Each country strives to create the most favorable economic conditions for its own development, ensuring the financial security of its citizens. However, the unpredictable nature of the global economy and sudden political events often lead to negative changes in the economic sphere. As the main financial institution of the state, the Central Bank manages and controls the monetary system, adjusting the basic conditions in accordance with the current situation. Interest rates are one of the main tools for quickly adapting the economy to current realities.

RegistrationDemo account

Interest Rate Determination

The interest rate is the cost of providing a loan received from the borrower. This indicator is expressed as a percentage of the loan amount and is accrued at specified periods in accordance with the loan agreement. The interest rate represents compensation for the risk of not repaying the borrowed amount, which inevitably arises in credit relations.

The lender determines the interest rate taking into account the following factors:

- the potential ability/inability of the borrower to repay the debt;

- availability of liquid collateral;

- current inflation level - the more active the inflation process, the higher the interest rate;

- duration of the loan agreement: long-term contracts are subject to higher risks;

- cost of borrowing funds: the lender's cost of earning money that was lent to the borrower

Interest rates are classified into main categories depending on the specifics and scale of the action.

#2. Discounting (helps you understand what is better: take an installment plan or pay now with a discount)

We looked at what rates there are and what methods of calculating interest there are. If interest is paid at the end of the deposit term, interest is called simple

, if interest is paid with some frequency, then such interest is called

compound

.

Let's solve the inverse problem. Let's say we know how much we will be paid in the future (for example, someone promised us payment for some product). We also know what the current interest rate is. How can we calculate the current price of this product?

As stated earlier, the future value of the payment amount will be equal to the current value multiplied by one plus the interest rate. If we express the current value from this formula, it will equal the future value divided by one plus the interest rate.

If interest is accrued at some frequency, then in general the formula looks like this:

T is the number of interest payment periods.

This process of dividing the future value by one plus the interest rate to the power of T is called discounting

.

And the multiplier, one divided by the sum of one plus r to the power of T, is called the discount factor

. Let's return to the problem of which award is better to choose. Depending on the bonus method, the payment amount may differ. However, it is not always obvious which method is preferable. To give the correct answer, you need to solve a math problem. Suppose we have the opportunity to borrow 105 thousand rubles at the end of the year at an interest rate of 5 percent. Or we can choose another bonus method, when we are paid 50 thousand rubles every six months at the same interest rate.

Let's compare these two payments. To do this, let’s calculate what the current value will be for each of these payments. Using the formula to find the current value, we need to discount 105 thousand at a rate of five percent (in this case T = 1). We get 100 thousand.

To find the current value of payments every six months, we must discount 50 thousand rubles (which we will receive in six months) at a rate of two and a half percent (because accrual occurs only in the first six months. Strictly speaking, the rate for 6 months is not equal to half the annual rate. N(1+x)(1+x)=N(1+0.05) => x=2.4695% we invest for 6 months, and then again for 6 and this is identical to investing for a year), five percent per annum divided by two , plus 50 thousand received at the end of the year, which we discount at a rate of 5 percent. As a result of calculations, we get the price of the first payment for six months in the amount of 48,780 rubles 49 kopecks and the second payment - 47,619 rubles 5 kopecks. The amount of valuables is 96,399 rubles 54 kopecks.

Obviously, the offer to receive 105 thousand rubles in a year is more profitable than receiving 50 thousand every six months. Although intuitively it might seem to you that the difference is insignificant, given that you will receive the money faster. Mathematics tells us that this is not so.

It is more profitable to receive a bonus of 105 thousand rubles by waiting longer.

This principle works when assessing various life situations.

For example, when you are offered to buy a car in installments or pay the full amount now with some discount. You need to take the future amount you will pay, reduce it to the current value, and then compare payments occurring at the same point in time.

In this case, the comparison will be correct.

National interest rates

The minimum interest rate is determined by the Central Bank of the country, which is under state control. The main banking institution issues loans to commercial banks, stimulating and controlling the entire credit and financial sector. Interest received from loans is sent to the state budget.

Using the base interest rate, the Central Bank can influence such important processes as the exchange rate of the national currency, the level of inflation, and the volume of consumer and mortgage loans. In all cases, the main goal is to create a favorable atmosphere for the country's economy with a decrease in unemployment, stabilization of inflation and an increase in gross domestic product.

