- Crypto exchange or broker?

- What is the difference between a broker and a cryptocurrency exchange?

- Registration and verification process

- Account replenishment and withdrawals

- Trade

- Safety

- Income

- Comparison table between broker and exchange

- Conclusion

No matter how long you have been working with cryptocurrencies, you probably know that there are two main ways to trade digital coins - a broker and an exchange. But even for those with extensive experience in blockchain solutions, the difference between a crypto exchange and a broker is not always obvious.

Crypto exchange or broker?

To begin with, let us note the obvious similarity with the operating principle of a conventional exchange.

Cryptocurrency exchange clients buy and sell both cryptocurrencies and fiat.

In this model, the exchange acts as an intermediary that arranges the transaction and charges a fee for this service.

There are two traditional ways to use crypto exchanges. The first is the purchase of cryptocurrencies for fiat, the second is the exchange of some cryptocurrencies for others, for example, BTC to ETH.

Different exchanges offer different trading pairs, and the trader independently decides where it is more profitable for him to trade. Let’s imagine a situation in which an investor replenishes his account in USD on the exchange. In this case, the initial choice of instruments for trading will be limited to pairs pegged to the US dollar, for example, BTC/USD or ETH/USD.

A cryptocurrency exchange is already a traditional way of exchanging cryptocurrencies, especially convenient for transactions with small amounts of funds.

A cryptocurrency broker is an intermediary between traders and the market.

Someone who uses a broker to conduct trading transactions deposits funds (fiat or cryptocurrency) into the broker's account and then uses the various products that the broker provides. The trader is not limited to trading only those pairs that are tied to the currency of his deposit - he can use any others. The broker will find a counterparty to carry out the required transaction, or act in this role himself and close the transaction.

Let's look at a simple example. The client transfers his bitcoins to the broker, but plans to trade Ethereum/XRP with leverage. That is, the client can immediately trade the selected pair for the number of bitcoins that he deposited into the account, taking into account the leverage used. If he wanted to do a similar transaction on a cryptocurrency exchange, he would first have to exchange his bitcoins for ether.

Introduction

The modern market has become more accessible to private investors. To start investing, you just need to have a smartphone at hand. Services allow you to trade stocks, bonds, futures and precious metals.

When choosing an investment application, you should pay attention to:

- broker rating;

- convenience of service;

- commission size;

- availability of necessary tools.

The services listed below make it possible to monitor the market situation, make transactions and receive advice from specialized specialists.

What is the difference between a broker and a cryptocurrency exchange?

Let's figure out how a cryptocurrency broker and an exchange differ fundamentally.

Brokerage services are more suitable for trading large volumes of currencies. There are several reasons for this, including security and high liquidity. After depositing funds, various trading opportunities open up for you, depending on which broker you contacted - leverage, etc. On the other hand, the exchange offers a simpler procedure using the order book of the trading pair associated with the deposited asset, be it cryptocurrency or fiat. Thus, the exchange brings together buyers and sellers, for which it charges a commission.

It is worth noting that in spot trading on an exchange, physical delivery of the asset being exchanged takes place, while in the case of broker-assisted margin trading, the underlying asset is traded without physical delivery.

The difference between an exchange and a broker can also be considered using the example of the target audience. The services of cryptocurrency exchanges are mainly used by hodlers who are interested in long-term or medium-term investments. Such clients, for example, buy a specific cryptocurrency and wait for its value to increase, or simply buy certain digital coins and then transfer them for secure storage to their hardware wallet.

Brokers are usually approached by speculative investors who use the services provided by brokers, such as margin trading. They make various types of trades with the ability to use available technical analysis tools. Such clients seek to obtain short-term or medium-term profit, and the broker acts as an intermediary who helps to obtain it.

Tinkoff Investments

- Commission: 0.3%

- Open a brokerage account

The projects, which are united by the name of Oleg Tinkov, are built on technology and conversation with the client on a first-name basis. In just a few months, Tinkoff Investments was able to become one of the three most active brokers on the Moscow Exchange. And in April 2022, the company overtook SberBank in terms of the number of registered clients and took first place in this indicator - 1.7 million people. In 2022 it reached 7 million investors.

The broker also leads in the number of active clients - those who made at least one transaction with shares per month - 1.5 million people. In terms of the number of open IIS (individual investment accounts), the company ranks second with 900 thousand accounts. In terms of monetary volume of user transactions, it ranks only 13th.

