Options allow you to speculate on the future price of an asset by paying a small premium. If your forecast comes in, you can buy or sell an asset at the strike price of the option contract, that is, make money.

If this does not happen, you will simply lose your bonus. Thus, options trading is an ideal mechanism for gaining access to financial markets with low risk and high reward.

With that said, trading options are much more complex than buying and selling traditional asset classes, so it's important that you know what you're doing before you part with your money.

That's why we suggest reading our options trading guide, Learn 2 Trade 2022. In it, we explain how options trading works, what you need to look for before buying a contract, and most importantly, how you can make money in this space.

Note. You need to figure out whether you are trading American or European options. In the first case, you can exit the trade before the contract expires. If it's the latter, it won't work.

Content

Eightcap - an adjustable platform with tight spreads

Our rating

- Minimum deposit is only $250

- 100% commission-free platform with tight spreads

- Free payments using debit/credit cards and e-wallets

- Thousands of CFD markets including Forex, stocks, commodities and cryptocurrencies

Visit Eightcap now

Start your journey to achieving all your financial goals right here.

Serious Information Data

Many of those who are interested in this type of good earnings, like binary options, should not rely heavily on the reviews of traders who have achieved success, since there is often no benefit from this. There are many types of business, but one of the most popular ones that allows you to improve your financial condition in a short period of time is the implementation of income strategies.

Those who are more agile in getting easy money are selling special video courses, printed publications, and so on. All this is supposedly aimed at getting rich overnight. It is clear that no one will post negative reviews in such projects and video courses. Everything here is as positive as possible. How much can you trust them? We need to think as critically as possible here. An option is a unique type of instrument that has a predetermined value, as well as the amount of income. If the trader strictly adheres to all the prescribed conditions, then as a result he receives the desired income.

No need to count on cosmic sums. It is clear that options cannot be compared with Forex, but at the same time they have a very complex system. In this regard, a certain amount of time is needed to understand them. Even when everything is fully studied, it will not be possible to give a 100% guarantee that you will be able to earn a lot on cryptocurrency in binaries and make money in general.

| Start trading binary options with the trusted brokers listed below |

What are the options?

Before we explore how the trading process works, we first need to discuss what the options actually are.

In short, options allow you to speculate on the future direction of an asset without taking immediate ownership. Instead, options give you the right, but not the obligation, to buy or sell the asset later. This is in stark contrast to futures, because by law you must take ownership when the contract expires. This became evident in April 2022 when the oil futures price turned negative as contract holders did not have the logistics to deliver! With options, by paying a small "premium" you gain access to the market. The general goal is for your asset to move above or below the "strike price" before the option contract expires. For example, let's say you pay a $100 premium to buy 100 IBM stock options.

The contracts have a strike price of $150 and a validity period of 1 month. If the IBM stock price exceeds the $150 strike price before expiration, you make a profit. Your profit is based on the market price at expiration minus the strike price. For example, if IBM closed at $160, that's $10 higher than the $150 strike price. You had 100 contracts, so this means that by exercising your right to buy shares at the strike price, you made a profit of $1,000 (10 contracts for $100).

At the other end of the spectrum, if IBM stock had closed below $150, you'd have a $100 premium. Even though you suffered a loss, you were able to speculate on the future direction of the stock without having to buy entire shares. In fact, you can purchase options contracts on almost any asset class. This includes everything from indices, energies, hard metals, ETFs and cryptocurrencies. As we'll cover in more detail later, you'll need to use a regulated online broker to access the options trading space.

Trading Recommendations

Below are recommendations that, if followed, will reduce the share of unprofitable trades in the statistics. They will also allow you to avoid most of the mistakes that are typical for novice binary options traders.

Consider market volatility

It may not be obvious to beginners, but volatility varies depending on the time of day. It is influenced by trading sessions, and maximum activity is observed during the work of Europe and America.

There are strategies for both highly volatile markets and flat ones. Take this into account when working:

- If the TS is intended for a calm market, it makes sense to look for entry points even after the US stock exchanges close. At night, such transactions work especially well. True, at this time brokers often cut the percentage of payments on transactions, compensating for the growing win rate of traders;

- If the strategy is trending, we exclude night time from work.

Do not use exotic currency pairs

Most brokers provide access to more than 100 instruments on which you can make transactions. But this does not mean that your strategy will work on each of them.

