If someone plans to purchase or sell shares on the stock exchange, he needs to have an accurate idea of what affects the MICEX stock price. Typically, factors are related to fundamental analysis.

The whole variety of factors can be classified into 2 groups:

- political-economic;

- private.

The stock exchange is a kind of unbalanced organism that is sensitive to various processes - financial, economic and others. The online MICEX stock price today reacts to what has already happened, as well as to various expectations. In other words, quotes often depend not on the situation, but on how market participants look at it.

Key factors influencing stock prices

Global and regional situation. This may include existing wars or those that will break out in the future, local conflicts, instability in the political system, change of government, etc. The place of origin of events is not always of fundamental importance. The duration and depth of the effect may vary.

An example would be presidential elections. Large capital usually gives preference to one of the candidates. Therefore, immediately before the elections, traffic on trading platforms is suspended. However, within a few days after the votes are counted, the expectation effect disappears. Therefore, the market value of securities may decrease only due to uncertainty.

Global economic and financial situation. This can include regional or local economic crises, as well as the likelihood of their occurrence, meetings of the G-7 countries, key decisions of the IMF, as well as economic forecasts.

Examples include the financial crises in the Russian Federation in 1998 and in Brazil the following year. If we talk about the influence of these states on the world economy, it is small. The exchanges reacted strongly to them, since large investments were made in the Russian Federation, and Germany had strong trade ties with South America.

The situation in industrialized countries. These include problems of large monopolies and banking organizations, a decrease in production volumes in certain areas, changes in the policies of the government and Central Banks.

The Fed's interest rates have a strong impact on the US and other exchanges. The higher the interest rates, the lower the stock exchange rates. This is due to the fact that when interest rates are high, investments in companies that are held through banking organizations increase in value. In this situation, depositors transfer their own interests to the Central Bank with a fixed interest rate (most often these are bonds), the consequence of this is a decrease in stock quotes on the MICEX. The opposite situation also occurs - when interest rates fall, the price of shares increases, since it becomes more profitable to buy them.

In Japan and the European countries, interest rates do not affect stock prices as much as in the United States. For example, in 2000, the Bank of Europe repeatedly increased interest rates, but this had virtually no impact on securities prices.

Unemployment rate or labor market situation. As the unemployment rate increases, stock exchange rates increase, and as the unemployment rate decreases, they decrease. As the number of jobs decreases, company costs decrease. If unemployment is high, the pressure on entrepreneurs is reduced due to higher wages. This is due to the fact that the unemployed are willing to work for lower wages.

The ratio of the currency to the US dollar and other currencies. This parameter affects imports and exports, resulting in changes in the profitability of companies. For example, if the Russian ruble becomes cheaper against the dollar, then American companies receive less benefits from cooperation with Russian organizations and vice versa. When the exchange rate value of a currency decreases, it becomes profitable to invest in its country.

The Black Swan is coming. How not to panic when the market crashes

MOSCOW, December 20 - PRIME, Tatyana Ternovskaya . With the growing number of investors in the stock market, many of them - first of all, beginners - are wondering: how to distinguish a correction from a real collapse, cope with panic and not make mistakes. “Prime” asked experts what newbies should do when something incomprehensible and frightening happens on the stock market.

US index futures, oil prices and government bond yields fall

There are more and more private investors in the stock market. Thus, in November, the number of brokerage accounts of citizens on the Moscow Exchange increased by a record 1.6 million, to 26.5 million. The number of individuals with access to exchange markets increased in November by 937.6 thousand to 16.2 million people. This is the largest influx over the entire period of observation. In November, private investors invested a record 91 billion rubles in Russian shares on the Moscow Exchange, and 100 billion rubles in bonds.

Traditionally, at the end of the year, volatility in the stock market increases. This year is no exception either. Thus, the events of December 14, when at the opening of trading the Moscow Exchange index lost more than 7%, hitting a nine-month low, were a big shock for many private investors, especially beginners. Blue chips fell to 8%.

