Ethereum is the second most popular cryptocurrency after Bitcoin. When mining, purchasing or exchanging Ether, you need to choose a reliable wallet for tokens and storing digital currency.

MyEtherWallet is one of the most famous free and open source Ethereum wallets. The main advantage of the wallet is that it is not a classic service for storing digital currency, but a full-fledged working tool for interacting with the Ethereum network and ERC-20 standard tokens.

MyEtherWallet private keys are not transferred to third parties. They are stored only on the personal devices of their owners: computers, smartphones, tablets, USB drives.

Registration and wallet creation

To start working with the MEW service, you need to register on the official website. When you first visit the site, a welcome window will open. Here are the basic principles of how MyEtherWallet works:

- A message that MEW is not a banking organization.

- Navigation through the interface.

- Introduction to blockchain.

- Ways to improve account security.

- How to protect yourself from scam.

The system also warns that users themselves are responsible for the security of their wallets.

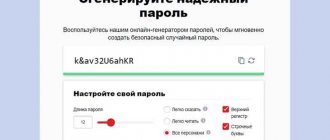

After familiarizing yourself with the basics of how your wallet works, create a new password. This is not a private key, but additional protection for the wallet. The system recommends entering a strong password consisting of at least 9 characters: numbers and letters. Click "CreateNewWallet".

Next, save the Keystore file. To do this, download it to your computer, cloud storage or USB drive.

Save the private key (PrivateKey) by copying it to a separate text file. This code gives access to your account, so take care of its safety. By clicking on “PrintPaperWallet”, you will open a *.pdf file with a private key. You can save it too.

What is Entry Point Confirmation

Most trading strategies use several types of market analysis. As a rule, there is a main one, for example, technical analysis, as well as those on the basis of which additional signals are monitored. Additional signs allow you to filter out false market entries and also increase the likelihood of choosing the right position.

For example, if you are trading at support and resistance levels, the entry point will be formed by a breakdown of one of the horizontal lines or a rebound from it. In this case, it is necessary to obtain confirmation of a breakout or rebound at least within the framework of technical analysis alone.

If the price bounces off the level, the reversal should be clearly formed.

IMPORTANT!

When entering a trade, you should pay attention to the fact that after the price has consolidated, there should be a rollback to the level overcome, and then a continuation of movement towards the breakdown.

Login to wallet

Before you can conduct transactions using your wallet, you need to unlock it. This step must be repeated whenever you operate the MEW.

To unlock your account, select a method to gain access to your account:

- MetaMask/Misk;

- Ledger Wallet;

- Trezor;

- Digital BitBox;

- KeyStore/JSON File;

- passphrase;

- Private Key / Parity Phrase

You can also simply view your wallet balance, but to carry out operations you will need one of the listed options.

By selecting the “Private Key” option, you can log in using PrivateKey by pasting the previously copied private key and clicking “Unlock”.

If you saved the Keystore file, you can go by selecting the “KeyStore / JSON File” option.

Attention! At the top of the interface you can change the language from English to Russian.

Forex indicator. When to enter a trade

Entering the market will be much more profitable if several filters are used to confirm the quality of the signal.

Let's look at the example of the iManhattan indicator.

The first signal that this indicator uses is 5 candles going in the same direction.

The indicator then uses Bollinger Bands as an additional filter. The price should go beyond the Bollinger Bands.

The indicator will show an arrow to sell or buy, taking into account the trend on D1 - this is the third filter.

The bars themselves are hidden so as not to distract the user. But you can display them on the screen and see that a signal is formed after the price crosses them.

Next we look at Fibonacci levels. The signal must be close to them.

It is recommended to use the indicator on the 5, 15, 30 minute chart and H1 (hourly), and calculate Fibonacci levels on the daily chart.

Important: the earlier version of the indicator showed entry signals only during a strong trend movement. If the trend was upward, then the indicator waited for a downward signal that went beyond the Bollinger bands, and vice versa in the case of a downward one.

Such signals happened quite rarely, since most of the time the market is in a flat.

In the new version of the iManhattan indicator, both sell and buy signals will be given not only during a trend, but also during a flat.

There are only two main indicators that are important to consider when making a decision: how to find the entry point into the Forex market using this indicator:

- an up or down arrow drawn by an indicator.

- finding the arrow near the Fibonacci level.

More details about the iManhattan indicator

Share or save:

- Telegram

Personal Area

In your personal account, in the top menu of MyEtherWallet, a minimum amount of information is collected:

- Interface language.

- Gas price. This item can be edited manually by indicating your cost. The lower the indicator, the slower the transaction speed.