Broker Tinkoff provides the user with a lot of stock information: fundamental indicators of companies, investment ideas, forecasts, news, dividend calendar. There is also a social network “Pulse”, where investors discuss securities, share ideas and deals.

Advantages:

- Low entry threshold. You can start investing with any amount.

- Remote opening of a brokerage account. The documents are delivered by courier.

- 24/7 chat support, investment ideas, analyst forecasts, news, ready-made investment portfolios for beginners.

- A robot advisor that will help you choose assets.

- About 11,000 securities in the catalog: Russian stocks, US stocks, ETFs and currencies.

- InvestIndex, which reflects the mood of investors in Russia. It shows which securities from different industries they currently prefer to buy or sell.

Registration and verification process

Each exchange its own registration procedure. For some sites, it is enough for the client to provide only an active email address, which then needs to be confirmed and a password set - this completes the registration procedure. Other platforms, in particular those that work with fiat, require verification. The client may be invited to a video call, asked to take a photo with an identification document, scan this document, or undergo a KYC (Know Your Customer) procedure. The KYC procedure is especially often used when a trader intends to use high limits for depositing and withdrawing his funds.

For example, one of the largest exchanges, Binance, allows you to trade without going through the full KYC procedure, but in this case the withdrawal limit will be set at 2 BTC per day.

The verification process can take from several hours to several days. For example, during the 2017/18 bull trend. some exchanges took much longer to verify, and some of them did not open new accounts at all due to the huge influx of users.

As with cryptocurrency exchanges, many brokers also offer easy registration methods. But verification for brokers is also very important, since their activities are subject to regulation. In most cases, their representatives will ask for proof of identification and some form of proof of home address, such as an electricity bill or rent.

The verification process itself usually takes less time than on the exchange. Immediately after the account is verified, the trader can deposit funds and start trading.

VTB

- Commission: 0.05%

- Open a brokerage account

Another bank that actively promotes brokerage services in Russia, with a customer base of 1.8 million people and the number of individual investment accounts of 745 thousand accounts. VTB is one of the leaders in terms of the volume of client transactions. In October 2022, the broker’s trading turnover amounted to 1.4 trillion rubles – fourth place. The broker provides information support to beginners: arranges mini-courses, holds online conferences, publishes ideas and stock analytics.

He, like other brokerage companies, has access to Russian and American stocks, bonds, and ETFs. You can hire a personal advisor or invest in structured products.

Advantages:

- A stable company with a reliable reputation.

- Training centers for beginning investors, courses, conferences, “Investor School”.

- Personal consultant services.

- A robot advisor that selects suitable investment instruments.

Account replenishment and withdrawals

The cryptocurrency exchange offers two options for depositing and withdrawing funds. The first option is to top up using fiat money, and there are several nuances here. Firstly, many exchanges simply do not accept fiat. Secondly, the exchange may charge a large commission for depositing fiat funds. Typically, fees are charged for depositing fiat through a bank account, as well as for using a debit or credit card. The same applies to withdrawals. Moreover, in this case, the commission may even be higher than when replenishing. If the client nevertheless decides to do this, he is usually recommended to make sure that the receiving bank accepts transfers from cryptocurrency exchanges in order to avoid unpleasant surprises.

Fees can be much lower if you deposit and withdraw crypto funds. Most exchanges do not charge commissions at all for replenishing funds, but only for withdrawals.

There are clear advantages for clients when using the services of a cryptocurrency broker. Brokers offer more options for depositing money: bank account, debit card, credit card, various types of electronic payment systems, as well as cryptocurrencies. However, as a rule, no commission is charged for depositing funds.

Additionally, traders will not have to pay high commissions when withdrawing funds from a brokerage account. They typically range from 0% to 3%, while some cryptocurrency exchanges charge 6% for withdrawals!

Quik mobile app

Quik terminals are used by brokers as their main or alternative system. At the same time, professional market participants offer this service as an addition to their own developments - for example, this is what Sberbank does, which simultaneously has its own product and Quik. The Quik mobile app includes market overview pages, as well as futures, stocks, options, and bonds. In addition, users have access to comprehensive information about the status of the brokerage account, balances, losses or profits.

Quik mobile app users get access to:

- domestic exchanges - Moscow and St. Petersburg;

- foreign exchanges - CME, NASDAQ, ICE and NYSE.