If the TS gives a win rate of 65-70% on EURUSD and GBPUSD, then at the same time it can consistently lose money on oil, cryptocurrencies or stock market instruments. This applies to a greater extent to indicator vehicles; universal techniques (graphical analysis, candlestick patterns) work on all instruments without exception.

On exotics, there is a high probability of geopolitical factors influencing the chart; gaps often occur. The chart can stand still for several days, and then instantly rise or fall by hundreds of points. They are difficult not only for beginners in binary options ; if on Forex this can still be justified by the potential for movement, then in the case of BO the profit does not depend on the distance traveled. So there is no point in additional risk.

Do not use exotic trading techniques in trading

Above we indicated only a general classification of trading strategies. In fact, there are many more trading techniques. Among them there are also exotic methods based almost on the analysis of the phases of the moon. Their usefulness is also questionable in Forex, where you can sit out a loss and wait for a movement in the right direction. In the case of BO, where input accuracy and fast signal processing are important, such techniques are useless.

As an example, let's look at wave analysis. It is believed that the main movement contains 5 waves, and the corrective one – 3. On history, the marking looks good, but when trying to analyze the chart in real time, when there is nothing to the right of the current price, it does not provide an entry point. You will only estimate different options for the location of the waves, not understanding where to enter the market.

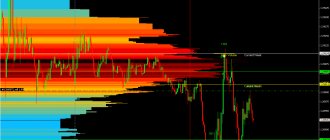

Such an analysis looks something like the one shown in the figure above. Effective, beautiful, but there is no main thing - a clear entry point.

Binary options for beginners are already difficult to master. Don't complicate your life even more by using complex fairy-tale vehicles, even if a step-by-step description is available. Use simple and reliable analytical tools. You can make money even on a blank chart.

Follow the economic calendar

Consider the economic calendar as a source of information about when the market may present an unpleasant surprise. A calendar is especially important for novice binary options traders, as it will help avoid spontaneous losses. If you see strong news on the calendar, then do not trade at that time. On Forex, you can try to catch strong movements, but with BO such tactics do not work well, and they are not for beginners.

Market reaction to news

Among the strong news we highlight:

- unemployment and employment data;

- interest rate decision;

- inflation statistics;

- GDP data;

- factors such as elections, meetings of regulators and comments from their heads regarding the state of the economy.

Perhaps because of this precaution you will miss a couple of entry points, but overall this will have a positive effect on the win rate.

Pros and cons of options trading

- You have the right, but not the obligation, to buy the asset later.

- Options can facilitate low-risk, high-return investments

- Possibility to sell or trade an asset

- Use leverage to increase the volume of your trades

- Hundreds of regulated options trading brokers to choose from

- Start with a debit/credit card or e-wallet

- Trade on the go with your broker's app

- Most new traders lose money

- You must be able to deal with the emotional side effects of losing trades.

Conclusion

Options are a complex but worth exploring derivatives market instrument. It is well suited for beginners, because when buying an option, the risks are limited by its value. When trading options, you need to have a good understanding of the price fluctuations of the underlying asset, because the result of the calculations depends on them.

Did you learn anything new about options? Are you ready to take advantage of new knowledge on the Moscow Exchange? Write in the comments what else you would like to read more about. Share this article with your friends on social networks so that they too become familiar with the concept of options.

Understanding Options Trading - The Basics

Unlike the traditional trading space, where you simply need to buy an asset and hope to sell it later, options trading is much more complex. With that in mind, we're going to walk you through the process step by step.

✔️ Call options and put options

To get things moving, you first need to determine which direction you think the asset will move in the markets. In the world of options trading, you will need to buy either a call option or a put option.

In its simplest form, if you think an asset will increase in value, then you will need to buy a call option. This is the same as placing a "buy order" in the traditional investing space, which means you are taking a "long" position on the asset.

Alternatively, if you think the asset will go down in value, you will need to buy a 'put option'. In the traditional trading space, this is the same as placing a “sell order,” which means you are taking a “short” position on an asset.

✔️ Starting price

Once you have decided whether you want to place a call option or a put option, you need to estimate the strike price of the asset. In the case of options trading, this is the price that will determine whether your trade will be successful. For example, let's say the strike price for Apple stock is $280.

If you place a call option, this means that you want Apple stock to close at a price above $280 upon expiration of the contract. If you placed a put option, then you would need the price to be below the $280 strike price.

Options brokers usually offer you several strikes to choose from. This will affect the premium you pay. In other words, as the likelihood of your prediction coming true increases, so does the premium.