- Network selection function. The default is Ethereum. You can change the network by selecting the appropriate option from the list.

In the “Wallet Information” section you can find:

- wallet address;

- Keystore file used to confirm MEW wallet actions;

- private key in unencrypted form;

- function of receiving a wallet in printed form;

- wallet address in QR code format;

- transaction history;

- current balance.

Point 1. Is it possible to trade on the market now?

The first point of the trading plan is the answer to the question “Is it possible to trade in the market now?”

It allows you to understand whether it makes sense to analyze a given financial instrument. If you cannot trade in the market, then determining entry points, observing smaller time frames, relevant news flows, or calculating position size is pointless - it is a waste of time.

This can happen when there is no directional trend in the market, or it is developing very actively, and it is too late to open a position. When the market fluctuates in a triangle or flat, it is not advisable to trade (if you are just starting to study trading in the market and see a triangle or flat, you cannot trade). Below is a video about why you should not trade in flats and triangles:

Quite often situations arise when trading on the market is impossible. It is better to wait than to enter the market simply because the trading terminal is already open and some time has been spent analyzing the market situation.

The first point of the trading plan should give a clear answer to the question: is it possible to trade now? Ignoring it is paid for by your resources, namely:

- time - the trader analyzes in detail instruments that are not worthy of attention in principle;

- money - if the market is not suitable for trading now, the likelihood of getting a negative result increases.

Working with a wallet

Having completed the process of creating a wallet, you can begin to work. MyEtherWallet features include:

- Sending and receiving Ether and tokens.

- Investing in digital currency.

- Offline translations.

- Cryptocurrency exchange.

Receiving and sending digital currency

It is very easy to receive Ethereum from another user. To do this, you need to provide the number (address) of your wallet to the sender.

To find out your account number, go to the "Wallet Information" section on the official MEW website. The address is located in the “Your Address” section.

The second way to get the address is to use the QR code located at the bottom of your personal account.

To send cryptocurrency, click “Transfer ether and tokens.” Unblock access to your wallet by choosing one of the proposed methods.

Enter the recipient's address and the transfer amount in Ethereum. Also indicate the gas limit. The higher the limit, the faster the process of sending electronic currency. Gas unused during the transfer will be sent back to your wallet in the form of Ether.

Reference! Gas is a unit of measurement that is used to confirm transactions, create and execute smart contactors on the Ethereum system.

Check the recipient's address several times before submitting your application. If you enter incorrect data, you will not be able to cancel the transaction.

Offline transfers

Offline transfer is the most secure way to transfer cryptocurrency to a computer that does not have access to the Internet.

To complete a transaction, open the “Offline Transfer” section.

Enter your wallet address as the sender.

Next, open your MyEtherWallet wallet on a computer without Internet access and go to the “Offline Transaction” section. Fill in the information fields with the recipient's address, transfer amount and gas limit.

Copy the signed transaction to a computer that is connected to the Internet via a third-party storage medium: USB drive, external HDD, etc. Check all the information again and click “Submit Transaction”.

Adding an ERC-20 token

To see your tokens in your wallet that you are about to transfer to MEW or have already transferred, you need to make them visible. So let's look at how to add tokens to MyEtherWallet. To do this you need:

- Go to your personal account by clicking “Wallet Information”.

- On the right side of the sidebar, click “Add your token” in the token balance block.

- Specify the token address, symbol and fraction. You can get this information on the ERC20 token catalog website - etherscan.io.

- After entering all the data, click “Save”.

How to sell tokens with MyEtherWallet? To do this, use the “Transfer ether and tokens” button.

Entry Point Detection Methods

Entry points into the Forex market directly depend on what trading strategy you are using.

There are types of trading strategies based on trend, counter-trend, news, as well as systems for working in price channels and in flats.

Counter trend

This is opening a transaction in the opposite direction from the main trend.

And if we correctly determine the entry point into Forex, we can catch the beginning of a new, big trend and make a good profit.

Or if we simply catch a corrective movement against the main trend, we can get a small, but still profit.

Corrections during an uptrend

But working with a countertrend is quite dangerous, since a large number of false signals are possible, so it is preferable to work with the trend.

News

A classic example of news trading looks like this:

5 minutes before the news release, two pending orders are placed: one to sell (sell stop), the other to buy (buy stop) at a distance of 100-200 pips from the current price.

Example of news trading

One of the orders is triggered and, depending on the volatility of the news, the take profit can be set from 100 to 2000 pips.

Important: as soon as one of the orders is triggered, the second one must be canceled.

