Over the past seven days, the first cryptocurrency has risen in price by more than 6%. To what level can the asset grow in the near future and what to expect from the crypto market during the New Year holidays

This week, the price of Bitcoin exceeded $51.8 thousand. As of 10:35 Moscow time on December 26, the first cryptocurrency was trading at $49.8 thousand. RBC-Crypto experts explained what to expect from the asset in the coming days.

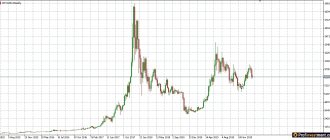

Bitcoin weekly price movement

Last week, BTC completed its second consecutive bearish candle. This resulted in a low of $46,930 on April 25th. Since then the price has recovered slightly.

Technical indicators are mixed. The MACD is declining and has given a bearish reversal signal. However, the RSI has triggered a latent bullish divergence, a strong sign of trend continuation.

The stochastic oscillator is neutral. It is declining, but has not yet made a bearish cross.

Hence, we need to look at lower timeframes to analyze the direction of the trend.

DeFi and NFT sectors will weather the market decline more easily

As for the DeFi market and the NFT sector, there will be no global changes.

“NFT, in my opinion, is generally still at the very beginning of its development path. Now this technology is used mainly in the field of art, although the product itself is much more powerful and interesting ,” says Ivan Petukhovsky, co-founder of EXMO.

Mikhail Bogdanov is confident that after the price of Bitcoin falls, the NFT market will also react with a decline, but this will most likely affect the cost of NFTs rather than the popularity of the platforms.

“As for the NFT and DeFi sectors, there is a direct relationship. If Bitcoin and major altcoins fall, then a similar fall will occur in both DeFi and the NFT market. But I want to clarify that assets will become cheaper, but this will not affect the popularity of services ,” Mikhail Bogdanov shares his forecast.

Anti Danilevsky from KickEX believes that a wave of scams will begin on the market. But this will have nothing to do with the fall in the price of Bitcoin.

“We should expect massive scams in the NFT segment, but this is not related to the fall in the BTC rate, this in itself is initially all a scam. DeFi will definitely fall; only those who understand what they are doing and know how to do tokenomics correctly will remain. Just compare Uniswap/Sushiswap and the recent epic failure from 1inch. Most DeFi is like this. They are trying to copy someone else’s success, but they don’t understand how the market works, or how users think, or how to competently build tokenomics ,” the expert believes.

Also, all experts agree that the fall of the crypto market was caused more by manipulation than by objective reasons.

“Any forecasts, any technical analysis are broken by the behind-the-scenes agreements of the new billionaires. You can try to guess something, but at the moment, a few news, a couple of tweets and large transactions in the market are enough to turn the price in the right direction. And while the market is young, while its volume is still tiny compared to mature fiat markets, this is how everything will happen. Now only strong regulation, serious investigations and strict punitive measures against manipulators can save the situation, but for now this too should not be expected ,” says Anti Danilevsky.

A similar opinion is shared by Ivan Petukhovsky. According to the expert, in traditional finance and other markets, market manipulation is prohibited and is punishable by insane fines and threatens to close the company. Therefore, now, given the complete absence of such legislation and often the need to disclose such transactions in their reports, the cryptocurrency market is very easily controlled from the outside.

Material prepared by https://beincrypto.ru

Daily BTC Movement

The daily chart paints a more bearish picture.

MACD, RSI and stochastic oscillator are declining. None of these major signals show any bullish signs.

However, BTC rebounded from the confluence of Fibonacci support levels. The $46,800-$47,690 area is the .786 Fibonacci retracement level (black) of the most recent part of the rally. Additionally, this is also the 0.5 Fibonacci retracement level (orange) of the long-term portion of the move.

If BTC continues to fall, the next significant support will be found between $42,550 and $43,050.

Analysis

Bitcoin Analysis

Despite the fall in Bitcoin, many analysts still maintain a positive outlook on the market. For example, Michael van de Poppe is pleased that the market, in his understanding, has held a key support level and is now expecting a rapid V-shaped recovery.

True, in the comments under this forecast we found this interesting infographic that shows how many times Bitcoin fell after Michael promised us growth.

Infographics by Michael van de Poppe

As you can see, not all cryptanalysts are equally useful, and this is the best argument for the fact that you can collect information from different resources, but you only need to analyze it and make decisions about buying or selling Bitcoin yourself.

Another crypto analyst at TechDev notes that Bitcoin is deviating from the standard bullish scenario seen in 2013 and 2022.

This is a worrying sign, but he has no plans to change his long-term forecast that Bitcoin is heading towards $300,000 in 2022.

And let’s give the opinion of another analyst, this is Will Clemente, who has now come over to our side. Previously, he pointed to Bitcoin support at $53,000 along the realized capitalization of short-term Bitcoin holders. As long as we are above this line, the market is considered bullish and, vice versa, and since today the price has fallen significantly lower. Will Clemente also spoke about the fact that it is time to prepare for a completely new cycle, which has not yet happened in the history of the first cryptocurrency.

