, WebQuik is a mobile version of the terminal, adapted for trading through mobile devices with Internet access.

The most popular among BCS brokers are QUIK and MetaTrader - special trading terminals for transactions on exchanges. They look much more complex than a mobile application. Many novice investors will find this option inconvenient and confusing. However, for professional traders and experienced investors, the trading terminal is more suitable. QUIK from BCS is considered one of the most convenient and flexible, compared to the terminals of some other brokers.

You can download the program for trading on exchanges from the official website of the BCS broker. To log into the system you will need security keys, which can be obtained in your broker’s personal account. You will have to pay for using the terminal if your brokerage account holds less than 30 thousand rubles worth of assets for a month.

How to open an IIS

An individual investment account, or IIA, is a special form of brokerage account that can only be used by individuals. The IIS structure includes two tax deduction options: up to 52 thousand rubles per year or a full 13% deduction on income for accounts 3 years and older.

With BCS Investments, opening an individual account is as easy as opening a brokerage account. When filling out the form and selecting the account type, move the slider to the “Open IIS” position, and then continue registering as usual. The only requirement is the absence of active individual investment accounts, since you cannot have more than one individual account. At the same time, you can apply for a new IIS if your previous account is already in the liquidation phase.

How to trade through BCS Investments

To enter the stock exchange, any Russian needs a brokerage account. It will not be possible to carry out transactions without the mediation of a broker. You can open an account with BCS in person or remotely. Online registration is available only to Russian citizens over 18 years of age.

Non-residents can open a brokerage account only in person at the company's offices. They will need a passport and a document confirming the right to stay in the Russian Federation.

Opening an account

When submitting an application remotely, BCS will request scanned copies of all pages of the passport, email address and mobile phone number for SMS confirmation of the profile. There are no other requirements for residents. If the quality of the document copies is poor, the application will be rejected.

An online application for opening a brokerage account with BCS can be submitted using the link:

- Enter your phone number.

- Check the box to register an IIS if you do not have such an account with other brokers. If you already have an IIS. Don't check the box. This is a very important point, since if one person has two IRAs, he will lose the right to a tax deduction.

- Give your consent to the processing of personal data.

- Enter the code from the SMS that will be sent to your phone.

- Wait until the data is processed. It rarely takes more than 1-2 hours, but can last about a day.

After moderation is completed, you can conduct transactions on the stock exchange.

To open a brokerage account at the company's office, fill out the registration form on the BCS website. When a company specialist gets acquainted with it, you will be invited to the nearest office.

Refill

You can top up your account at BCS in cash or by bank transfer. Cash can be deposited in offices or through ATMs with a cash-in function. For non-cash replenishment use:

- SBP – fast payment system. To do this, go to the mobile application of the servicing bank and enter your phone number. Transferring from account to account is free within the established limit, most often it is 50-100 thousand rubles per month. The money arrives within a few minutes.

- Broker card or bank account in BCS - transfer within the company is free and the fastest.

- Requisites. You can transfer money to a brokerage account using the details from any other bank account. The crediting period and commission depend on the sending bank. Most often, money arrives within 1-3 business days.

- A bank card from a third-party bank. Crediting funds to a brokerage account with BCS is free from cards of any banks, but the card issuing bank can write off a commission.

You can also top up your brokerage account with BCS from electronic wallets or through the Apple and Google Pay systems. Please check commissions, amount restrictions and crediting deadlines when sending money.

For different replenishment methods, a technical restriction on the transfer may be established. For example, in the BCS World of Investments application, a brokerage account cannot be replenished with more than 600 thousand rubles in one transaction. When replenishing an IIS, another restriction is legally established - it cannot be replenished in foreign currency and in an amount of more than 1 million rubles per year.

Available tools

Investors in BCS World of Investments have access to various exchange instruments. Therefore, the portfolio can be diversified according to the level of risk and possible profitability. Money can be invested in the following assets:

- stock;

- bonds, including OFZ and Eurobonds;

- BPIFs;

- ETF;

- foreign currencies.

In addition, BCS clients can use margin trading and also earn money from investing in options and futures.

