What difficulties may arise when logging into WebMoney?

To use WebMoney services, you need to register and create an account. To do this, you need to go to the official website of the system or download the application and go through a simple registration procedure. At the first stage, it is not necessary to undergo identification or confirm passport data according to a simplified procedure. Some of the system's capabilities will be available immediately - you only need an email address, phone number and password.

The latter is where difficulties most often arise. Incorrect entry of even one digit will make it impossible to log into WebMoney. And most often, users simply forget it - because they don’t write it down anywhere or because they lose the piece of paper with the written password.

Helpful advice! To store passwords, it is best to use special password managers, such as 1password.

There are several ways to log into WebMoney:

- standard entrance;

- authorization without a mobile phone (without SMS code);

- E-NUM connection.

The last method is the most convenient, since E-NUM will still be required when working with the system, since confirmation of payments and transfers with an SMS code is a paid service for owners of WebMoney wallets. Through E-NUM everything is free, but to work with it you will need a smartphone with the payment system application installed.

Payment system tools

Direct use of the WebMoney system is the use of an electronic money wallet. The most popular are those created in US dollars and Russian rubles. When making transactions, do not forget to indicate their identifier “R” or “Z”, otherwise the entry in the form of a digital wallet number will be incorrect.

E-num confirmation and webmoney keeper

Webmoney keeper (WM keeper) is a database of user wallets and transactions, services of the webmoney payment system, which is provided for use to participants of the webmoney system free of charge.

Raiffeisenbank, Lit. No. 3292

Debit card “Cashback” up to 4.00% on balance, Cashback

Raiffeisenbank, Lit. No. 3292

Apply for a card

Depending on what device you use - laptop, tablet, phone, netbook - you can choose a convenient application/program to use. WebMoney Keeper is presented both as an application to a web browser and as a separate, stand-alone program.

The WM keeper interface quite simply allows you to receive information about the status of calculations and update data.

Standard login to WebMoney

The classic method of logging into the WebMoney electronic wallet can be used by every user who has a phone and remembers the password. The actions in this case will be as follows:

- open the WebMoney website and select “Login” (a window for authorization opens);

- fill in the “Login” line, in which you must enter a phone number, e-mail or WMID (defined by the user);

- enter the password you created during registration;

- solve the captcha - numbers and letters from the picture that appears (if the picture is unreadable, the captcha can be updated).

The system will require confirmation of your phone number, so you should expect an SMS with a code.

There are two options that are needed to protect against hacking. In some cases, it is easier to use SMS authorization, since the phone is always at hand (WebMoney constantly requires confirmation of user actions). Confirmation via SMS is convenient in cases where the user does not have a smartphone, but a regular phone, or when he is in an area with an unstable Internet connection. In a few seconds, the robot will send an automatic message containing the code. It must be entered in the appropriate field. There are no more obstacles, the login to the WebMoney system is open, and you can start working with wallets.

Important! If the SMS is delayed or the code has not been received, the phone must be rebooted. If several requests are sent, the digits of the code of the last message are entered. If you enter an incorrect combination of code numbers several times in a row, the next SMS message will arrive on your phone after 20 minutes.

How to create a WebMoney e-wallet

Renaissance Credit Bank, Lit. No. 3354

Debit card "Main" up to 7.00% on balance, Cashback

Renaissance Credit Bank, Lit. No. 3354

Apply for a card

To register a wallet, go to Keeper Standard (Mini), open the “Finance” tab, then go to the “Wallets” item and click “+ Create wallet”

Next, to continue registering your wallet, you need to decide on the currency of the wallet, confirm your acceptance of the Webmoney terms and conditions and click the “Create” button.

If everything was done correctly, the system will send you a notification.

The system may not allow you to create an electronic wallet if your certificate level is not enough to create a wallet in a particular currency. In this case, you will receive a notification of refusal.

Login using different versions of WM Keeper

Taking into account the existence of several browser versions of Webmoney, the following should be taken into account:

- If you have WM Keeper Standard, the classic login system is used.

- Keeper WinPro requires downloading and installation on a PC; you will need a personal passport to log in.

- Keeper WebPro Light/Mobile are used for authorization on tablets and mobile phones.

The Keeper version is simplified, but you must enter a login and password. Security is ensured by code confirmation via SMS.

