Aave is a lending platform originally known as ETHLend, but with a radically revamped strategy. While ETHLend enabled direct lending relationships between lenders and borrowers, a decentralized pool-based strategy began with the release of the Aave protocol. We offer an overview of this platform from the editors of Profinvestment.com.

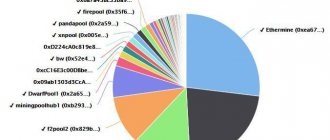

The lending pool works like this: Users create liquidity by depositing cryptocurrencies into the pool. Other users can use these funds, leaving others as collateral. Loans are not selected individually - the same conditions exist for everyone, which are adjusted depending on the current state of the pool. All operations are managed by smart contracts.

The interest rate is determined algorithmically for both borrowers and lenders. It depends on the ratio and value of the funds currently available in the pool.

LEND is a token created to control the protocol. Its owners can participate in voting for certain changes in the project. All voices are hard coded, and the actions that follow them are invariably executed.

You can trade the LEND token on the Binance cryptocurrency exchange. The pairs presented are: LEND/BTC, LEND/BNB, LEND/USDT, LEND/BUSD, LEND/ETH.

#Binance Lists December Community Coin - #ETHLend (LEND)@ethlend1 https://t.co/mXVFgg9yOD

— Binance (@binance) December 12, 2017

general information

[bsfp-cryptocurrency-table style=»style-2" scheme=»light» coins=»selected» coins-selected=»LEND» currency=»USD» title=»Characteristics of the Compound (COMP) cryptocurrency» show_title=»1" icon="" heading_color="" heading_style="default" bs-show-desktop="1" bs-show-tablet="1" bs-show-phone="1"]

| Name | Aave |

| Ticker | LEND |

| Token type | ERC-20 |

| Blockchain | Ethereum |

| Total emissions | 1 299 999 941 LEND |

| Current issue (as of 08/27/2020) | 1 256 361 931 LEND |

| Rate (as of 08/27/2020) | 0,84 $ |

| Market capitalization (as of 08/27/2020) | 1 056 622 843 $ |

| Official site | https://aave.com/ |

| https://twitter.com/AaveAave | |

| White Paper | https://github.com/ETHLend/Documentation |

| Source | https://github.com/aave |

| Exchanges | Binance, HitBTC, AEX |

Aavgotchi – Merging DeFi with Non-Financial Tokens

One of the most recent achievements of the Aave camp is Aavegotchi . Aavegotchis are non-fungible ERC-721 tokens represented by pixel ghosts. Like Cryptokitties , their value depends on how rare they are, with the rarest Aavegotchi bringing the most value.

Each Aavegotchi manages an Ethereum address that holds tokens in escrow, meaning users can earn interest on Aavegotchi ownership. The app effectively gamifies DeFi by introducing a collectible element.

At the time of publication, Aavegotchi was still a newbie. In January 2021, the project confirmed that it was moving from Ethereum to the second-layer Matic network due to speed and high congestion fees on Ethereum.

It will be interesting to see if this convergence of DeFi and NFTs succeeds, as it will potentially lay the groundwork for future projects to be replicated and innovated.

What features does Aave offer?

Flash Loans

Flash loans are one of the main features of Aave. While DeFi lending typically requires collateral, most lenders (like MakerDAO) allow users to borrow up to 75% of available collateral to protect against market volatility.

In turn, Flash Loans work through a smart contract, with which you can borrow funds without collateral with the condition that the loan will be repaid within one transaction (one block). The method is used by traders to make money on arbitrage, since it makes it possible to borrow funds unlimitedly for free until the loan is repaid.

This is quite difficult for a beginner, and the developers recommend using this lending method only for those who are well versed in Ethereum, programming and smart contracts.

Flexible interest rates

The interest rate strategy on the Aave platform is calibrated to provide maximum performance optimization and reduce risk. Interest rates on loans depend on the utilization rate of a particular cryptocurrency. It is based on the indicator of the presence of cryptocurrency in the pool:

- If there are enough funds, then low rates are set, which stimulate lending.

- If funds are scarce, high rates are set for liquidity providers to encourage them to invest capital.

A nice feature of Aave is the ability to switch at will between fixed and variable interest rates, choosing the most profitable option at a particular moment. Thanks to this flexible structure, Aave has been in high demand since its deployment. Fixed interest rates are not exactly fixed, but rather simply more stable and less susceptible to market fluctuations.

How Aave contributes to market development

One of the main reasons for creating a marketplace like Aave is to improve the traditional lending system. Every decentralized finance project aims to eliminate centralized processes in our financial institutions. Aave is part of a larger plan for developers to eliminate or reduce the need for intermediaries in financial systems.