Trading on news is a rather risky type of trading, since the price can go in a completely unpredictable way and hook both of our orders - this is called a helicopter.

There are news that always influence market behavior:

- NFP — NonFarmPayroll (number of people employed in the non-agricultural sector);

- FOMC meetings;

- discount rates;

- CPI - consumer price index;

News such as:

- Central Bank meetings;

- inflation;

- unexpected news. Suffice it to recall the fall of skyscrapers in New York and the behavior of the foreign exchange market afterwards;

- GDP data;

Do you trade on the news?

Not really

Price channels

A price channel is a price range on a chart between support and resistance levels.

Entry points into the Forex market here can be at a breakdown of the channel boundaries or at a price reversal inside the channel.

If the price has broken through the support line, then you need to open a position down (sell), and vice versa, if the price has broken through the resistance line, then open a position up (buy).

There may be false breakouts in this system.

It is also possible to open positions during a reversal inside the price channel; when the price bounces off the support line and goes up, then we make a purchase.

When the price bounces off the resistance line and goes down, we make a sale.

Flat trading

Most of the time the market is in a flat or sideways movement.

The price fluctuates in a horizontal price channel, between the support and resistance lines.

In this case, it is important to draw these lines correctly on the graph. You can build them yourself using local highs or lows, or using special indicators.

How to find an entry point into the Forex market?

Once the channel is built, this will not be difficult.

When the price bounces up from the lower border of the channel or support line, we buy the currency. If the price bounces down from the upper border of the channel, then we sell accordingly.

Likewise, the upper or lower boundary of the channel can become a potential point for taking profits and closing a position.

On it, either slightly above or below it, depending on whether we are selling or buying currency, we place a Take profit order.

Safety

The growing popularity of cryptocurrency is causing hacker attacks on exchanges, wallets, etc. Security in MyEtherWallet is ensured due to the fact that the wallet does not store money or private keys. All important data is stored on the devices of crypto wallet owners.

If you lose your personal data, you completely lose access to your MEW crypto wallet and the funds stored on it. Make sure to keep your personal login information in a safe place and make multiple copies of your keys.

The service cannot access other people's user accounts: reset and restore passwords, freeze accounts, change private keys, return lost funds.

The MEW project is written in JavaScript and is open source, which can be viewed on the GitHub service.

The wallet is controlled using PrivateKey. For this reason, care should be taken to keep this key safe to ensure maximum security.

MEW can be used for forks of the Ethereum digital currency: Ubiq, EtehereumClassic, Expanse.

On a note! Forks are electronic currencies created on the Ethereum platform.

To improve safety, follow these guidelines:

- Do not transfer personal data from the wallet to third parties: privatekey, keystore, etc.

- Before entering the site, check that the URL you entered is correct.

- Synchronize your wallet with the MetaMask service.

- Do not use MyEtherWallet on other people's devices.

Entry point from support level

If the price rises, it means the market is growing, the trend has been determined. At the retest along the support/resistance line of the uptrend, we wait for the third touch of the price - here, at the support level, are the most profitable entry points for Buy. So what do we need for this method:

- The trend is upward.

- The reference point is the support line.

- Entry type – Buy order.

Login from support level.

Breakouts followed by a high price rebound indicate the strength of the trend. They confirm the reliability of the entry point when the price touches the support line for the third time. If the price goes against the trend, this does not mean that the market has changed direction.

The method of entering from levels is simple and reliable, but it also has a downside - false breakouts when testing the level with the price. A true or false breakout will be shown by the second Japanese candlestick on the breakout. You need to wait until it closes. The chart below shows how the price tested the level three times. If the first two touches are considered “pivot points”, then the third touch is the correct entry.

Additional features

Exchange

To exchange currency, go to the “Exchange” section. Here you can exchange ETH or BTC for REP and BTC.

Important! The rate of digital currencies during exchange is dynamic. It depends on market quotes of the currency.

Working with smart contracts

One of the main advantages of the MEW crypto wallet over its competitors is the ability to work with smart contracts.

To get started, go to the “Contract” section.

You can enter the ICO by entering the contract address and its ABI. You can also select an existing contract from the general list.

To list your ICO on the Ethereum platform, click “Publish Contract”. Specify the bytecode and gas limit. Sending a smart contract to the blockchain is considered a standard transaction.

ENS

MyEtherWallet functionality allows users to personalize their account by specifying a unique address. To do this, go to the ENS (EthereumNameService) section. In the information entry field, enter the name of the crypto wallet in the domainname.eth format. This name will be displayed instead of the standard name like “0x52sd84sx...”.

