Bitcoin rate for all time

Since the founding of the cryptocurrency, the Bitcoin rate has always ranged from $0.0008 to $3242 per 1 BTC. All fluctuations for the period from 2009 to 2022 are described in detail in the article. During this time, there were both falls and growth of this market-leading cryptocurrency. Now it is recognized as official and has a high level of capitalization.

At the end of 2022, Bitcoin's capitalization is almost a trillion dollars. And the total capitalization of all cryptocurrencies has already exceeded $2 trillion. There are already more than 15,000 cryptocurrencies. The most famous, popular and reliable of them are offered for purchase and accepted for sale in the Matbea cryptocurrency exchanger.

Today you can buy Bitcoin there for 50,761 USD. Sell – for 48,321 USD. Matbea always keeps the course up to date. Compared to the recent historical maximum of almost 70 thousand dollars, today's price tag can be called low.

The Bitcoin exchange rate is very volatile - that is, it is subject to rapid and large changes. Probably, the recent collapse was facilitated by the refusal to support Bitcoin, announced by the head of the SEC (Securities and Exchange Commission), as well as the onset of a new strain of the Omicron virus throughout the world. If Bitcoin recovers from these events, then it is likely that its position will soon recover.

Purchasing Bitcoin on Matbea requires quick registration, identity verification and topping up your account balance with rubles, dollars or euros.

Those who believe that the Bitcoin rate will continue the already interrupted fall can sell their coins on Matbea, earning rubles, dollars or euros for them. It is possible to receive fiat funds using a VISA or Mastercard.

If the user has any questions, the team has prepared detailed video instructions.

Bitcoin rate for 2009-2012

Over a short period from 2009 to 2012, the Bitcoin rate increased to a record level. Many still regret that they did not invest money in it then and did not redeem this electronic currency. Who would have thought that it not only became more valuable than the dollar, but also thousands of times more expensive than it. This is explained not only by the popularity of cryptocurrency, but also by its small amount in circulation. It is practically not afraid of inflation, since further emission of electronic coins is not envisaged. The founding date of Bitcoin is considered to be October 5, 2009, when it had the following relationship to the dollar:

$1 = 1309.03 BTC

Then you could buy a lot of them, spending just a few dollars. There was no such unit as satoshi. Now it is equal to one hundred millionth of BTC. At that time, Bitcoin itself was one thousandth of a dollar, and its popularity was still at zero. There were users who even engaged in its extraction - mining. Of course, this took a lot of electricity, so the costs were not at all offset by the profits from mining.

2010

Bitcoin rate for all time and 2010

Cryptocurrency exchanges existed even 5-7 years ago. The first of them was Dwdollar. You could buy bitcoins with it and spend them on buying something on the Internet. This happened in May 2010. One of the users exchanged his existing bitcoins for dollars and bought himself a regular pizza. Then he had to spend 10,000 units of cryptocurrency on this, which was equal to 25 dollars. Now they are worth as much as three million dollars. The ratio was:

$0.008 = 1 BTC

Already in mid-2010 the situation changed dramatically:

$0.08 = 1 BTC – tenfold increase

And at the end of the year everything became even more optimistic:

$0.5 = 1 BTC

In just one year, the cryptocurrency has sharply strengthened its position and has become almost equal to the dollar.

Rate for 2011

It was this year that the following rate could be seen on the exchanges:

$1 = 1 BTC

In March 2011 the proportion was:

$31.91 = 1 BTC

But everything did not go so smoothly. On June 12, something bad happened for this cryptocurrency. From 30 dollars per unit, the mark dropped to 10. But that’s not all. Despite the falling exchange rate, Bitcoins were tried in every possible way to be stolen. There were constant hacking of wallets, exchanges and other hacker attacks. In fact, everyone was trying to get their hands on this electronic currency, anticipating its success.

year 2012

Bitcoin rate for all time and 2012

There were no significant changes in 2012, but one very important event occurred for the founders of the currency themselves. It has become not just electronic, but also partially physical. The Bitcoin Central bank was founded, which only increased the popularity of this cryptocurrency.

