The history of Japanese candlesticks

This type of market analysis was first discussed in Japan four centuries ago. It all started with the reform of the rice grain trade market. For the first time, a trader named Homma depicted the graphical construction: he depicted the volatility of the price of his own product in order to determine its max and min values. Gradually, more and more traders realized that such charts were an excellent basis for fairly accurate forecasting. Then the analytical candlestick method was born - a description of a large number of combinations in order to predict potential fluctuations.

Amega Bot is the latest tool for automated trading on the Binance exchange.

- Plus 20-30% to the deposit monthly in passive mode.

- Complete security of your funds, the bot cannot withdraw or transfer your money.

- Full transparency of all transactions and movement of funds.

You can get the bot on this page.

Let me remind you! The bot works completely automatically!

What do Japanese candlesticks say and show?

Regardless of the duration of the exchange transaction, Chinese candles on the exchange always show the same information:

- Low — prices for the current period.

- Hi — prices for the current period.

- The cost of opening a transaction on the market and closing it.

Due to their clarity, Japanese candlesticks are used to search for patterns that affect the conclusion of transactions when trading. Their structure also reflects the psychological state of the market: for example, behavioral patterns characteristic of certain trading participants. This helps to quickly and with great reliability predict how the market will react to certain circumstances.

Technical analysis in stock trading helps to determine the level of resistance and the level of support, and at any time interval.

How to make money in conditions of market uncertainty

There are only three ways to make a profit on any financial exchange. Let's make a comparative description of them and present the data in the form of a table.

| Method No. 1 | Method number 2 | Method No. 3 |

| Hope for casual income | Use of insider information | Search and development of market patterns |

| Scheme of work | ||

| The deal is opened at random without any prior forecast | A limited number of people become aware of important internal changes in the company. After this, information is assessed and transactions are opened in financial markets. When the news becomes public, insiders take large profits from the delayed market reaction. | In the chaotic market movement, users find a set of rules that, with a certain error, can bring money. Next, the noticed rules are transformed into a turn-based strategy that will work exactly until the majority of players start using it |

| How many exchange participants use each of the listed methods, % | ||

| 89 | 1 | 9 |

| This category includes beginners and failed traders who were counting on “quick money” | This hidden financial elite, into which the average citizen of any country is closed | This includes professional traders who, through numerous observations, have learned to take money from the market |

| Conclusion | ||

| If you want to make good money, learn to find patterns | ||

All patterns of classic candlestick analysis are outdated patterns that could be used to make money in the past. Now they can be trusted only if they are confirmed by signals from additional instruments (see the example in the Oracle TS).

Calculating a profitable pattern is extremely difficult: for most users it takes several years of training. An additional complication is that one trader's market techniques will be completely useless to another.

Therefore, if you are counting on stable exchange earnings , first of all take care of your personal algorithm and choosing a reliable company for cooperation.

| Company | Just2trade | United Traders | BKS | Tinkoff investments |

| Minimum deposit | From $100 | $300 | from 50,000 rub. | Unlimited, you can even buy 1 share, they recommend starting from RUB 30,000. |

| Commission per cycle (buy + sell trade) | 0.006 USD per share (min. 1.5 USD), 0.25 USD for each application. that is, per lap – $3.50 | “Beginner” tariff – $0.02 per share Average $4 per round | At the “Investor” tariff – 0.1% of the transaction amount, at the “Trader” tariff it is reduced to 0.015% | 0.3% for the “Investor” tariff |

| Additional charges | The ROX platform will cost at least $39/month. (for the American market), for an additional $34.50 they connect Canada/TSE, Level II On the over-the-counter market, the additional fee is 0.75% of the transaction volume (minimum $30), in the case of dividends - 3% from the issuer (minimum $3) | On the Day Trader tariff, they charge $60/month for the Aurora platform, free on other plans | If the account has less than 30,000 rubles - 300 rubles/month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, | — |