Experts interviewed by RIA Novosti suggested that inexperienced investors with small amounts of money, trading with borrowed funds in the hope of quick profits, became both participants and victims of the collapse of the Russian stock market and margin calls when brokers forced sales from their accounts cheaper shares.

“PANIK IS A PATH TO LOSSES”

Experts pointed out that in such cases it is important, first of all, not to panic. The ability to control oneself is very important for any investor, especially when something incomprehensible happens in the market.

Gref told which investments are the riskiest

Personal broker “BCS World of Investments” Artur Bedzhanov noted that first of all you need to remain calm, try to understand the reasons for panic in the market, assess how the current situation can affect our investments and assets, come to balanced conclusions and only then act . “With this approach, most alarmist news, articles and narratives will be just fluff aimed at increasing traffic to news agency sites,” he said.

First of all, Vladimir Tsybenko, head of the investment consulting department, recommended not to panic. He pointed out that you need to build on your risk profile and investment horizon.

“When talking about investing, we still usually count on some long-term history and do not consider working on the stock market as a way to come, quickly earn money in three months and leave. Therefore, you should not pay attention to any local fluctuations. Moreover, if we understand what this volatility is based on,” he explained and added that in the situation on December 13-14, “everything coincided” - geopolitics, a new variant of the virus, and inflation, which is almost everywhere except China. is almost outside the target values. All this led to such a correction.

“There is no need to panic, understanding that we are dealing with long-term investments. Panic is a path to losses,” he emphasized.

The Finam representative also recommended that investors strictly follow their chosen strategy. “You have to stick to your system,” he pointed out. “Then, at the end of the year, we can analyze this system and correct errors. But you cannot make adjustments during the process. If we have a plan, we must stick to it. If, based on the results of a certain period, we understand that the plan is bad, we redo the plan and then stick to the remade plan.”

CORRECTION OR CRASH?

Tsybenko told how to distinguish between volatility and trend changes. “The classic story, when the 200-day moving average crosses downwards can be a signal that, theoretically, a trend reversal is possible in the near term. But this is all very individual, it depends on the company, on the situation on the market,” he explained and added that when there are sharp fluctuations in the market, he would recommend refraining from any large transactions, both buying and selling. And he repeated his recommendation to follow his investment plan.

Moscow Exchange assessed the likelihood of private investors returning to banks

“Our task is not to guess the market movement, but to make sure that the profit on our profitable transactions always covers the loss on our unprofitable transactions,” the expert emphasized. “Unfortunately, we cannot run away from unprofitable trades.”

Bedzhanov called the collapse a special case of high volatility, for which you need to be prepared both psychologically and strategically. He emphasized that an investor should think through his action plan in a period of turbulence in the market in advance. “Disruptions have always followed markets throughout their history, and another decline is certain to come,” he said. “We should not forget that crashes of various kinds provide investors with exceptional opportunities to replenish their portfolio.”

LAWS OF THE MARKET

According to Bedzhanov, it is very important to monitor such indicators as the dollar index (DXY, the dollar exchange rate against a basket of six foreign currencies), the US government bond yield index, the corporate paper yield index, volatility indices (VIX, VIXN, OVX, etc.), commodities (CRB Index), stock indices (S&P, Dow Jones, Nasdaq, etc.), the ratio of current to historical asset volatility, trading volumes, decisions of world central banks and other government agencies.

“By watching these players, you can get a sense of how the market performs at certain times and find interesting relationships that you can use later to make investment decisions,” he explained.

"WATCH YOURSELF, BE CAREFUL"

How to control yourself when you see indicators and quotes flying down on the screen of the trading terminal? “Prime” asked psychologist-psychotherapist Yana Leikina to give some recommendations.

Tax-free income on deposits will increase to 85 thousand rubles

“If a person reacts overly impulsively to wild swings in the stock market, they should not be investing,” she said. “Before entering this area, he needs to prepare psychologically and work with his impulsiveness.”

As “training,” the psychologist recommended playing games such as poker or “Mafia,” which require cold-blooded calculation and control of one’s emotions. Also, according to her, you can use various practices - for example, meditation. “Or even shooting classes - absolute concentration of attention is also required there. Otherwise, you will definitely miss,” Leikina clarified and added that if a person comes to the stock exchange without learning all this, he will make wrong decisions and lose money.

