The cryptocurrency's wild rides continue to be unstoppable - and the hype is likely to grow even more as several Bitcoin futures ETFs go public.

The ProShares Bitcoin Strategy ETF began operations, launching on October 19 under the symbol BITO. Previously, the securities commission had been hesitant to approve a Bitcoin ETF, with 13 applications reportedly awaiting regulatory approval in July.

However, investors have many other options. Here are the best Bitcoin ETFs and other cryptocurrency ETFs available to investors today. We're looking at new Bitcoin ETFs, including a third fund launched in November.

But most of these products deal either with stocks that are somehow related to cryptocurrencies, or with other types of exposure that have their own characteristics.

The frenzied buying and selling of cryptocurrencies remains unstoppable – and the hype is likely to grow even further as several Bitcoin futures ETFs have come to life.

A short list of ETFs is at the bottom.

To have access to all of these funds, you need an account with an overseas broker, such as Interactive Brokers. How to open an account, read the detailed instructions.

ProShares Trust – ProShares Bitcoin Strategy ETF (BITO).

ProShares Bitcoin Strategy ETF, launched on October 19, became the first ETF in the United States to provide investors with exposure to Bitcoin futures.

The most important thing to note right away is that BITO does not invest directly in Bitcoin, allowing for the highest possible individual exposure. Instead, he invests in first-month cash-settled Bitcoin futures—the contracts with the shortest time to maturity.

The futures contracts in which BITO invests are regulated by the Commodity Futures Trading Commission. These contracts are traded only on the Chicago Mercantile Exchange and are subject to the rules of the CME.

The ETF may also invest in U.S. Treasury bills and repurchase agreements as short-term investment vehicles for cash positions and may also use leverage.

Investors looking for context should be aware that BITO will be more like the United States Oil Fund (USO), which also invests in futures and does not exactly track the price of oil, rather than a "physical" ETF such as SPDR Gold Shares (GLD). which invest directly in the underlying asset to provide more accurate price tracking.

The best crypto exchanges, read more.

What is an ETF?

Exchange Traded Fund (ETF) is an index fund whose shares are traded on an exchange.

In fact, an ETF is a type of security that acts as a certificate for a portfolio of stocks, bonds, commodities or cryptocurrencies. The price of this security follows an index based on certain underlying assets.

In the US, to register a fund, the ETF provider submits an application to the Securities and Exchange Commission (SEC). The latter classifies shares of such funds as securities.

Valkyrie Bitcoin Strategy ETF (BTF).

The BTF ETF launched three days after the ProShares ETF went public.

BTF itself is very similar to BITO in that it does not invest directly in Bitcoin, but rather in Bitcoin futures on the Chicago Mercantile Exchange through a subsidiary in the Cayman Islands.

Valkyrie, a Tennessee-based alternative asset manager with decades of experience managing traditional and digital assets, already offers trusts for a variety of cryptocurrencies, including Bitcoin, Polkadot, Algorand and others, but BTF is its first cryptocurrency ETF. However, the company believes it could launch additional futures-based Bitcoin ETFs in the coming weeks.

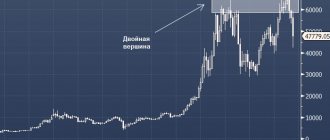

Expected market impact

Director of the financial company EMFINANCE, Evgeniy Marchenko, sees the launch of Bitcoin ETF as a positive factor. After all, no one will dispute the existence of investors with a risk profile that allows them to invest in virtual currencies. For them, the insecurity of the asset and its volatility do not matter much, since they are attracted by speculative risk.

At the same time, this group of investors is not satisfied with the legislative mechanisms used in trading. In addition, they question the security that regulators “supposedly provide” when using crypto wallets and crypto exchanges. Therefore, Bitcoin ETF is an ideal format for them, since it implies that the provider will resolve all issues related to the safety of assets.