| Account maintenance cost | $5/€5/350 rub. reduced by the amount of the commission paid | — | 0 RUR/ month on the “Investor” tariff. On other tariffs, funds are debited only if there was activity on the account this month | Free for the "Investor" tariff |

| Leverage | for Forex Up to 1 to 500 for stocks up to 1 to 20 (day) to 1 to 5 (night) | 1 to 20 on the Day Trader tariff, this is the maximum leverage (daily) | Calculated for each share, within the range of 1 to 2 – 1 to 5 | Calculated for different instruments, the calculation is linked to the risk rate |

| Margin call | -90% | Standard -30% of the deposit, in technical terms. support can be set -80% | Calculated based on the risk for each security | Depends on the asset |

| Trading terminals | MetaTrader5, ROX | Aurora, Sterling Trader, Fusion, Laser Trader, Volfix.Net, Pair Trader | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | The purchase of shares is implemented like an online store, professional software is not used |

| Available markets for trading | Forex, American, European and other stock markets, cryptocurrency | American and other stock markets, more than 10,000 assets in total, cryptocurrency | Foreign exchange, stock, commodity markets, there is access to foreign exchanges | American and Russian stock markets |

| License | CySEC | Lightweight license from the Central Bank of the Russian Federation | TSB RF | TSB RF |

| Open an account | Open an account | Open an account | Open an account |

In the next section, we'll look at a few tips that will save you time and effort.

How Japanese candlesticks are formed

The structure of the nuclear system shows the behavior of all players on the exchange. This allows the trader to predict the intentions of other players. There are three aspects that directly affect the structure of each Japanese candlestick.

Mood candle

The Candle Mood of a Japanese candle can be:

- Bullish (when the trade completed above the previous high).

- Bearish (when the transaction was completed below the previous Low indicator).

- Neutral (when the gradation of mood has not yet begun).

Each type of mood also includes 3 subtypes - low mood, medium and high. The definition of "mood" was coined by Lance Beggs.

Candle body

The body is the most important parameter that is looked at first. The longer the body of the Japanese candlestick is, the more significant the pressure exerted by bears or bulls on the market.

An equally important aspect is body color. If it is white and quite long, this means that at the moment the market is dominated by “bulls”, that is, buyers. If the body is black, the situation is reversed and the sellers control the market. In the MT4 terminal, the color indication is slightly different - the bearish LE is red, the bullish LE is green.

A short body indicates the imminent formation of a rollback from the trend or a flat. This happens when Ask and Bid are approximately equal. The market at such a moment is indecisive regarding the further quotation direction.

Tail of the candle

The tail is the same as the shadow of a Japanese candlestick. The tail is also called a wick. A long tail on the upper or lower side (otherwise known as a pin bar) characterizes a change in market sentiment.

Two candles strategy

Two candle strategy

is based on the assumption that on the chart there are rarely areas for a long time in which candles of different colors alternate through one and resemble a zebra. Such situations can arise during a strong flat, but if you limit yourself to trend fragments only, you can build a good trading system.

The rules of the strategy are as follows:

- you need to wait for the candle color to change;

- as soon as the color changes, a trade is opened in the same direction as the previous candle. If a doji has formed, you can take into account the color of the candle before it. Expiration is always equal to one candle.

It is clearly seen that most of the losing trades occur when working against the intraday trend. If you exclude such transactions from your work, the win rate will increase from 60-65% to at least 70+%.

Types of Japanese candles

There are the following types of candles:

- "Doji." One of the most common types of nuclear weapons. It is formed when the closing and opening levels are equal, which gives a clear signal about the upcoming trend change. If the Doji has a long wick, it is a Rickshaw model. If the "Doji" has a closing or opening level at the minimum o, if vice versa - "Dragonfly Doji".

- "Top". It comes in both black and white. The “Top” is characterized by a narrow body and short tails (equal both above and below). As an independent nuclear system, it provides little information, but is valuable as part of a combination.