What to do when the market is already collapsing? The first thing the psychologist advised was to take a break and not make any decisions. Be sure to change the situation - get out of the house, take a walk of 5 kilometers. “Running, fast walking, in winter - skiing. That is, you need to start moving rhythmically,” she said. “Rhythmic movement is one of the main stress antidotes.”

After this, Leikina advised turning to a professional for help and getting some guidance, as experienced players usually behave in such a situation. “Maybe it makes sense to consult more than one person. This will give you an understanding that the problem is not only with you,” the psychologist explained. — People often take everything upon themselves and believe that they are the ones who are unlucky, that they are the ones who are so poor and unhappy. And when a person understands that this is part of the profession, when he listens to what other people are doing, how they cope with it, then he will return to investing not on the principle of “lucky or unlucky,” but will understand his professional risk.”

DI Corporation shares soar due to Gangnam Style video

In October 2012, shares of semiconductor test device maker DI Corporation soared more than 800%.

There were no apparent reasons directly related to business for such growth. But there was one that was indirectly connected. As it turned out, the chairman and main shareholder of the company was the father of the singer PSY, who shot that very video with wild popularity. Moreover, the artist himself had a certain number of shares in the company. This turned out to be enough.

Interestingly, as a result of this whole story, the usual return of shares to the original price level in such cases did not occur. For many years after the release of the video, DI Corporation's capitalization remained at a significantly higher level than before, although some price correction occurred.

Electronic Arts shares collapsed due to the loss of the license of a popular football club in FIFA 20

In one of the most recent cases, shares of the game developer Electronic Arts collapsed due to the loss of the license to use the name and image of the Italian Juventus kit.

This team is a multiple champion of Italy, and what is even more important is that it features one of the main stars of world football, Cristiano Ronaldo. In the new version of the simulator, Juventus received the fictitious name Piemonte Calcio. On the day this became known, the company's shares lost 4% of their value. The reason for this could be that investors did not understand the scale of the problem. Many of them probably thought that with the loss of the Juventus brand, Ronaldo would also disappear from the game - and for his army of fans this would put an end to the entire simulator. However, in fact, EA retained the rights to use the real rosters of the Italian league teams, so only the name of the team and its uniform have changed. Therefore, subsequently, the share price corrected:

Assessing the company's potential for growth

There is no absolute formula for assessing the growth potential of asset prices. Indicators are used based on individual interpretation of factors based on objective and subjective factors. In some cases, the investor's personal conviction and even rumors.

Growth investors may use certain methods or criteria as the basis for their analysis, but these methods must be applied taking into account the specific situation of the company. That is, after analyzing its current position, in comparison with previously achieved production and financial indicators.

Overall, a growth investing strategy looks at five key factors to select companies that can provide capital growth. These include:

- Strong historical growth of the company's profit, at least over the last 5 years. The minimum earnings per share ( EPS ) growth depends on the size of the company. For example, for an organization with a capitalization of $4 billion , growth should be at least 5% . For smaller capitalization companies ( $400 million to $4 billion ), annual earnings growth should be within 7% . If a company, even with a small capitalization, demonstrates business expansion, it will develop successfully in the foreseeable future.

- Strong forward earnings growth. An earnings announcement is the official publication of earnings. Usually quarterly or annual. This information is published on specific dates, but they are preceded by profitability forecasts issued by financial analysts. It is the forecast and real indicators that investors evaluate when choosing stocks whose growth rates will be higher than the industry average.

- A company's high pre-tax profit margin is calculated by deducting all expenses from sales ( excluding taxes ) and dividing them by sales volume. This is an important metric to consider because a company can have fantastic sales growth but poor earnings growth. This may indicate that management is not controlling expenses and revenues.

- High return on equity ( ROE ), which demonstrates the amount of profit generated from the money received from investors. This ratio is calculated by dividing net income by shareholders' equity. A comparison is made of the company's current ROE with the average ROE of the enterprise and industry over the past five years. A stable, or better yet, growing ROE indicates that management is successfully generating profits from shareholder investments and effectively managing the business.