Aave aims to provide a seamless flow of transactions without intermediaries. In a typical traditional lending system, say banks, for example, lenders pay interest to the banks for lending their money.

These banks earn interest on the money they hold; Liquidity providers do not profit from their money. This is when someone rents out your property to a third party and takes all the money without giving you any of it.

This is part of what Aave eliminates. Lending your cryptocurrency on Aave has become illegal and untrustworthy. You can make these transactions without any intermediaries. Moreover, the interest you earn in the process goes into your online wallet.

Thanks to Aave, many DeFi projects have appeared on the market with the same goal. The network has helped take peer-to-peer lending to a new level.

How to make money on deposits

You need to connect to the pool using any decentralized wallet, for example, browser-based Metamask. There must be funds on the balance. Then click the “Deposit” button next to the asset you want to deposit (coins and tokens running on the Ethereum blockchain are supported). Once the transaction is completed, you will start earning interest. In this case, the deposited tokens are converted into an equivalent amount of aTokens .

aTokens holders receive continuous income based on the following indicators:

- 70% commissions on flash loans.

- Interest rate on loans. The average borrowing rate multiplied by the currency utilization rate. On the main page or in your personal account, the specific current rate for the desired token is always indicated.

You can also go to the page of any coin to view the history of interest rate changes.

There is no minimum or maximum limit, but if you deposit too little, there is a risk that the transaction costs of the process will exceed the profit. For one asset, a one-time deposit is allowed at either a stable or variable rate, but not both options at the same time. You can withdraw funds at any time without any penalties.

Pros and cons of cryptocurrency

Among the advantages are the following:

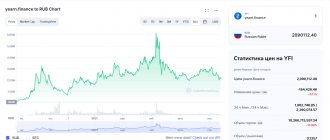

- Course dynamics. Aave tokens are becoming more expensive, and the network’s capitalization has grown over the life of the project. The developers also say they are seeing an increase in the user base as interest in decentralized finance increases.

- Anonymity. In order to lend money or receive loans, Aave customers are not required to undergo KYC and other procedures to combat money laundering or terrorist financing.

- Team. The creator of the project, Stani Kuleshov, worked in the field of decentralized finance on other lending projects on the blockchain. In Aave, he transferred his work experience from there and implemented functions that competitors did not have.

Disadvantages of the project:

- Competitors. There are already many projects operating on the blockchain that specialize in lending. The largest among them are Nexo [NEXO] and [NEXO]nd [COMP].[COMP]>Risks. The network has already encountered a user who contributed $10 to the project and earned $400 thousand through arbitrage. Users considered this situation risky and unfair.

- High loan collateral. A common problem with a niche that makes it unattractive to customers.

How to get a loan

Lending on Aave allows you to obtain working capital without selling your assets. To get a loan, you must deposit any asset that will be used as collateral. Then go to the Borrowing section and click Borrow on the asset you want to receive. Set the desired amount (the maximum amount depends on the available deposits used as collateral).

Choose a stable or variable rate - you can change it later at any time by simply going to the dashboard and clicking the button to change the APR type for the desired asset.

The interest rate depends on the relationship between supply and demand for a given asset. In this case, the stable one remains the same as it was at the time of taking, and the variable is constantly changing. There is no fixed loan repayment period. The main thing is to maintain the so-called “health factor”, an analogue of LTV, at the proper level.

Commissions, deposits and withdrawals

To pay off a loan, just go to the Borrow section and click on the repayment button for the desired asset. Then select the amount to return and confirm the transaction.

The Aave platform charges two types of fees:

- Borrowers are charged 0.25% of the loan amount. 20% of them goes to partners, and 80% is exchanged for a borrowed coin and burned.

- When taking out flash loans, 0.09% of the amount is charged. 70% is distributed among investors, 30% is distributed according to the 20/80 scheme described in the previous paragraph.

There are also platform-independent fees - these are blockchain fees, the size of which depends on the current network load.

Purpose of the LEND token

Aave's native token, LEND, is an ERC-20 token with a total supply of approximately 1.3 billion, of which a billion was sold during the ICO stage. It was initially used as a utility token of the ETHLend platform, which helped reduce fees, improve interest rates and LTV.

However, when ETHLend was replaced by the decentralized platform Aave, the LEND token gained additional uses, including platform management. Token holders have the right to vote on proposals from the development team regarding key parameters of the system.

How to save AAVE

Using either a software or hardware wallet allows you to store your cryptocurrencies. As a cryptocurrency lender or borrower, you should understand that not every wallet is compatible with the native Aave token (AAVE).

Since Aave is on the Ethereum platform, you can easily store the token in an Etheruem compatible wallet. This is because AAVE can only be stored in an ERC-20 compatible wallet.