- "Hammer". A powerful YA with a small body and a shadow below that is twice as large. There is either no tail on top, or it is very tiny. The “hammer” is formed at the bottom, so it is perceived as an indicator of an upward reversal. A similar but mirror image of the Hammer is the Inverted Hammer.

- “The Hanged Man” (or in other words “The Hanged Man”). It is similar to the previous one, but is created at the peak of an upward movement. Indicates an upcoming reversal and price movement in a negative direction.

- "Shooting Star" Externally, it is similar to the Japanese “Inverted Hummer” pattern, only it forms at the top and reports an upcoming reversal of the trend line.

candle shadow

The shadow (tail, wick) gives the trader a lot of important information, including displaying the price Low and Hi. A small wick at the bottom of a Japanese bearish candle and a larger wick at the top signal that the bulls were actively trying to push the price up. However, the bears were able to resist this tendency and brought the price back down to its previous place.

During trading, the opposite situation also occurs: at the bottom the bullish shadow is large, at the top it is small. This shows that the bears made attempts to push the price down, but the bulls did not let them do this and successfully raised it back up.

Uncertainty Candles

Such Japanese candles are created when Ask and Bid are equal and it is impossible to predict who will “take the upper hand” and in which direction the price will move. With Japanese candlesticks of uncertainty, the trader needs to wait for a more clear market indicator.

Bullish candles

Bullish SA is an indicator of the dominance of buyers (“bulls”). And as long as their number is greater than the number of sellers, it will remain bullish.

The larger the bullish body, the stronger it is. Accordingly, the thinner it is, the weaker it is.

For successful trading, it is not recommended to short if a bullish JS has formed. The best thing is to wait until the number of acquirers increases.

Bearish candles

By analogy with bullish ones, bearish ones indicate that at this moment the market is under the control of sellers. Accordingly, as long as their number outweighs, it will remain bearish.

For successful trading, it is not recommended to open a long position if a bearish JS has formed.

What other candles are there?

So, the traditional option is a candle with a body and two shadows. But there are also some others. Moreover, traders always pay attention to such candles. Let's look at them.

No lower shadow. Such candles usually predict a very strong price increase. That is, the market opened at a certain price value and then did not fluctuate at all. He immediately went upstairs sharply. There is a high probability that this growth will continue further.

Without a body. These candles signal to traders that the market is “undecided.” Bulls and bears cannot determine which of them is stronger. Such candles usually always have shadows, that is, there were attempts to rise and fall, as a result, the price closed in the same place where it opened.

In this example, “uncertainty” is clearly evident. The seven previous candles were also “neither this nor that”; the price could not “break out”, go up or down.

No top shadow. They show that the market has “exhausted” and it no longer has the strength to go up. That is, the candle was “born”, and the price immediately went down, it didn’t even try to go up.

Do you see what a powerful collapse occurred after this candle? Five white candles – the market fell down over five time intervals.

Combinations of Japanese candles

Let's look at common Japanese combinations in trading:

- "Doji." This is an example of a pattern consisting of one Chinese candlestick. It reflects the indecision of the trading parties to take active steps to reduce or increase prices. “Doji” has no body, “long-legged Doji” has long tails at the top and bottom, and if the closing and opening prices meet in the middle of “Doji,” then it is “Rickshaw.”

- "Hammer" ("Hammer"). This is the so-called reversal combination, which is formed at the support level. This indicator signals that the downward price decline is ending. The body of such a nuclear weapon can be both black and white. The shadow below is 2 times longer than the body itself. And the shadow above is most often simply absent, or very short. It is important to remember that the Hammer and the Hangman (this is a mirror hammer) always require confirmation (in a subsequent pattern). Because it is never known for certain whether a further reversal will occur.

