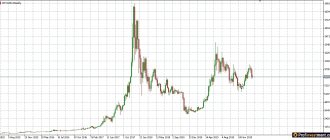

The Bitcoin exchange rate reached its historical maximum twice in a row, which caused an unprecedented stir around itself. Many experienced investors and beginners are at a loss as to what will happen to it next, whether it is worth investing their money in this risky, but such a profitable asset. No one can give a definitive answer to this question. The editors of Profinvestment.com analyzed the opinions of well-known analysts and popular personalities in the crypto world to understand what will happen to Bitcoin in the near future and what prospects await it.

What affects the price of Bitcoin

The Bitcoin exchange rate is influenced by a huge number of large and small factors, among which are:

- State regulation of cryptocurrencies. Despite the fact that Bitcoin was designed as a currency completely independent of centralized authorities, it turns out that its fate is closely tied to the central government. As soon as the government of a country announces a new law that accepts Bitcoin in a positive way, its rate soars. And vice versa, if cryptocurrency is banned somewhere, then the rate drops noticeably. For example, in 2022, the rate fell by almost $2,000 in one day due to a statement by the South Korean authorities about a possible ban on trading in digital currencies.

- Events in the fields of economics and politics. In times of crisis (for example, now, when the coronavirus is raging), people tend to think about how best to store their savings in order to protect them from inflation and other dangers.

- Trader behavior. The crypto market largely works on psychology (see the Bitcoin fear and greed index). Emotions caused by one or another news background can lead to price fluctuations.

- Halving. Halving occurs every four years and halves the amount of reward for a block added to the blockchain. Due to the resulting shortage, the cost naturally increases.

- Ratio of institutional and retail investors. The more institutions invest large sums in Bitcoin, the stronger it becomes in the market; it also improves his authority and reputation, including in the eyes of the government.

By tracking all these factors, you can form a rough vision of what will happen next with Bitcoin. The process requires careful monitoring of all cryptocurrency-related news and the rise and fall of enthusiasm in the market.

How can Satoshi Nakamoto affect the price of Bitcoin?

Bitcoin was born on January 3, 2009. The virtual currency was created by a person or group of people under the pseudonym Satoshi Nakamoto, who have already become a legend. These mysterious personalities are still shrouded in secrecy - no one has ever seen them.

If the anonymity that has been maintained for years is removed, the price of Bitcoin will plummet. This is what experts at the Coinbase crypto exchange think. In their general opinion, the business risks are high. Cryptocurrency has gained immense popularity due to its versatility and decentralization. Digital money is not controlled by either organizations or specific people. This idea appealed to millions of Internet users who joined the global community of Bitcoin fans. If the original principle is violated, the system will lose support and may collapse.

Satoshi Nakamoto is not only the legendary creator of virtual money. These are also some of the richest people in the world. There are currently 21 million bitcoins available for mining. 5% of them belong to Satoshi Nakamoto. If this digital money is put into circulation, a fall in the price of the cryptocurrency is inevitable.

Expert forecasts

Analysts daily express opinions about what will happen to BTC in the near future, which direction the exchange rate will go and what level the cryptocurrency will be at next year. We have collected both optimistic and pessimistic forecasts.

Positive opinions

An analyst from Bloomberg Crypto suggested in a regular monthly report that Bitcoin will retain its tendency to rise in price in 2022. Macroeconomic, technical indicators along with supply/demand indicators point to target resistance at $50,000, as well as market cap heading toward $1 trillion. The reason for the increased demand for BTC and gold this year was the slowdown in the growth rate of fiat currencies caused by the coronavirus, as well as government programs that stimulate inflation.

Wells Fargo's head of real asset strategy, John LaForge, recalled that in twelve years, cryptocurrencies have grown from zero to $560 billion in market capitalization. And he called the current price rally a bit like the early days of the 1850s gold rush, which involved more speculation than investment. At the same time, LaForge points out the promise of Bitcoin in the sense that “experiments usually do not last twelve years; There are good reasons for this—reasons that every investor should consider.”

The creator of the S2F model, PlanB, has no doubt that Bitcoin will reach $100,000 by December 2022. The S2F model attempts to predict the long-term price trend of Bitcoin by estimating its supply. Namely, it takes into account a fixed supply and halving, which reduces the production rate. The theory is that as the supply of Bitcoin decreases, the uptrend strengthens. The analyst confirmed that he has no doubt that the S2FX model is correct and BTC will reach $100-288 thousand before December 2022.