Economic and social function of interest rates

The interest rate reflects the cost of lending from the Central Bank. When interest rates fall, commercial banks can obtain large loans on more favorable terms. Accordingly, subsequent lending to businesses and individuals will be carried out with low annual interest rates. This situation will have a positive impact on the economy and the well-being of citizens. The opposite scenario will become a brake on economic activity with all the ensuing consequences. Below we will tell you in which cases an increase in the base rate becomes a positive factor.

Bank rate for today

The Bank of Russia sets the bank rate for commercial credit institutions for a certain period. You can find it on the official website of the financial institution or in open sources of information.

Each bank sets its own banking rate for its clients. Its size for individuals and legal entities and for certain types of loans may be different. Information about the bank rate can be found on the website of the financial institution. The bank rate is an important criterion for the profitability of cooperation with a credit institution.

Simple and compound interest

- Simple interest is a fixed loan price calculated from the initial cost of the loan.

- Compound interest is a lender's accumulative commission in which the principal body of the loan increases over a specified period, including interest rates from previous periods.

RegistrationDemo account

Example: A borrower takes out a loan of $10,000 with an annual rate of 10% for 3 years. If the agreement specifies simple interest, then every year you need to pay the bank an additional $1,000, and the entire cost of the loan will be $3,000.

If we are talking about compound interest, then the commission for the first year will be $1000, for the second – $1100 (taking into account 10% of the first interest premium), and for the third – $1210 (10% of the increased base amount of $12,100). Ultimately, the borrower will have to pay the bank a fee of $3,310.

Nominal, real and effective interest rates

- Nominal interest rate . Over the course of the loan agreement, the effective value of the interest rate may decrease as a result of inflation. Despite the fact that the purchasing power of the national currency may fall significantly over time, the lender will still receive a nominal interest rate in accordance with the agreement.

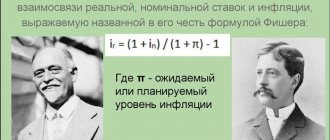

- Real interest rate . When the nominal loan fee is adjusted for inflation, the premium is called the real interest rate. If at the time of granting the loan (10% per annum) the inflation rate was 3%, and at the end of the contract it rose to 5%, then the real interest rate would be 8%, that is, it would be 2% less than the planned income.

- Effective interest rate . This type of bank credit commission is used when calculating the nominal interest rate on compound interest loans. In other words, it is a nominal interest rate that takes into account the complexity of the period. It is calculated using the formula:

Effective interest rate = [(1 + (i/n)^n) – 1] x 100

- i: interest rate

- n: difficult period

Example: A bank issues a loan of $10,000 dollars at a 10% per annum nominal interest rate compounded quarterly. Effective interest rate = [(1 + (10% / 4)^4) – 1] x 100 = 10.38%. In other words, when the 10% nominal interest rate is adjusted for the hard period, the bank will actually earn 10.38% interest on the $10,000 loan.

General information about PS

The interest rate set by the bank determines how much interest you will pay for using credit funds, and therefore whether it is profitable to take out a loan. We all know how important PS is for borrowing or saving money. So what does changing them mean in practice? The effect of increasing or decreasing PS is shown in Table 1 below. Table 1. Interest rate properties

| High interest rates | Low interest rates |

| Local currency becomes more stable | The local currency is losing its stability |

| Lower returns for foreign currency buyers | For foreign buyers, local currency becomes more accessible |

| Savings increase | Expenses are increasing |

| Less income | More income |

| Loan payments are increasing | Loan payments are decreasing |

| More interest on deposits | Less interest on deposits |

The impact of interest rates on the country's economy

The base interest rate determined by the Central Bank is a powerful tool for regulating the state economy. The main task of this function is to create an optimal monetary policy that promotes the development of all economic and financial sectors. Stable economic growth is usually predicted at the following indicators:

- inflation – at the level of 4%,

- GDP growth – at the level of 3%

- unemployment – at 4%

However, in practice, these standards are constantly getting out of control, which requires taking various measures, including adjusting the interest rate. Lowering or raising the base rate allows you to control the money supply, stimulating or restraining economic processes. Accordingly, there is another classification of base interest rates.

