The world's most popular cryptocurrency has risen in price due to the actions of speculators, experts say. This week, Bitcoin managed to cross the $5 thousand mark for the first time since November last year. But no one is making predictions that cryptocurrency can grow to $100 thousand and above. Bitcoin broke through the $5 thousand mark, and, as of Thursday, April 4, it does not fall below this level. Thus, according to information from the coinmarketcap.com exchange, the cost of the world’s most popular cryptocurrency was $5,025. The last time Bitcoin was at this level was in November last year.

Has Bitcoin risen in price due to the actions of speculators?

Global disillusionment with cryptocurrency began in 2022. Instead of reaching $100 thousand by the end of 2022, as Bitcoin enthusiasts predicted, Bitcoin fell below $5 thousand, writes Gazeta.ru.

Experts attributed this to unfulfilled hopes that the US Securities and Exchange Commission (SEC) would allow exchange-traded funds. However, no fateful decision was made for the cryptocurrency. Instead, the SEC began to cleanse the market of unscrupulous players.

After this, Bitcoin pessimists finally took over the market, and the view of the cryptocurrency as a bubble that will eventually burst only strengthened. In particular, the famous economist Niruel Roubini, a professor at the Leonard Stern School of Business at New York University, assured that the cryptocurrency “bubble” would deflate in 2022.

The most popular cryptocurrencies continued to fall in price, and a large number of crypto-investors on large investment platforms tried their best to get rid of the remainder of Bitcoin due to fears of a complete collapse of the cryptocurrency.

Traders are now arguing about what triggered the rise in Bitcoin's value and whether this can be expected to be a long-term trend.

Most explain this simply as successful speculation. The increase in the value of Bitcoin is associated with one-time purchases of this cryptocurrency, believes Dmitry Zharsky, director of the Veta expert group.

“In particular, on Several Exchanges in the USA and Luxembourg, an Unknown Buyer Bought 20 Thousand. Bitcoins for $100 Million, Which Provoked a Revival in This Market. After the Bitcoin Price Passed $5 Thousand, the Chain Reaction Had an Impact and Led to a Hype Around Other Popular Cryptocurrencies. As a result, the capitalization of the Cryptocurrency Market amounted to about $170 Billion, and the Daily Bitcoin Trading Volume Exceeded $14 Billion,” says the Expert.

According to Zharsky, the unknown buyer could be from Asia or a group of investors acting in their own interests. Also, according to him, such a large-scale purchase could have been carried out by a certain trading robot.

“This version is supported by the fact that the transactions were carried out through exchanges in the USA and Luxembourg and were a single algorithmically controlled order, which is very similar to a pre-thought out and programmed step,” says the Expert.

Most likely, some fund or large retail investor opened a large position in Bitcoin, which provoked a massive closure of selling positions, which caused quotes to shoot up like a bullet: in total, almost $500 million in transactions were closed, notes Gennady Nikolaev, an expert at the Academy. financial and investment management

“Such a practice is not uncommon in financial markets: This phenomenon can often be found on low-liquidity and high-volatility instruments, to which Bitcoin belongs. All this once again proves the immaturity of the market and does not in any way indicate any long-term growth. In the Absence of Fundamental Prerequisites, Bitcoin Should Return to $4,700 in the Near Time and Go Further to $4,300 - $4,000,” the Expert believes.

There are still no fundamental reasons for the growth of Bitcoin, agrees Gaidar Hasanov, an expert at the International Financial Center.

At the moment, the most likely reason for such a rise in cryptocurrency is the actions of one buyer who used an algorithmic system to initiate the purchase of Bitcoin through several exchanges, he believes.

“Those Who Bought Cryptocurrency in a Hurry Are Now Just Starting to Come to Their Minds and Think About What to Do Next?! Stay In A Position Or Exit At A Loss, This Especially Concerns The Last Buyers Who Jumped Into The Market At Prices Closer To $5,000. If New Buyers At High Prices Do Not Appear In The Near Time, Then The Patience Of The Other Participants May End, And We Will Record A Reverse Movement Toward $3,000 For Bitcoin,” He believes.

