Arbitrage transactions are a type of trading in which a trader tries to make a profit without market risks (right or wrong).

The key idea behind arbitrage is that there is inefficient pricing of an instrument or group of instruments—that is, the market misprices the value of an asset, which creates an arbitrage opportunity.

It is a common misconception that arbitrage involves risk-free transactions. In fact, an arbitrage transaction is just a directed position on a spread (the difference in prices between two assets), which is free from market risk, but does not eliminate other risks[1].

In a perfect world, arbitrage transactions would be impossible. In the real world, arbitrage opportunities quickly disappear due to the actions of market participants unless such actions are prevented by high transaction costs.

Arbitrage transactions are a type of trading in which a trader tries to make a profit without market risks (right or wrong).

The key idea behind arbitrage is that there is inefficient pricing of an instrument or group of instruments—that is, the market misprices the value of an asset, which creates an arbitrage opportunity.

It is a common misconception that arbitrage involves risk-free transactions. In fact, an arbitrage transaction is just a directed position on a spread (the difference in prices between two assets), which is free from market risk, but does not eliminate other risks[1].

In a perfect world, arbitrage transactions would be impossible. In the real world, arbitrage opportunities quickly disappear due to the actions of market participants unless such actions are prevented by high transaction costs.

What is arbitrage trading?

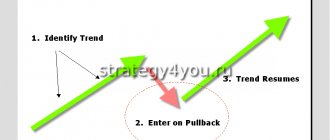

Arbitrage trading is a relatively low-risk trading strategy that takes advantage of price differences between different markets. In most cases, this involves buying and selling the same asset (for example, Bitcoin) on different exchanges. Since the price of Bitcoin should theoretically be the same on Binance and the other exchange, any difference between the two is likely an arbitrage opportunity.

This is a very common strategy in the trading world, but it has mostly been used by large financial institutions. With the democratization of financial markets thanks to cryptocurrencies, crypto traders also have the opportunity to take advantage of it.

Introduction

What if you could guarantee yourself a profitable trade? What would it look like? The answer is simple. You would know before entering a trade that you will definitely make a profit. Anyone with such an advantage will make the most of it while they can.

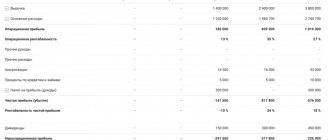

Although there is no guaranteed profit in the market, arbitrage trading is the closest thing to it. Traders compete fiercely for the opportunity to enter these types of trades. It is for this reason that profits in arbitrage trading are usually very small and highly dependent on the speed and volume of the transaction. This is why most arbitrage trading is carried out using algorithms developed by companies that engage in high-frequency trading (HFT).

What is arbitrage trading?

Arbitrage trading is a trading strategy aimed at making a profit by simultaneously buying an asset in one market and selling it in another. Most often this is done between identical assets traded on different exchanges. In theory, the difference in price between these financial instruments should be zero, since they are literally the same asset.

The job of an arbitrage trader, or arbitrageur, is not only to spot these price differences, but to be able to exploit them quickly. Since other arbitrage traders can also see this difference in price (spread), the window of profitability usually closes very quickly.

On top of that, since arbitrage trades generally involve low risk, returns are usually low. This means that arbitrage traders not only need to act quickly, but also have a lot of capital so as not to make trades to zero.

You might be wondering what types of arbitrage trading are available to crypto traders. Let's get straight to the point and look at the strategies you can use.

Types of arbitrage trading

There are many types of arbitrage strategies used by traders around the world in a wide variety of markets. Below are the most popular types of cryptocurrency trading.

Exchange Arbitration

The most common type of arbitrage trading is exchange arbitrage, where a trader buys the same crypto asset on one exchange and sells it on another.

The price of cryptocurrency can change quickly. If you look at order books for the same asset on different exchanges, you will find that prices are almost never the same at the same time. This is where arbitrage traders come into play. They try to exploit these small differences to make a profit. This, in turn, makes the underlying market more efficient as the price remains within a relatively limited range across different trading platforms. In this sense, market failure can signify opportunity.

