- The main question for a beginner: what are binary options?

- There are no freebies here

- Why are binaries so popular, what's all the fuss?

- Binary or Forex?

- How does it work in binary options?

- Trend up or down: bulls vs bears

- Live chart and trading tools

- Japanese candlesticks and binary trading

- Best time to trade binary options

- Intersection of time intervals

- Right time

- Nonfarm payrolls: important news of the month

- Best days of the week to trade

- What is the best expiration time?

- Expiration 60 seconds

- Expiration time: 10 to 15 minutes

- Expiration 30 minutes

- Which timeframes best show the trend - price movement?

- Binary options strategies for beginners

- Double red candle strategy

- “Pinocchio” strategy

- Strategy “3 peaks”

- Signal strategy

- Forecasts on TradingView

- Top 3 Indicators for Beginner Traders

- The best brokers for a beginner

- Video for beginners

- Best book for beginners

- No freebies, go for a walk, boy

- BO School, addition from 2020

Have you seen enough advertisements on Google or YouTube about binary options? Congratulations. Now I need to describe binary options to a novice trader in such a way as not to discourage them and at the same time disappoint them. I need:

- describe really cool prospects (you can make great money from this for years);

- don’t let the newcomer put on rainbow glasses (there’s no easy money here);

- set up for months of work.

Well, let's figure out which path a beginner should take. If, of course, he really wants to learn how to make money from this, and not hunch over his uncle or aunt.

The main question for a beginner: what are binary options?

This is a financial instrument that works on the “all or nothing” principle. We need to predict the price movement. Either you increase your income from the bet amount, or you lose it completely. This is such an uncompromising thing.

They trade binary on the AMEX and CBOE exchanges. But only large banks, investment and hedge funds.

Binary options brokers on the Internet are not affiliated with these exchanges in any way. These are not real trades, since transactions are not displayed on the interbank market. But this is good, otherwise we would have to work with a minimum deposit of 10 thousand dollars.

And in binary you can start from 1-10 dollars. We are given a platform where we will predict price movements, receiving a substantial reward for a successful forecast (from 60%), or losing the entire amount of the bet.

All this money is boiled in the broker’s system, successful traders earn money from losers (sometimes fantastic amounts), and losers cry into their pillows. In fact, this is simply financial betting based on the price level.

To avoid becoming a loser, prepare to study for several months. There is no indicator or strategy that will provide you with successful trades in 5 minutes.

There are no freebies here

All the strategies and indicators publicly available on Google will not give you quick access to successful trades. It is useless to look for simple ways here.

To make money in binary, we need 60% of successful transactions. So you have to learn and understand:

- what drives the market;

- how news influences;

- basics of technical analysis;

- and only then the main indicators.

The learning curve is similar to learning a foreign language - nothing works out, something seems to work out, and you slowly start to get the hang of it.

Read the 5 steps of a binary options trader to understand what you'll be up against.

Halva, easy money, the ability to quickly make money using a “strategy” found on Google - there’s nothing here. Well, or you can give your deposit to the broker and, in tears and snot, go into the sunset accompanied by romantic music.

BO trading for absolute beginners: how to trade profitably?

Due to the fact that some people who are far from financial markets and options trading believe that traders are practically engaged in guessing changes in asset prices, this type of activity is often compared to gambling. However, such a comparison is fundamentally incorrect.

The fact is that the choice of an asset and forecasts regarding changes in its price are preceded by a thorough study of the current market situation and the development of a competent strategy that guarantees high efficiency. It is also important to be aware of the functioning of the financial market.

That is why one of the key factors in trading BO without losses is the correct approach, excluding frivolity and the perception of this activity as an ordinary game in which everything depends on luck.

Today there are no specialized educational institutions where one could take a course in preparation for trading. Moreover, many specialists and experts claim that no special education is required to start trading binary options. However, this does not mean at all that a beginner can count on success without even undergoing basic self-training.

If a person still wants to start trading BO, then he should decide on a broker, register on the platform and make a deposit in the prescribed amount.