Founder and CEO of financial consulting firm deVere Group, Nigel Green, is convinced that the BTC rally is just beginning. He told Newsmax that 2022 will be another record year. Green expects a possible increase to $46,000, and considers $34,500 to be the minimum level.

According to a Citibank report, Bitcoin's future rally could potentially peak in December 2022 and see a move towards $318,000.

Negative opinions

There are significantly fewer such forecasts, but they also deserve attention.

According to Fortune's newsletter, a crash is all but inevitable—an asset that's up 400% in a short time can't keep going up forever. At the same time, the article expresses the opinion that the future decline will not be as noticeable as at the junction of 2022 and 2018, due to the huge number of large investments in cryptocurrency. Thus, analysts expect a correction at $8,000, which should attract a new wave of investors.

With each new record, Bitcoin enters yet uncharted territory. However, with volume and long-term investments in place, as well as payment giants like PayPal, the late 2020 bull run looks much more favorable than that seen in 2017. The COVID-19 pandemic has created a turning point for the cryptocurrency markets, and in general, it is noted that various pandemics have always been accelerators of financial history.

Pros and Cons of Buying Bitcoin Now

Depending on what happens to Bitcoin in the coming months, investors decide to buy the currency. BTC has already reached unprecedented heights, but could theoretically rise even higher. Factors that may influence the price of Bitcoin in 2022:

- Bitcoin ETF. Applications for this security are submitted with enviable regularity, but the US Securities and Exchange Commission (SEC) constantly rejects them. Analysts are of the opinion that the approval of ETFs will give a powerful boost to the world of digital currencies, reducing risks for those wishing to invest.

- Institutional investors. Now the volumes of funds invested by them significantly exceed the volumes from retail investors, which provides powerful support for the industry. A significant increase in the rate is expected if the cryptocurrency is listed on Nasdaq or another world-famous exchange.

- To attract attention. The “secret sauce” for Bitcoin’s growth is the imagination of users and what they associate coins with. The cryptocurrency has been compared to collectible coins, Morgan silver dollars and other rarities that appeal to older investors. A similar phenomenon was noted with vintage wines in 2009-2010 in China. It was like a mania, and what's happening with BTC is reminiscent of similar situations - the public's eyes have been opened to a new and rare asset class.

Thus, the question of a sharp increase in price remains open. Even a slight decrease is possible. But we can say with confidence that cryptocurrency will not depreciate or disappear in the coming year. Bitcoin has already spread far beyond the boundaries of the original industry; a lot of applications work with it. Authorities in different countries are regulating digital currencies, so far not always successfully, but progress does not stand still. It is unlikely that Bitcoin will soon replace the current financial system, but interest in it is only growing, and this will certainly have consequences.

Results

Bitcoin has been considered one of the most attractive and profitable investment instruments in recent years. Of course, there is a risk, and it is quite large, given the high volatility of this cryptocurrency and economic instability throughout the world. But if you study the crypto market well, track current trends and invest in doses and not thoughtlessly, success is not far off. Will the cost of Bitcoin rise to the expected 100-500 thousand dollars? Let's see! But at the moment the prospects are quite bright.

Author of the article: Nina Kolesnik

A professional journalist who knows how to find information where roads are closed to others. Thanks to 7 years of experience in financial and copywriting activities, she is able to analyze large amounts of data and prepare truly expert reviews.

How to buy or sell Bitcoin

Buying and selling Bitcoin can be done in several ways:

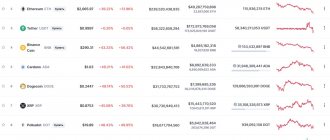

- On crypto exchanges (for example, Binance, Currency.com, EXMO, Bybit, Crex24, Huobi, FTX, Kraken) by creating an order in the trading terminal. Some sites also support instant exchange to save time.

- In exchangers (for example, Bitality, 365cash, Kassa, Magnetic Exchange, Bitobmen). This is an easy way to receive/sell cryptocurrency using a bank card or any electronic wallet convenient for you.

- On p2p exchanges (for example, LocalBitcoins, Paxful, HodlHodl, Cryptolocator, LocalCryptos). A direct method of exchange between users by selecting suitable offers and with a guarantor in the form of an escrow account.

- In cryptocurrency wallets (for example, Jaxx, Trust Wallet, Exodus, Ledger, Blockchain). Many wallets support exchange either for altcoins or directly to a card.

- Through payment systems (Payeer, AdvCash, Capitalist). These include PayPal, but so far the opportunity is open only to American users.

The methods differ in speed, convenience, commission fees, possible methods of payment and withdrawal of funds. Choose the option that suits you.