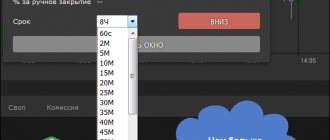

✔️ Validity period

Like futures contracts, options always have an expiration date. This is the date on which you will be able to exercise your right to buy or sell the asset. In the traditional options trading space, the expiration date is typically set to the third Friday of each month.

However, with an online broker, you have much more flexibility. In fact, options contracts range from 1 day to a full year.

✔️ Premium

To gain access to the options market in question, you will need to pay an upfront fee. This acts as a non-refundable deposit. In other words, if your forecast is correct, you need to subtract the premium from your profit.

For example, if you paid a $200 premium to access the market and your trade made a profit of $500, your actual profit would be $300. If your options trade is not out of the money at expiration, you will simply lose the premium.

As for how much insurance premium you will need, this will depend on a number of variables. This includes both the current market price and strike price of the asset, the expiration date of the contract, and whether the asset pays dividends or interest.

Moreover, the premium is often in the range of 5-10% of the asset price.

Let's look at a quick example based on a 5% premium.

- Do you think Amazon stock will trend higher in the coming weeks?

- So you decide to buy a call option.

- Amazon's current stock market value is $2,300.

- The exercise price of the option contract is $2,500.

- The contract expires in 2 months

- At 5% of $2,300, your premium is $115.

If Amazon closes in two months at $2,700, it will be $200 above the strike price. Without your $115 premium, that would give you a profit of $85. per share.

It's important to note that you likely won't be able to purchase just one share, as options brokers typically set minimum lot sizes, which we'll cover below.

✔️ Minimum lot size

In the Amazon stock example above, we based our returns on a single share. However, most options brokers will ask you to purchase a minimum lot size. In the traditional options space, this is typically 100 contracts. However, this is not always the case, especially if you are trading an asset that has much greater value.

That said, let's look at a quick example of how a minimum lot size of 100 contracts will affect both your premium and profit potential.

- Let's say you want to buy call options on Disney stock, which currently has a market price of $100.

- The exercise price is $107 and the options expire in 30 days.

- The premium on call options is 7% of the current market price, which is $7.00.

- The broker requires a minimum lot size of 100 contracts.

- This means you need to pay a total premium of $700.

Let's say the options are in the money and Disney shares are valued at $125 when the contracts expire in 30 days. That puts the price $18 above the $107 strike price. If you have 100 contracts, you will make a profit of $1,800. After you subtract the $700 premium you paid up front, you'll have $1,000 in profit.

Real examples from the Moscow Exchange

In practice, options are usually used to limit risk. Let's imagine that you want to buy shares of Sberbank - now they cost 239 rubles. In the future, they may increase in price, in which case you will receive unlimited profits. But they can also sharply lose their value; the value of shares can drop to at least 5 rubles per share. In this case, your losses will be simply enormous. This is where options come to the rescue. The options board of the Moscow Exchange presents options on a selected underlying asset with a specific expiration date - we choose SBRF-9.20 as the underlying asset, that is, futures on Sberbank shares.

If you scroll below, you will find tables with later due dates.

Let's look at the table - it is mirrored. On the left we have call options and on the right we have put options. The central column - “Strike” - plays a key role. The strike is the price at which a transaction on the underlying asset will ultimately go, that is, the price that is fixed by the option for a subsequent transaction.

So, if you expect that Sberbank share prices will rise by August 26, 2020, then you should buy a call option. If you predict a collapse in stock prices, then you should buy put options. But at what price should you buy options?

In the table you see four columns:

- theoretical price is the “ideal” price calculated by the exchange based on the settlement date, strike price and other parameters. The market strives for it, but does not always achieve it;

- the settlement price is the theoretical price adjusted for the volatility of the underlying asset. You don’t need to focus on this column - it’s not very important when buying options;

- buying and selling are the most important columns. This is where you can see the real price of selling and buying an option on the exchange. The option price is also called the premium.

Now we can make our example more clear. You can buy a call option with a premium of 57.0000 and a strike of 23,500. If the price of the underlying asset rises by more than 57.0 before 08/26, you will win. If the price rises, but by less than 57.0, you will not make a profit, but you will be able to partially offset the option premium by raising the price of the underlying asset. If the futures price falls, then there is no point in closing the trade - you can simply abandon the option.

Option code

By default, the asset code does not appear on the options board. To see it, you need to check the “Instrument code” box when creating a filter on the exchange website. I highly recommend displaying the instrument code because this way you can get information about the option faster.

