Distributed ledger

At the core of investments in blockchain technology is the belief that distributed ledgers, private or public blockchains, can be the solution to issues inherent throughout the current financial system: reducing the costs and time in the transfer of all types of assets. Some companies have begun selling these potential benefits to banks through consortia and pilot projects.

What’s most interesting is that not only commercial, but also government agencies are beginning to study blockchain. These are the central banks of Great Britain, Australia, India, Russia, Ukraine and other countries. In the United States, the federal Treasury and other securities agencies, as well as several state governments.

The global payment system whales - Visa, Master Card, American Express, exchanges and clearing houses are also exploring ways to use blockchain. A prime example of such integration was the Nasdaq exchange with its pilot program for a private equity market trading platform (Nasdaq Linq) based on blockchain technology.

Course forecast

The Bitcoin exchange rate does not depend on the policies of the Central Bank and other world currencies. The cost is influenced by the following factors:

- interest of Internet users;

- news;

- increasing complexity of cryptocurrency mining;

- emergence of new cryptocurrencies.

Analysts predict two scenarios for the development of events in 2018 - positive and negative. Dmitry Matsuk, founder of Blockchain.ru, predicts a rise in value to $40,000. Specialists at the Danish online bank Saxo Bank expect the price to rise to $60,000 in 2022, followed by a sharp drop in 2022. Konstantin Negachev, co-owner of VRT World, suggests that after the launch of futures, the rate will only increase. Experts suggest that Bitcoin in the future will be considered as a good investment option for large companies and will enter the world market on equal terms with official currencies.

Back office potential

Blockchain can solve many back office infrastructure problems of financial institutions due to high data processing speed, security, cost reduction and full transparency. Digital Asset Holdings has dedicated its work to solving these issues, for which in March it invited Blythe Masters, formerly a top manager at JP Morgan, as CEO.

The company made a number of acquisitions: Hyperledger, Bits of Proof and Blockstack, to focus on improving the financial infrastructure and back-office processes to achieve settlement efficiency and reduce counterparty risks.

How much does Bitcoin cost in rubles?

Judging by the current exchange rate, the cost of Bitcoin in rubles will reach 1 million. As of mid-December 2022, Bitcoin costs about 950,000 rubles. The exact cost depends on exchange rate fluctuations. Over the course of a day, the price of Bitcoin either decreases or increases. Sometimes the gap between the minimum and maximum values reaches 20,000 rubles. This is used by cryptocurrency exchange players who invest money in bitcoins. During November-December 2022, the cost increased by 400,000 rubles - from 550,000 to 950,000.

For more accurate price calculations, exchangers and cryptocurrency exchanges offer users online calculators. Just enter the amount of bitcoins in the window, select “Russian rubles” and click the “Transfer” button. The window that opens will display the amount in rubles at the current exchange rate.

Global projects

In 2015, the financial community turned towards blockchain. The largest companies on Wall Street have begun developing blockchain-based projects. More than 40 of the world's largest banks have joined the R3 consortium to apply blockchain technologies. This number included the Russian Sberbank.

More recently, the Open Ledger Project was created, led by the Linux Foundation and supported by IBM, Cisco and Intel, to develop custom blockchain systems and potentially implement smart contracts. From the financial sector, the London Stock Exchange, SWIFT and Digital Asset Holdings are participating in the project. They see the implementation of the blockchain system as an opportunity to provide banks and businesses with a secure way to transfer assets.

In November, the operator of the largest interbank network, SWIFT, launched an international program to improve customer banking services using blockchain. The project “International Program for Innovative Development of Payments” will be launched at the beginning of 2016.

It is also worth recalling Microsoft’s partnership with the Ethereum smart contracts platform. The prospects for this combination are vague, but the combination of the power of the largest software company and the potential of blockchain technology in the hands of a team of young programmers will produce brilliant results.

Bitcoin rate for all time from 2013 to 2016

Since 2013, the “golden period” of this cryptocurrency begins. Jumps down are still visible, but still it becomes the main one among other electronic analogues. One coin alone could fetch more than $1,000.

