- Bitcoin's collapse today was triggered by the flooding of a mine in China

The rate of the top cryptocurrency is volatile. Big jumps can be seen, but they are always followed by corrections. Leading world analysts predict a fall in the Bitcoin rate to $20 thousand. However, they do not rule out a short-term increase in value above $50 thousand, but a return to the 10-20 thousand mark is inevitable. Let's consider whether a fall in BTC is possible in the future and what is associated with the recent, albeit not critical, collapse of the cryptocurrency market.

Where to buy Bitcoin?

Buying BTC for USD on the EXMO exchange is very easy, you just need to follow a few steps:

- Login to EXMO or create an account if you don't have one;

- Go to the “Wallet” section of your personal account;

- Select USD currency and top up your balance;

- Go to the “Trades” page, select BTC/USD in the list of currency pairs;

- Scroll down to “Buy BTC” and “Sell BTC”;

- Select order type: Limit, Market or Stop:

- Use Order if you want to instantly buy or sell BTC at the current market price (currently 1 BTC is 44315.52 USD). This order does not require any additional settings.

- A limit order is an order to buy (or sell) BTC at a certain, more favorable price. A buy limit order is executed only at or below the specified maximum price, and a sell limit order is executed only at or above the specified maximum price.

- A stop order is a pending order for automatic purchase or sale operations, which is executed according to previously established restrictions in order to make a profit and (or) minimize possible losses.

- Fill in the “Amount” and “Price” fields (pay attention to the transaction fee).

- Click the “Buy” or “Sell” button.

Easy, right? Now you know that buying Bitcoin and exchanging US Dollars for Bitcoin is available to all users. You just need to figure it out a little.

Bitcoin is falling in price: how much will the cryptocurrency cost in 2022

The creator of the BTC network, known under the pseudonym Satoshi Nakamoto, launched his brainchild on January 3, 2009. At first, only a narrow circle of IT specialists were familiar with cryptocurrency. Over the years, interest in military-technical cooperation has grown so much that the price of the asset in 2022 increased to 64 thousand dollars. Experts agree that throughout the year the price will rise significantly, according to some experts - up to 100,000 USD.

According to Yuri Pripachkin, president of the Association of Cryptoeconomics, Artificial Intelligence and Blockchain, in the third quarter the cost of military-technical cooperation may rise to $75,000. But, in his opinion, a negative scenario is also possible. If there is a fall in the cryptocurrency market, the price will fluctuate from 10,000 to 25,000 USD, which will not prevent the cryptocurrency from rising in 2022-2023.

According to Vladimir Smerkis, founder of the Tokenbox project, the value of bitcoin is supported by its limited emission: out of the available 21 million bitcoins, 19,000,000 have been mined. The specialist believes that in 2022 the price of the cryptocurrency will remain above $50,000. However, it will not happen without temporary drops, so you need to invest with caution, since the cost can periodically drop to 12-15 thousand.

According to the forecasts of Arseny Poyarkov, head of , the price of Bitcoin will decrease significantly and may reach 10,000 USD, then begin to rise sharply. The average exchange rate for 2022 will be about 20,000 USD.

Leading Bloomberg analyst Mike McGlone suggested that Bitcoin will first rise to $50,000 in 2022, but then fall to $20,000.

The most optimistic are Yakov Barinsky, head of the crypto investment fund Hash CIB, as well as Yuri Mazura, head of the data analysis department of CEX.IO Broker. They believe that the price of Bitcoin can rise to 90-100 thousand US dollars with rapid growth, and up to 50 thousand with moderate growth. However, Mazura suggests that a negative scenario is also possible, in which the value of the cryptocurrency drops to 10,000 USD.

Bitcoin to US Dollar exchange service created for your convenience.

EXMO is a reliable cryptocurrency exchange with a high level of security of funds and data and the fastest technical support that responds within 15 minutes 24/7. Taking care of the client is the main priority of the EXMO team.

The EXMO platform, where you can exchange BTC for USD, was founded in 2013 and has offices in London, Kyiv, Istanbul and Moscow. EXMO is one of the largest exchanges in Europe in terms of traffic, BTC trading volume and liquidity.

