The Bitcoin price forecast for the end of 2022 was rosy. In particular, experts trumpeted that the cryptocurrency would cross the $100,000 mark. Additionally, ETH will be fixed at $10,000 and BinanceCoin will finally reach $1,000. However, it’s already December, and Bitcoin continues to trade at the level of $55–57 thousand.

Why does cryptocurrency stand still? Let's analyze what events will move the market from a dead point and whether the growth potential has been exhausted.

Large holders are increasing volumes

In early November, “whales” purchased an additional 43,000 BTC worth $2.8 billion. The assets were acquired within 5 days. Thus, the increase in volumes at the addresses of large wallets had a positive impact on the Bitcoin chart.

In just one night, the price of the digital coin increased by $3.5 thousand. As a result, over the course of a month, owners of wallets containing more than 10 thousand BTC purchased 93 thousand coins.

After a long portfolio build-up, large investors switched to profit-taking. First of all, let's figure out how this will affect the market.

Whales are putting pressure on Bitcoin

This year, BTC reached new historical values. The price of one coin was fixed at $65–69 thousand. On this wave, many expected that the height of $100,000 would be “conquered” by the end of December. But large asset holders decided otherwise.

Currently, Bitcoin is trading around $57-58 thousand and is moving sideways. 8848 Invest analyst Viktor Pershikov said that the trend will continue until the end of the year. In addition, he predicted a price reduction to $53 thousand.

First of all, the “whales” are putting pressure on the exchange rate. They have been taking profits for several weeks now. But the market continues to maintain a positive mood. At the same time, demand exceeds supply.

Still, the holidays are a period when retail investors begin to partially dump their assets. According to analysts, one should not expect a strong fall, but excess profits are also practically excluded.

More sustainable growth than in 2022

Coin Metrics co-founder Nick Carter identified several fundamental differences between Bitcoin's current growth and what it was three years ago.

He noted that in 2022, the market was pushed up by retail investors who, through Bitcoin, went into other crypto assets and participated in ICOs. Large players simply could not enter the market due to the lack of appropriate infrastructure.

“At that time there were no qualified custodians; prime brokerage was just gaining strength. Essentially, there was no lending market; futures trading had just launched on the CME,” Carter recalled.

According to him, over the past three years, access to the market by institutional investors has become “more comfortable.”

Carter noted that large market participants are committed to long-term holding of the first cryptocurrency as insurance against rising inflation caused by unprecedented monetary measures by governments.

Investors are concerned about the prospect of interest rates plunging deep into negative territory. They are attracted by the algorithmically limited emission of Bitcoin, he added.

Analyst Willy Wu also agrees with Carter’s conclusions about differences from 2022.

Who has been buying this rally? It's smart money...High Net Worth Individuals. You can see the average transaction value between investors taking a big jump upwards. OTC desks are seeing this too.

Bitcoin is still in it's stealth phase of its bull run. pic.twitter.com/3q41pmNVP9

— Willy Woo (@woonomic) November 9, 2020

“Who is behind this rally? This is smart money... People with high levels of wealth. The average transaction value between investors takes a big leap upward. Over-the-counter traders are also aware of this trend. The first cryptocurrency is still in the latent phase of a bullish rally,” he wrote.

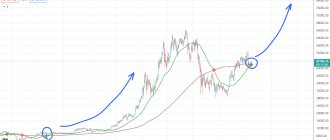

The following chart shows a jump in the orange line, which characterizes the rate of influx of new investors. The last time such rates were observed was at the end of 2022.

Best of all we are not just seeing smart money flow in, it's NEW smart money.

Orange line is the rate of new investors coming in per hour previously unseen before on the blockchain.

It's seriously bullish.

Another killer chart by @glassnode. pic.twitter.com/ZXk95ksx3b

— Willy Woo (@woonomic) November 9, 2020

The first cryptocurrency unexpectedly received support from China. Covering the price rally, state broadcaster CCTV said fundamentals such as the activity of Bitcoin developers and the dynamics of investments in the ecosystem are “more advanced” compared to the 2022 bull market.

CCTV, China's Official TV Channel: #Bitcoin price surpasses $17.5k, up 70% in less than 50 days. Compared with 2017's bull market, bitcoin's network, development and investment eco-system are now much better. The recent rise is driven by institutional funds. pic.twitter.com/yZqzGU5veM

— cnLedger (@cnLedger) November 18, 2020

The interest of major players in digital gold and products based on it is also evidenced by the increase in activity on the Chicago Mercantile Exchange (CME). Last week, open interest (OI) in Bitcoin futures on the regulated exchange reached a record $1 billion.

The orange line is open interest for Bitcoin futures on the CME. Data: skew.

The total OI in the Bitcoin futures market also reached an all-time high.

Aggregated OI for Bitcoin futures in regulated and unregulated markets. Data: skew.

Bitcoin price forecast: potential exhausted

Due to the influence of large holders, Bitcoin needs new reasons to increase its price. According to the head of the analytical department of Amarkets Artem Deev, the cryptocurrency is working out past events. In particular, the correction in stock markets and problems among Chinese providers.

The signing of a new bill by the US President also negatively affected the market. It will oblige cryptobrokers to report to the tax service all transactions worth more than $10 thousand.

Artem Deev's forecast is quite categorical. The analyst is confident that BTC will not see a new high anytime soon. The reason is the lack of growth potential and external factors that can restart the rate. Thus, investors can only wait for a change for the better.

Which coins will “survive” the decline in value?

Despite the fact that according to forecasts, BTC will enter 2022 with a value of $53–54 thousand, this will not affect other tickers. For example, ETH and BNB are holding up well at their maximum values. Ethereum has been worth more than $4 thousand for a month now, and BinanceCoin is more than $600.