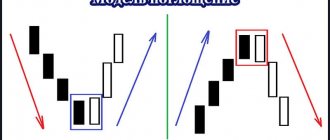

- "Absorption". The model consists of two Chinese candles of different colors. The body of the second nuclear system completely absorbs the body of the first. If the cost of opening the 2nd YES is less than the cost of closing the 1st, then the pattern is called “bullish engulfing”. If the situation is the opposite, then “bearish engulfing”. It is important to remember that during “absorption” it is the bodies that are eaten (i.e., the body of one nuclear unit is within the boundaries of the body of another).

- "Stars". The pattern is a powerful signal for a market reversal. With this combination, EAs appear at the top of an uptrend, or at the bottom of a downtrend, but in any case, it opens with a gap. The body of such a JS is short. The YA located next to the “Star” is as follows: on the left – long and white, on the right – short and black (in an upward trend). When descending, everything is exactly the opposite.

- "Morning Star" This Japanese model is also a reversal model. It is more complicated than the previous ones, because it consists of three nuclear systems. The Morning Star is created at a support level and signals an upcoming market reversal to the upside. The main parameters of the model are as follows: it is preceded by a bearish YA, after which a quote gap occurs and a small YA with a small body and the same shadow is formed. After the Morning Star, a bullish JS is formed (also with a gap).

- "Evening Star". This is a mirror image of the Japanese “Morning Star” model, also consisting of three nuclear weapons. "Evening Star" gives a signal of an upcoming market reversal downward.

- "Shooting Star" Again, a reversal combination formed at the resistance level. “Shooting Star” indicates the end of an uptrend. It doesn’t matter whether it’s bullish or bearish: the signal given is always the same - it’s a downward reversal. Graphically, the model is depicted with a tiny body and a very long upper wick.

- "Harami." Translated from Japanese into Russian, “harami” means pregnant. The model is formed from nuclear weapons with a long body (“mother”) and a short one (“child”). The first appears before the second is formed (otherwise it is already a “bullish engulfing” pattern). “Harami” shows that the current trend is ending and a market reversal in the opposite direction will soon occur.

- "The Abandoned Child" A pattern similar to "Morning Star" and "Evening Star". Based on the name, it becomes clear that the model implies a single nuclear system. It is created with a gap relative to the previous and subsequent candle.

- "Three Crows" A combination of nuclear symbols indicating a potential market reversal after an increase in value. The peculiarity of the model is that the closing cost decreases sequentially, and the opening cost is within the boundaries of the previous aggregate.

- "Upside-Gap 2 Crows" Quite an interesting Japanese model, externally reminiscent of the “Absorption”. The only difference is that both YAS are bearish. “Two Crows” is a signal for an imminent drop in value. Despite the price gap, buyers are not able to hold its level for a long time and push it higher. Therefore, a decline inevitably begins.

- "Mat Hold" This set of Chinese candlesticks is considered to continue the current trend. Outwardly, it is very similar to a flag or pennant.

Candlestick patterns formed from one or two nuclear symbols are characterized by a number of features:

- Such a set loses its own significance if it appeared during the current market movement.

- The model itself is not an indicator that says that you need to open a deal now. It only reflects the current market sentiment and its potential changes.

- Japanese trading literature supports the argument that a number of bearish patterns are much stronger than their bullish counterparts. However, for example, for Forex, such a statement is irrelevant, which is confirmed in practice.

Bullish and bearish engulfing strategy

This binary options strategy is based on a standard candlestick pattern in which one candle completely engulfs the other. In Price Action, a similar model is called Rails. It is possible to get a win rate of 70+% due to a number of additional filters.

We do not trade directly after the formation of a pattern; we need to wait for the movement to develop, get a pullback, and only after that the deal is concluded :

- after absorption, 3 candles of the corresponding color should form in a row. For example, during a bullish reversal, you need 3 consecutively rising white candles to appear (you need to focus on the closing price);

- after this series, a correction candle needs to appear; only the color of its body is taken into account. In the bullish engulfing example, after a series of 3 white candles, a candle with a black body should appear;

- immediately after the correction candle closes, a trade is opened in anticipation of the continuation of the main movement. Expiration is set equal to 1 candle. Signals are activated only if all conditions are met during the first 5 candles after the engulfing pattern.