After this you need to do the following:

- Specify the trading instrument. This could be cryptocurrency, currency pairs, stocks, etc.

- Determine the bet size. The minimum volume is determined by each specific broker.

- Set a period after which the contract will be closed.

- Give preference to the direction of the option (up or down).

How to trade on BO correctly to win?

How to choose the right strategies to constantly win on BO?

BO trading should be based on specific rules. Every trader must definitely decide on a strategy, which is a combination of analytical methods that signal the opening of a transaction. It is ideal if a trader has several strategies at once that will work under different conditions.

As a rule, beginners are looking for a strategy that guarantees trading binary options without losses. However, it is worth remembering that this is simply impossible. It should be borne in mind that trading is practically impossible without losing trades. But you can achieve profitability over a certain time period if the effectiveness of the chosen strategy is at least 60%.

There is no universal strategy that will be successful for all traders. As practice shows, if a system allows one BO trader to make a profit, this does not mean at all that it will help another trader gain profit. In order to conduct successful trading, you need to understand the basic laws of the market. Only based on the knowledge gained can you build a suitable model that will be effective and allow you to count on a stable income.

We should not forget that trading involves risks. Today there are systems characterized by varying degrees of risk.

In this regard, experts recommend that when choosing a strategy, pay attention not only to profitability, but also to a number of other aspects:

- Riskiness.

- A mathematical model that has proven its effectiveness over time and has received the approval of experienced traders operating in a wide variety of financial markets.

- Objectivity of signals and market analysis. A strategy whose signals are ambiguous will have low effectiveness.

- Designed to make deals when important economic news appears.

- Easy to use and understand.

In order to understand which strategy to give preference to and how to use it correctly, you should take a closer look at their description. Below is the essence and distinctive features of some strategies that are in demand among binary options traders.

BEST FOREX BROKERS ACCORDING TO INTERFAX DATA

Top ECN broker, operating for over 20 years!

Now I additionally receive income from their cashback promotion ==>>> CASHBASK FROM ALPARI | review / reviews 2010. Certified by CROFR! | MAXIMUM BONUS | review / reviews Verified foreign broker |

START WITH 10USD | review / reviews Included in the TOP 3 leading ratings of Forex brokers. Great for Russia | MAXIMUM $1500 BONUS | review/feedback AS WELL AS THE BEST BINARY OPTIONS BROKERS IN 2022:

This options broker has the best reputation on the web!

| START WITH 10$ | review / reviews New fixed options. These are the only ones! | START WITH 1$ |

review / feedback Example No. 1: Trend or directional trading strategy

When the market price moves upward and eventually reaches extremely high levels, an uptrend is formed. If the price decreases and low lows are observed, we can talk about downward trends. Both types of trends can be displayed on charts at absolutely any time. This creates conditions for effective trading for BO traders.

Typically, proponents of this strategy do not take into account minor changes in market value. All interest is directed towards determining the general direction of its movement over a certain period. In this case, methods and indicators of technical analysis are used.

A common trading technique offered by almost all BO brokers involves the use of BO call/put. The first of them pays off if the value of the asset exceeds its execution price after a certain time period ends. The second BO (put) pays off in the opposite case.

Bidders may also resort to using one-touch BO, which is riskier but also potentially more profitable. It involves forecasting the level that investors believe the market should reach as part of a trend.

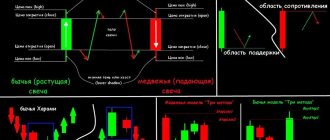

Example #2: Candlestick Pattern Strategy

A candlestick chart (candlestick) is a financial chart that is designed to describe the movement of the price of a stock, currency or other industrial instrument over a specific period of time. Visually, it looks like a candle, which is why it got its name.

Candlestick charts come in different sizes, colors and shapes because they are based on prices that are subject to constant change. These differences in shape, color and size help to trace trends in market psychology and make predictions about its future direction.

Advantages of candlestick trading:

- No difficulties even for beginners in the world of trading.

- Compatible with other indicators.

- Availability of a detailed description of everything that is happening on the market, as well as the interaction of both sides of the trade.