Lending and loans

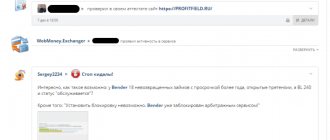

Lenders can make good money from this, and borrowers can receive money on favorable terms. The ratio between borrowers and lenders hovers around 10 to 1, so there is a demand for lending services.

One of the disadvantages of this method of earning money is the likelihood of encountering scammers. If the loan is not repaid to you, then the EPS will not compensate for the loss. Instead, sanctions are imposed on the borrower’s WMID - wallets are blocked. The documentation states that in the event of partial or complete non-payment of the debt, the borrower automatically agrees that his personal information may be transferred to the lender.

Agreement on the circulation of debt obligations

Accounting for issued loans and borrowings is carried out through special types of wallets:

- WMC – borrower's wallet . You can open it only if you have a personal passport. E-num must also be connected and the WMC account is opened only after a secondary verification of the issued certificate;

- WMZ – issued if you already have a formal certificate.

Both WebMoney wallets are analogues of WMZ, that is, payments between the borrower and the lender are carried out only in title units corresponding to the American dollar. They cannot be deleted once created.

As for the very principle of operation of the credit exchange, borrowers publish advertisements in which they indicate how long they need money, what monthly percentage will suit them, and the purpose of the loan. Usually they write either “working capital” or “business development”. The amounts most often appear are small.

Credit exchange Webmoney

If you decide to try yourself as a lender, pay attention to Business Level (business level) and TL (Trust Level) , the higher these indicators, the better. The trust limit is especially important; we’ll look at these characteristics of WMID a little later.

We do not recommend that beginners contact this service:

- It’s unlikely that anyone will lend you a large sum at a low interest rate;

- immediately after registration you will have a small BL and TL, which will reduce confidence in WMID on the part of potential lenders and borrowers;

- You can lend to other users, but you won’t earn much money here.

In general, everything is standard. Small amounts are borrowed for short periods of time at high interest rates. Larger loans are issued less readily.

Logging in without a phone

If there is no option to receive an SMS code and there is no way to log into WebMoney, you can use another login option. Moreover, there are two ways to enter if you don’t have a phone.

In the first case, the use of the telephone is completely excluded. Time will be saved, but the security of your account will be at risk. Before making a decision, you should realize that the risk is quite large - especially if you keep more or less noticeable amounts in your wallet. Disabling SMS verification can lead to unpredictable consequences. If the decision is made, the steps are as follows:

- open the “Settings” menu;

- select the “Security” column;

- select the line “Confirmation”;

- select the option “Disable two-factor authentication via SMS”;

- Click on “Save settings”.

- SMS confirmations will be disabled. Now only a login and password will be required to log into the system.

Basic conditions for using WMZ wallets

All types of Webmoney wallets require almost the same terms of use. Regarding WMZ wallets, it is important to know that the standard commission for transactions within the system and incoming transfers is 0.8% of the transaction amount. The maximum commission on dollar wallets is limited to no more than 50 WMZ.

Initially, Russian users proceed as follows: they register for a WMR wallet (according to the new rules - a WMP wallet), then proceed to open a dollar account. The more wallets a client has, the more convenient it will be for him to use the Webmoney online payment system.

Authorization using E-NUM

Even if it is not possible to receive SMS messages via phone, the issue of security for the user will still be relevant - we are still talking about money. How to log into WebMoney without a phone and at the same time ensure security at the proper level? The system provides this opportunity when E-NUM is activated. Using this program eliminates the risk not only when SMS is turned off, but also in case of loss of the SIM card. But you need to activate it in advance.

The “E-NUM Connection” option is located in the same place as the SMS authorization parameters. An integral part of activating E-NUM is installing a mobile application. You can download a free version of it in the Android and iOS app stores. It cannot be said that everything in the application’s operating algorithm is simplified, but its installation will ensure high-quality account protection. The essence of the application is as follows:

- The user must log in to the site by entering his email address.

- E-NUM activity is confirmed by displaying the number on the website.

- This number is entered into the running program on the phone.

- Accordingly, the program responds by issuing a code that should be entered into a line on the site.

The completed steps enable the user to subsequently log in without SMS and easily access their WebMoney personal account.