Some patterns are guaranteed to be missed, but for the remaining ones the win rate is above 65%. Conveniently, structures of this type are most often formed during the European and American sessions.

Japanese candles: all the secrets and nuances

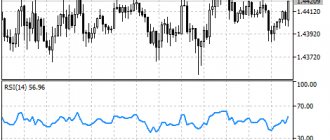

Working with candles in trading:

- Japanese analysis is most effective when trading with the D1 (daily) time frame. If the candlestick timeframe is less than H1 (hourly), it is unreliable.

- A reversal pattern does not always indicate a market reversal. Rather, it is an indicator of a changing situation.

- To identify long-term trends in the market, trading uses analysis with the W1 (one week) and MN (one month) time frame.

- Combinations with gaps are much more reliable. Of course, this does not apply to the Forex currency market, since gaps are very rare there.

- It is necessary that each candlestick pattern be confirmed. That is, after a specific combination is formed, the subsequent Japanese candlestick should reflect the market's intention.

Japanese analysis is based on a number of basic principles that everyone who is engaged or planning to engage in trading should know about:

- If there is a short wick and a long body, YAS builds a trend. This is an indicator of strong superiority of either sellers or buyers in the market (depending on color). The longest bodies, as a rule, are located at the beginning of a trend wave or at its end. An important nuance: if, after a long upward impulse, EAs with long bodies have formed, the trader needs to close the deal.

- A small body and a long wick in most cases are formed at a reversal of the trend line. This refers to situations where one of the YS's tails dominates to a significant extent over her body and the other tail. Roughly speaking, this is an “unfinished” large body. The appearance of such elements suggests that during trading the market was dominated by players who preferred to trade in the same direction, and then the course of trading was refracted by players who adhered to the opposite side.

- A small body and small tails are characteristic of nuclear units formed in a sideways trend. Such elements allow you to open a position with a short stop loss.

Perfect Pin Bar Strategy

The name of the strategy speaks for itself. Trading is based on the simplest reversal pattern; you need to wait for the formation of a pin bar, preferably as close as possible to the ideal one, and buy an option in anticipation of a reversal. Expiration period - 1...5 candles , usually the reaction to a reversal candle appears immediately.

For additional insurance, you can use horizontal levels. If the pattern is supported by strong support or resistance, the strength of the signal increases.

You need to take into work only those pin bars that correspond to significant extremes. If the chart is flat and something resembling this pattern appears, ignore it.

Compared to Forex trading, a trader working with BO is in a more advantageous position. To make a profit, he does not need a full-fledged reversal; a small movement after the pin bar is enough.

It is not recommended to use pin bars with abnormal shadow sizes . Such movements indicate the emotional nature of the market movement; trading at such moments turns into a lottery.

How to trade Japanese candlesticks?

Japanese candlesticks are not a full-fledged trading tactic, but an analytical tool that must be used wisely. It is not enough to simply find the combination of nuclear symbols on the chart. Exchange trading involves the use of a large number of other analysis methods in combination.

To start trading on the market using Japanese candlesticks, a trader needs to know at least their basic patterns. As soon as a beginner has mastered three or four models of nuclear language, he proceeds to consolidate the following patterns. Theory is always reinforced in practice - this rule is relevant not only for exchanges.

Doji

Doji is a candlestick pattern that can be found on charts quite often.

Ideally, she has no body, i.e. The shape of the doji resembles a cross or a sword without a handle. In order for it to form, the opening and closing prices must coincide. However, even a minimal body still places the candle in this category. In any variation, this is a strong signal of a trend change on time frames of 30 minutes and above. Doji works best in Forex, but in the stock market this candlestick pattern usually performs poorly.

