The London Stock Exchange is Europe's largest financial institution, located in the capital of Great Britain, specializing in the free auction purchase and sale of securities — shares of the world's largest corporations, bonds, bills, stock indices, options, derivatives, etc.

The London Stock Exchange (original name - London Stock Exchange , or simply LSE) is the main stock exchange in the UK and Europe, ranking 3-5 in the ranking of the largest stock exchanges in the world, along with the Tokyo and Shanghai Stock Exchanges.

Features of listing on the LSE

Listing, in simple words, is the inclusion of the shares of a corporation, after careful verification and audit, on the register of the stock exchange to begin trading on them.

To be listed on the London Stock Exchange (PLM - Premium Listed Main Market), a company must disclose commercial, financial and management information in the prescribed form, and also meet the following requirements:

- The value of the fixed capital is at least £700,000.

- An agreement with a market maker who is ready to satisfy any volume of purchases/sales of its shares at the current market price of the exchange.

- At least 25% of the shares must be owned by shareholders who are not directors of the organization.

- No shareholder should have more than 30% of the votes.

- FCA check.

- External audit of a licensed consulting company (99% of FTSE-100 companies choose an audit from one of the “Big Four” of the world’s most reputable consulting corporations - KPMG, EY, PwC or Deloitte, to remove any doubts among investors.

Currently, shares of more than 1.5 thousand companies are traded in this segment, incl. included in the FTSE-100 and FTSE-250 stock indices.

Bidders

on the London Stock Exchange is very large. The fact is that all major brokers not only in the European region, but also American ones are usually connected to this trading platform. This creates such good trading conditions, because the more participants there are, the higher the liquidity not only for the main securities, but also for the secondary ones. There are investors who collect portfolios of young, but at the same time quite promising companies, in the hope that some of the investments can later be left and receive high dividends or take profit by selling shares. So, there are only two main groups:

- Individuals . That is, these are just traders, private investors. True, most of them are speculators, since popular stocks show good daily ranges, not to mention stock indices.

- Legal entities . Basically, these are investment funds. The London Stock Exchange allows you to place significant volumes of orders and at the same time there is enough liquidity, that is, there are no sharp price jumps or they are extremely rare. Along with the New York Stock Exchange, the LSE is one of the main platforms in terms of the number and volume of transactions per day in the stock sector.

Also, the large number of traders is due to the fact that the shares of the London Stock Exchange are represented by a huge number of foreign companies. Typically, trading platforms mainly trade shares of companies in their own country. In the case of London, we have several dozen countries whose legal entities are listed. In total, at the moment you can purchase 4 thousand different shares. They are divided into groups, which we will consider further.

I also recommend reading:

How to buy Microsoft shares - company overview, prospects, online chart

Microsoft is one of the most famous brands on the planet; the IT giant's products are used in literally every country in the world. The company’s capitalization has long […]

Shares of which global corporations are listed on the London Stock Exchange

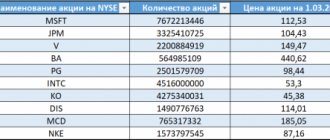

Traders and investors on the London Stock Exchange can buy shares of the following global giants

— Royal Dutch Shell (capitalization $192 billion) is the largest oil and gas company in the world, headquartered in The Hague (Netherlands). Its subsidiaries produce oil in the Gulf of Mexico, California (USA), Canada, Nigeria, Iraq, Oman, Egypt, Island. Sakhalin (RF), Arctic;

- HSBC Holdings plc (value $125 billion) led by the 7th bank in the world - HSBC, which has 3,900 branches in 67 countries of the European Union, Asia, Africa, North and South America, where more than 39 million of its clients.

— Unilever

($119 billion) - the 2nd largest (after Procter Gamble) manufacturer of consumer goods in the world, incl. tea (Lipton), soap (Lux and Dove), toothpastes (Close Up, Pepsodent), ice cream (Breyers and Magnum), etc.

— Diageo

($73 billion), the world's largest producer of elite alcohol, incl. such well-known brands as Smirnoff and Popov vodka, Johnnie Walker and White Horse whiskey, Gilbey's brandy, Don Julio tequila, Captain Morgan rum, Black Haus schnapps, Gordon's gin, etc.

— British American Tobacco ($70 billion), the 2nd (after Philip Morris) tobacco corporation in the world, controlling 17% of the market. Produces Kent, Pall Mall, Rothmans, Dunhill, Vogue, Lucky Strike, Viceroy, and in Russia, Java Golden cigarettes.

Table 1. Shares of which global corporations are listed on the London Stock Exchange

Shares of Russian corporations on the London Stock Exchange

More than 30 shares of Russian companies are presented in the form of depositary receipts on the London Stock Exchange. This

- in the financial sector - Sberbank of Russia, VTB Bank, Tinkoff Bank, AFK Sistema;

- in oil and gas production - Gazprom, Lukoil, Tatneft, Rosneft, Gazprom Neft, Integra, Novatek, Surgutneftegaz;

- in metallurgy and mechanical engineering - Severstal, Evraz plc, Magnitogorsk Iron and Steel Works, HMS Group, NLMK, TMK;

— in the food sector — Cherkizovo;

— fertilizers — Akron;

- mining and gold mining - Polymetal (included in the FTSE 250), Polyus, Petropavlovsk PLC (included in the FTSE 250 and FTSE Gold mining);

— construction — Hals-Development, LSR, PIK;

— energy — Rosseti, RusHydro, FGC UES;

— pharmaceuticals — Pharmstandard;

— telecommunications — MegaFon;

— IT sphere — Mail.Ru Group and Sitronics;

Table 2. Shares of Russian corporations listed on the London Stock Exchange

What did Russian companies gain from having their shares traded on the London Stock Exchange?

- direct investments. For example, AFK Sistema received an IPO in 2005. $1.3 billion;

— the image of a reliable and reputable international corporation, audited by the world's leading consulting firms, FCA and LSE;

— unlimited potential for receiving funds, both through the growth of the company’s share price and through the issuance of new securities.

Brief historical background

So:

- The official founding date of the LSE is considered to be March 3, 1801, but before that moment its history already spanned more than 200 years.

