Financial instruments of the St. Petersburg International Commodity and Raw Materials Exchange

There are 6 exchange markets at St. Petersburg International Trading Exchange:

- oil;

- petroleum products;

- gas;

- forest;

- chemical products;

- derivatives market.

Graph, trading volume on the derivatives market of the St. Petersburg International Commodity and Raw Materials Exchange for 3 months.

The St. Petersburg International Commodity Exchange operates an over-the-counter market , and also trades in electricity within the framework of the EAEU OER (Common Electricity Market of the Eurasian Economic Union).

Trading instruments:

- AI-95 gasoline;

- EURO standard diesel fuel;

- aviation fuel;

- Urals crude oil;

- oil for oil refineries;

- natural gas;

- liquefied gas;

- lumber (pine, spruce, fir, cedar, larch);

- ammophos;

- urea;

- soda ash;

- ammonium nitrate;

- corn;

- coal;

- futures contracts (more than 40) and stock indices are traded on the derivatives market.

In total, over 2,000 trading instruments are available to traders.

Help from the Masterforex-V Academy : futures of the Russian Urals crude oil are traded on the St. Petersburg exchange. This is the standard Russian oil mixture (high-sulfur Ural and Volga oil is diluted with low-sulfur, so-called light, West Siberian oil). Foreign analogues: North Sea mixture of Brent oil, North American WTI, Middle Eastern Oman and Dubai, etc. The price of Russian Urals oil is the price of North Sea Brent oil with a small (on the order of one or several percent) discount.

How dividends are paid

In order to receive dividends from foreign shares before closing the register of shareholders, it is important for the investor not to forget about the T+2 trading mode. That is, you need to buy shares of foreign companies paying dividends 2 days before the closing date of the shareholder register, and not on the same day.

Dividends will not come immediately. The average accrual period is 5-6 days after they are paid by the issuer. During these days, the broker's depository distributes them to clients' accounts. This is due to the time difference with the United States and the timing of bank transactions for transferring funds.

Indices of the St. Petersburg International Commodity and Raw Materials Exchange

A special feature of SPIMEX is that the exchange calculates indices.

Indices of the St. Petersburg International Commodity and Raw Materials Exchange:

Petroleum products:

- composite index is a universal indicator that reflects the dynamics of the price of 1 ton of light petroleum products;

- national indices – average cost on the domestic market, broken down by each type of petroleum product;

- territorial indices – the average cost of petroleum products regionally (in Siberia, the Far East, etc.);

- refinery price indices;

- UIA index – the cost of aviation fuel within the Moscow aviation hub.

Chart, composite index of petroleum products of the St. Petersburg International Commodity and Raw Materials Exchange.

Natural gas:

- natural gas index – general index;

- regional indices – price in the markets of different Russian regions.

Coal:

- indices broken down by region (Pechora, South, Kuzbass, Krasnoyarsk, etc.);

- indices broken down by type (brown, stone, anthracite, etc.).

Oil:

- regional stock indices (Timan-Pechora, Volga-Ural, West Siberian oil and gas basin);

- regional over-the-counter indices.

Chart, stock index of oil from the Timan-Pechora basin.

Access to foreign securities

Investors' shares and bonds are kept in Best Efforts Bank PJSC (Russia), and money is kept in a clearing account in the IFAC Clearing Center in the National Settlement Depository (NSD).

PJSC "Best Efforts Bank" takes into account investors' securities in a sub-account; investors' rights to securities are taken into account in the broker's depository and then, through a chain of nominee holders, this right is taken into account both in the American DTCC and in foreign depositories. The buyer is recognized as the ultimate owner of the shares, retaining all ownership rights due to him. That is, if you live in Ryazan and bought Tesla shares, you will become a real Tesla shareholder while living in your city.

Admission of securities of foreign issuers to trading is carried out without an agreement with the issuer on the basis of clause 4.1. Article 51.1. "Law on the Securities Market". This allows the shares and bonds of the most liquid foreign companies to be admitted to trading.

General information about the St. Petersburg International Commodity and Raw Materials Exchange

- SPIMEX began operating in May 2008 by decision of the President and Government of the Russian Federation.

- SPbMTSB is a joint-stock company, but its shares are not traded on stock exchanges. The state largely controls the exchange through shareholders - state companies Rosneft, Gazprom Neft, Tatneft, Russian Railways, etc. The government of St. Petersburg is also a shareholder.

- SPbIMEX is the dominant commodity exchange in Russia. 99% of transactions on key goods for the Russian economy - oil, petroleum products and natural gas, as well as timber and mineral fertilizers - pass through it.

- SPbIMEX operates on the modern electronic platform “TEK-Torg” and has a multi-level infrastructure, including guarantor banks, clearing, supply controllers, etc.