- Quickly visually determine the type of market (weakening or growing).

- Prompt identification of turning points in the market and assessment of their direction.

- Applicable to all markets.

- High accuracy when making forecasts regarding market trends.

The variety and numerous features of candlestick charts make trading candlestick patterns a key aspect in modern trading strategies used in the financial market today.

Example No. 3: Range and Breakout Trading Strategy

The strategy involves traders setting trading ranges and extracting income from them. Such ranges appear on the market when it fluctuates between the upper and lower boundaries.

It should be taken into account that this strategy is characterized by the use of binary options that do not go beyond the border. In this case, it is necessary to establish an upper and lower value that frames the value that the trader predicts the option will reach by the end of its validity period.

If a trader intends to trade on a breakout of the trading range, then he has the right to use the BO, which is located outside the border. This makes it possible to set a range with boundary levels, beyond which, according to the trader’s forecasts, the value of the option will be after the end of its validity period.

This strategy provides for the following possible exits from trading:

With profit (or in plus). In breakout trading, identifying an adequate target is of particular importance. For example, this could be the range of a cost channel. Having made a breakout, very often prices reach a target that is equal to the range of the trading channel. It is also possible to determine the average value of recent cost changes and take them as an adequate goal. It is possible to use moving averages and various indicators. At a loss. You need to decide in advance what to do next if the deal turns out to be unprofitable. After a breakthrough is made, the old levels should change their value in the opposite direction. This means that the support level will turn into resistance. Knowing this makes it possible to determine where to place a stop loss order in the event of a losing trade. So, if the price breaks through the resistance level, then you should set a loss stop several points lower. This will turn resistance into support unless the breakout turns out to be false, which will result in the price not hitting the stop loss, but moving into the road zone.

Why are binaries so popular, what's all the fuss?

Well why? There is an interbank international currency exchange market known as Forex. In Russia, hundreds of thousands of traders have been trying to make money on it for many years.

The main disadvantage of Forex is that it is difficult for beginners. Pips, take profits, stop losses, lots... in Forex there are no “rates” as such, and without a stop you can lose your entire deposit in an instant due to a sharp price movement. And even stop loss does not always help. This is a difficult area to learn to predict currency movements from.

Binary or Forex?

And then suddenly binary ones appear, the advantages of which are visible to the naked eye:

- two buttons: you only need to predict the price movement, and not its price level;

- income: from 70% per minute or more;

- adjustable bet size;

- there are no hidden commissions: the broker earns from the difference between the amounts that traders invested and received;

- There are many assets – there are literally dozens of them, not only currency pairs, but also gold, oil, whatever you want.

So if you compare binary with Forex, the latter begins to seriously lose. However, it also has advantages:

- leverage: the ability to trade very large amounts without actually having them on deposit;

- Forex is more flexible in terms of various strategies and trading methods.

So binary ones perfectly complemented Forex and became an opportunity for beginners to make their first forecast on price movement. And new brokers appear every single day.

How does it work in binary options?

Yes, that's it. You need to choose an asset, any one, like a currency pair, and predict where the rate will go and where it will be after a certain period of time.

- Will it go up? Press the “Up” button, also known as Call.

- Will it go down? “Down” button, also known as Put.

Let's say we took the gold rate. Let's bet, say, $100. Let the payout percentage be 72%. We decided that the rate would fall in 15 minutes and pressed the Put button.

We wait 15 minutes and if the forecast was correct, $172 will appear on our account. And if it’s not true, we lose our $100.

Do you see how? Risks and opportunities. We can earn a crazy percentage very quickly - not 6% per year in a bank, but from 70% in a few minutes. But the RISK is very significant.

However, with all brokers you can minimize the risk by specifying the amount that will be returned to you if the forecast is unsuccessful. So you can still get part of your bet back.

What should you not do?

Options trading rules may concern not only trading itself, but also prohibitions. All of them, like verification, are aimed at ensuring security, because, as you know, where there is money, there are scammers.