The platform's easy-to-use interface will be convenient for both beginners and professional traders. The platform uses TradingView charts , which contain all the tools and data a trader needs for technical analysis when trading Bitcoin or US Dollar.

Log in to the platform, buy/sell Bitcoin and store it in the EXMO multi-currency wallet.

Why did Bitcoin fall: what could prevent the rate of the top digital asset from rising

The reasons for the incredible price fluctuations of Bitcoin or Ethereum, the two most popular currencies today, remain unclear even to those who buy them. At the same time, these same buyers influence the value of the “coins,” as well as their governments and insiders. So why is Bitcoin falling?

Why is Bitcoin falling? The law of supply and demand is always in action!

Crypto is subject to the law of supply and demand, just like other assets. Its essence is simple. When the price of a product decreases, demand increases but supply decreases. When prices rise, demand falls and supply rises. The collapse of Bitcoin today may be triggered by this factor. When the price of Bitcoin rises to $20,000 per coin, holders are eager to sell them as quickly as possible. And, of course, some part of the “cryptocurrency” is sold. The result is the collapse of Bitcoin, the value of the cryptocurrency begins to fall rapidly because supply exceeds demand. After it returns to an acceptable level, demand increases and the cycle repeats again. This process is natural for market relations and significantly affects digital money, although this is not the only reason for the fall in cryptocurrency rates.

Bitcoin has fallen in price due to news, rumors and gossip

If you're wondering why Bitcoin is falling today, take a look at the climate in the crypto community. It is well known that rumors can lead to consequences that may be more significant than the consequences of the event itself. This is especially true for the open virtual money market. Built on the principles of supply and demand, it depends on a positive news background, which to some extent encourages purchase or investment. Rumors about the bankruptcy of the main crypto exchanges, the negative mood of the US government and bans on advertising “coins” by large social networks such as Facebook often lead to a decrease in quotations and we see that the Bitcoin rate has fallen. This happened in February 2022, but then the top coin began to grow rapidly.

Of course, while Bitcoin is falling, other coins may rise in price, but only Bitcoin has a key impact on the entire market. Other currencies have not yet come close to its capitalization. In addition, negative news or rumors about other “coins”, as a rule, go almost unnoticed by the market in general.

Bitcoin collapse provoked by government bans and restrictions

“They are furious from powerlessness” - this is how most users characterize the policies of states that limit or prohibit the circulation of digital money on their territory. Such negative sentiments of the authorities are explained by the inability to control and influence the flow of funds coming through the Internet from the sale and mining of cryptocurrencies. As a result, a decision is made to completely or partially restrict the operation of the market, which greatly affects the cost of those coins whose turnover in the territory of this country is the highest and the Bitcoin exchange rate falls.

For example, after the introduction of restrictions in China and South Korea, the rate of cryptocurrency fell by almost 30%. Similar measures in the DPRK, Laos or Vietnam had no effect on the global crypto market at all.

What events were associated with the fall of Bitcoin: examples

A report from the BitMEX cryptocurrency exchange revealed that there is an error in the Bitcoin blockchain that leads to a “double transaction.” In such a situation, there is no need to talk about the reliability of the virtual currency, and market players reacted negatively to this news. Subsequently, experts suggested that this was a false alarm caused by the simultaneous “mining” of two blocks at once, and, accordingly, a reorganization of the chain. This looks like a “double buy”, but it is not. Despite the refutation, investors still have a “sinus” left. What happened to Bitcoin after this news? Its quotations declined, but soon returned to normal.

It is also worth considering that US President Joe Biden has nominated his candidate for the post of Treasury Secretary, Janet Yellen. Previously, she made an extremely controversial statement in which she expressed concern about the existence of virtual currencies. According to her, they are used primarily for “illegal financial transactions.” Accordingly, you need to think about how to limit their circulation. This was not what crypto enthusiasts expected from the new American administration, and as a result the cue ball fell.

