Why did the price of Bitcoin collapse?

On the eve of Saturday, December 4, 2022, quotes of the first cryptocurrency instantly dropped to $42,000. The decline was accompanied by large-scale liquidation on the futures market - $1.3 billion in long positions. It is not surprising that Bitcoin pulled the rest of the market with it. According to CoinGecko, almost all digital assets from the top 10 by capitalization closed the week in the red zone. The exception was the native token of the Terra protocol blockchain - LUNA. Over the week, its price increased by almost 60%.

The decline in the Bitcoin rate occurred against the backdrop of news about China's largest developer Evergrande. The media reported that its founder was summoned to the government due to a warning about the lack of “guaranteed” funds to fulfill financial obligations.

Galaxy Digital Research analysts cited general nervousness as the reason for the fall in the cryptocurrency market due to the identification of a new strain of COVID-19 called “omicron” and Fed Chairman Jerome Powell’s statement about the option of accelerating the pace of reduction in bond repurchases.

What is the reason for the Bitcoin collapse?

The last two days have been the worst for Bitcoin since mid-May. The current high is $53.8K and the low is below $42K. Perhaps one of the main driving forces behind yesterday's sharp decline was the huge surge in the cryptocurrency futures market. Over the past 8 hours, open interest (OI) has plummeted by approximately $3.7 billion.

This day will go down in the history of the crypto market as one of the darkest and most tragic. Interestingly, the experts had not yet woken up, so they did not have time to come up with the reason why the collapse occurred. But don’t worry, they will definitely come up with it, and we will tell you about it, but for now let’s move on to equally interesting news.

Bitcoin price forecast for tomorrow, the next week and month

Bitcoin rate forecast for Monday, December 6th: $45,348, maximum 48,522, minimum 42,174. Bitcoin rate forecast for Tuesday, December 7th: $42,548, maximum 45,526, minimum 39,570. Bitcoin rate forecast for Wednesday, December 8th: $42,227, maximum 45,183, minimum 39,271. Bitcoin rate forecast for Thursday, December 9th: $41,785, maximum 44,710, minimum 38,860. Bitcoin rate forecast for Friday, December 10th: $41,703, high $44,622, low $38,784.

Bitcoin price forecast for December 2021 and early January 2022

| date | Day | Minimum | Maximum | Average rate |

| 06.12 | Monday | 42174 | 48522 | 45348 |

| 07.12 | Tuesday | 39570 | 45526 | 42548 |

| 08.12 | Wednesday | 39271 | 45183 | 42227 |

| 09.12 | Thursday | 38860 | 44710 | 41785 |

| 10.12 | Friday | 38784 | 44622 | 41703 |

| 13.12 | Monday | 38722 | 44552 | 41637 |

| 14.12 | Tuesday | 40909 | 47067 | 43988 |

| 15.12 | Wednesday | 41365 | 47593 | 44479 |

| 16.12 | Thursday | 38099 | 43835 | 40967 |

| 17.12 | Friday | 38579 | 44387 | 41483 |

| 20.12 | Monday | 38904 | 44760 | 41832 |

| 21.12 | Tuesday | 39545 | 45499 | 42522 |

| 22.12 | Wednesday | 38473 | 44265 | 41369 |

| 23.12 | Thursday | 37685 | 43357 | 40521 |

| 24.12 | Friday | 38406 | 44188 | 41297 |

| 27.12 | Monday | 38940 | 44802 | 41871 |

| 28.12 | Tuesday | 36992 | 42560 | 39776 |

| 29.12 | Wednesday | 37464 | 43104 | 40284 |

| 30.12 | Thursday | 35783 | 41169 | 38476 |

| 31.12 | Friday | 33988 | 39104 | 36546 |

| 03.01 | Monday | 34451 | 39637 | 37044 |

| 04.01 | Tuesday | 34789 | 40027 | 37408 |

| 05.01 | Wednesday | 34525 | 39723 | 37124 |

| 06.01 | Thursday | 34471 | 39661 | 37066 |

Subject:

- Bitcoin

- Cryptocurrency

How did the sharp drop in Bitcoin affect the market?

During the market decline, Bitcoin briefly dropped to $42,000 per coin, and Ethereum fell to $3,500. Currently, the cost of major cryptocurrencies has adjusted, but no growth is observed. Following Bitcoin, other tokens collapsed, including meme tokens. Stablecoins have held their own, which means that so far everything is relatively good.