You can often find negative comments about certain conditions on the Internet, but think about how you would react to them if your account was once hacked by attackers and all the money was withdrawn from it?

Important! all financial issues require manual verification. Brokers do not withdraw funds automatically, so the process may take several days. Specific deadlines are indicated in the user agreement, but they are not final, since the manager may need additional time to eliminate any doubts.

Surely, you would thank the dealer if he prevented this attempt, so before you grumble about some difficult conditions, think that they are in your favor too.

Don't try to fool the dealer

After trading for several days, and realizing that trading is not as simple as it seemed at first, many beginners think of trying to deceive their dealer in order to earn and withdraw money. Forget about it. Brokers' systems are protected no worse than banks, and any actions that cause suspicion lead to a complete blocking of the account, and sometimes without the right to restore it.

Here are some common mistakes newbies make:

- Using programs that hide your location. In fact, the broker is not interested in where you are; you can work from anywhere. The important thing here is that the system detects sudden movements of the user around the planet. This is regarded as the fact that you gave your account to someone so that they could trade on it. Sharing personal data is prohibited and your account will be frozen.

- Attempts to return money through lawyers or the cashback system. Please note that if the dealer turns out to be a fraudster, you can still get your money back, but you need to prove that you are right. Many newcomers do not think about this and try to return the funds that they themselves lost. Should not be doing that. Remember, the dealer stores all information about your activities in his platform. Every step you take is recorded and in the event of an attempt to deceive, he will easily prove his case in any court.

- Opening multiple accounts. In fact, it is not entirely clear why some users do this, but the rules for trading binary options clearly state that one user has the right to work with only one account. If you register another account, the system will detect this and block both accounts, even if there is money in them. By the way, returning frozen funds will be very difficult, and sometimes even impossible.

Get these thoughts out of your head right away. Nothing good will come from such cooperation. In their time, brokers have seen a lot of scammers and those who want to deceive them, and they are very skilled in preventing such actions, so you shouldn’t consider yourself the smartest and take such dubious risks.

By the way, if you still need a new account with a broker, for example, you decide to change the main currency, then you can do this under completely legal conditions. Just contact the technical support manager in any way convenient for you and describe the situation to him. It will block the current account with the appropriate note, and you will be able to register a new one.

Trend up or down: bulls vs bears

In general, the ability to predict prices is studied by such a thing as technical analysis. At the end of the article I will link to a very cool book on this topic, but for now let's learn the basics right now.

There are two types of traders in financial markets: bulls and bears. They constantly fight each other.

- Bulls are buying up (imagine them constantly pressing the “Up” or Call button)

- Bears are short (these ones love the “Down” button).

Depending on who wins – the bulls or the bears – the rate of our asset changes.

Here's a good example to remember:

How can we watch the fight between bulls and bears? On a line chart or on a chart with Japanese candlesticks.

Line graph

Japanese candles

Learn and develop

You can always copy other people’s tactics, schemes and algorithms, or you can gradually gain experience and try to analyze the market. Charts, indicators, oscillators, and economic calendar are just part of the list of useful and important auxiliary tools for a trader. Learn to work with them from the first day of your decision to enter the market. Over time, persistence and patience will yield results.

Live chart and trading tools

Well, since assets have a rate, you have to look it up somewhere, right? Most brokers show it only schematically. There are also brokers that have their own schedule, like IQ Option, but it is very inferior to its professional counterparts.

Therefore, we will open a normal chart in one window, and in the second we will press the broker’s buttons.

On the left is a live graph . On the right is the chart of the IQ Option .

What free, normal schedules can you recommend for work? One of them is presented on the website - a live chart via the link in the top menu. It's the same:

- TradingView;

- FreeStockCharts;

- Metatrader;

- ThinkOrSwim (for experienced ones);

- NinjaTrader (similar).

Rule #6: Constantly learn

The following rule of binary options seems unnecessary to most beginners. Well, the main thing is to find a couple of indicators. But, alas, along with the constant changes in the market, yours must also change. And here new tools will never be superfluous. I posted the two most detailed training instructions here:

- Instruction 1;

- Instructions 2.