- In 1565, merchant Thomas Gersham founded the first stock exchange in England with his own money.

- 1571 - the first commodity exchange opened in London

- 1695 - on the exchange, which by that time had received the status of the Royal Exchange, transactions with the first securities began (bills of lading, mortgages and shares of the first companies)

- 1801 (March) - official opening and approval of the legal status of the exchange. Only special accredited participants are allowed to participate in the auction.

- 1973 - the beginning of trading operations using the first computers that had just appeared. Systematic work begins on improving the electronic trading system.

- 2001 - The London Stock Exchange acquires the status of a joint stock company.

London Stock Exchange indices

Stock index is the arithmetic average of the prices of shares of those enterprises that are included in this index. Let's highlight the five most popular stock indices of the London Stock Exchange.

The FTSE All- Share Index shows the price dynamics of all shares that are bought and sold on the LSE.

Rice. 1. Index FTSE All-Share on LSE

FTSE 100 is the most popular LSE stock index, formed from 100 shares of the largest companies on the London Stock Exchange by capitalization. It includes such giants as HSBC Holdings, Rolls-Royce plc, Marks Spencer, Royal Dutch Shell, British Petroleum, Coca-Cola HBC, British Airways, Lloyds Banking Group, Barclays, Air China, RSA (insurance group), Toshiba, etc. .

Rice. 2. FTSE 250 Index

FTSE 250: This index contains 250 mid-cap companies. Russian companies are also present, for example, Evraz Group.

Rice. 3. FTSE 250

The FTSE 350 combines companies from the first two indices.

Rice. 4. FTSE 350

FTSE Small Cap. It is calculated based on the quotes of shares of a company with a small capitalization that are not included in 100 and 250.

Rice. 5. FTSE Small Cap

The most famous stocks traded here

There are quite a lot of companies here. There are both foreign and Russian. For example, everyone knows Sberbank, which has been successfully operating for many years in a row, Tatneft, which is engaged in oil production.

| Foreign companies | Russian companies |

| VR | Gazprom |

| Marks&Spencer | Tatneft |

| AstraZeneca | Megaphone |

| Greggs | Rosneft |

| Hays | Lukoil |

| ThomasCookGroup | |

| HardyOilandGas | |

| Mothercare | |

| Coca-Cola | |

| Durex | |

| Bentley |

FTSE Indices: a joint product of the Financial Times and the London Stock Exchange

The FTSE 100 index stands for Financial Times Stock Exchange Index , i.e. was originally a joint product of the reputable Financial Times newspaper and the London Stock Exchange. Since 1995, this stock index brand has belonged to the FTSE Group, a subsidiary of the London Stock Exchange, which has its own Internet portal www.ftserussell.com on whose pages you can easily find dozens of other financial products of the FTSE index:

- FTSE AIM UK 50 Index (50 largest UK companies);

- FTSE/Athex Large Cap (25 companies on the Athens Stock Exchange);

- FTSE Bursa Malaysia Index - 30 (30 largest firms on the Malaysian stock exchange)

- FTSE Bursa Malaysia Index - 70 (respectively, 70 enterprises)

- FTSE Bursa Malaysia Index - 100 (respectively, 100 enterprises)

- FTSE China A50 Index (50 largest enterprises of the Shanghai Stock Exchange);

- FTSE China AH 50 (50 largest Chinese enterprises of the Hong Kong Stock Exchange);

- FTSE China B Share All Cap Index

- iShares FTSE A50 China Index ETF

- Bosera FTSE China A50 Index ETF

- Bosera FTSE China A50 Index ETF-R

- FTSE Fledgling Index

- FTSE Italia Mid Cap

- FTSE MIB

- FTSE SmallCap Index

- FTSE techMARK 100

- FTSE4Good Index

Masterforex-V comments:

1. why so many stock indices?? According to the F TSE Group, they are necessary for professional investors (?), “asset managers” (?), “institutional investors”, “advisers on choosing the best instruments for an investment portfolio”, “for scientists” (??), etc. .

2. we have listed... only a small part of these indices, the rest can be found on their website;

3. Masterforex-V traders only use FTSE-100 and 250. Believe me, this is enough to find the trend (explanation below)

Trading strategies for professional trading of the FTSE 100 index

Masterforex-V Academy recommends a number of trading strategies with MF modifications:

- when trading on small time frames m5 and m15 - Scalping: classics and strategies Masterforex-V;

- for MEDIUM-term trading on n1 - n4 - Swing trading: classics and know-how Masterforex-V

- for a comprehensive market analysis, it is advisable to install “3 Elder screens” - more details Three Elder screens: essence, criticism and modifications of Masterforex-V and study at least the basics of Elliott wave theory.

Features of investing in the FTSE 100 and FTSE 250 index of the London Stock Exchange

Wiki Masterforex-V for LONG-TERM investments in stock indices LSE strongly recommends paying attention

1. for approximately a ten-year growth algorithm of all stock indices of the London Stock Exchange from one global economic crisis to the next (1987 / 1998 / 2008 / 2019-1920?)

Rice. 6. FTSE 100 and FTSE 250

2. absolute similarity of trends on w1 FTSE 100 and 250 . Look at both graphs - there is no difference. Therefore, there is no need to buy MULTIPLE indices on the LSE, they are practically the same for an INVESTOR in the “decade” of a LONG-term bull market.

Rice. 7. Comparison of FTSE 100 and FTSE 250 trends

3. all stock indices in the world are similar to each other. Compare London's FTSE 100 with the US Dow Jones 30 Index. Again there are no major differences.

Rice. 8. Comparison of FTSE 100 and Dow Jones 30 trends

Comments wiki Masterforex-V : pay attention to the support and resistance levels that we give to our traders on the closed forum of the MF Academy. Is it easier to understand the market if you know the movement vector and the immediate goals?

— do you need a stop loss when working on buy?

— where will you set take profit and open a new buy after a downward correction?

— have you already realized WHERE to look for bullish trend continuation patterns from ascending triangles to flags, pennants, wedges?

— Do you need Pivot Points to search for opening a sell or buy order?

— should you be interested in bullish or bearish trend reversal patterns within 9-10 years?

