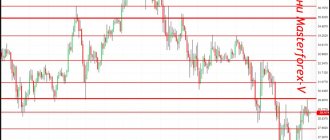

BTC/USD rate chart

BTC/USD rate chart online, prices come from the Binance exchange.

The dynamics of changes in the value of Bitcoin to the US Dollar for 2021–2022 are presented. To change the scale, hover your mouse over the graph and scroll the wheel. Display interval: 1 candle equals 1 day, but you can change this parameter at your discretion. In addition to the Bitcoin/USD rate chart, you can select any other cryptocurrency - Ehtereum (ETH/USD), Litecoin (LTC/USD), Forex currency pairs, etc. To save to bookmarks, press the CTRL and D buttons on your keyboard. We recommend viewing the rate all cryptocurrencies (1700+).

You can select the type of chart display: linear, area or bars. The initial interval of one division is 1 day, you can set any value up to 1 month. Indicators available - MACD, ZigZag and others. In the toolbar - trend lines, pitchforks, brush. The scale on the BTC/USD rate chart is changed with the mouse wheel.

Bitcoin/dollar quotes are received online from the Binance cryptocurrency exchange.

For reference: Bitcoin is the first cryptocurrency in the world, the first block was created in 2009. It occupies a leading position in terms of capitalization volume.

In December 2022, the Bitcoin rate against the dollar set a record and surpassed $19,000, coming very close to $20,000 per 1 BTC. In 2022, there is a correction in the market.

The price of the Bitcoin cryptocurrency depends on world news. Any restrictive measures could push the Bitcoin rate down. Conversely, the recognition of cryptocurrencies as an official payment instrument has a positive effect on its value and growth dynamics. The price of BTC is strongly influenced by market speculation of large players.

Bitcoin to dollar exchange rate 2013-2018 (screenshot):

The BTC cryptocurrency has a number of advantages over fiat currencies:

- Anonymity - entering personal data when registering a wallet, purchasing or transferring Bitcoin is not required.

- Transparency - any transaction can be tracked, but it is almost impossible to find out who performed it.

- Decentralization - no one can establish control over the blockchain network.

Bitcoin rate in 2010

February

Founding of the world's first Bitcoin exchange, dwdollar, which is no longer functioning.

May (buying pizza with bitcoins).

On May 22, 2010, a historic event occurred with the purchase of pizza for 10 thousand bitcoins (about $25), which today is almost $3 million. Just imagine how now that guy regrets that he spent them on some pizza. It was the most expensive pizza in the world!

July - 1 Bitcoin = $0.080

July 12, 2010 is the day when the value of Bitcoin increased tenfold, from $0.008/BTC to $0.080/BTC. Having remained at this level until October 7, the value of the cryptocurrency began to rise.

November – 1 Bitcoin = $0.50

A month later, on November 6, Bitcoin's capitalization reached $1 million, and the value on MtGox increased to 50 cents for each bitcoin.

How to buy Bitcoin at the best rate

You can buy bitcoins at a favorable rate:

- In exchangers (for example, Prostocash, Baksman, 60 cek, Xchange, 24paybank, Kassa).

- On crypto exchanges: Binance, Currency.com, OKEx, EXMO, FTX, Bybit, Huobi and others. You can exchange Bitcoin there for almost any payment system that you have.

In Bitcoin exchangers, the action algorithm is as follows:

- Register and receive a discount on each subsequent exchange.

- Select the direction of exchange and indicate the amount.

- Enter the required data, including the Bitcoin wallet address to receive. Click “Start exchange” and make payment according to the application.

- After confirming the transaction on the network, you receive bitcoins in your wallet.

Bitcoin rate in 2008

August (how Bitcoin appeared)

Three guys, Neil King, Vladimir Oksman and Charles Bry are applying for a patent on encryption technology. All three deny any connection to Satoshi Nakamoto, the supposed creator of the Bitcoin concept. That same month, the trio registered the domain Bitcoin.org using an anonymous domain name registration service.

October

Despite all of the above, Satoshi Nakamoto publishes his report on the concept of electronic mutual settlements entirely based on P2P technology. In his opinion, this will solve the problem of counterfeiting, and will also give Bitcoin the opportunity to gain a foothold at the legal level.

The launch of the first block, codenamed Genesis , initiates the start of “mining.” Later that month, the first transaction is recorded between Satoshi and Hal Finley, a developer and activist in cryptography.

Satoshi Nakamoto

How to open a Bitcoin wallet

There are “thick” and “thin” wallets for cryptocurrencies. In the first case, all blocks of the blockchain are downloaded locally, in the second - not. Further, there are also the following types: local, online, hardware, paper, and according to the storage method: “cold” and “hot”.

Let's briefly look at examples of how to create a Bitcoin wallet:

- Download and install on your computer or mobile device from bitcoin.org. There are several programs and online services to choose from for download: Bitcoin Knots, Bitcoin Core, Edge, Electrum, Green Address, GreenBits, etc. When installing the official Bitcoin Core wallet, you will need a lot of free space on your computer. For example, Bitcoin Core, after installation, downloads the blockchain with all transactions, weighing about 140 GB. Don’t forget to make a backup, or better yet, save your private keys right away. The Electrum wallet does not require downloading the entire blockchain, and you can make transactions with bitcoins instantly after installation.