Rate for 2013

In March 2013 the ratio was: $74.94 = 1 BTC. Already in April there was an increase of almost 30 points, but in October there was a sharp drop. This was due to the arrest of one of the exchanges. In November there was a sharp rise - up to $700 per coin. At the end of the month the price increased to $1,242.

Already at the end of 2013, there was a two-fold decrease - to $ 600. Then China banned the official use of this currency. But if we compare it with today’s statistics, it is within China alone that more than 80% of Bitcoin transactions take place.

year 2014

Bitcoin rate for all time and 2014

At this time, the TeraExchange exchange carries out the first operation through the official exchanger. Despite the exchange rate of $310, this cryptocurrency is still stabilizing and gaining a foothold in the market. Various platforms are appearing where it is possible to pay with such electronic coins, purchase or exchange them.

Rate for 2015

In January the rate fell sharply, but in March it was:

$281 = 1 BTC

Later there was an increase of as much as 200 points. This could be due to a Chinese pyramid scheme that actively used this cryptocurrency. But already in winter there was a sharp decline:

$355 = 1 BTC

2016

Bitcoin rate for all time and 2016

In 2016, one of the developers left the company, which affected the course. It fell 50 points. In addition, the developer published a devastating article. He wrote that the company was focusing only on operations in China. But after this, Japan decided to recognize Bitcoin as an official virtual currency, along with everyone else. South Africa also joined Japan.

In the first quarter of the year the rate was as follows:

$395 = 1 BTC

By April it had increased:

$451 = 1 BTC

It was in mid-2016 that Bitcoin’s capitalization amounted to as much as $30 billion. There was a sharp jump, which everyone associates with a large volume of bitcoin purchases from China.

In September the proportion changed slightly:

$600 = 1 BTC

Already at the end of 2016, you had to pay 1000 dollars for 1 bitcoin. This happened on the eve of the New Year holidays.

Opportunities for cryptocurrencies

Various publications have already said a lot that even if efforts are focused only on the blockchain, and not on the capabilities of Bitcoin as another electronic security system, cryptocurrencies will receive wider acceptance in the world.

In 2015, there was a significant shift in the mentality of the banking elite towards blockchain as a technology separate from its original use as a payment method. But the use of cryptocurrencies as a payment instrument continues to develop.

Technology companies and financial institutions continue to intensively explore and integrate Bitcoin technologies. Some have focused their efforts on creating a global remittance network to expand access to finance in unbanked regions. And cryptocurrencies are best suited for this.

In July 2015, Citibank created a pilot project with its CitiCoin cryptocurrency. Other banks, UBS and New York Mellon, are also creating such projects. This means that global financial institutions can accept blockchain as a technology and use cryptocurrency.

Bitcoin to ruble exchange rate for 2017

In 2022, there was a strong rise in the popularity of Bitcoin. Everyone not only uses them, but also engages in mining and invests in farms. This could not but affect the value of this cryptocurrency. The Bitcoin to ruble exchange rate in 2022 increased from $800 per 1 bitcoin to $15,000. Average rate for the whole year:

$3242 = 1 BTC

Bitcoin rate for all time

Even the historical maximum of this currency was updated. It can be used everywhere: on the Internet, currency transactions, payments for goods and services.

Situation in Russia

Although Russian financial authorities (the Ministry of Finance) have a skeptical and even aggressive attitude towards cryptocurrency, some of them are beginning to show noticeable interest, if not in Bitcoin, then in the blockchain that underlies it. The Central Bank of the Russian Federation is determined not to ban, but to regulate cryptocurrencies, and in September it created a working group to study the blockchain.

In September 2015, the QIWI payment system announced that it was planning to launch its cryptocurrency “bitruble”. The company planned to start issuing bitrubles in 2016. Perhaps the QIWI statement was one of the reasons for the Ministry of Finance to come up with a proposal to tighten penalties for the issuance and circulation of cryptocurrency in Russia.

Sberbank takes a slightly different position, at least with regard to blockchain. In December, it was one of the first Russian banks to join the international consortium R3 to develop services using blockchain. Other large banks are also interested in blockchain, although they do not advertise their work.