On the exchange, all securities are marked with codes so that experienced traders, with a quick glance at the table, understand what's what. If you plan to work with options, you should familiarize yourself with this marking - it is discussed in detail on the Moscow Exchange website. We will quickly go over it without going into details.

The first two characters are the code of the underlying asset. After them there are numbers - this is the strike, the price at the time the option closes. In our example, the strike consists of four numbers, but in practice there can be either less or more - it depends on the value of the underlying asset. The next letter is the calculation type. This takes into account the underlying asset, option category (European or American), and marginability. As we remember, on the Moscow Exchange there are only American margined options based on futures - they are marked with the letter B. This is what we see after the strike price in the code! The last two characters are the month and year of execution. The months are marked differently for puts and calls:

| Month | Call option code | Put option code |

| January | A | M |

| February | B | N |

| March | C | O |

| April | D | P |

| May | E | Q |

| June | F | R |

| July | G | S |

| August | H | T |

| September | I | U |

| October | J | V |

| November | K | W |

| December | L | X |

It is easy to notice that the marking is in the English alphabet - first the call, then the put. In the screenshot you see put options for August, so their code contains the letter T. The year is indicated only by the last digit - in our case, 0 (2020).

So, looking at the code, the trader will see:

- type of underlying asset;

- strike price;

- type of calculations;

- month of completion.

Options Trading: What Assets Can I Trade?

So now that you have a basic understanding of how options work, we're going to explore some of the many assets you can trade.

This includes:

Stocks: The most popular asset class for options trading is traditional blue chips. Most brokers will give you access to several markets, including the NASDAQ, NYSE and LSE.

Indices: You will also have the opportunity to buy call and put options on the broader stock markets. Known as indices (or indices), these include the Dow Jones, NASDAQ 100, FTSE 100 and S&P 500.

Currency: In the forex industry, options can be bought and sold. This will be based on a specific currency pair such as AUD/USD or GBP/USD.

Commodity Markets: Options are a great way to get exposure to multi-trillion dollar commodity markets. This includes gold, oil, gas, silver, wheat, sugar and corn. In fact, producers often buy options contracts to hedge against current market prices.

ETF: You can also buy options in the ETF (Exchange Traded Fund) space. ETFs track a wide range of assets, from real estate to gold to retail stocks.

Cryptocurrencies: A small number of platforms now allow you to trade Bitcoin options. However, there is no regulated market for this yet, so proceed with caution.

If you use a dedicated options trading site, you will likely have access to thousands of markets. This allows you to create diversified options trading strategies with the click of a button.

What is the difference between exchange and betting BOs?

Betting binary options are not an exchange instrument; the trader makes a bet on what the price will be after a certain time. There is no counterparty to the transaction; everything depends on the honesty of the company providing such services.

A distinctive feature of betting BOs is a huge number of assets and the ability to trade at any time except weekends; BOs for cryptocurrency are also available on Saturday/Sunday. Another feature is the amount of profit or loss known in advance. The trader either loses the entire bet or earns a fixed percentage of it.

Among the features of exchange BOs we also include the presence of Depth Market or market depth. Brokers show liquidity at different price levels. In betting BOs this is impossible since traders do not trade with each other, but place bets on price changes.

Standard exchange option contracts are a flexible instrument that provides the opportunity to purchase an underlying asset at a pre-agreed price. It is used both for speculative transactions and to eliminate the risk of unfavorable changes in the value of any product. They are traded on stock exchanges and are not available from betting brokers.

Exchange-traded binary options are a rare instrument available on the CBOE/CME and Nadex exchanges. On these exchanges there is not an abundance of different BOs, since for each transaction there is a counterparty, there may be situations when it is impossible to conclude a transaction. This is a more flexible instrument; the profit on a transaction can change and is not limited as strictly as in the case of betting BOs.

I also recommend reading:

Exchange binary options - what are they? What is the difference from betting BOs?

When it comes to binary options, the first association that arises is standard BO brokers, providing BOs for dozens of types […]

Options trading for hedging

The purpose of trading options is twofold. As we've already covered in our guide, the general purpose of buying call and put options is to speculate on the future price of an asset. By doing this you hope to make a profit.

However, options trading is also a very effective hedging mechanism. In fact, this is exactly what commodity suppliers do to hedge the current market price of their assets. For example, if corn farmers are currently profiting from above-average market prices, they may decide to buy put options.

