The New York Stock Exchange is a special financial institution for the auction purchase and sale of securities - stock indices, stocks, bonds. bills, options, certificates of deposit and savings, derivatives, etc.

The New York Stock Exchange (NYSE, an abbreviation for New York Stock Exchange) is the main US stock exchange and the largest and most famous in the world, where shares of all the world's largest corporations are listed.

The main advantage of the NYSE

The main advantage of the New York Stock Exchange over its famous competitors is the liquidity of securities, ensured by a gigantic turnover of $60 billion per day and a company capitalization of $32 trillion. (September 2018). For comparison, the capitalization of shares of companies at

- NASDAQ - $6.8 trillion (2017) or 21% of the NYSE;

- Tokyo Stock Exchange - $4.5 trillion (2017) / 14% of the NYSE;

- London Stock Exchange - $4.38 trillion. (2018) / 13.6% of NYSE;

- Shanghai Stock Exchange - $4 trillion (August 2022) / 12.5% of NYSE;

- Frankfurt Stock Exchange - $2 trillion (2017) / 6.25% of NYSE;

- …;

- Moscow Exchange (MICEX) - 28,701.8 billion rubles (03/1/2019) or $188 billion/0.0587% of the NYSE.

As Masterforex-V traders sadly joke, for such a disproportion in capitalization between the Moscow and New York exchanges, we must first of all “thank” the Bolsheviks, who for more than 70 years led the country along their “special” country road to communism away from the “autobahn” global investment.

Why do corporations need to list on the NYSE?

Listing is the inclusion of shares in the register of a stock exchange to begin trading on them.

According to the Masterforex-V wiki, listing on the NYSE is a “springboard” in the fate of the company for unlimited growth in the price of its shares , the formation of a positive image in the world and its hidden advertising. Experts say that listing a company on the world’s largest New York Stock Exchange is a direct path for shareholders to “the elite of the closed global business club of multimillionaires and billionaires.”

Thus, thanks to trading on the New York Stock Exchange, the capitalization of Microsoft Corp. reached $863 billion , and The Walt Disney Co. $169 billion, its owners became billionaires, and millions of traders and investors earned their capital.

Skeptics' objection: capitalization on the New York Stock Exchange is a “soap bubble” , because The “cost” of Gazprom, which controls 11% of global and 66% of Russian gas production, cannot be 3 times cheaper than McDonald’s Corp., which sells franchises to 25,578 restaurants in 118 countries (2009).

Comments wiki Masterforex-V:

- “The market is always right,” Charles Dow said more than a century ago and 99% of investors agree with him to this day;

- the figure of “capitalization” of corporations through listing on the New York Stock Exchange is not an abstraction, but a precisely calculated amount of real (!) money invested in the shares of these companies;

- Why does Gazprom's value seem undervalued? Reasons: US sanctions, corruption and opacity of financial documentation of numerous Gazprom assets, seizure of its assets in the European Union, fear of investors to lose their investments, etc. You, as an investor, will invest money for quick profit in the 100% transparent McDonald's Corp. or Gazprom, whose shares were never listed on the New York Stock Exchange? As a result, the amount of investment in the “restaurant chain” is 3 times more than the proceeds from investors in the No. 1 giant of the gas industry of the Russian Federation, whose shares on other stock exchanges have already fallen 4 times from 2011 to 2022;

- - NYSE investors have before their eyes another negative example of a 50 (!!) drop in the price of shares of another Russian holding Mechel on the New York Stock Exchange over the past 11 years from $115 to $2.3, despite the purchase of their large block of 33.74% of shares this company from the influential Deutsche Bank Trust Company Americas. Calculate the billion-dollar losses of Deutsche Bank and their shareholders and tell me whether you personally would accept such losses (story about Mechel below).

The most famous stocks traded here

If you list even the top companies that have access to listing on the stock exchange, it will take a long time. Let me just mention that among them there are:

- American Express Co. (AXP) (credit services).