If you answer these 5 questions correctly, you will understand more than what is covered in 90% of books, webinars and training courses on “working on the stock exchange”.

Requirements for parties involved in transactions

- If the stock exchange is created in the format of a non-profit partnership, then only those persons who are its direct members participate in trading;

- The procedure for admission to transactions for both issuers and any other persons is carried out in accordance with the rules of the site and requires their strict compliance;

- Unequal status of the parties when concluding contracts, as well as any infringement of rights, is not allowed;

- Providing all requirements and transparent disclosure of information is mandatory.

Recommended brokers for trading London Stock Exchange indices

Masterforex-V traders work on DIFFERENT markets, finding MEDIUM-term (from n8) and LONG-term (from d2) trends

— on Forex;

- on the stock market;

— in the cryptocurrency market;

— on CFD commodity futures of gold, silver, oil.

All these tools are available from the recommended brokers of the MF Academy. Half of our traders have opened trading accounts with NordFx with quotes for the FTSE-100, NASDAQ, Dow Jones, SP 500, DAX 30, Nikkei 225 indices, dozens of forex currency pairs and cryptocurrencies, as well as CFD futures of gold, silver, oil, crypto indices, etc.. This is enough to earn 300%-700% in foreign currency for several years, as can be seen from the online monitoring of MF traders’ accounts on our rebate autocopy service pro-rebate.com.

The second half of trading accounts of Masterforex-V traders is distributed between the British FxPro, the Swiss Dukascopy Bank SA and beginner cent accounts with Fort Financial Services.

Remember: what is important for successful trading is not the market (indices and shares of the London Stock Exchange, Forex, futures or cryptocurrencies), but finding a trend at the very beginning of its emergence.

Caution about BO and Forex

When talking about making money through buying shares, one cannot fail to mention binary options and the Forex market. Unfortunately, these ways to increase capital are ineffective and even dangerous for the well-being of your finances.

Binary options are securities traded by investors on the Chicago Stock Exchange. It is impossible to make money from them the way advertising presents it. Forex is an online casino that is not directly related to the stock markets. Earnings here are associated with significant risk. For you. Ready to be deceived - go ahead.

London Stock Exchange Innovation: Supporting the World's First Cryptocurrency Bonds

Unlike its competitors, the London Stock Exchange is very loyal to crypto projects and invests in them through its own company London Stock Exchange Group Plc (LSEG, operator of the London Stock Exchange LSE). Pay attention to what projects are being invested in.

1. London Stock Exchange Group Plc (LSEG) in February 2022 invested $20 million in bonds of the Nivaura crypto project to launch a blockchain that would significantly simplify the issuance of debt securities (bonds) based on cryptocurrency.

Nivaura is a digital platform for issuing and managing corporate bonds, loans and shares. According to Nivaura, head of international development at LSEG, issuing bonds now requires any stock exchange to take numerous steps over time. Using Nivaura blockchain technology, the time for this issue can be reduced by 80%, and the cost of raising capital will also be significantly reduced.

2. LSEG and HSBC invested in JP Morgan's crypto project of its own digital token, JPM Coin, linked to the dollar exchange rate, through which clients can instantly transfer funds to each other using the blockchain network. As a result, the bank's monthly expenses were reduced by 25%, and clients received a modern and secure currency exchange system.

3. Since 2022, LSEG has been collaborating with IBM to create a blockchain-based platform for issuing private shares for medium and small enterprises in Italy.

4. In 2022 The London Stock Exchange has registered the first cryptocurrency company, Argo Blockchain , associated with the mining of cryptocurrencies. The company offered remote mining with a monthly subscription for anyone. Argo Blockchain located its own mining facilities in the Canadian province of Quebec, which is quite attractive for cryptocurrency mining due to low temperatures and cheap electricity.

Argo Blockchain's IPO on the London Stock Exchange brought in £25 million. The company successfully passed the audit of the British Financial Conduct Authority (FCA) and began to successfully advertise services for mining Ethereum, Ethereum Classic, Bitcoin Gold and ZCash on its equipment. Users pay a monthly subscription and receive cryptocurrencies in proportion to the amount of money they deposit. Argo Blockchain CEO Jonathan Bixby said: “More than 90 percent of crypto mining is done on an industrial scale because doing it individually is technically very difficult... We want to be like Amazon Web, but in the crypto industry.”

Stock exchange (hereinafter, simply the word “exchange” or the abbreviation “FB” can be used) is “a financial institution that ensures the regular functioning of the organized securities market”[]. The material covers the concept, tasks, structure, types of participants and exchange trading scheme. The Moscow Exchange (MB) was taken as a sample. A list of the largest stock exchanges in the world is provided and briefly analyzed.

CONTENT:

1. The concept and purpose of the stock exchange 2. From the history of stock exchanges 3. Exchange legislation of the Russian Federation 4. The structure of the stock exchange using the example of the Moscow Exchange 4.1. Moscow Exchange Group 4.2. Stock exchange as a joint stock company. Corporate governance 4.3. Markets (sections) MB 4.4. Council and Committees of the Moscow Exchange 5. Moscow Exchange indices 6. Listing and exchange list of securities 7. Participants and the simplest trading scheme 8. How to start trading on the exchange 9. Technological solutions from the Moscow Exchange 10. The largest stock exchanges in the world Notes and links Abbreviations used

1. CONCEPT AND PURPOSE OF FB

Source[] defines a stock exchange as a “place, object” (organization) where brokers (brokers) and dealers can buy and sell securities (stocks, bonds, etc.), as well as derivative financial instruments (derivatives).

The SE provides both an organized secondary market for securities (SE), and their initial public offering/placement, Initial Public Offering, IPO. By and large, the entire securities market is divided into exchange and over-the-counter, in other words, into organized and unorganized.

Functions and tasks of the Stock Exchange[].

1) Licensed trading platform for the primary and secondary securities market.

2) Establishing a fair exchange price for a separate financial instrument (exchange quotation) and, as a result, assessing the market as a whole through stock index indicators.

3) Raising funds on the stock market and redistributing ownership of securities.

4) Transparency and openness of exchange operations.