RegistrationDemo account

- Interest rates in an active economy with a strategy of domestic and international expansion . In this case, we are talking about a decrease in interest rates, leading to cheaper loans. Accordingly, a business can use cheaper loans by investing the remaining funds in its own development, including modernization and expansion of its commercial geography. The dynamic growth of business activity increases the gross domestic product, creating conditions for successful competition with imported goods and services. Ultimately, consumer demand increases, which inevitably leads to price inflation in the domestic market. If this phenomenon remains stable, then the situation may end in hyperinflation of market prices. A significant increase in the cost of goods and services will lead to a drop in sales and demands for higher wages. This in turn could cause mass layoffs. As a result, rising unemployment will reduce GDP, and serious problems will arise in the country's economy. In this case, it is necessary to change expansive tactics to a containment strategy.

- Interest Rates in a Containment Economy . If the difficulties mentioned above begin to slow down economic development, the Central Bank decides to increase the base interest rate. Expensive loans will put a barrier to large expenses with a corresponding decrease in consumer demand. The imbalance of supply and demand will shift towards oversaturation of the market with supply. Therefore, prices for goods and services will inevitably fall, and with them hyperinflation will move into a moderate phase.

Loan interest and its use in a market economy

18.1. The nature of interest

Loan interest is a kind of price of the value lent for temporary use (loan capital).

The existence of loan interest is due to the presence of commodity-money relations, which in turn are determined by property relations. Loan interest arises where one owner transfers a certain value to another for temporary use.

For the lender, who renounces the current consumption of material goods, the purpose of the transaction is to obtain income on the loaned value; the entrepreneur also attracts borrowed funds in order to rationalize production, including increasing profits, from which he must pay interest.

If we proceed from the principle of equal return on invested funds, then for one ruble of borrowed funds there is a profit amount corresponding to the return on one’s own investments. The clash of interests of the owner of the funds and the entrepreneur who puts them into circulation leads to the division of profits on the invested funds between the borrower and the lender. The latter's share appears in the form of loan interest.

This definition of the nature of loan interest is based on a number of basic theoretical approaches to the interpretation of the reasons for its occurrence.

Marxist theory of interest

According to the Marxist theory of loan interest, the source of its formation is the surplus value obtained in the production process, which is divided into two parts: business income and loan interest as payment for the use of the provided capital. In this case, the interest rate is determined by the ratio of supply and demand for borrowed capital.

Marxist theory gives the following definition of loan interest: “If price expresses the value of a commodity, then interest expresses the increase in the value of money capital and therefore is represented by the price that is paid for it to the lender.” At the same time it is argued that “interest as the price of capital is an expression from the very beginning completely irrational,” since price is reduced to a purely abstract form, namely, to a certain amount of money paid for something that appears as a use value.

Marxist theory introduces a separation of two concepts: capital-property and capital-function. Interest is the income of capital-property, payment to the capitalist for being the owner of loan capital. Entrepreneurial income is the remuneration of the capital function for entrepreneurial activity.

Marginal utility theory

According to the theory of marginal utility, interest arises in connection with a person’s psychological preference to consume material goods today, as well as to receive additional income as a result of wise management of money, rather than postponing this process for the future. Accordingly, the interest is considered as some compensation for the refusal of the owner of the funds from their current consumption.

Net productivity theory of capital

In the interpretation of the theory of pure productivity of capital, interest arises as a result of the exchange of a sum of current goods for a larger sum of future goods. As a result of the productive use of capital, production efficiency increases, which leads to an increase in the output of the final product. This increase in output is called net productivity of capital and is measured by the level of interest.

Theories of interest in economic literature of the Soviet period

In the economic literature of the Soviet period (especially the 20-30s), loan interest was most often considered as a means of reducing production costs or as a way to reimburse bank expenses. Indeed, interest costs were included in the cost of production. It was believed that excessive interest costs due to irrational use of credit reduce the profitability of enterprises and, accordingly, reduce their savings. At the same time, the bank received a profit in the form of the difference between income from collecting interest and the cost of paying it, minus other expenses of the credit institution. It was argued that lower active rates would encourage banks to cut costs and ultimately improve their profitability.

Later, in the 50s, theories began to appear in which socialist accumulation was recognized as the economic basis of interest. Loan interest was considered as part of the savings of enterprises resulting from the use of working capital, including borrowed funds, and due to the bank for loans provided to them.

A similar approach continued in the 60-70s of the twentieth century, when loan interest was determined as part of the net income of society. During the same period, a number of specialists saw loan interest as a fee for the use of borrowed funds.

In the 80s, theories defining loan interest as the irrational price of a loan (loan fund) took a dominant place in Soviet economic literature.

Functions and role of loan interest

The development of market relations in Russia determined the transformation of the functions of loan interest inherent in it in the administrative-planned economy system: the stimulating function and the profit distribution function into a more broadly interpreted regulatory function.