Quik allows you to track your client portfolio and is characterized by high speed of information processing and prompt submission of applications.

Trade

The process of trading cryptocurrency on the exchange is quite simple. Most exchanges use order books, which you can use to place either a limit trade order or initiate a market order. The liquidity of each exchange depends on its market depth. The higher the liquidity, the smaller the spread between buy and sell orders.

Most exchanges provide only basic functions, which, however, are enough for the average user. A small number of specialist exchanges offer high leverage trading instruments such as futures or perpetual swaps.

The biggest advantage of the exchange is the ability to trade a wide range of cryptocurrencies.

Brokers provide additional tools for margin trading, such as Contracts for Difference (CFD), derivatives, etc. Brokerage platforms also often offer clients special tools that help users in the trading process. They include technical analysis tools, such as various indicators, moving averages, etc. and even automated trading strategies and robots. All of them are aimed at managing risks and improving trading results.

If a client trades CFDs, leverage can be used to expand financial capabilities. For example, if the selected cryptocurrency has a CFD leverage of 1:2, and the price moves by 5%, the CFD trader will make a profit of 10%, or, conversely, lose 10%. It all depends on the direction of price movement and the type of position chosen. This means that when trading CFDs you can either make a large amount of money quickly or lose it quickly. That is why this tool is recommended for experienced traders.

Also, crypto brokers provide tighter spreads than crypto exchanges. This is the main reason for their popularity, especially among those involved in margin trading.

SberBank

- Commission: 0.06%

- Open an account

Until 2022, as the largest bank in the country, SberBank maintained leadership in many indicators. Now it is in second place in terms of the total number of clients - about 5.2 million, and in third place in terms of the number of active ones - 291 thousand.

SberBank has the most registered IIS - 2.1 million. In terms of the volume of client transactions, the company closes the top ten (944 billion). This is most likely due to the fact that the bank mainly serves investors with small capital.

Advantages:

- The largest Russian bank.

- An account can be opened remotely through SberBank Online.

- Many service points.

- There are trust asset management, mutual funds, individual investment systems with ready-made strategies and model portfolios.

- You can buy precious metals

- Conferences and webinars on investments.

Safety

Have you heard about the recent hack of the KuCoin exchange? What about the hacking of the HitBTC or Mt.Gox exchange? As many of you know, crypto exchanges are being hacked all over the world, and even such a giant as Binance has become a target of hackers and scammers - in 2022, there was a Binance KYC data leak.

Cryptocurrency exchanges are still vulnerable and will continue to be vulnerable to hacker attacks. This does not mean that crypto brokers cannot be hacked or their funds cannot be stolen. The difference is that brokers are regulated by the authorities, so their clients' deposits are protected to some extent by an insurance system. Compensation in case of hacking and theft of funds is a good advantage in the eyes of users who come from the unregulated environment of crypto exchanges, where at times it is even impossible to determine the localization of the site.

Typically, the competent authorities monitor and verify the activities of brokers , which already increases their authority. A client definitely feels more confident sending funds to a broker that is audited and regulated by a government agency, such as the Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA), than to an exchange located in something in an offshore zone. Another guarantee of security when working with brokers is that the latter keep their clients’ funds in bank accounts.

If a client chooses between an exchange and a broker based on security concerns, he needs to focus on his own goals. By choosing a reliable exchange with access to a large number of altcoins, you can make high profits with a relatively low security risk.

Storing funds that are not intended for trading in hardware wallets like Trezor or Ledger is a common option and is also a safer option than cryptocurrency exchange accounts. The reason is obvious - hundreds of different types of cryptocurrencies can be stored on an exchange account, but all these funds do not belong to the user, who does not and cannot have private keys to crypto wallets. As long as the money is kept in the account, it belongs to the exchange. As they say: “Not your keys, not your crypt!”

Summary

It is difficult to say unequivocally which broker is the best in Russia. If we evaluate trading conditions, reputation, and turnover on the MICEX, then BCS . They offer adequate commissions, you can open an IIS of both types, and thousands of trading instruments are available. Another thing that speaks in favor of BCS is that on the MICEX this company is the leader by a wide margin.

If you don’t yet have money for a substantial deposit, you can open an account with Just2Trade . To do this, you will only need $200, you will develop practical skills and at the same time save for a larger deposit in a more serious company.