- AT&T (T) (telecommunications).

- Boeing Co., The (BA) (Aerospace and Defense).

- Caterpillar, Inc. (CAT) (agricultural and construction equipment).

- Cisco Systems (CSCO) (telecommunications).

- Chevron Corp. (CVX) (oil and gas company).

- Coca-Cola Co. (KO) (drinks).

- Exxon Mobil Corp. (XOM) (oil and gas company).

- General Electric Co. (GE) (industrial conglomerate).

- The Goldman Sachs Group, Inc. (GS).

- IBM. (IBM) (computer engineering).

- JPMorgan Chase and Co. (JPM) (financial group).

- Johnson & Johnson Inc. (JNJ) (chemistry, pharmaceuticals).

- McDonald's Corp. (MCD) (quick service restaurants).

- Nike Inc. (NYSE: NKE) Pfizer, Inc. (NYSE: PFE) (pharmaceuticals).

- Procter & Gamble Co. (PG) (household chemicals).

- Verizon Communications (VZ) (telecommunications).

- Visa, Inc. (V).

- Wal-Mart Stores, Inc. (WMT) (trade network).

- Walt Disney Co., The (DIS) (entertainment industry).

How to List on the NYSE

Of course, not every company can list its shares on the NYSE. To be listed on this exchange, you must meet at least the following requirements:

- The minimum income for the past year (before taxes) is $2.7 million.

- The minimum profit for the past 2 years is $3 million.

- The minimum net worth of tangible assets is $18 million.

- For shares in public circulation - at least $1.1 million.

- The minimum market value of shares is $19 million.

- The minimum number of shareholders who have 100 shares or more is 2,000.

- The minimum average monthly volume of stock trading over the past six months is $100 thousand.

Pros and cons of the NYSE

Like any trading platform, even such a monster has both pros and cons.

The advantages are as follows:

- Reliability - a long history and high reputation allow NYSE to be considered a leader in this area.

- Access to stable and promising securities.

- High level of software - when trading online on this US exchange, the trader’s orders are executed in a split second, which allows you to confidently predict profits.

- Absolute transparency of work.

- To a lesser extent (compared to other sites) it is subject to significant fluctuations in quotes.

- Convenient trading time for European Russia.

But there are also some disadvantages:

- Significant commission fees.

- From time to time there are sharp jumps in quotes.

How to avoid getting delisted on the NYSE

Delisting is the exclusion of securities from the stock exchange quotation list . The main reason for delisting on the New York Stock Exchange, as a rule, is new rules or sanctions from the SEC - the main all-powerful regulatory body of the United States, appointed by the president of the country with the approval of the US Senate.

You can check the delisting list at www.nyse.com/regulation/delistings . So, for February 2022. There are no issuers to be removed from the New York Stock Exchange.

Delisting on the NYSE is a force majeure event, meaning the “beginning of the end” for a company that immediately receives

- a serious blow to reputation among investors;

- a sharp drop in share prices as a result of panic and dumping of shares by institutional investors;

- a significant decrease in positions in international rankings;

- a strong decrease in the liquidity of these shares and much more.

According to the new SEC rules since 2008. whose value has dropped to less than $1 per share are subject to forced delisting on American stock exchanges At risk on the NYSE for March 2022. shares of the largest mining concern in the Russian Federation, Mechel, whose shares cost $2.37, although in 2008. traded at $115 and then fell for a long time after criticism of the concern from V. Putin and an investigation by the FAS.

If, as a result of the global crisis, shares fall below $1 , the exchange will apply forced delisting.

What's the point of the new SEC rules ? The US Securities and Exchange Commission protects the rights of investors. If the share price falls to $1, the issuer must attract investors or buy back some of its shares on the stock exchange, reducing their number and raising the price per share (for example, Mechel has 416 million shares outstanding on the NYSE). If the issuer does not do this, the investment is at risk, says the SEC. Agree, this has its own logic.