By clicking “RegisterSubdomain”, you can register a subdomain. It will appear in the format sub.domainname.eth.

DomainSale

In the DomainSale section you can buy and sell a crypto wallet domain. To sell you need:

- Transfer your domain to DomainSale. This is necessary to confirm that you are the owner of the rights to the domain.

- Set the exact or auction price. Once you indicate the exact price, it cannot be changed. The domain will be sold for the specified price.

When adding a lot to the auction, indicate the starting price. For selling a domain, you will be charged a 10% commission.

- Complete the auction.

Checking TX Status

In the “CheckTXStatus” section you can check the transaction execution status. To do this, enter the transaction code in the information entry field.

If the blockchain is overloaded, you can cancel the operation.

Combining timeframes

Combining timeframes can be a very important clue for a trader when determining entry and exit points in Forex.

If your strategy works on the M15 chart and gives a signal, say, to sell a currency when the price rebounds from the upper limit, then you should look at the hourly chart (H1) and the 4-hour chart (H4).

If the price on a larger time frame bounces off the high, then the likelihood of a profitable sale increases.

The same can be said, if the price breaks the high or low on a larger time frame, then this can be an excellent confirmation of opening a sell or buy position on a smaller time frame.

Important: a trader should pay attention to different timeframes in order to find more accurate entry and exit points on Forex!

Advantages and disadvantages

Like any other crypto wallet, the MyEtherWallet service has its advantages and disadvantages. Let's look at the pros and cons of MEW in more detail.

pros

- Anonymity. To work with the service, you do not need to provide personal data: first name, last name, e-mail, phone number. This allows transactions to be carried out completely anonymously.

- Integration with other wallets. For ease of use and increased security, you can integrate the MEW crypto wallet with other services.

- Ease of use. To use the service there is no need to download additional software to your computer. The entire work process takes place on the website.

- Currency exchange. If necessary, you can quickly exchange BTC for ETH and vice versa.

- High level of security.

- No limits on storing funds.

- Ability to add a token to your wallet.

- Minimalistic interface with Russian language support.

- Support for working with smart contracts.

- No connection to the operating system.

Minuses

- Lack of account recovery function. Registration of a wallet on MyEtherWallet is carried out without specifying personal data for the sake of anonymity. For this reason, it is impossible to restore access to your account in the event of data loss.

- Support for a limited number of cryptocurrencies. MEW allows you to work only with the Ethereum cryptocurrency, its forks and ERC-20 standard tokens.

What is a trading plan in trading?

If a trader does not have a trading plan, then in the long term the probability of losing money in the market tends to 100%. I have seen dozens of proofs of this rule while working in the brokerage business. My first trading accounts also became a clear confirmation of this. Traders who regularly lose money in financial markets most often do not have a trading plan and open and close trades on a whim; or there is a trading plan, but it is ignored at the most inopportune time.

I note that one of the biggest difficulties of this type of business is to follow a trading plan in a disciplined manner. It is enough to ignore it once to erase the trading results of previous weeks or months. Discipline is the basis of trading, but it will be meaningless without a clear plan of action that defines what you can do and what you absolutely cannot do.

Quote on topic

Don't be a hero. Don't stick out your “I”. Be critical of yourself and your capabilities. Don't flatter yourself for a moment. If this happens, you will be finished.

Paul Tudor Jones - founder of the hedge fund Tudor Investment Corporation

A trading plan is a document that you need to fill out yourself. It can be in paper or electronic form and should be on hand when trading the financial markets. It is very convenient to use Google Docs - your trading plans, as well as trading sheets and diaries, will be available on any device.

Perhaps you trade several accounts and trading strategies at the same time: for example, the first account is medium-term rebound trading on the Daily; the second is intraweek trading on the H1 and H4 timeframes. In this case, it is necessary to draw up two trading plans. This will allow you to make every trading decision as carefully as possible, and also, when the transaction is closed, will allow you to understand how well this trading operation corresponded to your trading system.

Extension for Google Chrome

To make working with MEW easier, you can install an extension for the Google Chrome browser.

The MyEtherWallet extension is available in 18 languages and provides users with the following features:

- Creating a wallet.

- Sending Ethereum cryptocurrency and ERC-20 standard tokens.

- Send only ETH or only ETC.

- Using the offline transactions feature.

You can install the extension from the official Google Chrome app store.

How to receive, send Ethereum Classic ETC

The MyEtherWallet wallet allows you to interact not only with the Ethereum blockchain, but also with the original Ethereum Classic network. Thus, you can receive and transfer the cryptocurrency Ethereum Classic (ETC).