As a result, if Bitcoin-ETF is launched on the American stock market (which is the largest in the world), we should expect an active infusion of funds into virtual currencies. And this will contribute to an increase in the value of the asset and a decrease in its volatility.

Tatyana Maksimenko, the official representative of the Garantex cryptocurrency exchange, agrees with this point of view. The acceptance and launch of a financial instrument will signal to the entire market about the emergence of a new asset, which cannot be ignored.

This will provoke a sharp increase in the Bitcoin rate, and will also become a driver for the development of cryptocurrency technologies and the introduction of digital assets into traditional financial services. Bitcoin-ETF is destined to turn BTC into the mainstream of the financial world - this is the opinion expressed by Maksimenko.

However, she also agrees that there is no point in waiting for the launch of a Bitcoin ETF this year. Most likely this will happen in 2-3 years. Although the world of cryptocurrencies is so unpredictable that anything can happen in it.

VanEck ETF Trust VanEck Bitcoin (XBTF).

VanEck Bitcoin Strategy ETF (XBTF) launched its first exchange-listed Bitcoin ETF in the US on November 15, and it comes to market as the low-cost leader among Bitcoin futures ETFs with expenses of 0.65%.

Greg Krenzer, VanEck's head of active trading, is an ETF portfolio manager and boasts more than two decades of trading experience, including futures. This is good because XBTF, like other Bitcoin-related ETFs that have launched over the past couple of months, invests in CME-listed Bitcoin futures.

“While a physically backed Bitcoin ETF remains a key goal, we are thrilled to provide investors with this important tool for building their digital asset portfolios,” says Kyle DaCruz, Chief Digital Asset Product Officer at VanEck.

Will Bitcoin replace gold? Read the experts' opinions.

Position of Bitcoin ETF Opponents

Many prominent members of the crypto industry are skeptical about exchange-traded funds.

Thus, trader and analyst Ton Weiss, well-known in the crypto community, argues that the price of Bitcoin will not necessarily rise after the launch of an ETF based on it.

Bitcoin evangelist Andreas Antonopoulos calls such funds a “terrible idea.” According to him, due to ETFs, the cryptocurrency market will become more centralized and subject to aggressive manipulation by institutional investors.

The famous cryptographer Nick Szabo also criticized the Bitcoin ETF. He believes that such funds may do more harm than good.

“I don’t lobby for ETFs. They can create more problems than value. The recent Bitcoin sell-off has thrown or will soon throw many ignorant people out of the market. We don’t need new ones to take their place ,” Szabo emphasizes.

Ethereum creator Vitalik Buterin is convinced that the crypto industry needs not so much exchange-traded funds as practical and useful applications.

Grayscale Bitcoin Trust (BTC) (GBTC).

Grayscale Bitcoin Trust (GBTC) is one of the few ETF-style funds that are not ETFs, or mutual funds for that matter. This is what is described as a closed grantor trust. This means that it issues a fixed number of shares when it goes public, and then those shares are traded on the over-the-counter market.

GBTC stock is designed to track the price of Bitcoin based on the CoinDesk Bitcoin Price Index. Currently, each share of the Grayscale Bitcoin Trust is worth 0.00093535 Bitcoin, but this number is not fixed. This is because, unlike ETFs, closed-end trusts such as GBTC can trade at a discount or premium to their underlying assets.

Today, the Grayscale Bitcoin Trust is trading at a 14% discount to the net value of Bitcoin held by the Trust, meaning you were effectively buying Bitcoin at 86 cents on the dollar. At the other end of the spectrum, it was trading at a 40% premium in December 2022.

Grayscale Investments manages over $38 billion in digital currency assets, with Bitcoin representing the majority of these assets.

Investors concerned about fees may not like the fact that the trust charges a 2% management fee. This is sky-high compared to the average fee of 0.53% for ETFs, but still quite high compared to the average fee of 1.42% for mutual funds.

