The main question of interest to the bearish crypto market in 2022 is “When will the price of Bitcoin rise?” Investors who have owned cryptocurrency since 2010 are familiar with its market cycles.

There was a correction in the market, reducing the price by more than 80%. Previously, from December 2022 to June 2022, the cryptocurrency also faced a 70% drop in value. Now the price of Bitcoin is close to 50% of its level last financial year. It's hard to believe, but buying Bitcoin for $1,000 just 18 months ago was commonplace.

Bitcoin has doubled in price 16 times in its history, based on $1. Now those who bought Bitcoin at the height of its growth in 2022 are asking the question: “When will I recoup my investment?” Well, it is unlikely that the price of Bitcoin will move at a parabolic rate in 2022.

What affects the Bitcoin rate?

In matters of the fall and growth of monetary units, the growth of demand plays a huge role, this also applies to cryptocurrencies. If there is a slow increase or decrease in the rate, it means that players have begun to buy Bitcoin, the same thing, but in a sharp form this already indicates the arrival of a pumper.

Both are people who have a sufficient amount of assets that have such an impact on the processes of growth and decline. They quickly react to the behavior of traders and, when necessary, create the illusion of an increase in the rate.

The consequence of this decision is the frantic purchase of bitcoins. As soon as all this happens, pumpers sharply dump assets and reduce the cost to a minimum. Such growth can be observed because it is preceded by an increase in the popularity of the cryptocurrency. The history of Bitcoin is rich in such fluctuations; there were cases when negative news was specially invented and released to the media, in the hope of collapsing the rate, but at the same time making money on it.

There is a significant difference between such concepts as drain, fall and correction. An experienced trader will quickly distinguish one from the other and earn additional capital on it.

Share of pessimism

Despite the fact that most experts agree on the positive development of events next year, there are those who hold a different view. So Chris Berniske considers Bitcoin to be just another speculative instrument, and its high price is completely unreasonable. As Chris states, Bitcoin 2018 will lose over 75%, thereby causing a fall in the rate of other cryptocurrencies.

The reason for such a negative movement may be an excess of volumes in the market and too much hype around electronic coins. It is assumed that the situation, having reached its climax, will provoke a final drop in the value of the cryptocurrency.

How has the complexity and size of the Bitcoin network changed the income of miners?

In the Bitcoin network, difficulty is considered the main indicator; it determines the ease of locating a block. The network is already configured and blocks are counted every ten minutes, therefore the power increases, to curb the growth, complexity is applied, it is recalculated on average once every two weeks.

It's only been in the last few years that the difficulty has dropped, and the reason was the shutdown of GHash.io, which was one of the largest pools. It is not easy to predict what will happen next. The greater the difficulty, the less cryptocurrency can be mined, and accordingly the value may increase, but this does not always happen this way, because this cryptocurrency is strongly influenced by demand.

Is it possible to legalize Bitcoin in Russia?

Experts around the world predict large-scale integration of blockchain technology into many areas of human life. This means we should expect the growth of digital money. Russian analysts in the field of electronic currency have a similar opinion and suggest that Bitcoin quotes against the ruble will increase significantly in 2022. They also hope that the government will find a common language with both miners and ordinary network participants who want to pay for online purchases confidentially and without commissions by adopting digital money at the legislative level.

The Bitcoin lifetime graph shows that this innovative currency is strengthening its position in the global financial arena every day. And soon Russia will fall under its onslaught, intending to recognize and allow the circulation of cryptocurrency on its territory in the near future.

How has the Bitcoin rate changed over the past 3 years?

Cryptocurrency has not existed for so long, but from the beginning of its work to this day its rate has increased to impressive sizes. Many see further development potential, while others are more pessimistic about such an investment.

In the first year of Bitcoin’s existence, there were no particularly large jumps in exchange rate changes. The rate rose to the level of 30 dollars per monetary unit only once from June to July 2011; by the end it fell again to the level of 5 dollars. It was from this situation that 2012 began and the rate systematically increased throughout the year, reaching $14 per bitcoin by the end. These were already good prerequisites for investing in cryptocurrency.

The end of 2013 was marked by a huge leap that surprised many experts and users. In December, the Bitcoin exchange rate was already $1,200 per unit, and some regretted that they did not dare to invest their own funds in the first stages of Bitcoin development.