How does this work in practice? Let's say there is a difference in the price of Bitcoin between Binance and another exchange. If an arbitrage trader sees this, he will want to buy bitcoins on the exchange at a lower price and sell them on the exchange at a higher price. Of course, timing and execution are critical. The Bitcoin market is relatively mature, and the windows of opportunity in exchange arbitrage are usually very small.

Funding rate arbitrage

Another common type of arbitrage trading for cryptocurrency derivatives traders is funding rate arbitrage. This is when a trader buys a cryptocurrency and hedges its price movement with a futures contract on the same cryptocurrency that has a funding rate lower than the cost of purchasing the cryptocurrency. The cost in this case is any commissions that the position may incur.

Let's say you have some Ethereum. You can be happy with this investment for now, however the price of Ethereum will fluctuate greatly. So, you decide to hedge your exposure to price risk by selling a futures contract (short) at the same price as your Ethereum investment. Let's say the financing rate on this contract pays you 2%. This will mean that you will receive 2% for holding Ethereum without any price risk, resulting in a lucrative arbitrage opportunity.

Triangular Arbitration

Another very common type of arbitrage trading in the world of cryptocurrencies is triangular arbitrage. This type of arbitrage occurs when a trader notices a price discrepancy between three different cryptocurrencies and cycles through trading them against each other.

The idea of triangular arbitrage comes from an attempt to exploit price differences between currencies (eg BTC/ETH). For example, you can buy Bitcoin with your BNB, then buy Ethereum with your Bitcoin, and finally buy BNB with Ethereum. If the relative value of Ethereum and Bitcoin does not match the value of each of these currencies in relation to BNB, there is an arbitrage opportunity.

Risks associated with arbitrage trading

Although arbitrage trading is considered relatively low-risk, this does not mean that the risk is zero. Without risk there would be no reward, and arbitrage trading is certainly no exception.

The biggest risk associated with arbitrage trading is execution risk. This occurs when the difference between prices changes before you can complete the trade, resulting in zero or negative returns. This could be due to slippage, slow trade execution, abnormally high transaction costs, a sudden spike in volatility, etc.

Another major risk when participating in arbitrage trading is liquidity risk. This occurs when you do not have enough liquidity to enter and exit the markets you must trade in order to complete the arbitrage. If you trade using leveraged instruments such as futures contracts, it is also possible that you will receive a margin call if the trade goes against you. As always, proper risk management is critical.

Final Thoughts

The ability to take advantage of arbitrage trading is a great opportunity for cryptocurrency traders. By having the right amount of speed and capital to engage in these types of strategies, you can quickly execute profitable, low-risk trades.

The risk associated with arbitrage trading should not be overlooked. Although arbitrage trading may imply "risk-free profits" or "guaranteed profits", in reality there is enough risk to keep any trader on their toes.

A few words about arbitrage between exchanges

Some bots can only arbitrate on one exchange; more powerful ones (such as HTS' Inter-Exchange Arbitrage Bot) are able to search for windows on multiple exchanges and make profitable trades, provided the required pairs are available on both exchanges. HTS is one of the few platforms that offers a bot with similar functionality.

An advanced cross-exchange arbitrage bot can be a recipe for success due to its speed and ability to maximize income. However, to achieve optimal results, the trader must customize the bot to suit his needs and be prepared for certain restrictions (such as the need to manually rebalance the wallet).

Traders can also complement automated trading with manual arbitrage. In this case, monitoring order book prices in real time can help predict the appearance of an arbitrage window.

Ultimately, any trader who spends enough time studying the markets and puts in the necessary effort will be able to create an arbitrage strategy that will generate a stable income.

Arbitrage currency transaction

Based on the types described above, it is easy to understand how a currency arbitrage operation is carried out. Spatial and time options are the simplest ways to make a profit in an arbitrage operation. It is worth noting that currency arbitrage is more difficult to implement in conditions of widespread availability of information (for example, via the Internet). Fluctuations are less significant, and market players have to resort to more complex types of operations (timely recording of rate fluctuations, placing deposits).