Examples include MyCrypto and MyEtherWallet (MEW). Additionally, you have the option to use other compatible hardware wallets such as Ledger Nano X or Ledger Nano S to store AAVE.

Don't make a hasty decision before choosing a crypto wallet for tokens. The type of wallet you choose for AAVE should depend on your plans for the token. While software wallets make transactions easy, hardware wallets are known for their security.

Additionally, hardware wallets are preferable if you want to store crypto tokens for a long time.

Where to store LEND

Any wallet that supports ERC-20 tokens will do. The list of such wallets is quite large, for example:

- Web wallet MyEtherWallet

- MetaMask browser extension

- Desktop and mobile Exodus

- Hardware Trezor, Ledger, KeepKey

- Desktop and mobile Atomic Wallet

Choose options with a proven reputation and a high level of security.

Technical features of Aave

It should be noted that the aave protocol has common features with other well-known DeFi platforms. You can conclude a contract and monitor how it is implemented. However, the features are much more important, thanks to which aave occupies a rather high 28th place in the coinpaprika rating. And it is predictable that it will climb even higher if the existing dynamics continue, as it provides:

- instantaneous opening of deposits, withdrawal of funds and receipt of loans;

- possibility of lending against several collaterals (multi-collateral lending);

- support for unsecured loans, flash lending and a number of other operations that can only be carried out through this service;

- borrowing with a choice of interest rates (variable, constant) and switching between them. This also opens the way to some profit;

- detailed understanding of the liquidity of collateral;

- the existence of a decentralized insurance fund.

Other protocols do not yet provide such broad capabilities. That is why the platform is so confidently rising in the rankings of thematic Internet resources.

Where to buy/sell LEND

You can purchase the LEND token on the Binance, HitBTC and AEX exchanges. As an example, let’s consider buying an asset on Binance - this is the most popular and in-demand crypto exchange with wide functionality and the ability to buy cryptocurrency for fiat (after verification).

The process looks like this:

- Create an account at https://www.binance.com/ru or log into an existing one.

- Top up your account if necessary. On our website you will find material with a detailed analysis of all methods of depositing and withdrawing funds to Binance.

- Go to the “Spot Wallet” section and use the search bar to find the LEND token we need.

- Click the "Trade" button.

- Choose which currency pair suits you. At the moment, LEND is traded in pairs with BTC, BNB, ETH, BUSD, USDT.

- Select the type of order (the market allows you to instantly buy an asset at the market rate, and the limit allows you to specify your price, and then the purchase will be completed as soon as the rate reaches this level).

After receiving tokens, try to immediately withdraw them to an external wallet for further storage if you do not plan to continue operations with them in the near future. Storing on an exchange is not considered safe.

Aave in 2022

Aave's growth momentum didn't end last year and will continue into 2022. The protocol continues to innovate and create further industry partnerships. In January 2022, a year after launch, Aave released a migration tool that allows users to seamlessly migrate their items from v1 to the newly launched v2. Additionally, v1 contracts will remain on Ethereum, but the future of the protocol is now firmly tied to v2. . Also in January, Aave introduced a solution closest to its own version of Layer 2 scaling, allowing tokens to be moved onto the Plasma-based Matic network. However, the ultimate goal of the protocol is full Layer 2 operations, but that will likely be the next major upgrade. As of this writing, the total liquidity of both versions of the Aave protocol has exceeded $4 billion, according to DeFi Pulse, although Aavewatch reports a lower figure. DeFi Pulse also lists AAVE as the second-largest protocol in terms of TVL, just behind DeFi stalwart MakerDAO, which currently has $5.5 billion. At the beginning of February, Aave held 13.3% of all liquidity locked in the DeFi ecosystem. According to Coingecko, on January 31, 2022, prices for AAVE tokens reached a record high of just over $310. This is a huge increase since last year's revaluation. Even institutional crypto funds like Grayscale are turning Aave into their next mutual fund. This shows how much trust in the platform has grown over the past year. The latest enticing tweet from founder Kulekhov at the time of writing was about the Aave credit/debit card. Who knows what's in store for this ever-growing DeFi giant.

AAVE Statement

DeFi is currently unregulated. However, Aave is exceptional as it has received an Electronic Money Institution (EMI) license from the UK Financial Conduct Authority. The FCA does not currently regulate DeFi. However, the license is an indicator that Aave intends to implement fiat integration in the future, which will be regulated by the FCA.

In an August 2022 announcement, Stani Kulechov, founder and CEO of Aave, stated that the protocol will remain decentralized and managed by the Aave DAO. However, he confirmed that the company will seek licenses to ensure it can connect users to the ecosystem in an appropriate manner.

Aave Ltd, the company behind Aave, has a separate website which states that there will be more news about these developments in the future.