Billionaire Warren Buffett once famously said:

“In the business world, the view in the rearview mirror is always clearer than the view through the windshield.”

This means that it is easier to look back and analyze what happened than to look forward and try to see the future. In the world of cryptocurrency trading, this rule works 100%.

The best Bitcoin indicators also use what is in the rearview mirror to predict with varying accuracy what awaits us in the future.

Let's look at the five most popular indicators for Bitcoin that can help predict future price changes of the main cryptocurrency.

Reasons for Bitcoin's growth

Before directly analyzing possible scenarios, let’s take a closer look at the reasons for the strong growth of cryptocurrency. The main reason for the growth is the imbalance towards demand, the reasons for this imbalance are as follows:

- Interest in cryptocurrency from institutional investors. For example, in mid-December 2022, the Ruffer Investment investment fund transferred 2.5% of its portfolio to Bitcoin. Due to this alone, BTC worth about $745 million was purchased. Other major players are also entering the crypto space, for example, MassMutual, MicroStrategy, Square. Investors of this type are distinguished by their large volumes and planning horizon; they are in no hurry to dump military-technical cooperation when the exchange rate increases by 5-10%. Due to substantial amounts and the Buy & Hold strategy, a significant part of the tokens are washed out of circulation.

- An abundance of “extra money” in the hands of ordinary people. The coronavirus pandemic has left many unemployed, but thanks to state programs to support the population, citizens have accumulated money in their hands that simply has nowhere to spend it. These funds went to the stock market and cryptocurrency. Investments are made both to protect capital from inflation and to increase it. Statistics prove this; already in the first half of December 2022, the number of wallets with a non-zero balance exceeded 33 million. Moreover, according to statistics, more than 98% of wallets are “in the money”, that is, their owners bought BTC at a lower price and now they are in the black.

- Halving, which halved the block reward . Miners began to mine fewer Bitcoins, and they are in no hurry to sell them.

- Perhaps the Bitcoin rate was affected by the situation with Ripple and the SEC's actions regarding this project . The cryptocurrency fell in price by more than 50%, probably, holders of XRP tokens went to Bitcoin.

All of these factors reduce the supply of tokens and increase demand. Against the backdrop of the growth of BTCUSD, more and more people are joining the ranks of crypto investors, adding “fuel” for the further growth of the main crypto.

There are also conspiracy theories according to which “whales” are waiting for the moment to exit Bitcoin and collapse its rate. According to conspiracy theorists, everything that is happening is a conspiracy of the world elites; it is impossible to prove or disprove this assumption.

What are technical indicators?

Indicators are tools for technical analysis (TA) that help traders predict the price and direction of its movement with varying degrees of accuracy. TA uses historical price data from a few seconds/days/months/years ago, turning it into easy-to-read indicators; In this case, indicators are created using mathematical methods.

Data from formulas is turned into graphical images that are overlaid on or next to price charts to help traders make decisions.

Where will Bitcoin's growth end?

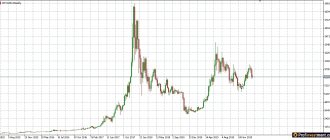

The main difficulty lies in the ultra-high volatility and constant updating of historical highs. There are no historical levels, when approaching which one could count on a correction or a full-fledged reversal.

What does graphical analysis say?

Events at the end of 2022 - beginning of 2022 are only partially reminiscent of what is happening in 2022. The growth is even sharper, with short-term pullbacks of 5-15%. The intermediate resistance at $13,500 was broken quickly; updating the historical high near $20,000 was somewhat more difficult. A full retest of the $20,000 mark never took place.

After the big players fix their profits, a downward movement will begin, most likely extended over time. The ideal scenario is a decline to $20,000, possible movement in a horizontal channel and subsequent growth with updating of historical highs.

Well-known personalities in the crypto world also say that Bitcoin is unlikely to fall below $20,000. Institutional investors entered the market at approximately these levels at the end of 2022; if BTCUSD declines to these values, they will most likely defend the $20,000 level. This point of view is shared by BitPay commercial director Sonny Singh, Bloomberg analyst Mike McGlone and other well-known people in the cryptosphere. McGlone, for example, is known for having predicted in mid-2022 that Bitcoin would rise to above $20,000 by the end of the year.

In conditions of increased demand and limited supply of BTC, even relatively small volumes can correct the behavior of BTCUSD. A longer downward correction will allow Bitcoin to fall to $13,500-$14,000.

An interesting picture is given by the Fibonacci levels applied to the last 2 large-scale movements; they are clearly visible on the daily time interval. During the first, BTCUSD fell slightly short of $20,000, the second took place in the spring of 2022. Fibo extensions of 2.618 and 4.236 are approximately at the same mark, it coincides with the round level of $50,000 . This also coincides with analysts’ predictions that in the near future the military-technical cooperation will set another record and at least test $50,000.