Against the backdrop of jumps in the exchange rate of the top coin, many are interested in the question: will Bitcoin collapse? Meanwhile, investor sentiment shows that the cryptocurrency market is already “overbought” and the quotes are not entirely adequate. According to a Deutsche Bank survey, more than half of 627 market players, when asked to rate the likelihood of a bubble on a scale of 1 to 10 (where higher is more dangerous), gave a “ten” rating. According to traders, Bitcoin is more likely to fall in price by half in a year than to rise in price.

As for the function of Bitcoin as an asset - a “safe haven” that protects against inflation and financial bubbles, analysts at JP Morgan in a recent review questioned this statement. Banking holding strategists John Normand and Federico Manicardi compared the main cryptocurrency with previous assets that had risen in price at record rates in the past. These included gold in the 1970s, the Japanese Nikkei index in the 1980s, dot-coms in the 1990s, commodities and the Chinese stock market in the 2000s, and, finally, shares of the largest Internet companies (Google, Apple, etc. .) in the 2010s. Each of them demonstrated colossal growth and received unique epithets from enthusiasts (from the “Japanese economic miracle” in the case of Nikkei to “endless growth” in relation to the Internet giants). Analysts concluded that all of these investment targets eventually began to rise and fall with the market after the initial rush, thereby turning into ordinary cyclical assets. In their opinion, the same fate will soon await Bitcoin, which will become the first victim in the event of market turmoil.

Bitcoin collapse or rate growth: what will happen to cryptocurrency next

People are asking why Bitcoin is falling in price today and will it continue? After recent events, cryptocurrency has already gained momentum, but is it possible for the scenario to repeat itself? A rebound in the value of Bitcoin is extremely likely in the near future. Many experts say this: “In the coming days, we should expect that Bitcoin may come close to the $50,000-60,000 mark. But then it is almost guaranteed to collapse two or three times, since at the current stage Bitcoin is clearly overvalued,” says Artem Deev, head of the analytical department at AMarkets.

Bitcoin is unlikely to become a safe haven in the event of any geopolitical tensions and market turmoil, says the author of the bitkogan Telegram channel, HSE professor Evgeniy Kogan. “Jumping into the last carriage of a departing train is already dangerous. After such a serious growth there is always a rebound. It is impossible to predict at what level the correction will begin and at what level it will stop,” he told Forbes.

Yuri Mazur from CEX.IO Broker believes that the Bitcoin rate will rise in the first quarter of 2022, and predicts serious volatility of the token in the range of $25,0000-50,000. “As paradoxical as it may sound, after the world passes the coronavirus pandemic, it is likely , risky assets will stabilize and decrease in price due to the fact that the recovery of the global economy will lead to the launch of deferred inflation,” he explains.

Now you know why Bitcoin is falling in price. All these events are not critical and the top asset has every chance of recovery and further growth. and therefore you should not make negative forecasts.

Why is Bitcoin falling today: recent news that affected the cryptocurrency rate

Review of recent events that affected the rate of the top cryptocurrency.

Bitcoin's collapse today was triggered by the flooding of a mine in China

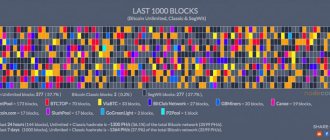

Why did Bitcoin fall today? Until recently, they gave 64 thousand dollars for one coin, and then an unpleasant incident occurred. How much did Bitcoin fall? The exchange rate dropped sharply by 10 thousand dollars. On April 16, 2021, the hashing power of leading Bitcoin mining pools dropped sharply due to a power outage in China's Xinjiang province after a mine was flooded. This was reported by local media, which noted a significant drop in the hashrate share of several large mining pools over the past 24 hours. Antpool's hashrate fell by 24.5%, Binance Pool's share fell by 20%, and BTC.com and Poolin fell by 18.9% and 33%, respectively. The incident is attributed to a regional power outage in Xinjiang due to comprehensive security checks. Local authorities began carrying out inspections following a recent coal mine flood that left more than 20 miners trapped in three different locations. About 1,500 rescuers were sent to the site. According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), Xinjiang province accounts for about 36% of China's total Bitcoin mining hashing power. Considering that China covers two-thirds of the world's mining capacity, the figure for Xinjiang is 23.3% of the world hashrate. According to Ycharts, Bitcoin's overall hashrate has decreased by about 2.2% over the past 24 hours, from 169.4 million TH/s to 165.8 million TH/s. This is why Bitcoin fell, but this is a technical problem that will be quickly resolved and the rate may return to its previous values.