However, when you consider that buying or selling Bitcoin directly can cost 1.49%, and the average hold time for Coinbase buyers and sellers is 53 days, the argument against high fees is not so clear-cut.

Where it leads?

The SEC's decision became a landmark for the entire crypto market. In fact, it may mean that other barriers may soon be removed, and cryptocurrencies will change their semi-legal status to a more official one and will receive recognition from the authorities of many countries.

This may cause rapid growth in both the overall capitalization of the cryptocurrency market and the value of individual digital assets.

Author

: Dmitry Noskov – expert of the StormGain crypto exchange (platform for trading, exchanging and storing cryptocurrency)

Amplify Transformational Data Sharing ETF (BLOK).

The Amplify Transformational Data Sharing ETF (BLOK) is similar to many US cryptocurrency ETFs in that it is primarily invested in stocks, but it has a clever way of providing a little more “direct” exposure.

BLOK is an actively managed fund that seeks to invest at least 80% of its assets in companies that are involved in the development of blockchain technologies or use them in their business.

The ETF has 47 companies, 10 of which make up about 45% of its assets. That number includes MicroStrategy (MSTR), a data analytics software company that has become better known for its Bitcoin investments than its existing business. Bitcoin miners such as Marathon Digital (MARA) and Hut 8 Mining (HUT), and Coinbase Global (COIN), one of the world's leading cryptocurrency exchanges, which went public in April.

However, there are several interesting companies outside the top ten. Specifically, BLOK invests in the Target Bitcoin ETF (two listings, one in Canadian dollars and one in US dollars), as well as the 3iQ CoinShares Bitcoin ETF—all of which are Canadian ETFs that directly track Bitcoin.

| SILVERGATE CAP | S.I. | 6.16% |

| NVIDIA | NVDA | 5.27% |

| COINBASE | COIN | 4.98% |

| GALAXY DIGITAL | GLXYCN | 4.90% |

| HUT 8 MNG CORP | HUT CN | 4.26% |

| HIVE BLOCKCHAIN TECHNOLOGIES | HIVE CN | 3.90% |

| BITFARS LTD | BITF CN | 3.83% |

| RIOT BLOCKCHAIN | RIOT | 3.65% |

| MARATHON DIGITAL HOLDINGS | MARA | 3.59% |

| OVERSTOCK COM | OSTK | 3.22% |

TOP 10 stocks in ETF BLOK.

Summary

- ETFs can be a remedy for many of the barriers preventing investors from entering the cryptocurrency market.

- Cryptocurrency ETFs can track a single cryptocurrency or a basket of different digital tokens and currencies.

- Cryptocurrency ETFs are already traded in a number of countries, but regulators have so far rejected repeated attempts to offer such products on US exchanges.

- There are a number of alternatives on the market that allow you to leverage cryptocurrency without requiring investors to manage the digital assets themselves, but these options are inferior to traditional ETFs in many ways.

- Blockchain ETFs allow you to invest in companies that are closely linked to the cryptocurrency market, and thus allow indirect investment in cryptocurrencies.

And that’s all about cryptocurrency ETFs today. Share the article with friends on social networks and instant messengers. Good luck and see you again on the pages of the Tyulyagin !

- 1

Share

Bitwise 10 Crypto Index Fund (BITW).

Launched back in 2017, the Bitwise 10 Crypto Index Fund (BITW) tracks the performance of the Bitwise 10 Large Cap Crypto Index, representing the 10 largest investable cryptocurrencies. These 10 cryptocurrencies make up 70% of the entire cryptocurrency market.

Since BITW is market cap weighted, Bitcoin makes up 65% of the portfolio. This is more than double Ethereum at 25%. Cardano is in third place with 4%.

BITW only became available on the OTC market in December 2020. He started trading with just $120 million in assets - less than a year later that was 10 times that amount, indicating how popular these instruments have become.

Its press release announcing the availability of the OTC market explains how it works compared to ETFs.