There were several people who, thanks to such an impressive leap, managed to become millionaires and it seemed that great prospects were opening up for further growth, but alas, the very next year the cryptocurrency began to lose ground and its value fell threefold.

Some associate the sharp collapse with the coming crisis; the price of Bitcoin for 2015-2016 looks more realistic and is in the range from $360 to $1,000. It was precisely this new round of price appreciation that Bitcoin accomplished in just two years; in 2022, it continues to grow relentlessly, and most economists perceive this growth as a prerequisite for new investments. The cryptocurrency has not exhausted its possibilities, so its price will continue to increase in 2022 until the demand for the monetary unit falls.

Bitcoin 2022: what awaits us next year?

The total capitalization of the site as of November of this year is a whopping $136 billion. Moreover, it is growing every day, as the service continues to be financed by both private investors and large investment companies. According to experts, the trend for infusions of funds into digital currency will continue until the end of this year and, most likely, will be relevant next year, and therefore we should expect a further upward movement in the value of Bitcoin.

Renowned analyst Cliff High predicts that 2022 could mark a major crisis in the traditional economic paradigm, with many financial institutions simply closing down. In order to stabilize the situation, the central banks of countries will be forced to expend a lot of effort, thereby weakening their positions, allowing, against the backdrop of these circumstances, digital payment systems to strengthen their position in the established model. It is because of this that most predictions regarding Bitcoin in 2018 are extremely positive. Its value is expected to be 3 times the price of gold.

In what corridor will the Bitcoin rate fluctuate in 2018?

There are experts who boldly talk about a sharp rise in the price of Bitcoin in the summer of 2022. Among them, the creator of the webbot program predicts the cost of one Bitcoin – $13,000. Arguing in this way, he relies on the collapse of the banking system and the emergence of problems in access to cash.

As soon as the banking system demonstrates its weakness, the need for cryptocurrencies will increase, and accordingly their rate will increase.

But this is just one expert point of view; already in mid-2017, there was a crazy demand for cryptocurrency in Japan; it became an official means of payment in some service sectors. This behavior became the impetus for increasing the rate to $1,000 per unit of bitcoin.

In China, the situation is completely opposite; they introduced strict policies to regulate the circulation of cryptocurrency, so most buyers went to the Japanese market. All this may cause a slow decline in the exchange rate next year. All experts on the issue of the further development of Bitcoin are divided into two large camps: some believe that it will collapse, others that it will rise sharply.

Results

The demand for cryptocurrency is booming, the number of players is increasing. Some optimistic financial analysts predict a bright future for Bitcoin to replace the declining dollar. At the same time, analysts have all the signs of a financial bubble, which, according to all the laws of physics and economics, will inevitably burst with a wild roar. But this is all just a theory; in practice we see something completely different.

PS Most likely, this year Bitcoin will hit the bottom (but this is not certain, there is always a theoretical “bottom”)

Great article 2

Average Bitcoin rate forecast for 2022

It would be foolish to ignore the popularity of digital currency when trillions have already been invested in it. This is one of the reasons why the Bitcoin rate is of so much interest not only to leading specialists and traders, but also to ordinary citizens who are in search of where they can get huge additional income during a crisis.

Recognition in the commercial market is responsible for the constant growth of cryptocurrency, the biggest jump was in 2022, when Bitcoin soared from $1,000 to $8,000. In addition, tomorrow it may receive government support, which has already been stated by Putin, which means that Bitcoin will become an official means of payment, but at the same time it will lose anonymity and this may affect demand and, accordingly, the exchange rate.

Bitcoin forecast for spring 2022

From year to year, the Bitcoin rate is growing, no matter what. There were high-profile hacker hacks of exchanges, major thefts, and attempts were made to regulate cryptocurrencies, but all this did not stop us from making x16 in a year.

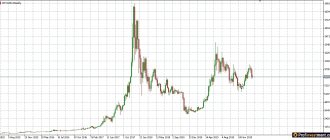

Almost every year history repeats itself, and this year we will certainly see rapid growth. For example, below is a picture with overlaid USD/BTC charts for the spring of 2016 and 2022.

BTC rate spring 2016-2017

I don’t think it’s worth explaining anything, you don’t have much time to buy bitcoins until the end of May. At the beginning of summer, we should definitely see the BTC rate in the region of $12,000-$13,000, followed by a rollback to $9,000, and a smooth recovery until the fall.

Should you keep your savings in Bitcoin in 2022?