- More than 2.2 thousand organizations take part in trading at the St. Petersburg International Commodity and Raw Materials Exchange. Traders have access to over 2 thousand trading instruments (crude oil, petroleum products, natural and liquefied gas, timber, etc.).

- The main goal of the St. Petersburg International Commodity and Raw Materials Exchange: to create and develop an organized commodity market for the main raw materials of the Russian Federation and other countries of the Eurasian Economic Community.

- The St. Petersburg International Commodity Exchange cooperates with the Shanghai Oil and Gas Exchange (SHPGX) and the Shanghai Commodity Derivatives Association (SOCDA).

- The central office of the St. Petersburg International Commodity Exchange is located not in St. Petersburg, but in Moscow.

New schemes on the sales market

Any price is a product of the non-resistance of the parties to the transaction and during exchange trading is regulated only by the supply and demand of raw materials. An important advantage of the new electronic tool is that the operator does not have one specific supplier, there are many of them, and the position of the seller and the buyer changes quickly. At any time, the buyer can act as a seller, and the seller can act as a buyer.

The progress of trading with the introduction of the new system makes it possible for a market participant who has a cash gap and has inventory balances, for example at an oil depot, to raise money in real time against the security of these balances using a repo scheme, which means a purchase with an obligation to resell.

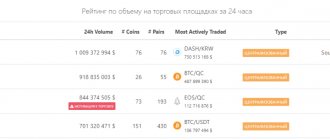

Key indicators of the St. Petersburg International Commodity and Raw Materials Exchange

Exchange market indicators for 2022:

- 1 million tons of crude oil were sold.

- Natural gas – 15.1 billion cubic meters.

- Timber – 1.38 million cubic meters.

- The trading volume on the derivatives market is almost 41 thousand contracts worth 13.83 billion rubles. (approximately $220 million).

OTC market indicators for 2022:

- Liquefied gas – 13.4 million tons.

- Crude oil – 530 million tons (+4.8% per year).

- Natural gas – 1.47 trillion. cubic meters (+46.8%).

- Coal – 693.8 million tons (+5.6%).

- Grain – 100 thousand tons.

Masterforex-V Academy Help : Have you noticed that the indicators of over-the-counter transactions are significantly higher than those on the exchange? No, this is not a mistake. In accordance with Russian legislation, all transactions in crude oil, petroleum products, liquefied and natural gas, coal and grain must go through a commodity exchange. Therefore, even if the buyer and seller agreed to shake hands outside the walls of the St. Petersburg International Commodity Exchange, they still must conduct the transaction through it (or another Russian commodity exchange).

Electronic exchange trading of petroleum products - Gazprom Neft PJSC

Gazprom Neft PJSC today actively supports the development of exchange trading in petroleum products in the Russian Federation. Exchange sales, in the opinion of the company’s management, allow us to achieve the most transparent pricing for petroleum products. In addition, the exchange can become a fairly powerful sales channel for products. In terms of exchange sales volumes, Gazprom Neft PJSC is guided by the recommendations of the Ministry of Energy of the Russian Federation and the Federal Antimonopoly Service.

PJSC Gazprom Neft is one of the co-founders of SPbMTSB. The company's petroleum products have been put up for exchange trading since the end of 2009. Already in 2014, the company confidently became one of the three leading Russian oil companies in terms of trading volumes on the stock exchange. On average, Gazprom Neft PJSC increases exchange sales indicators within 10% per year.

Choosing a broker for trading financial instruments

The widest range of financial instruments, which is important - ON DIFFERENT MARKETS (!), is offered to traders and investors by brokers from the TOP-13 Masterforex-V Academy rating: Nord FX (No. 1 rating), as well as FXPro, Dukascopy Bank SA, Alpari ), Interactive Brokers, OANDA, Swissquote Bank SA, FXCM, Saxo Bank, FIBO Group, FOREX.com, Fort Financial Services (FortFS) and Finam.

Statistics from the free autocopy rebate service pro-rebate.com of the Masterforex-V Academy show that approximately 50% of successful traders have deposits with NordFx . The broker offers:

- popular stock indices Dow Jones 30, S&P 500, NIKKEI 225, FTSE 100, DAX 30, NASDAQ-100;

- cryptocurrencies – BTC, XRP, ETH, LTC, ETC, BTG, EMR, OMG, EOS, NEO, IOT, DSH, ZEC, etc. (16 in total);

- cryptocurrency indices – 10ALT (10 altcoins to USD), TOP14Crypt (14 cryptocurrencies to USD), TOP3ALT (3 altcoins to USD), etc.;

