Bitcoin is called “digital gold”. It was this electronic coin that became the first popular cryptocurrency. The key principle of the platform is decentralization. However, at the moment the currency has every chance of losing this important quality.

There are two scenarios for Bitcoin centralization. The first option involves establishing control of one company over most of the equipment produced, and the second - over most of the hashrate.

By the way: Bitmain's power is approaching 51% of Bitcoin's hashrate

Already, Bitcoin mining is largely carried out at the expense of large mining pools. For ordinary users, Bitcoin mining is almost unprofitable. Add to this the limited emission, most of which has already been done, and the picture is complete. She is unlikely to make you happy.

Bitcoin is a cryptocurrency with limited emission

The release of coins occurs when new blocks are created in the chain. They contain all the necessary information about the transactions being carried out. The more blocks are formed, the greater the amount of information that needs to be recorded, and the larger the Bitcoin coins themselves become.

The cue ball emission is fixed. It is limited to 21 million tokens. This volume cannot be changed. It is “hardwired” into the platform’s program code. The last BTC will be mined by 2140. Moreover, 99% of the coins from the planned issue will be mined within the first twenty-eight years from the founding of the cryptocurrency. The remaining period of more than a hundred years is left for the last 1% to mine.

Mine Bitcoin or give preference to altcoins

If you look at how many bitcoins have been mined, most people have a logical question: is it worth mining them, knowing how many bitcoins exist. It is almost impossible to give an unambiguous answer to this question, because each person has his own powers and prerogatives. To understand the issue, you need to pay attention to a number of criteria:

- how many bitcoins can you mine using your existing equipment if you convert them into USD;

- how many different altcoins you can mine in the corresponding period in terms of US dollars;

- prospects for the growth of the cue ball and the selected token in%;

- whether long-term storage or immediate sale is planned (often used in pools).

If the cryptocurrency developers do not change their policy, then we can safely not wait for all the bitcoins to be mined, because more than 100 years will pass. It is quite possible to purchase a certain amount of bitcoins for other currencies in order to save them for the longest possible period of time in anticipation of an increase in value, but more and more people prefer to switch to developing projects, in which the actual daily profit is many times higher, and an increase in the exchange rate provides many prospects.

What is the difference between limited and unlimited issue coins?

The most striking example of a currency with unlimited emission is ETH. The main risk associated with this coin feature is inflation. Currently, the consensus level on the acceptable amount of cryptocurrency is one hundred million. At the same time, the authors of the project have repeatedly stated that the size of the issue will be limited, and some of the coins will be “burned” to prevent depreciation.

Unlike ETH, BTC is not at risk of inflation due to excessive emission. On the contrary, the high rate of “digital gold” is largely due to the limited release of coins. This aspect is the main difference between electronic currencies with different emission principles.

Who are Bitcoin whales?

There is a high concentration of wealth in the Bitcoin market. This means that the majority of coins are concentrated in a few addresses. Recently, the situation has been aggravated by huge institutional funds such as Grayscale and MicroStrategy buying up thousands of coins. Additionally, Bitcoin creator Satoshi Nakamoto is reported to have mined around 1 million BTC, and none of these coins have moved in the last decade.

According to the list of the largest Bitcoin addresses, 14% of all coins in circulation are held in 101 addresses. This is about $90 billion at current exchange rates. Another 30% of all bitcoins are stored in whale addresses with a balance of 1,000 to 10,000 coins.

Another interesting fact: about half of all addresses contain less than 0.001 BTC. Thus, more than 85% of all Bitcoins currently in circulation are held in addresses containing more than ten coins.

If this trend continues, and the whales show no intention of getting rid of their savings, the number of coins available to the average person will be negligible.

Why is the number of BTC coins limited?

As you have already learned, limiting the release of Bitcoin prevents the cryptocurrency from depreciating. However, many are interested in where the figure of 21 million coins came from? This limitation is associated with miner remuneration formulas, which are created based on the law of inverse geometric progression.

Simply put, the existing principles for forming bonuses for token miners do not allow them to mathematically step over the line of 21 million BTC. The maximum emission is 20,999,999.9769 BTC.

There is an opinion that the creators of the cue ball limited themselves to this size of issue for a reason. The number of coins was chosen for the prospect of full integration of BTC into the global economy. At the time of the creation of the cryptocurrency, the total amount of money that existed in the world was 50 trillion USD.