There is no consensus on what to expect from cryptocurrency today and tomorrow. Some say that the monetary unit will continue to develop, others predict a fall in the exchange rate and the disappearance of Bitcoin. The whole point here is that as long as people believe and buy cryptocurrency, it will work, because like nothing else it depends on demand.

It is impossible to create an infinite number of bitcoins, this currency is limited to 21 million, it cannot be obtained in the form of money, only mined, which requires enormous power. Any investment is to some extent a risk; perhaps for a few more years with cryptocurrency this risk is much lower than with the euro or dollar.

An objective picture of the world of cryptocurrencies

Many people believe that cryptocurrency is a “bubble” and it is about to burst. Such statements could be heard/read throughout perhaps the entire existence of cryptocurrencies, and while some “stated this fact,” others earned millions on cryptocurrencies. Another good half of people do not believe that cryptocurrency is something serious. But, as a rule, such skeptic “experts” cannot answer the question: “what is blockchain?” Only a small part of the world community actually understands the essence and all the prospects of the phenomenon that lies behind the generally accepted common noun - “cryptocurrency”.

The bottom line is that cryptocurrency, as a digital unit for mutual settlements, is just the tip of the iceberg, the basis of which is Blockchain technology. Blockchain is a revolutionary technology that can optimize all modern structures and systems, eliminating intermediaries, which are connecting links in them, but in fact are unnecessary links that take up a significant part of time and financial resources to ensure the functioning of such systems. Moreover, blockchain here can ensure a certain environmental friendliness of interaction, eliminating such phenomena as, for example, bureaucracy and corruption.

So, in order to forecast the Bitcoin exchange rate for 2022 (and any other), you first need to understand what the cryptocurrency market actually is, who the market participants are, who and what events can influence its positive or negative development.

Bitcoin price forecast for 2022 - forecasts need to be made based on a comprehensive understanding of what is happening.

The cryptocurrency market today is built on the belief of its participants that products based on blockchain technologies (payment systems, industry services, social applications and much more) can really be implemented and enter our lives like the solutions and products of such companies. like IBM, Microsoft, Apple, Google, Amazon. Some develop and implement similar projects, others invest their funds in them.

Teams of enthusiastic developers are constantly developing and beginning to organize into full-fledged companies. There are more and more such companies with their own individual solutions/offers, and at the same time, there are more and more people interested in being equity participants in cryptocurrency projects. Supply continuously meets an increase in demand, which creates a positive trend in market development and the corresponding dynamics of growth in the value of cryptocurrency.

At the same time, we must understand that the market cannot constantly grow. Like a steam locomotive picking up speed, you need to periodically “let off steam.” From time to time, so-called corrections in the value of cryptocurrencies occur, one of which we can observe now.

Each time this is caused by the erosion of trust/faith in the further growth of the value of the cryptocurrency among its owners. As a consequence, this change of opinion leads to its sale. Mass sales of cryptocurrency (panic sell), accordingly, lead to a significant decrease in its value.

Who and what events can cause an erosion of trust and, as a result, a decline in the cryptocurrency rate?

Currently, the cryptocurrency market is practically unregulated; in fact, there are no rules for playing the game. This leads to the fact that the market contains both unscrupulous development teams/scammers and investors who are interested solely in the speculative component of the market. Often these are large players with serious capital who can influence the movement of cryptocurrency rates. The former lead to a direct loss of funds from investors, the latter are manipulators whose actions are also aimed at enriching themselves at the expense of less experienced market participants. The actions of these categories of people often cause a large part of the community to become disillusioned with the possibilities of the market.

In addition, cryptocurrency as a decentralized system is inconvenient for government managers, since they still have little idea how to deal with it. There is a clear risk for them of losing control over the movement of money, and, as a result, losing their certain significance. Now there is more and more talk about regulating the market, introducing taxes on relevant activities, etc., but no one seems to know how this can be implemented and enforced.

Any negative information from all of the above representatives leads to a decline. People begin to sell their assets and withdraw funds from the market, often recording losses.

Forecast adjustments, or points worth paying attention to

When making previous forecasts, analysts were extremely cautious. Modern Bitcoin exchange rate forecasts should be made taking into account:

- studying the impact of legalizing the use of major cryptocurrencies in countries;

- possible consequences of correction of the use or production of cryptocurrency by the government;

- the growth of influential companies expanding the cryptocurrency circulation system as a whole.

