Stock exchange and market - what is it?

A stock exchange is a specially organized place that provides the opportunity to carry out transactions with securities. It provides control over participants, and also guarantees fairness and speed of transactions. Each transaction performed is subject to registration.

Every minute a large number of transactions are carried out on the exchange, in which several participants are involved:

- Investor. An investor can be either a legal entity or an individual. Its purpose is to invest capital with the aim of making a profit. To achieve his financial goals, an investor can buy and sell stocks, bonds, mutual funds, futures or other stock market instruments.

- Issuer. It issues securities primarily to raise capital. The issuer can be a company, a city, or even a state. The exchange is a platform for issuers to sell issued securities.

- Broker. Acts as an intermediary between the issuer and the investor. When making transactions on the market, brokers act exclusively on behalf of the investor. The investor, in turn, does not have the right to carry out any transactions on the stock exchange without concluding an agreement with a broker and opening a brokerage account.

- Registrar. He maintains a register of all securities. This way the company knows who its shareholders are.

- Depository. This is another professional stock market participant. He stores securities and also keeps records of the transfer of rights to them when concluding transactions.

- Regulator. The activities of the exchange in Russia are regulated by the Central Bank. It also issues operating licenses to professional participants in the securities market. This is necessary to protect investors from unscrupulous companies.

Stock market

Stocks and bonds

Today, the stock and securities market is accessible to everyone thanks to the Internet and global communication, which allows you to connect to trading regardless of location. But before you contact a broker and open your account on the stock exchange, you need to gain the necessary knowledge, otherwise the stock market and its experienced players will take your money.

A good place to start is with a brief history, a list of definitions, market structure, and specific steps to start trading. This will help you effectively gain new knowledge in the future. It is important to remember that the stock market requires constant development and study of the situation, only then can it give good financial results.

“What you do should bring you joy”

Warren Buffett

Well, a material reward will only be a further incentive for improvement.

A little history

History of the stock market

The first mention of operations that, with a significant stretch, can be called “stock exchange” dates back to the 12th century. It was then that the first financial instrument, the bill of exchange, appeared in the Italian trading republics (Venice and Genoa). It was not yet an exchange, but only mutual transactions between individuals. In other words, these were documented financial relationships with the possibility of going to court if they refused to comply with previously agreed terms.

Bill of exchange

- a security containing information about the mutual bilateral financial obligations of the participants, on the basis of which it is possible to demand funds in full at the maturity date.

There are two parties to a bill - the holder and the debtor. If the bill is simple, the obligations and ownership cannot be transferred to other persons. A bill of exchange allows the holder and debtor to change subject to specified conditions.

For the first time, a centralized platform, similar in basic operating principles to the stock market, appeared in Bruges. It was founded by Italian merchants in 1531 and was essentially an international platform, working with traders from many countries. In 1592, the first exchange bulletin in history was published there - a sheet indicating the securities traded on the site and their value. This date is considered to be the year in which the concept of the stock market emerged as an institution for regular trading and exchange of securities.

The second Dutch exchange with a “national” bias was organized in 1556 in Antwerp. She was the first to propose instruments issued by the government - a series of bonds to stimulate public contributions to finance government projects related to the construction of a modern fleet, the colonization of distant lands, and trade in spices and rare items brought from afar.

The Dutch fleet grew stronger, connections with colonies and settlements became stronger, profits grew, and in 1611 the Dutch East India Company was the main driving force behind the creation of the Amsterdam Exchange, which was destined to become the main trading platform in Holland in the 17th century. Specific forms of trade operations with distant countries required new approaches; there and then, for the first time, futures and forward contracts appeared, transactions with precisely designated dates, and short-term operations with speculative purposes began to be carried out.

The “Tulip Mania”, the first ever stock market bubble in 1636-1637, dates back to this period. At its peak, the price of one rare tulip bulb was what the average Dutch artisan would earn in a lifetime. It sounds crazy now, but they bought it.

In the 17th - 18th centuries, their own centers for the circulation of securities appeared in Belgium, France, England and other significant European countries.

The first exchange platform in the United States was created almost immediately after the North American states gained independence, in 1791 in Philadelphia. A little later, in 1792, as a result of an agreement signed between 24 major financial players in New York, the NYSE (New York Stock Exchange), the largest platform of our time, arose.

By the 20th century, as a result of the development of a new form of doing business - the organization of shareholders, stock trading took the place of the main asset on trading platforms around the world. In the 2nd half of the 20th century, trading on the stock exchange began with futures and options, and relatively recently technical analysis and credit default swaps arose. Traders’ workplaces are already unthinkable without powerful computers: many processes are automated, trading robots are widely used, increasingly complex indicators are being developed and, reportedly, methods for predicting market behavior using neural networks and artificial intelligence.