- Create a wallet on special online sites. Popular services are blockchain.com, Coinfy, Guardo, Lumi, Rahakott, BitGo, etc. You don’t have to download the blockchain or install anything on your computer.

- Register an account on a crypto exchange, after which you will be able to use a wallet that has accounts in different cryptocurrencies. Popular exchanges: Localbitcoins, EXMO, Binance. After registering with them, you will be able to buy, sell and store cryptocurrencies included in the listing: Bitcoin, Ethereum, Dash, Monero, Ripple, Litecoin, Zcash, etc.

- Buy a hardware device: Ledger, Trezor, KeepKey, DigitalBox. This is the best way to store cryptocurrencies as they cannot be hacked. More details in the article: Review of the Ledger Nano S wallet.

- "Paper" method. On the website bitaddress.org you can generate and print a private key. Generation takes place locally on your device, information is not transferred to third parties. The Java generator is open source. Private Key is a private key (do not give it to anyone), Bitcoin Address is the wallet address for receiving cryptocurrency (public key).

Important. After registering or installing a wallet, you will have an address to receive bitcoins, which you will use when purchasing or transferring cryptocurrency. It consists of a chaotic set of 33-34 numbers and letters of the Latin alphabet. Do not confuse the address with the private key, which must be stored in a safe place.

Let us remind you: to save the page with the Bitcoin to dollar rate chart, add it to your bookmarks (CTRL and D).

Bitcoin rate in 2011

On February 9, 2011, 1 bitcoin cost $1, after which there was a long decline. On March 23-24, BTC reached parity with the euro and the British pound. On June 2, the cost of one BTC was $10, and a week later it soared to $31.91.

The Big Bubble is the common name for an incident that occurred on June 12 when, after peaking in value, Bitcoin plummeted to $10. There were a lot of different events that year! On July 13 of that year, the largest theft became known: 25 thousand BTC were stolen from the electronic wallet of the founder and participant of the Bitcoin Forum. The remaining months of that year marked the history of Bitcoin with a series of hacks and thefts and a general decline in confidence in Bitcoin as a promising tool for mutual settlements and investments.

Bitcoin rate in 2013

In fact, from 2011 to 2013, the price of Bitcoin remained virtually unchanged, but on February 22, the quote rose to $30. The next increase occurred on February 28 – then Bitcoin rose to $31.91. On March 11, the price rose to $37, and on March 22, to $74.90. Finally, on April 1, the cost jumped above $100, and in the next 9 days it doubled (as of April 10, 2013, the cost was $266). But on April 15, another Bitcoin crash happened.

October 2 is the day that represents a significant drop in Bitcoin (to $109.71), which occurred due to the arrest of the Silk Road trading platform.

On the 20th of November, the cost of one bitcoin soars to $700.

On November 6, the price of Bitcoin rose to $269; on November 17, the price doubled to $503.10, and in the following week it rose to an all-time high of $1,242. It seems that on that day everyone realized the true potential and significance of this currency.

December

By December 5, the price had dropped to $1,000, and by the 17th it had almost halved and was below $600. This decline occurred due to the Chinese Central Bank banning financial institutions from working with Bitcoin. This ban came after the People's Bank of China stated that Bitcoin is not a currency and has nothing to do with legally backed fiat currencies. Such harsh measures reflect the potential for Bitcoin to affect the financial stability of China, but today China retains its status as the largest Bitcoin trader, with 80% of transactions taking place in this country.

Distributing the investment portfolio: expert advice

Cryptocurrency is a highly volatile instrument. Even popular coins backed by projects and businesses (for example, BNB) sometimes fall by tens of percent per day. Therefore, it is important to follow the rules of diversification. This will help avoid losses on one asset, covering them with income from another.

Analysts advise distributing the budget this way:

- 50% to the top three digital currencies by capitalization (BTC, ETH, BNB);

- 25% in promising coins (SOL, TWT, ADA);

- 10% in risky instruments (memcoins, DeFi tokens and blockchain games);

- 15% in stablecoins (will allow you to have a reserve for purchasing a trending asset).

This distribution will allow you to avoid loss of funds and minimize risks. Investments in large cryptocurrencies will provide an opportunity to receive constant income in the long term (see growth chart). Finally, the rest will allow you to have additional profit if the outcome is positive.

Bitcoin rate in 2015

The beginning of 2015 gave great hope, and we saw another rise in Bitcoin. By March 3, 2015, the price of Bitcoin was $281, after a sharp drop to $177 in mid-January.

October

The price of Bitcoin exceeded $500, it seemed that some global changes were taking place and a revaluation of the value of the digital currency. However, later this was associated with the activity of a financial pyramid in China, which was allegedly founded by Sergei Mavrodi, already known to us from MMM. According to other experts, now is simply the most favorable moment for the development of digital currencies.

December

The beginning of winter 2015 for the Bitcoin rate was marked by a rebound; on average, the rate was at the level of $355-380.

Bitcoin rate in 2012

The Bitcoin rate this year fluctuates around $8-14.

The year 2012 in the history of Bitcoin was marked by the act of incarnating Bitcoin from a digital abstract currency into something physical - the Bitcoin Central Bank, which received a license and recognition from European regulators. However, there were no significant changes in the value of the currency.