If the level of loan interest is based on the relationship between demand and supply of credit, which is typical for a market economy, it must clearly reflect changes in economic conditions. Incentives for additional investment using credit will continue as long as the expected profitability is greater than or equal to the current interest rate. However, this scheme currently does not fully correspond to real economic conditions. Despite the market formation of the level of loan interest, a number of reasons (inflation, features of monetary regulation, underdevelopment of the money market, the forms of state regulation of certain sectors of the economy used) do not allow interest to fully realize its regulatory function.

At the same time, in the conditions of the modern Russian economy, certain elements of economic regulation related to loan interest operate. This is manifested in the role that interest plays in the economic sphere:

- through the interest rate, the ratio of demand and supply of credit is balanced. It promotes a rational combination of own and borrowed funds. In the conditions of market formation of the level of loan interest, attracting borrowed funds into circulation is profitable only if the loan covers temporary and necessary additional needs. Any excessive use of credit reduces the overall level of return on investment;

- The rate of payment for resources established by the Bank of Russia, along with the norm of required reserves and the conditions for the issue and circulation of government securities, is gradually becoming an effective means of managing commercial banks. Without resorting to direct regulation of the interest rate policy of the latter, the Bank of Russia determines the unity of interest rate policy across the economy, stimulating an increase or decrease in interest rates;

- interest regulates the volume of deposits attracted by the bank. The growth in the economy's needs for loans must be covered by a corresponding increase in bank deposits as sources of lending. This leads to an increase in deposit interest rates to an amount that balances the supply of deposits and the demand for them from the credit institution. On the contrary, with a reduction in the farm's need for loans, the bank's income from loans provided will decrease. He will be able to increase profits by reducing the volume of passive transactions. Thus, a decrease in the influx of resources into the credit system is a reaction to a decrease in the economy’s need for borrowed funds;

- The interest rate policy of a commercial bank today is aimed at appropriate management of the liquidity of its balance sheet. Differentiation of the level of loan interest on active operations depending on the liquidity of investments leads to compliance of the demand for risky credit on the part of borrowers with the liquidity requirements of the banks' balance sheets. The role of interest on deposit transactions as an incentive to attract the most stable funds into the circulation of a credit institution can be seen in a similar way.

In general, strengthening the role of loan interest in the economy and turning it into an effective element of economic regulation is directly related to the state of the economic situation in the country. Modern economic relations are characterized by the strengthening of the role of loan interest as a result of the manifestation of its regulatory function.

Forms of loan interest

Loan interest can take different forms; their classification is determined by a number of characteristics, including forms of credit, types of operations of a credit institution, types of investments using a loan, and loan terms.

As an example, we can cite the following classifications of loan interest forms (Fig. 18.1 and 18.2).

Rice. 18.1.

Rice.

18.2. The presence of various forms of loan interest in practice determines the variety of interest rates.

Discount rate relative to the federal funds rate

In the United States and several other major economies, central banks can set different interest rates on central bank and interbank lending. The interest rate for borrowing from the central bank is called the discount rate, while the interest rate for interbank loans is called the federal funds rate.

The federal funds rate is usually lower than the discount rate. This imbalance makes it possible to stimulate commercial banks, which find it more profitable to receive loans from each other than to apply for government loans. If the Central Bank is the lender, then the commercial loan is financed either from national reserves or by printing money. Interbank lending does not have a negative impact on the state of the money supply. Therefore, this division of the base interest rate allows for flexible manipulation of the main instruments of the financial and credit sector, reducing the likelihood of hyperinflation.

How to factor interest rates into your trading decisions

Interest rates, like the trade balance, are retrospective economic indicators determined based on historical data from economic reports. Analyzing the figures of the past reporting period, the Central Bank decides to increase or decrease the base interest rate. Another option is to keep the rate at the same level.

Decisions on changes in interest rates are made every month or once every six weeks. This process is accompanied by a public conference at which the leadership of the Central Bank justifies the correction of base interest rates. In crisis conditions, unscheduled adjustments can be made to reduce the consequences of global economic shocks.

RegistrationDemo account

Raising interest rates is considered by Central banks as an aggressive move (“hawkish strategy”), since in this case the cost of lending in the national currency inevitably increases. Banks receive more income in the form of loan fees. The value of the national currency on international markets increases, beginning to stimulate imports. At the same time, the profitability of government treasury bonds, which at all times are considered the safest and most reliable investment, is growing. Accordingly, investors focus their attention on these assets, temporarily ignoring riskier investments in stocks and indices.