Fibo levels do not provide a 100% guarantee that a reversal will take place in the designated zone. But we are in the area of absolute historical extremes; there are no values on the left that we could focus on.

Possible scenarios after growth stops:

- Smooth correction up to $20,000 , transition to sideways movement, smooth growth.

- Institutional investors are gradually exiting the cryptocurrency - the level of $20,000 will not survive, and the rate is declining below $15,000.

- Large capital immediately dumps the crypt - Bitcoin falls below $5,000.

A scenario is possible in which the price of military-technical cooperation will no longer fall below $30,000-$35,000. On H4, the nearest support levels are visible in the area of $38600, $38000, $36500, $30000, $28000. Recently, Bitcoin has been moving according to the pattern of formation of accumulation - exit from it - emergence of new accumulation, a whole array of support levels has been formed.

It makes sense to switch to lower timeframes only with active intraday trading. At H1 and below, the situation changes too quickly; in a few hours, Bitcoin can either grow by 5-10% or adjust by the same amount.

In the coming days, the determining factor will be the resistance at $41,500. If we get a confident breakout of the level, growth will continue and the target of $50,000 can be achieved as early as January.

Folding meter on BTCUSD chart

A folding meter is a pattern formed by an increasingly accelerating growth or decline of an asset. Conventionally divided into 3 phases:

- Moderate growth/decline , in the case of Bitcoin it lasted from approximately the spring of 2022 until the first half of October of the same year.

- Acceleration of growth/decline , on the BTCUSD chart this stage was observed from October to mid-December 2022.

- Almost vertical movement , rollbacks, if they form, are literally on a few candles; this is not an attempt at a reversal, but an exit from the market for those who decided to take profits at the achieved levels. Bitcoin is in the third phase, there is a recoilless growth, which at any moment can be replaced by an equally sharp fall.

Typically, when trading the folding meter pattern, entry into the market is made when the trend line of the third phase is broken. The target is the trend lines of the 2nd and 3rd phases, which also gives a possible decrease in BTCUSD to the area of $30,000 and $20,000 with a deeper rollback .

Formally, consolidation under the last trend line will provide an entry point for selling, but this is too risky a signal for trading. Instead of the expected decline, movement in a horizontal corridor may begin.

Indicator readings

Indicator analysis is also popular in the crypto market. Standard indicators show a classic picture for an overbought market:

- The chart is very far from the 200-day moving average . This is the maximum discrepancy in the entire history of Bitcoin. Formally, the upward trend has been present since the spring of 2022, when the BTCUSD chart consolidated in the zone above the moving average line.

- Stochastic has remained in the overbought zone since the beginning of December last year , only briefly falling below the level of 90. This is a typical picture for the absolute dominance of buyers.

- The BTCUSD chart remains on the upper line of Bollinger Bands , this pace has been maintained for almost a month. With each new candle, the likelihood of at least a correction beginning increases.

The only alarming thing is the decline in the Cumulative Volume Index against the backdrop of Bitcoin’s latest records. Typically, such discrepancies are quickly corrected by the market, but this does not mean that BTCUSD will begin to fall right now.

Is there a bubble and when will it burst?

There are several explanations and ways to define a bubble in financial markets. The simplest one was proposed by Saxo Bank; according to their version, a bubble is formed in a situation when the price of an asset rises sharply, but its consumer properties do not change. There should also be an exponential rise/fall in asset value and growth rate.

The section of the chart from December 2022 does resemble a bubble, but there is a rationale for this growth. These are both the actions of institutional investors and the interest of ordinary users looking for ways to leave fiat currency and protect savings from inflation.

The current growth cannot be called a bubble, similar to the one that occurred, for example, in the late 90s with Internet companies . But growth cannot continue indefinitely. What is most likely is not a sharp collapse of the bubble, but a decrease in volatility and deep corrections. As for dates, it depends on the stabilization of the world economy and the monetary policy of the US, EU and other countries. Once the consequences of the pandemic are overcome, the volatility of the cryptocurrency may decrease.

The volume of search queries for the term “bitcoin” has decreased

One of the easiest ways to gauge the excitement around the cryptocurrency market is to look at Google Trends. Search volume shows how often users searched for “bitcoin” in a given period in a specific region. In the previous cycle, the bull market ended when search volume for Bitcoin reached 100. This was in December 2022.

Sponsored

Sponsored

During the current bull market, the Google Trends score peaked in May 2022 at 79 (green circle). Since the beginning of July, the indicator has returned to the range of 24-36, and this week it was at the level of 26.

Source: Google Trends

Bitcoin value in the long term

Representatives of the largest investment funds, information and analytical agencies, and major players in the crypto market have repeatedly shared their vision of the future of the crypto market.

Against the backdrop of the current growth of Bitcoin, rumors about a long-term goal of $146,000 and even $400,000 per 1 BTC have intensified.