What is happening in the cryptocurrency market can hardly be called a reversal and a return to the former peaks of Bitcoin’s value is not yet in sight, Zharsky sums up.

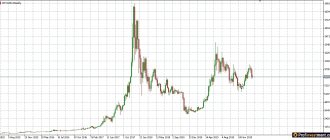

Long-term movement of BTC

BTC movement during the week from April 12 to April 18 was intense. On April 14, it reached an all-time high price of $64,854.

However, it began to decline soon after, and the rate of decline accelerated on April 17. BTC hit a low of $50,931 on the same day.

Currently, BTC has recovered and is trading around $57,000.

Despite the ongoing recovery, technical indicators are bearish. The MACD gave a bearish reversal signal and the RSI fell below 70. The stochastic oscillator is declining but has not yet made a bearish cross.

When combined with a bearish candle, the long-term trend shows significant weakness.

Why did Bitcoin fall?

What failures plagued Bitcoin? In 2022, far from being the most successful year for the cryptocurrency market, Bitcoin experienced a lot of troubles. These included, among other things, problems with the operation of exchanges, actions of hackers and fraudulent ICOs. The largest hack of crypto exchanges in world history occurred in January 2022, when the Japanese cryptocurrency exchange Coincheck lost more than $500 million as a result of a hacker attack. In June 2022, two South Korean exchanges were already affected. Bithumb, the sixth-largest cryptocurrency exchange in the world by trading volume, lost about $31.5 million, and ten days before that, another South Korean exchange, Coinrail, was robbed of $40 million. This was already the second major robbery for Bithumb. Three months later, in September 2022, attackers hacked the Japanese exchange Zaif and stole $60 million. Each of the three cases was accompanied by a decrease in the Bitcoin exchange rate.

Momentary movement

The 6-hour chart shows major resistance areas at $57,900 and $59,500. They are created by Fibonacci retracement levels of 0.5 and 0.618, respectively.

The current recovery has been V-shaped, which is unusual.

Technical indicators are still bearish. Therefore, it seems unlikely that BTC will be able to clear both of these resistance areas without some kind of failure.

The 2-hour chart shows some bullish signs but does not confirm a reversal.

If BTC declines, major support levels will be at $53,370 and $54,100.

People started searching for the word “bitcoin” again on the Internet.

For the first time, growing interest in the main cryptocurrency was noted by the Google Trends service, which analyzes the activity of Google search engine users, literally a few hours after Bitcoin reached the psychological mark of $5,000.

The largest Chinese Internet search engine Baidu recorded a similar trend. According to local news site cnLedger, “bitcoin” has become one of the most common words in internet searches.

The number of Baidu system users interested in the topic of BTC price growth continues to grow and has already reached its highest point in 2022.

What is Bitcoin backed by? National currencies used to be backed by gold or silver, now they are backed by GDP. Theoretically, you could go to any bank in the country and exchange your paper money for its equivalent in gold and back. Bitcoin is not backed by anything, it is pure mathematics. Anyone anywhere in the world can run a bitcoin mining script on their computer and feel like a miniature central bank. The source code of the script is published in open form, everyone can see how it works.

Experts note that interest in Bitcoin is growing in China even against the background of the extremely negative attitude of the country’s authorities towards cryptocurrencies. Let us remind you that the Chinese government, together with the People’s Bank, which acts as a financial regulator, banned the trading and use of cryptocurrencies back in 2022.

A recently published study by Nairu Capital says that the growing interest of Internet users in Bitcoin does not mean that they will start buying this coin. People are always massively interested in a product or asset that is aggressively growing in price.

For Bitcoin, the growing interest from users of the World Wide Web is still a positive signal, as it helps to increase people's knowledge about decentralized technologies.