If you have any comments about the brokers included in my rating, leave them in the comments. Share your experience working with these companies there.

This concludes today’s review; I wish you success in investing and stable capital growth. Don't forget to subscribe to my blog updates. This way you will be among the first to know when new materials are released on the site.

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

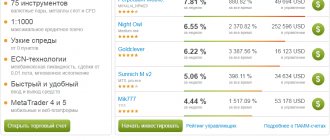

Income

What are the similarities and differences between a cryptocurrency broker and an exchange when we talk about them as sources of income? After all, both the exchange and the broker make a profit from trading commissions.

Cryptocurrency exchanges attract traders with a variety of trading pairs, for which they have a fairly large spread due to the liquidity of the relatively shallow market depth. They typically charge higher fees for trading, withdrawals, and sometimes even deposits.

The broker , for its part, offers lower commissions for withdrawals and trading operations, but they trade larger amounts, so the overall profit from commissions may be the same as with exchanges.

Alfa Bank

- Commission: 0.3%

- Open an account

Alfa-Bank provides brokerage services through the Alfa-Investments branch. Its monthly number of active investors on the Moscow Exchange in 2022 rose to 78 thousand.

In the general trend, the number of investors in the company is growing: from 129 thousand at the beginning of 2022 to 1.3 million by the end of 2022. At the same time, only 26 thousand IIS are registered through a broker. And in terms of the volume of operations, it is not even included in the TOP-25.

Advantages:

- Investment services from one of the leading banks in Russia.

- Opening an account in any branch or online.

- Trust management, ready-made investment solutions and strategies.

- Training in stock exchange trading, investment ideas, analytics.

- Mutual funds and asset management services from Alfa Capital Management Company.

Comparison table between broker and exchange characteristics

| Broker | Exchange | |

| Liquidity | High | Average |

| Exchange glass | Potentially larger | Limited |

| Support | With Rich Features | With limited functions |

| Functional | For advanced users | For regular users |

| Use of fiat funds | Yes | Not really |

| Number of cryptocurrencies | Few | A lot of |

| Spread | Narrow | Wide |

| Security of funds | Protected | Partially protected |

| Regulation | Yes | Depending on jurisdiction |

Crypto exchange and broker comparison table

FINAM

- Commission: 0.05%

- Open a brokerage account

FINAM has long been among the leaders of the Russian market. Brokerage services are the main specialization of the company. Until 2022, the brand was consistently among the top five active and large brokers according to various indicators, but due to growing competition it is gradually losing its position. In 2022, according to Moscow Exchange, FINAM has 306 thousand clients, of which 44 thousand are active every month.

The company has different types of services. In addition to access to trading on Russian and foreign markets, the company trains beginners, provides ready-made strategies through the Comon.ru service, collects investment portfolios using artificial intelligence, and provides personal consultations.

Advantages:

- A reputable company with extensive experience.

- Representative office in 90 cities.

- Consulting service.

- Courses, webinars, seminars via Skype, school of finance, availability of a demo account.

- The Right robot is a broker’s partner project that selects the optimal investment portfolio based on artificial intelligence.

- The Autofollow service is an opportunity to trade like a professional, even for those who have never invested in securities.

Gazprombank

- Commission: 0.085%

- Open a brokerage account

Bank GPB rose to the top ten of Russian brokers in December 2019, gaining 37 thousand clients. In 2022, the number of open brokerage accounts with Gazprombank increased to 69 thousand. Active investors – 8 thousand, IIS – 26 thousand. At the same time, the company is in eighth place in terms of the total volume of transactions - 1.1 trillion rubles.

Advantages:

- There is trust management and personal consulting.

- An investment constructor that helps you choose a strategy.

- Combined products where you can get a percentage of a bank deposit and income from investments.

- Sale of precious metals, commemorative and investment coins.

Access to foreign securities

Now I’m thinking about getting into trading on foreign exchanges. I'm just interested in comparing our dismal market with the American market. I would like to see super cool and long-term trends, etc. And now the factor that is important to me is whether the broker has access to foreign sites.