How to work on the NYSE from Russia

As with other exchanges, you cannot register directly with the NYSE. There is no need to buy a license; this option is interesting for brokers. To work on the American market, it is enough to find a broker that provides access to this trading platform. There are such companies in Russia too.

The easiest way is to register with Interactive Brokers. This company accepts traders from Russia and provides access to all major platforms in the world, including the New York Stock Exchange. Another company that accepts traders from the Russian Federation and has no restrictions on entering US sites would also be suitable.

Such companies include broker Otkritie, BCS, VTB, Finam. To gain full access to the American market you need the status of a qualified investor.

I also recommend reading:

Interest-bearing investments - TOP 9 best options

Investments with interest involve investments with a known income in advance, the amount of income is indicated as a percentage of the invested capital. Of course, guarantee […]

If there is no desire or opportunity to obtain this status, you can open an account with a sub-broker (these are subsidiaries of brokers operating in Russia). A sub-broker is essentially not a broker in the usual sense of the word; it is an intermediary; it resells the services of an American company that has full access to the NYSE and NASDAQ. An example of such an intermediary is BCS Cyprus, a subsidiary of the Russian broker BCS.

When trading, keep in mind that you will have to pay several commissions. A small fee is charged by the exchange itself, the broker, and most likely the depository will also be paid.

The commission here is small and depends on whether liquidity is added or removed. So, for shares whose value exceeds $1.0:

- when working with securities from Tape A and reducing liquidity, you will have to pay $0.0030 when buying/selling 1 share. A decrease in liquidity refers to immediately executed orders; this occurs when trading at the market price;

- if work is carried out with the same securities, but there is an increase in liquidity, then the commission is reduced to $0.0012.

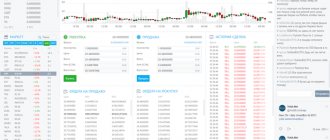

New York Stock Exchange stock indices

The second most popular financial instrument, after stocks, is the NYSE stock indices . Stock indices are arithmetic averages of the share prices of a number of the largest US enterprises, demonstrating online the growth, fall or flat of the entire economy and shares in the stock market.

The largest stock indices of the New York Stock Exchange.

- Dow Jones Industrial Average - arithmetic average index of share prices of the 30 largest NYSE companies, details in the main wiki article Dow Jones Index: classics and innovations of trading Masterforex-V;

- SP 500 is a similar index of the arithmetic average price of shares of the 500 largest US companies on the NYSE and NASDAQ;

- NYSE Composite - an index of average prices of all stocks on the NYSE;

- NYSE ARCA Tech 100 Index is an index showing the change in the value of 100 stocks of innovative companies on the NYSE.

Popular indices

The New York Stock Exchange calculates and publishes several indices. The most famous and popular are Dow Jones, NYSE Composite and NYSE 100 US Index.

Dow Jones Index

Appeared in 1896 and initially included 12 companies. With the development of the economy, the number of participants grew, today it is 30. These are the “blue chips” of the American market. Among them there is not a single company from the 1896 list.

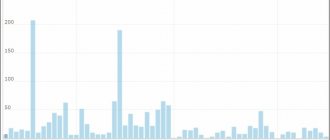

The graph for the entire history of the index is presented below.

The quote increased from 40.94 to 33,896 points (as of May 19, 2020). And the most rapid growth has been observed since the 80s of the last century. The structure of the index has also undergone major changes. If previously a large share was made up of shares of railway companies, today:

- 21.3% belongs to IT companies;

- 20.8% – to the consumer sector;

- 17.1% - industrial companies;

- 17% – healthcare;

- 15.7% - financial sector;

- 4.7% – communication services;

- 2% – to energy companies;

- 1.2% – to the materials production sector.

NYSE Composite Index

First published on 12/31/1965, the base value was 50. The key feature and difference from other indices is that the NYSE Composite is measured in US dollars. At any given time we can find out the average price of a stock on the New York Stock Exchange. Over more than 50 years, it has grown from $50 to $16,233 (as of May 19, 2021).

