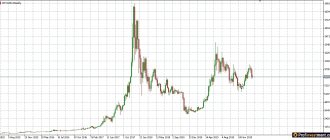

In 2022, the Bitcoin exchange rate could reach $100 thousand, according to analysts interviewed by Izvestia. In their opinion, the market is now at a decisive moment. However, over the weekend, cryptocurrency prices dropped sharply. The Bitcoin rate fell by almost $15 thousand within 24 hours and on December 4 dropped to $42 thousand. At this moment, the quotes of all leading altcoins decreased. Of the top 10 cryptocurrencies by capitalization, the prices of Polkadot, Solana and Cardano have fallen the most since the end of last week. The main reasons are profit-taking by large investors, the sale of Bitcoin and a temporary decline in indices of technical companies, experts say.

Why did the price of Bitcoin decrease?

Crypto market quotes fell amid news of US President Joe Biden signing an infrastructure plan, says Artem Deev, head of the analytical department at AMarkets. According to him, this law actually equated digital assets to cash and obliged brokers and operators to report to the tax service on all cryptocurrency transactions worth more than $10 thousand.

“The reporting will need to indicate information about the sender of digital assets, and those who do not do this will be considered violators of the law. Of course, such news could not but lead to negativity on the part of investors - as a result, sales began in the market ,” the analyst explained.

According to Deev, the negative reaction was observed mainly from retail investors, while institutions continue to maintain positions in the cryptocurrency. Considering the fact that the law itself will come into force only in 2024, we can talk about a temporary correction in the digital asset market, the analyst noted.

Bitcoin fell, but what rose?

COXSWAP (COX) was the top gainer over the past 24 hours, rising 756.79%. At 8 a.m. it was trading at $0.00000009096. On the other hand, Degem (DGM) shares suffered the biggest loss over the past 24 hours, falling 97.24% to trade at $0.0006719.

Small recovery attempts are being made with bounces from the extremes in Bitcoin, Ethereum and XRP. It's unclear how deep the market could fall. However, it is worth watching carefully, since such fluctuations can very easily change and provoke a large-scale rebound.

The market is correcting, what happens next?

The current decline in Bitcoin to $58.3 thousand is a correction relative to the growth of recent weeks, says leading analyst at 8848 Invest Viktor Pershikov. According to him, many market participants are taking advantage of the situation and actively buying the first cryptocurrency at the drawdown, as indicated by various indicators.

“The decline in prices on the crypto market in recent days is due to an increase in the volume of cryptocurrency sales by institutions, but there are currently no negative fundamental factors ,” the analyst explained.

According to Pershikov’s forecast, the price of Bitcoin as part of the current correction may drop to $55 thousand, but by the end of the year there is a high probability of updating the historical maximum above $70 thousand.

The recent update of the Bitcoin network, together with the increase in purchase volumes by institutions and the start of trading of the first Bitcoin ETF in the United States, outweigh the local negative, so a significant drop in the crypto market is not expected in the coming months, Pershikov added.

On November 14, the Taproot update was activated on the network of the first cryptocurrency, which is aimed at increasing the scalability, confidentiality and efficiency of the Bitcoin network. On October 19, the first US exchange-traded fund based on Bitcoin futures began trading on the New York Stock Exchange (NYSE). Two days after the start of trading, assets under management of the Bitcoin Strategy ETF (ticker BITO) of ProShares exceeded $1 billion. The fund broke the record growth rate to $1 billion, which lasted 18 years.

What is the current outlook for Bitcoin after a 20% drop?

Experts note that nothing extraordinary is happening with Bitcoin: there was a normal correction. They also emphasize that the Bitcoin exchange rate is very easy to manipulate

Photo: Dado Ruvic/Reuters

The price of Bitcoin fell by 20% on Saturday night. At the moment it dropped below 42 thousand dollars - for the first time since the end of September. The cryptocurrency began to fall in price following the financial markets, which are under pressure from uncertainty due to the new strain of Covid and inflation. Bitcoin pulled other cryptocurrencies with it - traders lost more than $2.5 billion. In just one day, the margin positions of 400 thousand traders were forcibly closed. The greatest losses occurred in transactions with Bitcoin - over a billion dollars. Users trading Ethereum lost more than $600 million.