Although the Bitwise 10 Crypto Index Fund is structured differently than GBTC, it can still trade at a premium or discount to its net asset value per share. BITW is currently trading at a healthy 22% discount to NAV.

Siren Nasdaq NexGen Economy ETF (BLCN).

It is a passively managed index ETF that tracks the performance of the Nasdaq Blockchain Economy Index, which consists of stocks that support or use blockchain technology for their businesses.

BLCN, launched in January 2022, has 63 companies. The index starts with all companies with a market capitalization greater than $200 million that exhibit the characteristics of a “blockchain company.” It then assigns them a “blockchain score,” a proprietary index screening methodology that ranks each company based on their ability to benefit from blockchain technologies.

The ETF is quite diversified. The top 10 companies account for just 20% of its total assets. Silvergate Capital (SI), which provides loans and banking services to companies related to cryptocurrencies, blockchain and fintech, is the largest company with a 2.6% share of the portfolio. Silvergate provides loans and banking services to companies related to cryptocurrencies, blockchain and financial technology.

The top three are technology (43%), finance (33%) and communications (11%). And BLCN is very much a "global" fund, with the US accounting for 53% of assets and the rest coming from other countries, including Japan (13%) and China (13%).

First Trust Indxx Innovative Transaction & Process ETF (LEGR).

First Trust Indxx Innovative Transaction & Process ETF (LEGR) is another equity-based cryptocurrency ETF that launched in 2022. It tracks the performance of the Indxx Blockchain Index, an index that tracks companies that have some exposure to blockchain technologies - and it has an interesting weighting methodology.

The LEGR Index takes into account all available blockchain companies and ensures that each company meets certain size, liquidity and trading minimums. It then applies a score of 1 to companies actively developing blockchain technology, 2 to companies actively using blockchain technology, and 3 to companies actively exploring blockchain technology.

In this case, the index only includes companies rated 1 or 2, with 50% of the weight given to companies rated 1 and 50% weighted to companies rated 2, completely excluded. The portfolio is limited to 100 stocks, and the index is rebalanced and updated twice a year.

Simplify US Equity PLUS GBTC ETF (SPBC).

The Simplify US Equity PLUS GBTC ETF (SPBC) offers very limited exposure to Bitcoin, but this is intentional.

The fund, which launched in late May, has already amassed more than $100 million in assets, "giving it 110 percent." That is, SPBC manages to provide a 100% investment in stocks along with an additional 10% investment in Bitcoin.

The majority of SPBC's exposure to the market comes from holding the iShares Core S&P 500 ETF (IVV), which is one of the core S&P 500 ETFs. However, it also invests a small portion of its assets in the E-mini S&P 500 Futures, which provides much greater exposure to a broader market than an ETF can provide. This allows him to invest between 10% and a maximum of 15% in the Grayscale Bitcoin Trust, which we discussed earlier in this article.

For decades, allocation funds acted as a “turnkey portfolio,” providing investors with bonds and stocks in one product. Consider SPBC a more modern iteration for people who find it important to invest in both the stock market and cryptocurrencies.

Bitwise Crypto Industry Innovators ETF (BITQ).

Bitwise Crypto Industry Innovators ETF (BITQ) is another stock-focused cryptocurrency ETF. This index fund tracks the performance of the Bitwise Crypto Innovators 30 Index, created by Bitwise Index Services LLC, which is a subsidiary of Bitwise Asset Management, the world's largest crypto index fund manager.

To be included in the index, a company must generate at least 75% of its revenue from the cryptocurrency ecosystem or have 75% of its net assets in Bitcoin or some other liquid crypto asset. They are considered "crypto innovators" and make up 85% of the index's assets. The remaining 15% of the fund consists of non-innovators with a market capitalization of at least $10 billion and who either have a dedicated business initiative focused on the crypto ecosystem or own at least $100 million in Bitcoin, Ethereum or other liquid cryptocurrencies.

