A diligent beginner who came to Forex, mastered the basics of technical analysis, worked out his strategy and tactics on a demo account and achieved a stable increase in his virtual deposit, in anticipation of real earnings, opens a trading account with the Forex broker he likes and begins to trade, without even suspecting that on Forex there are many pitfalls, some of which are: requotes and slippages.

Requotes and slippages in Forex trading practice

The concepts of requote and slippage in Forex are inextricably linked. Traditionally, we use a simple example. The trader opens a long position on the EUR/USD currency pair at point 1 at the level of 1.29442. The price goes in the right direction, the trader decides to take profit at point 2 at the level of 1.29874.

Rice. 1. An example of the occurrence of slippage.

However, during the processing of the order by the broker, the price dropped below point 2, and, instead of enjoying the increase in money on the deposit, the trader observes something like this.

Rice. 2. Example of a requote.

The trader again tries to take profit and succeeds only at point 3 at the level of 1.29755, which is almost 12 points less than expected. Is it worth reminding that in the euro/dollar pair, when trading a standard lot of 12 points, this is $120? Another option is also possible, when a stop loss sometimes brings a loss several dozen points more than planned.

What really happened?

In fact, the trader became familiar with slippage and requotes. Slippage in Forex refers to the difference between the price at which the trader declared the order to be executed and the actual price at which the broker executed this order. That is, slippage occurs when during the processing of an order from the trader to the liquidity provider executing it (which is a fraction of a second), the price changes its value and execution at the stated price becomes impossible. Slippage can be positive or negative, depending on where the price is heading.

There can be several reasons for slippage:

- High volatility in the foreign exchange market, especially during the publication of important economic releases such as interest rate decisions or NonFarm Payrolls;

- Slow execution of orders resulting from communication failures when transmitting an order on the side of the trader or broker;

- And, sad as it is, the broker himself is a fraud. It is worth noting that this is the fault of the so-called market makers or “kitchens”, who deliberately delay the execution of orders, since the trader’s loss is their earnings.

With requotes everything is much simpler. A requote (from the English “re-quote”) is a re-request from a broker to execute an order at a new price. This delay occurs due to the same reasons as described above. If the price moves quickly and the broker only orders execution at the price (Instant Execution) specified in the order, then requotes can be a significant problem when trading, for example, on good news.

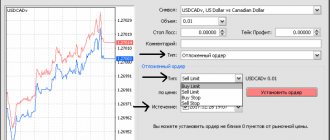

Rice. 3. An example of a repeated price request.

Re-quote (requotes) what is it?

The English term re-quote can be translated as “re-quote”. This is a situation when a trader gives a trading order, but the price changes so quickly that the broker does not have time to execute it at the order price. As a result, he sends the trader a request to change the quote in the form of a proposal to process the order at the market price, which the trader must confirm/reject manually.

Requotes are directly related to such a Forex market phenomenon as slippage (which I talked about in the previous article). Let me remind you that slippage is the execution of an order by a broker at a price different from the price specified in the trading order. If there is no agreement between the trader and the broker on the amount of slippage, which is recorded in the trading terminal, the broker uses requotes. So what are requotes? A way to preserve a trader's capital? Or an opportunity to save money for the broker?

The permissible slippage value can be set directly in the order opening window of the MT4 trading terminal. In this case, it is possible, to a certain extent, to avoid the appearance of requotes, but only until the actual slippage exceeds the value regulated by the trader. In addition, the slippage amount can be set when setting up a trading robot if automatic trading is used. Typically this option is called Slippage.

Requotes are a completely normal part of a volatile market. Moreover, requotes can bring not only losses, but also profits. After all, the price can make a jump not only against the trader, but also in his favor. This situation is called positive slippage. In situations with requotes, it is recommended to immediately exit the transaction - it is unknown how the price will behave at the next moment in time.

I also recommend reading:

RAMM trades copying service from AMarkets

What is the RAMM service and how to copy trades in it

Execution of Instant Execution and Market Execution orders and slippage

To gain a deeper understanding of the process, it is worth understanding the different ways of executing orders. There are Instant Execution and Market Execution systems. What is their difference?

In the Instant Execution order execution system, the broker will execute the order exactly at the requested price or issue a requote if it changes, as in the example above.

Let's say a trader sends a request to a broker to open a position to buy EUR/USD at a price of 1.2950. Order processing is not instantaneous and may take up to 20 seconds. During this time, the following options are possible:

- The price has not changed - the broker will execute the order at the requested price.

- The price has gone down - the broker will execute the order at the requested price.

- The price has gone up - instead of executing the order, the trader will receive a message about a requote.

The advantage of the Instant Execution system is that the entry is carried out with the requirements pre-set by the trader.

In the Market Execution order execution system, the broker will execute the order not at the requested price, but at the current price on the market.

The same situation: the trader sends a request to the broker to open a position to buy EUR/USD at a price of 1.2950. The following options are possible:

- The price remains the same - the broker will execute the order at the requested price.

- The price has gone up or down - the broker will open a deal at the current price.