Do you understand where I'm going with this conversation? By the way, this is the argument and example I spoke at the beginning of the article. A trader grows, evolves and can expand his field of activity.

| Broker | Access to foreign sites |

| FGS BKS | access available |

| Opening | access available |

| Finam | Access available |

| Alor+ LLC | access available |

| Keith Finance | access available |

| Aton LLC | At the first level there is no access. And the second level from 10 million rubles |

Broker Aton LLC is knocked off our list of brokers. I would like to start trading on the American market with smaller amounts of money.

Freedom Finance

- Commission: 0%, but there is a monthly subscription fee of 600 rubles.

- Open an account

Investment company Freedom Finance was founded in 2008. What sets her apart from others in this ranking is her work not only on the Moscow Stock Exchange, but since 2013 on the Kazakhstan Stock Exchange. Freedom Finance offices are open in Moscow, St. Petersburg, Almaty and other 46 cities.

There are 129 thousand clients registered on the Moscow Exchange through this company, of which approximately 10 thousand are active per month. The number of issued IIS is 11 thousand.

Advantages:

- Consulting management, ready-made strategies, mutual funds, analytics.

- Open seminars, trading training, portfolio investment training, webinars, stock exchange university.

XM

XM is included in the list of Top 10 most reliable Forex brokers in Russia and operates in 196 countries around the world. It was founded in 2009, so it cannot be called young. This is already an advantage. The company has more than 3,500,000 clients and over 2,400,000,000 transactions without requotes or rejections.

As you can already see, XM is a very large, reputable and experienced player in the Forex broker market. Over many years of operation, the company has received a huge number of awards, which you can find on the official website.

Here is a short list of the benefits of the XM broker:

- Operates for more than 10 years on the market, which indicates reliability and trust from clients (traders)

- Covers 196 countries

- Has an incredible number of clients - 3,500,000

- Uses more than 25 reliable payment systems

- Has 16 multifunctional trading platforms

- The support service works 24/5 in 30 languages, including Russian

- 99.35% of all trade orders are executed in less than 1 second

- Provides free Forex market analysis

- Conducts free daily webinars on Forex

- Provides unlimited access to training videos

- Daily trading signals for Forex

- Free daily technical analysis

- Daily Forex Market Review

Provides the ability to work in platforms such as:

- MT4

- MT5

- XM WebTrader

Forex broker XM allows you to trade the following types of assets:

- Over 55 popular currency pairs

- CFD on indices (major world indices)

- CFD on commodities (sugar, cocoa, wheat, etc.)

- CFD on shares (over 600 companies)

- CFD on metals (gold, silver, palladium, etc.)

- CFD on energy resources (oil, gas, etc.)

You can register and start cooperation with forex broker XM on the official website – xm.com

Opportunity to open a brokerage account online

Brokers' offices are usually located in large cities. And now you can open a brokerage account without coming to the broker’s office if you live somewhere in a remote taiga village. This service is available from almost all major brokers.

Let's see, after all, maybe some of the brokers still have problems with remote servicing.

| Broker | Possibility to open a brokerage account online |

| FG BKS | available online |

| Opening | available online |

| Finam | available online |

| Renaissance Broker | dropped from the list. The site is very inconvenient for customers |

| Alor+ LLC | available online |

| Univer Capital LLC | only available in the office |

| LLC IC “Freedom Finance” | There is no online service, but you can courier documents to the office without personal participation |

| Keith Finance | available online |

| Group of Companies Region | no online contract conclusion |

| Aton LLC | available online |

I went through the websites of the brokers listed above and several brokers who have problems with remote account opening are dropping out of the competition.

- Renaissance broker

- Univer Capital LLC

- LLC IC “Freedom Finance”

- Group of Companies Region

ATON

- Commission: 0.035%

- Open an account

ATON is the most experienced investment group in Russia, founded in 1991. She works with investors of any capital. There are services for wealth management, trust management, mutual funds, and structured products.

The organization has registered 58 thousand clients (3–3.5 thousand active) and 12.5 thousand individual investment accounts on the Moscow Exchange. In 2022, the average volume of customer transactions amounted to 947 billion rubles – tenth place in the ranking.

Advantages:

- One of the oldest companies on the Russian stock market.

- Representative offices in 63 cities of Russia - from St. Petersburg to Yakutsk.

- There are investment funds and financial management services.

- Aton Space is a platform for wealthy investors that brings together the investment committee, analytical team, financial advisors, portfolio managers and traders in one information space.

Try the Right robot, a service that helps you choose stocks and bonds. Invest like a pro – without experience or special knowledge