There are three reasons to buy this new ETF: it gives you exposure to the crypto market without directly owning crypto assets, it gives you exposure to companies building crypto infrastructure such as Bitcoin miners, trading platforms, etc. and finally, it gives you a share of global cryptocurrency players like Coinbase.

BITQ owns many of the same stocks as the other funds on this list - names like MicroStrategy, Galaxy Digital (BRPHF) and Silvergate. But due to the concentrated nature of a 30-stock portfolio, the top 10 stocks account for 64% of assets.

A short list of ETFs for Bitcoin or the crypto industry:

- ProShares Trust – ProShares Bitcoin Strategy ETF (BITO).

- Valkyrie Bitcoin Strategy ETF (BTF).

- VanEck ETF Trust VanEck Bitcoin (XBTF).

- Grayscale Bitcoin Trust (BTC) (GBTC).

- Amplify Transformational Data Sharing ETF (BLOK).

- Bitwise 10 Crypto Index Fund (BITW).

- Siren Nasdaq NexGen Economy ETF (BLCN).

- First Trust Indxx Innovative Transaction & Process ETF (LEGR).

- Simplify US Equity PLUS GBTC ETF (SPBC).

- Bitwise Crypto Industry Innovators ETF (BITQ).

This article is for informational purposes only; we do not encourage investing in cryptocurrencies and other risky assets.

CEF, ETF, ETN: how to invest in cryptocurrency through securities

Cryptocurrencies are risky, but can provide great returns. Their price also does not correlate very strongly with the stock and bond markets, because this is, in fact, a different class of assets. Therefore, some investors are ready to allocate part of their portfolio to cryptocurrencies. You can get cryptocurrency, for example, by mining or by purchasing it on crypto exchanges and exchangers. These are the main methods. However, they are not suitable for everyone, for example, due to fears of encountering fraud or reluctance to understand new services and programs.

However, there are cryptocurrency funds and exchange-traded notes, the price of which depends on the behavior of the asset being tracked. This means that you can invest in the most popular cryptocurrencies through the usual exchange infrastructure.

Some of these assets can be accessed through a Russian broker if you have qualified investor status and the broker allows you to trade on foreign exchanges. But it is better to have an account with a foreign broker: you will have access to a larger number of funds and notes.

We'll tell you how cryptocurrency funds and notes are structured and give some examples. Please note that this is not investment advice.

Closed-end funds (CEF), or closed funds

CEFs are similar to Russian closed-end mutual funds. Such funds issue units (shares) upon creation and, unlike conventional mutual funds, open-ended mutual funds and exchange-traded funds, do not constantly accept new money. In this case, the shares are traded, and their price changes throughout the day - just like an ETF.

The problem with CEFs is that the share price can deviate greatly from the “fair” price, calculated as the value of the assets divided by the number of shares. The deviation can persist for quite a long time and at the same time be quite significant. The premium may well be tens of percent, the discount can also be large.

Part of the list of American CEFs sorted by largest discount. Source: CEFconnect

The largest Bitcoin fund at the moment exists in the closed-end fund format. This is GBTC (Grayscale Bitcoin Trust) from Grayscale Investments, launched back in 2013 and made public in 2015.

In mid-November 2022, the fund held 654,600 bitcoins worth $41.9 billion. The fund tracks the CoinDesk Bitcoin Price Index and holds Bitcoin itself rather than using Bitcoin futures, swaps, or anything else. The Factsheet states that Bitcoins are held in offline (cold) storage at Coinbase Custody Trust Company. The fund's expense level is 2% per year.

The fund's shares are actively traded on the over-the-counter (OTCQX) market. GBTC is available, for example, through Interactive Brokers, but Russian brokers may not provide access to it even with the status of a qualified investor.

For quite a long time, GBTC was characterized by a premium: the share was traded above its fair price. In May 2022, the premium exceeded 132%. However, for almost all of 2022, the fund was trading at a discount, that is, below its fair price, and now the discount is 15.6%.