Forex arbitrage advisors – review of the Newest PRO robot

Before we begin our review of the best Forex arbitrage advisors, it must be said that for them to work effectively, you need a slow broker whose quotes lag and a fast quote provider.

It is precisely the freezing (lag) of quotes that is arbitrage in Forex.

We will not consider the reasons for such a freeze, we will simply clarify that the difference in quotes is especially noticeable during high market volatility at the moment when analytical data is published, important news comes out, economic data changes, and the like.

Now you can go directly to the review of the best arbitration advisors and find out their advantages. Let's start with the Newest PRO trading robot, which is connected via a special program “Trade Monitor” directly to stock quotes.

The advantages of using this advisor are that it allows us to find out quotes before they appear in brokers’ terminals.

Let us immediately note that previously such a system was available exclusively to large traders of the futures market with a capital of 250 thousand US dollars or more and was not used on Forex.

The Newest PRO advisor, through the Forex arbitration program “Trade Monitor”, connects to the 4 fastest quote providers at the moment: Lmax Exchange, Rithmic, Saxo Bank and CQF FX. However, you can work with each of them on a real or demo account.

Arbitration advisors like our Newest PRO receive quotes from Trade Monitor every millisecond and compare them with broker quotes located in their terminals. When lags in quotes are detected, the robot’s trading algorithm is triggered, which makes it possible to “squeeze” maximum profit from each signal.

Today, a new version of the advisor and Trade Monitor 3.7 software is already available, in which the developers have integrated with the world's largest exchanges such as NYBOT, CME CHICAGO, NYSE and some others. As you can see, the advantages of using this arbitration advisor are obvious.

BEST FOREX BROKERS ACCORDING TO INTERFAX DATA

Top ECN broker, operating for over 20 years!

Now I additionally receive income from their cashback promotion ==>>> CASHBASK FROM ALPARI | review / reviews 2010. Certified by CROFR! | MAXIMUM BONUS | review / reviews Verified foreign broker |

START WITH 10USD | review / reviews Included in the TOP 3 leading ratings of Forex brokers. Great for Russia | MAXIMUM $1500 BONUS | review/feedback AS WELL AS THE BEST BINARY OPTIONS BROKERS IN 2022:

This options broker has the best reputation on the web!

| START WITH 10$ | review / reviews New fixed options. These are the only ones! | START WITH 1$ | review/feedback

ARB IND advisor for arbitrage trading on Forex

So, the review of the best Forex arbitrage advisors continues with a trading robot that uses the ARB IND indicator in its work. Orders here are opened with a constant lot, and opposite positions are closed when a new position is opened.

Entering “BUY” occurs at the moment of the indicator reversal, when the previous and current value is higher than the previous one, but below the DOWN LEVEL (lower level), intersects upward with the zero value, but does not reach the lower level. And also, at the moment the indicator is above the zero value and above the value that it reached on the previous order of the opposite type.

Transactions on “SELL” are opened under completely opposite transaction conditions for “BUY”.

It should be noted that the advisor we are considering provides for the inversion of transactions, and since the robot trades on already established bars, the quality of the modeling itself has virtually no effect on its profitability.

The main indicator settings include:

- MA1 – 20 (first moving average);

- MA2 – 10 (second moving average);

- UP LEVEL (upper level) – 150;

- DOWN LEVEL (lower level) – 150;

- LOTS (lot of orders that are placed) – 0.1;

- inverse (inversion of orders) – false.

Download the updated ARB IND advisor with instructions

Types of currency arbitrage

The main types of currency arbitrage have emerged and are used based on their demand. Let's look at some of them:

- intermarket, spatial - the main type of arbitrage, involving the purchase and sale of currency in different markets (to extract the greatest profit);

- temporary – profit is obtained due to the difference between rates during a period of time;

- conversion - this type is based on random fluctuations in quotes of various currencies (sequential conversion leads to profit);

- currency-interest - currency is not only purchased, but also placed on deposit, after which the deposited funds are sold for another currency.

Legislative regulation of the activities of commissions

Exchange arbitration performs the functions of an arbitration court, and in its activities is guided by the requirements of the following regulatory legal acts:

- European (Geneva) Convention of 1961 “On Foreign Trade Arbitration”.