The index includes all US and foreign stocks that are traded on the New York Stock Exchange. It serves as an excellent indicator of the state of the US economy, because the majority of its composition is represented by American companies.

Why the New York Stock Exchange is America's favorite investment vehicle

The Dow Jones and SP500 stock indexes are our favorite investment vehicles. They are simple, logical, reliable, and understandable. They grow for about a decade, then sharply go down due to correction during global economic crises. And this has been repeated for decades.

Notice how

- The Dow Jones-30 index logically goes up from level to level of the MF, which we give on the closed forum of traders Masterforex-V

- fall in December 2022 The Dow Jones index showed the starting point of the global financial and economic crisis.

We see a similar picture for the SP500 stock index:

- a decade of growth;

- strong fall in December 2022

- hint of 2 original indicators of the Masterforex-V Academy (JSC Zotik and WPR_VSmark) instead of the outdated MACD and RSI oscillator. AO_Zotik can be downloaded for free by registering on the Academy forum.

>

The end of the trading pit and the beginning of electronic trading on the New York Stock Exchange

Until the end of the 90s. All trading on the NYSE and other stock exchanges took place through the “exchange pits” (or trading “on the floor”) - a place below the floor level where the exchange brokers and the leading trader were located. The broker's assistants sat on a raised platform, taking phone calls from clients and, from top to bottom, transmitting orders to buy or sell shares with finger and hand signals to their brokers, and they to the broker. It is this emotional noise, din and screaming that most people forever associate with the stock exchange. Watch a documentary about this legendary era, which faded into oblivion due to the development of electronic trading (although the film is based on the Chicago Mercantile Exchange, the behavior of stock exchange players was the same on the NYSE and other stock markets of the world).

All brokers from the “pits” of that time (like, for example, Richard Dennis, the author of the “turtles” training) remember this time with sadness and nostalgia, because The emotions of the players helped to sense the “psychology of the market” and the dominant mood of “bears” or “bulls” in it.

On January 24, 2007, there was a transition to an electronic trading system via the Internet. From then until now, during stock exchange sessions, everything is calm, quiet and... boring. In the half-empty trading floor of the New York Stock Exchange there are kiosks (“posts”) where you can find out news from “specialists” about certain stocks. Tours are given around the trading floor, brokers drink drinks, read newspapers and discuss with each other everything the same as clerks in a regular office center.

Choosing a broker for trading on the NYSE

Electronic trading over the Internet has sharply reduced the value of a brokerage seat on the New York Stock Exchange . The broker can no longer tell the “mood in the room”; he sees almost the same information as a trader who decides to trade stocks on the NYSE from an office or home thousands of kilometers from the United States.

Therefore, it is not surprising that if in 1928. a place on the NYSE was sold for $625 thousand (the equivalent of modern $12 million), but now its price ranges from $1.5 to $3 million. Considering that the NYSE has been trading since 2005. it no longer sells “places”, but issues trading licenses for 1 year, then the “purchase of a place” occurs through a change in the composition of the founders from one of the brokers of the New York Stock Exchange.

An increasing number of traders choose institutional forex brokers to trade on the NYSE , which

- provide the opportunity to simultaneously trade financial instruments of the stock market (NYSE, NASDAQ, London Stock Exchange, etc.), commodity futures of the Chicago Mercantile Exchange (gold, silver, oil, gas, copper, etc.), currency pairs of the Forex and crypto market;

- provide greater leverage;

- open trading accounts with minimal amounts when trading only 0.01 lots;

- contain Russian-language technical support for customers;

- provide round-the-clock trading in financial instruments from Monday to Friday, placing transactions not only on the NYSE, but also on other stock exchanges around the world, bypassing the gaps of the New York Stock Exchange when quotes move from one day to another;

- less picky about opening trading accounts by citizens from the territory of the former USSR than US stock brokers, etc.