Obviously, no one will make such developments publicly available; they will remain the private property of those, because the stock market is a place where they make money, and do not share the secrets of their success.

What is the stock market

A short list of definitions

Stock market terminology

The stock market and securities market has its own specific terminology:

- Long

- “long” position. Purchasing an asset at the current price with the goal of subsequent sale when the value rises. - Short

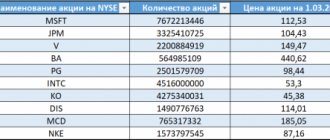

- a “short” position. Selling an asset at the current price for the purpose of subsequent repurchase at a lower price. - Shares are the main financial instruments in the stock market. They allow you to claim a share in the issuing company’s profits, paid in the form of dividends, and to participate in making decisions at a meeting of shareholders. The stock market is quite extensive, there are ordinary shares, the income of which is directly proportional to the profitability of the organization, and preferred shares: with a fixed return, but the holder does not have the right to influence the internal policy of the company.

- A bond is perhaps the most reliable instrument with a guaranteed return, usually relatively small, allowing the owner to receive not only the deposit amount, but also interest at the end of the billing period. They are issued by government agencies and, less frequently, by large private companies.

- Forward

is an agreement for the delivery of an asset or product, the delivery date of which will occur in the future at a precisely defined time (deferred contract). Payment for future operations is made in advance, during the current time period. - Futures

are a secondary financial instrument with predetermined future delivery dates for the underlying asset. In terms of the general scheme of work, it is similar to a forward, but differs in greater standardization and less flexibility in timing decisions, and most importantly, it is a regularly renewed offer on the stock market that is constantly present. - An option

is a contract under which the buyer has the right to sell the underlying asset at a previously agreed price and/or within a predetermined time frame, and the seller of the option is obliged to confirm the transaction. In fact, this is a game on where the price of the underlying asset will go, what limits it will reach and in what time frame. An important nuance and key difference from a futures contract is the right, and not the obligation, of the option buyer to carry out further transactions with the underlying asset upon the occurrence of the conditions specified in the option: you can refuse to sell or buy the underlying asset. - Swap

is a trade and financial transaction that involves, in addition to the main transaction, a “counter transaction” on reverse conditions, which is usually carried out after a predetermined time. As a result, swaps provide for a periodization of the payment exchange. They are used to increase assets, to reduce risks (hedging), and to conduct transactions in the markets of another jurisdiction. - A venture capital firm

is an organization that engages in high-risk investments with the expectation of increased financial returns if successful. The likelihood of capital loss in some projects is balanced by high profits if others are successful. Diversification of investments and work in different directions allows you to control risk with a given degree of reliability. - A hedge fund is the exact opposite of venture capital. This is an investment company operating on the principle of “maximum profit with a pre-calculated risk”, or “minimum risk with a precisely defined target profit.” In all cases, the hedge fund seeks to reduce risk. A “cut down” version of a hedge fund can be called a mutual fund, which is quite widespread in Russia.

- Blue chips

are shares of large companies that promise stable profitability. As a rule, the performance of these companies makes up the stock market index basket. As an example, for the USA these are Apple, McDonalds, IBM. For Russia - Sberbank, Gazprom. The disadvantage of blue chips is their relatively low profitability and chronically inflated prices, fueled by demand. - Derivative

is the general name for secondary, derivative financial instruments, contracts on the stock market; under their terms, participants previously agree to carry out certain transactions with underlying assets. Derivatives include: contracts for difference, futures, options, swaps. While underlying assets are currencies, products, services or securities. Important: each of the secondary financial instruments can be based on two or more underlying assets simultaneously. - Forex

(Foreign Exchange) is a global platform for trading national currencies of different countries of the world. Exchange operations, not only for speculative purposes, are carried out at free prices in accordance with the current rates of traded assets through commercial banks and dealing centers. The advantage of Forex is its accessibility to a wide range of participants - opening an account and starting trading requires a minimum of effort. How profitable this is is a question, but the popularity of the Forex market has been steadily declining in recent years, because the stock market requires more resources to enter it.

What types of exchanges are there?

There is a classification of exchanges. They mainly differ in the following characteristics:

- Product type. In addition to stock exchanges, there are commodity, cryptocurrency and currency exchanges. We have already figured out that securities purchase and sale transactions are executed in stock markets. Cryptocurrency is traded on cryptocurrency exchanges, which have emerged quite recently. On commodity exchanges - real goods (agricultural products, oil, gas, precious metals). As for currency exchanges, they trade currencies. There are also so-called derivatives markets - these are markets where trading of industrial financial instruments (futures, options, etc.) takes place.