Japanese candlesticks and binary trading

In order for your trading to go smoothly, you need to figure out what the chart is showing us. And he shows us Japanese candles.

This concept is not difficult at all. A candle is the price movement over a certain period of time. She has a body and shadows - a maximum and minimum price.

Candles come in different colors:

There are also candles that you need to pay special attention to:

- A) Doji: The opening and closing prices of the candle are the same. Be careful - the price does not yet know where it will go.

- B) Long-legged Doji: if it appears after small candles, the course will soon reverse.

- C) Zero Doji: The opening and closing prices are the same. We ignore such things altogether.

Best time to trade binary options

One of the important aspects of binary trading that a beginner should know about is trading timing. Of course, trading options, currency pairs, indices and the like is carried out 24 hours a day, 5 days a week. However, not every minute is worth entering into a trade.

There are times and days of the week when the pair has greater volumes and liquidity, which is reflected in its volatility, that is, how active, vigorous and fresh the rate is. And where there is more activity, there are more opportunities to enter into a deal.

Intersection of time intervals

The foreign exchange market is most active when sessions of different exchanges intersect. It is during this period that couples demonstrate active movement.

The time shown in the diagram is Greenwich Mean Time, GMT. For Moscow time just add +3.

When several markets are active at once, volatility increases and the price takes on a clearly defined movement. But during off-peak hours there is often a flat market. This is the so-called “consolidation period” during which, by the way, I made most of my money in BO.

Right time

We, binary options traders, make money by predicting price movements. Therefore, volatility or its absence is very important to us.

We see that a good time, according to Moscow, is:

- 11:00 – 12:00 (Tokyo/London);

- 16:00 – 19:00 (London/New York);

- 3:00 – 9:00 (Sydney/Tokyo).

Research shows that the most active trading hours take place during the European session (see London). Also in the USA at 16:30 Moscow time, important economic indicators are often published, which greatly influence trade.

Nonfarm payrolls: important news of the month

Every first Friday of the month in the United States, data on the number of people employed in the non-farm sector is released. They are also known as NFP (Nonfarm payrolls).

This is one of the key news every month.

If this indicator grows, the dollar exchange rate also rises; if not, it falls. This data ALWAYS affects all exchange rates where USD is present. In pairs such as EURUSD, USDCHF and many others. Very important news, look at it always and everywhere.

You can watch the news on a live chart or in economic calendars .

If NFP data is positive, the dollar usually strengthens; if not, it sinks. Always follow this news. Or don’t trade it at all - all this is described in the BO school.

Best days of the week to trade

There are days when the price is more pleasant for trading. This Tuesday and Wednesday are definitely the best times. Friday also performs well , especially when European trading hours overlap with American ones (from 16:00 to 19:00 Moscow time). on Monday , but not in the early hours.

But after 7 pm on Friday, there is no need to trade anymore - the markets will soon close and the price will get up to hell.

Nuances of the days of the week

Monday is a sluggish and mostly flat day of the week. The worst thing that can happen on Monday is opening the session with a gap. The reason for this is the recent weekend and the lack of macroeconomic publications. Good, active trading occurs over the next 3 days. A lot of news and optimism among speculators contribute to rapid price movements. Friday is characterized by sharp short-term price jumps, especially before the close of trading. This is facilitated by a large volume of closing orders before the weekend. Trading on Friday is highly discouraged because the market is generally unpredictable. The release of weekly reports, events at the beginning and middle of the week that received a response on Friday, macroeconomics and fixation of weekly profits - all this increases the risks for making a profit.

Weekend

Trading on weekends is usually unconditional. All trading platforms are closed, nothing affects the price. The only explanation for the ability to trade on weekends is simply a function given by the broker. Such trading is very questionable. But still many take advantage of this opportunity. The only nuance of such trading may be cryptocurrency. This is a new and fairly developing segment of trade. The only recommendation when trading on weekends is to strictly adhere to the rules of your own strategy and trading system. News cannot influence the market; the response will occur only on Monday. You just have to adhere to the rules of technical analysis and trade at your own peril and risk.