5) Organization of exchange turnover, in accordance with regulatory documents, standard contracts, regulations, and FB rules.

5) System for providing guarantees for transactions. The main principle is “Delivery versus payment” (DVP), English. Delivery Versus Payment (DVP)[].

6) Conducting trading through licensed participants, members of the exchange. Other investors, individuals and legal entities act as their clients.

2. FROM THE HISTORY OF STOCK EXCHANGES

The Russian word “exchange” sounds and is written approximately the same in many European languages. In French bourse, German börse, Italian bórsa, Spanish bolsa, finally in Dutch beurs[]. Only with the Anglo-Saxons everything is different from the rest. They have an exchange - exchange, stock exchange - stock exchange, securities exchange.

The origins of exchange trading in securities are in bill fairs held in Italian Florence, Venice, Genoa, as well as in London and Bruges in the 12th-15th centuries. In Bruges, in West Flanders, on the territory of modern Belgium, bill transactions since 1409 were concluded in a small area near two hotels “Ter Beurse” and “De Oude Beurs”, owned by the venerable Van Der Burse family with Polish-Jewish roots[]. According to other sources[], the Van Der Burses had one hotel and it was called “Huis ter Beurze”.

Hotel "Huis ter Beurze" in Bruges (in the center of the photo)[]

The Van Der Burse family coat of arms is three purses. Purse in Latin is bursa. It turned out that bill trading in Bruges at the beginning of the 15th century gave a single name for all exchange operations.

The signal for the opening and closing of trading on the Van Der Burse exchange was the ringing of the bell. This tradition was inherited and carefully observed by the New York Stock Exchange (NYSE).

Over time, the center of stock exchange trading in securities moved to Amsterdam, Holland. The impetus for the creation of the Amsterdam FB was the founding of the famous Dutch East India Company (Verenigde Oostindische Compagnie) in 1602. The establishment of the stock exchange dates back to 1602; the Amsterdam Commodity Exchange opened a little later, in 1608. The FB building was located directly opposite the office of the East India Company. Very comfortable, distinctive, tailgating from the early 17th century.

Courtyard of the Amsterdam Stock Exchange in the 17th century []

At that time they traded in Amsterdam, mainly government securities (government bonds) of the leading colonial, seafaring powers: Britain, Portugal and the Netherlands, and securities of the Dutch East and West India companies. The exchange register consisted of about four to five dozen positions.

The Amsterdam FB is a rare long-liver in the financial world. As a separate stock exchange, it existed for almost exactly 300 years, until its merger in 2000 with the Paris and Brussels exchanges[]. The new structure received the sign “Euronext NV”, and its Dutch subsidiary “Euronext Amsterdam”.

Then the stock exchange movement spread throughout Europe and around the world. Its most important centers were and remain to this day London and New York.

In 1571, Queen Elizabeth I of England opened the London Royal Exchange. Transactions with securities began to be carried out there in 1695. The official year of establishment of the London Stock Exchange, London Stock Exchange (LSE) is considered to be 1801. In 2007, the LSE Group was formed, combining the London and Milan (Borsa Italiana) FBs. LSE Group address: London, 10 Paternoster Square.

The most famous American stock exchange, the New York Stock Exchange (NYSE), dates back to the famous Buttonwood Agreement (“Agreement under the plane tree”), signed by 24 brokers on May 17, 1792 under a spreading plane tree, opposite the Tontine coffee shop on Wall -straight.

Sycamore tree on Wall Street, 1790s.

By the way, another coffee house, London's Jonathan's, played a key role in the fate of the future London FB in the 18th century. They say the terms “bulls” and “bears” were born there. London brokers fell in love with “Jonathan” so much that when the question arose about the name of the full-fledged FB being created, they wanted to call it simply and unpretentiously “New Jonathan,” but then changed their minds.

Formally, the NYSE opened in 1817 under the guise of the New York Stock and Exchange Board. To this day, it is often referred to as The Big Board[]. In 2013, NYSE was acquired by Intercontinental Exchange (ICE). Located at 11 Wall Street, Lower Manhattan, New York.

The largest modern Russian stock exchange is the Moscow Exchange (MB). Established through the merger of MICEX (Moscow Interbank Currency Exchange) and RTS (Russian Trading System) in 2011[].

The Moscow Exchange building in Sredny Kislovsky Lane[]

3. EXCHANGE LEGISLATION OF THE RF

The core Russian legislation on exchange operations is based on the Federal Law “On Organized Trading” dated November 21, 2011 No. 325-FZ (hereinafter referred to as the Law).

Key aspects of the main Russian regulatory “exchange” document help to understand the functioning of not only domestic, but also global exchange systems.

The law regulates the activities of all exchanges: commodity, financial, stock exchanges.

Certain points of the Law that you should pay attention to.

1) What is an exchange and exchange trading?

Article 9 of the Law interprets the exchange as a “Trade Organizer” with an exchange license. According to Article 2, “Trading organizer is a person providing services for conducting organized trading in the commodity and (or) financial markets on the basis of an exchange license or a trading system license.”

The Russian stock exchange can only be in the form of a joint stock company.

Exchange trading is interpreted as “organized trading held on a regular basis in accordance with established rules that provide for the procedure for admitting persons to participate in trading to enter into contracts for the purchase and sale of goods, securities, foreign currency, repurchase agreements and contracts that are derivative financial instruments” .

2) Exchange rules.

The trade organizer (exchange) has the right to carry out activities in accordance with the Rules of Organized Trading, subject to registration with the main financial regulator of the Russian Federation - the Bank of Russia (Central Bank of the Russian Federation). The Rules must contain a number of mandatory items prescribed in Article 4 of the Law, namely, requirements for trading participants, regulations of exchange operations, rules for listing/delisting of securities, etc. It is possible to create a package of exchange documents for individual items of the Rules.

3) Exchange sections and exchange council.

Depending on the type of participants, securities or type of contracts concluded, the exchange may conduct trading in designated sections.

The exchange is obliged to form a general exchange council and/or exchange councils for each section.

4) Trading participants and market makers.