Japanese candlestick trading strategy

In trading, the main element of working with Japanese candlesticks is themselves. And the Japanese candlestick trading strategy is based on several methods:

- Search for combinations. When studying the chart, you need to identify a combination of 3-4 Chinese candles, colored in the same color and moving in the same direction. Having found such a pattern, the trader takes a contract opposite to the current situation, since such trends allow one to anticipate a rebound or reversal.

- Determining the trend. This is necessary so that no contradictions arise between it and the reversal found by the trader.

- Determining the level of resistance and support. You can only visualize them, or you can draw them. This helps the player, when trading, to react in a timely manner when the price approaches Low or Hi, and based on this, enter into profitable contracts.

How did the Japanese come to this way of analyzing the stock market?

The appearance of one of the first futures markets in the world is attributed to Japan and dates back to the early 17th century. At the end of the Hundred Years' War, which united Japan in 1600, the capital of the country became Edo (the ancient name of modern Tokyo). All the feudal lords of the country were forcibly relocated to Edo. And their rice estates were scattered throughout Japan.

As you understand, at that time it was impossible to deliver a large harvest over such distances. Therefore, feudal lords built storage facilities in large port cities. They were feudal lords for a reason... They traded not only the available rice in storage, but also came up with a way to quickly get rich, wrote out receipts for future deliveries, the so-called “empty rice contracts”, because... in fact no one possessed this rice.

This is how one of the world's first futures markets appeared. Rice futures quickly became the subject of speculation and actually led to the emergence of Japanese technical analysis. But graphical analysis did not yet mean the appearance of candles and candlestick analysis. It took Japanese traders 270 years before candlesticks appeared. And up to this time, the graph has undergone significant evolution:

- Stopping chart;

- Pole chart;

- Bar chart;

- Anchor chart;

- Candle chart;

Briefly about each...

Stop chart (only closing prices were noted)

In this type of chart, only closing prices were marked and connected by lines. This chart was also called a star chart. It received the name “stop” from the prices at which the trading interval stopped. A similar analogue of the line chart in Western technical analysis, but it appeared much earlier.

Pole chart (maximum and minimum)

The pole chart, named after its resemblance to a pole, provided more information; one could see the maximum and minimum prices of the trading session, as well as its range.

Bar chart (high, low and closing price)

This schedule was a combination of a stop and pole schedule.

Anchor chart (high, low, open, close)

The anchor chart was so named because of the port cities in which the main trading floors were located. This was already a breakthrough in technical analysis. These charts appeared around 1715-1720. If the trading session closed below the opening price, the anchor was directed downwards; if the closing price was above the opening price, the anchor was directed upwards. Those. All the necessary information was already on the chart, and the opening and closing prices were clearly visible.

Candlestick chart (high, low, open, close)

Candlestick chart is a new stage in the development of Japanese technical analysis. The date of appearance of candlestick charts dates back to 1865-1870. Candlesticks were a more advanced version of the anchor chart. Thanks to coloring, the relationship between supply and demand has become more visually distinguishable. Nowadays, candlestick charts are tinted mainly in red and green, these are the default colors set in most charting and trading platforms.

How to correctly read Japanese candlesticks on the stock exchange and chart

Japanese price chart analysis always pursues the same goal - searching for similar combinations (patterns) that periodically appear on charts. Patterns consist of 1-2 candles or more. Combinations in trading are divided into reversal patterns (the vast majority) and trend continuation patterns.

Initially, all candles are presented on stock charts as a horizontal line, i.e. Candle Mood is neutral. And depending on which Japanese candlestick is formed - bullish or bearish, the trader will understand who currently dominates the market.

If the price rises, the market is dominated by bulls, i.e. buyers. If the price falls, then bears – sellers – predominate in the market.

The formed Japanese candlestick shows who won the confrontation - buyers or sellers.