Withdrawal of funds

You can withdraw all money from your brokerage account in BCS My Investments only after completing settlements for transactions. To do this, pay attention to the trading mode. For example, currency transactions are completed on the same day, for some bonds – on the next business day, for shares – after 2 business days. Therefore, if you sold Gazprom shares on Friday, you can withdraw the amount from the transaction no earlier than Tuesday.

BCS transfers rubles from brokerage accounts free of charge. The broker charges a commission for withdrawing currency.

In the withdrawal order, you can specify the card or account number within BCS or in another bank. The broker will charge a commission for withdrawals to third parties. If a withdrawal order is submitted before 5:30 p.m. on a business day, it will be executed immediately. If later - the next business day.

When funds are withdrawn from an IIS, the account will be closed. This must be taken into account when applying for withdrawal. If the IIS is less than three years old, you will lose the right to a tax deduction. In addition, if you have already received tax deductions for this IIS, they will have to be returned, taking into account penalties for use. If the account is more than three years old, the right to a tax deduction will not be lost.

Deposit/withdrawal of funds

In BCS you can top up your brokerage account in the following ways:

- In cash at any BCS cash desk with a passport. The operator will need to provide the date and number of signing the General Agreement and indicate the trading platform

- By non-cash method through any bank with the execution of a payment order (all details necessary for such a transfer are indicated in the notification that the client receives when opening an account)

By the way, when withdrawing money from your account, the broker does not charge a commission!

Rates

Until recently, the BCS broker had more than 10 tariff plans. This caused dissatisfaction on the part of customers. Very often they could not figure out which option to choose and how to switch from one tariff to another. Now the broker has simplified this task as much as possible for all clients. Today BCS has only two tariff plans:

| Category | Investor | Trader |

| Monthly fee | For free | 299 rubles per month |

| Payment if there are no account transactions | For free | For free |

| Transaction fees | Until December 31, 2021, transactions are free, then 0.1% | From 0.03% to 0.01%, the higher the trading volume, the lower the commission |

| Instructions to a broker by phone | For free | Up to 5 orders per day - free, starting from 6 - 59 rubles for each |

The mobile application and custody account maintenance are free for both tariffs. The “Investor” tariff is suitable for clients with a monthly turnover of up to 500 thousand rubles. The “Trader” tariff is for those who conduct many transactions during the trading day and manage large capital.

Fee for using the trading terminal for transactions on exchanges:

| Condition | Payment |

| One QUIK or WebQUIK terminal | If the account has more than 30,000 rubles - free If the account has up to 30,000 rubles - 300 rubles per month |

| Fee for the second and all subsequent QUIK or WebQUIK terminals | 300 rubles per month |

| QUIK mobile application | If the account has more than 100,000 rubles - free If the account has up to 100,000 rubles - 200 rubles per month |

| Fee for the second and all subsequent terminals of the QUIK mobile application | 200 rubles per month |

| Providing a MetaTrader terminal | Free for the first 3 terminals, if the commission for all sites exceeds the commission for using these terminals, under other conditions - 200 rubles per month |

There is a fee for withdrawing funds from a brokerage account outside the BCS company. Each currency has its own tariff. For example, for withdrawing US dollars, you will be charged 15 $, for withdrawing euros – 30 €.

All broker and exchange commissions can be viewed in the broker report. It can be viewed daily, weekly or monthly. BCS has no hidden fees.

Pros and cons of the company

Among the advantages of the broker, I would include, first of all, its high reliability and convenient location (BCS offices are open in every major city in Russia). Well, of course, it is worth noting the broker’s well-thought-out product line and, of course, not the lowest, but not the highest commissions.

I would especially like to note the possibility of exchanging currency at the exchange rate. The service is very relevant, for example, when exchanging $100,000 for rubles, you will save about 70,000 rubles (relative to exchange at a bank)!

Now a few words about the “fly in the ointment”. BCS clients often complain about the presence of hidden commissions, paperwork, large currency spreads, failures and lags in the operation of trading platforms and the incompetence of technical support staff.

Training from broker BCS Investments

All newcomers to the issue of investment can undergo training from the BCS broker, in the “Investment 101” mobile application. The application is free and publicly available on the Play Market.