Bitcoin and Satoshi Nakamoto

Where did the history of Bitcoin begin? When we say “cryptocurrency,” the term bitcoin immediately comes to mind. Bitcoin and the blockchain network were first developed and released by a certain Satoshi Nakamoto. More than a dozen years later, no one knows exactly who he really is. There is even an opinion that this is a group of people, and not one person.

The history of Bitcoin begins with the fact that in 2007 Mr. Nakamoto began work on the network, and already in 2008 a description of the famous Bitcoin was presented. Well, at the beginning of 2009, the first cryptocurrency began its development and improvement. It really worked on Windsows 2000, NT and XP.

The first bitcoins were created in the same 2009. Their amount was 50 coins. And 10 of them were first sent by Mr. Nakamoto to Mr. Finney, who became the second in the Bitcoin network. This is how the history of Bitcoin began.

Bitcoin rate for all time from 2013 to 2016

Since 2013, the “golden period” of this cryptocurrency begins. Jumps down are still visible, but still it becomes the main one among other electronic analogues. One coin alone could fetch more than $1,000.

Rate for 2013

In March 2013 the ratio was: $74.94 = 1 BTC. Already in April there was an increase of almost 30 points, but in October there was a sharp drop. This was due to the arrest of one of the exchanges. In November there was a sharp rise - up to $700 per coin. At the end of the month the price increased to $1,242.

Already at the end of 2013, there was a two-fold decrease - to $ 600. Then China banned the official use of this currency. But if we compare it with today’s statistics, it is within China alone that more than 80% of Bitcoin transactions take place.

year 2014

Bitcoin rate for all time and 2014

At this time, the TeraExchange exchange carries out the first operation through the official exchanger. Despite the exchange rate of $310, this cryptocurrency is still stabilizing and gaining a foothold in the market. Various platforms are appearing where it is possible to pay with such electronic coins, purchase or exchange them.

Rate for 2015

In January the rate fell sharply, but in March it was:

$281 = 1 BTC

Later there was an increase of as much as 200 points. This could be due to a Chinese pyramid scheme that actively used this cryptocurrency. But already in winter there was a sharp decline:

$355 = 1 BTC

2016

Bitcoin rate for all time and 2016

In 2016, one of the developers left the company, which affected the course. It fell 50 points. In addition, the developer published a devastating article. He wrote that the company was focusing only on operations in China. But after this, Japan decided to recognize Bitcoin as an official virtual currency, along with everyone else. South Africa also joined Japan.

In the first quarter of the year the rate was as follows:

$395 = 1 BTC

By April it had increased:

$451 = 1 BTC

It was in mid-2016 that Bitcoin’s capitalization amounted to as much as $30 billion. There was a sharp jump, which everyone associates with a large volume of bitcoin purchases from China.

In September the proportion changed slightly:

$600 = 1 BTC

Already at the end of 2016, you had to pay 1000 dollars for 1 bitcoin. This happened on the eve of the New Year holidays.

Do you remember how it all began..?

The bitcoin.org domain appeared back in August 2008. Already on October 31 of the same 2008, the first official document “Bitcoin P2P e-cash paper” appeared. It described the very concept of an anonymous payment system, and also revealed some technical aspects.

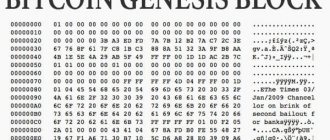

The network’s birthday was January 3, the day when the BTC network went live and its mysterious creator Satoshi Nakamoto generated the first 50 BTC. They were called Genesis Block. A week later, the first transaction took place on the network: Satoshi Nakamoto sent 10 BTC to Hal Finney.

These were the first steps of what would become the leading cryptocurrency by market capitalization and launch a new digital asset world.

At first, Bitcoin was of interest to an extremely limited circle of people, in particular, geeks and experimenters. They had a kind of toy, however, without real value and with an uncertain future. At the same time, Satoshi Nakamoto (whether it was 1 person or a group of people) managed to mine about 1 million coins in the first months after the creation of his brainchild.