- Form of participation. There are two types of exchanges - open and closed. On open exchanges, transactions can be carried out by sellers, members of exchanges, as well as buyers. On closed ones, only exchange members have the right to trade.

- Principle of organization. Most existing exchanges are joint stock companies. Exchanges may also be of a mixed type if the shareholder is the government in addition to private companies.

- Role in world trade. Exchanges are divided into national and international. National exchanges are relatively small, and they trade securities of small companies that do not meet the requirements of an international exchange.

Adviсe

Once you become a full member of the exchange industry, and fully correlate your own funds with the activities of stock exchanges, you should adopt the practices of experienced traders that can take your income to a fundamentally new level:

- Once you try on the role of an investor, be prepared to incur some financial losses;

- The stock exchange loves persistent players, never change your own opinion, be stable in your own beliefs;

- Investing is a serious business that cannot be learned in a short period of time. Be patient, listen to all advice, and success will be guaranteed to you;

- Always be in a positive mood; you should not be discouraged when working with securities;

- If you are not acting on your own, choose the right broker with a good reputation;

- A beginner should open a margin account, but not a cash account;

- A beginner should not initially deal with modern investment instruments - futures and options;

- Don’t “spray yourself” on different types of promotions, concentrate your attention on one direction.

By following simple rules that have been proven over the years, you can achieve success and become one of the best participants in both domestic and foreign stock exchanges.

Main tasks of the stock exchange

The Exchange supports fair pricing in the securities market. She also organizes auctions. All issuers are required to provide the exchange with their financial statements before being admitted to trading. Transactions occur at certain times according to the rules established by the exchange. Information about them is publicly available and can be found on the website of the exchange you are interested in.

If we talk about the main functions of the exchange, we can highlight the following points:

- Creation of a permanent securities market.

- Redistribution of funds between countries, various sectors of the economy and industry within one country, as well as between individual organizations.

- Fixation of the investor's share of participation in a particular valuable asset.

- Ensuring liquidity and guarantees for the execution of transactions concluded on the exchange.

What is sold on the stock exchange

The stock exchange trades stocks, shares of mutual funds, bonds and other financial instruments.

We have already found out that securities are issued by issuers to attract capital. The issuer can offer the buyer a stake in its company by issuing shares. By purchasing such shares, an investor becomes a co-owner of a particular company. When issuing bonds, issuers borrow money from investors, promising interest payments for using the borrowed funds.

Securities have their own key parameters, which are determined by the company that issued them, namely: type of security, par value, quantity. Securities undergo a mandatory registration procedure in a special register and are then placed on the stock exchange.

Exchanges in Russia

The main exchanges in the Russian Federation are considered to be Moscow and St. Petersburg. Securities, foreign currency and precious metals can be purchased on the Moscow Exchange. If you want to buy or sell foreign securities, you can do this on the St. Petersburg Stock Exchange.

The regulator of exchanges in Russia is the Central Bank. It publishes information about the legality of the actions of the exchange, as well as trading on it.

How do transactions take place on the stock exchange?

Many people imagine the stock exchange as a place where there is constant noise, active trading, and shouting - just like in the movies. Previously, everything was really like this, and bidders shouted out offers for purchase and sale. Now almost all activity on exchanges has been transformed into a digital format.

Each transaction made on the stock exchange necessarily goes through several stages:

- Application. The buyer can submit a request online or by phone call. Then the purchase or sale application enters the electronic system.

- Reconciliation. All parameters of the transaction are carefully checked by both the investor and the seller of securities.

- Clearing (the so-called mutual settlements that occur on the stock exchange). During this procedure, the correctness of the transaction is checked. Also at this step the paperwork is completed.

- Execution of the transaction. At the last stage, the securities are directly exchanged for the investor's funds.

It is worth noting that in the stock market there are certain periods of time during which it is possible to carry out purchase and sale transactions. For example, if you trade on the Moscow Exchange, then you should know that transactions on stocks, bonds and ETFs (as foreign investment funds are called) can be carried out from 10:00 to 18:44 (Moscow time) and only on weekdays. There are also evening sessions, which take place from 19:05 to 23:50, where you can buy some shares. You can always find out more about the schedule on the official website of the Moscow Exchange: https://www.moex.com/s1167. The opening hours of the St. Petersburg Stock Exchange are slightly different from the Moscow Stock Exchange. Thus, you can trade securities from 10:00 to 22:59 (Moscow time) on weekdays. A more accurate and detailed description can also be found on the official website: https://spbexchange.ru/ru/stocks/inostrannye/raspisanie/. It is important to remember that exchanges are closed on weekends. The Moscow Exchange is also closed on Russian public holidays, and the St. Petersburg Exchange is closed on US public holidays.