In addition, the Shiba Inu memecoin is growing again. In two days (from November 28 to 30) it rose in price by 55%. Luna, Matic, LiteCoin and Solana also rose.

If you have these coins in your portfolio, then it is worth considering keeping them. Additionally, analysts recommend increasing assets during drawdowns of 1–5%.

When does alt season start?

If Bitcoin does not make a profit this year, you can pay attention to promising coins. They may give "X" in the short term, but the risks are high.

Bestchange platform analyst Nikita Zuborev shared his opinion. To get more profit, he offered two types of assets: “meme” and GameFi tokens.

First of all, the expert recommended paying attention to the outsiders of “meme” coins. Here they are: Doge-Inu, Dogeswap, The Doge NFT, SafeMoon Inu. However, when investing in such instruments, remember that they have no value beyond their name. The value can fall to zero at any moment.

The analyst advised to leave part of the portfolio for native social tokens. For example, Hive, WAX, Steem and others. Additionally, you can choose a few popular blockchain games and invest in their coins.

Allocating no more than 10% of your budget for risky investments. Zuborev suggests investing them in the MANA coin. The token, which belongs to the Decentraland virtual platform, has already shown explosive growth.

Additionally, 2022 will see news buzz around Facebook and its metaverse. Virtual offices, augmented reality, etc. will be tested. This is also beneficial for other VR-related projects, including the MANA token.

The Bestchange platform specialist recommended AVAX and ETH as safe investments. The first is used in the DeFi sector, which is considered extremely promising. The second, according to many analysts, will reach $10,000 next year.

What factors traditionally determine the price of BTC

Late last year, ByteTree released the “Bitcoin value drivers” report. In it, the platform analyzed the market from 2008 to 2022 and found out what factors actually shape the price of BTC. This is what they were able to notice.

Bitcoin loves easy money. One of the main factors shaping the price of BTC is the availability of “easy” (or “hot”) money to investors, which they gain access to as a result of the “quantitative easing” (QE) policies of central banks. Roughly speaking, investors take out cheap loans from EU or US banks and invest them in risky assets with high returns.

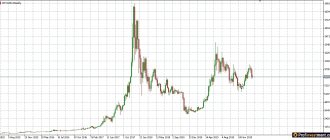

Statistics show that during the period when central banks pursue a policy of “quantitative easing,” Bitcoin is actively growing, as it was in 2013, 2022 and 2020-2021. And when they tighten conditions, Bitcoin plummets, as it did in 2014 and 2022. Here's what it looks like on a graph:

Balance sheets of the US Federal Reserve System (FRS) and the Bank of Japan, the European Central Bank and the People's Bank of China, as well as the BTC balance

Bitcoin loves a weak dollar. When the dollar rises, the global economy experiences liquidity problems as businesses and banks need to repay loans at higher costs. When the dollar falls, the price of dollar loans falls and investors can use the savings to buy bitcoins. However, the connection here is not as strong as in the case of QE.

Inverse correlation between the US dollar index and Bitcoin

The report also noted that the price of Bitcoin correlates with risky stocks and bonds. But they do not determine the price of BTC; the correlation simply reflects the general trend towards an increase or decrease in market interest in risky assets, including Bitcoin and other cryptocurrencies.

Distributing the investment portfolio: expert advice

Cryptocurrency is a highly volatile instrument. Even popular coins backed by projects and businesses (for example, BNB) sometimes fall by tens of percent per day. Therefore, it is important to follow the rules of diversification. This will help avoid losses on one asset, covering them with income from another.

Analysts advise distributing the budget this way:

- 50% to the top three digital currencies by capitalization (BTC, ETH, BNB);

- 25% in promising coins (SOL, TWT, ADA);

- 10% in risky instruments (memcoins, DeFi tokens and blockchain games);

- 15% in stablecoins (will allow you to have a reserve for purchasing a trending asset).

This distribution will allow you to avoid loss of funds and minimize risks. Investments in large cryptocurrencies will provide an opportunity to receive constant income in the long term (see growth chart). Finally, the rest will allow you to have additional profit if the outcome is positive.

Conclusion

Unfortunately, the optimistic forecast for the Bitcoin exchange rate was not confirmed. It won't cross $100,000 this year. However, there are dozens of other projects that allow you to make a profit.

In all likelihood, coins will reach new historical values in the future. Owners of large funds and companies believe in BTC at $300–400 thousand, ETH at around $100,000 and BNB at about $10,000 in 5 years. Therefore, increase your assets and follow the development of the cryptocurrency market.

The Unstoppable Growth of DeFi

The decentralized finance (DeFi) segment continues to grow exponentially. Since the beginning of the year, the total value of assets blocked in this sector (TVL) has increased 22 times.

On January 1, TVL was $752 million. By the end of November, the figure exceeded $17 billion. Data: DeBank.

Together with the DeFi sector, the segment of bitcoins tokenized on the Ethereum blockchain is demonstrating rapid growth.

Among “bitcoins on ether”, the Wrapped Bitcoin (WBTC) protocol leads in terms of the volume of blocked funds. Data: Dune Analytics, ForkLog report “October 2020 in numbers: Bitcoin, Ethereum, DeFi, CBDC race.”

According to Dune Analytics, as of November 23, there are 152,333 bitcoins in circulation on the market. This corresponds to 0.716% of the total supply of the first cryptocurrency.

Protocols like WBTC, renBTC and HBTC offer digital gold holders access to the application-rich DeFi sector. The demand for Ethereum assets backed by Bitcoin reserves also limits the active supply of the first cryptocurrency and, therefore, contributes to its growth.