Bitcoin to ruble exchange rate for 2017

In 2022, there was a strong rise in the popularity of Bitcoin. Everyone not only uses them, but also engages in mining and invests in farms. This could not but affect the value of this cryptocurrency. The Bitcoin to ruble exchange rate in 2022 increased from $800 per 1 bitcoin to $15,000. Average rate for the whole year:

$3242 = 1 BTC

Bitcoin rate for all time

Even the historical maximum of this currency was updated. It can be used everywhere: on the Internet, currency transactions, payments for goods and services.

Prerequisites for the formation of BTC

So, back in 1983, David Chaum, a researcher at the computer science department at one of the universities in Santa Barbara, thought about the problems of anonymity of payments, their transparency, and the security of monetary transactions. We can say that it was then that the idea of a new digital gold appeared.

After some research, the scientist proposed using the so-called “blind subscription” algorithm, which can be used to conduct secure transactions between anonymous users. At the same time, each such transaction and its origin will be visible to other users.

David, together with his colleagues from Israel, developed an electronic cash protocol, using which the merchant approves the financial transaction only after the authenticity of the payment by the other party is confirmed. It is this technology that has become the foundation for conducting transactions with cryptocurrency.

Main provisions of White Paper

The White Paper is the main technical document by which BTC operates. It talks about the principles of creating a distributed monetary system that will help avoid manipulation of digital currencies.

White Paper for Bitcoin

Key points to understand:

- Cryptocurrencies are self-regulated peer-to-peer and never rely on a third party, meaning there is a complete elimination of intermediaries.

- It is based on a public register of all transactions taking place on the network - blockchain . The information in it is transparent.

- Each transaction is recorded in a “block” - an element containing information about transactions such as time, digital signatures of the sender and recipient, and the addresses of their wallets.

- The information in the blocks is protected by encryption; the method is called a cryptographic hash function. It is asymmetrical - that is, it is impossible to decipher the input data from the output data.

- play an important role in transactions - public (open) and private (closed). The public key is published along with the transaction, and the private key is known only to the owner. Both keys are issued to the user at the time of creating a cryptocurrency wallet. The key system allows the registry to be made publicly available without exposing the privacy of the participants.

- Once created, blocks are arranged in chronological order, forming a chain, and cannot be changed or moved in any way - this is the basic principle of the integrity of the cryptocurrency network.

- Blocks are created by miners, or more precisely, by their computers. By going through a huge number of probable values one after another, the computer must guess the value that is currently set by the network - the “hash”. Once the value is guessed, a new block of transactions is created.

- For creating a block, the miner is rewarded with freshly minted cryptocurrency. It is noteworthy that although Nakamoto does not use the term “miner,” he writes in one of the paragraphs: “The constant addition of a certain number of new coins is similar to gold mining, which expends resources to extract gold.” That is, it initially compares cryptocurrency mining to a mine.

In addition to these points, the white paper touches on many more complex technical nuances, from saving disk space using a Merkle tree to confirming the “computational impracticality” of trying to modify transactions. Moreover, the document takes only nine pages, so all provisions are described quite succinctly and compactly.

You can read the Bitcoin white paper on the official website, there is even a version in Russian: https://bitcoin.org/files/bitcoin-paper/bitcoin_ru.pdf

In connection with the situation with Craig Wright described above, there is a risk that one day access to the document will be denied not only to the British. It’s okay - as a matter of public knowledge, the document has already spread almost throughout the Internet. Here are just a few options where you can find it:

- On the website of the Estonian government.

- In IPFS (Interplanetary File System).

- On the Kraken exchange website.

- On Facebook affiliate sites: Novi, Casa, Square, CoinCenter, NYDIG.

The whitepaper is also stored directly on the blockchain, in parts as a PDF file. There is an article on how to get it.

Invest $10 in Bitcoin every day

But what if you invested $10 in Bitcoin every day for the last five years? How much would you receive now?

If an investor had invested $10 per day for the last five years in BTC, the total amount spent would have been just over $18,300. But the amount in BTC would have been over $334,000.

Your investment would have grown by 1800% in return on investment in 5 years. Thus, an investment of $300 per month would generate an income of more than $300,000 in net profit.

If you go back not 5, but 10 years, your investment in cryptocurrency would have grown by more than 100,000% in the last decade alone.