Article 16 provides a list of participants in exchange (organized) trading. The Legislator includes dealers (acting on their own behalf and at their own expense), brokers (conducting transactions in the interests and at the expense of clients), securities managers with a license as a professional participant in the securities market, and a number of other persons. In general, they fit the concept of a “qualified investor” given in Article 51.2 of Law 39-FZ[].

Other individuals and legal entities enter the exchange exclusively through its participants. Sometimes the latter are called “FB members”.

An important participant is called the “market maker”. According to Article 2 of the Law, a market maker is “a trading participant who, on the basis of an agreement, one of the parties to which is the trade organizer, assumes obligations to maintain prices, demand, supply and (or) trading volume in financial instruments, foreign currency and ( or) goods on the terms established by such an agreement.”

4. STOCK EXCHANGE STRUCTURE USING THE EXAMPLE OF MOSCOW EXCHANGE

Modern stock exchanges have a similar architecture, so you can understand in general terms the structure of any stock exchange by considering the structure of one of the large platforms. The Moscow Exchange is quite suitable for this role. Capitalization[] of the MB in the third quarter of 2022 amounted to 35.76 trillion rubles[], which at the current exchange rate exceeds half a trillion dollars. This fact brings the MB closer to the top twenty of world stock exchanges. In addition, from a practical point of view, information about the Moscow Exchange will be most useful to the Russian reader.

(Please note that information on the Moscow Exchange is relevant as of the date of publication of the article)

4.1. Moscow Exchange Group

One of the trends in the current “exchange construction” is associated with the processes of mergers and acquisitions in the industry, leading to the formation of exchange groups and holdings.

As mentioned above, the LSE Group includes the London and Milan Stock Exchanges. Euronext NV includes Brussels, Paris, Lisbon and the oldest Amsterdam FB[]. Formally, the NYSE is a division of the Intercontinental Exchange (ICE).

Russian stock trading was no exception. In 2011, the two largest stock exchanges that emerged in the Russian Federation after the collapse of the USSR merged: the MICEX, opened in 1992, and the RTS, founded in 1996. The new, vertically integrated company became known as the Moscow Exchange.

Moscow Exchange is the core of the Moscow Exchange Group[]. In addition to the Moscow Exchange PJSC itself (the full official name is PJSC Moscow Exchange MICEX-RTS), the group includes: Non-banking credit organization - the central counterparty "National Clearing Center" (NCC) and the central depository - "National Settlement Depository" (NRD).

NCC and NSD perform critical functions in exchange trading: clearing, central counterparty (CCP) option and securities accounting.

The first two positions are taken by NCC.

Clearing is the settlement of counter homogeneous claims between exchange trading participants at the end of the trading session. The simplest form of clearing, netting, is the determination of the final net position (net position) for each participant.

The central counterparty assumes the risk of non-fulfillment of obligations: the seller to the buyer and the buyer to the seller. In all transactions on the Moscow Exchange, the Central Committee acts as a seller to a buyer or a buyer to a seller.

NSD takes into account the transfer of ownership of securities, primarily shares and bonds, in the securities accounts of persons trading on the stock exchange.

4.2. Stock exchange as a joint stock company. Corporate governance

As mentioned above, according to Law 325-FZ, any Russian exchange can only exist as a joint-stock company (JSC).

In February 2013, MB, as a public joint-stock company, held an IPO and raised 15 billion rubles. On the Moscow Exchange its own shares are traded under the ticker MOEX.

Dynamics of Moscow Exchange shares, monthly breakdown[]

MB is not alone, as an exchange corporation, with the listing of its own shares. The NYSE had a similar experience in the early 2000s. After an interim reorganization, which consisted of a merger with the Archipelago electronic exchange, on March 8, 2006, the NYSE introduced shares with the ticker symbol NYSE Group[] for initial public offering and subsequent trading.

The corporate governance structure of the Moscow Exchange is the same as that of any other Russian joint stock company.

The General Meeting of Shareholders (GMS) is the supreme governing body of Moscow Exchange PJSC. The Supervisory Board (Supervisory Board) of the exchange carries out the general management of the MB, except for resolving issues within the competence of the GSM by Law. The exchange's board is the executive body and is entrusted with the current management of the Moscow Exchange.

As of the date of writing, the composition of the main shareholders of Moscow Exchange PJSC looks like this:

source[]

4.3. Markets (sections) MB

Depending on the type of instrument, trading on the Moscow Exchange is carried out on separate markets.

The key ones for trading securities on the MB are the stock and derivatives markets.

Shares, depositary receipts, mutual fund units and bonds of all types are traded in the stock market sections. The derivatives market allows you to operate futures and options with stock, currency and commodity underlying assets.

As additional markets/divisions of the MB in relation to securities (CS), one can consider the money market, the market for standardized derivatives (derivative financial instruments), the CB sector of uncertain investment risk, as well as the over-the-counter transaction service (OTC system).

In the money market section, repo operations are carried out, among other things[]. The traditional asset for repo is government bonds (federal loan bonds).

In the standardized derivatives market, derivatives are traded, the specifications of which maximally comply with the standards of the international over-the-counter derivatives market, in particular, the requirements of ISDA (International Swaps and Derivatives Association).

The Central Bank included securities with uncertain investment risk in the sector, which the Moscow Bank classified as the third level of listing.

(more details about listing on MB, see below)

The OTS system of the exchange (subsystem of the MOEX Board information service) makes it possible to conclude transactions on the over-the-counter market.

Thus, the “securities” and derivatives direction of the Moscow Exchange can be depicted as follows:

The diagram does not include only two basic MB markets: foreign exchange and commodities.

4.4. Moscow Exchange Board and Committees

According to Law 325-FZ, the exchange is obliged to form an exchange council and/or councils for individual sections (see part 3 of section 3 of this article).

At the International Bank, the role of the main exchange council is performed by the Exchange Council, acting in accordance with a separate Regulation[]. Based on the Regulations, the Exchange Council is an advisory body. Its main task is “representing the interests of exchange market participants”, a kind of “exchange parliament”. The number of members of the Moscow Exchange Council varies from 15 to 26.

Exchange Committees act as exchange councils for markets/sections on the Moscow Exchange. Committees have been formed for all MB markets. Moreover, several Committees operate in certain areas.