Fundraising with WebMoney

WebMoney

wallet makes crowdfunding possible; if you interest other participants in the system, you will receive funding for the implementation of your projects. The following options are possible here:

- charity , you can place a fundraising widget on your website or add the ability to raise funds on a page on a social network;

- crowdfunding – recommended for those who pursue exclusively commercial goals. The point is that you present your project to the public, give its description, development prospects, set the collection parameters and wait. If system participants consider it promising, receive money for its further development;

Crowdfunding on WebMoney - collective purchase - the name speaks for itself. This option is used by organizers when recruiting participants for wholesale purchases of any product. It could be anything - smartphones, smart vacuum cleaners, cosmetics and other categories of goods;

- organizing events is practically the same as regular crowdfunding, only here we are no longer talking about various projects, but about a specific event.

It will be very difficult for fraudsters to use these services. The accuracy of the information provided is controlled. In addition, the system has personal information about the organizer of the fundraiser, so in case of problems it will not be difficult to organize the filing of an application with law enforcement agencies.

About authorization errors

If all actions have been completed, but login to the system is denied, you must re-check your login and password. It is possible that the login or password was entered incorrectly, an error occurred when selecting the keyboard layout (data is entered in Russian), or upper case is turned on and capital letters are used instead of lowercase letters.

In rare cases, the cause of the error message may also be corruption of the program files if authorization occurs through Keeper WinPro. This requires reinstalling the program and another attempt to log in. If the user is sure that all actions were performed correctly, then for security reasons (what if the account was hacked by scammers and the password was changed?) should contact technical support.

Attentiveness and a responsible approach make it possible to quickly and easily gain access to wallets. Problems with logging into WebMoney occur quite rarely - all you need to do is enter your credentials correctly.

5 / 5 ( 2 voices)

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Wallet management

Using wallets, you can perform various operations, from exchanging funds to paying for purchases. In the web version of WebMoney, the side menu is used to navigate to other tabs, and all available wallets are located in a special panel.

When you click on a specific wallet, a menu opens where information about recent payments is indicated. You can also transfer or exchange funds by clicking on the appropriate button.

But it is advisable to consider the “ More ” tab in more detail. It contains the following items:

- Limits – the ability to set restrictions on the withdrawal of funds. This allows you to protect your money from theft.

- Exchange funds – used to transfer one currency to another. The rate changes periodically and is indicated in the “ Information ” menu.

- Go to transaction history – detailed information on receipts and expenditures of funds. Here you can find out the payment date, view its amount and note.

- Order a report – an opportunity to receive a statement for a specific wallet.

- Transfer – allows you to archive wallets with a zero balance.

From wallets you can also transfer funds to other users to a card or bank account.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Evgeny Nikitin

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

What is webmoney

The WebMoney payment service has been operating since 1998. The name often used is webmoney. Main site https://www.wmtransfer.com/. In each country where it works, it has its own website: www.webmoney.ru - in the Russian Federation, www.webmoney.ua - in Ukraine, and so on. Ownership of WM Transfer Ltd. Management, development and technical support are carried out in Russia.

WebMoney is the most widespread payment service in the post-Soviet space. The number of users exceeded 36 million in January 2022 and is constantly growing. On average, about 280 thousand transactions are made per day.

The payment portal allows you to exchange “title units” that are denominated in different currencies. From a legal point of view, they are not money, but are equivalent to them in value.

WebMoney has developed services that make it possible to account for, exchange funds, and conclude transactions. It will take seconds to transfer money, even if the recipient is in another country. All users are provided with a single interface for using the system. The storage of valuables is carried out by Guarantors - participants in the system in different countries.

What can you pay with webmoney?

Why do you need WebMoney? What opportunities does it give to its users? Using this payment portal you can:

- transfer payments for utilities;

- pay in online stores, including in other countries;

- purchase software;

- transfer money to bank cards (your own and others);

- top up your mobile phone account;

- pay for Internet services, cable television;

- publish your book;

- donate to charitable projects;

- purchase goods on credit;

- borrow money;

- pay fines and taxes.

All transfers from a personal account in the system can be made quickly and conveniently while staying at home.

The service is often used when hiring remote specialists (freelancers). They can fulfill orders while at home in another city or even country. Payment will be credited to their e-wallet.