- Federal Law “On Arbitration Courts”, which came into force on July 24, 2002 No. 102-FZ.

- Federal Law “On International Commercial Arbitration”, introduced in 1993 on July 7 under No. 5338-1.

- The provisions of the arbitration commission, the relevant rules and the arbitration agreement between the parties to the proceedings.

The governing documents specified in the last paragraph are developed by exchange employees or external specialists. The regulations on the arbitration commission and the Rules of arbitration proceedings are approved by the supreme governing body of the exchange at a special meeting. An entry on this issue is made in the protocol and an appropriate decision is made.

Initiation of proceedings in the case

Arbitration proceedings begin with the presentation of claims to one of the parties to the proceeding in the form of an application. The Chairman of the Exchange Arbitration shall issue a corresponding resolution on the acceptance of the document for production. List of mandatory information that the statement of claim must contain:

- Name and details of the plaintiff and defendant in the case.

- Justification of the commission’s competence to consider the contentious issue on its merits.

- A detailed statement of the circumstances of the case and the claims against the defendant.

- Evidence base.

- Justification of requirements with references to legislation.

- Total cost of claims.

- Information about the main or reserve arbitrator.

- List of documents attached to the application.

The claim price is the total amount of claims expressed in rubles. If we are talking about foreign currencies, then the calculation is carried out at the rate of the Central Bank on the day of submission of the application. When submitting an application to the Arbitration, the plaintiff pays a registration fee, which is not refundable regardless of the outcome of the consideration of the case. At the pre-trial stage, the parties can reach an agreement on reconciliation.

The procedure for preparing a case for consideration

After receiving the application from the plaintiff and eliminating all shortcomings, the Executive Secretary sends a copy of the application to the defendant within two working days. The document is accompanied by a list of exchange arbitrators and other papers. The defendant, within a specified period of time (usually 10 days), prepares a response to the claim indicating its objections. This document is submitted to the Arbitration along with the evidence in the case.

At the stage of preparing the case for consideration by the commission, the following are determined:

- The composition of the arbitration tribunal and its chairman, including the reserve, are elected.

- Place of hearing.

- The exact date of consideration of the case on the merits.

The case is transferred to the arbitration tribunal for consideration after all preparatory measures have been decided. The parties involved in the process pay the established arbitration fee, as well as the amount of the court's expected expenses. The plaintiff and defendant are notified of the exact time and place of consideration of the case by the Exchange Arbitration Commission.

Hearing

The consideration of controversial issues is carried out behind closed doors. Persons not participating in the process may be present at the hearings only with the consent of the court and the parties to the conflict. The plaintiff and defendant have the right to have their interests represented by qualified specialists. During the process, the parties may perform the following procedural actions:

- call witnesses and experts;

- submit petitions;

- present evidence to the court;

- express objections.

The conflict at any stage can be resolved by concluding a settlement agreement, which is approved by the arbitration court. If the parties are unable to find a compromise, then the Arbitration makes a decision on this case, which includes the following information:

- name of the authority, case number, date and place;

- the names of the arbitration tribunal;

- information about the plaintiff and defendant;

- justification of the competence of the commission to consider the case;

- a detailed statement of the controversial issue, claims and objections of the defendant;

- justification of the court's decision, taking into account the evidence of the parties to the trial;

- a resolution to satisfy or reject claims indicating the amounts awarded to the plaintiff in the case.

The decision of the Exchange Arbitration is not final and can be appealed in state courts. The document comes into force within 10 working days after its issuance.

Who is “arbitrage” and where does it get its money?

The idea is to use the "future" exchange price before it even appears in a specific trading terminal. We open an order, already having information about where exactly (higher/lower) - the price will be in a few milliseconds. The transaction will be guaranteed to be profitable, but it must be opened and fixed as quickly as possible, with literally several points of profit. And no drawdown.

The deal “lives” for only a few seconds. The trading scheme does not depend on the market situation; the main thing is to obtain the necessary information in a timely manner.