Bitcoin is currently trading above $49,000. Alena Narignani, CEO of the Crypto-A agency, discusses the prospects for the world’s most popular cryptocurrency:

Alena Narignani, General Director of the Crypto-A agency “What is happening with Bitcoin now is a standard correction of the cryptocurrency rate. Bitcoin is a highly volatile currency. Now it will probably adjust further, that is, it seems to me that the price will drop a little more, somewhere, perhaps, to 42-40 thousand dollars, and after that the situation will stabilize, because there will be no significant events on the market, such super-scale ones, which would provoke a fall in the Bitcoin rate, and in the long term the currency would take a very long time to recover from them, and only after that begin to grow, has not happened recently. The question is how large this correction will be and when growth will resume. In my opinion, it will be quite noticeable in terms of interest, that is, perhaps it will drop to about 40 thousand dollars, after which it will grow upward, but I do not think that it will be very long. By the end of 2022 - beginning of 2022, the coin rate will stabilize and return to 60-65-70 thousand dollars.”

Sharp fluctuations in the Bitcoin rate occur when Europe is sleeping, and the pre-New Year rally in the market is already a tradition, says Alexander Brazhnikov, executive director of the Russian Association of Crypto Industry and Blockchain:

Alexander Brazhnikov, executive director of the Russian Association of Crypto Industry and Blockchain “If you look at what happened with Bitcoin when it was worth 42 thousand dollars, all this happens at a time when the European part of the world is sleeping, and the American side is actively waking up and acting at that time. As America wakes up, various disturbances begin. And as America goes to bed, everything begins to calm down. This is standard in every month before the New Year, this has always happened. And that year, too, Bitcoin once cost 13 thousand dollars, and then after the New Year it jumped to 40 thousand at once. I think this year there will be a similar situation, that now many people were buying back at the moment of 42 thousand, as I understand it, this was done specifically so that those investors who kept Bitcoin in their investment package would throw it off for those who are interested. Now it has started to grow again, I think until the New Year it will go in this system - from 50 thousand to 60 thousand dollars. Then in the future there will be growth again due to the fact that Bitcoin is a finite unit of its financial asset, it is not infinite, and the recession will end, the cue ball will grow, but not fall in any way, it will fall only at the moment when it is for someone. then you need it. While various financial groups are still able to manipulate Bitcoin well, that’s why all this is moving.”

Previously, the founder of Navellier & Associates, which manages $2.5 billion in assets, predicted an 80% correction in Bitcoin and a decrease in its value to $10,000. Louvie Navellier believes that the actions of the American Federal Reserve in the future will only intensify the correction of high-risk assets, which are cryptocurrencies.

The last time Bitcoin exceeded its all-time high was in early November, due to investors’ desire to protect their savings from inflation. Then the cryptocurrency reached 68 thousand dollars.

Add BFM.ru to your news sources?

The bullish trend is in force

In general, the fundamental mood of the crypto market is now very positive, says Crypterium co-founder Vladimir Gorbunov. According to him, at the moment it is very early to talk about the market moving into a bearish phase.

“Even if Bitcoin fell to $45 thousand today, it would still have the potential to grow to a level of $100 thousand or more ,” the expert noted.

According to Gorbunov, Bitcoin has many factors to continue its growth: a large number of investors are entering the market, global players such as Visa and Mastercard are actively continuing to move towards cryptocurrencies and are adapting more and more new services from the classical infrastructure for the crypto market.

Bitcoin price change over the past week

Bitcoin (BTC) was trading at $53,029.87 at 7 a.m., down 5.88% over the past 24 hours. Over the past seven days, the price of Bitcoin has decreased by 5.62%, and Bitcoin's dominance in the cryptocurrency market is 41.19%, with a decline of 0.14% in the last 24 hours.

The second-largest cryptocurrency by market capitalization, Ethereum (ETH), fell 7.34% over the past 24 hours to trade at $4,154.68.

Binance Coin (BNB) fell 4.12% in the last 24 hours to trade at $587.01. Tether (USDT), fourth on the list by market capitalization, traded at $1, down 0.02%. Solana (SOL) is down 9.99% over the past 24 hours to come in fifth on coinmarketcap.com's list, trading at $204.62.

Long-term analysis

Long-term wave analysis continues to suggest that all price action since July is a massive bullish 1-2/1-2 structure. This means that the rate of price growth will accelerate once BTC completes its current correction.

Bitcoin is currently in sub-wave 2 (yellow) of wave 2 (white). Sub-wave 3 of wave 3 is typically the most aggressive of all bullish waves. Therefore, it may well push the market to a new historical high.