According to analysts, the first wave of liquidations on exchanges has already taken place. It is known that $1.3 billion was written off, which belonged to traders who incorrectly assessed the direction of movement of the crypto market. The President of El Salvador has already taken advantage of the low price of Bitcoin by announcing the purchase of another 150 coins. This allowed him to increase the number of coins in his wallet to 1,370. Nayib Bukele notes that he missed the bottom of $42,000 for only 7 minutes, so he had to pay a little more than $48 thousand per coin.

The founder of Tron also announced the purchase of hundreds of Bitcoins. Justin Sun writes that he decided not to miss the chance, following the example of Nayib Bukele. Apparently, Elon Musk could not ignore such an event. He posted several memes. We hope that you will appreciate the humor of the Tesla founder, as well as his real attitude towards cryptocurrency.

Features of the cryptocurrency market

The cryptocurrency market capitalization today is $271 billion. Bitcoin has 151.

151 billion dollars were definitely not pumped into the crypt, because the coins were created out of thin air, people held them, no one bought them. Actually, the coins purchased in the niche are, I think, 10 percent. Let the crypto market be 15 billion of real money that entered there.

Then the brothers take the conditional half a billion dollars and move the market up. The result is obvious: everyone hears about the growth of Bitcoin and enters the niche. The same Gemini has more clients, more operations and more commissions from them.

The guys from Gemini and other Consensus visitors are all about market growth. They don't want to buy low and sell high. They are waiting for growth to receive more commissions from what is happening on their sites. They need new people, new clients who follow the cries of “Bitcoin is growing,” “Bitcoin is the future,” and “Bitcoin must be taken.”

Take a look at these graphs. If anything, the event took place from May 13 to 15.

Query “How to buy Bitcoin.”

Source: Google Trends

Just "Bitcoin".

Source: Google Trends

And Binance, the largest cryptocurrency exchange in the world.

Source: Google Trends

After almost every Consensus, the market flies up. It looks like the ad is working.

Bitcoin price fell below $55,000

On Friday, November 26, the quotes of the first cryptocurrency dropped below $55,000. The drop over the past 24 hours was 5.9%, according to CoinGecko.

The chart below shows a sharp correction amid a surge in trading volumes. At the time of writing, Bitcoin is trading around $55,200.

Hourly chart of BTC/USD exchange Bitstamp. Data: TradingView.

Following Bitcoin, all crypto assets from the top 10 by capitalization entered the red zone, except USDT:

Data: CoinGecko.

On the futures market, positions worth $161.94 million were liquidated over the past 24 hours, and $90.97 million in an hour.

The total market capitalization is $2.56 trillion, Bitcoin is $1.03 trillion with a dominance index of 40.3% (data from CoinGecko).

Not everyone in the crypto community was concerned about the correction. Analyst Michael van de Poppe called the current price dynamics “beautiful.”

Beautiful price action #Bitcoin. I like it.

— Michael van de Poppe (@CryptoMichNL) November 26, 2021

He noted that it is not only the cryptocurrency market that is falling. In his opinion, PlanB's ideas about Bitcoin achieving Fr.

The markets are dropping down heavily, not only #crypto, but also equities are dropping.

The Plan B idea of $98K is gone.

The realization of a lengthening cycle is there.

We're still fine, even if we drop some more.

Just a longer cycle for #Bitcoin.

— Michael van de Poppe (@CryptoMichNL) November 26, 2021

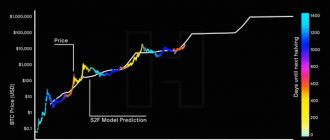

Previously, Huobi analysts called PlanB's Stock-to-Flow model untenable. The author later admitted that the price of digital gold would not reach $98,000 until the end of November. However, he still considers the $100,000 goal realistic.

On November 26, the National Institute of Infectious Diseases announced the identification of a new strain of coronavirus in South Africa. The World Health Organization will hold a special meeting on Friday to discuss the issue and its implications for vaccinations and treatment, CNBC reports.