Bitcoin collapsed due to a series of political events

Recently, more events occurred that caused the collapse of Bitcoin. News from the world of politics is not encouraging. Before the crypto community had time to recover from the previous fall, something terrible happened - Bitcoin fell sharply again. On April 23, the cost of the main cryptocurrency on the Binance crypto exchange dropped to $47.5 thousand. At 13:35 Moscow time, Bitcoin was trading at $49.4 thousand. In just one day, its price decreased by 12% (from $55.5 thousand). Amid falling quotes, users of crypto exchanges lost $3.7 billion, according to the bybt service. In total, the positions of almost 600 thousand traders were closed, one of them lost $11.3 million. Why did the Bitcoin rate fall?

Bitcoin fall today: why quotes are falling

There are several reasons for the decline in the price of Bitcoin, says Nikita Soshnikov, director of the Alfacash cryptocurrency exchange service. The cryptocurrency began to fall in price over the weekend due to reports of the US Treasury’s readiness to tighten regulation in this area. The expectations of crypto enthusiasts regarding the direct listing of Coinbase shares on Nasdaq were not fully met; many expected more stunning results, although those that were achieved exceed the reference price from Nasdaq, the expert noted. He also recalled the power outage in the mining provinces of China, which led to a drop in the network hashrate. This is why Bitcoin fell in price.

A large-scale correction was triggered by news about US President Joe Biden’s plans to almost double the capital gains tax for the wealthy, says EXANTE lead strategist Janis Kivkulis. In his opinion, there is now obvious speculation in the market, since Americans will prefer to declare capital income now, at current rates, so as not to give away about half of the profit later. “The tax news is a big bomb under Bitcoin that exploded at a very bad time, after a period where early buyers were actively taking profits and waiting for new signals about the future direction,” Kivkulis added. Bitcoin is falling amid these negative events.

Bitcoin collapsed: what else is associated with the change in trend

The current decline can be interpreted as a natural transition to the bearish phase of the market, says Vitaly Kirpichev, director of development of the TradingView platform in Russia. The price has fallen below the support level of $50 thousand, which was formed by the last significant correction in March, this indicates that technically the trend is beginning to break, the expert says.

According to Vitaly Kirpichev, the first signal to change the trend was on April 13, when the price of Bitcoin exceeded the historical maximum at $64.8 thousand, but there was no further growth. Good news is no longer perceived by the market, and any information with a minus sign is sensitively perceived by traders, says the development director of the TradingView platform in Russia. Can we consider that the cryptocurrency market has fallen? It is difficult to make forecasts, because by the end of April the cost of BTC had recovered and rose to above 52 thousand dollars.

Reasons for growth

Fluctuations in rates are normal for a volatile cryptocurrency market. The charts here never maintain a positive or negative trend for a long time: a fall is followed by a rise, and a rise is followed by a fall.

In this case, several factors coincided. First of all, the cryptocurrency market was inspired by the imminent release of the Libra stablecoin from Facebook. The white paper of the new coin has already been published, the security does not raise much doubt: this is not an abstract project and not another cryptocurrency, but a basket of securities that have earned the trust of the market.

The presentation of the TON (Telegram Open Network) blockchain project by Pavel Durov is just around the corner. The creator of VKontakte set a deadline for his team to launch the main blockchain project before the end of September 2019. Otherwise, investors will have to return their money.

The TON test network is actively tested by independent companies. After the launch of the main network, the Gram cryptocurrency will also become available. A limited number of investors received the right to buy it in three rounds of closed sales. Information about the resale of the opportunity to purchase Gram appears every now and then (and on this, investors have already earned 2-10 times more than they invested). But these are isolated cases: others hope that with the release of Gram they will earn even more.

There are dozens of other smaller reasons that contribute to the growth of Bitcoin. Major players in the traditional market began to reckon with cryptocurrencies and accepted them as inevitable. Adaptation of legislation in individual countries, of which there are an increasing number, also contributed to this.