Step-by-step steps on how to interpret nuclear symbols when trading:

- The first step is completely analytical. First you need to see whether the body is growing or, conversely, shrinking. The questions need to be answered: “Which of the two sides of the market is currently dominant? And is it strong enough to set conditions for the creation of even more nuclear systems, in particular the next one? You should also pay attention to shadows, since they are an equally important source of information. Next, it is necessary to establish whether the YAS is based on the resistance (or support) level.

- The second step is retrospective analysis. It is necessary to study previous Yas. Understand whether there is currently growth or decline. It is necessary to analyze past nuclear weapons, their number and embedded information. You need to understand whether they can confirm the current price direction or not.

- The third step is predictive. It is necessary to predict the color of the subsequent nuclear weapon.

- The fourth step is also predictive. Once the trader has been able to establish the type of pattern on the chart, it is necessary to predict the direction of the market.

An important trading rule is to wait patiently for closed candles. After all, the market is unpredictable, so nuclear weapons can suddenly change their color and shape.

How to Find a Profitable Stock Exchange Pattern

Turn off your emotions

Begin to calmly observe the chart and find repeating cycles on it. Add indicators and horizontal levels , write down candlestick combinations that help predict market movements.

Remove unnecessary things

Remember that your main goal is to earn . This is only possible if you stop having fun, eliminate all adventurous schemes and leave only the most profitable patterns. The fewer there are, the faster you can move on to trading.

Test

100 formations ” exercise, consisting of the following steps, will help you with this

1) you translate each pattern found into a step-by-step plan; 2) rewind the chart; 3) find 100 entry points; 4) honestly record the result and leave only the strongest formation; 5) make adjustments and prepare to trade with a real deposit.

Do not give up

Trading is a special type of business where capital is increased solely through the knowledge of the trader. Only 10% of participants are successful. Therefore, do not despair if you have been opening trades for several years without success. Progress comes to everyone differently . Your task is to work hard and not stop searching even after numerous failures.

Follow the example of the pros

Below is a recording of Larry Williams' . This is a record-breaking trader with 50 years of experience. In his practice, he uses no more than 8 patterns and teaches his listeners to love unsuccessful trades . This is an extremely important video that everyone should watch.

Japanese candlesticks and market analysis

Having summarized all the theoretical material, we can formulate the main positions necessary for market analysis and trading using Japanese candlesticks:

- Coloring a Japanese candle. This will allow you to understand whether the bulls or bears are currently in control of the situation.

- Accounting for tail length. This is an indicator of how much the price bounced from a specific level.

- Taking into account body size. This is an indicator of the strength of sellers and buyers.

- Taking into account the length of the shadow. The longer it is, the greater the price rebound and the more powerful the pressure from sellers will be.

Relatively speaking, market price volatility is a battle between buyers and sellers. If there are more of the former, the cost decreases. If there are more of the latter, it grows.

Clarifying Candlestick Patterns

We have shown that there is no need to remember any candle formations if you understand the 5 x 5 candle elements discussed earlier. To illustrate how candlestick patterns are constructed, look at the following figure. As you can see, both hammer and pinbar formations form engulfing candlestick formations, and it all happens when you stack two engulfing candlesticks.

That being said, this is just one example of how candlesticks are created and once you understand how to read prices and candlesticks, you will notice that there is no need to memorize the candlestick formations at all.

Pros and cons of candlestick analysis

Each method of market analysis in trading, including Japanese candlestick, has its own advantages and disadvantages.

The advantages of Japanese candlesticks are the following:

- Versatility. The Japanese tool is suitable for analyzing all types of markets (this includes the stock market, foreign exchange market, commodity market, etc.).

- Credibility. Unlike other technical trading tools, EAs analyze the direct behavior of the value itself.

- Ubiquitous. Japanese candlestick analysis is available in every modern trading terminal.

In fact, no other method of chart analysis in quote trading can properly compete with the Japanese method. Even extreme simplicity in visual design puts the method in an advantageous position. Japanese traders have developed a truly optimal tool for identifying current market sentiment and its changes. And this is the essence of trading itself.