This is what we proposed to do at the end of November to prepare for non-standard behavior of Bitcoin.

As you can see, analysts disagree on the future of Bitcoin, so next we will talk about our key price levels and how we will look at the market, depending on further market movements.

Bitcoin forecast and BTC/USD rate for today and May 2021

The 6-hour chart shows the descending resistance line that BTC has been following since its record high price on April 13th. So far he has made three unsuccessful attempts to break out.

The line coincides with the minor resistance area at $53,200.

Until it is corrected, we cannot consider the trend bullish.

EMA Ribbons and Нash Ribbons indicators indicate BTC purchases

If we look at the Bitcoin chart above (blue circles), we can see that the EMA Ribbons is already flipping into the buy zone at the moment, and the Hash Ribbons is in the final zone before the blue “BUY” circle appears, showing the ideal point to enter long.

Both of these indicators are followed by tens of thousands of traders, bloggers and investors around the world, so they greatly influence the cryptocurrency market, and the entry of both indicators into the buy zone will serve as a strong bullish signal that will send BTC to the region of $50,000 and above.

Up down?

The hourly chart shows the double bottom created on April 25th.

The decline leading to the low of the range does not appear to be impulsive. Most likely it was a flat ABC adjustment structure. Additionally, A:C waves have a 1:1.61 ratio, which is common for such structures.

If this is true, BTC is expected to make another low before eventually moving higher.

Conclusion

Thus, Bitcoin forecast and price for May 2022, due to the lack of signs of a bullish reversal, it is more likely that BTC will make another low before breaking short-term resistance.

Growth in trading activity

Within a week, Bitcoin could rise in price to $55 thousand with periodic drawdowns to $51 thousand, predicted Nikita Soshnikov, director of the Alfacash cryptocurrency exchange service. In his opinion, immediately after the New Year, the cryptocurrency may attempt to exceed $60 thousand, but the likelihood of consolidating above this mark is low.

“I don’t think that the New Year holidays will significantly decrease in trading volume. On the contrary, during this period we can expect an increase in trading activity,” the expert explained.

In general, Bitcoin is still in a bull market, so a breakthrough to $60 thousand is a very likely scenario in the near future, Soshnikov says.

“Bitcoin has established itself as one of the hedging instruments, so investors’ fear of inflation contributes to the flow of liquidity from the stock market to cryptocurrencies. However, Bitcoin is unlikely to rise above $60 thousand; the market does not yet have enough powerful impulses for this,” the expert added.

Why you shouldn't sell Bitcoin when the price falls

Many experts warn that investors in crypto assets will face a big drawdown at the beginning of 2022. Bitcoin could fall from $100 thousand by 40–45% and remain there for several months.

Well-known crypto-financiers advise how market participants should behave when the exchange rate falls.

Max Kaiser - head of Heisenberg Capital, TV presenter, financial analyst

Kaiser believes that Bitcoin's rise to $100,000 by the end of this year is inevitable. It will subsequently reach $0.4 million, so it's worth playing for the long haul. The businessman does not disclose what such assumptions are based on. However, thousands of retail investors have already trusted his bold forecasts.

Robert Kiyosaki - writer, serial entrepreneur

The author of Rich Dad Poor Dad tweeted: “Yay! Bitcoin is above $60,000 again. But I'm waiting for a pullback before I invest more."

Thus, Kiyosaki cautions against investing in the asset at this stage. And after the price decreases, you can open an order for a long-term purchase.

Adam Back - CEO of Blockstream

From Beck's point of view, Bitcoin should be in every investment portfolio. According to him, you should not pay attention to the correction and exit the asset. Moreover, the price of the main cryptocurrency may rise to $0.3 million. by 2026.

Reasons for Bitcoin's rise to $42,000

Below we highlight the five main reasons why Bitcoin not only updated its all-time high of $20,000, but also headed towards $42,000:

- Technical analysis. Many traders have repeatedly argued that $12,500 is a significant level, consolidation around which will trigger a bullish price rally.

- Spread of coronavirus COVID-19. This epidemic has become a real shock to the economies of all countries of the world. The authorities of the United States and other developed countries began to print billions, which certainly led to inflation. It was inflation that became the main incentive for ordinary users to start purchasing Bitcoin.

- May halving. In simple words, this is a reduction in the reward to miners for mining blocks.

- Capital influx from institutional investors. Over the past six months, many large hedge funds have announced their investments in Bitcoin. MicroStrategy alone invested over $1 billion in Bitcoin, which certainly became a driver for the growth of the price of the cryptocurrency.

Bitcoin follows the Wyckoff accumulation model

Bitcoin exactly went through 4 phases according to the Wyckoff model and the last rollback to the area of $40,000 (green circle on the chart below), aka Last Kiss was the last chance to purchase before BTC grew to the area of $50,000 and above, we wrote in more detail about this here : Bitcoin price forecast for July and August 2022 - Bullish growth using the Wyckoff accumulation method

Bitcoin chart overlaid on the Wyckoff accumulation model.

Wyckoff accumulation