If and when the price of corn falls, the farmer will not lose. This is because although they will receive a lower market price for their corn, they will make money in the financial markets through put options. This way everything balances out - minus a small commission percentage.

The same is true for those who invest in financial markets. For example, let's say you own $10,000 worth of Amazon stock. You feel like a global recession is looming, so you want to protect your portfolio. So you purchase put options.

Why sell options

As we have already found out, buying options does not impose any liability on you - you do not risk any amounts other than the value of the option. She may fight back or not, but you will not lose more than this amount. Relatively speaking, buying an option means possible unlimited profit with limited risk. Selling options is the complete opposite situation. Why sell options then? The answer is simple - for the sake of the prize.

The option premium is the amount the seller receives simply for selling the security. For these gains to be reversed, the value of the underlying asset must rise (in the case of a call) or fall (in the case of a put) by an amount greater than the premium. In all other cases, the option seller wins. Simply put, as much money as the buyer loses, the seller gains, and vice versa.

Beginners should not sell options - this is a very risky venture, unlike buying them. And experienced traders can easily get a considerable income from selling this instrument.

American and European options

There are two main types of options available in the investment arena - American options and European options. The one you buy will determine when you can exercise your right to buy or sell the underlying asset.

American options trading

American options allow you to exit options trading at any time between the time you pay the premium and the expiration date of the contracts.

For example, if the options expire on July 1, 2022, you can exercise your right to buy or sell the asset at any time before that date. This is very beneficial for you as an options trader, as you have the opportunity to lock in profits long before the contracts expire.

Let's look at a small example.

- You purchased call options on oil at the strike price of $33 per barrel.

- The options expire on August 14, 2022 and you have 100 contracts.

- You only paid a premium of $1.30 per contract.

- On August 4, the price of oil will be $45 per barrel, which is $12 above the strike price of $33.

- So you decide to cash out your American options, exercising your right to buy the asset.

- You have 100 contracts, you made $12 per contract - minus $1.30, so your total profit is $1,070.

As you can see from the example above, the trader was able to lock in his profit 10 days before the options expired. No one knows whether this was a smart move before the August 14 expiration date. For example, if the price of oil closed at $50 per barrel, the trader missed out on higher profits.

At the other end of the spectrum, the price of oil could fall below the $33 strike price, meaning they would lose their premium and make no profit at all!

European options trading

Unlike American options, European options do not allow you to exercise your right to buy or sell an asset before the option expires. In the example above, we noted that the trader was in the money 10 days before expiration.

However, if the purchase were made under a European options contract, the investor would not be able to cash out his profits sooner. Instead, they will have to wait until August 14 to find out what price oil closed at.

On the one hand, this puts you at a disadvantage compared to American options because you don't have the flexibility to lock in your profits early on. On the other hand, European options usually have a much lower premium price, so you need to take that into account.

How to make a deal through QUIK

This platform confuses beginners with its unusual appearance. You have to manually configure the location of all the elements needed for trading. First, we’ll briefly look at how to quickly set up Kwik for options trading, and later we’ll move on directly to work.

Setting up QUIK to work with options

We will need:

- A table of current trades is added through the “ Create window ” tab. For example, let’s select only the September 1 option on RTS index futures. The parameters can be limited to the price of the last deal and closing, as well as the change in contract value as a % of Close.

- Depth of glass and price chart .

- Options board , the same information is duplicated here as on the MICEX website, but without delays. It is more convenient to have it at hand, rather than constantly switching between the terminal and the Moscow Exchange.

To add an options board:

- Go to section "Create Window" and at the bottom of the menu select "All types" or just click F7.

- In the menu that opens, enter in the search bar "Options board" and select it.

- Next, you set the parameters of the options board and the information that will be displayed on it. You can limit yourself to the parameters set in the default settings. The chart is called up by double-clicking the right mouse button on the desired strike.

The QUIK setup is now complete. As a result, you should get something like the desktop that looks like the one in the picture below. As an option, you can add 2 tables of current trading for Puts and Calls. Kwik also has a function for linking the order book and chart to it, which makes the work more convenient. But this is not necessary; you can manually open the order book and chart.

Make a deal

To enter the market:

- Double-click on the price you are interested in in the order book.

- In the window that opens, set the price of 1 option and volume in contracts, and also select the direction of trade. The maximum possible position volume is automatically calculated based on the current guarantee and direction of trade (GO for buying and selling does not match). If you don’t want to work with limit orders, oh, and the terminal itself will place an order at the current price.