So unless assets have actually doubled in the last 5 years, it's unlikely to be a growth stock. Statistics confirm that with an annual of 10% , the company's share price doubles in 7 years.

For capitalization to double, the share price must grow by 15% . We can say that these indicators allow us to call the assets of even a young company growth shares.

What is a quote?

This is the cost of a product or paper that is announced by the seller or buyer. This is a kind of assessment of the value of an asset, formed on an analysis of supply and demand. Exchange participants rely on quotes and conduct transactions at current rates.

Quotes are summarized in dynamic tables that show current exchange rates, as well as data on the status of securities. Information is updated online. Each market participant can display the indicators he needs in his own table. The asset values in each trader's table are the same and are updated simultaneously.

Reasons for rising stock prices

What could be the reason for the sharp rise in stock price:

- positive news - for example, shares of biopharmaceutical companies grew rapidly on news of testing vaccines against coronavirus;

- investor expectations - for example, investors expect breakthrough renewable energy technologies from “green energy companies” and therefore are actively buying their shares;

- fashion and the “herd” effect - in the period before the dot-com crisis, many investors invested in IT companies, as it was fashionable and promising;

- counting on future profits in the form of dividends - sooner or later growing companies transform into classic ones (for example, Apple has long been a growing company, but now occupies an intermediate place between growing and value companies, continuing to increase profits, but at the same time actively sharing dividends with investors) .

When investing in growth stocks, you need to ensure that as the price rises, the quality of the business also grows. Otherwise, such a stock will turn into an ordinary bubble, as happened with Uber or Tesla.

How can investors protect themselves from such stock price surges?

Unsubstantiated ups and downs in company shares happen periodically.

However, for investors, in general, such events carry more risks than opportunities to earn money. To avoid the temptation to succumb to the sentiments of the crowd and, on the wave of hype, to buy shares of a company, which may soon seriously fall in price, it is necessary to use low-risk investment instruments. These include, for example, structured products or model portfolios. Structured products are different financial instruments collected in a single portfolio. The brokerage company's analysts select them in a certain proportion to ensure either minimal or near-zero risk when investing on the stock exchange.

It works like this: a structured product “collects” assets with low risk and small possible profit and riskier assets, which, under a successful set of circumstances, can bring higher income. The idea is simple - if a risky instrument “does not work” and there is a loss on it, then it will be compensated by the profit from a less risky asset - therefore its volume in the structured product is higher.

For example, 90% of a structured product may be federal loan bonds (OFZ), and 10% shares of a company. This is what a structured product with a capital protection level of 100% might look like:

In turn, a model portfolio is an investment portfolio that consists of several securities selected according to certain characteristics (for example, bonds or shares of one sector of the economy). It is somewhat similar to a structured product, but there are fewer opportunities for risk management, although you can start investing with slightly smaller amounts (tens, rather than a couple of hundred thousand rubles).

Such portfolios are convenient for novice investors who have several tens of thousands of rubles, but have no experience working on the stock exchange, which means there is a high probability of losses when trading independently. Each portfolio has an expected return so that the investor understands how much he can earn.

An example of such a portfolio: a model portfolio of American stocks - the possible return is 23% per annum with a low level of risk. Read more about model portfolios here.

How to predict a market decline

Denis Yablonsky, author of the t.me/seekalpha channel and the investment club Tea with Buffett at the Clubhouse

First, I determine whether the market is really falling or is it just a temporary pullback. The theory I work on allows me to buy shares in a falling market and make money within a period of several months to a year. I'm not interested in market pullbacks, when some stock falls by half a percent, I wait for truly impressive crashes and make money on them.

High and Low are the tops (peak) and bottoms (bottom) of the market. A mistake novice investors make is buying at the market peak and selling at the bottom. Although in every book they write that you need to buy at the bottom and sell at the peak.