Holidays

As a rule, the market on holidays is sluggish and mostly flat. This is especially true for the New Year and Christmas holidays. Many traders advise not to trade on such days and just wait them out. This is due not only to “boring” movements. But also sharp jumps in quotes. This happens due to large and often one-time injections of large volumes. It is impossible to predict this. News and reports are often released the day before the holiday, and cannot influence the rapid growth of quotes.

Non-farm

Every first Friday of the month, the most important report on the performance of the American labor market is published. It provides statistics on job vacancies. This indicator also affects unemployment data. On Non-Farm Friday, all currencies quoted against the Dollar fluctuate greatly in one direction or another depending on the reporting data. Many traders do not trade on this day. But these indicators often influence exchange pricing throughout the month. Only news that has a more significant impact on the dollar can balance the response to these indicators. Since Friday is not the best day for trading anyway, you don’t have to trade at all. But you can also base your trading on anticipation of Friday's reports from the American labor market.

News

Trading on economic news has both supporters and opponents. Many people consider such trading to be very risky. The main risk is the unpredictability of the market reaction before the news is released, and the immediate reaction to the information received. But you can build proper and profitable trading here too. There are certain indicators that affect the pricing of the currency of any country in relation to major currencies. You just need to select a currency pair and wait for such news to come out. These could be reports on employment, unemployment, GDP indicators, and wages. Some news comes out once a week, month, quarter or year. During the period when such fundamental news is released, the market is either calm or panicked. Many news sites offer a free news calendar and include their forecasts for previous data. All this information can be used to make a profit.

Example of market interest

Using the example of the EUR/USD pair during a trading period of one day, certain conclusions can be drawn. These conclusions are similar for most currency pairs. The figure shows that during the Asian and Pacific sessions traders were not interested in this pair. This is due to the fact that trading was mainly carried out in local currencies, and the EUR/USD pair remained in a sluggish narrow corridor throughout the entire session. After the opening of the European session, not only the increase in demand is noticeable. Also noticeable is the Euro's attempt to increase the price of the Dollar relative to itself. This continues exactly until the American session opens. America's disinterest in such a price for the euro is already visible here. The price is going down a bit. This is a battle over pricing. Next, you can see a breakdown of the support level and a deep price drop. There was only one dollar left. The European session has closed. America is interested in paying less for one euro. This is a simple example of the complete disinterest of Asia and Australia and the struggle of Europe and the United States over the price of their currency. It turns out that when trading the EUR/USD pair during the European session at the beginning of its opening, you need to be prepared for the Euro’s desire to increase its price. Next come more serious and frequent movements due to the struggle over pricing, since America, having opened the session, does not agree with such a price for the euro. This is a simple example of why a currency pair moves in a particular direction.

What is the best expiration time?

In binary options trading, the timing of the transaction - that is, expiration - is a very important factor.

As a rule, all traders choose a period from 60 seconds to 30 minutes. Let's look at them briefly.

Expiration is the end time of the transaction, which we choose from the broker.

A timeframe is a time interval on a price chart.

In the broker window (in this case, IQ Option), we select the expiration time. The time for which we make a forecast and after which our transaction will be closed.

But on the price chart, as in the example below, we select a time frame. Let's say if we chose 5 minutes, then each candle on the chart will indicate a price movement during these 5 minutes.

The longer the timeframe, the more understandable the price movement will be, since this is how market noise is “filtered out.”

Expiration 60 seconds

A very unpredictable period of time. Quick results, but predicting price movements is extremely difficult. It's more like gambling than trading. But there are people who earn money this way. Their chart is on a 1-minute timeframe.

Expiration time: 10 to 15 minutes

During this period, the price can sometimes turn in the other direction. To figure this out, use a live chart set for 5 minutes.

Expiration 30 minutes

Perhaps the optimal expiration for trading. Economic news must also be taken into account here. Half an hour is enough time for the asset to begin moving confidently in the predicted direction.

In this case, you must definitely look at the news, as well as the chart at 5-15 minutes and 1 hour, in order to understand how best to enter a deal.