Tinkoff investments

Tinkoff Bank has become the most popular in Russia in recent years. It provides unique conditions for owners of credit and debit cards, and also offers to invest profitably in the future.

The list of stock exchanges has been expanded with a special offer from Tinkoff, and then we will look at what the advantage of these investments is.

If you want to make a profit, you can invest in securities and currencies; Tinkoff Investments is a great way to increase money. The service is able to provide high-quality tools for managing investments remotely, without the need to have constant contact with the manager.

The stock market implemented on the basis of Tinkoff investments does not require special skills, but it is always useful to analyze it. The platform has unique features that users should be aware of. As an individual, you can open a brokerage account with a subsidiary company and invest funds through this account in financial organizations.

According to bank managers, even housewives who do not have special skills in the operation of stock exchanges can understand Tinkof Investments. All you need to do is open a brokerage account. But it is worth understanding that the bank itself is not an intermediary; it has a partner through which users carry out transactions on the stock exchange.

If you have firmly decided to engage in brokerage activities and are a client of the bank, then you can fill out an application on the company’s official website to open a special brokerage account. The procedure will take a little time, and you can quickly start “playing” on the stock exchange.

In addition, the stock exchange, access to which is provided by Tinkoff Bank, has a number of privileges for users, as well as an active affiliate program. Register on the exchange and bring a friend, then you are guaranteed to receive bonuses, which stimulates the broker to further activities within the framework of a special offer from Tinkoff.

How to make money on the stock exchange

Profit on the stock exchange is far from luck. Income depends on many factors: strategy, market trends, state of the economy. One way or another, income can be predicted.

Let's look at an example of how trading on the stock exchange works: you buy and resell stocks and bonds. Over time, shares become more expensive or cheaper; income comes from their timely sale and purchase. Some stocks can bring you dividends, bonds provide income in the form of guaranteed interest - coupons. Income from bonds is less, but more reliable.

Your profit will also depend on the chosen strategy. Typically, the higher the yield, the higher the risk of losing money. The return on the stock market may be higher than on deposits. But it is important to keep in mind that it is not guaranteed. Because securities investments are not insured, you run the risk of losing some, or sometimes all, of your investment. Remember to invest wisely. Before making transactions on the stock exchange, we recommend that novice investors acquire basic knowledge and skills, decide on their strategy, and choose a reliable broker or trustee.

Risks associated with trading on the stock exchange

Remember that when you trade in the stock market, you risk losing some of your capital, even if you have a trustee acting on your behalf. Basically, the risk arises from a fall in the value of a particular security. Unfavorable market conditions can cause prices to fall on the stock exchange. For example, the introduction of any sanctions against Russia may negatively affect the value of securities. News about an increase in the company's dividends may, on the contrary, have a positive impact on the price of securities. However, we should not forget that there is a risk of bankruptcy of the company. Thus, both the broker and the management company may go bankrupt. Investors in Russia are not insured against such a risk, but, in the event of an unfavorable set of circumstances, they can transfer money to another broker.

What is it for?

Let's figure out what functions the stock market performs and what role it plays in the economy.

The main task of stock markets is the redistribution of funds. Wealthy individuals and organizations invest in stocks or bonds to help struggling businesses grow through financial investment. In return, they receive profit in the form of dividends and the difference between the exchange rates.

That is, the stock market helps buyers and sellers find each other and interact. Companies find investments, and investors find many ways to increase their capital.

In addition, foreign capital is attracted to the stock markets. Domestic startups often need investment, and they find it from foreign investors.

What to remember

- The stock exchange trades securities issued by issuers.

- The activities of the exchange in Russia are under strict control of the Central Bank.

- Carrying out transactions on the stock exchange is easier than it seems, but it requires basic knowledge.

- To trade on the stock exchange, you need a reliable broker or trustee.

- Remember that returns in the stock market are not guaranteed, so you need to be smart about your investments.

- You can always contact a financial advisor for advice.

- #Stock

- #Broker account

- #Bonds

- #Tips for beginners

- #Financial Advisor

- #Beginners

Was the article helpful?

Thanks for the answer!

Summary

- Stock markets are vital components of a free market economy because they provide democratized access to trading and capital exchange for all investors.

- They perform several functions in markets, including efficient price discovery and efficient transactions.

- In the US, the stock market is regulated by the SEC and local regulators. In Russia, the regulator is the Bank of Russia (CBRF).

And that’s all for today about the stock market and the stock exchange. If you have any questions, write them in the comments! Also, please don’t forget to bookmark the article and site! See you soon on the pages of the Tyulyagin project!

- 53

Shared