In December, the head of the Ministry of Telecom and Mass Communications of the Russian Federation, Nikolai Nikiforov, said that his ministry was studying blockchain technology and believed that it should be used in the interests of the population.

Bitcoin rate for 2009-2012

Over a short period from 2009 to 2012, the Bitcoin rate increased to a record level. Many still regret that they did not invest money in it then and did not redeem this electronic currency. Who would have thought that it not only became more valuable than the dollar, but also thousands of times more expensive than it. This is explained not only by the popularity of cryptocurrency, but also by its small amount in circulation. It is practically not afraid of inflation, since further emission of electronic coins is not envisaged. The founding date of Bitcoin is considered to be October 5, 2009, when it had the following relationship to the dollar:

$1 = 1309.03 BTC

Then you could buy a lot of them, spending just a few dollars. There was no such unit as satoshi. Now it is equal to one hundred millionth of BTC. At that time, Bitcoin itself was one thousandth of a dollar, and its popularity was still at zero. There were users who even engaged in its extraction - mining. Of course, this took a lot of electricity, so the costs were not at all offset by the profits from mining.

2010

Bitcoin rate for all time and 2010

Cryptocurrency exchanges existed even 5-7 years ago. The first of them was Dwdollar. You could buy bitcoins with it and spend them on buying something on the Internet. This happened in May 2010. One of the users exchanged his existing bitcoins for dollars and bought himself a regular pizza. Then he had to spend 10,000 units of cryptocurrency on this, which was equal to 25 dollars. Now they are worth as much as three million dollars. The ratio was:

$0.008 = 1 BTC

Already in mid-2010 the situation changed dramatically:

$0.08 = 1 BTC – tenfold increase

And at the end of the year everything became even more optimistic:

$0.5 = 1 BTC

In just one year, the cryptocurrency has sharply strengthened its position and has become almost equal to the dollar.

Rate for 2011

It was this year that the following rate could be seen on the exchanges:

$1 = 1 BTC

In March 2011 the proportion was:

$31.91 = 1 BTC

But everything did not go so smoothly. On June 12, something bad happened for this cryptocurrency. From 30 dollars per unit, the mark dropped to 10. But that’s not all. Despite the falling exchange rate, Bitcoins were tried in every possible way to be stolen. There were constant hacking of wallets, exchanges and other hacker attacks. In fact, everyone was trying to get their hands on this electronic currency, anticipating its success.

year 2012

Bitcoin rate for all time and 2012

There were no significant changes in 2012, but one very important event occurred for the founders of the currency themselves. It has become not just electronic, but also partially physical. The Bitcoin Central bank was founded, which only increased the popularity of this cryptocurrency.

August. Hard fork of Bitcoin and the emergence of Bitcoin Cash

In August, the first part of the BTC reform took place - the introduction of SegWit support. And although the reform was supported by the majority of miners, there were still some dissenters in the Bitcoin community who advocated other methods of speeding up transactions. They believed that SegWit was a departure from the original principles of Bitcoin, described by its author Satoshi Nakamoto in 2008. In their opinion, all information about payments should continue to be recorded in the currency blockchain, but its block should be radically increased: not 2, but 8 times - from 1 MB to 8 MB. They embodied these ideas in their new version of Bitcoin, which was called Bitcoin Cash (BCH).

Advertising on Forbes

The loud hard fork of Bitcoin, and even with the division into two currencies - the updated BTC and the completely new BCH - frightened non-professionals. Many assumed that the Bitcoin rate could collapse. But that did not happen. The BTC rate continued to grow, setting a new record on September 2 – $4850. Its capitalization reached $80 billion, once again leaving Ether and other altcoins far behind. The BCH rate also showed a positive trend. Its initial price was about $300, and by August 19 it exceeded $900. The capitalization of the new currency at that moment amounted to $15 billion - third place in the world ranking of cryptocurrencies.