I'm talking about the American market, but, in principle, this is also true for the rest. For example, in March last year everything collapsed: gold, bonds, indices. And they recovered at approximately the same pace.

We could take any stock - be it Apple or Microsoft - everything looked the same. Because large funds invest through indexes rather than individual stocks.

There are four main indices in the USA:

- DowJones - industrial companies;

- S&P - large wealthy companies;

- Nasdaq - technology companies;

- Russell - small cap companies.

There were situations when I expected the market to fall and missed it for two or three months. It was in 2022, when all the analysts said that everything would collapse, but it only worked at the end of February, when the pandemic began.

So for me, a very important thing is to wait for the real market drawdowns, when stocks fall very strongly.

Purchasing them gives you income in subsequent months and sometimes years. We saw this at the end of 2022 and into 2022.

Companies used the word "blockchain" to increase capitalization

From December 2022 to January 2022, statements about rebranding and the launch of a new direction allowed companies that were previously not related to IT to sharply increase their capitalization.

The cryptocurrency market was at its peak back then. in December 2022, the tobacco company Rich Cigars Inc. became Intercontinental Technology, Inc. and announced that it plans to engage in mining, its stock quotes increased by 2233%. The same rebranding was carried out by several other companies from the fields of medicine, construction, food and light industry.

This move helped for a short time. Thus, the shares of the mentioned Rich Cigars Inc, as well as the securities of a number of other companies, fell significantly in price within two weeks after the rebranding.

Types of quotes

Some believe that quotes are identical to foreign exchange rates. The exchange rate is a ratio of currency values, i.e. How much of one currency can you buy 1 piece for? another.

Depending on the state of affairs, rates may change. The quote is the published exchange rate value for a certain date and at a certain point in time.

- Direct quotation. Used in currency pairs, for example, dollar/ruble. Let's consider the quote USD\RUB=65.12. USD stands for the abbreviation of the United States and its currency is the dollar. The same principle lies in the formation of abbreviations for other currencies. In our pair, the dollar is an asset, and the ruble acts as money. In other words, for 1 dollar you need to pay 65.12 rubles. The direct quotation is tied to the basis - the conditional product. It implies the amount of national currency in one unit of basis. Direct quotes can be found on the information boards of exchangers or in banks. On the world market, the basis is the dollar. He traditionally stands in 1st place. The quote currency is in 2nd place.

- Reverse quotation. It shows how much foreign currency you can get for 1 unit of national currency. In our example, the reverse quote is: RUB\USD=0.0153. In practice, reverse quotation is used in euro/dollar, pound/euro, pound/dollar, etc.

Thus, each asset that operates on the stock market has its own quotes. They are published publicly on a daily basis so that all participants have the same rights when building strategies.

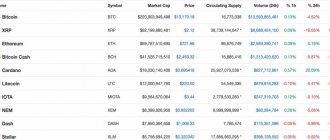

Table with quotes

Here is an example of a standard table with quotes.

As you can see, there are quite a lot of indicators. For orientation, let’s decipher the meanings of each of them.

Each participant, in order to make money in the market, must know and read the table indicators well. This is a basic skill, without which, in principle, work will not work.

Let's consider all the indicators from the table in one position.

The specified asset is in the table and has its own quotes. What a trader sees when looking at them:

- The position has a growing trend, as indicated by the green arrow (tick). This means that its value has increased by at least one position.

- The last transaction involved an exchange of 2,500 pieces at a price of $71.65 per piece.

- A ratio of 3x1 means that the seller is willing to sell at least 100 units. at a cost of $71.65, and there is also a buyer willing to buy 300 pcs. $71.63

- A value of -1.2% means that the selected asset was 90 cents cheaper yesterday than it is today.

- The asset is in good demand because 3,973,100 shares have already changed their owners, i.e. were overbought or resold.

- The maximum price reached $72.94, and the minimum was $71.36.

- Transactions take place at a cost quite close to the maximum, which indicates the presence of an aggressive trader in the game.

Thus, there seem to be a lot of numbers, but they form a picture of the market situation for the selected asset. Based on this data, each participant makes a decision on transactions with this asset.