The following are responsible for the securities and derivatives markets/sections directly:

- Derivatives Market Committee;

- Stock Market Committee;

- Fixed Income Securities Committee;

- Collective Investment Market Committee;

- Share Issuers Committee;

- Primary Share Market Committee;

- REPO and Securities Lending Committee;

- Bond Issuers Committee;

- Debt Market Indicators Committee;

- Index Committee.

5. MOSCOW EXCHANGE INDICES

One of the most important purposes of the stock exchange is the formation of a fair, market, equilibrium (the list of synonyms can be continued) price for an individual instrument and the market as a whole. Stock indices are used as general market indicators.

There are two sides to the situation.

Firstly, the FB provides quotes for securities included in the basket of “over-exchange indices”, that is, those indices that are not calculated on the FB and for which it is not formally responsible. Vivid examples are the Dow Jones index (the Dow family of indices, the key one being the DJIA) and the American broad market index S&P500.

Secondly, the exchange can generate its own indices based on the results of its trading. The Russian stock market and the MB followed this path.

Moscow Exchange provides users with a wide range of stock indicators for any trading sector. The main stock indices from the MB are: the Moscow Exchange IMOEX index and the RTS RTSI index. They are the basic indicators of the Russian stock market for domestic and foreign investors,

The Moscow Exchange positions both indices as (literally) “price, market capitalization-weighted (free-float) composite indices of the Russian stock market, including the most liquid shares of the largest and dynamically developing Russian issuers, the types of economic activities of which relate to the main sectors of the economy.”

According to the exchange methodology[], the same basket of Russian issuers is weighed. One of the fundamental differences between the indices is the currency of the calculation base. For IMOEX it is the ruble, for RTSI it is the US dollar. The ratio of IMOEX capitalization to RTSI capitalization is exactly equal to the current dollar/ruble exchange rate.

The composition of the index basket is variable. As of February 26, 2019 – 42 companies. The largest weight belongs to Lukoil (16%), Sberbank (15%, together with preferred shares) and Gazprom (12%).

Combined dynamics of indices since March 2006[]:

The red curve corresponds to the ruble IMOEX, the blue one to the dollar RTSI.

The trends clearly and clearly reflect the trends in the Russian currency and stock markets over the past 13 years. Almost complete combination of IMOEX and RTSI until the end of the last “calm” year of 2013 (including the global crisis of 2007-09) and even a trend of accelerated growth of the dollar index, due to the periodic strengthening of the ruble, and an absolute divergence since the beginning of 2014.

In addition to IMOEX and RTSI, among the stock indices from the MB we can note:

- blue chip index;

- two indices of mid- and small-cap companies;

- two broad market indices;

- Moscow Exchange index 10 (top 10 index);

- index of innovative companies;

- three total return indices that take into account dividend payments.

For bonds, indices of state, municipal and corporate bonds are calculated separately.

6. LISTING AND EXCHANGE LIST OF SECURITIES

An important question in stock trading is what to trade?

The procedure for admitting securities and other instruments to the exchange floor is determined by the exchange's listing rules. After passing it, the Central Banks are included in the exchange list/register.

The listing mechanism, maintaining a security on the exchange list, changing the listing level and the delisting algorithm are prescribed in the listing rules in great detail. “The listing rules of Moscow Exchange PJSC, approved by the decision of the Exchange Supervisory Board in September 2022, contain as many as 196 pages.

The exchange list (hereinafter referred to as the List) of the MB has three levels: first, second and third. The first two (highest) belong to the quotation part of the List, the third level is a non-quote fragment of the exchange list.

To be listed, shares of any level must meet the following four conditions:

1) Comply with the requirements of Russian legislation, including regulations of the Bank of Russia.

2) The prospectus for the issue of securities must be duly registered.

3) Issuers of shares are required to disclose information in accordance with relevant Russian regulations.

4) Securities must be accounted for in the Settlement Depository (on the Moscow Exchange - in NSD).

Further, restrictions related to the capitalization of the company, the number (shares) of free-float shares, the period of existence of the joint-stock company, and corporate reporting are applied to shares of the first and second levels. There are no such clauses for third-level papers.

To maintain a stock in the first or second level of the List, it must meet minimum quarterly trading volumes. The turnover of the security must be supported by at least two market makers (see the concept of a market maker above). Again, this is not necessary for third-level central banks.

As of 02/01/2019, the quotation part (first and second levels) of the MB exchange list included 72 ordinary and 9 preferred shares. In the third level – 147 and 46, respectively.

7. PARTICIPANTS AND THE SIMPLE TRADE SCHEME

Conventionally, traders on any exchange can be divided into two groups, unequal in number: participants/members of the exchange and their clients. The first are qualified, professional stock market participants who have registered on the FB. The second are all other individuals and legal entities who have expressed a desire to trade on the exchange and have signed agreements with exchange members (usually for brokerage services).

The elite of exchange participants are market makers who maintain liquidity for a particular instrument. On the NYSE and a number of other foreign exchanges, the role of market maker is played by the so-called “specialist”, specialist[].

A brief view of Russian legislation on the issue is presented in Part 4 of Section 3 of this article. It is not much different from world practice.

“Very roughly, to a first approximation,” the buyer-brokers-seller interaction diagram on any FB is presented below:

source[]

Transactions in the trading system of the exchange are carried out through the central counterparty, the Central Committee (see subsection 4.1). At the MB, the functions of the Central Committee are assigned to the “National Clearing Center” (NCC).

The main purpose of the Central Committee is to minimize the risks of exchange trading. For these purposes, a guarantee fund and other types of security for the execution of transactions are formed on the Stock Exchange.

Securities are accounted for in securities accounts (securities accounts) of Central Bank depositories. On the Moscow Exchange - in the National Settlement Depository (NSD).

Based on the results of each trading session, clearing is carried out and the net position is calculated. The total amounts are debited from buyers and securities are credited to securities accounts according to the net position. For end sellers, the picture is the opposite: plus for money, minus for the Central Bank.

The trading session on the Moscow Exchange stock market lasts from 09.30 to 19.00 Moscow time. For urgent, commodity and foreign exchange: from 10.00 to 23.50. Settlements for shares occur in T+2 mode, on the second day after the transaction is concluded.