Instructions on how to switch MEW to work with Ethereum Classic:

- Go to the official website www.myetherwallet.com and select the ETC pool (Epool.io) at the top:

- Follow the standard wallet login procedure.

- The address for ETC will be the same as for ETH.

Comparison with MyCrypto

One of the founders of the MyEtherWallet service announced on February 8, 2022 that he was leaving the project and creating a new one – MyCrypto. At first glance, it is extremely difficult to find significant differences between MEW and MyCrypto.

The interface of both services is similar: in both cases, a design with a minimum number of unnecessary elements is used. The wallet creation process and functionality are also identical. In MyCrypto you can send and receive ETH, make offline transactions, exchange cryptocurrencies, etc.

Currently, MyCrypto has the opportunity to participate in beta testing of the new version, which offers users:

- Changed interface.

- New ways to access your account.

- “Broadcast Signed Transaction” function.

When choosing between MyEtherWallet and MyCrypto, it is best to choose the first option, since it is already a finished product that has won the trust of users with its reliability.

You may also be interested.

Blockchain 0

How to create a MyEtherWallet wallet

Since there is no need to download or install anything on your computer, the process of creating a new wallet in MEW happens right in your browser at myetherwallet.com. Usually, after entering the resource, the Russian version of the interface is immediately activated. But if the switching does not occur automatically, you can activate the desired language through the drop-down menu in the upper right part of the main window.

Opening a new crypto wallet occurs after clicking on the main menu item “New wallet”. You should enter a strong password in the appropriate field and click on the “Create wallet” button.

Figure 1. Opening a new wallet

The next step is to download the Keystore file (UTC/JSON). It should be kept in a safe place and under no circumstances given to third parties or used on phishing sites.

The Keystore file paired with a password provides access to funds stored in the Ethereum blockchain. If the user loses it, he will not be able to log into the wallet and manage his coins. Therefore, you should create a copy of the file and store it in a safe place.

Figure 2. Downloading a file with a Keystore personal key

Next you need to click the “I understand. Continue." A new window will open showing the private key. It can be copied, transcribed by hand, or printed in pdf format. The private key must also be kept in a safe place.

Figure 3. Saving the private key

After clicking on the “Save your address” button, the wallet creation stage will be completed. To see the address, you need to unlock your wallet. You can log in either using a Private key or using a Keystore file in combination with a password.

Figure 4. Authorization methods

Already within your account, you have the opportunity to print the form or save it as a PDF file. QR codes for quick authorization will also be shown here.

Figure 5. PDF file with address and private key

Storing Ethereum cryptocurrency on exchanges

Many traders prefer to store digital assets in internal exchange wallets. The advantage is that you can immediately make trades or exchange cryptocurrency for other coins. Private keys are stored by the service operator. The site may be subject to hacker attacks (events have occurred more than once). Large sums that accumulate and do not take part in trading are best withdrawn from the exchange balance.

It is important to choose trusted cryptocurrency exchanges. Many sites have been operating successfully for a long time. An important condition that needs to be emphasized is the level of protection. If one password is enough to log in, it is better not to use the service.

Despite skepticism about exchange wallets, many are safer than official online wallets. If you consider a cryptocurrency exchange as a potential storage facility, you need to choose from proven resources.

Breakout Trading

Strategies for trading on price breakouts through important levels are considered the most effective ways to manage trading positions that provide high profitability. They are often associated with stop orders, which are triggered immediately at the moment of breakout and thus provide the opportunity to take a position at the very beginning of a developing price impulse.

This is all true, but in many markets stop orders are not very practical and are often even dangerous for a trading account, so this path is not always justified. For breakout strategies, market entry options using limit orders provide a greater opportunity for profit with relatively low risk.

In a growing market, we often see prices moving upward, developing in a zigzag manner. As a rule, in the first third of a trend, when it has already emerged and the bulls have launched a consistent offensive, the bears still have serious strength, so they often manage to reduce prices so much after each price surge that they fall to the level of the penultimate peak. Sometimes the fall stops here, followed by a new upward movement, pushing prices higher.

If the trend is strong, then the depth of the decline rarely exceeds 23%, and even more rarely, the 38% level of the last fully completed downward market movement.

As can be seen from the figure above, points 1, 2 and 3 are the breakout of previous highs. Points 4, 5 and 6 are the optimal entry points and they are at the levels of 38.2%. Thus, instead of using stop orders to enter a position, you can use limit orders.