When registering, you can independently set the level of difficulty - beginner, experienced or professional. And also choose topics:

- stock,

- investment,

- bonds,

- financial planning,

- trading,

- world markets,

- derivatives market,

- currency,

- ETF,

- trading platforms,

- IIS,

- FOREX;

- Mutual funds and trust management,

- precious metals.

The application contains free and paid courses. When you complete free courses and successfully pass tests, you are awarded special points that can be used when paying for paid courses. Training programs are compiled by BCS broker experts taking into account the real experience and needs of students.

The courses consist of video lessons and notes. The rating of the “Investing 101” application is not too high - only 3.4 points. The majority of users refer to malfunctions on certain devices or intrusive advertising after registering in the application. Here, too, not a single comment is left without feedback. Broker BKS compares favorably with many other mobile application developers.

Broker BCS teaches not only through the application. He conducts face-to-face classes and online webinars for investors and traders of varying backgrounds. The schedule of upcoming courses and their brief descriptions are available at this link. Classes can be selected according to several parameters:

- deadline;

- formats – seminars, webinars or BKS-Live;

- payments - paid or free;

- to the speaker.

All previous programs and courses are collected in the archive. You can view them without leaving the broker’s website.

In addition, BCS publishes educational materials that will help you understand the topic of investing and markets. The company's blog contains analyzes and analytical articles for clients with different experiences. Here you can explore the “Personal Experience” section, where first-person stories of BCS clients are published.

The broker also has a separate information training portal BCS Express, which contains many articles for beginners and more experienced investors.

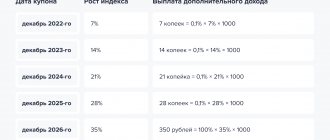

BKS Premier structural products

A structured product is a ready-made investment program. To earn additional income, you will only need assets, and you don’t have to worry about time. BCS Premier offers, depending on your wishes, to choose either protective products or profitable products.

A security product assumes that the money you invest will be returned in any case. Funds are invested in the most reliable assets - bonds of reliable companies, deposits of large banks. Such investments, while secure, have potentially high returns; most often, you will not be required to make additional expenditure transactions, and you will not need special knowledge in the field of investing.

An income product allows you to get increased income with higher risks. An investment portfolio of profitable products most often includes securities of young, promising companies. Income investments are suitable for investors who are prepared to take financial risks. And they understand that if they succeed, high profitability awaits them.

The main advantage of structured products is the opportunity to generate income. Both in rising and falling markets, as well as the possibility of investing in various currencies.

Additional services

In addition to the mobile application, trading terminal and training, the BCS broker provides clients with additional services:

- Bank cards Broker and Broker Premium;

- currency strategies;

- structural products;

- trading for beginners;

- financial strategies;

- dual strategies;

- investment strategies;

- insurance products;

- single brokerage account.

BCS also provides assistance in returning taxes from investment activities and obtaining the status of a “qualified investor.”

BCS broker cards

With the help of BCS cards, clients save on commissions when withdrawing funds to accounts and cards of third-party issuers. For the Broker Premium premium card:

- free cash withdrawal at any ATM up to 1 million rubles;

- daily limit of 0.5 million rubles at bank ATMs;

- free service for the first 2 months, then 1,900 rubles;

- free transfers in rubles to other cards and accounts;

- fixed commission for transfers in other currencies to cards and accounts of third-party banks;

- 2 free Priority Passes and 4 free Gett Premium trips per month;

- 1% bonuses from purchases of any goods and 9% in one of the categories when spending from the card 50 thousand rubles per month.

Conditions for the standard Broker BCS card:

- free cash withdrawal at any ATM up to 100 thousand rubles per month;

- free service;

- You can link your card to accounts in three currencies – rubles, dollars or euros.

- 1% bonuses from purchases of any goods and 7% in one of the categories.

A standard card is offered to all clients who open accounts with BCS.

Single brokerage account

On a single BCS brokerage account you can trade on both Russian and foreign exchanges in different currencies. This is a more convenient tool for investors, because there is no need to switch between accounts when conducting transactions and redistribute funds.

In addition, with a single brokerage account, you can enter into transactions in foreign markets secured by Russian assets and receive US analytical reviews in Russian.