GBTC premium and discount for the last 5 years. Source: YCharts

Grayscale wants to convert GBTC into an exchange-traded fund - ETF, for which it recently filed an application with the US Securities and Exchange Commission (SEC). If the SEC approves it and the fund becomes an ETF, the discount may disappear.

Grayscale has other cryptocurrency funds. This is, for example, ETHE, which tracks the price of ether and has a ready cost of 2.5%.

Like GBTC, it had both a premium and a discount. At the end of 2022, the premium reached a mind-blowing 3550%, and now the shares are trading at a slight discount. Current premium and discount data can be viewed in YCharts.

There are also ZCSH (Grayscale Zcash Trust), HZEN (Grayscale Horizen Trust) and several other funds. There is a list of them on the Grayscale website.

Other companies have similar products. Thus, the OBTC (Osprey Bitcoin Trust) fund has been operating since the beginning of 2021. This is approximately the same as GBTC, but from a different company, much smaller in size and with a lower commission. The premium reached 240%, and now, as YCharts shows, the fund is trading at a discount of about 15%.

There are also cryptocurrency CEFs in Canada. These are QBTC, which tracks the price of Bitcoin, and QETH, which tracks Ether. However, Canada is more interesting for its crypto ETFs, so let’s move on to them.

Exchange-traded funds (ETF), or exchange-traded funds

Exchange-traded funds ETFs are familiar to many investors, and the ETF screener on the Indexera.io website is dedicated to such funds. They belong to open-ended funds and are able to constantly accept new money by acquiring additional assets and issuing new shares.

ETFs can hold a variety of assets, from stocks to commodity futures. Since 2022, there are also cryptocurrency exchange-traded funds.

The first cryptocurrency ETF was the BTCC fund, which tracks the price of Bitcoin. It was launched by Canadian company Purpose Investments in February 2022. This fund is available to Russians, for example, through Interactive Brokers.

There are other Bitcoin ETFs in Canada: BTCQ, BTCX, EBIT and a few more. Their expense level is usually around 1% per year.

Also in Canada, ETFs that track the price of ether began to appear in the spring of 2022. These are, for example, ETHH, ETHQ, ETHX and several more. The expense level is approximately 1% per year, similar to Bitcoin funds.

There is also an ETC fund from Evolve ETFs, which contains both Bitcoin and Ethereum. Essentially, this is a wrapper for two corresponding funds of this company, and ETC itself, unlike the underlying funds, has no commission.

Apparently, all Canadian cryptocurrency funds own Bitcoin or Ether itself, without using derivatives. This improves the quality of tracking.

The launch of BITO, the first American Bitcoin ETF, created quite a stir in October 2022. It was created by ProShares, and the expense rate is 0.95% per year.

The American Securities Commission (SEC) has not approved cryptocurrency ETFs for a long time. The fact that such a fund has appeared in the United States gives hope for wider acceptance of cryptocurrencies - or at least higher demand for Bitcoin, which could lead to an increase in price.

The problem with BITO is that it is based on Bitcoin futures traded on the Chicago Mercantile Exchange (CME). It's highly likely that BITO will track the price of Bitcoin less well over the long term than Canadian ETFs, but at least there shouldn't be a large premium or discount like GBTC and similar closed-end funds.

The fact is that Bitcoin futures have contango, that is, they are traded at a higher price than the underlying asset. This can lead to losses when transferring from futures whose expiration date is approaching to more distant futures. This is discussed, for example, in the article about BITO on Seeking Alpha.

At the end of October 2022, the SEC approved VanEck's application to create a Bitcoin ETF. Its ticker is XBTF. Like BITO, the fund is based on futures and has a lower expense rate of 0.65% per year. Trading began on November 16.

The first day of XBTF trading is November 16, 2022. Source: Interactive Brokers

Currently in the United States, applications for the creation of other bitcoin ETFs are being considered, both based on futures and with physical replication, that is, with bitcoin or ether in the fund’s assets. The funds want to create Direxion, Invesco, VanEck and other providers.