8. HOW TO START TRADING ON THE EXCHANGE

A person who decides to conduct transactions on the stock exchange (SE) remotely (remote mode) must go through the following steps:

1) Decide on a broker - a member of the exchange.

2) Sign a brokerage agreement with him.

3) Open a trading account (TA) with a broker (through a broker) for transactions on the stock exchange.

4) Install software for online trading on your personal computer (mobile gadget).

5) Place money and/or securities on the vehicle.

Moscow Exchange provides a list of more than 400 licensed participants with a list of markets/sections of the Moscow Exchange in which they are admitted.

A trading account, often called a “brokerage account,” combines a cash account (in the Russian Federation – in rubles) and a securities account (an account for recording securities). Securities accounts are opened by a broker for a client at the Central Bank depository. On the Moscow Exchange - at the National Settlement Depository (NSD), part of the Moscow Exchange group.

One person can open an unlimited number of vehicles with different brokers. Funds for vehicles in the Russian Federation are not insured, unlike bank deposits. The personal income tax rate (NDFL) for the vehicle is 13%

The client pays the broker a commission for conducting transactions on the vehicle. Regularly, usually once a month, the broker generates a report on the movement of funds and securities on the client’s vehicle. Additional client costs are due to exchange fees. Electronic document management and electronic signature are widely practiced.

Recently, IIS (individual investment accounts) for transactions with securities have been developed in Russia. IIS – ruble accounts that give owners tax benefits (tax deductions). It is possible to use IIS in combination with a traditional brokerage/trading account. For example, replenish an IIS from a vehicle.

9. TECHNOLOGICAL SOLUTIONS FROM MB

Stock exchanges use the latest IT achievements to provide client access to trading, conduct exchange transactions, and protect and store information.

The Moscow Exchange offers, among others, such developments.

1) Colocation (Co-location).

An exchange participant places its equipment in the exchange data center (data processing center), as close as possible to the core of the exchange trading system. This ensures minimal time for exchanging information with the trading platform. The user receives the fastest quotes. The communication channel is characterized by the highest level of reliability.

2) Dedicated access server.

The technology is useful for a brokerage firm with a large number of clients. The server is located at the bidder's place and reduces the load on its software and hardware. The user receives a separate module for receiving/transmitting exchange data.

3) Universal scheme for connecting a participant to the trading system:

source[]

Dedicated networks of authorized telecom operators are used.

4) Internet access.

Basic view for online trading:

source[]

10. LARGEST FBs IN THE WORLD

Having good dynamics, the Moscow Exchange still lags behind world leaders in such a key indicator as market capitalization. As noted above, in the third quarter. In 2017, the capitalization of the MB barely exceeded half a trillion dollars.

Leading trading platforms are on a completely different level.

List of exchanges with capitalization over $2 trillion as of January 31, 2015[]:

| Stock Exchange | A country | Headquarters | Market capitalization, $ trillion | Trading volume per month, $trillion | |

| 1 | NYSE New York FB | USA | NY | 19,223 (as of February 2022 – 30.1[]) | 1,52 |

| 2 | NASDAQ | USA | NY | 6,831 | 1,183 |

| 3 | LSE Group | Great Britain Italy | London | 6,187 | 0,165 |

| 4 | Japan Exchange Group (Tokyo and Osaka FB) | Japan | Tokyo | 4,485 | 0,402 |

| 5 | Shanghai FB | China | Shanghai | 3,986 | 1,278 |

| 6 | Hong Kong FB | China | Hong Kong | 3,325 | 0,155 |

| 7 | Euronext NV | Netherlands France Belgium Portugal | Amsterdam | 3,321 | 0,184 |

| 8 | Shenzhan FB | China | Shenzhan | 2,285 | 0,8 |

| total | 49,643 | ||||

The NYSE has the undisputed first place. It has 38.7% of the total capitalization of the top eight at the beginning of 2015. Last year it increased significantly, breaking through the $30 trillion level. The largest monthly turnovers are also recorded on it. There are approximately 2,400[] public companies listed on the NYSE.

More than half of the capitalization (52.4%) is occupied by the two largest US exchanges, NYSE and NASDAQ. Three FBs represent China. Their share in the list is slightly less than 20% (19.3%). Obviously, the figure will increase.

Everything is quite predictable. The leaders are the world's leading economies: the United States, China and the European Union. The latter’s position is strengthened by Frankfurt-based Deutsche Börse AG with a capitalization of $1.762 trillion. Tenth place, if we continue the list from January 31, 2015.

Vladimir Nalivaisky

NOTES AND LINKS

- "Stock exchange", Wikipedia.

- "Stock Exchange", Wikipedia.

- "DVP", Wikipedia.

- "Exchange", Wikipedia.

- "Van Der Burse", Wikipedia.

- "Amsterdam Stock Exchange", Wikipedia.

- "New York Stock Exchange", Wikipedia.

- "Moscow Exchange", Wikipedia.

- Federal Law of the Russian Federation dated April 22, 1996 No. 39-FZ “On the securities market.”

- The capitalization of a stock exchange is understood as the total capitalization (total value) of all securities (shares) of companies traded (listed) on a given stock exchange.

- "Euronext", Wikipedia.

- https://www.moex.com

- Repo transaction (REPO) – two transactions for the purchase and sale of a package of securities, formalized in one agreement. It assumes the existence of a condition for the mandatory repurchase of securities at a pre-agreed price on a fixed date. The repurchase price is determined based on the repo rate. The economic essence of a repo is a loan secured by securities.

- “Regulations on the Exchange Council of the Public Joint Stock Company “Moscow Exchange MICEX-RTS”, approved by the decision of the Supervisory Board of PJSC “Moscow Exchange” on March 27, 2017.

- “Methodology for calculating Moscow Exchange indices”, approved by the minutes of the Management Board of PJSC Moscow Exchange on July 6, 2018.

- https://ru.investing.com

- "Specialist", Investopedia.