Will Bitcoin or Digital Currencies Eventually Crash?

Bitcoin futures, like other cryptocurrencies, are unpredictable. While Musk, China and various regulators in the United States were struggling with the price of Bitcoin, then people were buying it.

US companies enter the highly volatile cryptocurrency world to escape inflation, so although the Bitcoin market sometimes falls, it always recovers.

People know that capital gains are high, which tech stocks cannot provide. While buying stocks is lucrative, it also carries much higher risks than cryptocurrencies.

In business news you can see how they differ from each other and where stock market losses are more relevant. However, the highly volatile IRS currency is not legally accepted by the United States.

Bitcoin payment companies are also gaining publicity, positive or negative, because they handle anonymous transactions. The IRS believes that people may use BTC for money laundering, fraud, or terrorist financing.

But cryptocurrency trading has also gained notoriety due to its misuse by some users. Recently, a group of hackers broke into the database of an American gas distribution company. The cyberattack ended when the company paid a ransom in cryptocurrency to a wallet in which its owner remained anonymous.

Summary

Bitcoin will not die because it has shown its potential and many investors have embraced it as “digital gold.” Cryptocurrency transactions may be subject to some strict restrictions that help stabilize and legalize the virtual currency. With these new cryptocurrency exchange measures, Bitcoin will improve its base, which will increase its price and popularity.

The death of Bitcoin and other cryptocurrencies is far from over, although the market has changed. Cryptocurrency will likely be dusted off, taken more seriously, and serve its purpose of replacing fiat currency or fiat money. Many authorities in China, India and even the United States have created their own tokens for investment and joined the world of cryptocurrencies.

What's next for Bitcoin investors after the scare?

After extreme trader concerns about BTC, Bitcoin Cash and its low capitalization, it is expected to recover. The Wall Street Journal supports cryptocurrencies and does not hesitate to say that they will soon rise in value again.

Unfortunately, the cryptocurrency crash is very sensitive to investor comments. Some people think that Musk has given up on the "Bitcoin game" because it will grow organically and not as a bubble.

Real estate companies in the United States have joined the cryptocurrency exchange, as have tech giants such as Apple. Recent announcements regarding cryptocurrencies include its adoption by the El Salvadoran government.

The year is not over for Bitcoin yet. He just needs to recover and take advantage of this opportunity. It is clear that many people have left cryptocurrency trading after losing their assets.

This period of BTC loss has become an opportunity for novice investors to get in on the game.

The Bitcoin 2022 conference, which will be held in Miami in 2021, has attracted the attention of professional and novice investors. This new session discussed regulations that have impacted trade in recent months.

Senators in Michigan in the US support this asset and have opened up to teach new investors how to manage it. Such actions give greater value to virtual money and protect it from possible disappearance in the market. At the Bitcoin conference there was also talk about investing in the current bear market because its value is about to skyrocket.

While the IRS action was also a topic at the conference, senators concluded that they were doing it to protect money. The Internal Revenue Service only strives to ensure that trade goes in the right direction and does not allow it to fall into piracy and illegal schemes.

As a final point, the Bitcoin asset will seek to upgrade itself to improve price security.

Who's against it?

On the other side are people who once bought a lot of bitcoins for pennies or mined them. They see growth and decide to withdraw to fiat.

Why should they go into fiat, you ask? Well, people don’t live forever, they want a beautiful life, and eternal HOLD is stupid. The result of a long wait should be the purchase of another yacht or house.

Even if participants sell a thousand BTC - the equivalent of $8.5 million - this is not so small compared to the estimated $15 billion on the market.

They sell coins and drain the rate. The market is going in the opposite direction.

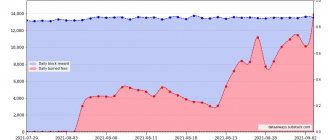

This also includes regular Bitcoin miners. Today they receive $17 million worth of cryptocurrencies per day, and this amount did not flow into the market in the form of fiat. This is money out of thin air, millions of dollars appear in the form of Bitcoins out of thin air every day. And these BTC miners immediately sell to cover the costs of electricity, rent, equipment, and just to buy food for themselves at home. Or upgrade the wheels on your Koenigsegg Agera RS.

Source: Blockchain.com

Millions simply arose due to the peculiarities of the network in accordance with the idea of Satoshi Nakamoto. But no one paid for it in cash, so a financial bubble is created.