Experts spoke about the prospects for Bitcoin

The load on the blockchain coin decreased immediately after the correction began. This may indicate that the value of the asset is artificially inflated by large market participants

On the night of April 5, the average market price of Bitcoin adjusted from $5,040 to $4,837, and now the coin has returned to the level of $5,000. What happened could be a serious signal that the cryptocurrency rate is being manipulated, says Nikita Zuborev, senior analyst at Bestchange.ru. He noticed that today the load in the coin’s meme pool (the set of all transactions awaiting confirmation on the network) has dropped sharply, according to Blockchain.com. This could be a harbinger of a sharp drop in value - stronger than most experts expect, writes RBC.

“The point is that on Monday, along with the beginning of the growth of the Bitcoin rate, the load on the Blockchain began to increase, and Trading Volumes on the Exchanges showed record values. Everything Said That Interest in Cryptocurrency Has Increased to Previous Levels. Considering such a sharp drop in load with the previous indicators of complexity and hashrate of the network immediately after the start of the correction, we can safely talk about artificially inflating the data using a DDoS attack on the blockchain,” explained Zuborev.

Given the Blockchain Transparency Institute's research, which showed that only 3 of the 25 largest trading platforms show real trading volumes, exchanges cannot be trusted, he added.

“The Hype Around Cryptocurrencies This Week Is Most Likely Just an Attempt at Manipulation, Possibly To Some Degree With the Collusion of Major Market Participants. Therefore, the Hope for a New Wave of Investor Interest and Rapid Growth Today is Not Justified, and the Correction May Turn Out to be Deeper Than Most Experts Predicted,” the Specialist concluded.

Information and analytical analyst Vladislav Antonov has a different opinion. He attributed Bitcoin's rise on April 2 to the cascading execution of stop orders on short positions.

“During the Correction, Sellers and Buyers Started to Re-Open Positions. Sellers Believe that the Growth Was Unreasonable. Buyers Believe That “Crypto Winter” Is Over, And Bitcoin Will Rise in Price to $6000-$6300. “Bears” Are Now Licking Their Wounds, Since Many Stops And Liquids Have Triggered (Forced Liquidation Of Open Positions Due To Lack Of Margin Collateral). They Won’t Enter the Market for About a Month,” Antonov suggested.

The analyst is confident that in the next 2-3 days the first cryptocurrency will consolidate at $5,000. Bitcoin needs to stay above $4800 and approach $5300. Only after this is it possible to test the next level of $6,000, the expert added.

Earlier, the co-founder of the Wall Street company Fundstrat, Tom Lee, named the fair price of Bitcoin. In his opinion, the cryptocurrency should now trade at $14,000.

BTC daily chart

The daily chart is not so bearish. BTC created a long lower wick of 9%. This is a very strong sign of buying pressure. Additionally, it was created right at the $51,000 support zone.

Moreover, technical indicators remain optimistic. The RSI caused a significant hidden bullish divergence, which was confirmed by yesterday's close.

The MACD is positive and the stochastic oscillator has not yet made a bullish crossover.

Where do bitcoins come from?

There are several ways to become the owner of bitcoins - buy them in exchange for rubles or other real currency, or receive them as a reward for work done. But the original source is mining: generation through mathematical calculations. Theoretically, owners of any computer can install mining programs in order to earn the virtual currency Bitcoin.

When they try to understand everything about bitcoins, they first study the issues of its mining.

In practice, the following features of Bitcoin currency mining have developed:

- The economic feasibility of mining depends on the power of the computer. It should have the most powerful gaming video card installed, then it makes sense to engage in generation.

- Before starting round-the-clock operation, it is worth measuring the mining speed, and then comparing the real energy costs with the profit received.

- You can significantly speed up the procedure for receiving bitcoins by joining a pool with like-minded people. Due to the shared network computing resources of each of the participants.

The high complexity of calculations limits the rapid generation of BTC currency; the process is limited by the limited capacity of typical home computers (even for gaming configurations). Therefore, the transition to professional cryptocurrency mining is carried out through the acquisition of specialized equipment. It is capable of calculating/calculating BTC with maximum efficiency since the hardware and software of such technology is created exclusively for this purpose.