Masterforex-V Academy traders open trading deposits with 2 institutional brokers recommended in the rating - FxPro (London) and Interactive Brokers (USA) . Of this pair of well-known brands on the market, the majority chose the more “flexible” and “democratic” FxPro, which provides

- the MT-4 trading platform familiar to all traders;

- the ability to trade from a micro lot of 0.01 to 10,000 lots;

- minimum trading account from $100 (note: the minimum recommended deposit for money management MF is from $800-$1000 when trading 0.01 lot)

- leverage from 1:30 to 1:500;

- All types of trading strategies are allowed, from automated advisors to day trading, swing trading, scalping, etc.

- acceptable swaps when transferring positions to the next day, especially with highly profitable trading and earnings on global financial and economic crises; (for example, a positive swap when working on sell on WTI oil futures +$6.41 for 1 lot per day, +$5.83 on gold futures (Gold), Dow Jones stock indices, SP-500, NASDAQ-100, etc.)

- insurance payments up to 20,000 euros from the Investor Compensation Fund in case of bankruptcy of a company (compensation for non-trading risks)

How important is it to choose the right broker for many years to come? Read the material on the Masterforex-V wiki Why, when setting a stop loss, should you be 100% confident in your broker? Are you surprised that the fingers of one hand are enough to weed out all the other would-be brokers after 15 years of trading on the market?

Remember, no money management will save an investor or trader if the broker does not give you the earned profit and deposit.

How to access trading

In order to work with the NYSE, a trader will need to enter into an agreement with a broker licensed to access this platform. This can be either a Russian broker or under US jurisdiction. However, carefully check the authenticity of the license so as not to end up in the hands of scammers, of whom there are especially many around this exchange.

The broker provides software that allows you to access the exchange directly and start trading immediately. Then everything depends only on your skill.

Many people believe that trading on the site requires a huge deposit. However, this is a myth; starting capital of 1000-2000 US dollars will be enough to open an account with foreign brokers. Some of our brokers will open with $200, the only question is what will you do with such a small deposit.

Interactive Brokers CapTrader Exante Just2Trade

In fact, the only real major American broker who still works with Russians.

Pros:

- There is support in Russian

- Good commissions

- The deposit can be replenished with rubles (bypassing currency control)

The disadvantages include:

- Minimum deposit $10,000

- Inactivity fee

Read the review for the full set of working conditions.

German IB introducing broker for direct access to foreign markets. This is where my investment portfolio is located.

Pros:

- works with Russians

- Availability of a Russian-language version of the site

- reasonable commissions

- no fee for inactivity

- insurance under US law for $500k

The disadvantages include:

- Support exclusively in English and German

- The support service itself is poor

For a detailed review, see this post.

Another interesting broker for going abroad, and not from the IB family. Unfortunately, contracts are opened for Russians only in Cyprus.

Pros:

- Acceptable commissions

- The fact of successful verification of work by the SEC

- Russian-language website and support

On the downside:

- Cyprus jurisdiction

- Inactivity fee

Read a detailed review here. You can get a $500 bonus when opening an account here.

The company is an American subsidiary of Finam and was created to bring clients from the CIS to the American market.

Pros:

- The easiest way to open an account

- Russian-language support

- Opening an account from $200

Minuses:

- Quite high commissions

- Various additional payments

Read the fullest review here.

A Caution About Binary Options and Forex

I consider it my duty to clarify some points.

NYSE is a stock exchange. It trades stocks, bonds and options. It has nothing to do with Forex - as you know, only currencies are traded on it. And certainly no binary options, which are anything other than an electronic casino, are used on the world giant.

Therefore, I really hope that none of the online scammers, of which there are a great many, to my great regret, will seduce you with easy winnings and “win-win” strategies. They began to very often hide behind the NYSE as the most popular platform. They even claim that they provide online quotes on a chart, as well as real forecasts of market movements.