Which timeframes best show the trend - price movement?

To find the price movement, which is displayed through Japanese candlesticks, we need a large time frame.

As a rule, it is at least 1 hour. However, traders who prefer short-term transactions can choose 5- and 15-minute ones.

In this case, the 1-minute chart is used to find the exact entry point into the trade, but on the 5- and 15-minute chart we confirm both the trend and draw support and resistance lines.

If you trade with expiration from 15 to 30 minutes, then 1- and 4-hour charts are well suited for analyzing price movements.

Trading platform

After the account is registered and replenished, we move on to the next stage - familiarization with the trading platform. As a rule, this is a web version that allows you to trade directly from your browser, meaning there is no need to download anything. The trading platform has a set of analysis tools and all the main indicators of technical analysis.

However, a truly high-quality analysis should be carried out in a trading terminal designed for traditional currency trading, that is, in MetaTrader version 4 or 5. This is due to the fact that MT is much more convenient, functional and more accurate than the still “raw” platforms of binary options brokers. Considering the number of indicators written for it, everyone can choose the most suitable one.

It is also possible to trade binary options from mobile devices ; special versions have been made for Android and iOS for this purpose. They can work on both a smartphone and a tablet. The functionality is approximately the same, everything you need is there, the system requirements are very low, so there is no need to have a powerful device. In general, everything is approximately the same as in regular trading, it is important to have a stable connection, otherwise the mobile platform meets all the requirements. This, of course, will not replace a full-fledged analytical system, but in the case of trading, for example, using candlestick patterns, we don’t need all the functionality - it’s enough to just visually evaluate the model and understand the prospects. True, this applies to a greater extent to medium-term trading, that is, on H1 candles and above.

Binary options strategies for beginners

Of course, you are eager to learn about strategies that allow you to trade successfully. Let's say right away - there is definitely no .

There are a great many of them, and you can succeed in them only if you skillfully operate with different time frames, use various indicators and spend a lot of time watching how the price develops.

But do you have to start somewhere? Here are 5 strategies to get you started.

Double red candle strategy

This short-term strategy is based on a resistance line. Trading is carried out on a 5-minute live chart.

The signal we need is when 2 red candles bounce off the conventional line at the top. We enter a trade on the 3rd candle down (Put button).

- We are waiting for the first candle.

- We are waiting for the second red candle.

- If the second red candle closes lower than the first, that’s great.

In this case, the third, as a rule, will be even lower than the second.

- Expiration time: no more than 15 minutes;

- Time on chart: 5 minutes.

Exceptions:

- not suitable for too high a price;

- do not use when important news comes out.

“Pinocchio” strategy

In the USA, it is called, of course, the Pinocchio Pinocchio strategy - this is a candle with a very small body and a very long shadow - that is, the nose.

Pinocchio strategy - this is a candle with a very small body and a very long shadow - that is, the nose.

This candle is loved by all traders and is called by several names: Shooting star, Hanging man, Hammer and Inverted Hammer.

As you remember, Pinocchio’s nose grew when he began to lie shamelessly. So it is here, if the shadow (nose) is significantly longer than the body of the candle, therefore, the market is deceiving us, and we need to trade in the opposite direction.

Where exactly to enter a trade, you will determine with practice. It is not uncommon for traders to wait for the next candle after Pinocchio, while others enter a trade immediately after the Pinocchio nose candle has closed.

If the nose is looking up, the price will soon go down and vice versa, if the nose is down, the price will go up.

- Time on the chart: from 5 to 15 minutes;

- Expiration: 1-1.5 hours.

Exceptions:

- do not use the 1-minute chart;

- do not trade on a “flat” market; the real Pinocchio signal comes when there was an upward price movement before it.

Pinocchio may not be lying if the price has not moved anywhere before - so be careful.

Strategy “3 peaks”

A very popular strategy described in hundreds of books on technical analysis. She looks like this:

- After the price has risen briskly, look for 3 tops as shown in the figure. You need to start, of course, from peak number 1.

- After the first peak, we look for the second one – number 2.