Compared to this figure, 21 million seems like a small number. However, such an issue would be enough even to completely replace fiat money. If you directly exchange 50 trillion USD for the issue of Bitcoin, you will get 2,381,000 BTC. In this case, one satoshi would be equal to 2.381 cents. This means that the selected emission would be quite sufficient to service the global economy.

A Brief History of Bitcoin

The mysterious Satoshi Nakamoto began developing Bitcoin in 2008. In October of that year, he published a white paper entitled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

On nine pages, he outlined the principle of operation and purpose of a digital currency, which was supposed to be the first ever anonymous, decentralized monetary unit that did not require the participation of intermediaries. Quote from the Bitcoin white paper:

“We need an electronic payment system that is not based on trust, but on cryptographic proof, allowing any two parties to transact directly with each other without involving a third party as an intermediary or guarantor.”

Satoshi was not a fan of the modern banking system, especially the principles of fractional reserve banking. The idea is that a bank takes deposits and uses that money to make loans to other people or invest it in projects. At the same time, it is obliged to maintain reserves in its accounts equal to only a portion of its deposit obligations.

At first, people sent bitcoins to each other for fun and just to test how it worked. The new coin was first used for purchase in 2010. Then Laszlo Hanyec bought a pizza for 10,000 bitcoins. For his bitcoins, he received pizzas worth $25. Thus, the first ever exchange of BTC for tangible assets took place.

In the first year of Bitcoin's existence, there were no cryptocurrency exchanges where one could exchange BTC for fiat or vice versa. This need was soon filled by Jed McCaleb, who turned his domain mtgox.com into the world's first Bitcoin exchange - Mt. Gox. Initially, the platform, which appeared in 2007, was engaged in the exchange of Magic the Gathering game cards. Hence the name: The Magic: The Gathering Online Exchange.

By 2014, Mt. Gox processed 70% of all Bitcoin transactions, and its infrastructure began to crack, unable to cope with growing cash flows. The exchange closed in 2014 after a hack cost it 744,000 bitcoins.

However, the popularity of cryptocurrency grew, and along with it, the number of trading platforms allowing the exchange of digital coins increased. Bitcoin turned ten years old on January 3, 2019. By that time, it had evolved into an established digital asset worth $3,870.

How many Bitcoins are lost?

Paradoxically, digital money can be lost just as easily as fiat money. According to the latest data, permanent losses of Bitcoins range from 2.8 to 3.8 million BTC. In other words, about twenty percent of the final currency issue is lost forever. Experts arrived at these figures after conducting a detailed empirical analysis of the platform.

The reasons for losing funds vary. This is mainly due to the loss of private keys or an incorrectly entered recipient address. The lion's share of BTC was lost in the first years after the emergence of the cryptocurrency. Then the value of the coin was low, and the prospects were too vague. Therefore, many users did not pay enough attention to security issues and maintaining access to their wallet.

Lost bitcoins - 20% of the entire issue

In 2022, industry experts estimate that at least 4 million BTC were “lost” and 2 million coins were stolen.

An estimated 4m BTC lost, 2m BTC stolen. @lopp at #BuildingOnBitcoin pic.twitter.com/xsXayfKiaP

— Willy Woo (@woonomic) July 4, 2018

Thus, there are actually about 14.5 million coins in circulation, available for trading and use. The Wall Street Journal estimates that about 20% of all existing coins have been "lost" and are unlikely to return to circulation.

There are other data as well. For example, Timothy Peterson, manager of Cane Island Alternative Advisors, conducted a study in April 2022 and found that 1,500 bitcoins are lost every day, which means that it is unlikely that there will ever be more than 14 million coins in circulation.

Why does the difficulty of Bitcoin mining increase every year?

The complexity of BTC mining is growing every day. This is a problem for many miners.

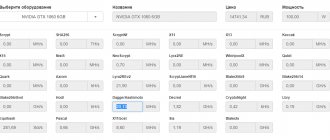

Technically, the increase in the complexity of cue ball mining is due to:

- Network hashrate;

- Mining speed of 2016 blocks.

The difficulty of mining coins is increasing due to the constant expansion of the mining community. Every day, more and more users are looking to use their excess computing power to mine coins.

The more miners there are, the less time it takes to find one block. After passing the milestone of 2016 blocks, the mining difficulty indicator changes. According to the following formula:

How many bitcoins have been mined in the world today?

The functioning of Bitcoin within the ecosystem is based on complex mathematical calculations. The blockchain network operates on the interaction of chains consisting of blocks. They are generated as a result of complex mathematical manipulations, then miners are awarded a reward in the form of coins. This is how the cryptocurrency mining process works.