Always separate flies from cutlets. Trading is speculation, it's fleeting, and I'm not really in the mood to discuss it. And investments are a long-term and reliable strategy for additional income, which is very possible with the help of the NYSE, but only with a planning horizon of 3 years.

As they say, “be careful and careful.”

How much do traders earn when trading on the New York Stock Exchange?

Alexander Gerchik earned an average of 10%-15% per year on the NYSE . Few? For this reason, an unknown side of Gerchik’s conflict with BCS arose in 2011, when the head of BCS could not understand what the trader was proud of if the bank needed to pay 18% on deposits to the bank’s depositors.

Traders of Masterforex-V, according to the free autocopy rebate service pro-rebate.com, have an average income of 300%-700% for 3-4 years of monitoring their accounts on Forex, the crypto market, stock and commodity exchanges.

This comparison once again shows the advantages of trading not on one, but on several financial markets at once , which is typical for Masterforex-V traders. For successful trading, what is important is not the market (NYSE indices and shares, forex, futures or cryptocurrencies), but finding a trend at the very beginning of its emergence.

This week for one financial instrument, next for another, in a month for a third. Stock indices and shares of the New York Stock Exchange are only a small (albeit significant) part in the ocean of financial markets.

Impact on the economy

The company's valuation ranges from 20 to 30 trillion US dollars. The market covers several thousand assets, not limited to US-registered companies.

New York Stock Exchange - the largest stock exchange

The impressive turnover has led to the fact that global trends depend on the initiative of traders on the New York Stock Exchange. Typically, NYSE transactions are reflected in European and Asian prices a day later. Therefore, professional traders use tools aimed at monitoring market quotes.

Trading stops when indices collapse on the New York Stock Exchange

Since 2013, the NYSE has introduced new rules to automatically suspend trading for 15 minutes when the market falls sharply by 7% and 13% on the SP 500 stock index . If the market falls by 20%, trading is suspended until the next day.

This happened only once on July 8, 2015, due to panic after the publication of news about a possible cyber attack on the New York Stock Exchange. The rumors were not confirmed. The next day, trading continued as usual.

Comment No. 1 wiki Masterforex-V: take a look at the chart of time frame d1 of the SP500 index on 07/08/2015.

- the price is at the lower limit of the auxiliary level MF = 2036.3;

- after the rumors are not confirmed, it goes up to a large resistance level = 2123.3, knocking down stops above the previous top and from which it pushes down and falls, breaking through level after level up to 1830.3;

- Do you believe it was an accident that news of a cyber attack was published on that day?

Comments No. 2 wiki Masterforex-V: Think again, where is it better to trade the Dow Jones and SP500 stock indices - directly on the NYSE or through CFD Forex brokers who do not stop quotes, switching from exchange to exchange?

NYSE opening hours

Trading on the stock exchange takes place every day, except weekends. There are 9 more closed days during the year, which are major public holidays - weekends in the USA.

On the NYSE, the trading session opens at 9:30 local time and closes at 16:00.

The exchange operates on the famous Wall Street, house number 11.

Peculiarities

One of the features of the NSE is its transparent operation. The exchange opens at the same time, and the activities of each trader are recorded. If you wish, you can download a specialized program:

- Arca Book;

- LEVEL-2;

- NYSE Open Book.

Each application is designed for stock market participants. By installing it, you can not only monitor the status of quotes, but also track the actions of other traders. At the same time, NYSE terminals ensure prompt closing of transactions.

Interesting facts from the history of the New York Stock Exchange

1. The New York Stock Exchange was born on May 17, 1792 , when 24 brokers signed the Buttonwood Agreement to create a stock exchange in New York.

2. For almost a century, the New York Stock Exchange was in the shadow of the Philadelphia Stock Exchange , established 2 years earlier than the New York. In the USA, hundreds of studies have been published on the topic of how “sleepy New York” managed to overtake the “financial capital of hardworking Protestants Philadelphia”, which before the Civil War was home to the “First Bank of the USA” (de facto National Bank), “Second Bank of the USA”, not to mention financial oligarchs of the time, who were all... Philadelphians.