- If the new upward movement does not exceed top 1, and turns down, this is how top 3 is formed.

- When the price falls below top 2, it is time to buy a Put option.

- Expiration time: depends on which chart timeframe you saw this pattern on.

- Exceptions: it is better to open 2 transactions with a shorter expiration time than one, but with a very long one.

Signal strategy

Absolutely useless in itself, because signals by themselves do nothing. However, they can save time because they are a banal mechanical forecasting system.

Below the live chart is an example of such a technical system.

The point here is clear - instead of throwing dozens of indicators on the chart, investing has already done it for you. All that remains is to open the chart and, focusing on the metrics, decide what to do next.

- Actively selling is a signal that the price may go down.

- Actively buy - the price may go up.

Pay attention to the “maybe” - these are not signals as such, but simply an indicator system. There is no need to work strictly on it .

Forecasts on TradingView

The full version of the tradingview.com chart, where you can register completely free, has a ton of useful information and several tens of thousands of traders who share their forecasts completely free of charge.

This is not just one of the best charts on the planet, but also the best social network for traders. And there are… tons of forecasts out there.

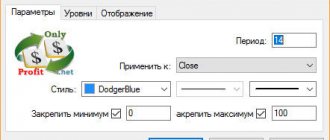

Top 3 Indicators for Beginner Traders

In addition to a live chart, candles and strategies, we need indicators, right? They are selected in the live chart using the Indicators button.

What indicators can be recommended:

- Relative Strength Index (RSI);

- Stochastic;

- Bollinger Bands.

Read the description carefully and you will immediately find excellent opportunities for their use.

Capital

Caution for a novice trader is the same norm as having a demo account instead of a real one. But this does not mean that you need to start trading with a deposit of 5-10 dollars and here’s why. According to the rules of risk management, the bet size should not exceed 5% of the deposit amount. The minimum amount of 5-10 dollars is not enough even for 20 transactions necessary to understand the principle of the terminal’s operation and strategy.

A limited budget is the path to losing your deposit. To prevent this from happening, experts recommend starting with at least $100. This is a comfortable amount for trading at the initial stage and making your first income.

Best book for beginners

The best book for the future binary options trader was written by the CEO of Reuters, the most famous financial news agency in the world.

However, Thomson Reuters is also one of the three leading quote providers used by brokers and live charters around the planet.

Who else but them should know where to start? Be sure to use this source, only 160 pages, and everything is to the point.

Management of risks

The most important question that should be studied even before starting to delve into the analysis. It’s just that even with good knowledge, you can lose your deposit in several trades by succumbing to emotions and conducting disorderly trading with increasing contract sizes. This is a separate section that cannot be described in a nutshell; it is better to just read all the material presented here:

Money management on BO

But one main point simply needs to be remembered once and for all - any martingale system will sooner or later result in a complete drain of the deposit. This is simple mathematics, which in the case of binary options works even better and more clearly than in regular trading. Therefore, there should be no progressive rates, no matter how colorfully someone describes and convinces otherwise.

No freebies, go for a walk, boy

Realize right away - on the charts you see the movement of currencies on the international interbank foreign exchange market. Our trades are not based on it - but we place bets on this movement.

If you decide that you can just predict the movement of the euro, dollar or yen on the interbank market, think again. Nice. It should dawn on you that only a currency analyst can make such forecasts in a stable, positive manner.

Are you ready to become one? Are you ready to spend six months to a year on training, practice, everyday trading, and working with your psychology? If so, good luck.

If not, you have only one prospect: drain your deposits and walk off into the sunset in snot. Decide what you need in advance. And don’t expect miracles - all miracles depend strictly on you, and not at all on books, signals, indicators or sites like this.

Rule #4: Rest

Yes, yes, just rest. Believe me, you need to give yourself a rest, especially in trading. This is the unspoken rule of binary options. Judge for yourself how many mistakes a tired trader can make, not to mention the fact that when constantly monitoring charts, both concentration and attention are lost. The result is, again, mistakes (plus such trading is not very beneficial for health).