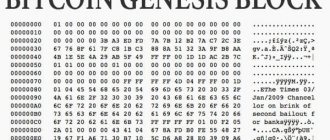

What was the rate in 2008

August

Three guys, Neil King, Vladimir Oksman and Charles Bry apply for a patent on encryption technology. All three deny any connection to Satoshi Nakamoto, the supposed creator of the Bitcoin concept. That same month, the trio registered the domain Bitcoin.org using an anonymous domain name registration service.

October

Despite all of the above, Satoshi Nakamoto publishes his report on the concept of electronic mutual settlements entirely based on P2P technology. In his opinion, this will solve the problem of counterfeiting, and will also give Bitcoin the opportunity to gain a foothold at the legal level.

The launch of the first block, codenamed Genesis, initiates the start of “mining.” Later that month, the first transaction is recorded between Satoshi and Hal Finley, a developer and activist in cryptography.

March. ETF registration failure and continued Bitcoin growth

For several years now, the relationship between states and cryptocurrencies has been uncertain. Some of the idealists of the crypto market like its “protest” non-state position, but realists understand that bridges need to be built between crypto-economics and traditional economics. Including to protect yourself from events like those that happened in China in winter. And if the cryptocurrencies themselves are not recognized by the state, then you can try to create classical financial instruments that depend on their rates and trade them according to the current laws of the stock market. Such instruments have existed on the over-the-counter market since 2012, when Exante launched a Bitcoin-tracking fund (the price of a share of which is equal to the price of Bitcoin). But Bitcoin activists also wanted official exchange recognition. To this end, the Winklevoss brothers developed a Bitcoin ETF project - the same tracking fund, but traded on the exchange like an ordinary share. This would attract many classic investors to Bitcoin, boost its rate and mean partial official recognition.

Unfortunately, on March 10, the US Securities and Exchange Commission denied the brothers registration of an ETF. Moreover, she refused to use wording that left no doubt: the problem is not a specific ETF project, but Bitcoin itself with its derivation. The American government is not ready to help its development and does not consider it a tool worth dealing with.

However, Bitcoin reacted surprisingly mildly to this. On March 10, its rate fell from $1,250 to $1,100, but by March 15 it had regained its position. From March 16 to March 25, there was a deeper decline to $900, but it was also won back by April 11.

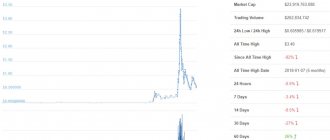

December. Bitcoin futures and record market growth

On December 10 and 18, events took place that opened a new page in the history of the cryptocurrency market and overshadowed the November scandals. The Chicago Board Options Exchange (CBOE), and then the Chicago Mercantile Exchange (CME, the largest in the world), introduced Bitcoin futures. They managed to do what the Winklevoss failed to do in March: make Bitcoin trading accessible to classic stock investors.

Bitcoin never received recognition as a currency in the United States, but this turned out to be not necessary for trading futures on it. There are futures for oil, grain, and other commodities, as well as for abstract market values such as the Dow Jones index. Likewise, for the Chicago exchanges it was not so important what Bitcoin actually is: the main thing is that it has a market rate, the value of which can be the subject of bets.

This time, the American government swallowed the “pill” and did not ban the initiative. Exchange recognition of Bitcoin has had a very positive impact on the entire cryptocurrency market. Firstly, because now large financial players who are accustomed to the regulated rules of classic exchanges and were afraid of the unregulated crypto-currency market can trade Bitcoin. The introduction of futures for other cryptocurrencies is probably now only a matter of time. Secondly, because after such a precedent it will be much more difficult for Western states to take steps in the opposite direction. On the side of cryptocurrencies are now not only armchair traders and ideological anarchists, but also the world's largest financial players. Which the state is forced to reckon with.

Advertising on Forbes

Perhaps realizing this, CBOE has drafted several new Bitcoin-based ETFs. And perhaps, less than a year after the March rejection of the Winklevoss ETF, the American government will be forced to change its position and allow similar ETFs.

At the time of writing (December 19), the Bitcoin exchange rate is about $19,000, and its capitalization is about $320 billion. Thus, over the year, these values have increased approximately 20 times. And the capitalization of the entire cryptocurrency market is more than 34 times. And this growth continues.