- "List of stock exchanges", Wikipedia

ABBREVIATIONS USED

FB – MB Stock Exchange, Moscow Exchange – Moscow Exchange Central Bank – securities NYSE – New York Stock Exchange, New York Stock Exchange LSE – London Stock Exchange, London Stock Exchange Law, Law 325-FZ – Federal Law “On Organized Trading” dated 11/21/2011 No. 325-FZ JSC - joint stock company PJSC - public joint stock company NCC - Non-banking credit organization - central counterparty "National Clearing Center" (JSC), NCO NCC (JSC) NSD - Non-banking credit organization "National Settlement Depository" , NCO NSD (JSC) Central Committee - central counterparty GSM - general meeting of shareholders, in this article - at Moscow Exchange PJSC Pension Fund - derivative financial instrument TS - client's trading account on the exchange with a broker IIS - individual investment account

London Stock Exchange shares and takeover attempts

Exchanges also have shares. The LSE is no exception, whose shares can be freely purchased on its own platform. It's easy to see that over the last decade they have risen in price by 750% from £610 to £4,600. Knowing this result, answer the question for yourself whether the founders of the London Stock Exchange were right or wrong when they rejected tempting offers to sell it four times.

According to the authoritative The Wall Street Journal and Financial Times

1. In 2004, the Deutsche Boerse stock exchange (Germany) offered 1.35 billion pounds for a large stake. It was not about a takeover, but rather a merger. The united exchange would have become a leader in the European market, but the deal did not take place. The LSE considered the proposal to be one that “does not reflect the real situation.”

2. A year later, in 2005, the Australian investment bank Macquarie bank wanted to buy LSE for 1.48 billion pounds ($2.62 billion). The British rejected this proposal as well.

NASDAQ exchange was more persistent in its desire to acquire the London Stock Exchange (this platform presents shares of companies in the high-tech sector, which is why it is called that). In 2006, the Americans made a generous offer to the British, but LSE considered it not at all generous and rejected it. Unlike the Germans and Australians, the Americans decided to take the plunge and began aggressively purchasing shares of the desired company. In a short time they managed to acquire a substantial stake of 28.75%.

4. In 2007, there was a second attempt by NASDAQ to buy the LSE. They had a substantial stake, but the Americans wanted to increase it to a controlling stake. At that time, they offered twice as much as the Germans two years earlier - 2.9 billion pounds, but were again refused with a similar explanation: “You underestimate us.” After this, the Americans refused to continue the fight for the LSE, reselling its shares, and in the meantime they themselves acquired another European exchange platform, but that’s another story.

London Stock Exchange under Brexit

Due to Brexit, London may lose its position as a global financial center, thanks to which the London Stock Exchange has developed so successfully and rapidly in recent decades. Banks, insurance and investment companies are one after another moving part of their employees and capital to the European Union due to fear of losing access to the EU market - this is a negative forecast given by many financial analysts, incl. in the Z/Yen report.

Already, 33% of companies in the UK financial sector have publicly announced that they intend to move some operations or employees outside the UK due to Brexit, according to an EY report. We are talking about all the major banks, including Barclays and HSBC, as well as a branch of the CME group - BrokerTec - a subsidiary of CME, which moved its “European” headquarters from London to Amsterdam.

Gold market

There is also a precious metal that is traded on the London Stock Exchange - gold. It always stood apart in this establishment. Representatives of five firms gather in a separate room to carry out trading. The leading chairman proposes a price, and the “five” expresses their readiness to conclude deals. After all approvals and approvals, fixed prices are announced, at which contracts will be concluded. Copper is bought and sold using a similar scheme. The London Metal Exchange is certainly one of the most famous British financial institutions. But there are three more institutions that are worth mentioning separately.

Interesting facts about the London Stock Exchange

1. According to historian E. Morgan, the stock exchange terms “bulls” and “bears” first appeared among traders on the London Stock Exchange.

- “bears” were those who tried to “lower the market” by selling shares, even those... that they did not own, in an attempt to sow panic on the stock exchange. They said about such people: “they share the skin of a bear that has not yet been killed”;

- the “bull” was the traditional rival of the bear in bloody fights in the center of the City on the Thames - a favorite pastime of the same stock exchange traders. So the bull began to be seen as an opponent of the bear, and these names of stock market players have been preserved to this day.

2. Outside the LSE building there is a dynamic sculpture by the Greyworld artist collective called "The Source". This is a cube of marbles placed on ropes in the atrium of the new London Stock Exchange building. The cube consists of 729 balls - 9 bases by 9 balls and 9 balls in height by 32 meters, up to the roof of the building. The balls are controlled by a computer system and can move independently of each other, creating different shapes and forms depending on the current situation on the stock market. The sculpture opens (the closed sculpture creates a simple cube) at 8 am, when active trading begins in the market.

At the end of the day, lights placed in each of the 729 balls show the closing price of the London Stock Exchange. The sculpture was unveiled on July 27, 2004 by Queen Elizabeth II, and a broadcast of the event was sent around the world. Interestingly, each sculpture is shown on TV every morning. The audience is estimated at 80 million people.

3. On April 5, 2000, trading in London was paralyzed for almost eight hours due to a failure in the electronic system. Losses amounted to several million pounds and the FTSE-100 fell just 0.74%.

4. In 2022, the Antimonopoly Committee of the European Commission blocked the decision of the London and Frankfurt stock exchanges to merge. The head of the committee, Margrethe Vestager, said that the European Commission took this decision because “a merger could lead to the formation of a de facto monopoly in a number of markets, and one of the commission’s goals is to ensure that the merger does not harm competition.”

New exchange

Unfortunately, the Great Fire of London destroyed it, and a new building was rebuilt only in 1669. A gallery was also organized, consisting of 200 seats for rent. The brought goods were stored in the basement of the building. In 1698, brokers were expelled from the exchange building for indecent behavior (botherance and noise). Jonathan's coffee shop was chosen for negotiations and conclusion of deals. At the same time, the first price lists for securities appeared. 50 years later, the coffee shop “Jonathan’s” repeated the fate of the very first exchange - it burned down. However, visitors restored the building on their own. In 1773, brokers built a new building near the coffee shop, christening it “New Jonathan” (later the name was changed to “Stock Exchange”).