The reduction in interest rates is unofficially called the “dovish approach”, which opens up access to cheap loans in the national currency, which is gradually losing value. Interest-bearing lending also depreciates to some extent. In this situation, investors are willing to take risks by expanding their portfolios with investments in stocks, indices, commodities and precious metals.

Example of market reaction to interest rate changes

Let's say the US Federal Reserve is due to announce an interest rate decision soon. Analysts currently forecast a decline of 0.25%. Market sentiment already includes a decision for the day, with key USD pairs falling into a downtrend. The dovish approach will inevitably reduce the US dollar. Moreover, in the event of a serious reduction in the base rate, for example by 0.5%, panicky “bearish” sentiment can reduce dollar quotes to a minimum. In the opposite scenario, investors would begin to bullish, which would lead to the formation of an upward dollar trend.

Taking this example into account, interest rates provide an opportunity to speculate on the rise or fall of a currency, concluding transactions based on fundamental analysis and analytical forecasts. Well-informed information creates trading opportunities, but also risks due to the fairly rapid increase in market volatility. The actions of the central banks of leading countries in this sector shape the prospects for reliable news analysis with the subsequent adoption of effective trading decisions.

What is a key rate and why is it changed?

The key rate is the interest rate at which the Central Bank lends money to commercial banks. And also the maximum rate at which they place funds on Central Bank deposits. There are eight meetings of the Board of Directors of the Bank of Russia per year, at which they decide to change the key rate or keep it at the same level. The schedule is known in advance; it is published in the Key Rate Decision Calendar on the Central Bank website.

By changing the key rate, the Central Bank can maintain the target inflation rate - currently about 4%. In this case, prices rise at a more planned rate, and people and businesses feel a little calmer. If inflation rises, the Central Bank raises the rate. This somewhat slows down business processes, but at the same time it also slows down prices. The opposite is also possible: the economy is slowing down. Then the key rate decreases, credit money becomes cheaper, which spurs business.

The key rate reached a historical minimum. The key rate of the Bank of Russia was on July 24, 2022 - it was lowered to 4.25% and raised only on March 19, 2021 - by 0.25%. The maximum was 17%. On December 16, 2014, it was immediately raised by 6.5% About the key rate of the Bank of Russia and other measures of the Bank of Russia due to the sharp strengthening of the dollar. This was done to prevent banks from taking out cheap loans to buy foreign currency and encourage further weakening of the ruble.

Screenshot: Central Bank website

Base interest rates of leading countries

US Federal Funds Rates

- Region: North America

- Issue date: 8 times a year

- Issuing Agency: Federal Open Market Committee (FOMC) of the Federal Reserve System (FRS)

- Assets involved: US dollars; US stocks and bonds; Dow Jones, S&P 500, NASDAQ 100; goods traded in US dollars

Official EU interest rates

- Region: Europe

- Issue date: 8 times a year

- Issuing Agency: European Central Bank (ECB)

- Affected assets: EUR; EuroStoxx50; DAX 30, CAC 40; government bonds of EU member states

UK base rate

- Region: Europe

- Issue date: 8 times a year

- Issuing Agency: Monetary Policy Committee (MPC) of the Bank of England (BoE)

- Assets involved: GBP, EUR; UK shares; FTSE 100; British gilding

Canada Interest Rate

- Region: North America

- Issue date: 8 times a year

- Issuing Agency: Bank of Canada (BoC)

- Affected Assets: CAD; Canadian stocks; S&P/TSX; Canadian market bonds; raw oil

Interest Rates In Japan

- Region: Asia

- Issue date: 8 times a year

- Issuing Agency: Bank of Japan (BoJ)

- Assets taken into account: JPY; Japanese stocks; Nikkei 225; Japanese government bonds

China Base Interest Rate

- Region: Asia

- Issue date: 8 times a year

- Issuing Agency: People's Bank of China (PBC)

- Assets involved: CNY, AUD, NZD; Chinese stocks; China A50; Chinese government bonds

Australian Basic Rate

- Region: Oceania, Asia

- Issue date: 8 times a year

- Issuing Agency: Reserve Bank of Australia (RBA)

- Affected assets: AUD, NZD; Australian and New Zealand shares and bonds; ASX 200 index