The advantage of the Market Execution system is the fast execution of orders. The disadvantage is that the order is executed at the current price. In case of increased volatility, the price may change abruptly and there is a high risk of receiving an order opened at a price that differs greatly from the requested one.

How do requotes affect trading?

The influence of this factor depends on the trading style. If trades are kept open for several hours or more, then requotes will not be able to significantly change the result. The trader may lose part of the profit due to re-submitting the order, but the losses are calculated in a few points.

The influence of requote increases as the working time frame and trade target decrease. If the average take profit is 40-60 points, then the loss of 2-3 points due to a requote will not be critical. But if work is carried out, for example, on M1 and an average transaction takes 10-20 points, then requotes can reduce profits by 30-40%.

Requotes are especially harmful to news trading . During this period, large players may leave the market, not wanting to take risks, and brokers widen the spread. Most impulses are short-term movements; if a trader receives 1-2 requotes, he will miss most of it and will not be able to make money. For news strategies, ECN accounts are selected, which have slippages, but no requotes.

If you don't trade during news and trades are kept open for at least a few hours, then you don't have to worry about requotes. They will not have a significant impact on the result.

I also recommend reading:

Pareto's rule (20-80) and its application in real life

This pattern can be compared with the Fibonacci sequence and the relationships derived from it. They work in all spheres of human […]

How to reduce the likelihood of requotes?

As safety measures we can recommend:

- choose ECN accounts . Requotes are excluded due to the nature of order execution (market, not instant). Another bonus is the fast execution of orders and a low spread, for majors it starts from 0-0.1 points. Among the disadvantages, we note increased requirements for starting capital. If for a standard account the broker may not set a minimum threshold for replenishing the account, then for ECN the company requires at least $100-$300;

- If a broker takes a long time to process orders, you can change it . Not all companies publish statistics on the speed of execution of customer requests; you will have to choose based on your own experience;

- if work is carried out on standard or cent accounts, then when opening transactions, set the maximum permissible deviation not 1-2, but 5-10 points. Due to this, the range of price values will expand, which will increase the likelihood of the order being executed without a quote;

- do not trade during news releases . Most Forex requotes

occur during this period; - work on higher timeframes . When concluding a deal, for example, on H4, a trader may get a requote, but this will not affect the result. If the profit on the transaction is 100+ points, then the loss of 1-2 points due to execution at a worse price will be unnoticeable;

- if the work is carried out using advisors, then in the robot settings, set the slippage parameter with a margin . You can also choose a VPS server with minimal delay in transmitting signals to the broker’s servers;

- guarantee a reliable connection to the broker's servers;

- use pending orders . However, there is a risk that the broker will execute the limit order at a much worse price. Stop and limit orders solve the requotes problem, but there is a risk of slippage, do not abuse this tool.

An ordinary trader is rarely faced with the impossibility of executing an order at the current price. Following any of the listed safety rules reduces the likelihood of this happening significantly.

Slippage

Slippage - a trade was opened, but the price does not correspond to the one you saw on the screen, usually the discrepancy is only a few points, but when using some Forex trading strategies, even these couple of points can be quite significant.

This trouble can be planned when you work on an account with Market Execution and set the slippage amount yourself, or unexpected, which occurs as a result of a malfunction of the broker or trading terminal.

In the first case, everything is under control, set a deviation of 2 points and work calmly, but if the second option works, there can be quite big troubles, especially if there is a large gap in an unfavorable direction. As a result, you suffer losses or receive less profit.

The solution to the problem in this case is to change the dealing center with which you work.

In order to avoid such misunderstandings during your work, first test the terminal on a demo account, then try to work with a minimum lot, and only after testing start trading in full force.

Read the article “Forex Candlestick”.

Why do requotes occur?

Requotes can occur for a number of reasons. Now let's go through them in detail.

Slippage

Slippage is a sudden change in market price.

Slippage can often be encountered when important news is released, when volatility in the market increases very sharply.

For example, we want to buy at a price of 1.5500 and send an order. And for us to buy, someone must sell it to us at this price.

News comes out that indicates the exchange rate is strengthening. And no one wants to sell at 1.5500. Most people want to buy according to the market.

And, for example, the nearest seller who is ready to sell to us is already at a price of 1.5550. The market price skyrockets to 1.5550. But with our request to buy at 1.5500, the new price does not beat. And the system gives us a re-request in the form of a message that the price has changed to 1.5550, and we are asked if we are ready to buy at this new price.

And we can only agree to a new price or refuse the deal.

And such slippages at high volatility occur almost instantly, while we send an order to the broker and he processes it. It can literally be a split second.

Technical problems

Our order may be transmitted with a delay due to a poor Internet connection, failures on the broker's side, and so on. For example, the equipment may not be able to cope with the increased load when some particularly important news is released, when many traders rush to open and close transactions almost simultaneously.

Dealer dishonesty

If your Forex dealer is dishonest, he can artificially create such requotes. After all, thanks to them, the trader enters the market at less favorable prices, and the bad dealer puts this difference, along with the spread, into his pocket.

It is also beneficial for such a dealer to create requotes when trying to close transactions: the trader closes at a less favorable price, loses more money, and the dealer puts more in his pocket.