- quotes EUR USD, GBP CHF, GBP USD, GBP AUD, GBP CAD, GBP NZD, CHF JPY, AUD JPY, USD JPY, USD CHF, NZD JPY, USD CAD, NZD USD, AUD USD, USD RUB, EUR RUB, AUD CHF, USD UAH, USD BYN, USD SEK, USD NOK, USD CNY, EUR CHF, EUR JPY, EUR GBP, EUR NZD, EUR AUD, EUR CAD, EUR NOK, EUR SEK, GBP JPY, GBP SEK, GBP NOK and etc.;

- CFD (oil, gold, silver, etc.);

- investments in investment portfolios of leading investment funds with trust management (FD) Pro-Industry Fund, Pro-TECH Fund, Pro-Expert Fund and American stocks NYSE and NASDAQ - Intel Corp., Microsoft, McDonald's, Apple, Motorola, Boeing, Alibaba, Nike, Coca-Cola, Visa Inc., PayPal, Google, Facebook, Ferrari, 21 FOX, Pfizer, HP Inc, Jonson & Jonson, Nvidia, Cisco, Electronic Arts, Mastercard, PayPal, Fedex, etc.;

- PAMM and RAMM accounts.

At the broker

- the trading platform Meta Trader 4, Meta Trader 5 and Meta Trader 4 Mobile, well known to all traders, with a wide range of built-in indicators and oscillators for technical analysis of forex charts, commodity, stock and cryptocurrency markets;

- minimum trading account from $10, recommended deposit for money management MF from $800-$1000 when trading 0.01 lot);

- leverage from 1:50 to 1:1000;

- Various trading strategies are available from automatic advisors to day trading, swing trading, long-term, medium-term and position trading, scalping, the use of martingale, anti-martingale methods, etc.;

- financial regulation CySEC in the European Union.

By opening a real trading account from $3000 at NordFx, all traders get the opportunity to study for free for 1 year at the Masterforex-V Academy, receiving daily trading tips on a closed forum and on Skype.

Shareholder composition

In February 2022, the largest shareholders of the Moscow Exchange, with 5% or more of the votes, were:

The Moscow Exchange includes PJSC Moscow Exchange, which manages the platform. The group itself also includes a central depository (“National Settlement Depository”) and a clearing one (Joint Stock Company).

“National Settlement Depository” is a professional participant in the securities market licensed by the Central Bank. It keeps records of what financial instruments its participants own. “National Clearing Center” is also a professional participant who is responsible for mutual settlements between the buyer and seller of securities, acting as an intermediate link for each of them.

Other key commodity exchanges of the world

Other largest commodity exchanges in the world are

Intercontinental Exchange (ICE, Atlanta, USA);

Chicago Mercantile Exchange (CME, Chicago, USA);

London Metal Exchange (LME, London, UK);

Dalian Commodity Exchange DCE, Dalian, China;

Multi Commodity Exchange of India (MCX, Mumbai, India).

Other universal exchanges in the world

The universal exchange combines commodity, currency and stock exchanges in one person, i.e. trading in commodity futures, currencies, securities and derivatives - stocks, ETFs, blue chips, bonds, warrants, bills, etc. on their trading platforms.

These are the Moscow Exchange MOEX (formerly RTS and MICEX), the Singapore Exchange (SGX), the Istanbul Exchange (Borsa Istanbul, BIST), the Hong Kong Stock Exchange (HKE), the Australian Securities Exchange, ASX), Kuala Lumpur Futures Exchange (KLSE), Taiwan Stock Exchange (TWSE).

Working hours of the St. Petersburg International Commodity and Raw Materials Exchange

The full version of trading times is available on the website of the St. Petersburg Exchange spbexchange.ru/ru/stocks/inostrannye/raspisanie/.

* not carried out for securities specified in the list.

** Limit orders valid until a certain date, established by clause 15.8.2 of the Rules for Organized Trading in Securities of PJSC St. Petersburg Exchange, can be submitted from 10:00 a.m. to 00:00 a.m. Moscow time.

WINTER-SUMMER TIME. When the US switches to Daylight Saving Time, liquidity periods move forward by 1 hour. The changeover to winter time takes place on the first Sunday in November, and to summer time on the second Sunday in March.

Taxes

Taxation is carried out in rubles even in cases of dollar trading. If they make a loss, they still have to pay tax. For example, an investor purchased a share of Apple for $200. The latter cost 66 rubles, but the security began to fall in price. The investor sold it for 190 rubles and lost 10 dollars. Due to the change in the exchange rate, the profit amounted to 300 rubles. You need to pay tax.

The opposite situations happen when you don’t need to pay. The income would be in dollars, and the loss would be in rubles. As on the Moscow site, on the St. Petersburg site the tax agent is a broker. He calculates the tax on profits and transfers it to the tax office.