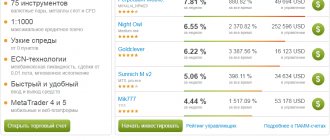

Autofollow

Autofollowing is a service that any investor can connect to a new account and until the end of the year, no commission for transactions will be deducted from him. The service is available in the BCS My Investments mobile application. You can choose the strategy yourself or entrust it to a broker. In the second case, indicate what you want to achieve as a result - save money or take a risk and earn money.

BCS offers 45 strategy options to choose from. They can be sorted by profitability, risk level, rating or minimum amount.

Open a brokerage account in

1

BCS Investments

Go

You can make money on exchanges in two ways. The first is to become a trader and trade. However, this is a long way to go. It is not possible to become an experienced specialist in a short time. An easier way is to become an investor. That is, you invest a certain amount, and the trader, using them, begins to trade. The portfolio consists of the money of several investors. Plus + the trader can add his own money.

However, for trading you need to use the services of special platforms. Therefore, below we will analyze the BCS platform and see how to open an account on it.

Advantages and disadvantages of cooperation

When collaborating with BCS, clients note both advantages and disadvantages, but there are significantly more advantages than disadvantages. Main advantages:

- one of the first brokers in the Russian Federation, which has been operating on the market for 26 years;

- access to American and international exchanges;

- convenient application interface;

- instant changes in quotes and execution of transactions during stock exchange opening hours;

- remote submission of an application for a brokerage account;

- access to the account and transactions are possible within 5 minutes after the application is approved;

- demo version for training beginners;

- a special application for teaching trading and investing;

- free replenishment of brokerage accounts in various ways;

- ready-made strategies that can be followed without special knowledge and without being too immersed in the market;

- a single brokerage account from which you can trade in different currencies and on all available exchanges;

- high level of broker reliability according to rating agencies - AAA;

- availability of feedback via several remote channels - chat, telephone, special form.

Broker BCS has a hotline for calls from investors - 8 800 500 55 45. Also, all clients can fill out a feedback form and receive personal advice. To do this, you will need to indicate the subject, name, phone, email and state your question.

Disadvantages of cooperation with a BCS broker:

- technical failures in the operation of applications and terminals, although they are not very frequent compared to many other brokers that have recently entered the market;

- reduction in service level and intrusive advertising;

- paid withdrawal of currency from a brokerage account.

According to current clients, the BCS broker is losing ground a little and is beginning to cede leadership to its closest competitors, who are conducting aggressive advertising and attracting many more new clients. But he still manages to be among the top 5 companies in terms of the number of clients who conduct transactions on the Moscow Exchange.

Personal opinion

Experience shows that technical failures and managerial errors happen with any broker. But not all major Russian brokers can boast of such reliability and such a “range” of products and services.

It is also worth noting the excellent design of the site and the “chic” address on the RuNet - broker.ru, which speaks of the company’s attention to detail. In general, I consider BCS to be quite a worthy option for cooperation, especially for beginners who are entering the Stock Market for the first time. By the way, if you are just such a beginner, I recommend that you first attend this free webinar by Dmitry Mikhnov.

What are your impressions of working with BCS Broker? Subscribe to updates and don't forget to share links to the most interesting posts on social networks!

Summary

BCS is a well-known broker on the Russian market. About 15 thousand new clients come to the company every month. The broker is constantly expanding its product line and offering investors and traders additional services. Despite the emergence of new active players, BCS still occupy a leading position in terms of turnover.

According to experts and analysts, growing competition in the Russian brokerage services market benefits everyone. Not only for companies, but also for clients, since they have a choice of where to open brokerage accounts in order to receive the most profitable and high-quality service.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Determine your attitude to risk

Investments always involve risk, and it is important for a new investor to remember this. If you shudder at the thought of possibly losing your investment, you should probably look at reliable instruments with full capital protection. If you are willing to take some risk for increased returns, you can consider high-risk assets. To understand which investment instruments are right for you, go through risk profiling—most brokers provide this service.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

Stick to your chosen strategy

Choosing an investment strategy and building a portfolio is just the beginning of the journey. Investments will bring the desired results only if they are managed correctly. The proportion of assets in a portfolio may change over time, making it riskier or, conversely, overly conservative. The investor’s task is to periodically bring the ratio of investment instruments to their original values. This procedure is called rebalancing and allows you to maintain an optimal level of portfolio risk.