Thus, the analysis for the forecast should include the following key points.

The phenomenon of cryptocurrency legalization in Japan and its consequences

In the spring of 2022, the Japanese government, under pressure from the public and the lack of any other option, was literally forced to legalize cryptocurrency. However, the process received some adjustments due to the lack of a complete scheme for integrating the new instrument within the Japanese financial system. Thus, settlement transactions have received permission, but all reporting must still be regulated in yen.

China and bans

The beginning of autumn was marked by a black streak for cryptocurrency and Bitcoin in particular. The reason for this was the Chinese authorities’ ban on ICOs. Since at the time this resolution was issued, China was the main player in the crypto mining market, the price of Bitcoin began to decline rapidly. However, contrary to analysts' opinions, the market recovery did not take long. The accumulation of strength during the period of calm allowed the currency to resume growth with renewed vigor, giving analysts information regarding the strength of support for Bitcoin.

Mass transition of large companies to cryptocurrency

The active transition of companies to using cryptocurrency is represented by a chain reaction. Due to the extensive network of interaction with each other, expanding the list of companies is a natural result of maintaining favorable terms of cooperation. In addition, Bitcoin has become a tool to stimulate the financial position of companies. The absence of taxes, commissions, a high degree of transaction protection and the impossibility of control, which exempts from reporting, is a trump card that everyone strives to take advantage of. Thus, by simplifying the actual turnover of companies' funds, Bitcoin receives powerful support in its development. Additionally, it is necessary to consider the Bitcoin forecast for 2022, taking into account government measures. Thus, the government of many countries today is concerned about the lack of actual control over the field of cryptocurrencies. First of all, the problem is indicated by the lack of control over the circulation of funds. As a result, the security problem is becoming more acute. To create a platform for integrating cryptocurrencies into financial systems, many countries today are actively developing methods of influence. Overall the picture looks like this:

- active sublimation of experience occurs;

- The involvement of specialists from various financial fields in the problem is being intensified.

In any case, the active work of government agencies to create a platform for cryptocurrency is a powerful support for its active growth.

Bitcoin is blown away - is it so?

Bitcoin is blown away - is it so?

All cryptocurrencies are associated with Bitcoin, considering it a kind of standard, king, or even the grandfather of digital currencies. But few realize that he now performs the same function as the Queen of Great Britain. It seems that she exists, but only nominally. Power is concentrated in completely different hands. However, the life of the royal family is under the radar of cameras around the world. Her rating is high and her authority is indestructible.

The same thing happens with Bitcoin. The level of trust in it is stable, the coin has a high rating and authority. But still, many call it a soap bubble that is now deflating. And the reason is not even a low rate or bad news, but technical coins. Other cryptocurrencies (altcoins) have appeared on the market for a long time. They have the following advantages:

- Faster transaction processing speed, unlike slow Bitcoin.

- Low commission.

- New technology, such as smart contracts or advanced blockchain.

- Scalability.

The main advantages of altcoins compared to Bitcoin are listed, but there are many more. Technically, the cue ball is significantly behind its competitors, but still has nominal power, like the British queen. But will his debt rating be indestructible? If large investors who want to pour their capital into Bitcoin do not appear on the market, then its leadership position will be shifted.

However, the largest trading volumes with cryptocurrency in dollar equivalent belong to the cue ball. It still has the largest capitalization and rate. Therefore, the majority gives an optimistic Bitcoin forecast for 2022 with a price increase of several thousand dollars. Of course, it began to deflate as a soap bubble, since it is technically weaker than its competitors.

Bitcoin: features and dynamics of currency on the market

Bitcoins are a digital asset that is an electronic analogue of the dollar. The value of bitcoins grew rapidly throughout 2017, constantly changing its ratio to the dollar and other international currencies, which can be explained by several factors. The main one is the influence of market psychology: a high level of demand for any currency increases its value. Another factor that significantly contributes to the increase in the value of bitcoins is the corresponding policy in the market: many of its participants are interested in increasing the value of this currency, and therefore massively play to increase it.

The ban on bitcoins observed in some countries, on the contrary, fuels interest in cryptocurrency. And this, in turn, is one of the factors that makes it more popular, and therefore more valuable in comparison with other currencies. Other factors influencing the exchange rate of this currency also occur, but they are relatively insignificant and are not of cardinal importance.