If we talk about the disadvantages of nuclear systems, then this is the difficulty in mastering. This Japanese method of analysis is quite complex, so novice traders often spend considerable time studying it and further practical application.

Among the shortcomings there is one more - the Japanese method is not suitable for trading with short time frames on Forex (less than M30 - thirty minutes).

List of candle designs

Reversal patterns include:

- shooting star and inverted hammer;

- hammer and hanged man (hanged man);

- tombstone and dragonfly - a type of doji;

- 2 types of absorption;

- a gap in the clouds and a curtain of clouds;

- morning and evening star.

The colorful names are explained by the specifics of Japanese culture. Candlestick analysis originated in Japan, hence the unusual terms. But even if you don’t remember all the terminology, it’s enough to at least understand what happens in the market when reversal candlestick patterns form.

Examples of trading on the stock exchange

As soon as a trader masters the theoretical foundations of nuclear symbols in trading, studies their models and learns to distinguish between them, then he can start trading. We must remember that a candlestick combination is not an independent trading tool. The player must take into account the context of the entire stock chart. Don’t forget about the tools for fixing losses and controlling risks.

An example of trading on the Forex currency exchange using a concrete example:

- Let's say a trader decides to use a strategy called "Three Candles". As part of this strategy, you need to find this figure on the chart.

- The model looks like this on the graph: two nuclear units on the sides are located higher than the one in the middle. Knowing that a similar pattern is formed after a price correction, the trader finds the right combination.

- If the trend is upward, the player bets on an increase in price. If the trend is downward, then downward.

Examples and descriptions of candlestick patterns in real trading

Of course, not all the models discussed above have the same signal strength. Some are stronger, some are weaker and rarer.

Let's look at the strongest combinations based on the experience of professional traders.

3.1. Candlestick pattern “Hammer” - description and examples

Hammer figure on the Alrosa stock chart (June 6, 2017):

Hammer pattern on the EOSBTC chart (March 18, 2018):

3.2. “Shooting Star” pattern - description and examples

Shooting star figure on the Exxon Mobil chart (June 5, 2012):

Shooting star pattern on General Electric chart (December 11, 2000):

3.3. Bullish and bearish “Engulfing” pattern - description and examples

Bearish engulfing pattern on Berkshire Hathaway chart (June 22, 1998):

Bullish engulfing pattern on the Wells Fargo chart (January 16, 2015):

The wider the candle, the stronger the signal. Sometimes such days are called “wide-range”. Absorption candlestick patterns are one of the most reliable types of trading signals.

Summarizing

Japanese candlesticks are an advanced and effective trader’s tool. But you need to understand that you can trade with it only in combination with other analytical tools. It is not so important to thoroughly memorize all the candlestick combinations, the main thing is to learn to think outside the box.

Summary of the main points in the article:

- This is an analytical trading tool that allows you to reflect the real movement of market prices and trade more profitably. If the price rises, the market is dominated by bulls, i.e. buyers. If the price falls, then bears – sellers – predominate in the market.

- This is not a full-fledged trading strategy, but an analytical tool that must be used wisely. It is not enough to simply find the combination of nuclear symbols on the chart. Trading involves the use of a large number of other analysis methods in combination.

- If there is a bullish YS on the trading chart, then the opening price in all cases is less than the closing price. If it is bearish, on the contrary, the opening price is higher than the closing price.

Summary

Candlestick reversal patterns are not a ready-made strategy, but only a market analysis tool. Its effectiveness depends only on how the trader uses it. Pros work almost on a clean chart, guided by patterns on higher timeframes. Beginners often try to take into account everything that even remotely resembles candlestick formations and get one stop after another.

If you want to get the most out of candlestick reversal patterns, integrate them into a trading system based on graphical analysis. These instruments fit together perfectly.

Sniper X is suitable for the role of such a TS. Candlestick patterns will complement entry points based on the chart’s reaction to levels.

Download the Sniper X basic course for free here