- In the additional menu you can change the execution condition. Default the application is immediately sent to the general list and, if there is a counterparty, is satisfied. You can choose an option "Withdraw balance" or "Immediately or reject". The last option means that the order will either be executed instantly or deleted. GO is the amount that the broker will block on the account, and the price is the money that the trader is willing to give to the seller.

Technically, trading options in QUIK is no different from working with futures and other instruments. After entering the market, daily .

In the table of transactions you can see the trading history . Information on market entries is displayed here.

The table “Positions by Client Accounts” displays indicators for transactions. In particular, the variation margin, recalculated every day. Also, transactions and their direction are shown on the price chart.

When trading, I recommend taking into account the distribution of orders in the order book . If you want to buy a large volume at one time, you can choose all the liquidity at the nearest price levels and end up getting a not the best cost for executing the order.

Calculation example

Suppose you need to buy 100 Call options on RTS . With this version of the order book, as in the figure below, liquidity will be selected at several levels at once. First, the buyer will purchase 8 contracts at a price of 4,590 rubles. , then 25 - for 4630 each, and so on until there are 100 options. Due to a large transaction, the supply at the levels of 4590-4990 and partially at 5000 .

In this example, the option board lists the purchase price as RUB 4,590. But in this scenario, the average cost of executing an application will be equal to 4688.30 rubles. There may be more unprofitable options.

Also, I do not recommend specifying prices that are very different from what you see in the order book. Let’s assume that an upward trend is developing in the RTS index, the minimum cost of the Call is 4,590 rubles . The buyer wants to save money and places a limit order in the region of 4,000 rubles .

His application will be accepted, but the likelihood that it will be fulfilled is small. As a result, due to the desire to save money, you may miss the entry point.

If the trader waits until the contract expires, he will receive the corresponding futures to his account. But since working with options is carried out with the aim of making money on speculative operations, this makes no sense.

Start trading through BCS

The vast majority of traders close positions early . In the case of options trading, closing means taking current profits. That is, if you bought 1 Call option, then to close the position you need to sell the same volume with the same expiration. There is no point in describing the process step by step - the stages are the same as when entering the market.

American are traded on the MICEX , which means that they can be executed ahead of schedule . A trader can call the broker and leave a corresponding request. At evening clearing, the option contract will be executed - this method is also suitable for exiting the market. Can be used, for example, when the glass is empty.

Difference between options trading and binary options

Apart from the traditional options trading space, you may also come across “binary” options. While there are some similarities between the two, they are actually completely different asset classes.

Extremely important - and as the name suggests, binary options have only two possible outcomes. You will either win a fixed amount of money on the trade or lose your entire bet. For example, if the win rate on binary options is 70% and you bet $1,000, then you will win $700 per landing in the money.

If the strike price was $40, it wouldn't matter if the stock closed at $41, $100, or $5,000—you would still win the same amount. If the asset doesn't hit the money, you simply lose your $1,000 bet.

As a result, we would avoid binary options trading as your earning potential is limited. In contrast, there is no limit to the amount you can earn from traditional options trading. This is because the greater the difference between the strike price and the closing price of your trade, the greater the profit you will make.

Best book for beginners

The best book for the future binary options trader was written by the CEO of Reuters, the most famous financial news agency in the world.

However, Thomson Reuters is also one of the three leading quote providers used by brokers and live charters around the planet.

Who else but them should know where to start? Be sure to use this source, only 160 pages, and everything is to the point.

How to start trading options today

So now that you know how options trading works, we're going to show you how you can start investing today. By following the steps below, you can enter the market with a put or call option in less than 10-15 minutes!

Step 1: Select an Options Trading Site

The first step you need to take is to choose an options trading site that suits your needs. You will need to undertake a lengthy research process as no two brokers are alike.

This should include key indicators such as:

Regulation: Make sure the options trading site is regulated by a first-tier licensing authority. Examples include FCA (UK), CySEC (Cyprus) and ASIC/ASIC (Australia).

Trading Assets: Find out what asset classes options trading sites offer. The best platforms will give you access to thousands of markets.

Payment Methods: Select an options trading site that allows you to deposit and withdraw funds using your preferred payment method.

American or European: Make sure you understand the options. Specifically, does the broker place American options, European options, or a combination of both?

Premium vs. Strike Price: You need to evaluate how competitive an options trading site is when it comes to premium. In other words, how high is the premium relative to the strike price?

Customer Support: Find out what customer support channels the options trading site offers. This comes in handy if you need your broker to explain how your chosen market works.