The main reason for Philadelphia losing its status as the financial capital of America in favor of New York is the American Civil War (1861-1865), which took place in Philadelphia (Pennsylvania), while many of its residents had business contacts and sympathized with the South, which lost in that war. Since then, the second largest city in the United States has been turning into a province, and in terms of the number of residents it will soon be overtaken by Houston (Texas), Chicago (Illinois) and Los Angeles (California);

3. The New York Stock Exchange played an important role in Roosevelt's New Deal from 1933. on the country's recovery from the crisis and the revival of the United States. Since 1934, the NYSE has worked closely with the SEC to “restore investor confidence” and “protect their rights,” and the NYSE itself has become, with government guarantees, a successful working tool in attracting trillions of dollars of investment into the United States , incl. 54% of Americans invest their savings in the American stock market.

I wonder if any of the politicians b. Does the USSR know that it was not the “construction of highways”, but the attraction of investments (not loans) that became the cornerstone for the revival of the USA since 1933?

What is the capitalization of enterprises at $32 trillion? on the NYSE? This is more than the GDP of China and the United States combined in 2018. Now do you understand what Wall Street is for the modern world?

How it was created and developed

NYSE (New York Stock Exchange) is the largest US stock exchange, about which many films have been made and many books have been written. It is the platform that is associated with instructive stories of instant riches and the collapse of traders; it is the platform that investors all over the world dream of trading on.

Complete information about current strategies that have already brought millions of passive income to investors

The New York Stock Exchange sets trends in trading not only in America, but throughout the world, because more than 60% of all transactions are carried out here. In addition, the stock listing includes global giants, on whose development the state of both the American and global economies depends. Competitors include Nasdaq, London (LSE) and Tokyo exchanges.

Let's go through the key moments in the development history.

The NYSE dates back to 1792, when 24 brokers decided to create a stock exchange to discuss transactions and signed the Buttonwood Agreement. The work was carried out in a New York coffee shop on Wall Street, and the transactions were barter with an exchange commission of 0.25%. The first stock to be listed was Bank of New York.

At the beginning of the 19th century, the young exchange introduced a number of initiatives that were progressive for that time. Firstly, it allowed everyone to register their companies on it, i.e., it introduced a simplified listing procedure. Secondly, it adopted a provision according to which shareholders were not responsible for the company’s activities and were not liable for its debts.

More than 100 cool lessons, tests and exercises for brain development

Start developing

The technological innovation of the telegraph in 1840 helped further cement New York's primacy in stock trading. And the introduction of the telephone in 1878 allowed transactions to become even more dynamic because investors could quickly call their broker and instruct them to buy or sell a security.

If at first it was mainly banks and insurance companies that were traded on the stock exchange, then with the rapid development of the railway network, it was their shares that began to dominate.

The activities of the American stock exchange of the 19th century are well described in T. Dreiser’s book “The Financier”. I highly recommend reading this work. Many points in the book remain relevant today, especially for beginners. For example, the psychology and risks of trading on debt. And the ending, perhaps, will stop someone from risky transactions and force them to look at long-term investments, and not at speculation, when you can earn millions in one day and lose everything.

The exchange received its official name New York Stock Exchange in 1863. The number of traders grew so much that it was necessary to introduce restrictions and fees for space. The stock ticker also first appeared in New York in 1867. In 1896, the Dow Jones index appeared, which is still followed by investors from all over the world.

The beginning of the 20th century was not the most optimistic. First, the First World War stopped the operation of the exchange for 4.5 months, then the Great Depression caused a collapse in quotations and the hopes of many brokers and investors for enrichment.

After World War II, the NYSE continued its development. In 1943, women were allowed to trade, in 1977 - foreign brokers, and in 1965, the NYSE Composite index appeared.