Due to the emergence of the strain, the UK and Israel have suspended flights to several African countries. Traditional markets reacted to the news from South Africa: the European STOXX Europe 600 index fell by 3.88%, the Chinese CSI 300 weakened by 0.74% at the end of trading, and the S&P 500 index futures fell by 1.82%. The Russian Moscow Exchange index fell by 2.94%.

The fall in Bitcoin may also be due to the expiration of options on November 26 worth almost $3 billion. Most of the expiring options have an exercise price set above Bitcoin's all-time high ($69 thousand).

Ready for the big expiry tomorrow? Up to $2.6 billion in notional Open Interest, Bitcoin has recently broken upwards through the measured Max pain of $58k. With a P/C ratio of 0.42, option traders are buying a significant amount of calls against puts, showing bullish sentiment. pic.twitter.com/3lXWE00e8P

— Deribit (@DeribitExchange) November 25, 2021

On November 25, the media noted that options markets were indicating increased bearish sentiment ahead of the upcoming US Federal Reserve meeting.

Stay in touch! Subscribe to Cryptocurrency.Tech on Telegram. Discuss current news and events at the Forum

Is cryptocurrency out of politics?

It is likely that the Bitcoin rate has undergone a correction due to too much news about cryptocurrency. This was facilitated by the legalization of “virtual gold” in El Salvador. The authorities of this country even purchased 400 (according to other sources, more than 550) electronic coins. According to the laws of El Salvador, residents of the country will now be able to pay for Bitcoin purchases and pay taxes. Now citizens have access to currency exchange without commissions.

The Kremlin stated that there will be no legalization of Bitcoin. Press Secretary of the Russian President Dmitry Peskov even called it a “quasi-currency.” The authorities believe that the legalization of Bitcoin will negatively affect the country's economy.

Reasons for the fall in the Bitcoin rate

Analysts say investors have a number of internal issues affecting the value of the cryptocurrency. None of the experts dared to talk about them. The public was provided with only external reasons for the collapse of the exchange rate:

- Over the past week, more than 3,000 cryptocoins with a total value of $145 million have entered the market, so due to the excess of “virtual gold” its value has decreased;

- the beginning of a criminal investigation into the Uniswap crypto exchange;

- major miners have started selling Bitcoin coins.

Leading analyst at 8848 Invest Viktor Pershikov noted that approximately 2.9 thousand coins were sold over the last week. The specialist referred to data from the Glassnode company.

Consensus Members

Now let's remember the participants of the event. Who was the most active at Consensus? The Winklevoss brothers are the owners of the Gemini exchange.

Literacy Minute: Gemini in the original is read as “Geminay”. Not “Gemini” or “Gemini”, but “Gemini”. The word translates as "twins".

Tyler and Cameron caused a stir when they paid for coffee at Starbucks using cryptocurrency.

Even if you think carefully, it is difficult to come up with more suitable news for the general public. The masses who are not familiar with the principles of blockchain, but will shake their heads with approval when they learn about buying a drink from a world famous coffee shop with crypto.

Thus, the Winklevoss brothers advertised the SPEDN application from the Flexa team. The service converts coins into fiat and allows you to pay with crypto at various retail outlets.

But if you look more globally, Winklevoss did not advertise the application, not the developers, or even their stablecoin GUSD. They promoted cryptocurrencies. Cryptocurrencies that the exchange sells and buys, and also earns profit in the form of commissions from these transactions. Well, the profit is exchanged for fiat and also pays for employee salaries, server rental and other costs. And he puts it in his pocket, of course.

They held a Consensus, it was all over the media, they were shown everywhere. The audience saw that the crypt was alive, that the movement inside was enormous.

After this, viewers entered the industry in the form of new investors.

Bitcoin rate changes

BTC price jumps are nothing new. Today they offer $8,543 for a coin, and exactly a month ago they offered $5,816. It would seem that losing money over the last 30 days was impossible, but this is not so. Take a look at the chart.

Source: CoinMarketCap

Bitcoin jumped hundreds of dollars in a matter of hours - as well as fell. Therefore, hodlers also lost money, and short-sellers also made money. Last week, BTC even took $9,000, after which it pulled back quite well.

What does it mean? At least two things.

- You can make money on the cryptocurrency market at any moment. Bull market or bear market, it doesn't matter.

- A clearly defined trend in the market does not guarantee movement in one direction. Corrections cannot be avoided.