If you don't have time to study the indicators listed above, we recommend using one of the three brokers recommended on this page. All of our top-rated platforms are highly regulated, offer multiple options markets and allow you to deposit funds instantly via debit/credit.

Step 2: Open Account and Download ID

Once you have found the right options trading site, you will need to open an account. The broker will ask you to provide some personal information, such as:

- Full name

- Date of Birth

- Home address

- National tax number

- Residence status

- Cell phone number

- Your email

The broker will also need a copy of your government-issued identification. This is necessary to ensure that the platform complies with anti-money laundering laws. Therefore, upload a copy of your passport or driving license.

Step 3: Fund your trading account with options

To access the options trading markets, you will need to pay a premium to your broker. So now you need to fund your trading account. Most, but not all brokers will have a minimum deposit threshold that you will need to meet.

In terms of payment methods, this often includes:

- Debit card

- Credit card

- Paypal

- Skrill

- Neteller

- Bank transfer

Except for the bank account option, all other deposit options are instant.

Step 4: Find an options market to trade

Now that you have funded your trading account with options, you will need to find a market to trade. Brokers typically offer thousands of markets, so search for an asset that interests you.

Once you do this, you will need to evaluate the following metrics:

- Current market price of the asset

- Asset strike price

- Premium required by broker

- When does an option contract expire?

- Minimum lot size

- Whether European or American options

You often have to choose from several markets for one financial instrument. For example, if you want to trade Nike stock, your broker may offer different strike prices, each requiring a different premium.

Step 5: Buy a Call or Put Option

Once you have assessed the options market offered by the broker, you will need to place a trade. So, decide whether you think the asset will increase (call option) or decrease (put option) relative to the strike price.

You will then need to enter the number of contracts you want to buy, making sure you meet the minimum lot size. The bid total will update when you enter the number of contracts in the order field.

For example, let's say you want to buy call options on Nike stock at a premium of $4 per share. When you enter "200" in the amount field, the bet will change to $800 ($4 premium x 200 contracts).

Finally, complete your order. Once you do this, your options trading will be active!

How can you recognize deception?

An easy way to make money using binary options is very attractive and therefore many people working on the Internet are interested in this opportunity. It is clear that the number of those who want to get rich and do nothing is not decreasing. There are situations when the fact of deception is clearly visible, but sometimes it happens so that it is practically impossible to recognize it.

When visiting the landing page (broker’s website), it becomes clear that the truth is completely absent here. The client continuously receives income, and at the same time he is promised that the amount of income will constantly grow. Strange as it may seem, even today you can find people with a firm belief that this should be one way and no other way. As soon as they start working in another field of activity, they will immediately start shoveling money. You always want to believe in good things, but you shouldn’t believe in such nonsense at all.

The second stage is more realistic – demo accounts. The winning percentage of the case coincides with the real one. In this case, there is one point that needs to be paid attention to, namely, there is a complete coincidence of quotes with quotes that arise in real market conditions. This is understandable, since demo accounts are aimed at teaching beginners the basic working skills and principles of the resource used as automatic earnings without investing in options.

When you don’t want to join the ranks of those deceived by unscrupulous dealers, you need to give your preference only to reliable brokers for trading BO. In addition, you need to remember that demo accounts demonstrate opportunities, but not actual income generation.

It is worth initially understanding that in the process of working with real money the situation becomes stressful, and the level of difficulty also increases several times.

Best Options Trading Sites in 2022

Looking for the best options trading sites of 2022 but don't have time to research a broker yourself? Below you'll find three of our top picks. Each of the following brokers are licensed by Tier 1 authorities, allow you to easily deposit funds via debit/credit card, and best of all, offer thousands of markets.

AVATrade – 2 Forex Welcome Bonuses of $200

The AVATrade team is now offering a huge 20% Forex bonus of up to $10,000 - $50,000. This means you will need to deposit $100 to receive the maximum bonus distribution. Please note: You are required to deposit a minimum of $0.1 to receive the bonus and your account must be verified before funds are credited. As for the bonus withdrawal, you will receive $100 for every 100 lots you trade.

Our rating

- 20% welcome bonus up to $10,000

- Minimum deposit $100

- Verify your account before crediting your bonus

Visit AVATrade

75% of retail investors lose money when trading CFDs with this provider.

City Index - The most extensive options trading department

If you're looking to build a diversified portfolio of options contracts, City Index may be worth considering. The online broker offers a very extensive list of options markets, including everything from stocks, commodities and indices. You can get started with your account in minutes, with a minimum deposit of £100. The platform is highly regulated, with licenses including the UK FCA.