Whether the SEC will approve the launch of such funds is a separate question. But there is a good chance, at least for those funds that are based on futures, like those already approved by BITO and XBTF.

In Australia, the Securities and Investments Commission (ASIC) has approved cryptocurrency ETFs. Such funds must own the currencies themselves, not derivatives, and can also invest in shares of companies associated with cryptocurrency, such as mining companies and crypto exchanges. So far, only the CRYP fund from BetaShares has been launched, consisting of shares of such companies.

The Russian Central Bank is wary of cryptocurrencies. It is unlikely that we should expect such ETFs or mutual funds in Russia in the coming months, or even years.

In Europe there are no full-fledged crypto ETFs available to everyone yet. However, there is a BTC fund on the NYSE Euronext Paris exchange - Melanion BTC Equities Universe UCITS ETF, which invests in shares of companies related to cryptocurrency. There is also a Bitcoin ETF from Jacobi Asset Management, but it is only available to institutional and professional investors, and admission to trading on CBOE Europe is only pending. The fund's assets are held by Fidelity Digital Assets.

But in Europe there are cryptoETNs, so let’s move on to them.

Exchange-traded notes (ETN), or exchange-traded notes

If funds are sets of assets with units (shares) traded on an exchange, then ETN is, in fact, a debt obligation. You can think of an exchange-traded note as a bond, the price of which follows the dynamics of the underlying asset: a stock, index, commodity, etc.

In general, notes are similar to ETFs, they are also traded on an exchange and also have a built-in commission. However, unlike funds, notes have risk associated with the issuer—the person who issued the notes. Because it is a debt obligation, problems of the issuer, especially bankruptcy, can lead to default and loss of money invested in the notes.

Cryptocurrency ETNs are quite common in Europe. They may be referred to as ETP (exchange traded product), but for consistency we will further call them notes or ETN.

According to justetf.com, there are 24 cryptocurrency ETNs in Europe. In fact, there are probably more of them: for example, the list does not include several securities from the company 21Shares. I'll make out two notes.

VBTC from VanEck allows you to invest in Bitcoin. VanEck owns bitcoins, which are held in offline storage. Expense rate is 1% per year.

HODL from 21Shares tracks the 21Shares Crypto Basket index and consists of five currencies: Bitcoin, Polkadot, Ether, Cardano and Cosmos. The weight of one currency ranges from 3 to 50%, rebalancing is carried out once a month, and cryptocurrencies are used, not derivatives. The cost level is 2.5% per year.

HODL note price chart in US dollars. Source: Interactive Brokers

21Shares has another 16 exchange-traded notes that allow you to invest in one or more cryptocurrencies or short Bitcoin.

Part of the 21Shares sheet music range.

Source: 21Shares What is worth remembering about cryptocurrency funds and notes

If you want to invest in cryptocurrency and do not want to master mining and crypto exchanges, exchange-traded funds and notes are suitable. You won’t be able to invest in new and not very popular currencies, but you can invest in Bitcoin and Ethereum.

Funds exist in the United States and Canada in the form of CEFs, or closed-end funds, and ETFs, or exchange-traded funds. Canadian ETFs are based on ownership of cryptocurrencies and generally look like the best way to invest in Bitcoin or Ethereum on an exchange. Both US crypto ETFs track the price of Bitcoin through futures, which could lead to a strong deviation from Bitcoin's performance.

Cryptocurrency notes (ETN) are popular in Europe.

Among the notes there are those that allow you to invest directly in a basket of currencies, and this is convenient. But unlike funds, in the case of notes there is a risk of losing money due to problems of the company that issued them. It is worth choosing notes from large, reliable companies, at least if you plan to invest in them for a long time. Tell us, do you include cryptocurrencies in your portfolio and, if so, which ones, with what weight and through which instruments?

The material was prepared by the author Oleg Goncharov specifically for indexera.io