This is a long-term goal that the first cryptocurrency could achieve within a few years. The main argument in favor of this scenario is the increase in confidence in Bitcoin; more and more investors will begin to consider it as a replacement for gold. This will trigger an outflow of money from gold ETFs and their redirection to BTC tokens. JPMorgan does not give exact dates, but says that this could happen in the next few years.

Scott Minerd (Guggenheim Partners) even stated that according to their analysis, Bitcoin should cost about $400,000 - this is its fair price. The goal is also long-term, but it should not take decades to achieve.

Different numbers are mentioned, but most agree that this year Bitcoin will test the endurance of investors more than once. There will be sharp upward surges and equally rapid declines. As the BTC increases, expectations regarding the expected range of motion also adjust. With Bitcoin price above $40,000, support in the $20,000-$30,000 region is considered the most likely minimum.

Not all analysts believe that Bitcoin will be able to maintain its current growth rate in the coming months. For example, David Rosenberg (analyst at Rosenberg Research) said that what is happening with Bitcoin resembles a giant bubble, and all bubbles tend to burst sooner or later.

A similar point of view is shared by Material Indicators and WhaleMap. Material Indicators analysts reported an impending drain of Bitcoin by “whales”. In WhaleMap, I consider a similar scenario with a potential decline in BTCUSD to support around $32,000. True, there are no guarantees that at these levels the military-technical cooperation will not be bought out by institutional investors and growth will not continue.

Cryptocurrency indices: is there any practical sense?

By analogy with the stock market, some enthusiasts decided to acquire cryptocurrency indices

. In simple words, several cryptocurrencies are selected, their current market value (rate) is summed up and divided by the quantity. The selection of assets mainly takes place between the most strengthened representatives of the market. As a result, we obtain an average value that gives a general idea of the entire sector. A kind of moving average for the market.

Wait, is Bitcoin not average?

Market indices have their own specific task - to track the average return of the entire market and protect against drawdowns of individual assets. For example: Bitcoin grew by 10%, but ripple does not want to go up - investors lost 7% on it. Quite a real picture

, is not it?

Let's tell you a little secret: retail

rarely afford to purchase a wide variety of cryptocurrencies. They often hold 1-3 coins. Imagine that they all fall in price. The situation is unpleasant, but very realistic.

But if they diversified

your portfolio, you wouldn’t have found yourself in such an unpleasant situation.

Or invested in a market index

, which gives the average return on the market. In our hypothetical example, the average return on the market would be 3% - a modest figure, but it can protect against unexpected drawdowns, right?

I admit, the index is not that useless. Where to invest?

In fact, the index serves as a hedge

risks.

make money

on loss protection . Interested?

To be fair, cryptocurrency indices are worthy of a separate review. We will name a few of the most famous of them:

- Bittwenty;

- Coinbase Index Fund;

- Crypto20;

As an illustrative example, take a look at the Bittwenty index called Bit20 (ticker: BTWTY):

Bit20 index rate for 2022, coinmarketcap

It is immediately noticeable that the quotes differ in appearance from Bitcoin

.

A good sign: there is no correlation

, the portfolio is distributed across different coins - the risks are lower.

Volatility is okay: over the last month the price has been sliding in the range of $500-$1000. It was really possible to make money on such a price difference

.

Let us immediately warn you that you should not invest blindly in indexes. To begin with, it is recommended to carefully study the contents of the “portfolio”, and only then make investment decisions.

Hint:

the fewer BTC in the index and the more diverse altcoins, the safer it is.

Have you started for your health...?

And we ended up with hedging, which in 2022 cannot be avoided with “normal” (volume) investments in Bitcoin. Investing in cryptocurrency indices will add confidence and perfectly diversify your portfolio, adding a couple of hours of good sleep.

As a protection against the risks associated with the fall of Bitcoin, you can invest in altcoins. Investments in ICOs are especially relevant now: check out the basics in our Investor Education Center.

Whales on the market: a threat or a hint?

Cryptocurrency and blockchain have opened up a new type of fundamental analysis of Bitcoin - analytics of the actions of big players, jokingly called “whales” because of their “fat wallets.” Of course, the public data of the big guys is at your fingertips, why not take advantage of it? What if they have insider information? Maybe it’s worth following them?

Newfangled tool: does it work?

In fact, tracking large “whales” has become a “fashionable” analysis tool. But is the influence of “big” capital really that significant, and if so, why?

Essentially, anyone with enough cryptocurrency can be called a whale. For example, the organizers and CEOs of projects are also whales, and the buying or selling decisions made by them can cause a remarkable stir (and sometimes even a whole performance) among traders.

Let's look at a specific example. Recently, Kobayashi, the trustee of the fallen Mt.Gox exchange, transferred 16,000 BTC and BCH each. Unfortunately, market participants do not always perceive such news rationally, confusing translations

funds with

sale

. But even if the whale did sell 16,000 BTC, would this really affect the market value of Bitcoin?