- First class customer service

- Easy account opening process

- Excellent reputation in the traditional brokerage scene

- KYC process is a bit cumbersome

Visit city index

75% of retail investors lose money when trading CFDs with this provider.

CMC Markets - options trading site with risk management tools

Founded in 1989, CMC Markets gives you access to thousands of markets, including the options market. We like this broker because it offers risk management tools that help reduce your losses in the event of a losing trade. CMC Markets does not have a minimum deposit amount and you can fund your account with a debit/credit card or bank account.

- Thousands of financial markets supported

- Demo accounts without risk

- Listing on the London Stock Exchange

- More suitable for experienced traders

Visit CMC Markets

75% of retail investors lose money when trading CFDs with this provider.

About us: Admiral Markets

Trading the financial instruments (CFDs, shares, ETFs) offered by Admiral Markets carries a high level of risk which is not suitable for all investors due to the complex nature of the financial markets. Please be sure to review our terms of service before entering into a customer agreement or completing a transaction. If necessary, consult with a professional to ensure you understand the risks associated with trading.

This article is published for informational and educational purposes only. The content is developed by Admiral Markets UK and distributed by Admiral Markets Group investment firms to a global audience. Therefore, please understand that the information contained in this article may not be suitable for everyone. For relevant information regarding schedules, trading conditions and any other details, please visit admiralmarkets.com, select your country of residence and contact the relevant organization. This content is for general information only and is not intended to provide trading or investment advice or personal recommendations. Any information regarding past trading performance does not necessarily guarantee future results. Admiral Markets is not responsible for any losses you incur, directly or indirectly, as a result of making any trading decisions based on any information in the above published content.

The information is not directed at residents of the United States, Belgium or any particular country and is not intended for distribution to or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

FAQ

What is options trading?

Options give you the right, but not the obligation, to buy or sell an asset at a later date. To gain access to the market, you need to pay a premium.

What is the minimum deposit on options trading sites?

It depends on the site you want to register on. For example, CMC Markets has no minimum deposit amount and IG asks for £250.

How does the “premium” work in options trading?

The premium is a non-refundable fee that you pay for access to the options trading market of your choice. If you don't receive the money, the broker will keep it for himself.

Are options trading sites regulated?

By law, options trading sites must have a regulatory license. We prefer sites that are regulated by first tier authorities such as the FCA, ASIC or CySEC.

What is the difference between American and European versions?

While American options allow you to exercise your right to buy or sell an asset before it expires, European options do not. Instead, you need to wait until the contract expires before you can realize your profits.

Can you use leverage when trading options?

Yes, most regulated brokers allow you to use leverage when trading options.

No freebies, go for a walk, boy

Realize right away - on the charts you see the movement of currencies on the international interbank foreign exchange market. Our trades are not based on it - but we place bets on this movement.

If you decide that you can just predict the movement of the euro, dollar or yen on the interbank market, think again. Nice. It should dawn on you that only a currency analyst can make such forecasts in a stable, positive manner.

Are you ready to become one? Are you ready to spend six months to a year on training, practice, everyday trading, and working with your psychology? If so, good luck.

If not, you have only one prospect: drain your deposits and walk off into the sunset in snot. Decide what you need in advance. And don’t expect miracles - all miracles depend strictly on you, and not at all on books, signals, indicators or sites like this.

Trading volumes as an effective training method

This course would be incomplete if I left out the topic of trading volume. How can you find out how much money is currently involved in trading? That's right, using volumes. But why do we need to know this? Everything is very simple. There are always people who create the market; they are the biggest players.

Trading volumes will help you understand what a major player is doing at the moment and you can follow him. Any trading strategy will be filtered using volumes.

Where should I start?

To receive your first income using options, you must first learn how to work in stock exchange conditions. There are no particular difficulties here, since the threshold for entry is minimal. Trading mechanisms are not complicated.

Algorithm of actions:

- Initially, you should choose a suitable brokerage company. The selection is based on special criteria and ratings;

- create an account;

- We analyze the available proposals.

The brokerage company offers its clients to buy one or another type of asset at a special price. The trader, for his part, predicts the situation regarding whether the amount will increase or, on the contrary, decrease over a clear period of time. If the situation develops in the trader’s favor, income will be received. When the situation takes a reverse turn, it is clear that losses cannot be avoided. Each trader chooses the time period as desired.