The system is programmed so that Bitcoin mining is always within the permitted limits

To ensure that the distribution of rewards is standard, special payment limits are installed. Thanks to this mechanism, experts can calculate the number of bitcoins issued and make predictions.

The system is programmed so that Bitcoin mining is always within the permitted limits. Artificially increasing the production rate beyond the limits leads to blocking.

Production statistics:

- 10 minutes – mining 1 block;

- 2 weeks – 2016 blocks;

- 4 years – 210 thousand blocks.

Based on average statistical data, analysts made calculations: by the end of 2022, 18.5 million coins have already been mined.

What happens when the last Bitcoin is mined?

There are fears that after the last BTC is mined, the system will stop working properly. After all, miners will be deprived of their main motivation - the reward for the block. However, this is unlikely to happen.

Miners not only make money by calculating hashes, but also receive a small reward for processing user transactions. Currently the size of this bonus is small. It is less than one percent. However, in the future, this figure is likely to increase, due to which the performance of the system will be maintained at the proper level.

How many BTC are mined per day?

Daily production depends on several conditions:

- transaction complexity;

- overall network hashrate;

- volume of reward in coins.

A certain number of coins are available to miners and investors every year

At the start, the reward was about 50 coins. Today this figure has dropped to 6.25 coins per block. The total daily amount of mined bitcoins reaches 900 coins.

Prospects for Bitcoin mining in the coming years

In the foreseeable future, it is expected that mining will continue to become more difficult and rewards for new blocks will decrease. Already today, profitable coin mining is possible only through ASIC. According to many experts, the future of BTC mining lies in large mining pools.

The forecast is disappointing for “loners” - they will have to leave the market, since mining coins using small computing power will become unprofitable. An increase in remuneration for processing transactions can partially change the situation.

This is the most pessimistic scenario, but there are other opinions. You can find some of them below.

Summarizing

The turnover of bitcoins is growing every year, and with it the available number of tokens and their value are increasing. The final level will not be reached very soon, and even at that moment there will be significantly less money in circulation than was planned. There are many reasons for this - more than one generation of people will change, many wallets with coins will be lost, and some exchanges will close without compensation, etc.

The number of transactions is increasing every day, and even skeptics have no doubt that electronic currencies will replace fiat money that has existed for centuries. But no one even knows approximately which cryptocurrencies will survive. After all, even Bitcoin with its positions is subject to regular criticism, and modern systems of protection and anonymity surpass it many times over.

How China helped the USA, but not Belarus

By their actions, the Chinese authorities, unwittingly, helped the United States break into first place and, in a matter of months, capture almost half of the world's bitcoin production. Experts at the University of Cambridge said that after the ban on cryptocurrency was introduced, Chinese miners began to move en masse to North America, as well as to the countries of Central Asia. It is thanks to this that the United States became a leader, and Kazakhstan moved from fourth place to second within a year.

The migration of cryptocurrencies has also helped Canada. Over the course of the year, it rose from eighth place in the ranking with a 1.87 percent share to fourth place and 9.55 percent.

The history of Chinese mining ended in July 2022

It is not yet clear why Chinese miners chose to move from their country to North America. They could try to conduct their “business” in Belarus, where back in December 2022 a decree was passed allowing individuals to own cryptocurrencies and carry out various operations with them, including mining, without taxation. The document also provides for a number of other benefits for miners.

How many bitcoins can you mine?

21 million bitcoins can be brought into the world.

That's exactly how much was created to make the system work. But cryptocurrencies will not disappear, they will simply go into circulation. That is, the mining process, at least regarding bitcoins, will cease to make sense. Considering that there are about 4 million left, we need to hurry up with mining. But this is not true, because according to the data that the calculator shows, the last Bitcoin will be received somewhere in 2140. This is only preliminary data. The calculator shows statistics, but nothing more. For each block, miners are given 12.5 bitcoins, but due to scaling, this number will be halved. The last time this happened was a year ago. Previously, until July last year, you could earn 25 bitcoins, but they cost almost three times less than now. And even earlier, Bitcoin cost less than a cent.

But then people didn’t know what to do with them. For example, there was a funny case where one person ordered two pizzas and paid for them with cryptocurrency. The food cost him ten thousand bitcoins. Now it is more than twenty-seven million dollars. Many have never seen so much money in their entire lives. We hope the pizza was at least tasty. At least she will leave a good impression. Just imagine how much these 10,000 will cost in ten years. After all, every year production becomes exponentially more complicated, which means the exchange rate will rise.